Price Discrimination

Consider the following examples.

The family doctor in your neighbourhood charges a higher fee from a rich patient compared to the fee charged from a poor patient even though both are suffering from viral fever. Why?

Electricity companies sell electricity at a cheaper rate for home consumption in rural areas than for industrial use. Why?

The above cases are examples of price discrimination. What is price discrimination? Price discrimination occurs when a producer sells a specific commodity or service to different buyers at two or more different prices for reasons not associated with differences in cost.

Price discrimination is a method of pricing adopted by a monopolist in order to earn abnormal profits. It refers to the practices of charging different prices for different units of the same commodity.

Further examples of price discrimination are:

- Railways separate high-value or relatively small-bulk commodities which can bear higher freight charges from other categories of goods.

- Some countries dump goods at low prices in foreign markets to capture them.

- Some universities charge higher tuition fees from evening class students than from other scholars.

- A lower subscription is charged from student readers in case of certain journals.

- Lower charges on phone calls at off peak time.

Price discrimination cannot persist under perfect competition because the seller has no influence over the market determined price. Price discrimination requires an element of monopoly so that the seller can influence the price of his product.

Conditions for price discrimination: Price discrimination is possible only under the following conditions:

- The seller should have some control over the supply of his product i.e. the firm should have pricesetting power. Monopoly power in some form is necessary (not sufficient) to discriminate price.

- The seller should be able to divide his market into two or more sub-markets.

- The price-elasticity of the product should be different in different sub-markets. The monopolist fixes a high price for his product for those buyers whose price elasticity of demand for the product is less than one. This implies that, when the monopolist charges a higher price from them, they do not significantly reduce their purchases in response to high price.

- It should not be possible for the buyers of low-priced market to resell the product to the buyers of highpriced market i.e there must be no market arbitrage.

Thus, we note that a discriminating monopolist charges a higher price in a market which has a relatively inelastic demand. The market which is highly responsive to price changes is charged less. On the whole, the monopolist benefits from such discrimination.

A numerical example will help you understand price-discrimination more clearly.

Suppose the single monopoly price is ₹ 30 and the elasticities of demand in markets A and B are respectively 2 and 5. Then,

MR in Market

Mr in Market

It is thus clear that the marginal revenues in the two markets are different when elasticities of demand at the single price are different. Further, we see that the marginal revenue in the market in which elasticity is high is greater than the marginal revenue in the market where elasticity is low. Therefore, it is profitable for the monopolist to transfer some amount of the product from market A where elasticity is less and therefore marginal revenue is low, to market B where elasticity is high and marginal revenue is large. Thus, when the monopolist transfers one unit from A to B, the loss in revenue (₹ 15) will be more than compensated by gain in revenue (₹ 24). On the whole, the gain in revenue will be ₹ 9 (24-15). It is to be noted that when some units are transferred from A to B, the price in market A will rise and it will fall in B. This means that the monopolist is now discriminating between markets A and B. Again, it is to be noted that there is a limit to which units of output can be transferred from A to B. Once this limit is reached and once a point is reached when the marginal revenues in the two markets become equal as a result of transfer of output, it will no longer be profitable to shift more output from market A to market B. When this point of a equality is reached, the monopolist will be charging different prices in the two markets – a higher price in market A with lower elasticity of demand and a lower price in market B with higher elasticity of demand.

Objectives of Price discrimination:

(a) to earn maximum profit

(b) to dispose off surplus stock

(c) to enjoy economies of scale

(d) to capture foreign markets and

(e) to secure equity through pricing

Price discrimination may take place for reasons such as differences in the nature and types of persons who buy the products, differences in the nature of locality where the products are sold and differences in the income level, age, size of the purchase, time of purchase.

Price discrimination may be related to the consumer surplus enjoyed by the consumers. Prof. Pigou classified three degrees of price discrimination. Under the first degree price discrimination, the monopolist separates the market into each individual consumer and charges them the price they are willing and able to pay and thereby extract the entire consumer surplus. Doctors, lawyers, consultants etc., charging different fees, prices decided under ‘bid and offer’ system, auctions, and through negotiations are examples of first degree price discrimination.

Under the second degree price discrimination, different prices are charged for different quantities of sold. The monopolist will take away only a part of the consumers’ surplus. The two possibilities are:

a) Different consumers pay different price if they buy different quantity. Larger quantities are available at lower unit price. For example, a family pack of soaps or biscuits tends to cost less per kg than smaller packs.

b) Each consumer pays different price for consecutive purchases. For example, suppliers of services such as telephone, electricity, water, etc., sometimes charge higher prices when consumption exceeds a particular limit.

Under the third degree price discrimination, price varies by attributes such as location or by customer segment. Here the monopolist will divide the consumers into separate sub-markets and charge different prices in different sub-markets. Examples: Dumping, charging different prices for domestic and commercial uses, lower prices in railways for senior citizens, etc.

Equilibrium under price discrimination

Under simple monopoly, a single price is charged for the whole output; but under price discrimination the monopolist will charge different prices in different sub-markets. First of all, the monopolist has to divide his total market into various sub-markets on the basis of differences in elasticity of demand. For the sake of making our analysis simple we shall explain a case where the total market is divided into two sub-markets. In order to reach the equilibrium position, the discriminating monopolist has to make three decisions:

1) How much total output should he produce?

2) How the total output should be distributed between the two sub-markets? and

3) What prices he should charge in the two sub-markets? The same marginal principle will guide his decision to produce a total output as that which guides a perfect competitor or a simple monopolist. In other words, the discriminating monopolist will compare the marginal revenue with the marginal cost of the output. But he has to find out first, the aggregate marginal revenue of the two sub-markets taken together and compare this aggregate marginal revenue with marginal cost of the total output. Aggregate marginal revenue curve is obtained by summing up laterally the marginal revenue curves of the sub-markets.

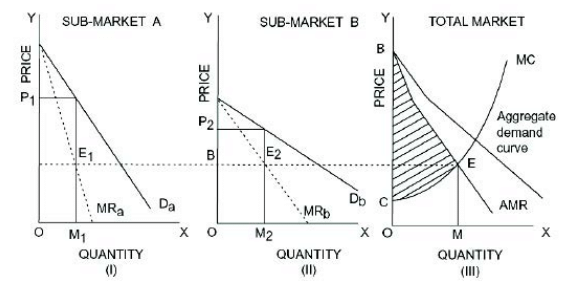

In figure 28, MRa is the marginal revenue curve in sub-market A corresponding to the demand curve Da . Similarly, MRb is the marginal revenue in sub-market B corresponding to the demand curve Db . Now, the aggregate marginal revenue curve AMR, which has been shown in Panel (iii) of figure 28 has been derived by adding up laterally MRa and MRb . The marginal cost curve of the monopolist is shown by the curve MC in Panel (iii) of figure 28.

The discriminating monopolist will maximize his profits by producing the level of output at which marginal cost curve (MC) intersects the aggregate marginal revenue curve (AMR). It is manifest from the diagram (iii) that profit maximizing output is OM, for only at OM aggregate marginal revenue is equal to the marginal cost of the whole output. Thus, the discriminating monopolist will decide to produce OM level of output.

Once the total output to be produced has been determined, the next task for the discriminating monopolist is to distribute the total output between the two sub-markets. He will distribute the total output OM in such a way that the marginal revenues in the two sub-markets are equal. The marginal revenues in the two submarkets must be equal if the profits are to be maximized. If he is so allocating the output into two markets that the marginal revenues in the two are not equal, then it will pay him to transfer some amount from the sub-market in which the marginal revenue is less to the sub-market in which the marginal revenue is greater. Only when the marginal revenues in the two markets are equal, it will be unprofitable for him to shift any amount of the good from one market to the other.

For the discriminating monopolist to be in equilibrium it is essential not only that the marginal revenues in the two sub-markets should be the same but that they should also be equal to the marginal cost of the whole output. Equality of marginal revenues in the two markets with marginal cost of the whole output ensures that the amount sold in the two sub-markets will together be equal to the whole output OM which has been fixed by equalizing aggregate marginal revenue with marginal cost. It will be seen from figure (iii) that at equilibrium output OM, marginal cost is ME.

Now, the output OM has to be distributed in the two markets in such a way that the marginal revenue from them should be equal to the marginal cost (ME) of the whole output. It is clear form the diagram (i) that OM1 must be sold in the sub-market A, because marginal revenue M1 E1 at amount OM1 is equal to marginal cost ME. Similarly, OM2 must be sold in sub-market B, since marginal revenue M2 E2 of amount OM2 is equal to the marginal cost ME of the whole output. To conclude, demand and cost conditions being given, the discriminating monopolist will produce total output OM and will sell amount OM1 in sub-market A and amount OM2 in sub-market B. It should be noted that the total output OM will be equal to OM1 + OM2 .

Another important thing which the discriminating monopolist has to discover is what prices will be charged in the two sub-markets. It is clear from the demand curve that amount OM1 of the good can be sold at price OP1 in sub-market A. Therefore, price OP1 will be set in sub-market A. Like wise, amount OM2 can be sold at price OP2 in sub-market B. Therefore, price OP2 will be set in sub-market B. Further, it should be noted that price will be higher in market A where the demand is less elastic than in market B where the demand is more elastic. Thus, price OP1 is greater than the price OP2 .

Fig. 28: Fixation of total output and price in the two sub-markets by the discriminating monopolist

Price discrimination is usually resorted to by a monopolist to secure higher profit and to acquire and sustain monopoly power. There is loss of economic welfare as the price paid is higher than marginal cost. Price discrimination also results in reduced consumer surplus. However, there are some favourable outcomes as well. The increase in revenue due to price discrimination will enable some firms to stay in business who otherwise would have made a loss. By peak load pricing, firms having capacity constraints will be able to spread its demand to off-peak times resulting in better capacity utilization and reduction in costs of production. Many essential services (e.g. railways) cannot be profitably run unless price discrimination is followed. Some consumers, especially, poor consumers, will benefit from lower prices as they would not have been able to purchase the good or service if uniform high prices are charged for all consumers.

Economic effects of monopoly

1) Monopoly is often criticized because it reduces aggregate economic welfare through loss of productive and allocative efficiency.

2) Monopolists charge substantially higher prices and produce lower levels of output than would exist if the product were produced by competitive firms.

3) Monopolists earn economic profits in the long run which are unjustifiable.

4) Monopoly prices exceed marginal costs and therefore reduces consumer surplus. There is a transfer of income from the consumers to the monopolists. Not only that consumers pay higher prices, but they would also not be able to substitute the good or service with a more reasonably priced alternative.

5) Monopoly restricts consumer sovereignty and consumers’ opportunities to choose what they desire.

6) Monopolists may use unjust means for creating barriers to entry to sustain their monopoly power. They often spend huge amount of money to maintain their monopoly position. This leads increases average total cost of producing a product.

7) A monopolist having substantial financial resources is in a powerful position to influence the political process in order to obtain favourable legislation.

8) Very often, monopolists do not have the necessary incentive to introduce efficient innovations that improve product quality and reduce production costs.

9) Monopolies are able to use their monopoly power to pay lower prices to their suppliers. 10) The economy is also likely to suffer from ‘X’ inefficiency, which is the loss of management efficiency associated with markets where competition is limited or absent.

Since monopolies are exploitative and generate undesirable outcomes in the economy, a number of steps are taken by governments to prevent the formation of monopolies and to regulate them if they are already present.