Class 12 Economics Solved Paper (2012 Outside Delhi Set-I) | Additional Study Material for Commerce PDF Download

Ques 1: Define microeconomics.

Ans: Micro Economics is the branch of Economics, in which we study the behaviour of individual. Economic units like a firm, a consumer, an industry etc.

Ques 2: Give one reason for a shift in demand curve.

Ans: A demand curve shifts when there is a change in a factors other than own price of the product.

Ques 3: What is the behaviour of Total Variable Cost, as output increases?

Ans: When output increases total variable cost also increases initially at a decreasing rate. After a point it increases at increasing rate.

Ques 4: What is the behaviour of Marginal Revenue in a market in which a firm can sell any quantity of the output it produces at a given price?

Ans: In the given situation marginal revenue in the market will always remain the same. This situation known as perfect competition.

Ques 5: What is a price-maker firm?

Ans: A price maker firm is one which participates in fixing the price of the product.

Ques 6: Define Production Possibility Curve. Explain why it is downward sloping from left to right.

Ans: A production possibility curve is a hypothetical representation. Which represents the amount of two different goods that can be produced with the full use of given resources in an economy under technological conditions.

PP curve slopes downward from left to right because of the fact that in a combination if we produce more of one good with limited resources, the less we produce of the another good.

Ques 7: A consumer consumes only two goods X and Y and is in equilibrium Price of X falls. Explain the reaction of the consumer through the Utility Analysis.

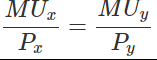

Ans: The basic condition fulfilling the condition of consumer?s equilibrium when two commodities according to utility analysis is:

If the price of X falls, per rupee marginal utility of X will increase and becomes more than of Y. the consumer will transfer expenditure from Y to X, and will buy more of X.

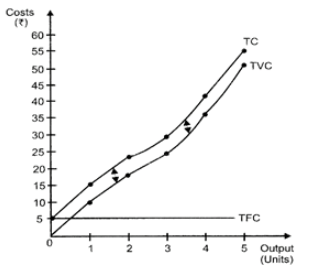

Ques 8: Draw Total Variable Cost, Total Cost. Total Fixed Cost curves in a single diagram.

Ans:

In the short period the total cost is the sum of total variable cost (TVC) and total fixed cost (TFC). Total variable cost initially increases with the increase in output at a decreasing rate and after that it increases at an increasing rate. Therefore total cost initially increases at a decreasing rate and after that increases at an increasing rate.

Ques 9: A producer starts a business by investing his own savings and hiring the labour. Identify implicit and explicit costs from this information. Explain.

Ans: Implicit cost: The producer is using his own savings in his business which elsewhere would have earned interest. Therefore the value of the interest on the savings invested is implicit cost.

Explicit cost: When producer is hiring labour for his business than the cost of hiring the labour involves expenditure given by the producer. Therefore the wages paid to the labour will be explicit cost.

Ques 10: Explain the implications of large number of buyers in a perfectly competitive market.

Or

Explain why there are only a few firms in an oligopoly market.

Ans: The implication of large number of buyers in a perfectly competitive market is that no individual buyer can affect the market demand for a commodity. In a perfect competition market, the number of buyers is so large and each individual buyers purchases only a small portion of the total output. As a result, no single buyer can influence the prevailing market price. He can only decide the quantities of the commodity to purchase and cannot influence the existing price.

Or

Under oligopoly there are only a few large firms, each produces a significant portion of the market output. There are some barriers, such as patents, large capital requirement, control over raw material, etc. which prevent new firms from entering into industry. Small firms, in general, do not survive because of the threat of competition, though they are independent to exist.

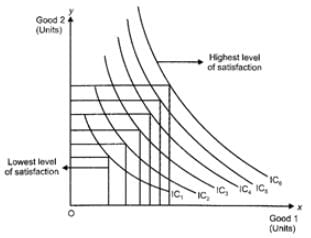

Ques 11: Define an indifference map. Why does an indifference curve show more utility towards right? Explain

Ans: Indifference map is a family of collection of indifference curves that depicts the different levels of satisfaction and preferences of a consumer. Each indifference curve in an indifference map depicts a particular level of satisfaction.

Higher IC denotes higher level of satisfaction and lower IC denotes lower level of satisfaction.

The above figure depicts an Indifference Map comprising of six indifference curves (from IC1 to IC6). As the consumer moves farther away from IC1 to higher indifference curves the level of satisfaction derived by the consumer increases. IC6 Depicts the highest level of satisfaction. On the other hand, IC1 depicts the lowest level of satisfaction.

An indifference curve is downward sloping from left to right. It implies that a consumer cannot simultaneously have more of both the goods. An increase in the quantity of one good is associated with the decrease in the quantity of the other good. This is in accordance with the assumption monotonic preferences.

Ques 12: A consumer buys 10 units of a commodity at a price of Rs. 10 per unit. He incurs an expenditure of Rs. 200 on buying 20 units. Calculate price elasticity of demand by the percentage method. Comment upon the shape of demand curve based on this information.

Ans:

Price (Rs.) | Quantity (units) | Total Expenditure (Rs.) |

10 | 10 | 100 |

10 | 20 | 200 |

P = Rs. 10, P1= Rs. 10, Q = 10, Q1= 20

ΔP=10−10=0, ΔQ=20−10=10

Since the price remains the same the shape of demand curve will be perfectly elastic. Demand Curve will be parallel to x-axis.

Ques 13: What does the Law of Variable Proportions show? State the behaviour of marginal product according to this law.

Or

Explain how changes in price of inputs influence the supply of a product.

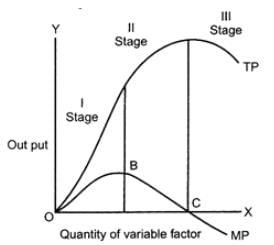

Ans: The law of variable proportions shows how the product will be affected if one factor is variable and other is fixed. The law explains if the units of a variable factor are increased the total product will also increase. This law can be divided into three stages. The behaviour of MP curve will be as shown in the diagram.

(i) In the first stage, the firm starts from the point of original to the point where MP curve is maximum. According to diagram this stage is from point of origin to point B. In this stage MP curve rises and reaches the maximum.

(ii) In the second stage, MP curve ranges from point B (where it is maximum) to point C (where it is zero) i.e., MP decreases but is positive.

(iii) The third stage goes from point C and goes below X-axis. In this phase, MP decrease and gets negative. Therefore a firm always operates in the second stage.

Or

The increase in. the cost of input or factors of production leads to an increase In. the cost of production, which affects the supply of a commodity. Example: When the prices of factors increases, the cost of production also increases. In the result, the supply of commodity will be less at a given price.

Similarly, when the cost of inputs and the factors of production fall the cost falls. The cost of the product will not be changed. In this case producer will get profit. This induces producers to supply more.

Ques 14: Explain the difference between (i) Inferior goods and normal goods and (ii) Cardinal utility and ordinal utility. Give example in each case.

Ans:

(i) Inferior goods are those goods whose demand falls with the increment in income of consumers. This is because when income rises the consumers want superior goods than before. Those goods which are affected negatively are called inferior goods.

Normal goods are those goods whose demand increases with the increment in income and vice-versa.

In short, when income increases the demand of normal goods increases and the demand of inferior goods decreases.

(ii) Cardinal Utility means the utility derived from units can be measured in numerical terms. Such as utility from first unit consumed is 8, from the unit consumed is 6 etc. Unit analysis approach explains consumer?s behaviour which is based on cardinal approach.

Ordinal Utility approach explains the consumer?s behavior in the case of preferences of the combination of two commodities instead of adopting cardinal utility approach.

ndifference curve approach is basically based on ordinal approach because the fact that indifference curves express the level of satisfaction of the consumers which may be more or less. It cannot be measured in numerical terms.

Ques 15: Explain the difference between 'change in quantity supplied' and 'change in supply'. Use diagram.

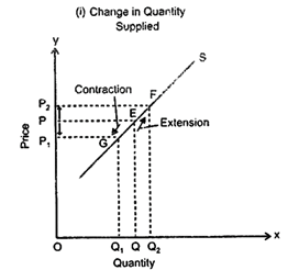

Ans: Change in quantity supplied means the changes in supply which are caused by the changes in the price of the good, other things remaining constant. In this case, when price increases quantity supplied also increases and when price falls quantity supplied also falls. In this case, a movement along the supply curve takes place upwards or downwards as the case may be. As shown below in the diagram, when price increases from OP to OP2, there is a movement on supply curve from point E to point F. On the other hand, when price falls from OP to OP1, there is a movement downward on the supply curve from point E to point G. When price increases, Quantity supplied also increases and hen price falls, quantity supplied also falls. This is clear looking at the diagram (i).

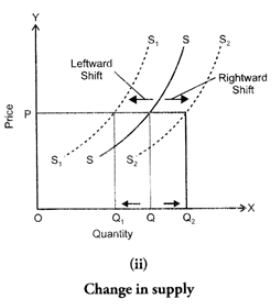

Change in supply. In case of change in supply, supply supplied increases or decreases due to factors other than price. These factors may be price of other commodities, state of technology, cost of production etc. In short, in the case of change in supply, the supply is either more or less at the same price.

In the case of change in supply, a shift takes place in the supply curve towards right when there is an increase in supply and towards left when there is a decrease in supply. As shown in the Diagram (ii), when supply curve shifts to S1S1 supply falls from OQ to OQ1, On the other hand, when there is a shift in supply curve from SS to S2S2 supply increases from OQ to OQ2. In both the cases price remains the same, i.e., OP.

Ques 16: Market for a good is in equilibrium. There is simultaneous 'decrease' both in demand and supply but there is no change in market price. Explain with the help of a schedule how it is possible.

Or

Market for a good is in equilibrium. Explain the chain of reaction in the market if the price is (i) higher than equilibrium price and (ii) lower than equilibrium price.

Ans: When the Quantity Supplied and Quantity demanded are equal then the market price is in equilibrium. According to the demand supply schedule given below, the equilibrium price is Rs. 7 where the quantity of demand and supply both are 16 units in other situation there is simultaneous decrement in both supply and demand but there is no change in market price. Therefore according to the new condition di and Si is drawn. There is no change in market price, new demand and supply are equal at 12 units. Therefore the equilibrium quantity is 16 in the original condition. In the new situation equilibrium quantity is different but the price is the same i.e., Rs. 7. This has been possible because there is equal decrease both in demand and supply in the new situation. It is because of that the equilibrium quantity has fallen from 16 to 12 units.

| Demand | Supply | ||

(Rs.) | D | D1 | S | S1 |

5 | 24 | 20 | 9 | 4 |

6 | 29 | 16 | 12 | 6 |

7 | 16 | 12 | 16 | 12 |

8 | 12 | 8 | 20 | 16 |

9 | 8 | 4 | 24 | 20 |

10 | 4 | 0 | 28 | 24 |

Or

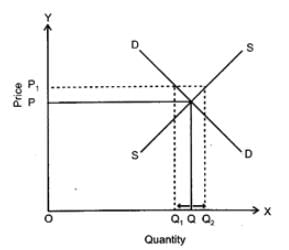

(i) When market price is higher than the equilibrium price. There is excess supply of goods and producers are not in a situation to sell all they want to sell at the given price. This leads to competition among producers which leads to lowering of price which in turn raises the demand and the supply reduces.

As shown in the diagram, equilibrium price is OP where equilibrium quantity is OQ. Say, if market price is fixed at OP1 then there will be disequilibrium between demand and supply. Demand will be OQ1 and supply OQ2, thus there will be excess of supply equal to Q1Q2. For bringing equality between demand and supply, market price should be reduced from OP1 to OP, so that there is no excess supply.

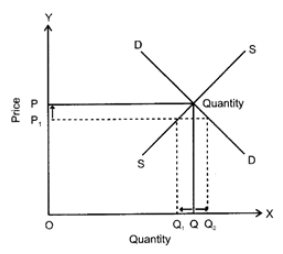

(ii) When market price is lower than the equilibrium price.

There is excess demand and consumers are not able to buy all they want to buy at the given price. This leads to competition between consumers which leads to a rise in price. Rise in price reduces demand while raises supply. As shown in the diagram equilibrium price is OP and quantity demanded OQ. If OP1 is fixed as market price (lower than the equilibrium price there will be excess demand equal to Q1Q2. Therefore for bringing about an equality between demand and supply market price needs to be increased from OP1 to OP, so that there is no excess demand.

Ques 17: Define flow variable.

Ans: Flow variable refers to those variables that are measured over a period of time. These variables have an element of time attached to them. For example, interest earned on bank deposits for 1 year, i.e., from October 01, 2009 to October 30, 2010 is a flow variable.

Ques 18: Define consumption goods.

Ans: Consumption goods are those goods which are ready for the consumption in satisfaction of human needs and wants and are not used in the production of another goods.

Ques 19: What are time deposits?

Ans: Those bank deposits which cannot be withdrawn before the expiry time which has already decided. These are bank deposits, such as fixed deposits.

Ques 20: Define a 'direct tax'.

Ans: Direct tax is a tax whose liability cannot be shifted to any other person. Example - Income tax.

Ques 21: What is a fixed exchange rate?

Ans: Fixed exchange rate is fixed by the Government Central Bank.

Ques 22:

Find Net Value Added at Market Price: | ||

(i) | Depreciation (Rs.) | 700 |

(ii) | Output sold (units) | 900 |

(iii) | Price per unit of output (Rs.) | 40 |

(iv) | Closing stock (Rs.) | 1,000 |

(v) | Opening stock (Rs.) | 800 |

(vi) | Sales tax (Rs.) | 3,000 |

(vii) | Intermediate cost (Rs.) | 20,000 |

Ans:

Net Value Added at Market Price

= (Units of output sold x Price per unit of output) + Closing stock - Opening stock - Intermediate cost - Depreciation

= (ii) × (iii) + (iv) - (v) - (vii) - (i)

=(900× 40)+1,000−800−20,000−700

=36,000+1,000−21,500 = Rs. 15,500

Ques 23: Outline the steps taken in deriving Consumption Curve from the Saving Curve. Use diagram.

Ans: Before deriving consumption curve from saving curve we should know the following:

(i) Y=C+S

∴ S=Y−C

(ii) C = Autonomous consumption + That part of income which is consumed, as such.

When C is positive, saving is negative and when C = Y, S = 0

(iii) On the basis of this information, we can draw consumption curve and saving curve as shown in the diagram.

In the diagram, SS is saving curve. At OS level of income C = Y, therefore S is zero. Beyond that SS becomes positive.

When SS is positive consumption is less than income and the part of consumption curve is MC.

Ques 24: Find Consumption Expenditure from the following:

National Income = Rs. 5,000

Autonomous Consumption = Rs. 1,000

Marginal propensity to consume = 0.80

Ans:

National Income, Y= Rs. 5,000

Autonomous consumption (a) = Rs. 1,000

Marginal propensity to consume (b) = 0.80

∴ Consumption, (C) =a+bY=1,000+0.8(5,000)=1,000+4,000=Rs. 5,000

Ques 25: Distinguish between receipts and receipts in a government budget. Give example in case.

Or

Explain the role of government budget in economic stability.

Ans:

Revenue receipts are those which do not either create a liability or lead to a reduction in assets, such as tax revenue.

Capital receipts are those funds which government raises either by incurring liability or by disposing of assets, such as recovery of loans, loans raised etc.

Or

Ensuring economic stability is one of the important objectives of a government budget. Government aims at insulating me economy from major economic fluctuations (such as inflation, unemployment, etc.) and the business cycles such as boom recession, depression and recovery. It aims at achieving higher economic growth rate while combating such situations.

Through the budget policy, government aims at maintaining price and employment stability. This aim of economic growth with stability ensures a smooth and efficient functioning of an economy.

Ques 26: Should the following be treated as final expenditure or intermediate expenditure? Give reasons for your answer.

(i) Purchase of furniture by a firm.

(ii) Expenditure on maintenance by a firm.

Ans:

(i) Purchase of furniture by a firm is a final expenditure because firm does not invest on the furniture daily. So it is a kind of investment.

(ii) Expenditure on maintenance by a firm is an intermediate expenditure because it occurs again and again and is not of permanent nature.

Ques 27: Explain the 'lender of last resort' function of the central bank.

Or

Explain 'government's banker? function of the central bank.

Ans: When commercial banks exhaust all resources to supplement their funds at the time of liquidity crisis, the Central bank acts as the lender of the last resort for them.

When Commercial banks cannot meet obligations of their depositors, the Central bank comes to their help. The Central Bank advances credit against eligible securities subject to certain terms and conditions. This saves the Commercial banks from a possible breakdown. This is an important function of the Central banks in the banking system of a country

Or

The Central bank works as a Commercial bank for the government. Central bank provides all services and facilities to the government like ordinary banks provides services to public. Central Bank manages funds of all government departmental undertakings and the funds of government. It also provides loans when government needs. It manages Public debt also. It also accepts the payment of taxes from the public on the behalf of the government and makes payment for the cheques issued by government. Deficit financing through borrowing from RBI.

Ques 28: Explain the concept of 'fiscal deficit' in a government budget. What does it indicate?

Ans: Fiscal deficit refers to the excess of total Expenditure over total receipts during the given fiscal year including borrowings.

(a) If fiscal deficit is increasing then the amount of debt repayment is also increasing. The total borrowing of the government are increasing.

(b) If government requires borrowing then it may borrow from Reserve Bank of India. When RBI prints new currency to meet the deficit requirements it increases the money supply in the economy and creates inflationary pressure.

(c) The debt and financial burden of interest payments on the revenue expenditure causes a reduction on the capital expenditure for growth and development of the economy.

Ques 29:

Find out (a) Gross National Product at Market Price and (b) Net Current Transfers to Abroad: | ||

(Rs. crores) | ||

(i) | Private final consumption expenditure | 1,000 |

(ii) | Depreciation | 100 |

(iii) | Net national disposable income | 1,500 |

(iv) | Closing stock | 20 |

(v) | Government final consumption expenditure | 300 |

(vi) | Net indirect tax | 50 |

(vii) | Opening stock | 20 |

(viii) | Net domestic fixed capital formation | 110 |

(ix) | Net exports | 15 |

(x) | Net factor income to abroad | (-) 10 |

Ans:

(a) GNPMP

= Private final consumption expenditure + Government final consumption expenditure + (Net domestic fixed capital formation + Closing stock - Opening stock + Depreciation) + Net exports - Net factor income to abroad.

= (i) + (v) + [(viii) + (iv) - (vii) + (ii)] + (ix) - (x)

=1,000+300+110+20−20+100+15−(−10)

=1,300+210+15+10=Rs. 1.535 crore

(b) Net Current Transfers to Abroad

= GNPMP - Depreciation - Net national disposable income

= GNPMP - (ii) - (iii)

=1,535−100−1,500

= Rs. (-) 65 crore

Ques 30: Explain the concept of 'inflationary gap'. Also explain the role of 'legal reserves' in reducing it.

Or

Explain the concept of 'deflationary gap'. Also explain the role of 'margin requirements' in reducing it.

Ans:

Inflationary Gap: The situation of inflationary gap arises when equilibrium is established after the stage of full employment. The excess of aggregate demand over aggregate supply at the full employment level is inflationary gap. For bringing equality between AD and AS as the full employment level AD has to be reduced because AS cannot be increased since all the resources are fully employed.

(i) Legal reserves: Legal reserves refer to a minimum percentage of deposits commercial banks have to keep as cash either with themselves or with the central bank. The central bank has the power to change it. When there is inflationary gap the central bank can raise the minimum limit of these reserves so that less funds are available to the bank for lending,

This will reduce Aggregate Demand.

(ii) Bank rate: Bank rate is the rate of interest which central bank charges from commercial banks for giving them loans. It bank rate is increased, the rate of interest for general public also goes up and this reduces the demand for credit by the public for investment and consumption. Therefore, for controlling the situation of inflationary gap, bank rate is increased. This ultimately will lead to the decline in the demand for credit Decline in the volume of credit as a component of money supply will have controlling pressure on inflationary forces.

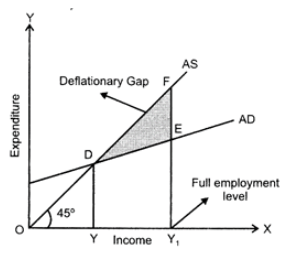

Or

The situation of deflationary gap arises when equilibrium is established before the stage of full employment of output. In this case, at the full employment level, aggregate demand is less than aggregate supply. In the diagram, DEF is deflationary gap. For removing deflationary gap, the level of aggregate demand needs to be increased.

Margin requirements. Commercial banks never advance loans to its customers equal to the full value of collateral or securities. They always keep a margin with them, such as keeping a margin of 20% and advancing loans equal to 80% of value of security. The rate of margin is determined by the Central bank. In the situation of deflationary gap, this margin will be reduced so that more credit may be advanced against the security.

Ques 31: Give the meaning of 'foreign exchange' and 'foreign exchange rate'. Giving reason, explain the relation between foreign exchange rate and demand for foreign exchange.

Ans:

Foreign exchange: It means foreign currency. It also means the stock of foreign currency of a country. The total reserves of foreign currency is the stock of foreign currencies that a country holds at a given time.

Exchange rate: The rate for exchanging domestic currency (say Rs.) into another currency (say US$) is known as exchange rate. The rate of exchange represents the value of home currency.

For Example if US$1 is equal to 60.86 Indian rupees then exchange rate between American dollar and Indian rupee is $1=Rs.60.86.

There is an inverse relationship between foreign exchange rate and demand for foreign exchange. Higher is the exchange rate, and lower is the demand for foreign exchange and vice - versa. The inverse relation between the two can be explained by an example if price of US dollar in India falls down from Rs. 60.86 to 55 it means now Indian people will pay 55 for US $1 instead of Rs. 60.86. This means American goods have become cheaper for Indians. When exchange rate decreases, the demand of foreign currency decreases and vice-versa.

|

4 videos|168 docs

|