Class 12 Economics Solved Paper (2012 Delhi Set-III) | Additional Study Material for Commerce PDF Download

Ques 1: State reasons why does an economic problem arise?

Ans: The following are the main causes due to which every economy faces economic problem.

(i) Unlimited human wants: Human wants never-ends and they keep on arising. The unlimited human wants require unlimited resources to get fulfilled. But no matter how well an economy is endowed with resources, it will fall short to fulfill every wants.

(ii) Limited availability of resources: Every economy has unlimited wants but its endowment of resources remains scarce to fulfill these unlimited wants.

(iii) Alternative uses: The scarce available resources have alternative uses. This implies resources can be allocated to the production of different goods and services. The allocation of resources to one use involves a cost in terms of sacrifice of the other possible uses. Therefore, every economy has to decide the allocation of its resources in the best possible manner by analyzing the opportunity cost.

Ques 2: A producer invests his own savings in starting a business and employs a manager to look after it. Identify implicit and explicit costs from his information. Explain.

Ans: In this implicit cost consists of imputed value of the interest on the saving and the explicit cost consists of the salary paid to the manager.

Implicit cost (Imputed cost) refers to cost of the factor that a producer neither hires nor purchases. Such costs are not actually paid by the producers yet are included in the cost of production. It is a difference between the economic profit and accounting profit. On die other hand, explicit costs are those costs that are borne directly by a firm and are paid to the factors of production. Another way of distinguishing the two is that while explicit costs are referred to as out-of-pocket expenses, on the other hand, implicit costs do not result in any cash outlay from the business. Thus, in the case given, the salary is to be paid to the manager, so it is considered as explicit cost, while, the costs of investing (interest) producer?s saving is considered as implicit costs, as no cash is expended for borrowings these funds (savings).

Ques 3: Define an indifference map. Explain why an indifference curve to the right shows higher utility level.

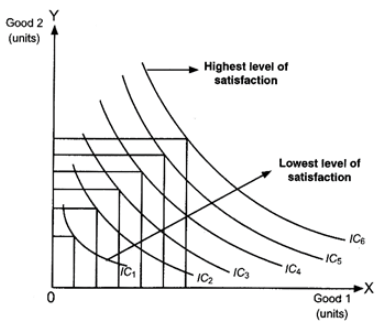

Ans: Indifference map is a family or collection of indifference curves that depicts the different levels of satisfaction and preferences of a consumer. Each indifference curve in an indifference map depicts a particular level of satisfaction.

Higher IC denotes higher level of satisfaction and lower IC denotes lower level of satisfaction.

The above figure depicts an Indifference Map comprising of six indifference curves (from IC1 to IC6). As the consumer moves farther away from IC1 to higher indifference curves the level of satisfaction derived by the consumer increases IC6 depicts the highest level of satisfaction. On the other hand, IC1 depicts the lowest level of satisfaction.

An indifference curve is downward sloping from left to right. It implies that a consumer cannot simultaneously have more of both the goods. An increase in the quantity of one good is associated with the decrease in the quantity of the other good. This is in accordance with the assumption of monotonic preferences & there is an inverse relation between good 1 & 2.

Ques 4: A consumer buys 20 units of a good at a price of Rs. 5 per unit. He incurs an expenditure of Rs. 20 when he buys 24 units. Calculate price elasticity of demand using the percentage method. Comment upon the likely shape of demand curve based on this information.

Ans:

Price (P) | Quantity (Q) | Total Expenditure (TE) |

5 | 20 | 100 |

5 | 24 | 120 |

We know,

Price × Quantity = Total Expenditure

or, Price × 24 = 120

or, Price = 5

Now,

Percentage change in quantity =

Percentage change in price =

Substituting the values in the formula of price elasticity of demand,

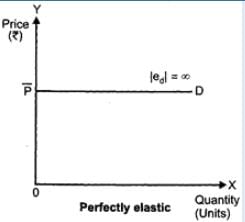

ed = 20/0 = ∞

Thus, the demand is perfectly elastic.

As the demand is perfectly elastic, so the demand curve is a horizontal straight line parallel to the quantity-axis.

Hence, the likely shape of demand curve is parallel to the x-axis, i.e., perfectly elastic.

Ques 5:

Find Net Value Added at Market Price: | ||

S. No. | Items | Amount |

(i) | Output sold (units) | 800 |

(ii) | Price per unit of output (Rs) | 20 |

(iii) | Excise (Rs) | 1,600 |

(iv) | Import duty (Rs) | 400 |

(v) | Net change in stocks (Rs) | (-) 500 |

(vi) | Depreciation (Rs) | 1,000 |

(vii) | Intermediate Cost (Rs) | 8,000 |

Ans: Net Value Added at Market Prices (NDPMP) = Total Value of Sales + Change in Stock - Intermediate Consumption ? Depreciation

NDPMP=(800× 20)+(−500)−8000−1000

or, NDPMP = Rs. 6,500

Ques 6: Find consumption expenditure from the followings

| Items | Amount |

| Autonomous consumption | Rs 100 |

| Marginal propensity to consume | 0.70 |

| National Income | Rs 1,000 |

Ans:

Given:

C = Rs. 100

MPC (b) = 0.70

Y = Rs. 1,000

To Calculate: Consumption Expenditure

Consumption Expenditure (C) =  −bY=100+0.70× 1,000=Rs. 800

−bY=100+0.70× 1,000=Rs. 800

Ques 7: Comparing reason explain how should the following be treated in estimating National Income:

(i) Interest paid by banks on deposits by individuals.

(ii) National debt interest.

Ans:

(i) Interest is a factor payment by a producer, so, interest paid by banks on deposits by individuals is included in the estimation of National Income.

(ii) National debt interest is a transfer payment and this loan is taken for consumption purposes. So, it is not included in the estimation of National Income.

Find out (a) Gross National Product at Market Price and (b) Net Current Transfers from abroad: | ||

(Rs. crore) | ||

(i) | Net Indirect Tax | 35 |

(ii) | Private final consumption expenditure | 500 |

(iii) | Net national disposable income | 750 |

(iv) | Closing stock | 10 |

(v) | Government final consumption expenditure | 150 |

(vi) | Net domestic fixed capital formation | 100 |

(vii) | Net factor income to abroad | (-) 15 |

(viii) | Net imports | 20 |

(ix) | Opening stock | 10 |

(x) | Consumption of fixed capital | 50 |

Ans:

(a) GNPMp

= Private final consumption expenditure + Government final consumption expenditure + (net domestic capital formation + Closing stock - Opening stock + Consumption of fixed capital - Net imports - Net factor income to abroad

= (ii) + (v) + [(vi) + (iv) - (ix) + (x)] - (viii) - (vii)

=500+150+(100+10−10+50)−20−(−5)=650+150−20+15\

=815−20=Rs. 795 crore

(b) Net Current Transfer from abroad

= Net national disposable income - (GNPMp- Consumption of fixed capital)

=750−795+50

=800−795=Rs. 5 crore

|

4 videos|168 docs

|

|

Explore Courses for Commerce exam

|

|