Question & Answer: Financial Statements of Not-for-Profit Organizations | Accounting for CA Foundation PDF Download

Multiple Choice Questions

Q.1. Scholarship granted to students out of specific funds provided by the Government will be debited to

(a) Income and Expenditure Account.

(b) Receipts and payments Account.

(c) Funds.

(d) None of the three.

Ans: (c)

Q.2. In the case of NPO, excess of total assets over liabilities is known as

(a) Profits.

(b) Surplus.

(c) Capital Fund.

(d) Accumulated Fund.

Ans: (c)

Q.3. General donations and legacies are credited to

(a) Receipts and Payments Account.

(b) Income and Expenditure Account.

(c) Capital Fund.

(d) Fund Account.

Ans: (b)

Q.4. Interest on prize funds is

(a) Credited to Income and Expenditure Account.

(b) Credited to Receipts and Payments Account.

(c) Capital Fund.

(d) Added to prize fund.

Ans: (d)

Q.5. Special aids are

(a) Treated as capital receipts.

(b) Treated as revenue receipts.

(c) Added to Capital Fund.

(d) Both (a) and (c)

Ans: (d)

Theory Questions

Q.1. Distinguish Between Receipt and Payment and Income and Expenditure Account.Ans:

| Particulars | Receipt and Payment A/c | Income and Expenditure A/c |

| Cash and Noncash transaction | Only cash transactions are recorded here. | It is not confined to, cash transactions only, i.e. non-cash transactions are also included in it. |

| Shows an items | Receipts are shown on the debit side and payments on the credit side. | All revenue incomes appear on the credit side and expenditure on the debit side. |

| Capital and revenue items | It includes both capital and revenue receipts & payment | It includes only income and expenditure of revenue nature |

| Balance sheet | It includes both capital and revenue items, so it need not necessarily be accompanied by a Balance Sheet. | It includes only revenue items, so it must be accompanied by a balance sheet, the balance sheet contains the remaining balances. |

| Type of Account | It is a Real Account | It is a Nominal Account |

| Transfer of Closing Balance | Its balance is carried over to Receipts & Payments Account of the next year. | Its balance is transferred to Capital Fund. |

| Opening Balance | This account shows opening balance except in the first year. | It has no opening balance. |

Transactions | Transactions relating to past, present and futures are recorded. | Transactions relating to current year only are recorded. |

| Adjustment | Adjustments are not considered, because it is prepared on cash basis of accounting. | Adjustments are considered necessary because it is prepared on accrual basis of accounting. |

| Use of Double Entry System | The double entry bookkeeping system is not followed while its preparation. | Double entry bookkeeping system is followed strictly while its preparation. |

Q.2. Not-for-profit organisations have some distinguishing features from that of profit organisations. State them.

Ans: Some features of NPO are:

- Such organisations are not required to pay income tax on net income.

- Service motive, hence earning profit is not their ultimate objective.

- Surpluses are not distributed among its members.

- Managed by elected members.

- Majorly their funds are collected in the form of donations, contributions, membership fees, etc.

Q.3. Differentiate between profit and not-for-profit organisations.

Ans:

| Feature | NPO | Profit Organisation |

| Motive | To serve the community interest | To earn profit |

| Ownership | NPO subscribers | Proprietors of the business |

| Sources of funds | Subscription amount, donations, contributions, etc. | Capital brought in by partners/proprietors, loan. |

| Final Accounts | Receipt and Payments A/c, Income and Expenditure A/c and Balance Sheet | Trading A/c, Profit and Loss A/c and Balance Sheet |

| Distribution of profits | Surplus or deficit is not distributed between members, else is adjusted in the Capital Fund | Profit and losses are distributed among the partners of the business. |

Q.4. Write any four features of Income and Expenditure Account?

Ans: The main features of Income and Expenditure Account are :

- It is prepared for an accounting period on the accrual concept following the matching principle. All expenses related to accounting year whether paid or not are recorded.

- Only revenue items are considered, while the capital item is excluded.

- All items both cash and non cash (depreciation) are recorded.

- Expenditure is recorded on the debit side and incomes on the credit side and ends with Surplus or Deficit as the case may be(difference between revenue and expenditure).

Q.5. What is endowment?

Ans: Endowment is a donation with a condition by the donor to use only the income earned from investment of such fund for some specified purpose so that the original donated amount remains intact.

Practical Questions

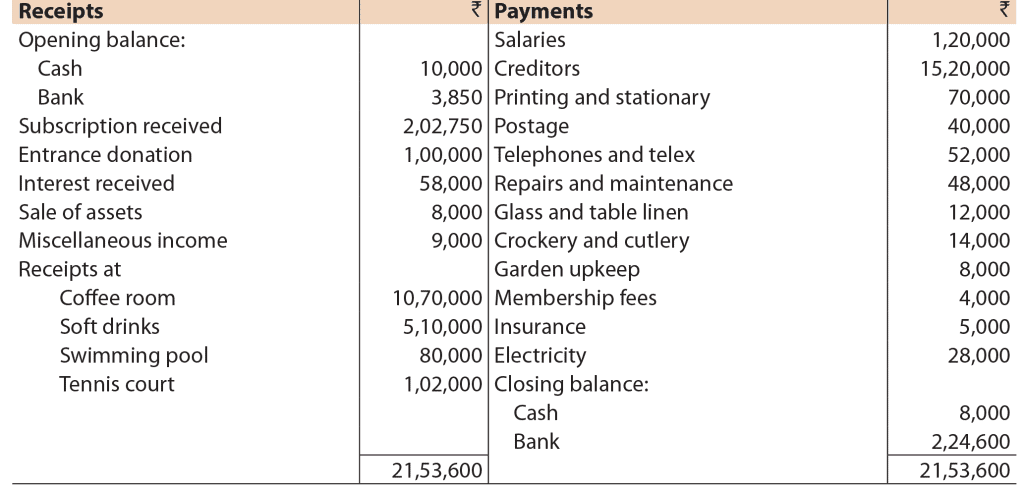

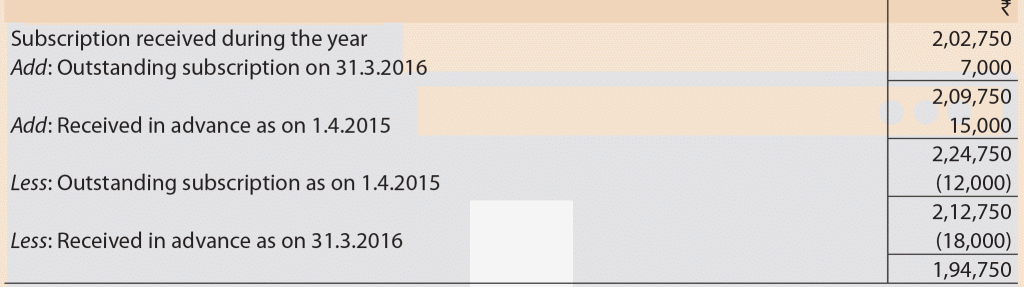

Q.1. The following is the Receipts and Payments Account of Lion Club for the year ended 31st March 2016.- Subscription received in advance as on 31st March, 2016 was Rs 18,000.

- Outstanding subscription as on 31st March, 2016 was Rs 7,000.

- Outstanding expenses are salaries Rs 8,000 and electricity Rs 15,000.

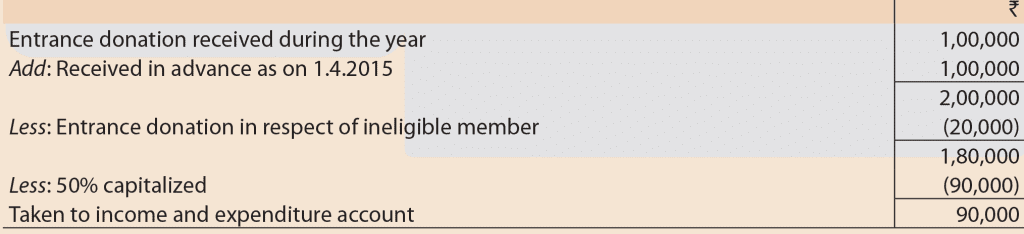

- 50% of the entrance donation was to be capitalized. There was no pending membership as on 31st March, 2016.

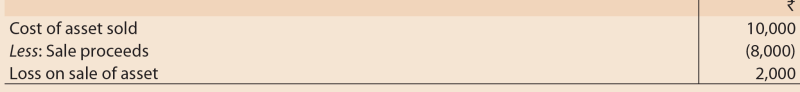

- The cost of assets sold net as on 1.4.2015 was Rs 10,000.

- Depreciation is to be provided at the rate of 10% on assets.

- A sum of Rs 20,000 received in October 2015 as entrance donation from an applicant was to be refunded as he has not fulfilled the requisite membership qualifications. The refund was made on 3.6.2016.

- Purchases made during the year amounted Rs 15,00,000.

- The value of closing stock was Rs 2,10,000.

- The club as a matter of policy, charges off to income and expenditure account all purchases made on account of crockery, cutlery, glass and linen in the year of purchase.

You are required to prepare an Income and Expenditure Account for the year ended 31st March, 2016 and the Balance Sheet as on 31st March, 2016 along with necessary workings.

Ans:

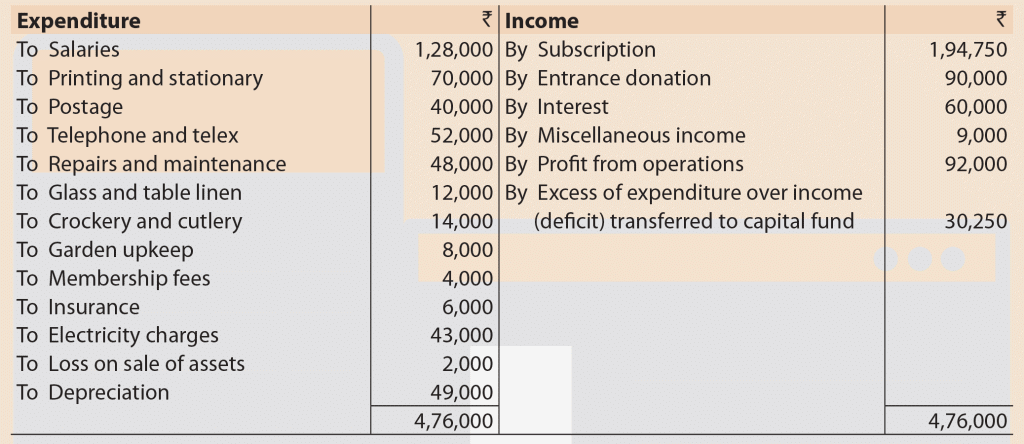

Income and Expenditure Account of Lion Club for the year ended 31st March, 2016

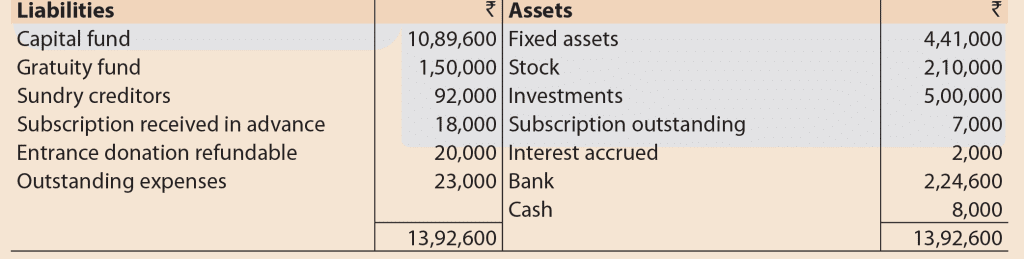

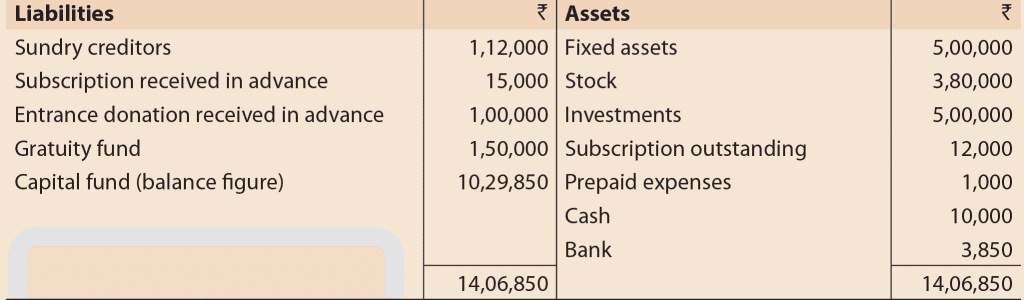

Balance Sheet of Lion Club as on 31st March, 2016

Working Notes:

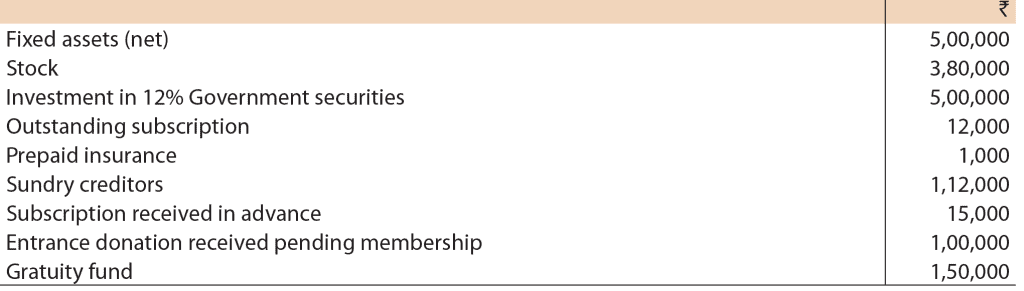

Opening Balance Sheet Balance Sheet of Lion Club as on 1st April, 2015

2. Subscription

3. Entrance donation

4. Loss on sale of asset

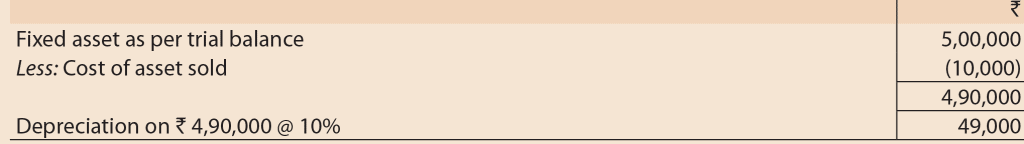

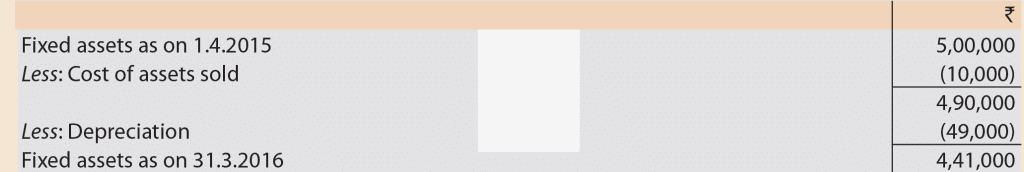

5. Depreciation

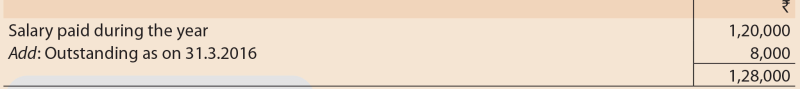

6. Salaries

7. Electricity charges

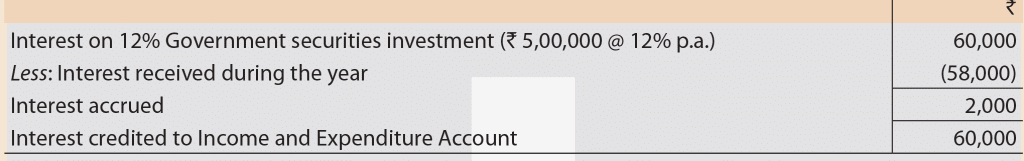

8. Interest

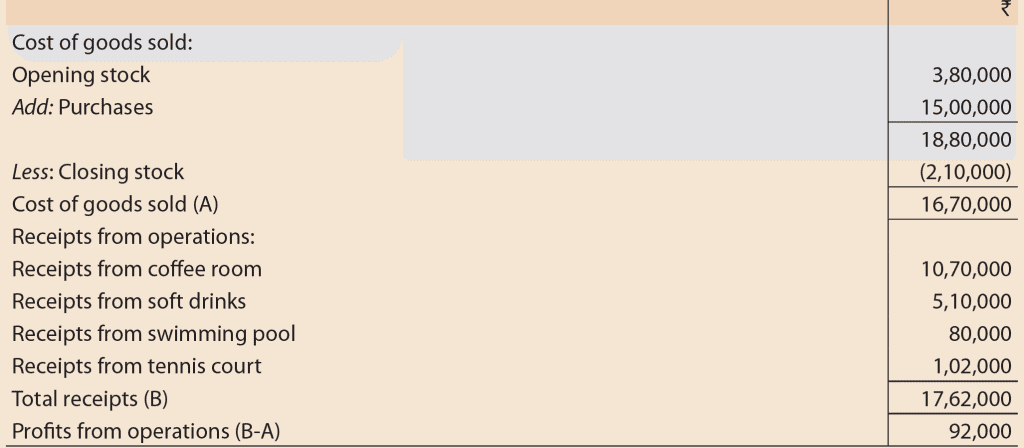

9. Profit from operations

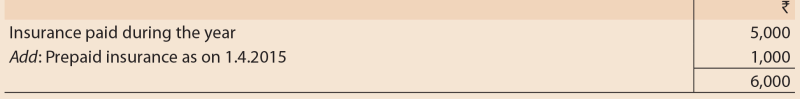

10. Insurance

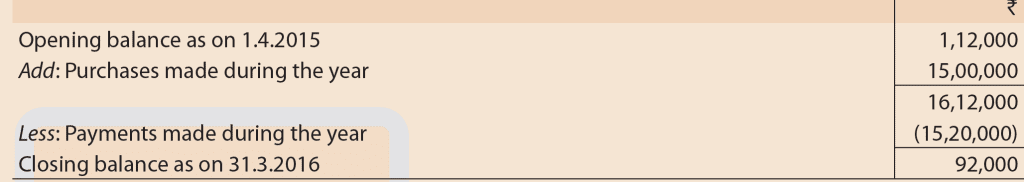

11. Sundry creditors

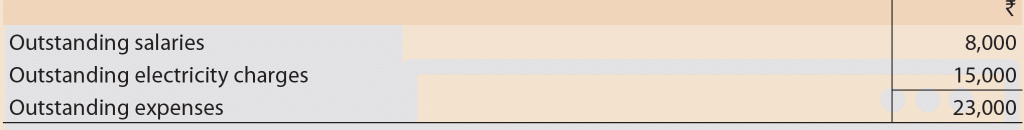

12. Outstanding expenses

13. Fixed assets

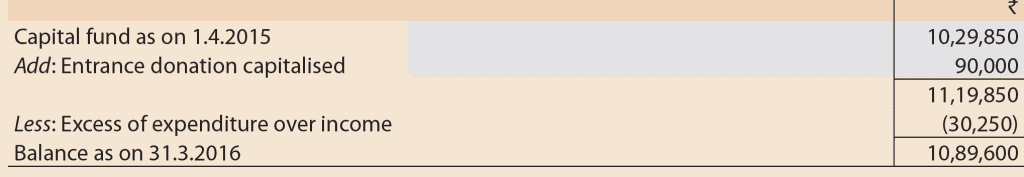

14. Capital fund

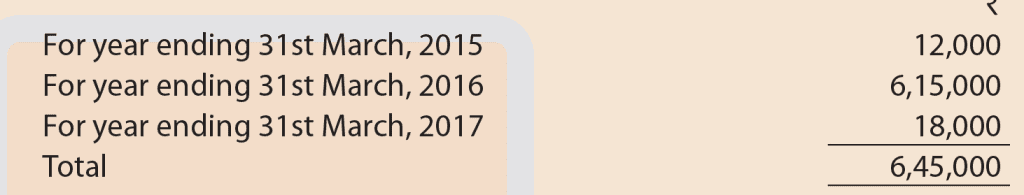

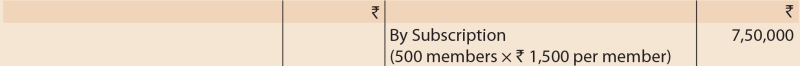

Q.2. During the year ended 31st March, 2016, Sachin Cricket Club received subscriptions as follows: There are 500 members and annual subscription is Rs 1,500 per member.

There are 500 members and annual subscription is Rs 1,500 per member.

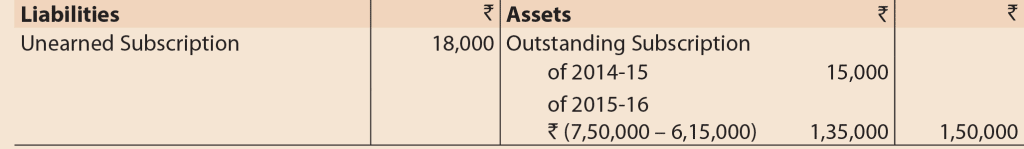

On 31st March, 2016, a sum of Rs 15,000 was still in arrears for subscriptions for the year ended 31st March, 2015. Ascertain the amount of subscriptions that will appear on the credit side of Income and Expenditure Account for the year ended 31st March, 2016. Also show how the items would appear in the Balance Sheet as on 31st March, 2015 and the Balance Sheet as on 31st March, 2017.

Ans:

Income & Expenditure Account (An extract) of Sachin Cricket Club For the year ended 31st March, 2016

Balance Sheet of Sachin Cricket Club as on 31st March, 2015 (An extract)

Balance Sheet of Sachin Cricket Club as on 31st March, 2016 (An extract)

Q.3. Summary of receipts and payments of Bombay Medical Aid society for the year ended 31.12.2016 are as follows:

Opening cash balance in hand Rs 8,000, subscription Rs 50,000, donation Rs 15,000 (raised for meeting revenue expenditure), interest on investments @ 9% p.a. Rs 9000, payments for medicine supply Rs 30,000 Honorarium to doctor Rs 10,000, salaries Rs 28,000, sundry expenses Rs 1,000, equipment purchase Rs 15,000, charity show expenses Rs 1,500, charity show collections Rs 12,500.

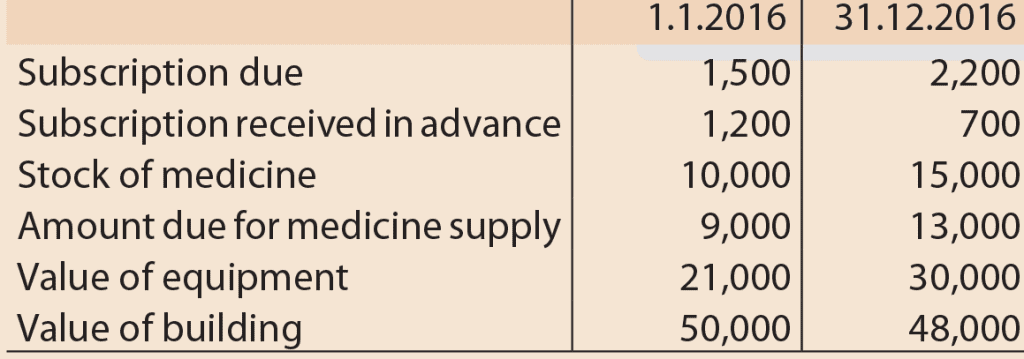

Additional information: You are required to prepare receipts and payments account and income and expenditure account for the year ended 31.12.2016 and balance sheet as on 31.12.2016.

You are required to prepare receipts and payments account and income and expenditure account for the year ended 31.12.2016 and balance sheet as on 31.12.2016.

Ans:

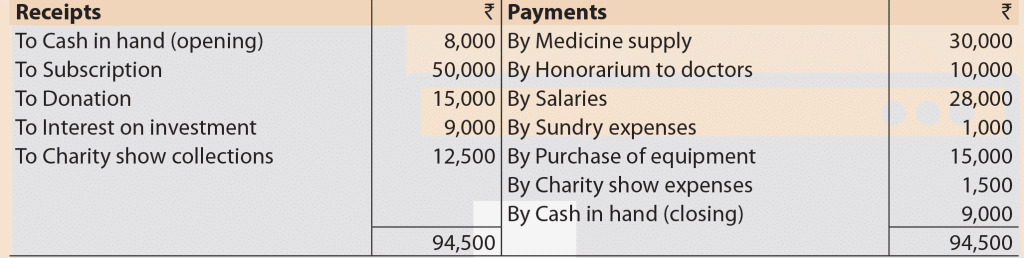

Receipts and Payments Account of Bombay Medical Aid Society for the year ended 31st December, 2016 Income and Expenditure Account of Bombay Medical Aid Society for the year ended 31st December, 2016

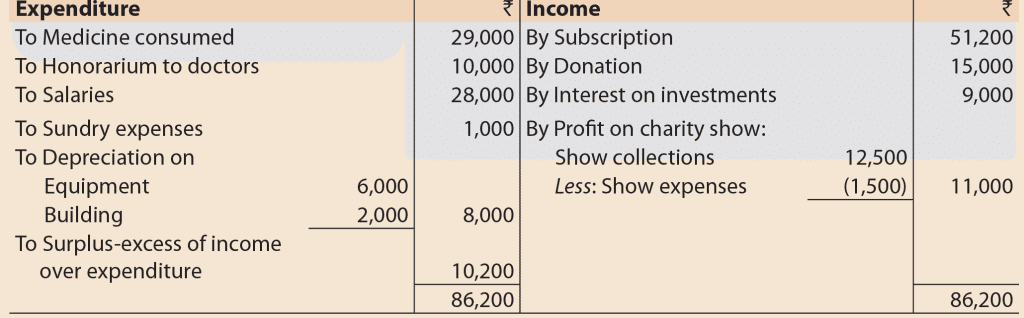

Income and Expenditure Account of Bombay Medical Aid Society for the year ended 31st December, 2016

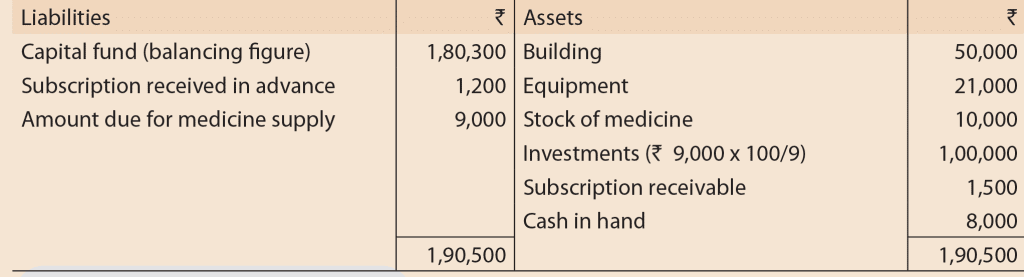

Balance Sheet of Bombay Medical Aid Society as on 31st December, 2016

Liabilities | Assets | ||||

Capital fund: Opening balance | 1,80,300 | Building Less: Depreciation | 50,000 (2,000) | 48,000 | |

Add: Surplus | 10,200 | 1,90,500 | Equipment | 21,000 | |

Subscription received in advance |

| 700 | Add: Purchase | 15,000 | |

Amount due for medicine supply |

| 13,000 |

| 36,000 | |

|

|

| Less: Depreciation | (6,000) | 30,000 |

|

|

| Stock of medicine | 15,000 | |

|

|

| Investments | 1,00,000 | |

|

|

| Subscription receivable | 2,200 | |

|

|

| Cash in hand | 9,000 | |

|

| 2,04,200 | 2,04,200 | ||

|

|

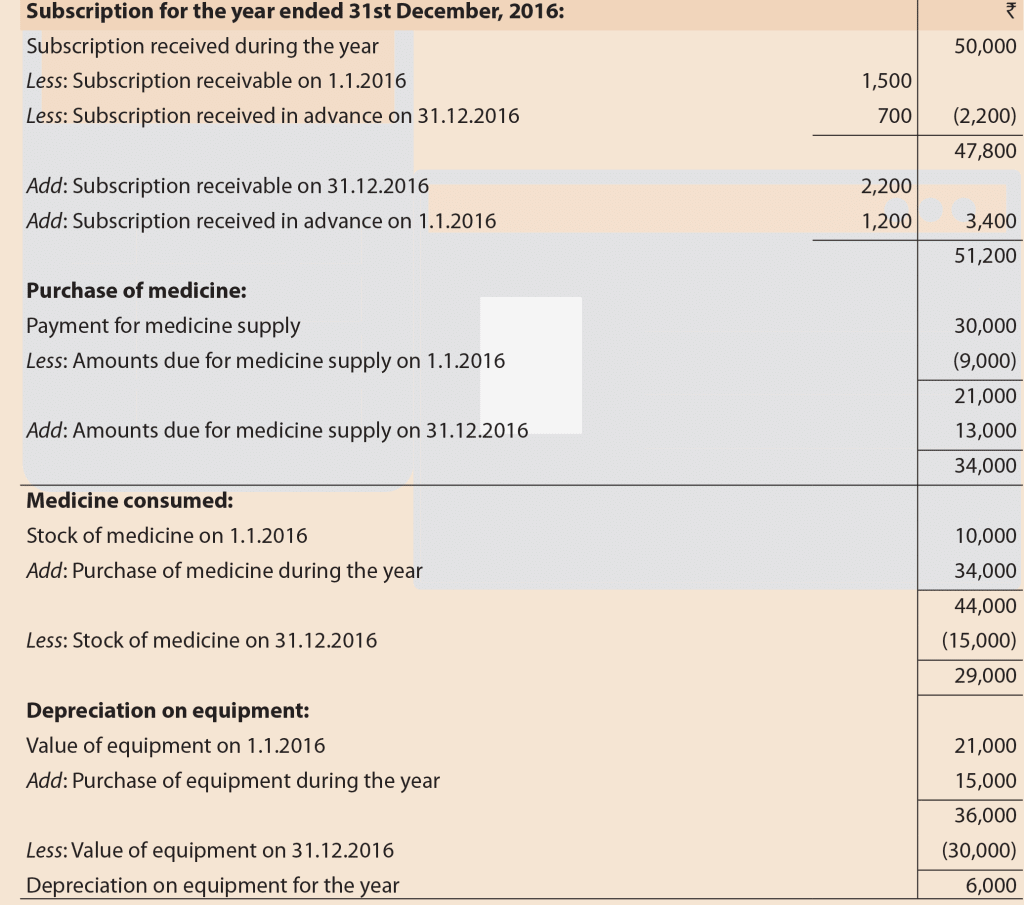

Working Notes:

Balance Sheet of Medical Aid Society as on 1st January, 2016

|

68 videos|160 docs|83 tests

|

FAQs on Question & Answer: Financial Statements of Not-for-Profit Organizations - Accounting for CA Foundation

| 1. What are financial statements of not-for-profit organizations? |  |

| 2. What is the difference between financial statements of for-profit organizations and not-for-profit organizations? |  |

| 3. What is the purpose of financial statements of not-for-profit organizations? |  |

| 4. What are the common financial ratios used in analyzing financial statements of not-for-profit organizations? |  |

| 5. What are the steps involved in preparing financial statements of not-for-profit organizations? |  |