Origin of Transactions- Source Documents and Preparation of Vouchers | Accountancy Class 11 - Commerce PDF Download

Q.1. The following transactions took place in M/s. Goodluck Computers. Prepare the Accounting Vouchers:

Transactions marked with * are subject to levy of CGST and SGST @ 6% each.

Ans. (i) Bought Computer Mouse (4 Nos.) vide Cash Memo No.338*

(ii) Wages paid for the month of December, 2016

(iii) Purchased two Desktop Computers from M/s. Computech for cash vide Cash Memo No. 170* (iv) Paid cash to Hari & Sons vide receipt No. 102 for repairs*

(iv) Paid cash to Hari & Sons vide receipt No. 102 for repairs*

(v) Paid postage

(v) Paid postage (vi) Cash withdrawn from bank.

(vi) Cash withdrawn from bank.

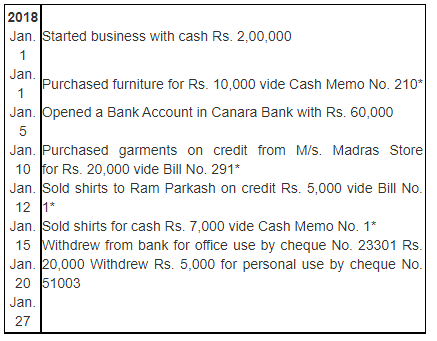

Q.2. Prepare the Accounting Vouchers for the following transactions:

Transactions marked with * are subject to levy of CGST and SGST @ 6% each.

Ans. (i) Started business with cash Rs. 2,00,000 (ii) Purchased furniture for Rs. 10,000 vide Cash Memo No. 210*

(ii) Purchased furniture for Rs. 10,000 vide Cash Memo No. 210* (iii) Opened a Bank Account in Canara Bank with Rs. 60,000.

(iii) Opened a Bank Account in Canara Bank with Rs. 60,000.

(iv) Purchased garments on credit from M/s. Madras Store for Rs. 20,000 vide Bill No. 291

(iv) Purchased garments on credit from M/s. Madras Store for Rs. 20,000 vide Bill No. 291 (v) Sold shirts to Ram Parkash on credit Rs. 5,000 vide Bill No. 1.

(v) Sold shirts to Ram Parkash on credit Rs. 5,000 vide Bill No. 1.

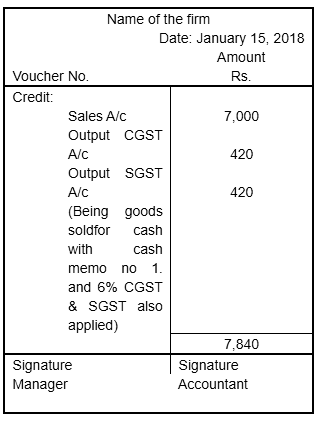

(vi) Sold shirts for cash Rs. 7,000 vide Cash Memo No. 1

(vi) Sold shirts for cash Rs. 7,000 vide Cash Memo No. 1

(vii) Withdrew from bank for office use by cheque No. 23301 Rs. 20,000

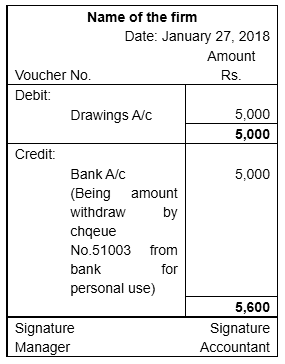

(vii) Withdrew from bank for office use by cheque No. 23301 Rs. 20,000 (viii) Withdrew Rs. 5,000 for personal use by cheque No. 51003.

(viii) Withdrew Rs. 5,000 for personal use by cheque No. 51003.

Q.3. Prepare the Vouchers to be recorded in the books of M/s. Computer Aids:

Transactions marked with * are subject to levy of CGST and SGST @ 6% each.

Ans. (i) Bought computer for resale for cash vide Cash Memo No. 512

(ii) Salary paid for the month of December, 2017

(iii) Sold computer for cash vide Cash Memo No. 6

(iv) Withdraw cash from bank for office use vide cheque No.1345

(iv) Withdraw cash from bank for office use vide cheque No.1345

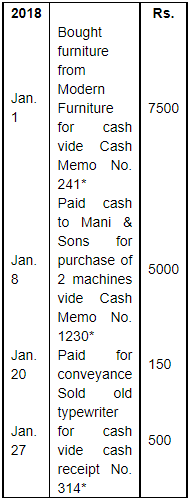

Q.4. Prepare the Vouchers to be recorded in the books of M/s. Elegant Furniture’s, New Delhi:

Transactions marked with * are subject to levy of CGST and SGST @ 6% each.

Ans. (i) Bought furniture from Modern Furniture for cash vide Cash Memo No. 241 (ii) Paid cash to Mani & Sons for purchase of 2 machines vide Cash Memo No. 1230.

(ii) Paid cash to Mani & Sons for purchase of 2 machines vide Cash Memo No. 1230.

(iii) Paid for conveyance.

(iv) Sold old typewriter for cash vide cash receipt No. 314.

Q.5. Prepare the Vouchers:

Transactions marked with * are subject to levy of CGST and SGST @ 6% each.

Ans. (i) Received cash from Wahi & Co. on account vide Cash receipt No. 551 (ii) Commission received vide Cash receipt No. 520

(ii) Commission received vide Cash receipt No. 520

(iii) Sold leather purses for cash vide Cash Memo Nos. 307-310. (iv) Sold two old machines vide Cash Memo No. 1560.

(iv) Sold two old machines vide Cash Memo No. 1560.

Q.6. Prepare the Transfer Vouchers from the books of Mangla Agencies, Faridabad, Haryana from the Source Vouchers:

(i) Purchased goods from M/s. Eufora New Delhi vide Bill No. 912, paid IGST @ 12%. (ii) Sold goods to M/s. Yardley, Faridabad, Haryana vide Bill No. 31596, charged CGST and SGST @ 6% each.

(ii) Sold goods to M/s. Yardley, Faridabad, Haryana vide Bill No. 31596, charged CGST and SGST @ 6% each. (iii) Depreciation charged on building @ 10% on Rs. 2,00,000.

(iii) Depreciation charged on building @ 10% on Rs. 2,00,000. Point of Knowledge:

Point of Knowledge:

Depreciation = Value of Assets × % of Depreciation

= Rs. 2,00,000 × 10%

= Rs.20,000

|

64 videos|153 docs|35 tests

|

FAQs on Origin of Transactions- Source Documents and Preparation of Vouchers - Accountancy Class 11 - Commerce

| 1. What are source documents in commerce? |  |

| 2. Why are source documents important in preparing vouchers? |  |

| 3. How are vouchers prepared in commerce? |  |

| 4. What is the purpose of preparing vouchers in commerce? |  |

| 5. Can vouchers be prepared without source documents in commerce? |  |

|

Explore Courses for Commerce exam

|

|