Commerce Exam > Commerce Notes > Ledger (Part - 1)

Ledger (Part - 1) - Commerce PDF Download

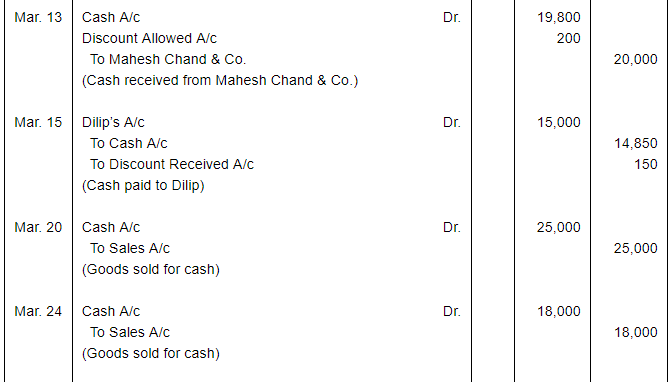

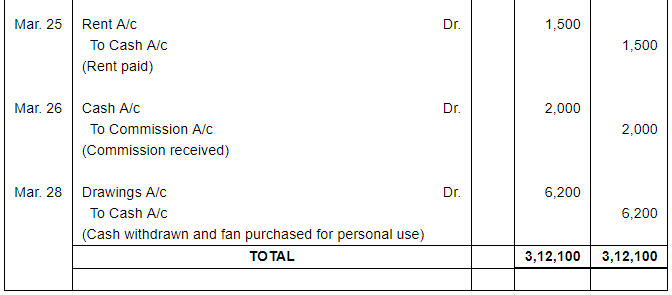

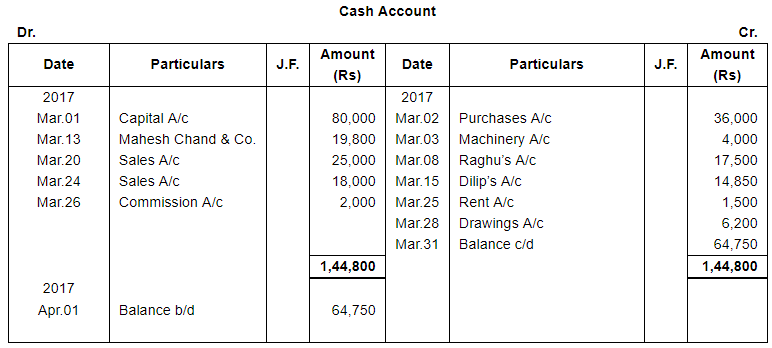

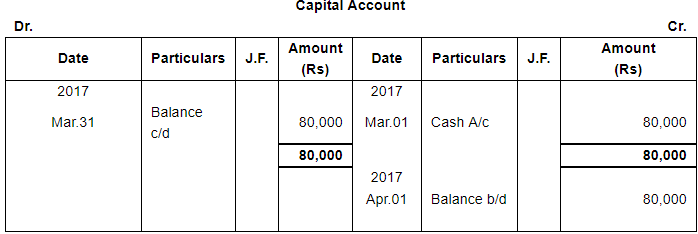

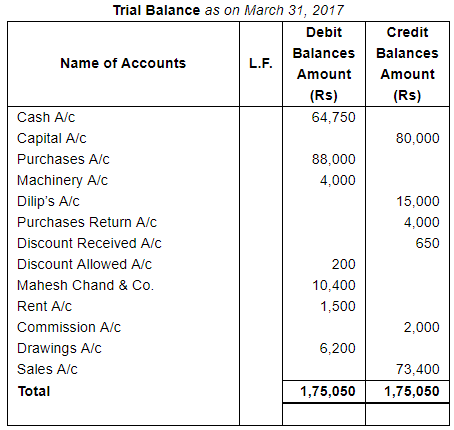

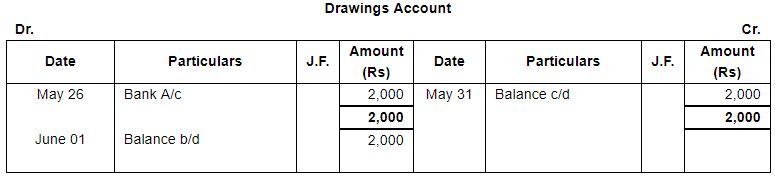

Page No 13.57:

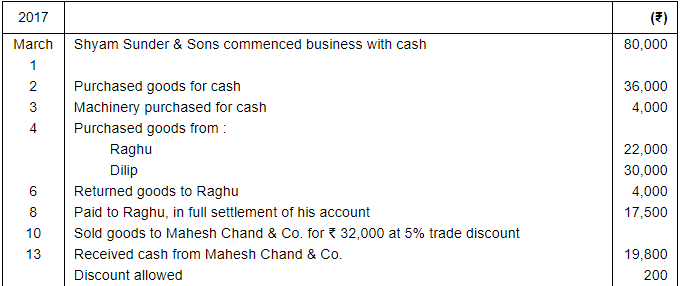

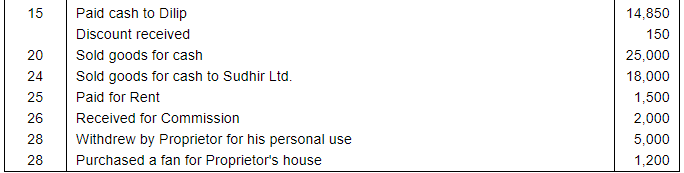

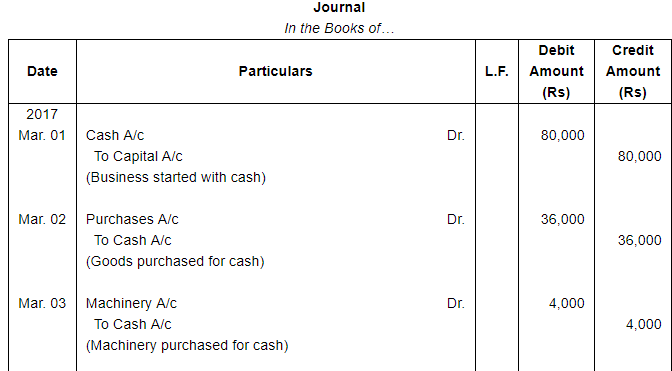

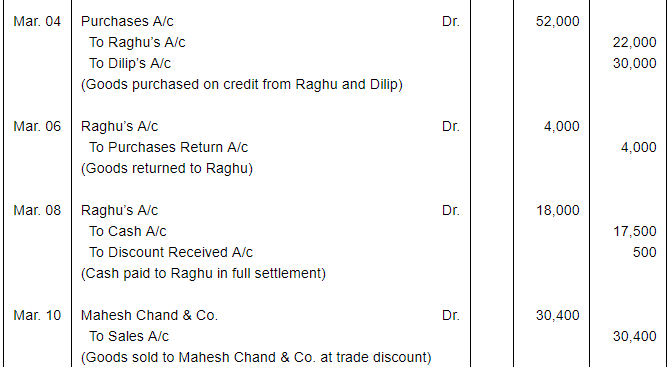

Question 1:

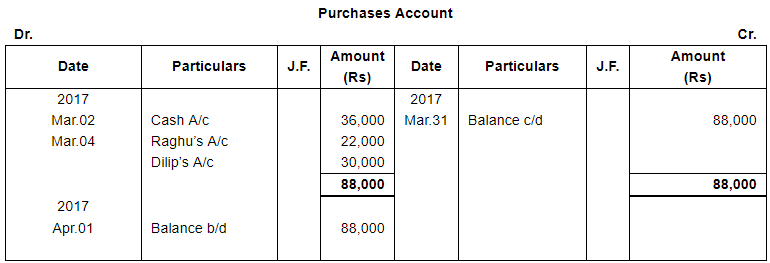

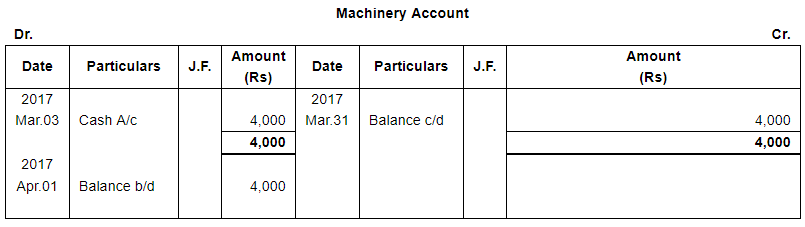

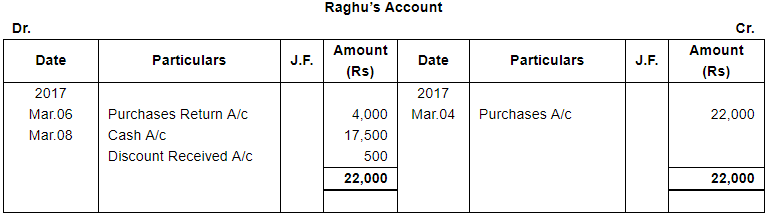

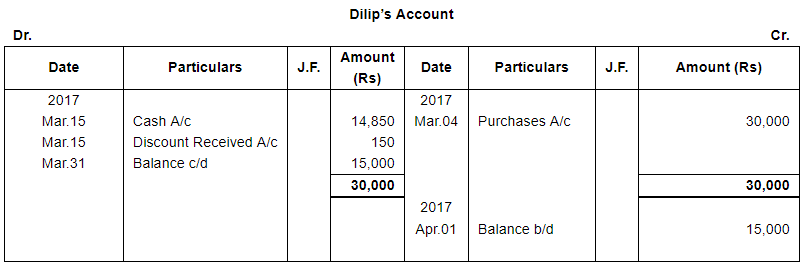

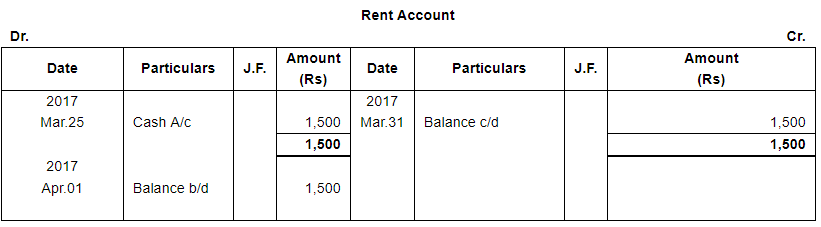

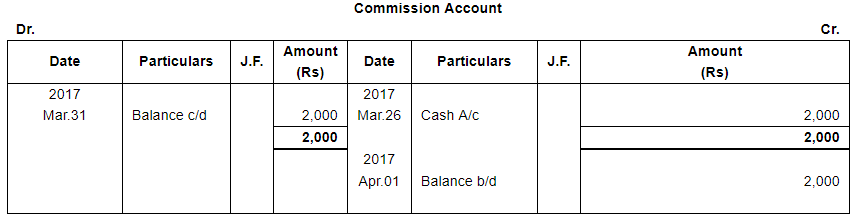

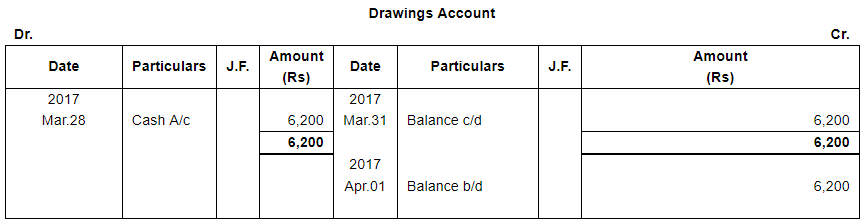

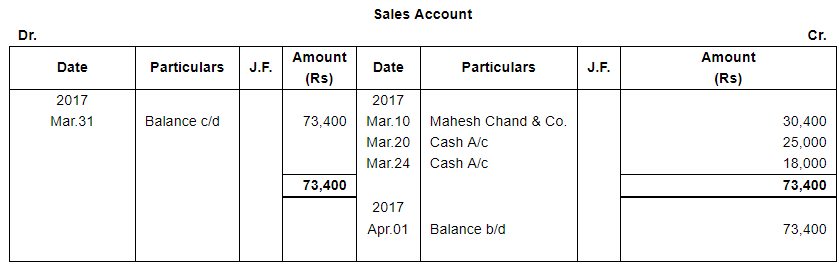

Journalise the following transactions, post them into Ledger, balance the accounts and prepare a Trial Balance:−

ANSWER:

Page No 13.58:

Question 2:

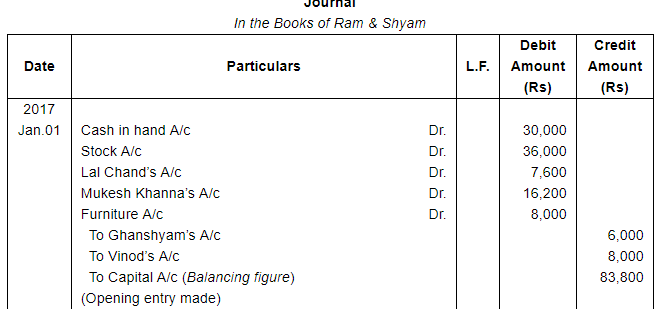

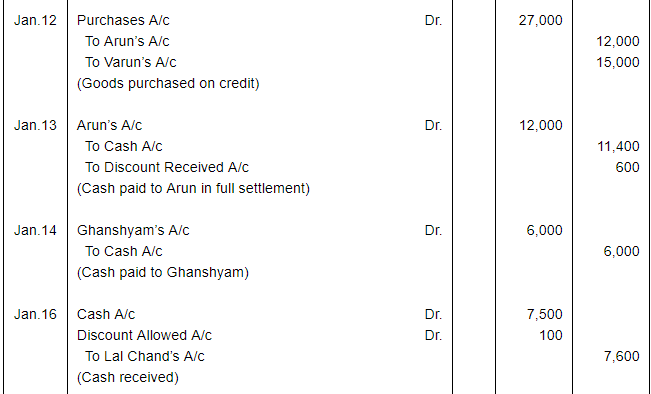

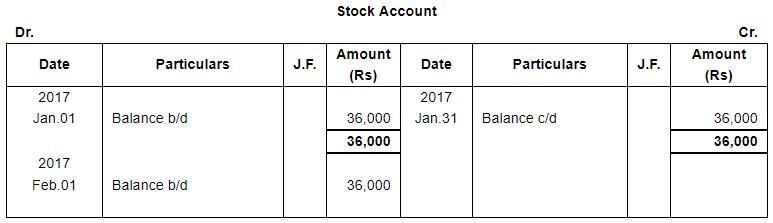

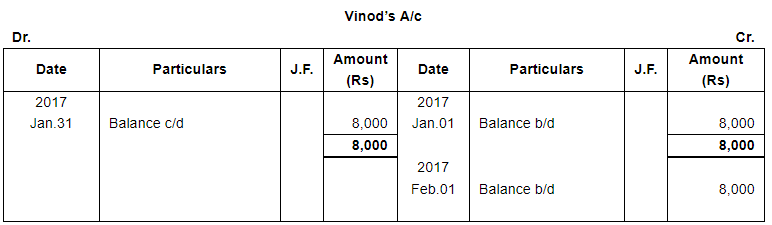

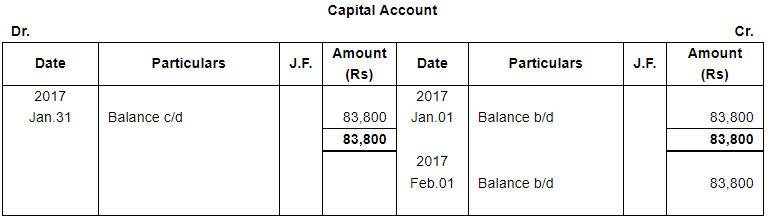

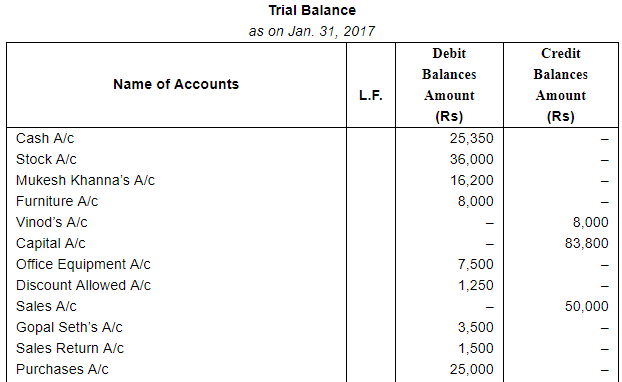

Following balances appeared in the books of Ram & Shyam on January 1, 2017 :−

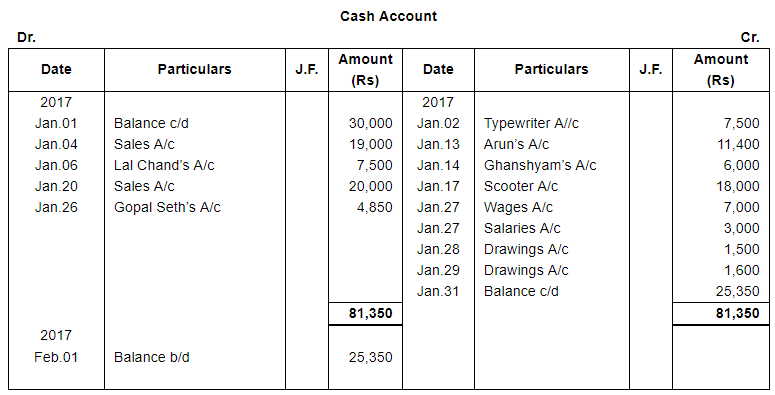

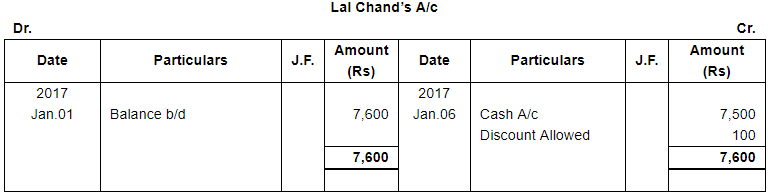

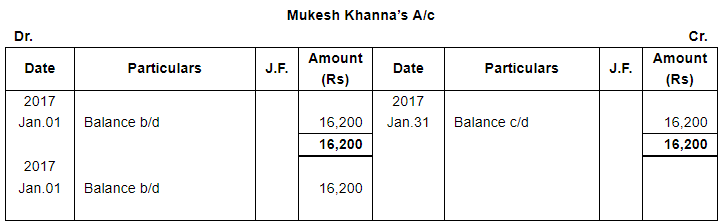

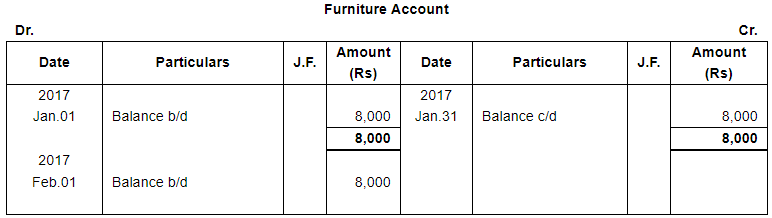

Assets : Cash in hand ₹ 30,000; Stock ₹ 36,000; Lal Chand ₹ 7,600; Mukesh Khanna ₹ 16,200; Furniture ₹ 8,000.

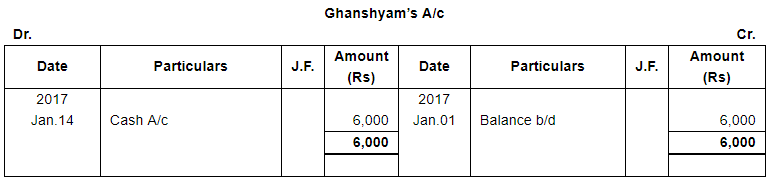

Liabilities : Ghanshyam ₹ 6,000; Vinod ₹ 8,000.

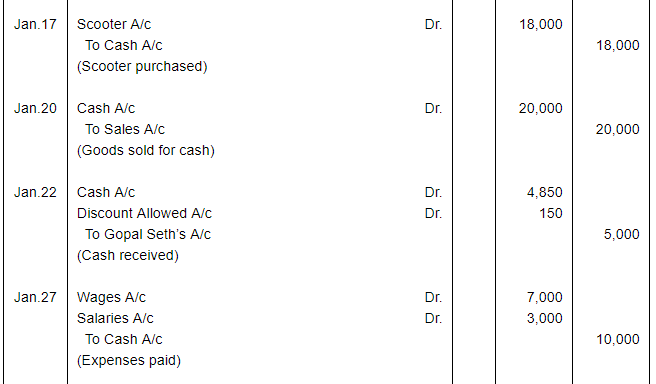

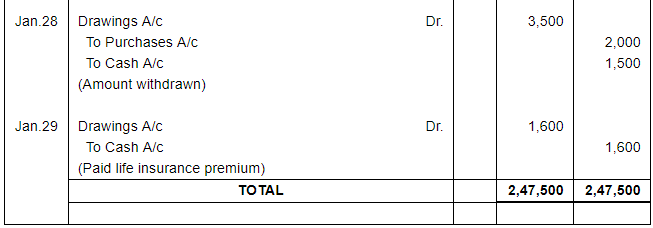

Following transactions took place during Jan. 2017:−

2017 | |

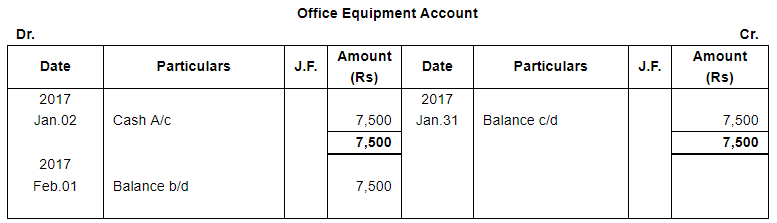

| Jan. 2 | Purchased Typewriter for ₹ 7,500. |

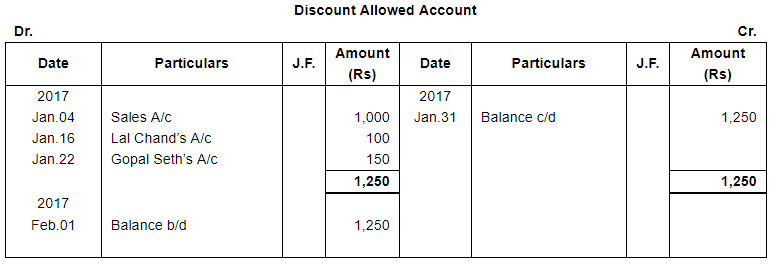

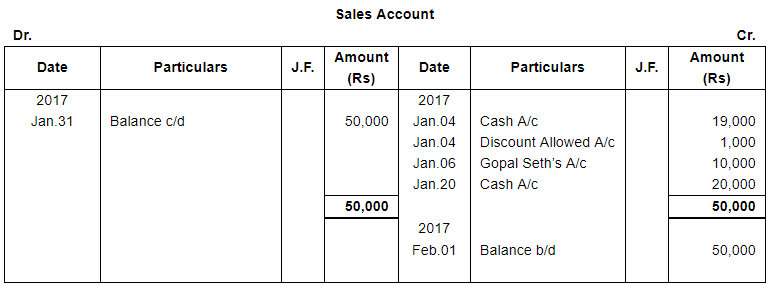

| 4 | Sold goods for Cash of the list price of ₹ 25,000 at 20% trade discount and 5% Cash discount. |

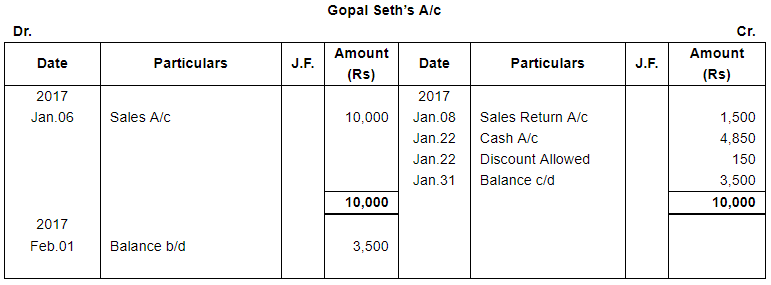

| 6 | Sold goods to Gopal Seth for ₹ 10,000. |

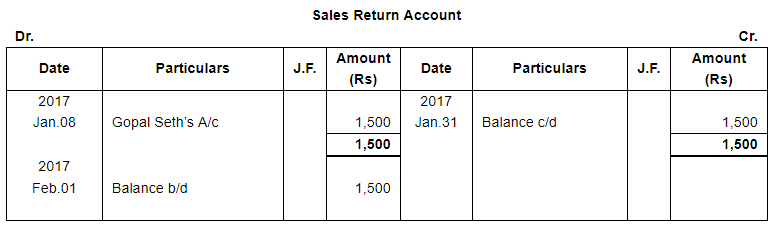

| 8 | Gopal Seth returned goods for ₹ 1,500. |

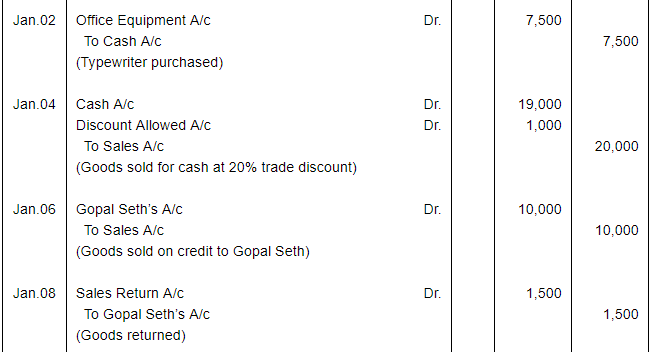

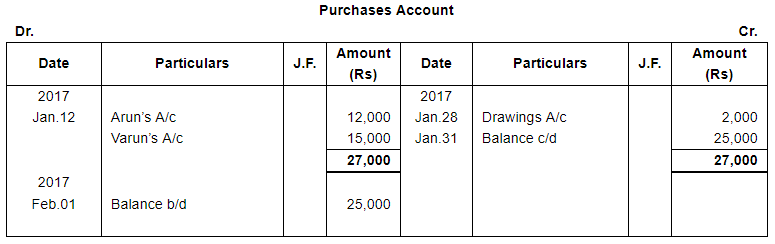

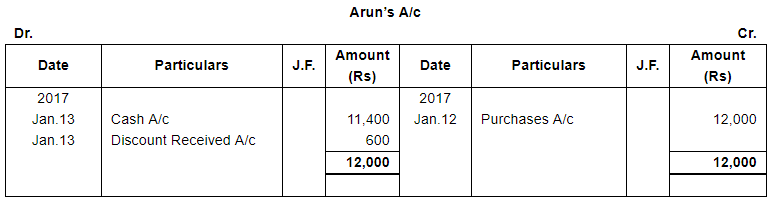

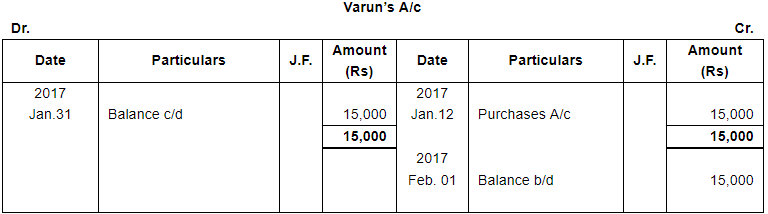

| 12 | Purchased goods from Arun ₹ 12,000; and from Varun ₹ 15,000. |

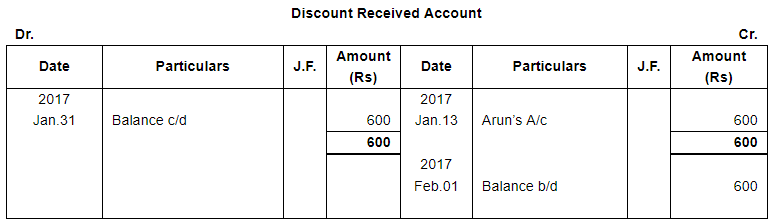

| 13 | Settled Arun's account in full after deducting 5% for cash discount. |

| 14 | Paid cash to Ghanshyam in full settlement of his account. |

| 16 | Received ₹ 7,500 from Lal Chand in full settlement of his account. |

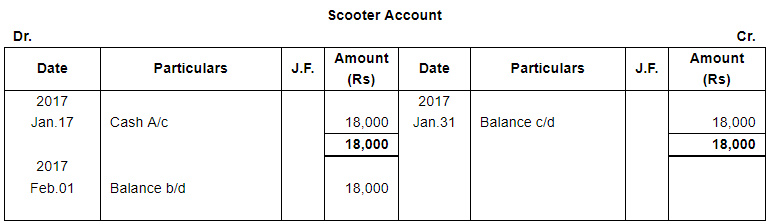

| 17 | Purchased a Scooter for office use ₹ 18,000. |

| 20 | Sold goods for cash ₹ 20,000. |

| 22 | Received from Gopal Seth ₹ 4,850 and discount allowed ₹ 150. |

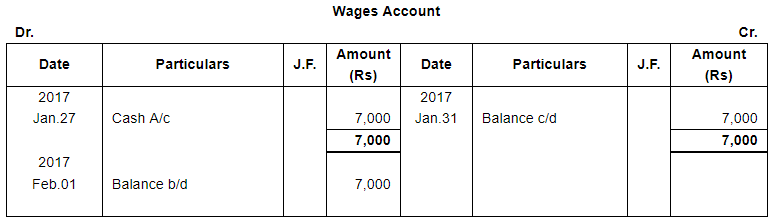

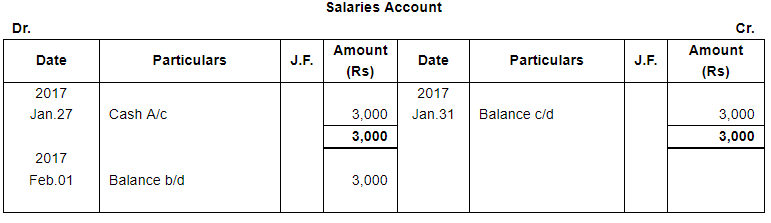

| 27 | Paid for Wages ₹ 7,000 and Salaries ₹ 3,000. |

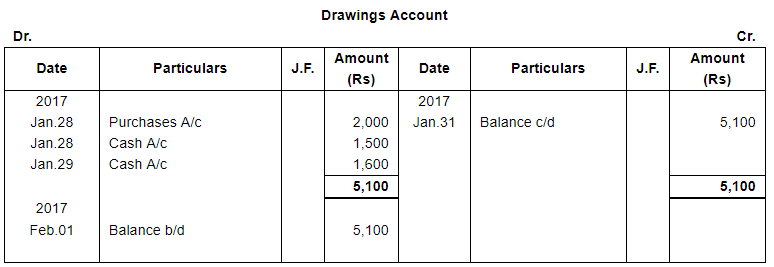

| 28 | Withdrew goods for ₹ 2,000 and Cash ₹ 1,500 for private use. |

| 29 | Paid for Life Insurance Premium of the Proprietor ₹ 1,600. |

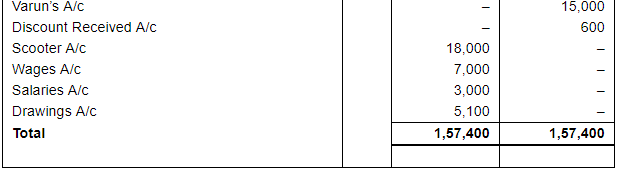

Journalise the above transactions, post them into Ledger, balance them and prepare a Trial Balance.

ANSWER:

Page No 13.59:

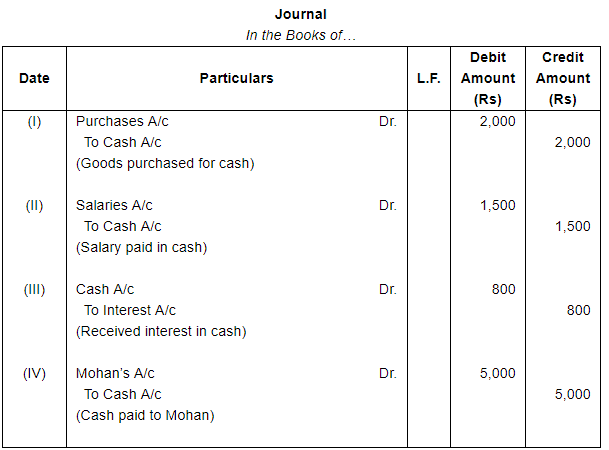

Question 3:

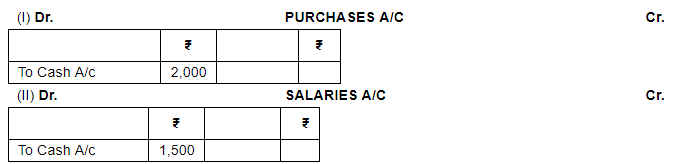

Prepare Journal Entries of the following postings :-

ANSWER:

Page No 13.59:

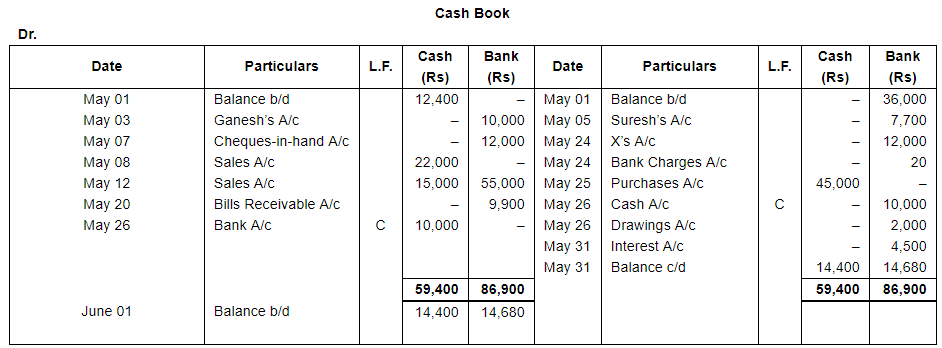

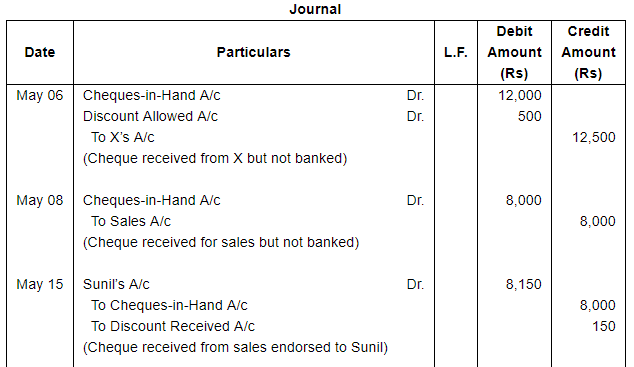

Question 4:

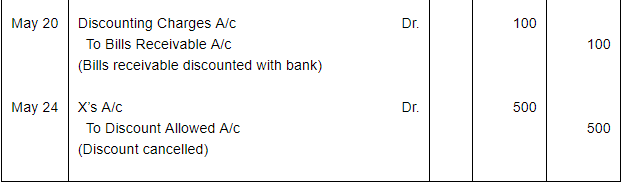

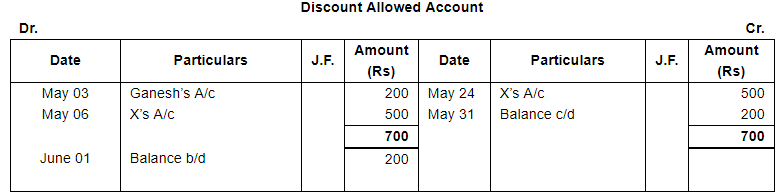

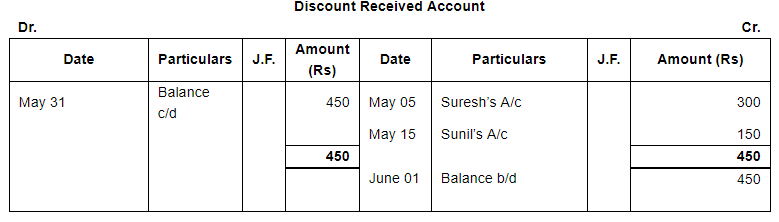

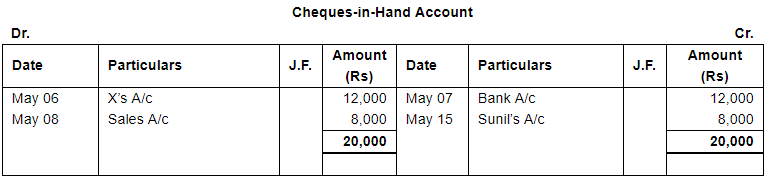

Enter the following transactions in a Double Column Cash Book and Journal Proper and post them into Ledger∶

| May 1 | Balance of Cash in Hand ₹ 12,400; Bank Overdraft ₹ 36,000. |

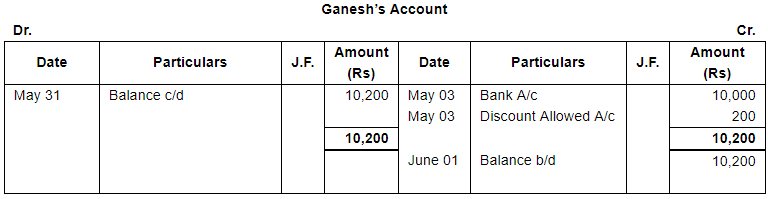

| 3 | Direct deposit by Mr. Ganesh in our bank account ₹ 10,000. Discount allowed ₹ 200. |

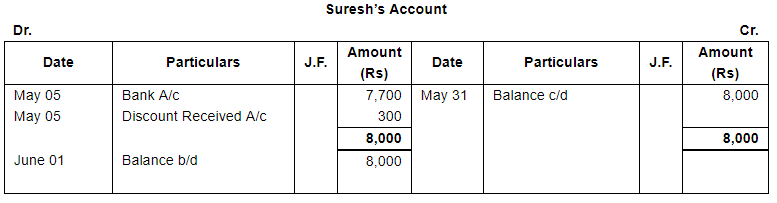

| 5 | Issued a cheque of ₹ 7,700 to Mr. Suresh in full settlement of his account of ₹ 8,000. |

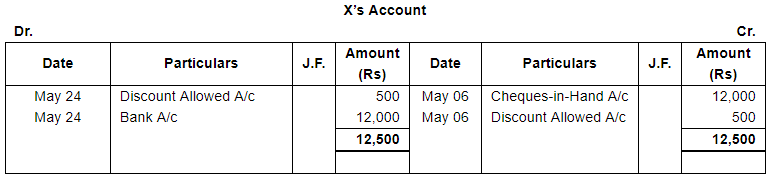

| 6 | Received a cheque from X for ₹ 12,000. Discount allowed ₹ 500. This cheque was deposited into bank on 7th May. |

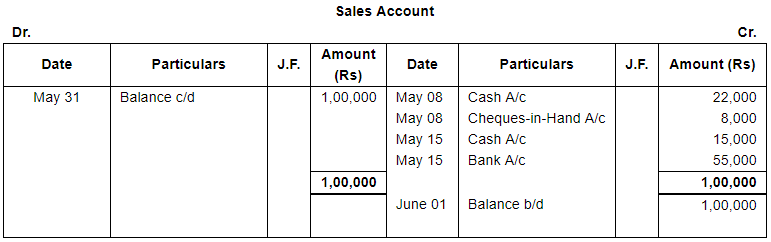

| 8 | Received Cash ₹ 22,000 and cheque of ₹ 8,000 for cash sale. |

| 12 | Cash sale ₹ 70,000 of which ₹ 55,000 banked. |

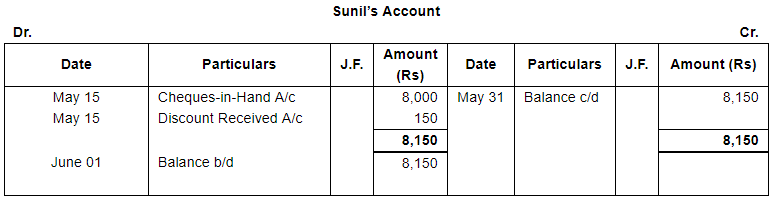

| 15 | Cheque received on 8th May endorsed to Mr. Sunil. Discount received ₹ 150. |

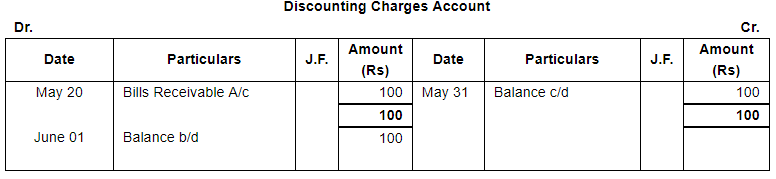

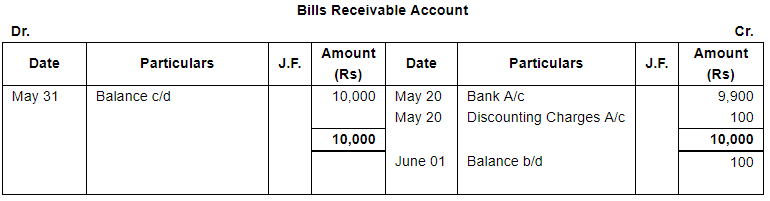

| 20 | Discounted a B/R of ₹ 10,000 at 1% through bank. |

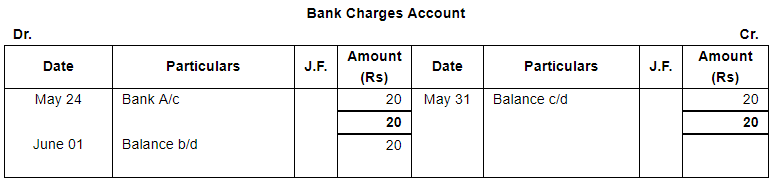

| 24 | Cheque received from X dishonoured, Bank debits ₹ 20 in respect of bank charges. |

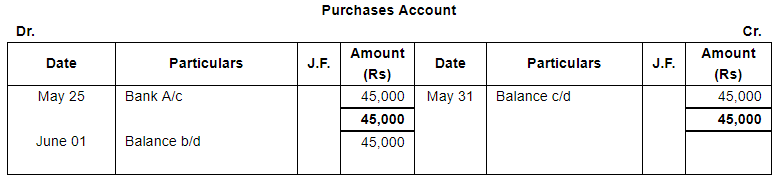

| 25 | Purchased goods for ₹ 50,000 at a trade discount of 10%. Payment was made in cash. |

| 26 | Withdrew from bank ₹ 10,000 for office use and ₹ 2,000 for personal use. |

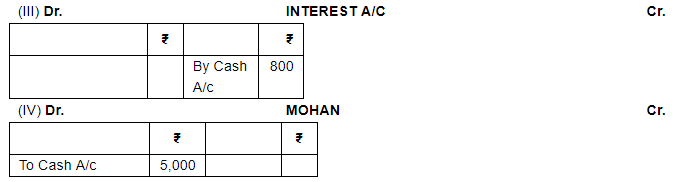

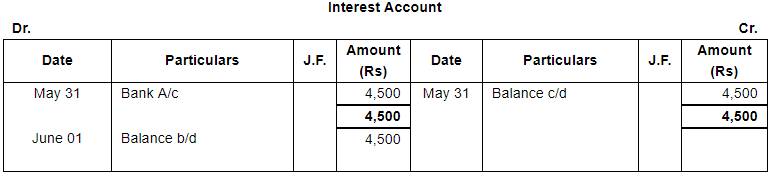

| 31 | Interest debited by Bank ₹ 4,500. |

ANSWER:

FAQs on Ledger (Part - 1) - Commerce

| 1. What is a ledger in commerce? |  |

Ans. A ledger in commerce refers to a book or a database that contains all the financial transactions of a business. It records the details of each transaction, including the date, description, and monetary amounts involved. The ledger serves as a central repository of financial information, allowing businesses to track their income, expenses, assets, and liabilities.

| 2. How is a ledger different from a journal in commerce? |  |

Ans. While both a ledger and a journal are used in commerce to record financial transactions, they serve different purposes. A journal is the initial record where transactions are first recorded in chronological order, while a ledger is a collection of accounts that summarizes and categorizes these transactions. The ledger provides a more organized and systematic view of the financial activities of a business.

| 3. What are the types of ledgers commonly used in commerce? |  |

Ans. There are several types of ledgers commonly used in commerce, including the general ledger, accounts receivable ledger, accounts payable ledger, and sales ledger.

- The general ledger contains all the financial transactions of a business and serves as the primary ledger.

- The accounts receivable ledger tracks the amounts owed to the business by its customers.

- The accounts payable ledger records the amounts owed by the business to its suppliers.

- The sales ledger keeps a record of all sales made by the business.

| 4. How does a ledger help in financial analysis and decision-making? |  |

Ans. A ledger plays a crucial role in financial analysis and decision-making by providing accurate and up-to-date financial data. It allows businesses to generate financial statements, such as balance sheets and income statements, which provide insights into the financial health of the company. The ledger also enables businesses to identify trends, analyze income and expenses, calculate profitability, and make informed financial decisions.

| 5. Can a ledger be computerized or is it limited to physical books? |  |

Ans. Yes, a ledger can be computerized using accounting software and databases. Computerized ledgers offer several advantages over physical books, such as increased efficiency, accuracy, and ease of data retrieval. With computerized ledgers, businesses can automate the recording and processing of transactions, generate real-time reports, and easily search for specific financial information. However, some businesses may still prefer to maintain physical ledgers for record-keeping purposes or as a backup to digital records.

Download as PDF

|

Explore Courses for Commerce exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.

Related Searches