Ledger - 1 | Accountancy Class 11 - Commerce PDF Download

Q.1. On 1st April, 2018, Mohit started business with a capital of Rs. 50,000. He made the following transactions:

You are required to journalise the above transactions and show the respective Ledger accounts.

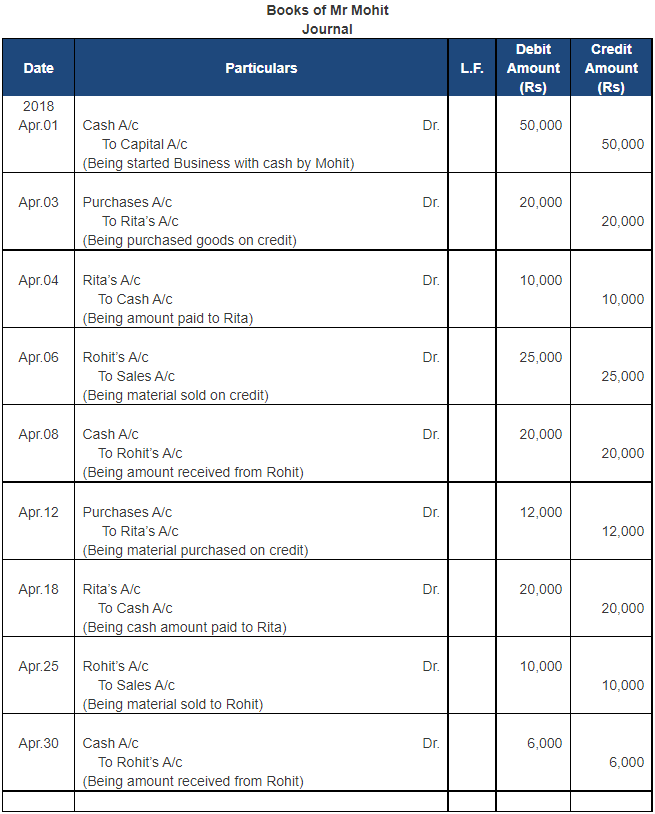

Ans. Statement showing Journal of Mohit

Following are the ledgers shown in the books of Mohit

Point of Knowledge:

- If the debit side total is more than the credit side total write the difference on the credit side as “By Balance c/d”.

- If the credit side total is more than the debit side total write the difference on the credit side as “To Balance c/d”.

Q.2. Suresh, Kanpur commenced business on 1st January, 2018 introducing capital in cash Rs. 1, 00,000. His other transactions during the month were as follows:

Enter the above transactions in his books of account

Ans. Statement showing Journal of Suresh, Kanpur

Following are the ledgers shown in the books of Suresh, Kanpur

Point of Knowledge:

- As Sales made on Jan. 15 is on credit so the Assets (debtors) will increases.

- As Purchases made on Jan. 18 is on credit so the liability (creditor) will increases.

Q.3. Journalise the following transactions in the books of Afzal, Kolkata and post them to the Ledger:

Intra-state transactions are subject to levy of CGST and SGST @ 6% each whereas inter-state transactions are subject to levy of IGST @ 12%. Out of the above transactions, transactions marked (*) are not subject to levy of GST.

Ans. Statement showing Journal of Afjal, Kolkata

Following are the ledgers shown in the books of Afjal, Kolkata

Point of Knowledge:

Trade discount is the part of purchases & it should be deducted from the purchases. It is no shown in the books of accounts.

Q.4. Pass Journal entries of M/s. Bhanu Traders, Delhi from the following transactions. Post them to the Ledger:

Intra-state transactions are subject to levy of CGST and SGST @ 6% each whereas inter-state transactions are subject to levy of IGST @ 12%. Out of the above transactions marked (*) are not subject to levy of GST.

Ans. Statement showing Journal of M/s Bhanu Traders

Following are the ledgers shown in the books of M/s Bhanu Traders.

Point of Knowledge:

- Discount allowed when a payment is made. Discount received when payment is received. Discount allowed is an expense for business so it should be debited and discount received is a gain so it should be credited.

Q.5. Journalise the following transactions in the Journal of M/s. Gupta Brothers (Prop. Shri R. K. Gupta), Delhi and post them to the Ledger:

Inter-state transactions are subject to levy of IGST @ 12% and Intra-state transactions are subject to levy of CGST and SGST @ 6% each. GST is not levied on transactions marked with (*).

Ans. Statement showing Journal of M/s Gupta Brothers

Following are the ledgers shown in the books of M/s Gupta Brothers

Point of knowledge:

- When we use goods for personal use it reduce the value of purchases with the value of goods use as personal. It is so because if goods are used for other purpose other than sale, the amount of such goods reduced.

Q.6. Following balances appeared in the books of Ashok, Delhi on 1st April, 2018:

Assets: Cash Rs. 50,000; Stock Rs. 30,000; Debtors–Ram Rs. 50,000; Machinery Rs. 60,000.

Liabilities: Creditor – Rajesh Rs. 30,000.

The following transactions took place in April, 2018:

CGST and SGST @ 6% each is levied on intra-state transactions and IGST is levied @12% on inter-state transactions. Transactions marked (*) are not subject to levy of GST.

Pass Journal entries for the above transaction, post them into the Ledger and prepare the Trial Balance on 30th April, 2018.

Ans. Statement showing Journal of Ashok, Delhi

Following are the ledgers shown in the books of Ashok, Delhi

Point of Knowledge:

|

64 videos|152 docs|35 tests

|

FAQs on Ledger - 1 - Accountancy Class 11 - Commerce

| 1. What is Ledger? |  |

| 2. How does Ledger ensure the security of cryptocurrencies? |  |

| 3. What is the significance of Ledger's 1 Commerce platform? |  |

| 4. Can Ledger's hardware wallets support multiple cryptocurrencies? |  |

| 5. Is it possible to recover cryptocurrencies if a Ledger hardware wallet is lost or damaged? |  |

|

Explore Courses for Commerce exam

|

|