Ledger - 1 | Accountancy Class 11 - Commerce PDF Download

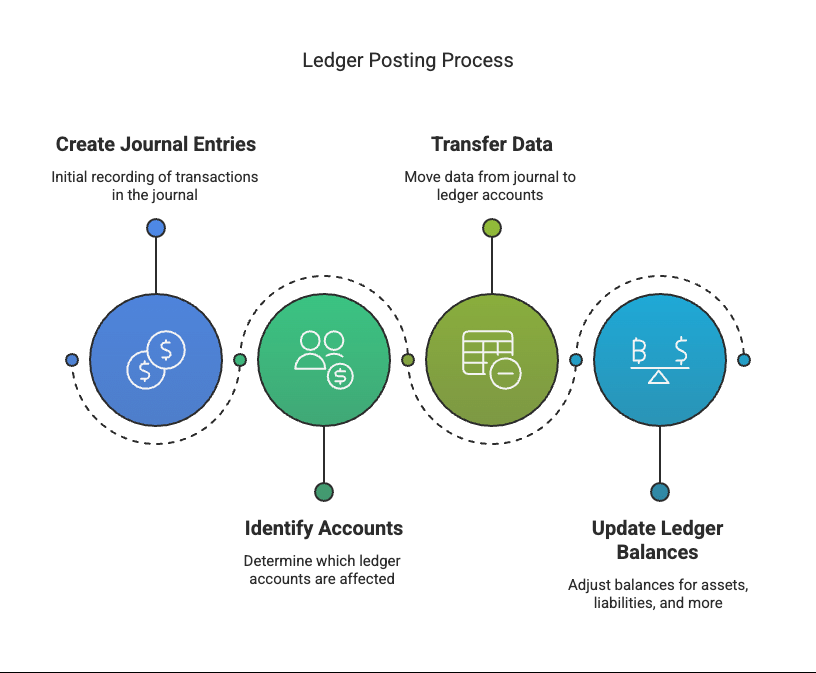

Ledger posting means transferring journal entries into individual ledger accounts to track balances for assets, liabilities, capital, expenses, and revenues.

Key Concepts

Here’s a quick rundown of terms and concepts you’ll encounter:

- Journal: The first book of entry where transactions are recorded chronologically with debits and credits. For example, Mohit starting a business with Rs 50,000 (Q1) debits, Cash and credits Capital.

- Ledger: A set of accounts summarizing transactions from the journal. Each account (e.g., Cash, Sales, Purchases) shows all debits and credits affecting it, ending with a balance carried down (c/d).

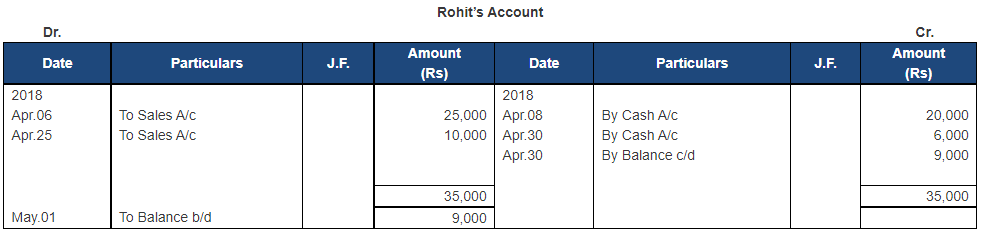

- Double-Entry System: Every transaction has a dual effect—debit one account, credit another. For example, selling goods to Rohit for Rs 25,000 (Q1) debits Rohit’s account (asset) and credits Sales (revenue).

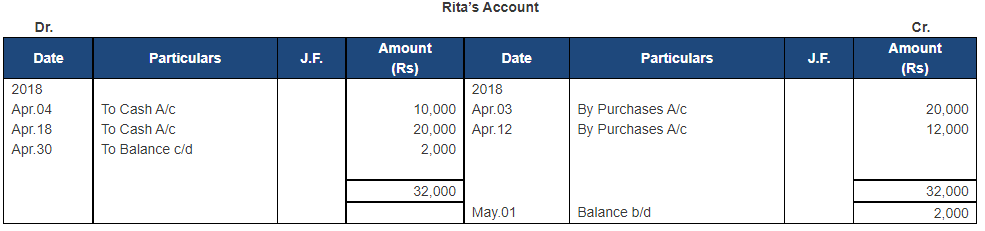

- Debtors and Creditors: Debtors owe you money, increasing assets. Creditors are those you owe (e.g., Rita), increasing liabilities.

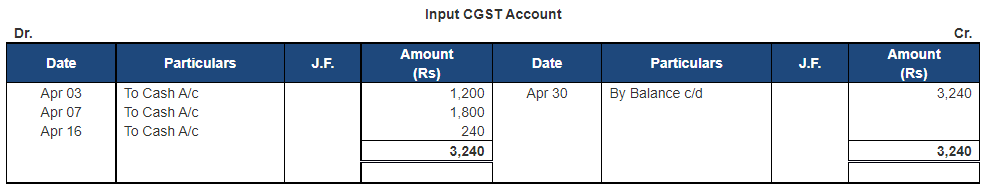

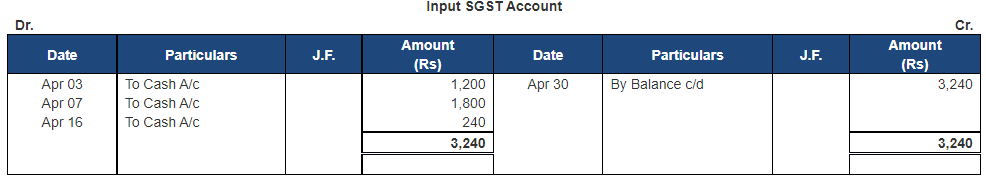

- GST: Goods and Services Tax applies to certain transactions—CGST and SGST (6% each) for intra-state, IGST (12%) for inter-state. Transactions marked with (*) are exempt.

- Balancing Accounts: At month-end, ledger accounts are totaled. If debits exceed credits, the difference is “By Balance c/d” (credit side); if credits exceed debits, it’s “To Balance c/d” (debit side).

- Personal vs. Business Use: Goods taken for personal use reduce Purchases and Capital, reflecting a withdrawal.

Solved Questions

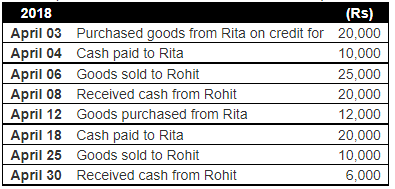

Q.1. On 1st April, 2018, Mohit started business with a capital of Rs. 50,000. He made the following transactions:

You are required to journalise the above transactions and show the respective Ledger accounts.

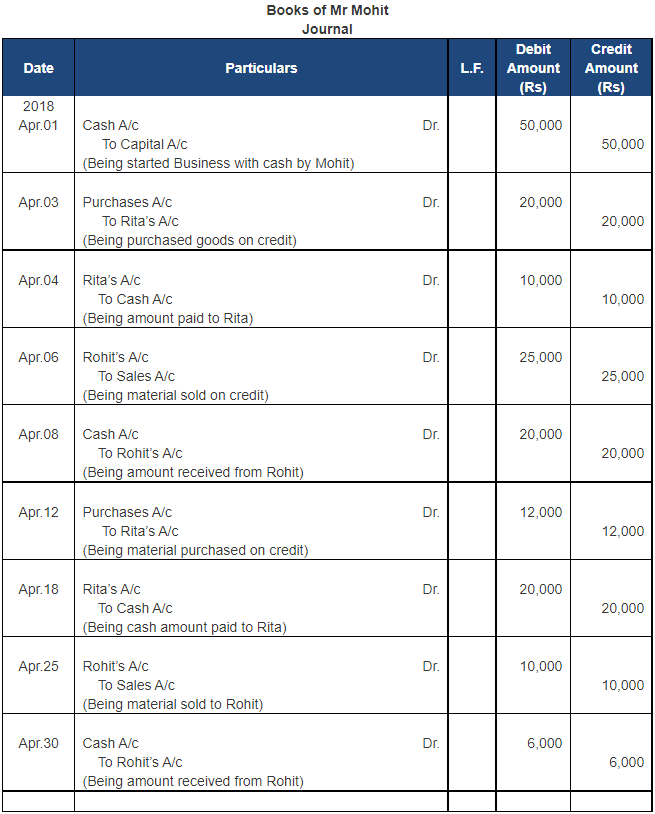

Ans. Statement showing Journal of Mohit

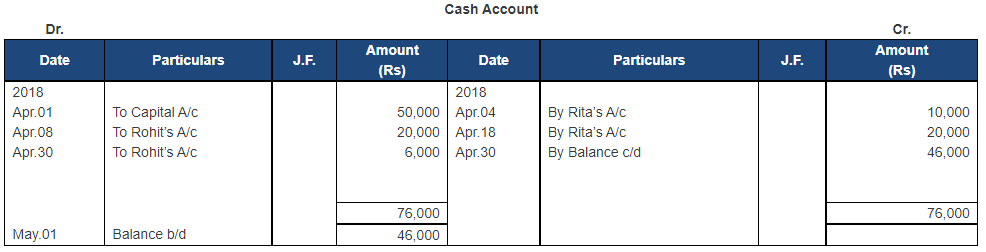

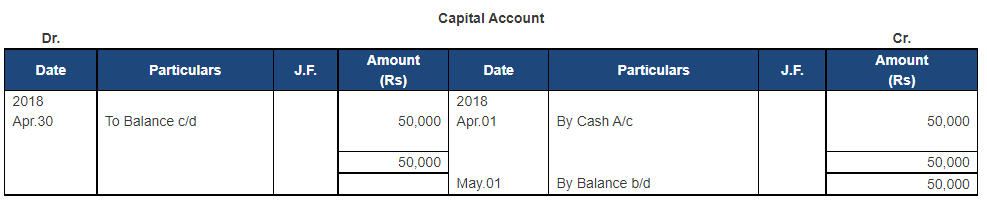

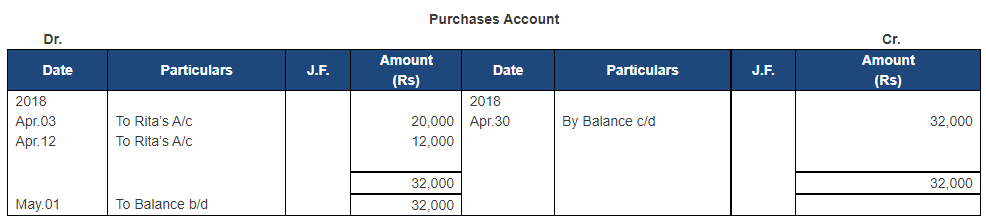

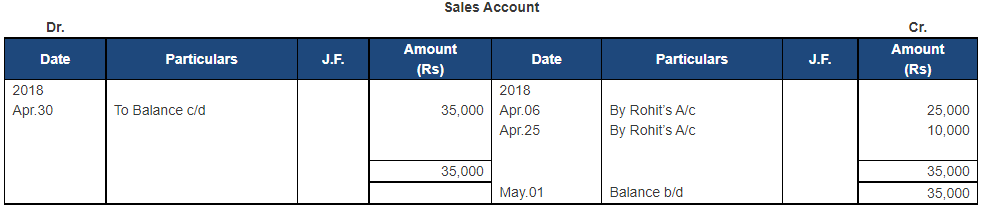

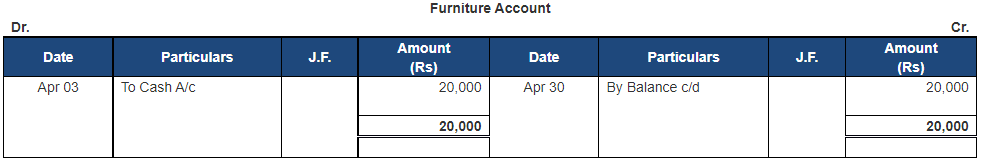

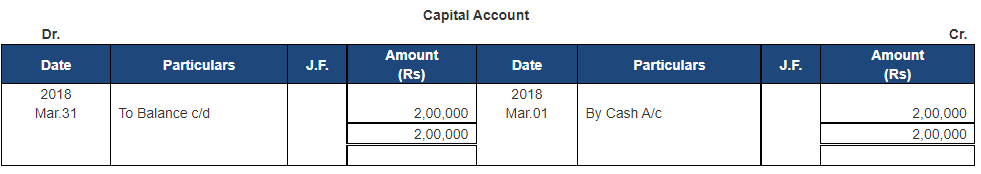

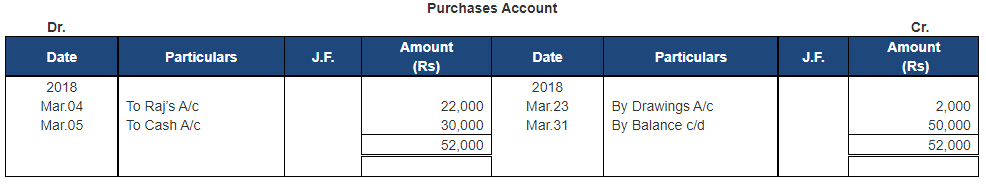

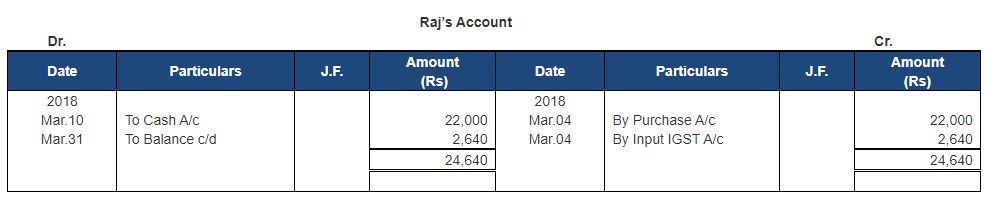

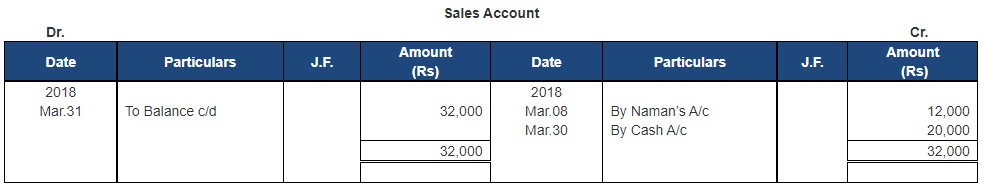

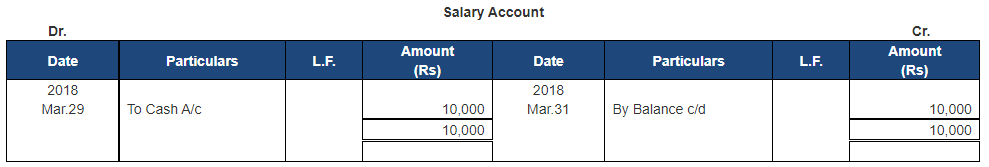

Following are the ledgers shown in the books of Mohit

Point of Knowledge:

- If the debit side total is more than the credit side total, write the difference on the credit side as “By Balance c/d”.

- If the credit side total is more than the debit side tota,l write the difference on the credit side as “To Balance c/d”.

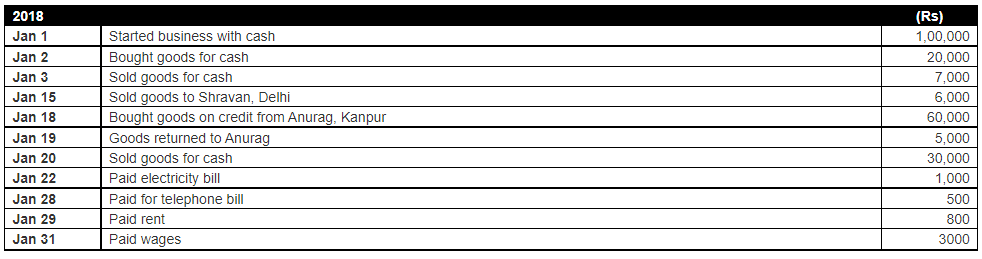

Q.2. Suresh, Kanpur commenced business on 1st January, 2018 introducing capital in cash Rs. 1, 00,000. His other transactions during the month were as follows:

Enter the above transactions in his books of account

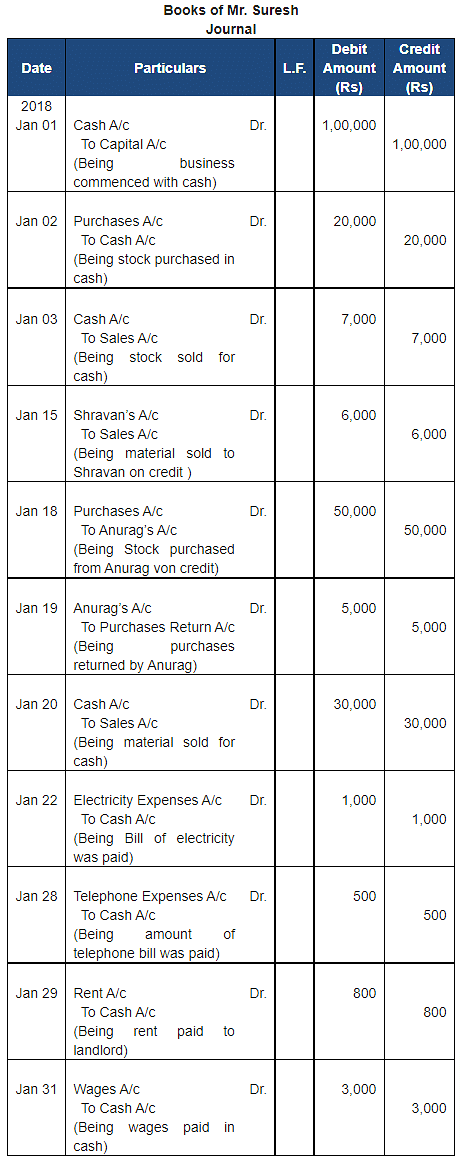

Ans. Statement showing Journal of Suresh, Kanpur

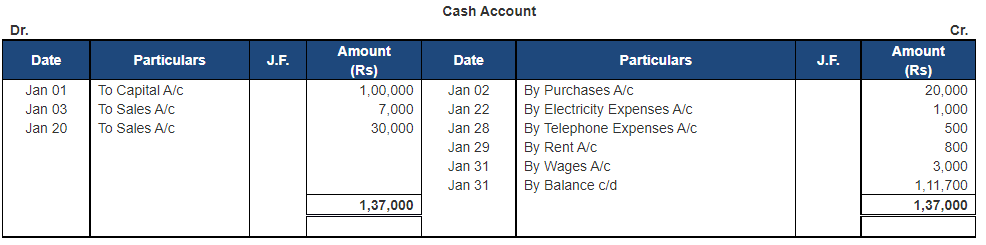

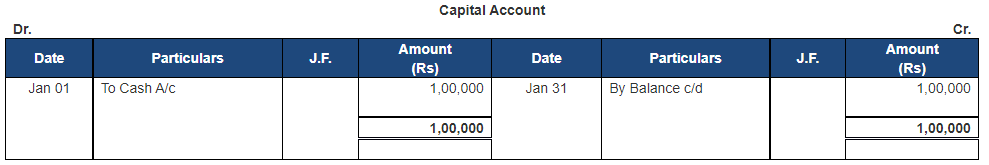

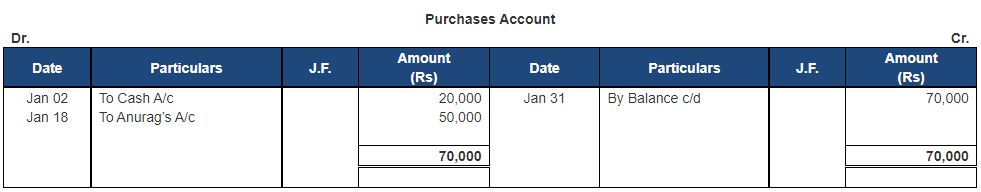

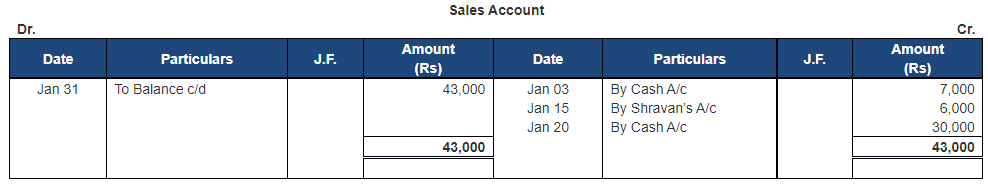

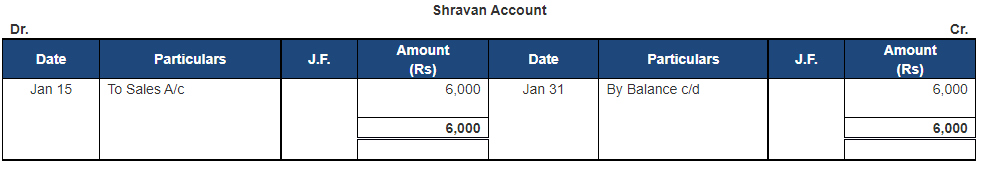

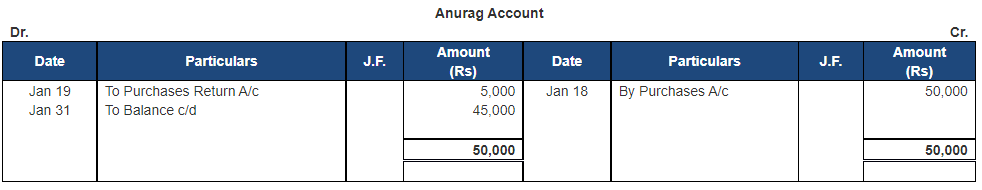

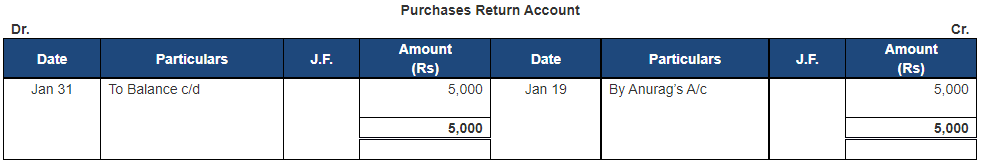

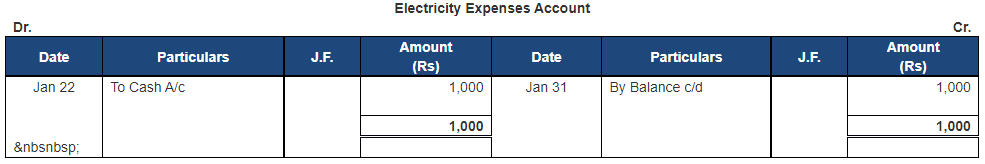

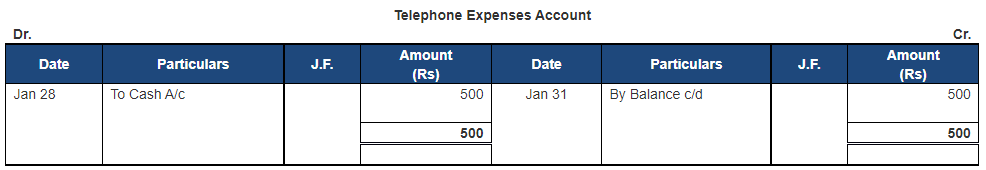

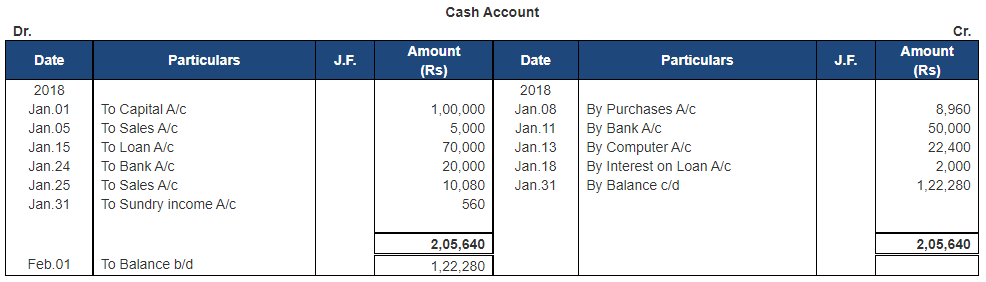

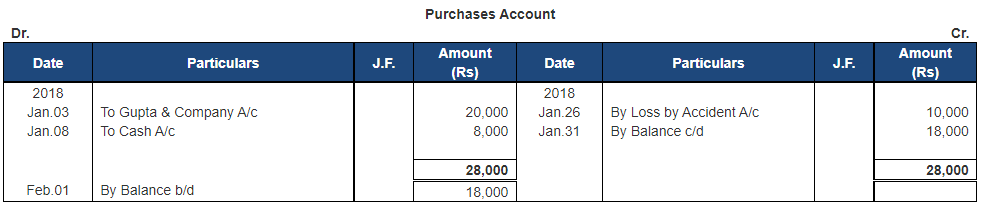

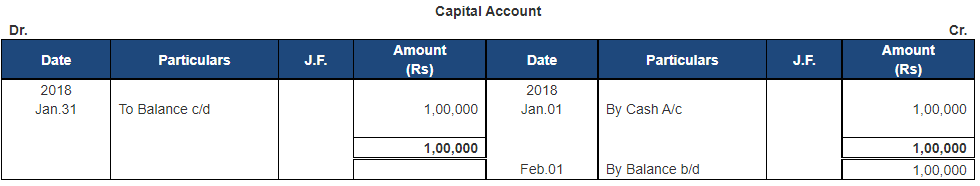

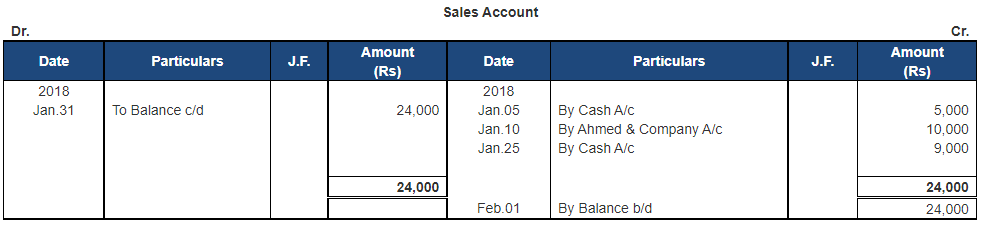

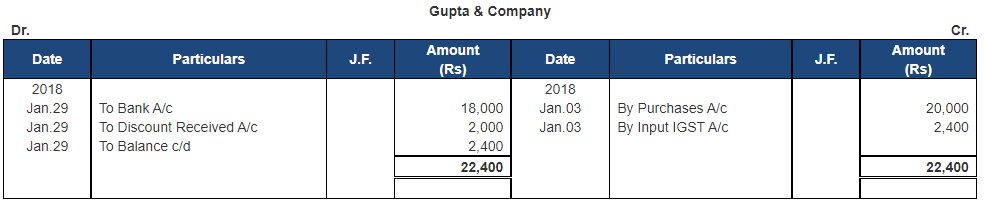

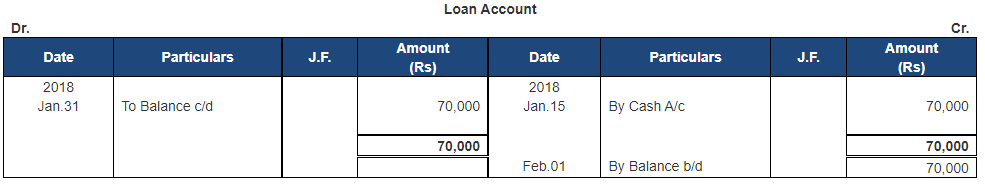

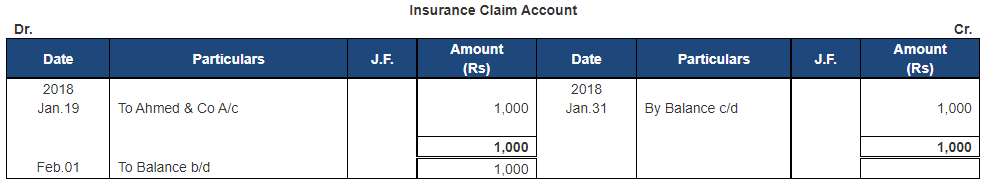

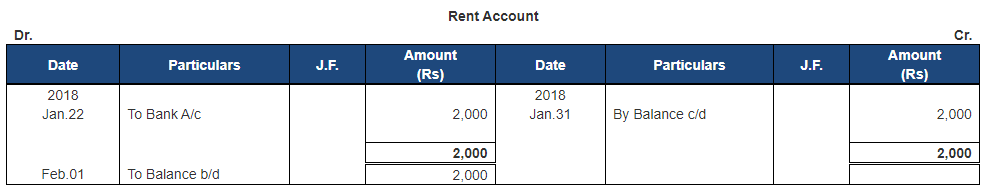

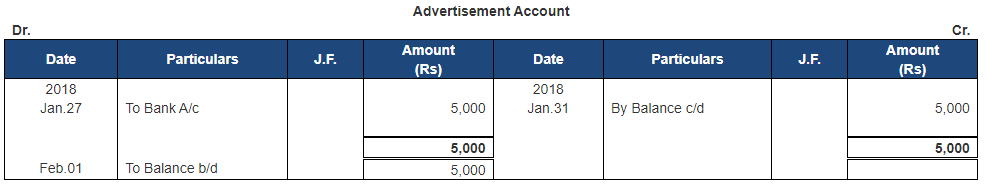

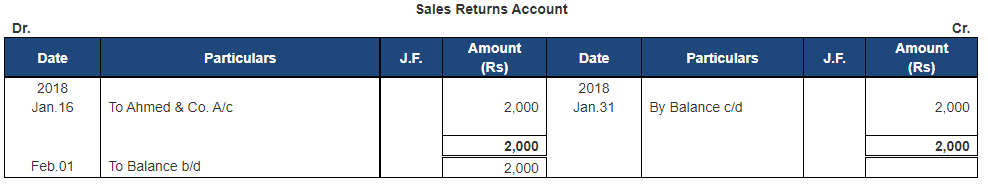

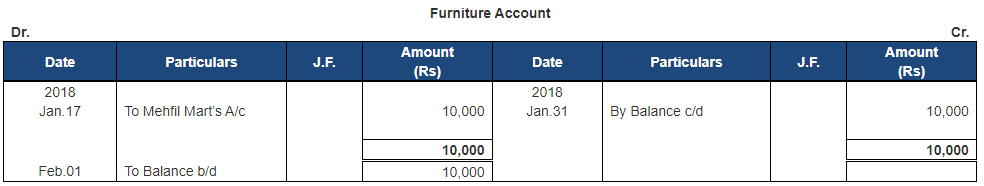

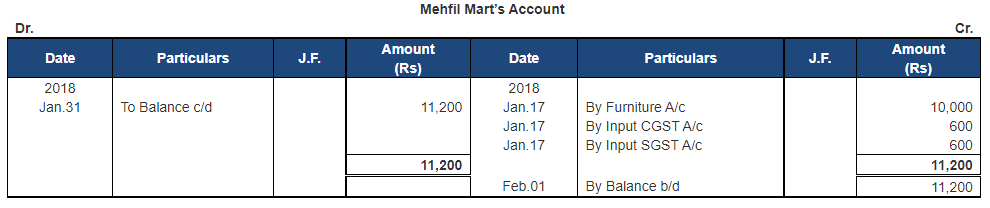

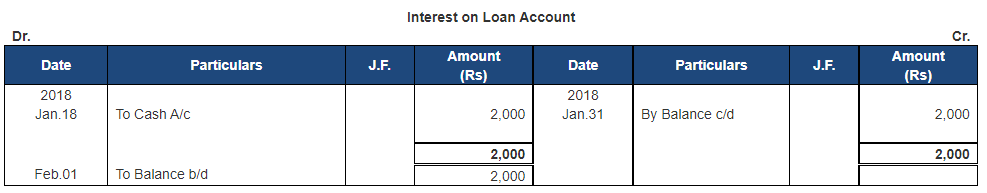

Following are the ledgers shown in the books of Suresh, Kanpur

Point of Knowledge:

- As Sales made on Jan. 15 is on credit so the Assets (debtors) will increase.

- As Purchases made on Jan. 18 is on credit so the liability (creditor) will increase.

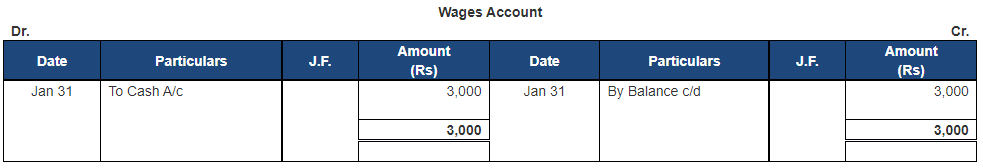

Q.3. Journalise the following transactions in the books of Afzal, Kolkata and post them to the Ledger:

Intra-state transactions are subject to levy of CGST and SGST @ 6% each whereas inter-state transactions are subject to levy of IGST @ 12%. Out of the above transactions, transactions marked (*) are not subject to levy of GST.

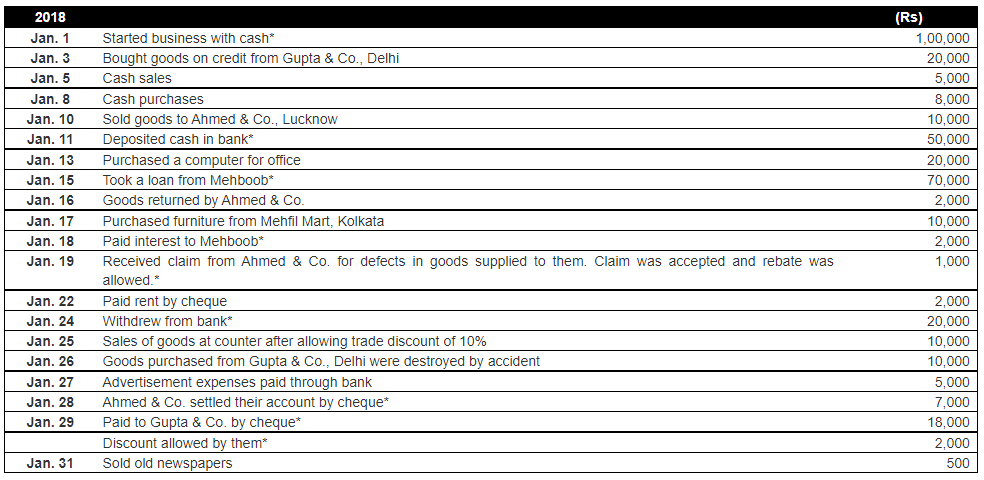

Ans. Statement showing the Journal of Afjal, Kolkata

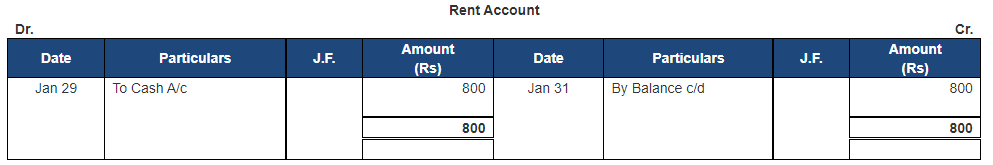

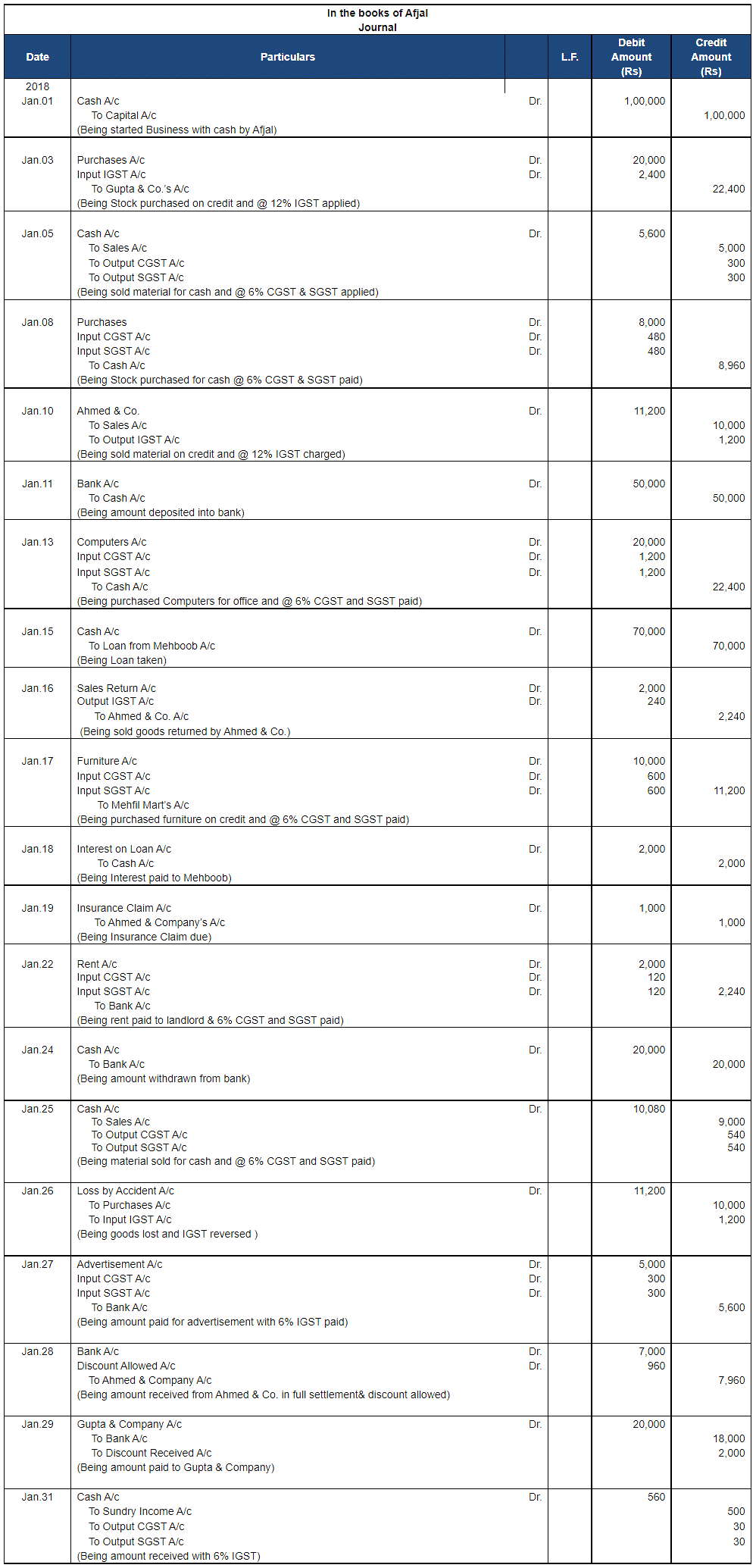

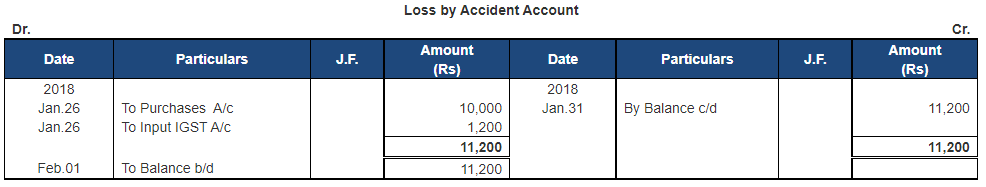

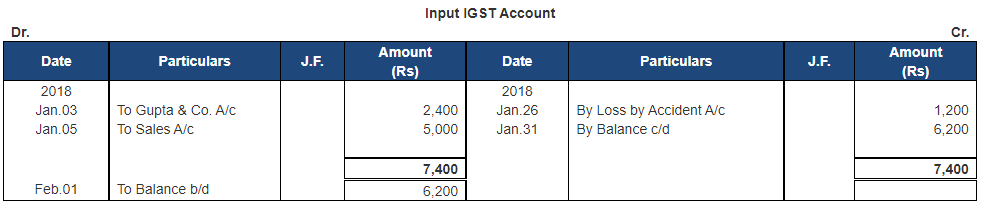

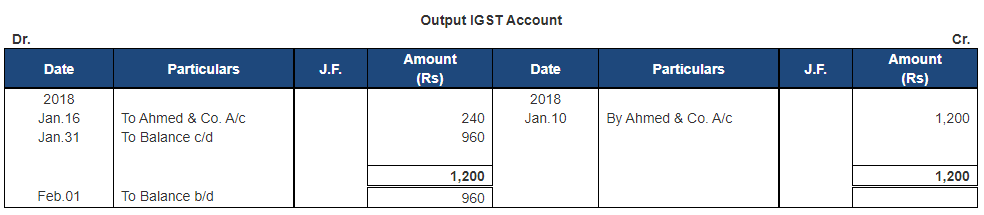

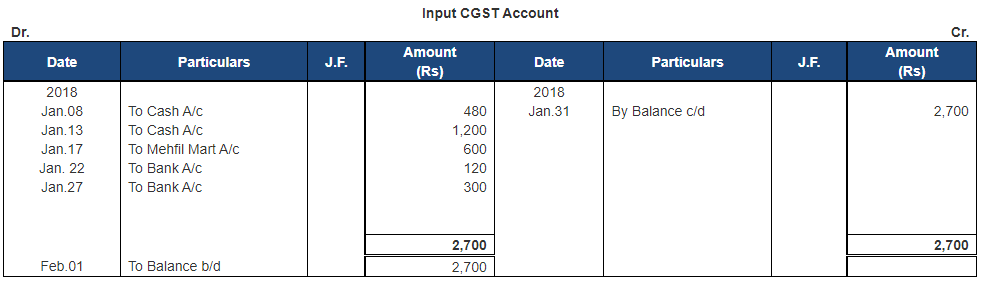

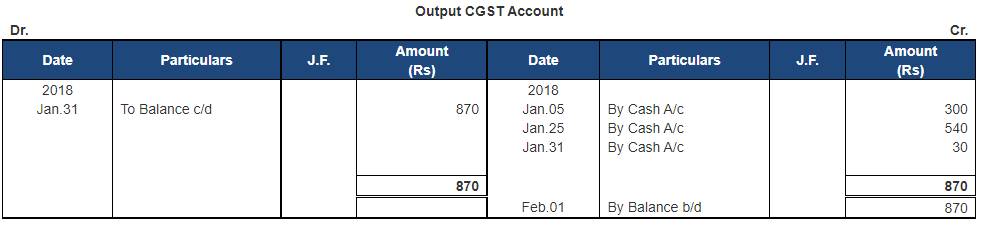

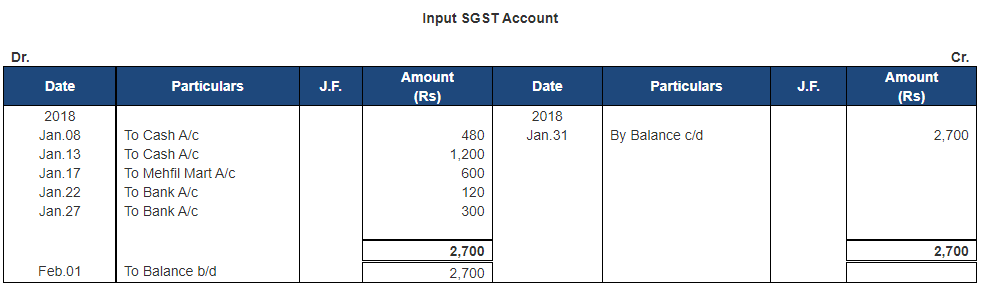

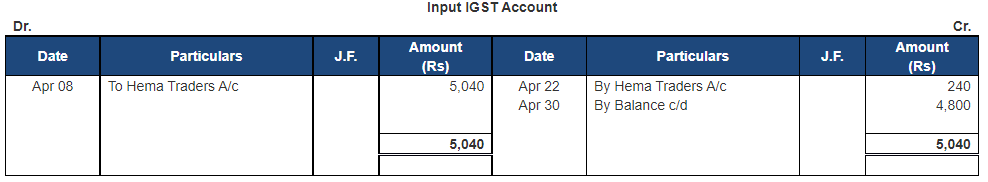

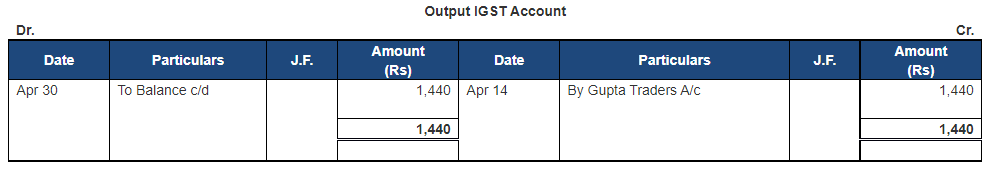

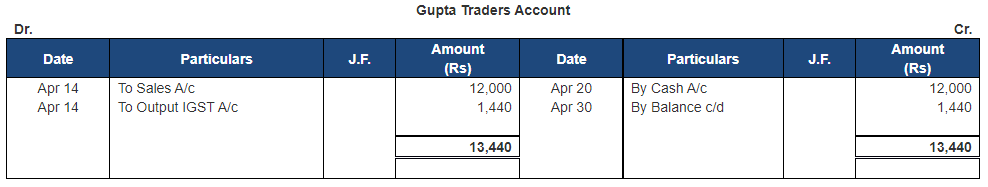

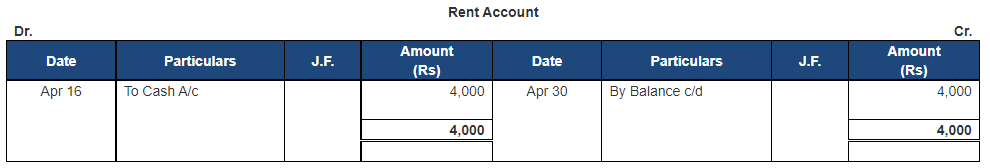

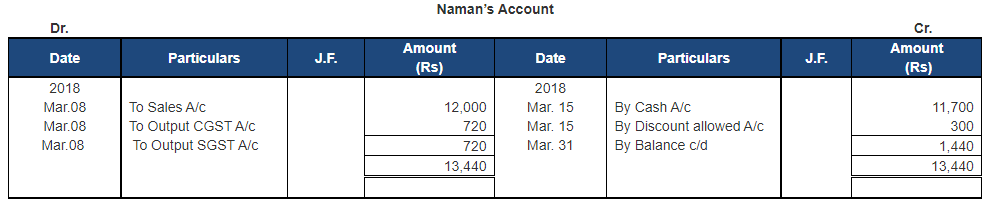

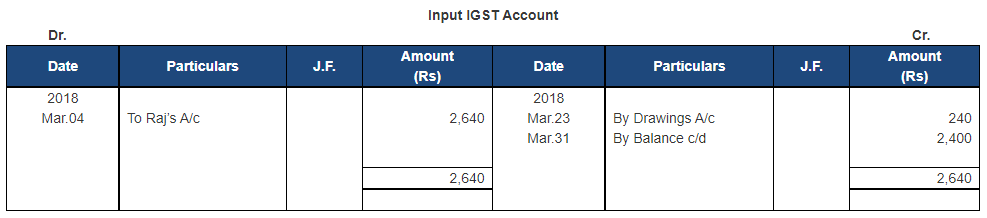

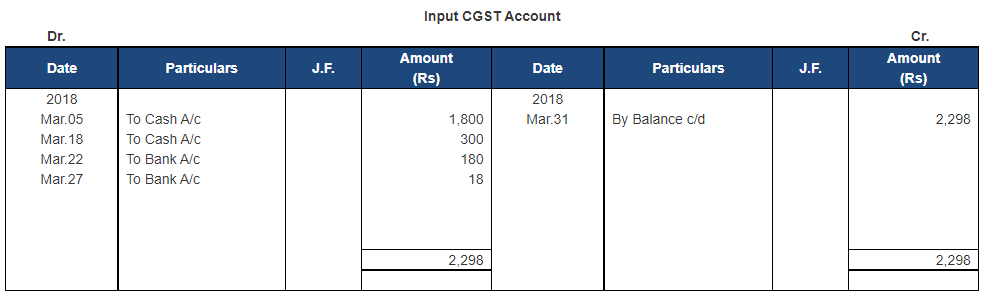

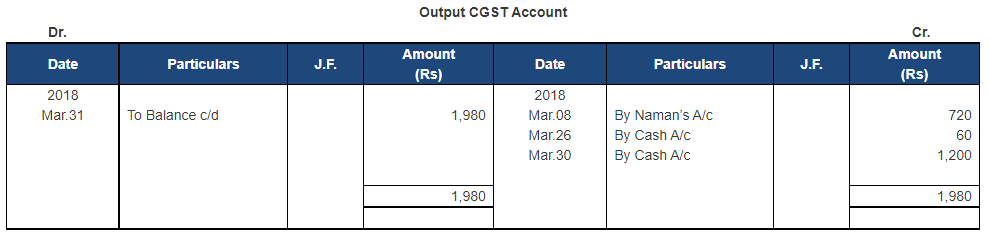

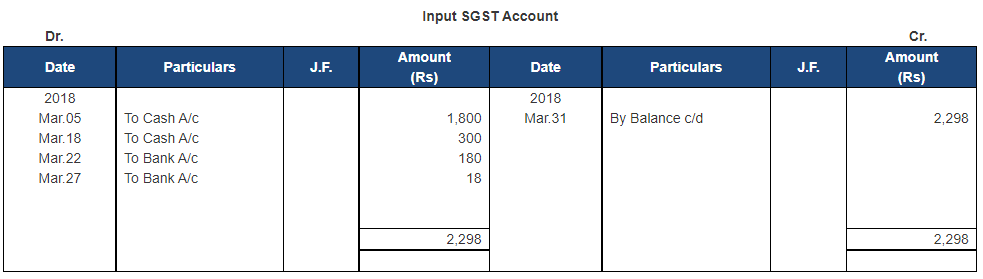

Following are the ledgers shown in the books of Afjal, Kolkata

Point of Knowledge:

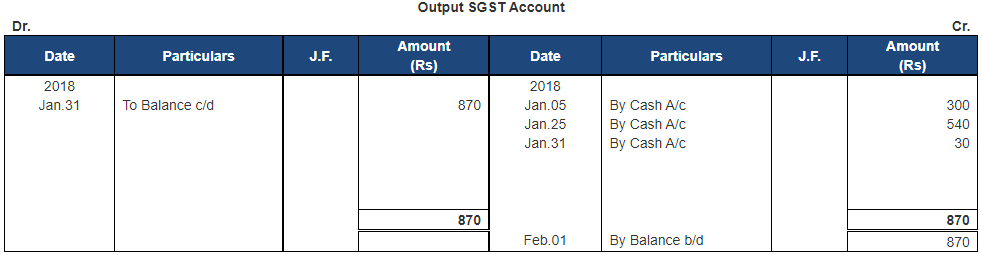

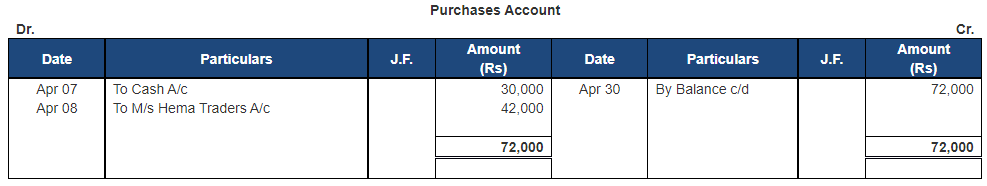

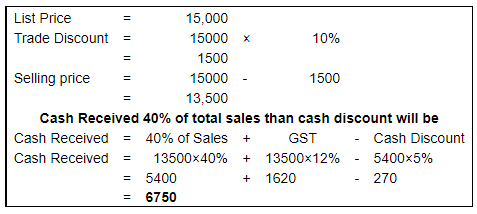

Trade discount is the part of purchases & it should be deducted from the purchases. It is no shown in the books of accounts.

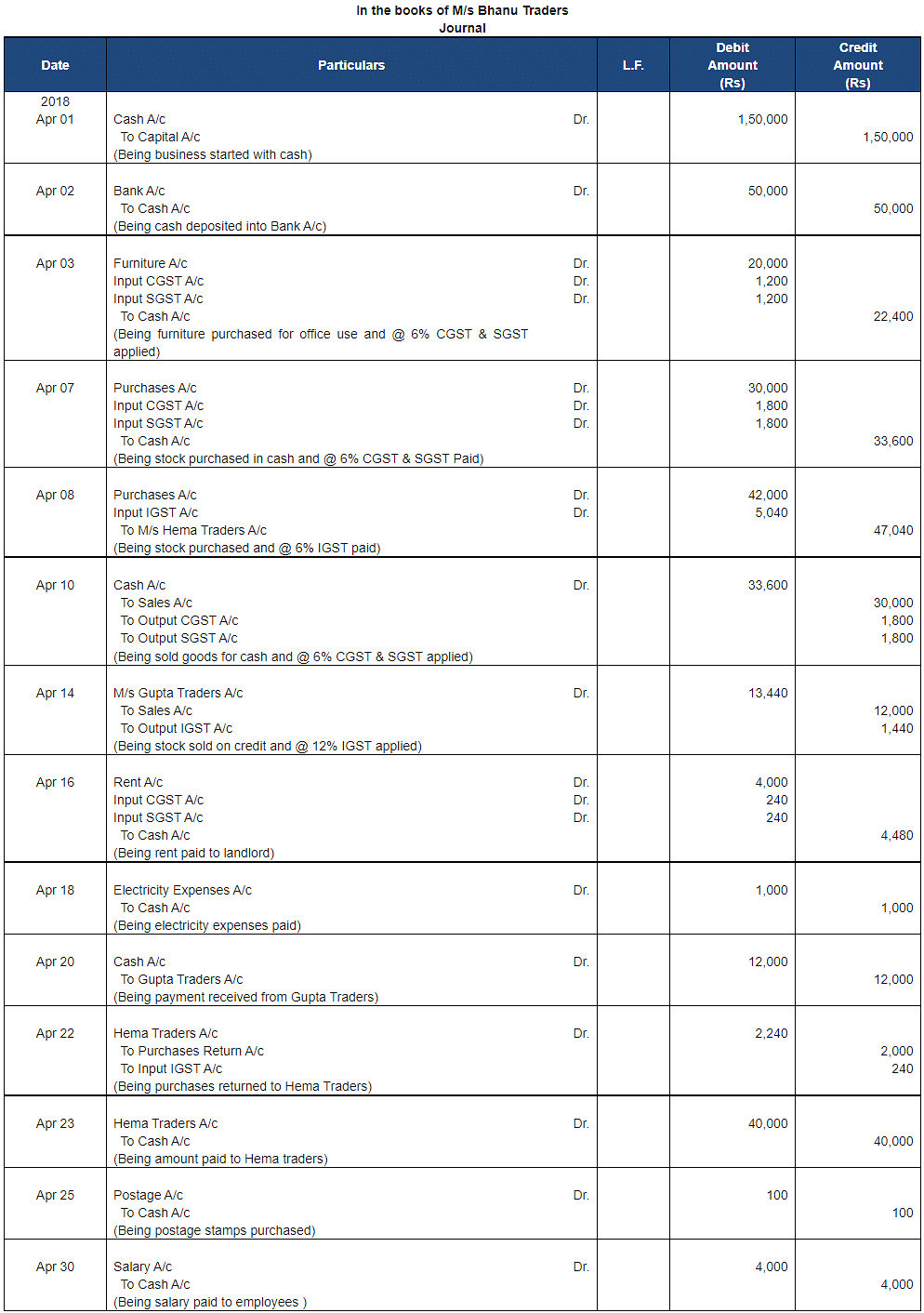

Q.4. Pass Journal entries of M/s. Bhanu Traders, Delhi, from the following transactions. Post them to the Ledger:

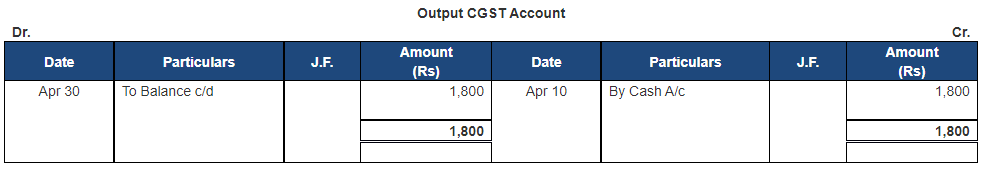

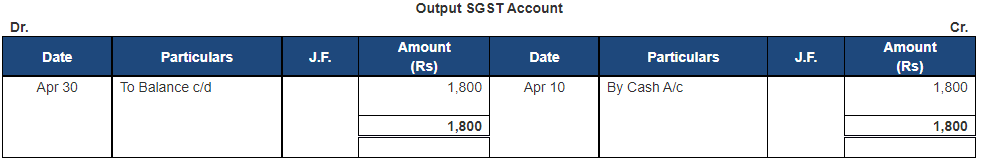

Intra-state transactions are subject to levy of CGST and SGST @ 6% each whereas inter-state transactions are subject to levy of IGST @ 12%. Out of the above transactions marked (*) are not subject to levy of GST.

Ans. Statement showing Journal of M/s Bhanu Traders

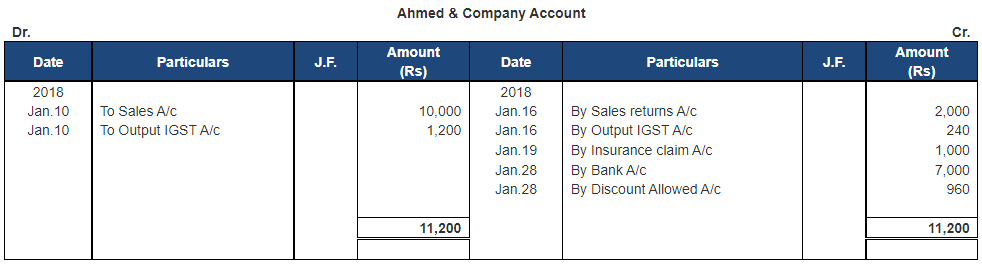

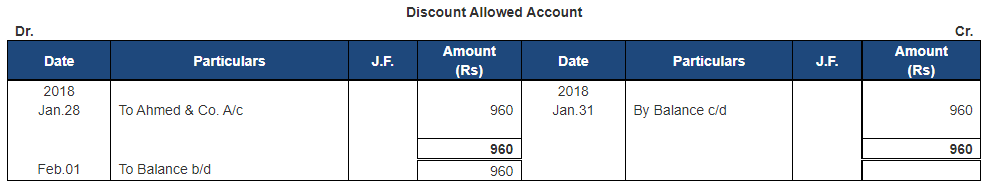

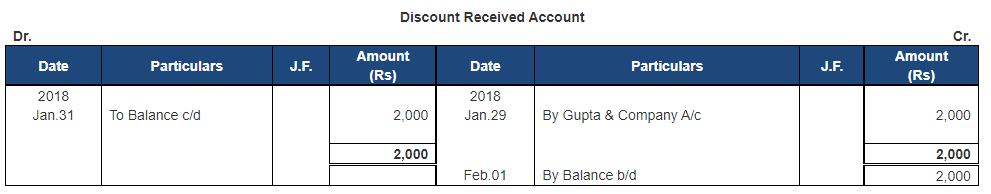

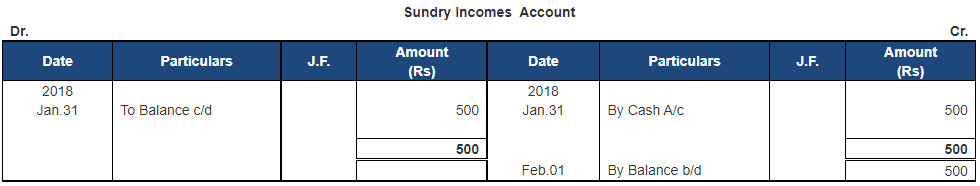

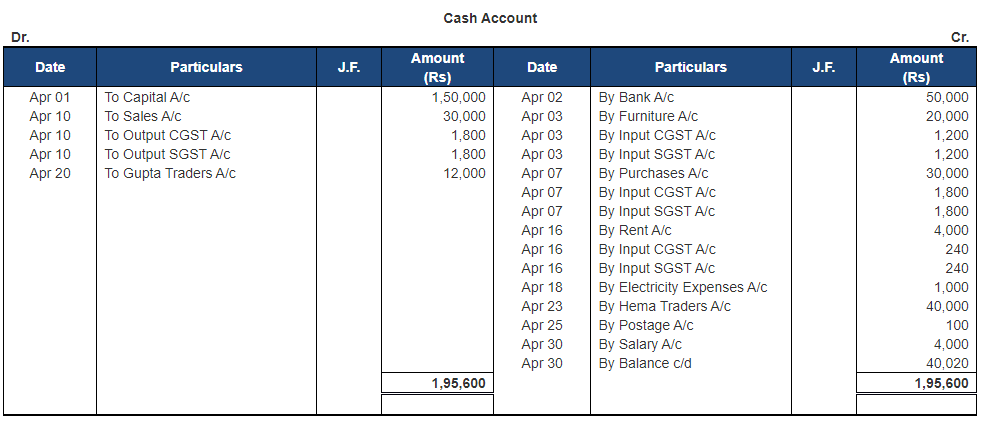

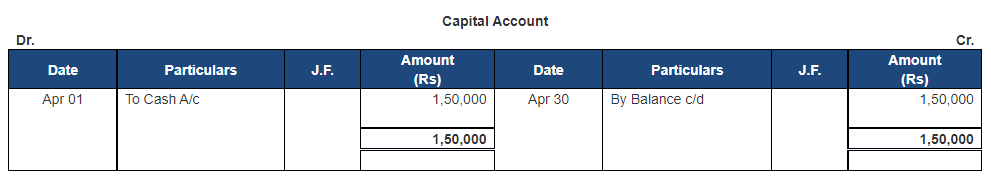

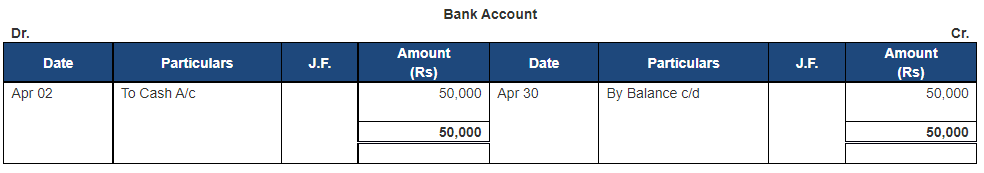

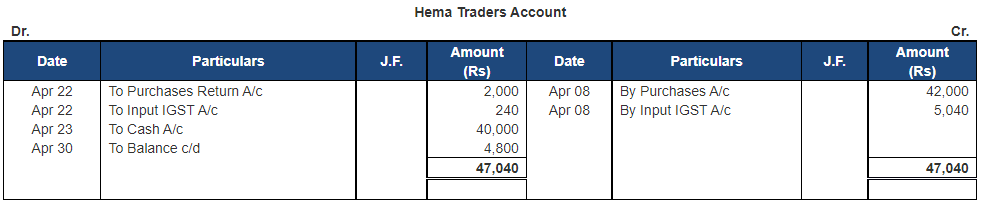

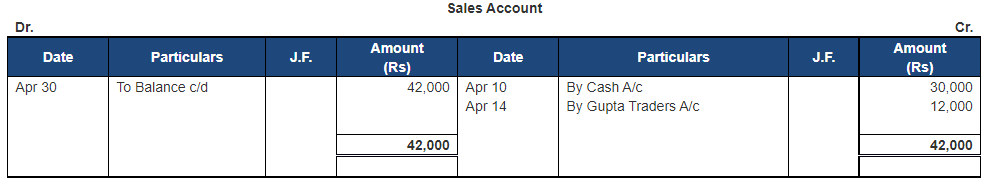

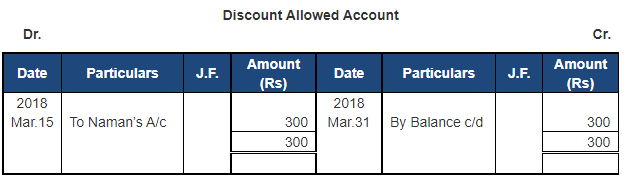

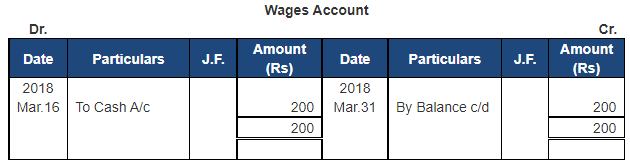

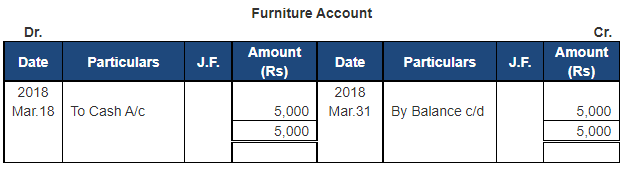

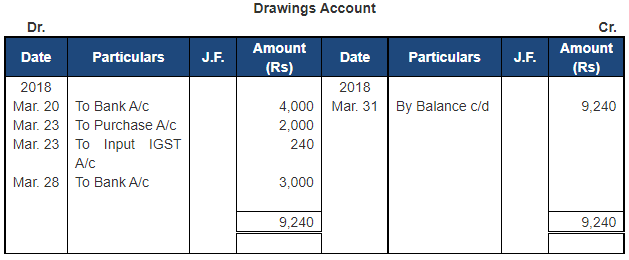

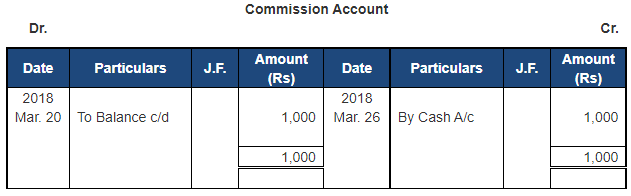

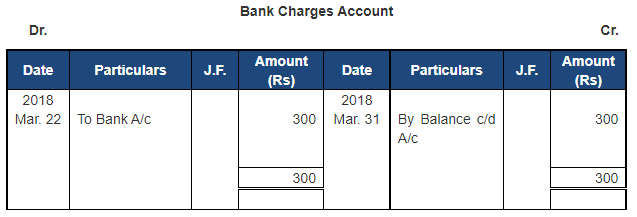

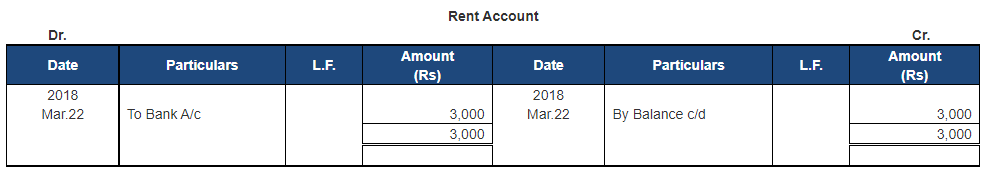

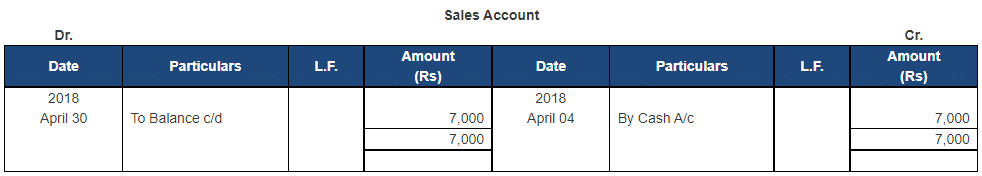

Following are the ledgers shown in the books of M/s Bhanu Traders.

Point of Knowledge:

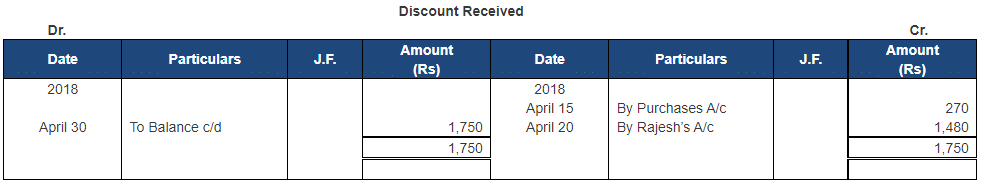

- Discount allowed when a payment is made. Discount received when payment is received. Discount allowed is an expense for business, so it should be debited, and discount received is a gain, so it should be credited.

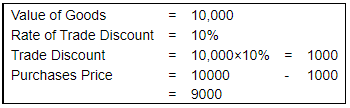

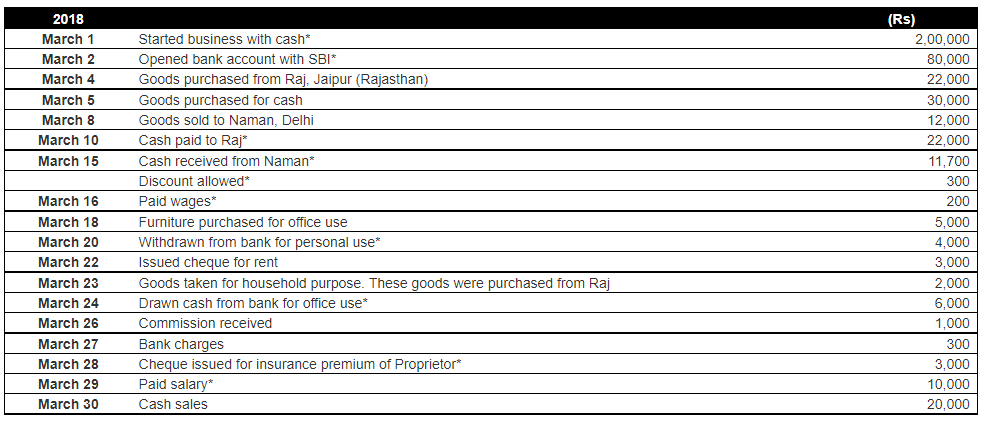

Q.5. Journalise the following transactions in the Journal of M/s. Gupta Brothers (Prop. Shri R. K. Gupta), Delhi and post them to the Ledger:

Inter-state transactions are subject to levy of IGST @ 12% and Intra-state transactions are subject to levy of CGST and SGST @ 6% each. GST is not levied on transactions marked with (*).

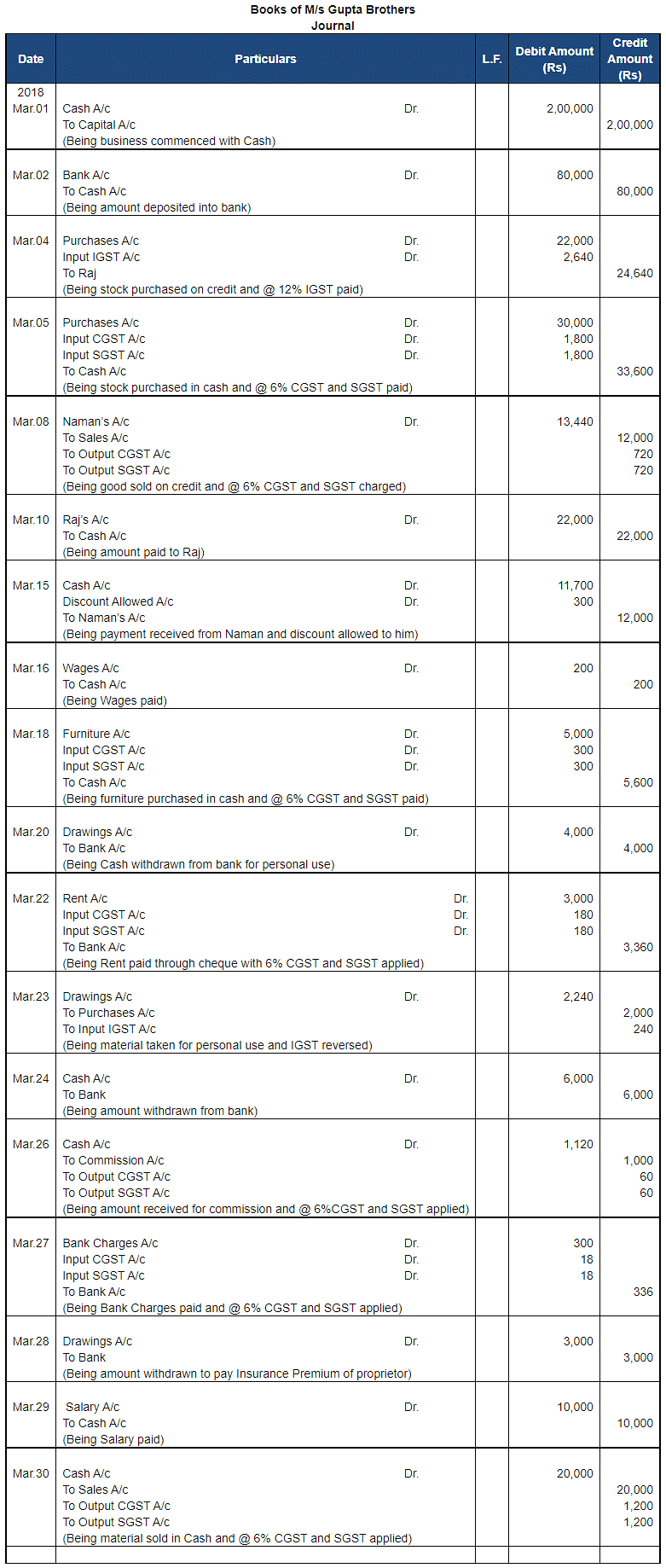

Ans. Statement showing Journal of M/s Gupta Brothers

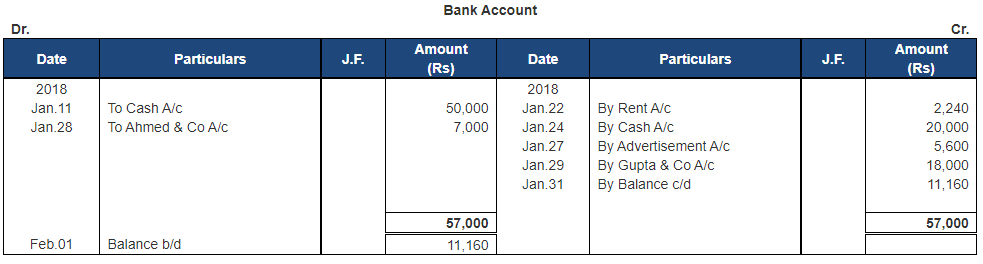

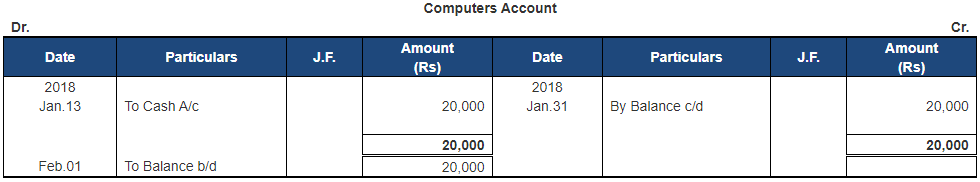

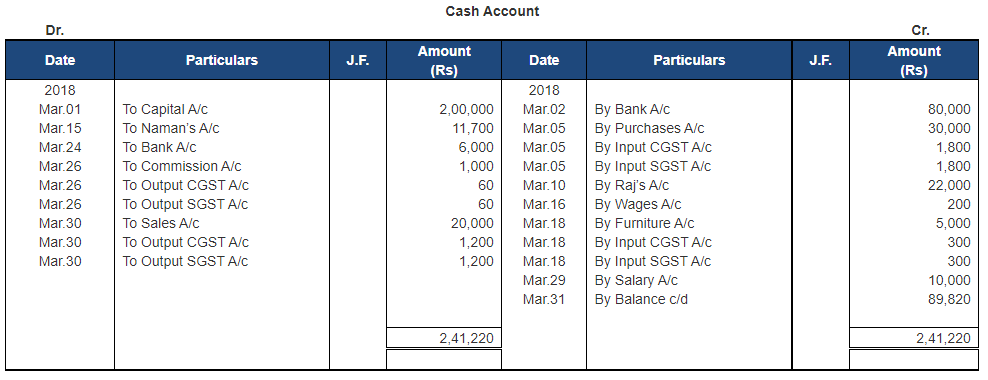

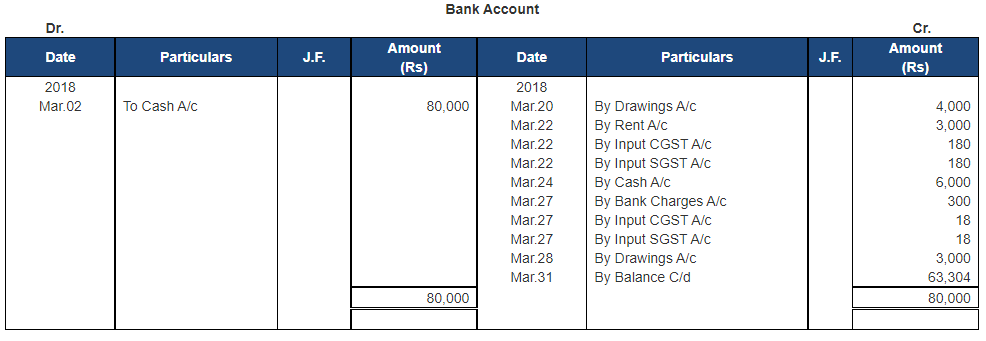

Following are the ledgers shown in the books of M/s Gupta Brothers

Point of knowledge:

- When we use goods for personal use, it reduces the value of purchases with the value of goods used as personal. It is so because if goods are used for purposes other than sale, the amount of such goods is reduced.

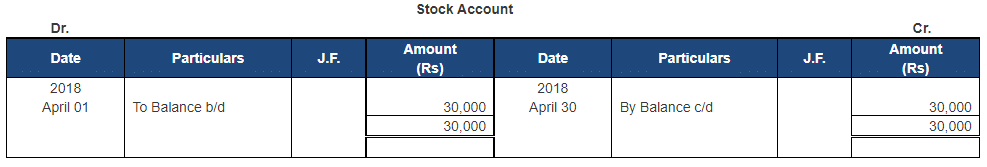

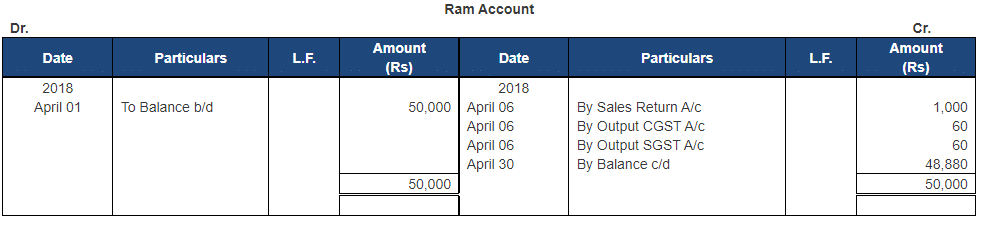

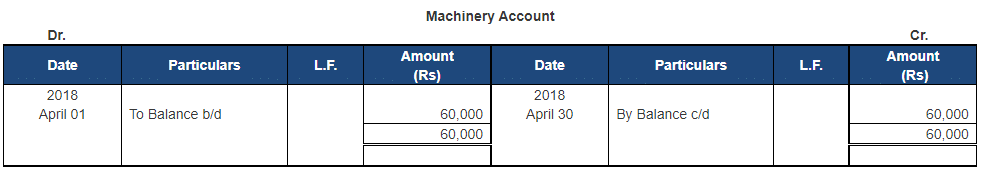

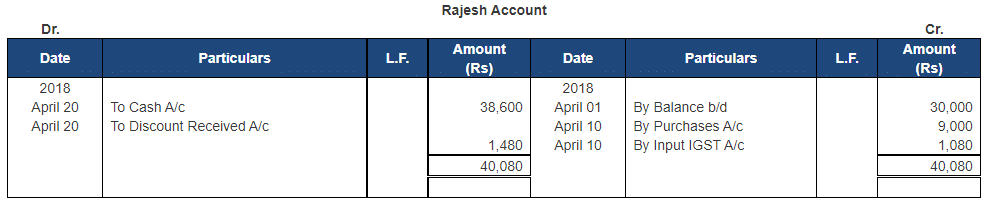

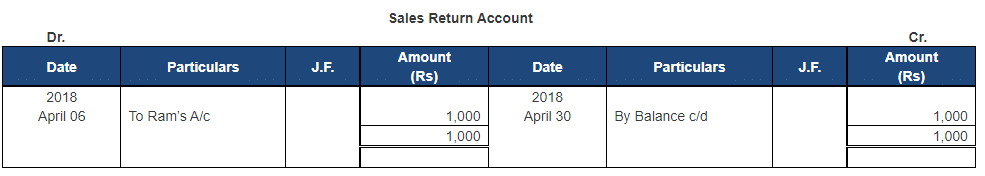

Q.6. Following balances appeared in the books of Ashok, Delhi on 1st April, 2018:

Assets: Cash Rs. 50,000; Stock Rs. 30,000; Debtors–Ram Rs. 50,000; Machinery Rs. 60,000.

Liabilities: Creditor – Rajesh Rs. 30,000.

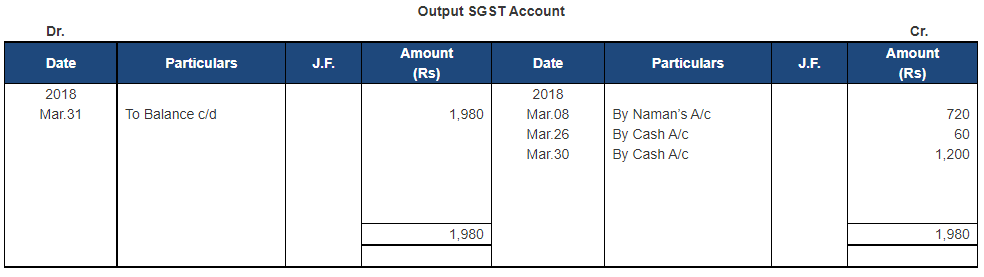

The following transactions took place in April, 2018:

CGST and SGST @ 6% each is levied on intra-state transactions and IGST is levied @12% on inter-state transactions. Transactions marked (*) are not subject to levy of GST.

Pass Journal entries for the above transaction, post them into the Ledger and prepare the Trial Balance on 30th April, 2018.

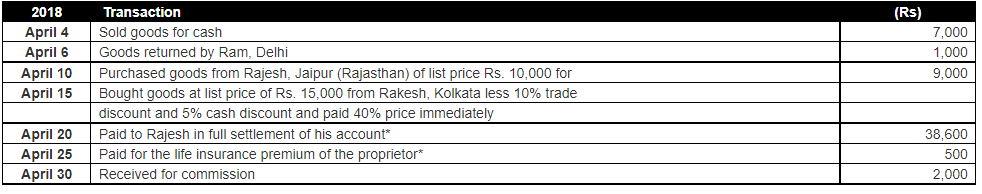

Ans. Statement showing Journal of Ashok, Delhi

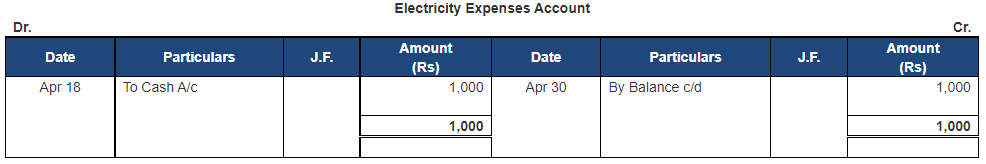

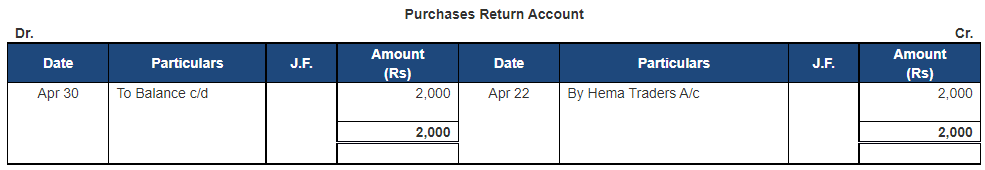

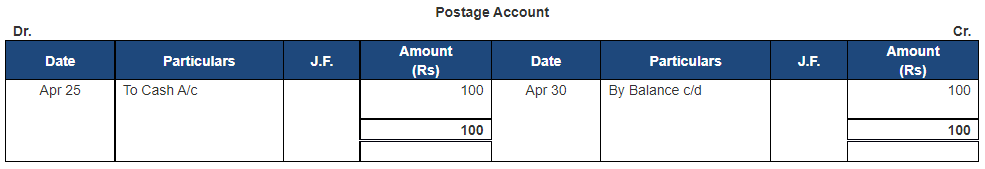

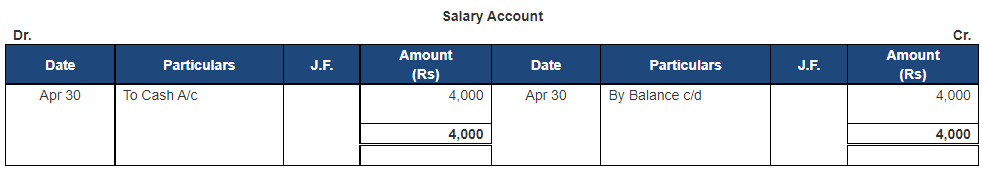

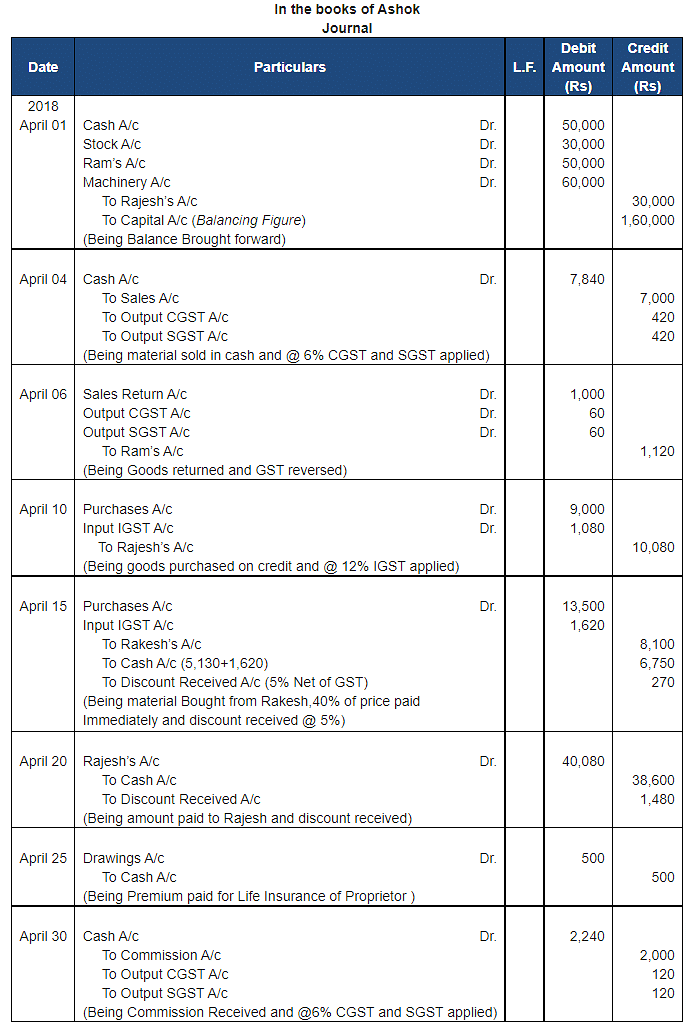

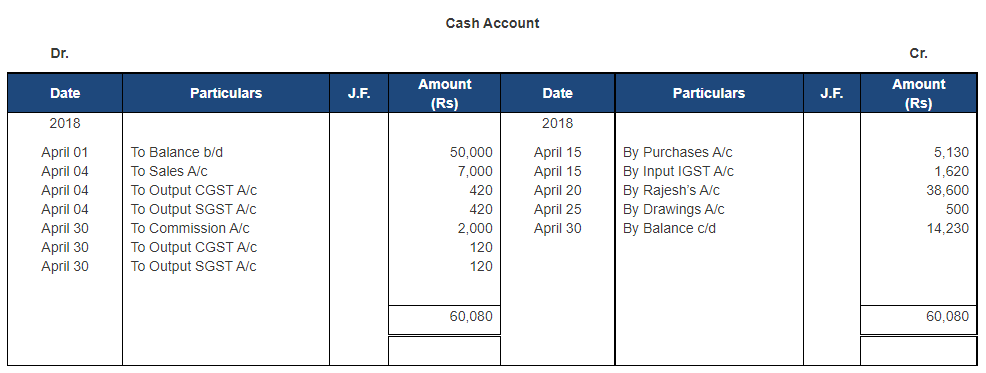

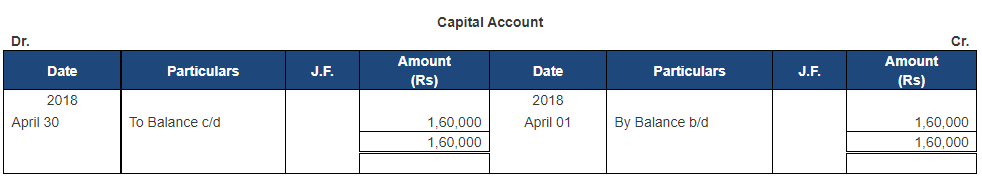

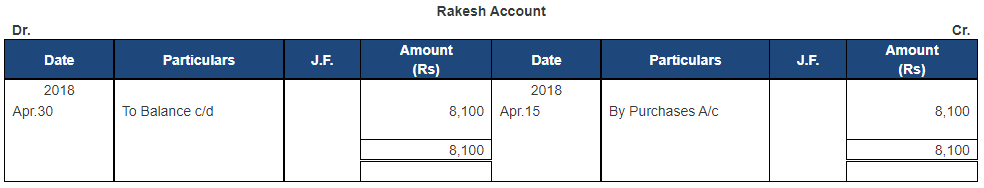

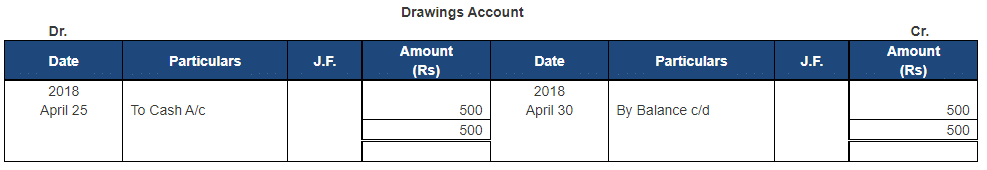

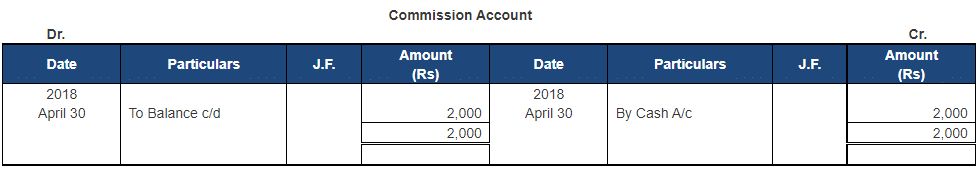

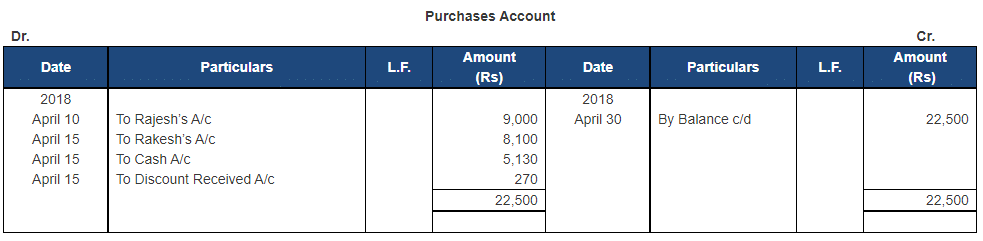

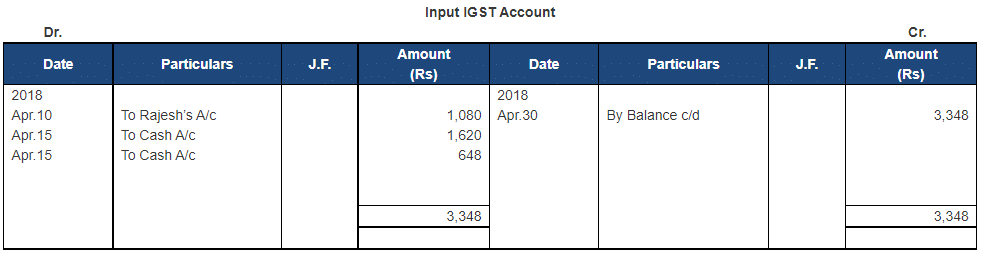

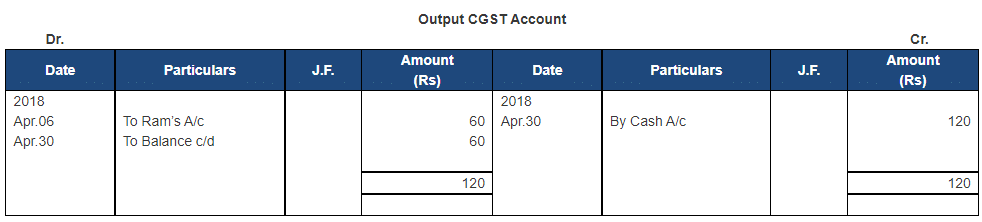

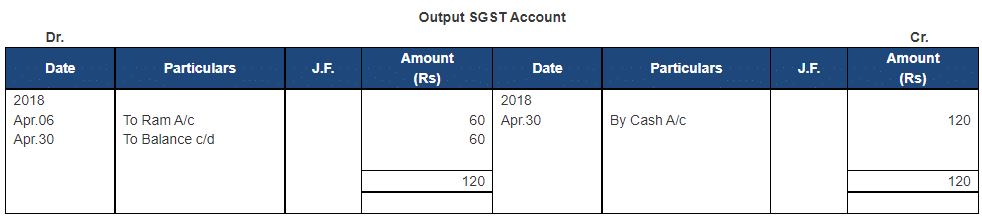

Following are the ledgers shown in the books of Ashok, Delhi

Point of Knowledge:

|

61 videos|227 docs|39 tests

|

FAQs on Ledger - 1 - Accountancy Class 11 - Commerce

| 1. What is Ledger? |  |

| 2. How does Ledger ensure the security of cryptocurrencies? |  |

| 3. What is the significance of Ledger's 1 Commerce platform? |  |

| 4. Can Ledger's hardware wallets support multiple cryptocurrencies? |  |

| 5. Is it possible to recover cryptocurrencies if a Ledger hardware wallet is lost or damaged? |  |