Ledger - 2 | Accountancy Class 11 - Commerce PDF Download

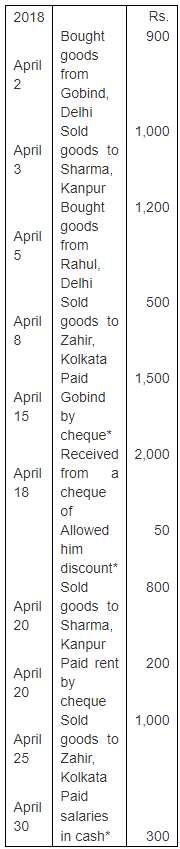

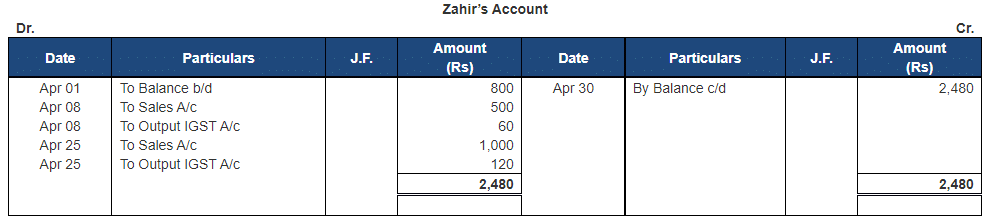

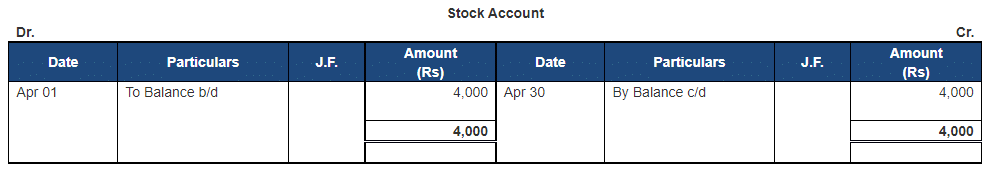

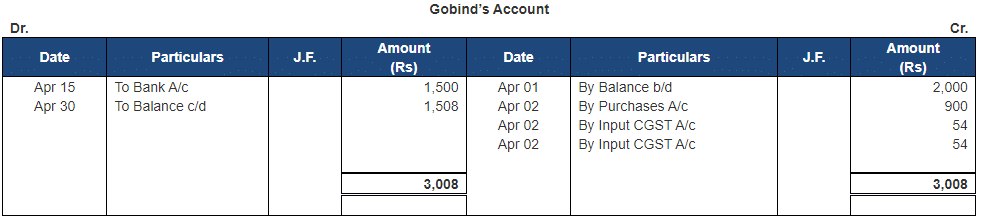

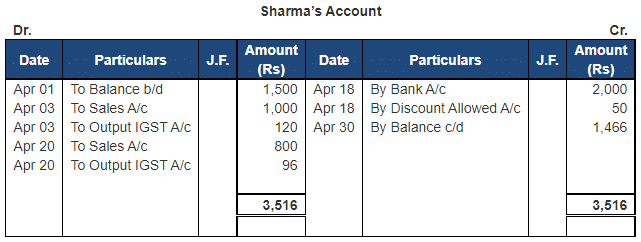

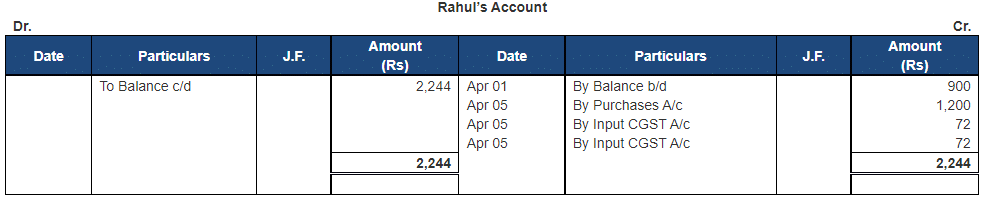

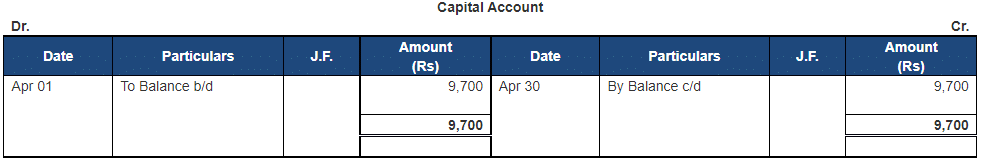

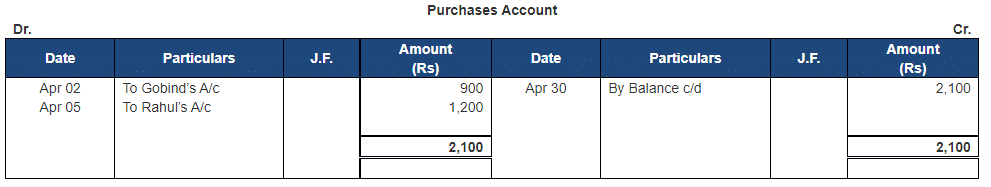

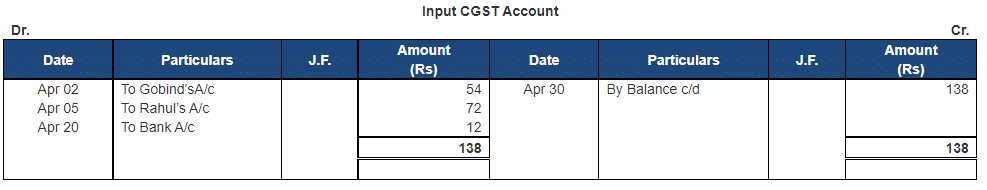

Q.7. On 1st April, 2018, the following were Ledger balances of M/s. Ram & Co., Delhi: Cash in Hand Rs. 300; Cash at Bank Rs. 7,000; Bills Payable Rs. 1,000; Zahir (Dr.) Rs. 800; Stock Rs. 4,000; Gobind (Cr.) Rs. 2,000; Sharma (Dr.) Rs. 1,500; Rahul (Cr.) Rs. 900; Capital Rs. 9,700. Transactions during the month of April, 2018 were:

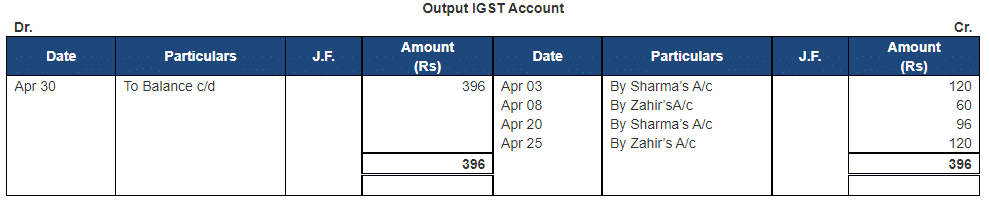

Inter-state transactions are subject to levy of IGST @ 12% and Intra-state transactions are subject to levy of CGST and SGST @ 6% each. GST is not levied on transactions marked with (*).

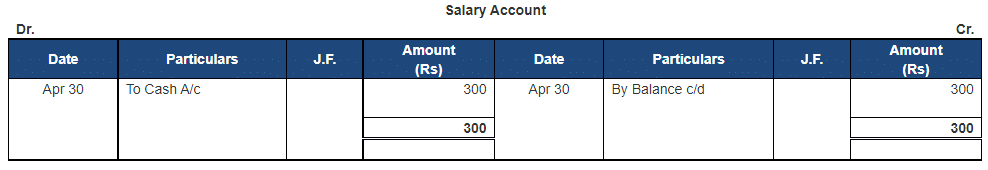

Post the above transactions to the Ledger and prepare the Trial Balance on 30th April,2018. [Trial Balance Total−- Rs. 18,148]

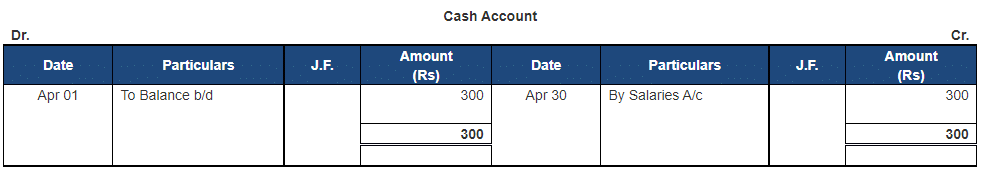

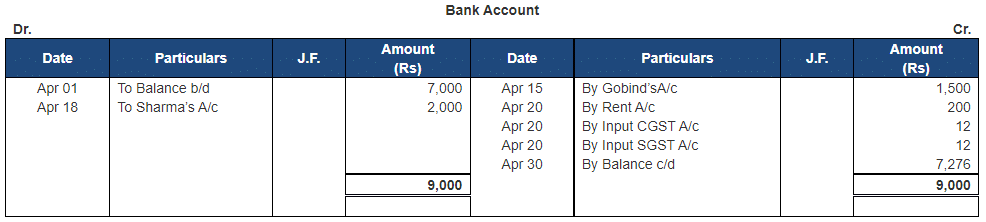

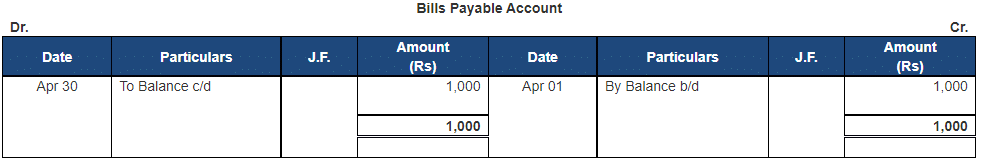

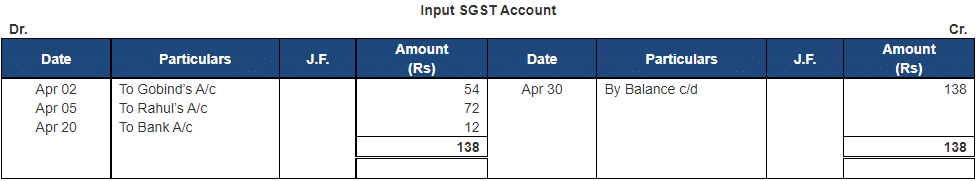

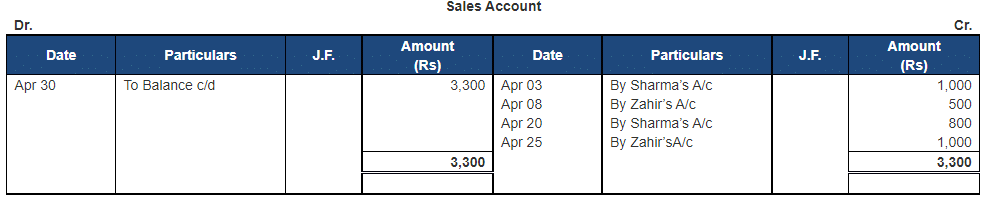

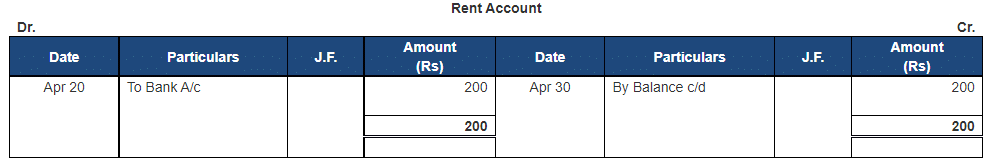

Ans. Following are the ledgers shown in the books of M/s Ram & Co., Delhi

Statement of Trial Balance of M/s Ram & Co., Delhi as on April 30, 2018

Point of Knowledge:

- If the two sides do not match of a Trail Balance it means there is definitely some error in Ledger or Trail balance.

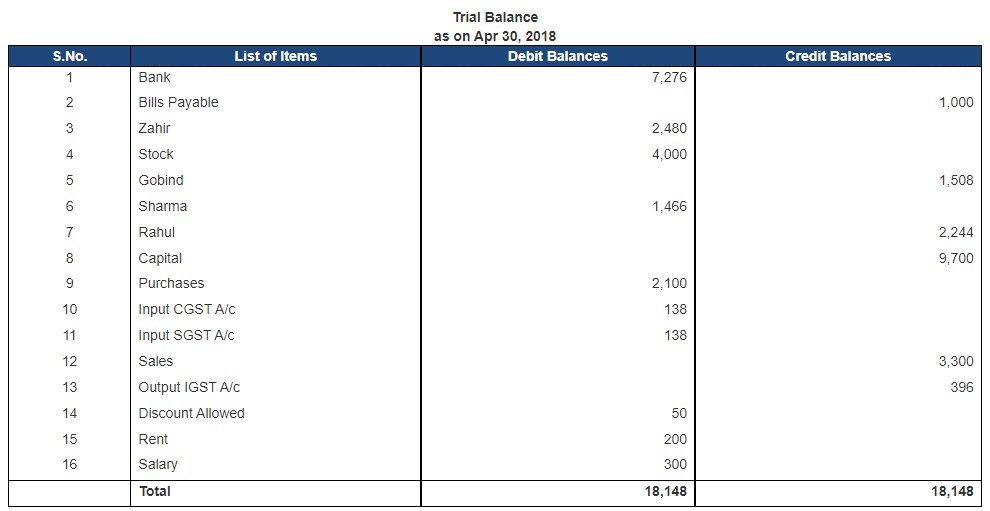

Q.8. You are to open the books of Rajesh Prabhu, Gurugram (Haryana) a trader, through the Journal to record the assets and liabilities and then to record the daily transactions for the month of April, 2018. A Trial Balance is to be extracted as on 30th April, 2018:

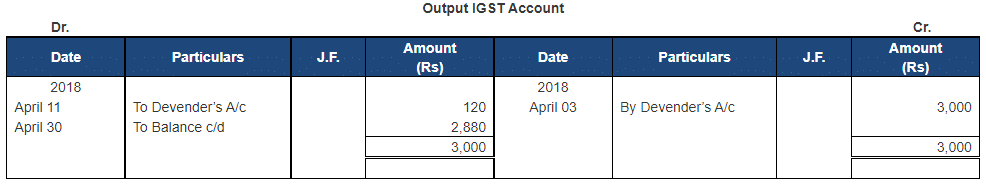

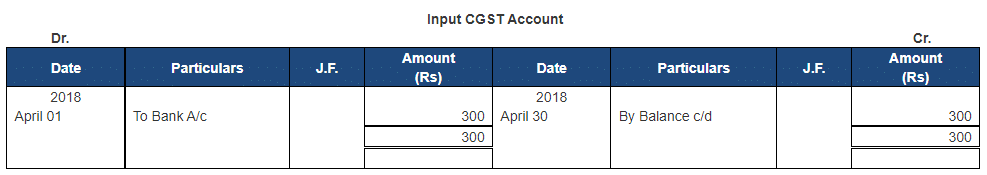

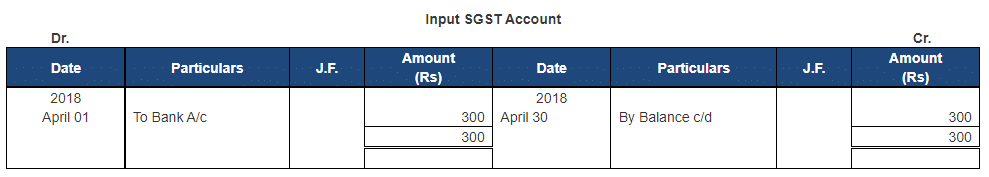

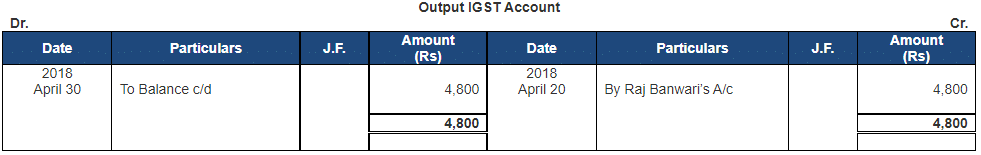

Inter-state transactions are subject to levy of IGST @ 12% and Intra-state transactions are subject to levy of CGST and SGST @ 6% each. GST is not levied on transactions marked with (*).

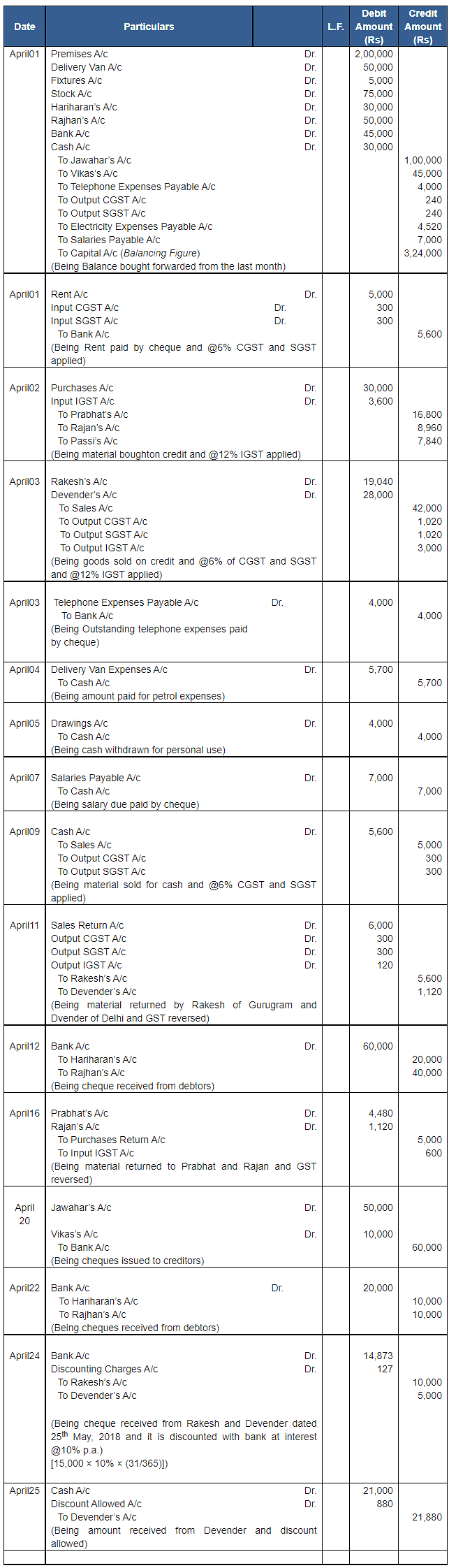

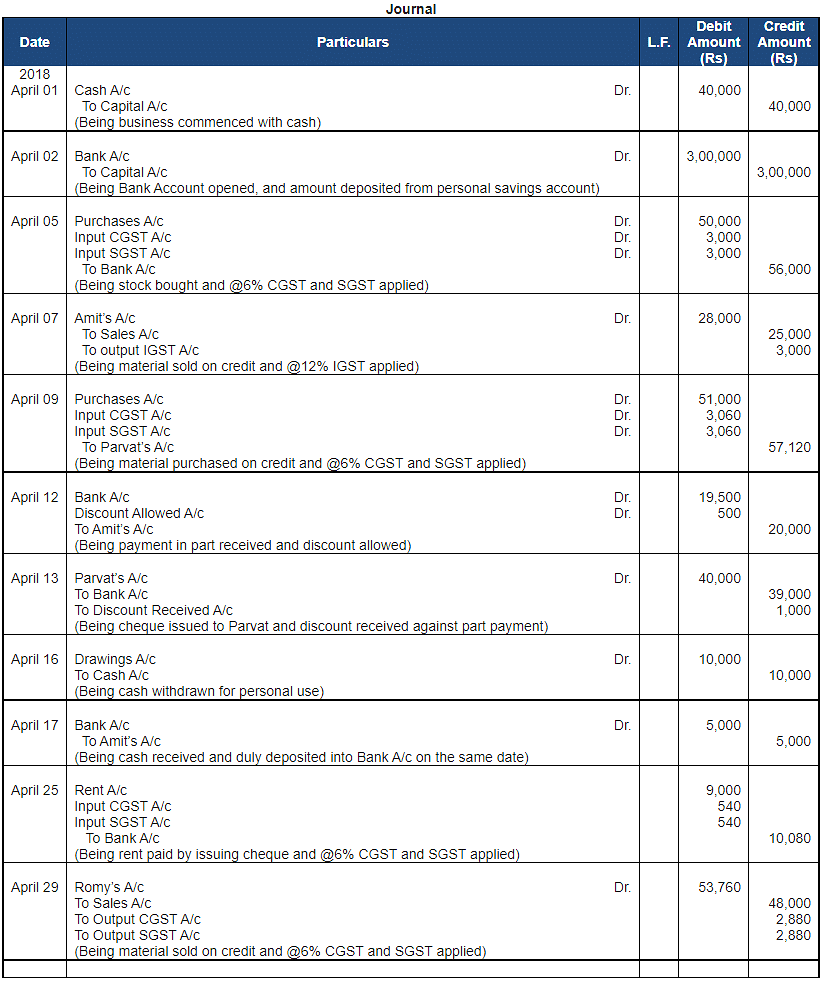

Ans. Statement showing Journal of Rajesh Prabhu, Gurugram (Haryana)

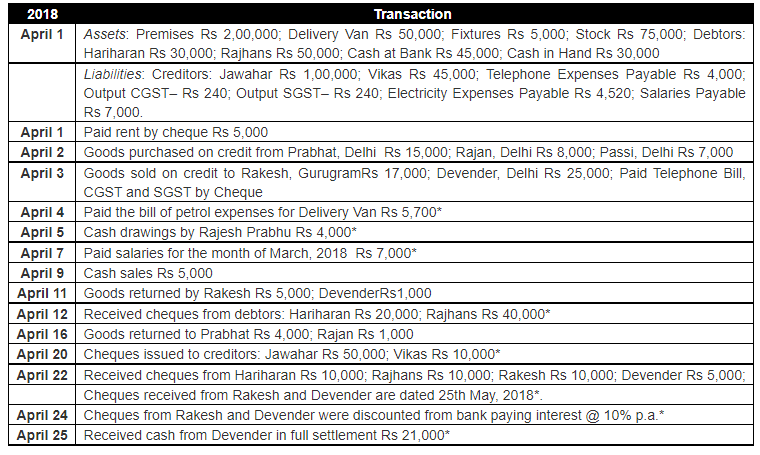

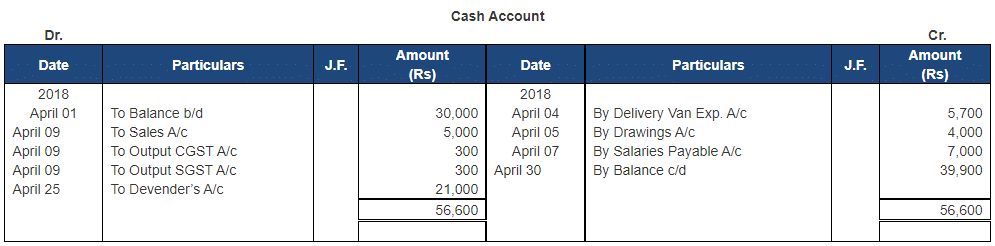

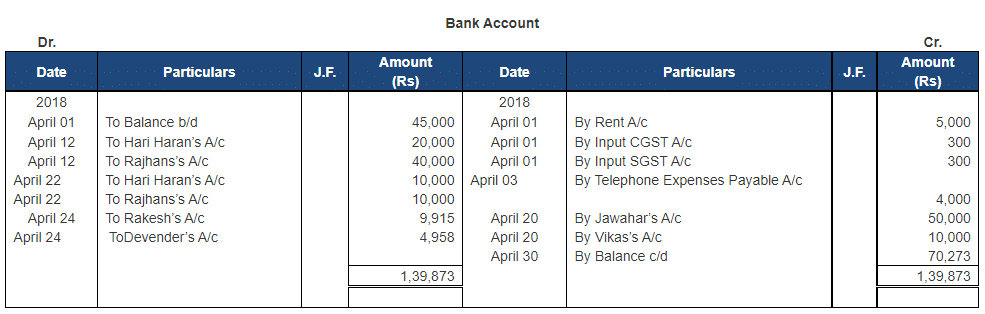

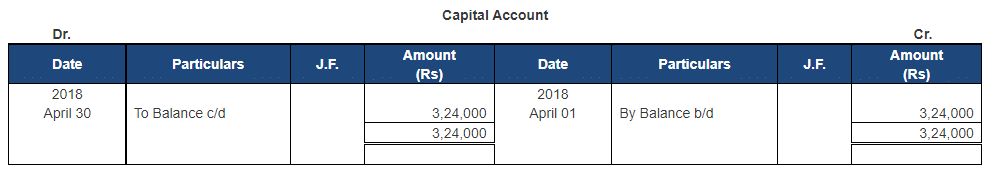

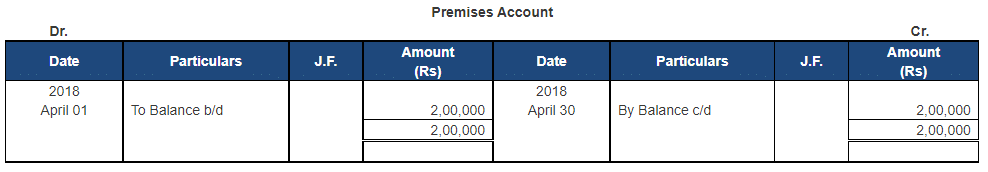

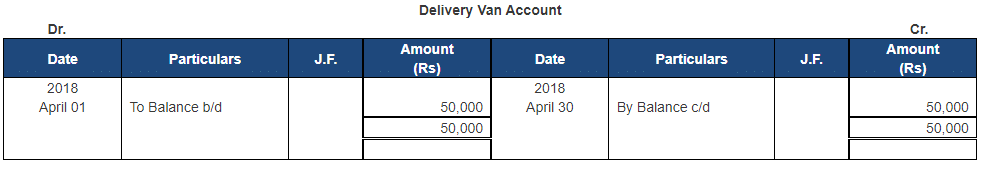

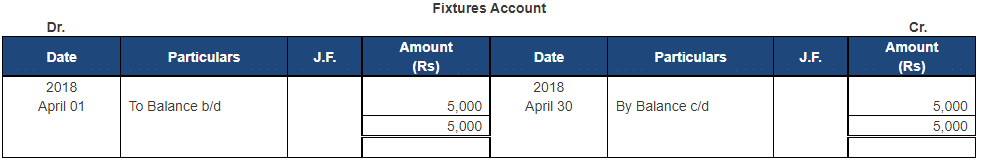

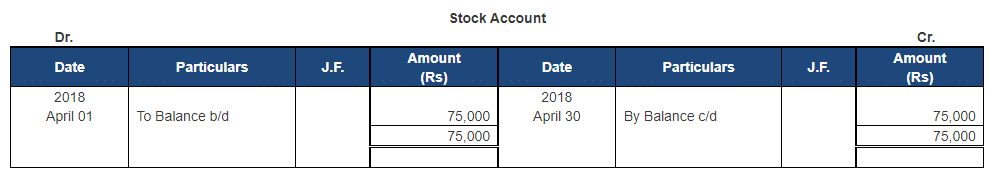

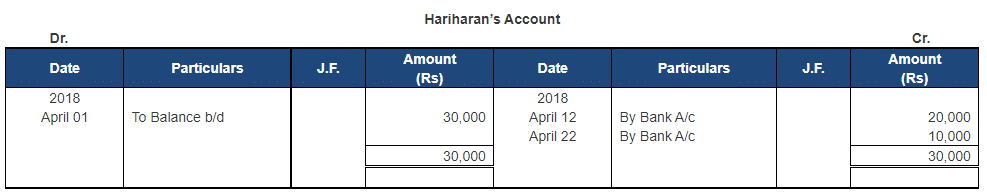

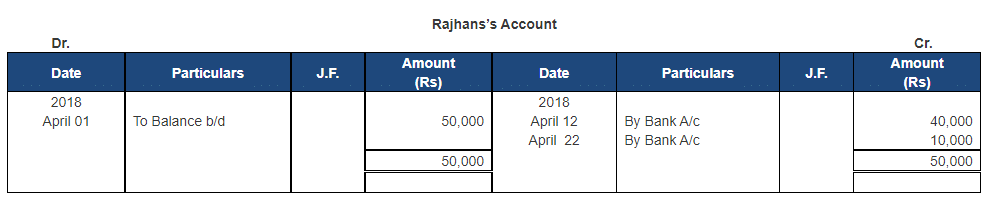

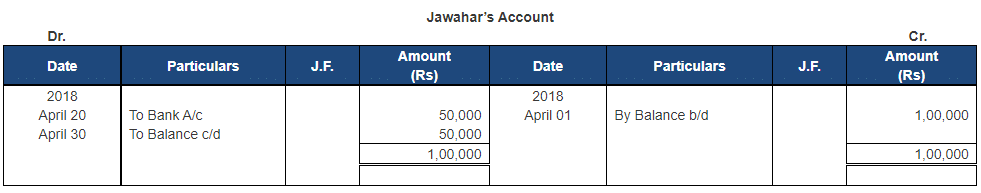

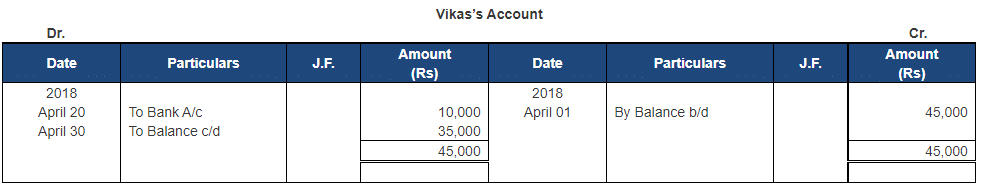

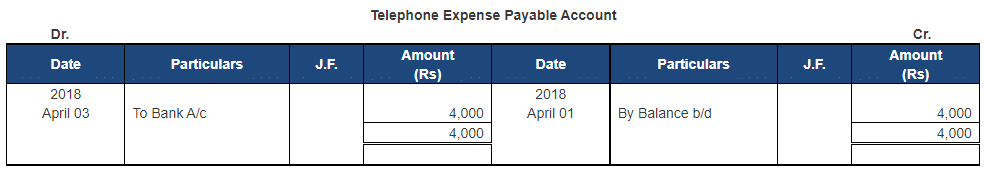

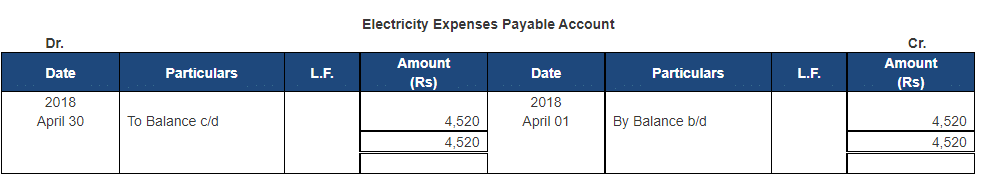

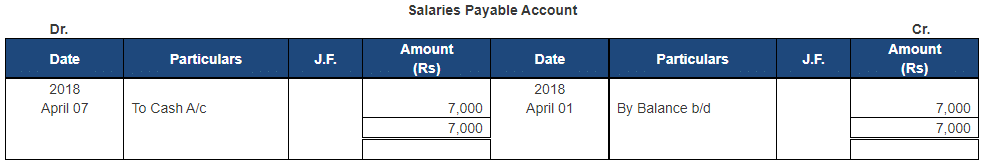

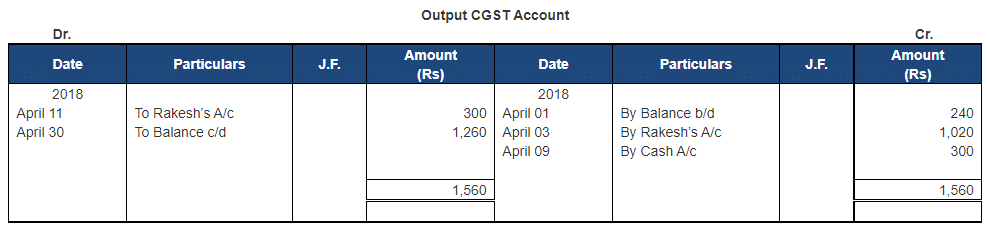

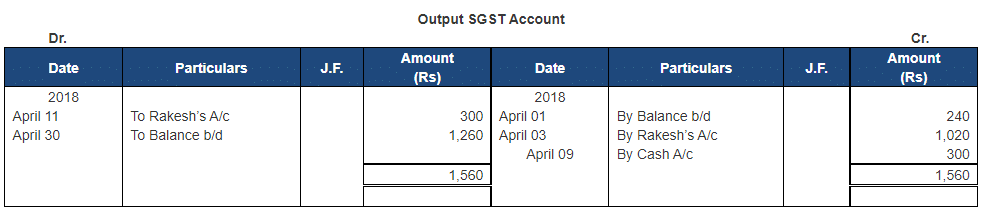

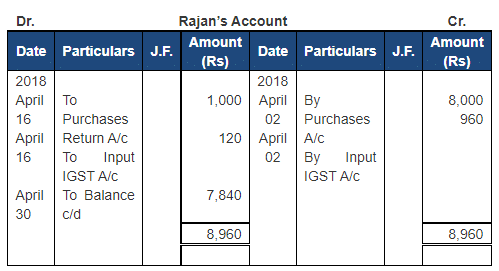

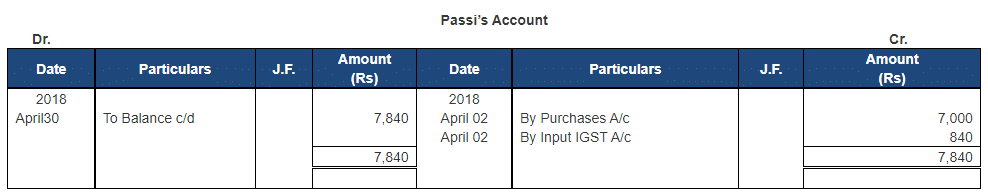

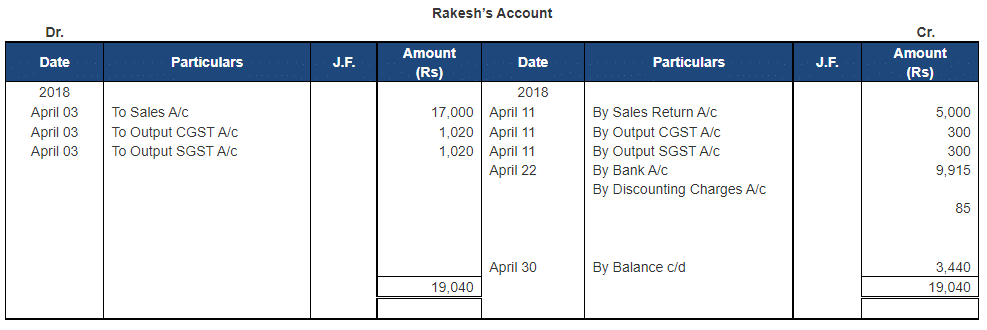

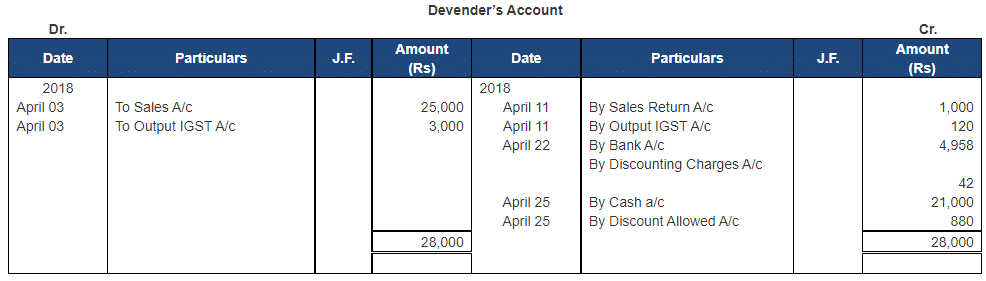

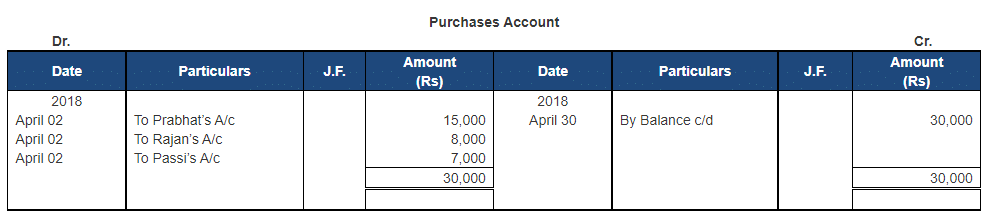

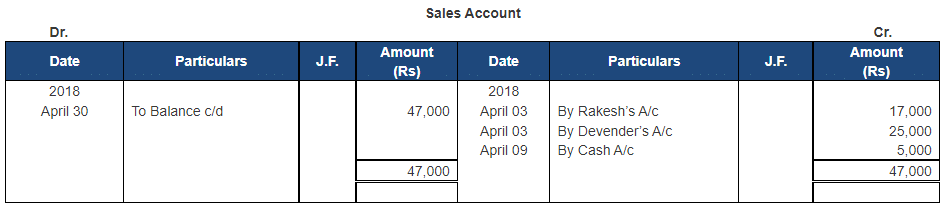

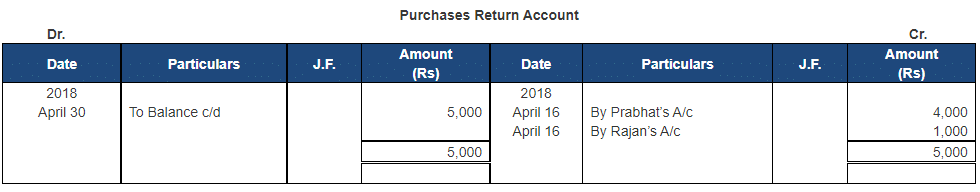

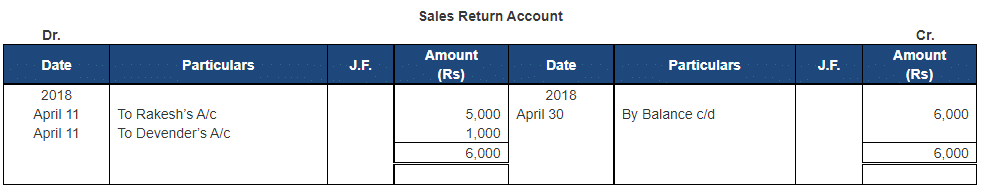

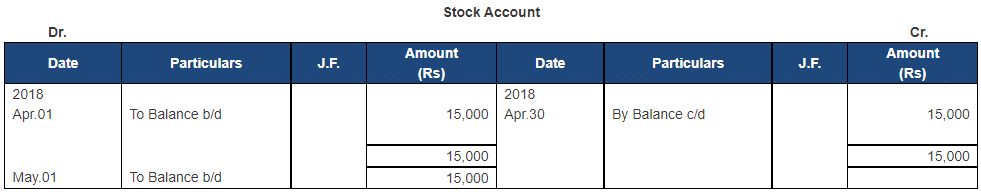

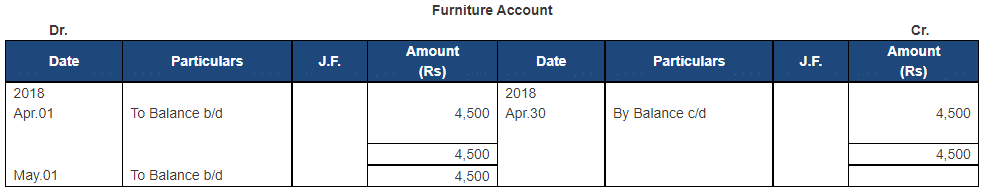

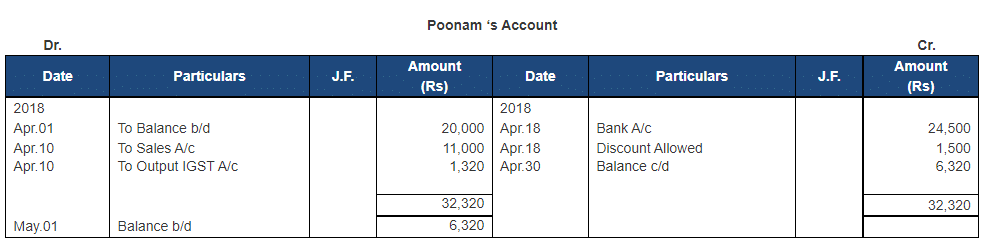

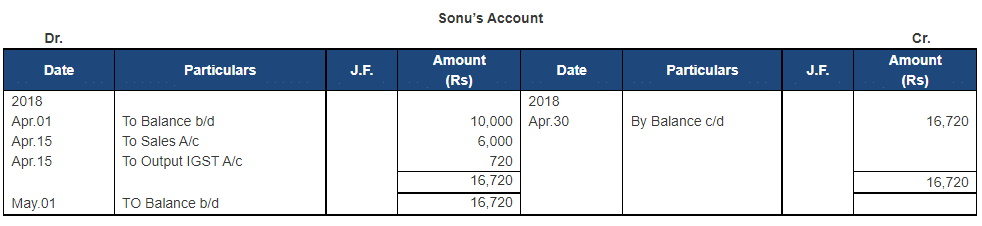

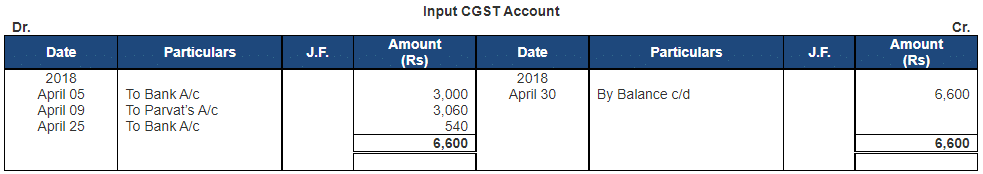

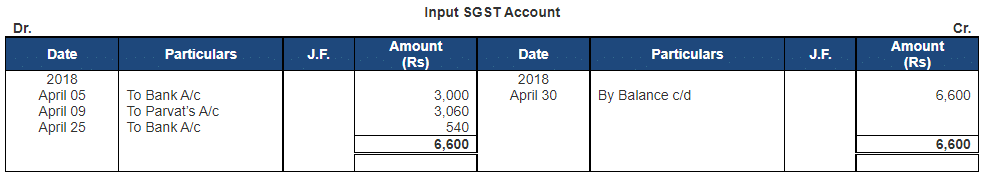

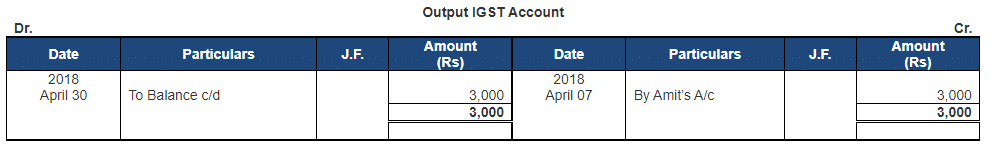

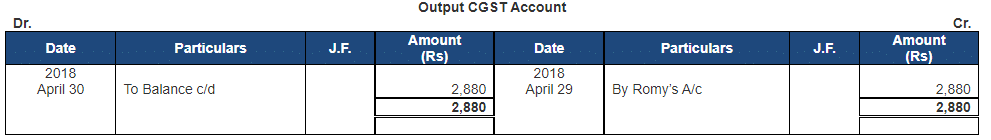

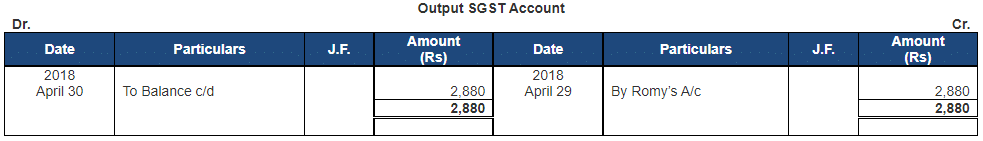

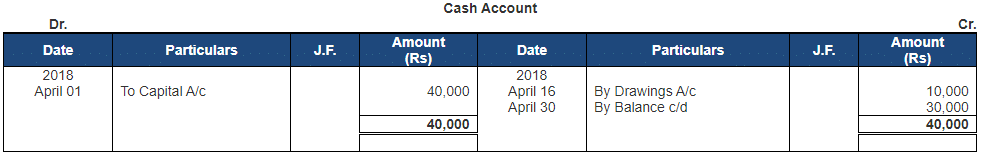

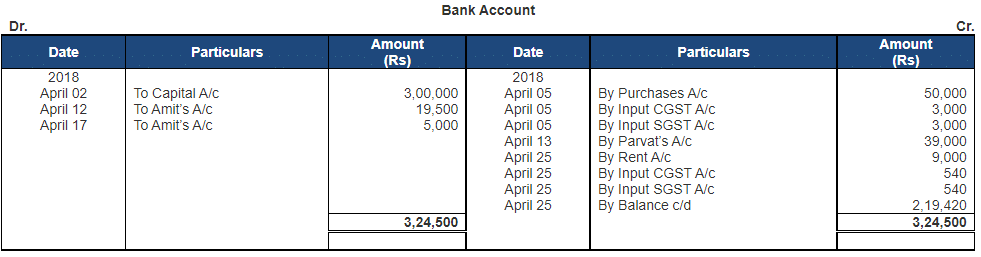

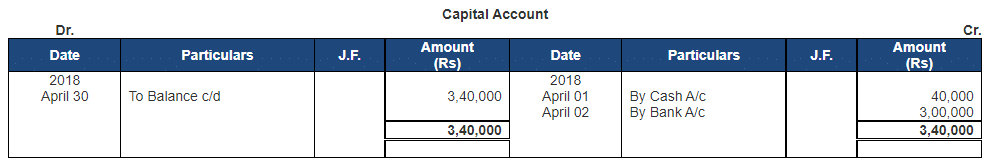

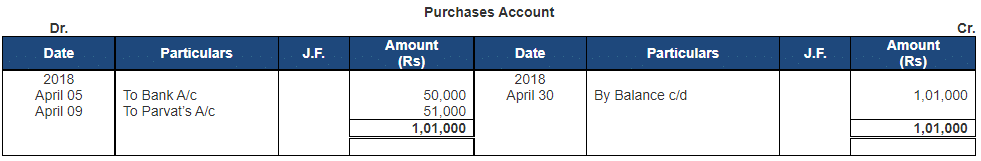

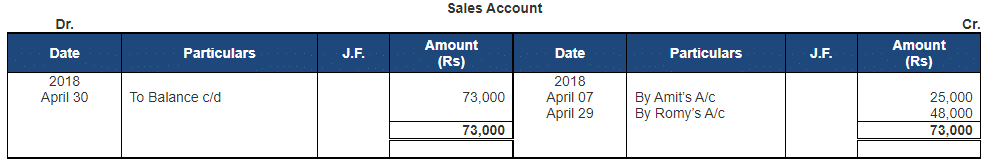

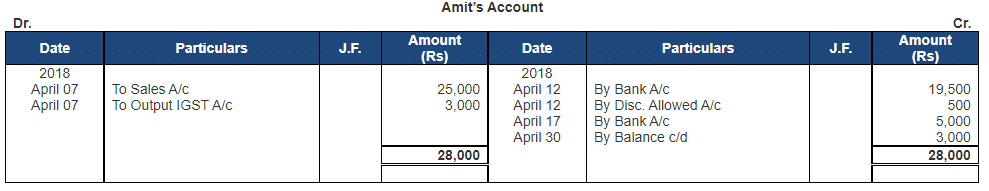

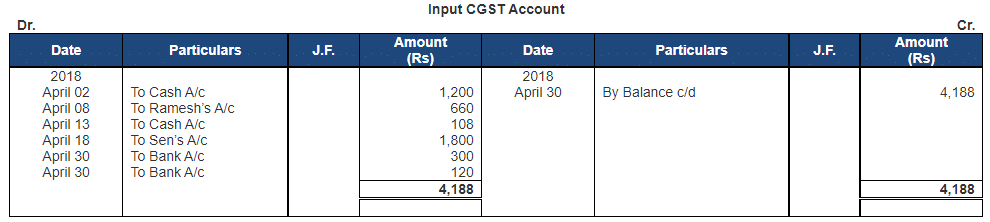

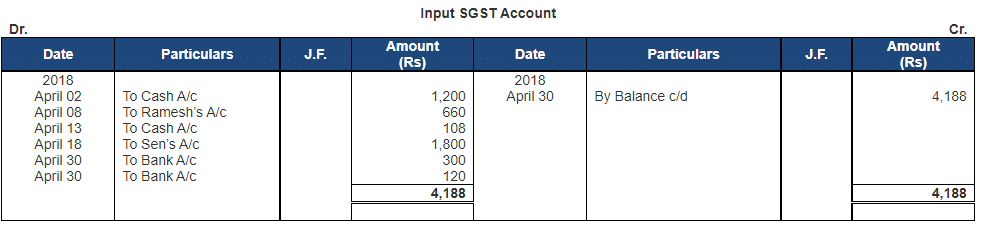

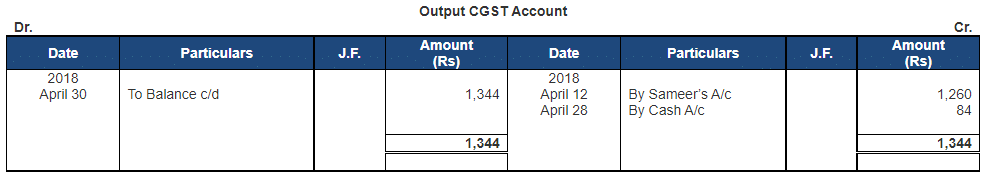

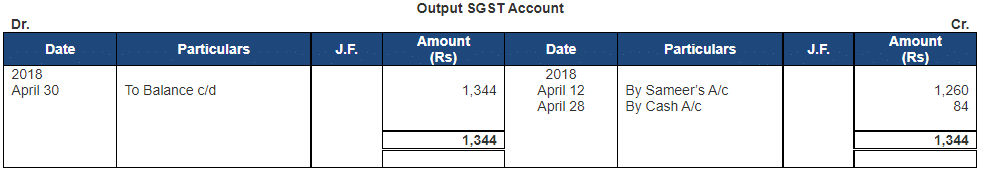

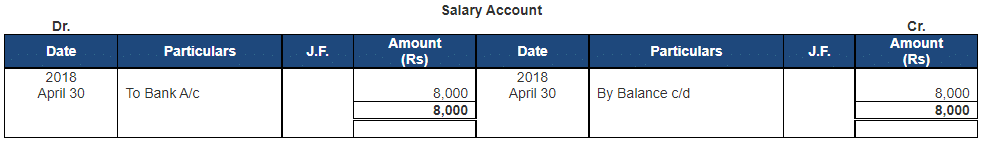

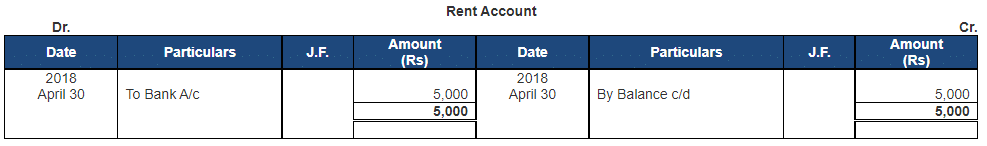

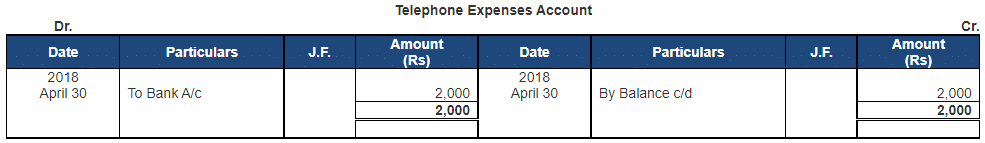

Following are the ledgers shown in the books of Rajesh Prabhu, Gurugram (Haryana)

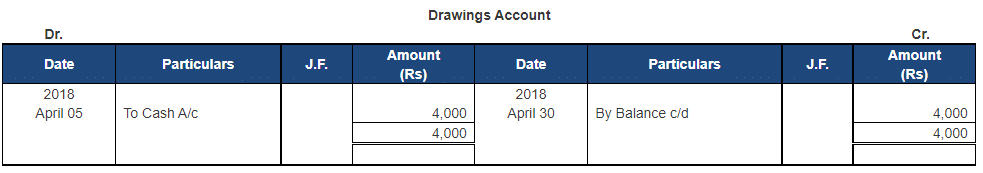

Statement of Trial Balance of Rajesh Prabhu, Gurugram (Haryana) as on April 30, 2018

Point of Knowledge:

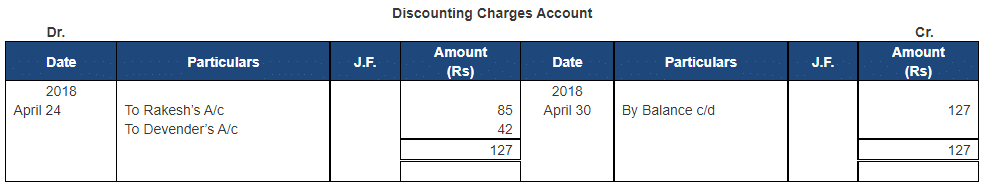

On April 24th, cheque received from Rakesh and Devender dated 25th May, 2018 being discounted with bank and bank deducted charges @10% 15,000 × 10% × (31/365) = Rs. 127

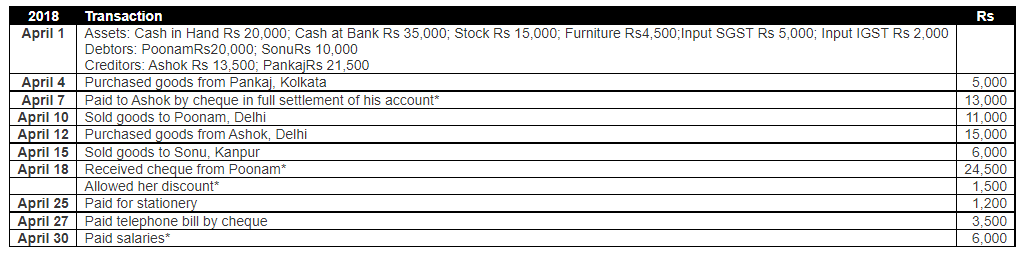

Q.9. Enter the following transactions in the Journal of M/s. Karim Bros., Prop. ShriKarim Khan, Kolkata, post to the Ledger and prepare the Trial Balance:

Inter-state transactions are subject to levy of IGST @ 12% and Intra-state transactions are subject to levy of CGST and SGST @ 6% each. GST is not levied on transactions marked with (*).

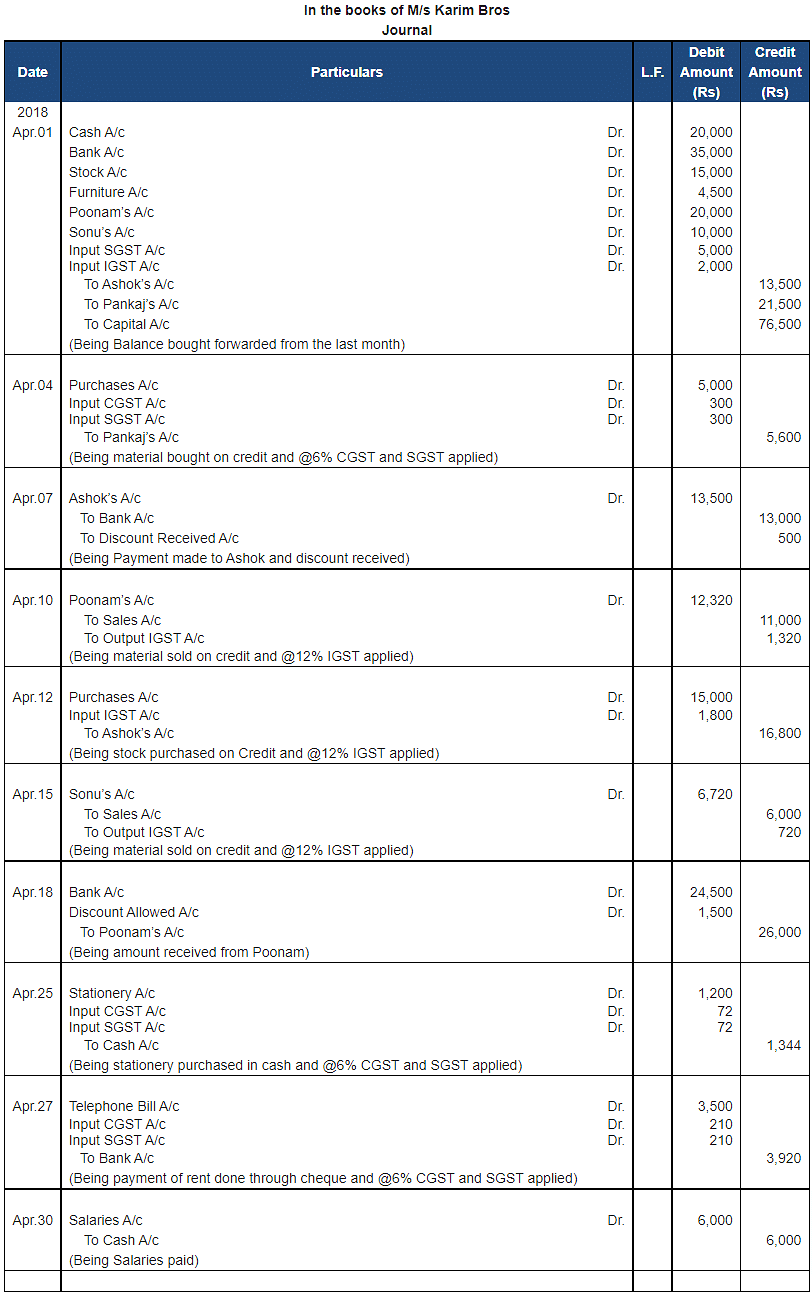

Ans. Statement showing Journal of M/s. Karim Bros.

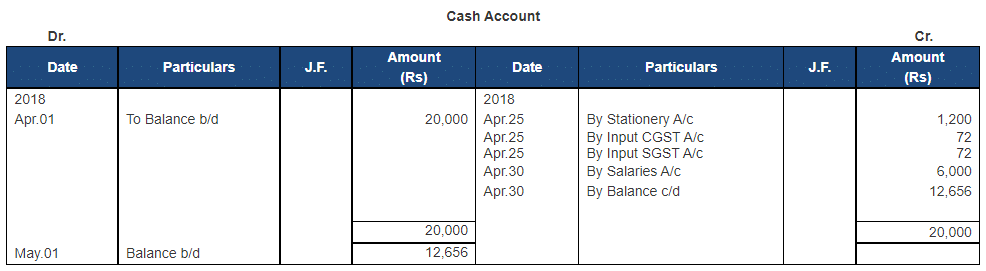

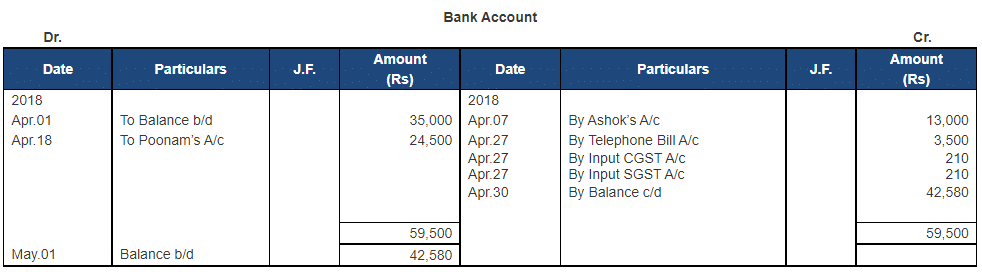

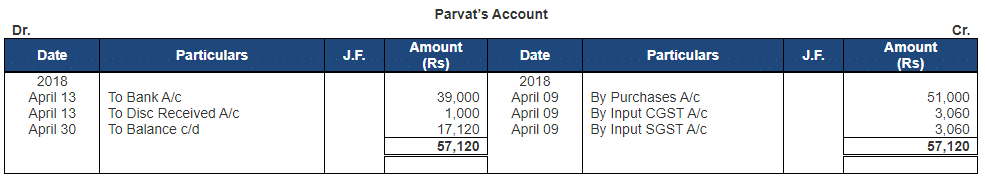

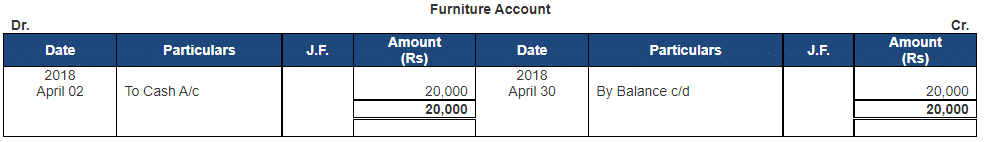

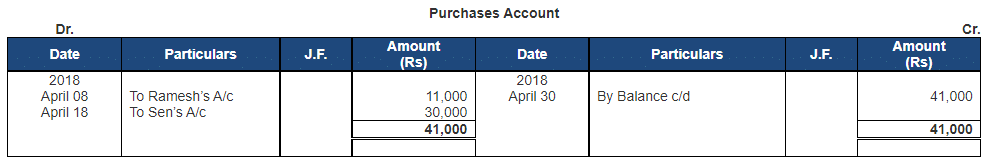

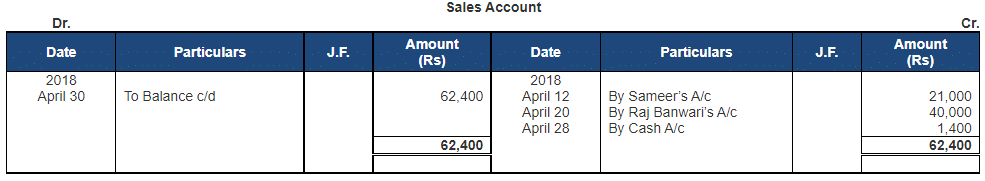

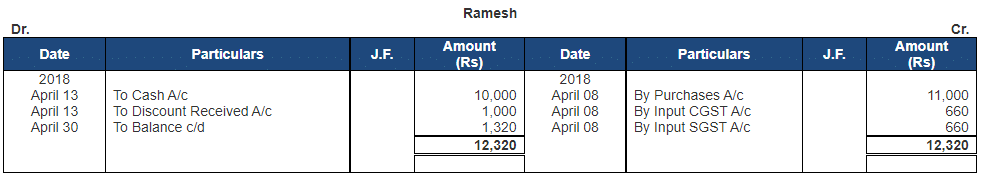

Following are the ledgers shown in the books of M/s. Karim Bros.

Statement of Trial Balance of M/s. Karim Bros., as on April 30, 2018

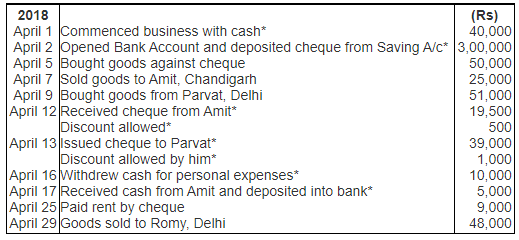

Q.10. Write up the following transactions in the Journal of Ashok, Delhi and post them to the Ledger for April, 2018. Also, prepare the Trial Balance as on 30th April, 2018.

Inter-state transactions are subject to levy of IGST @ 12% and Intra-state transactions are subject to levy of CGST and SGST @ 6% each. GST is not levied on transactions marked with (*).

Ans. Statement showing Journal of Ashok, Delhi

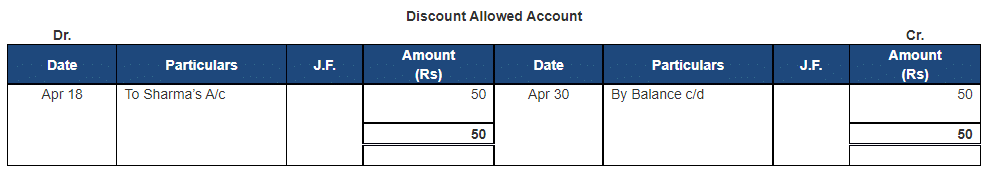

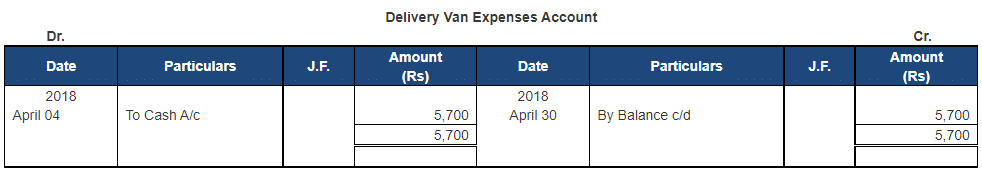

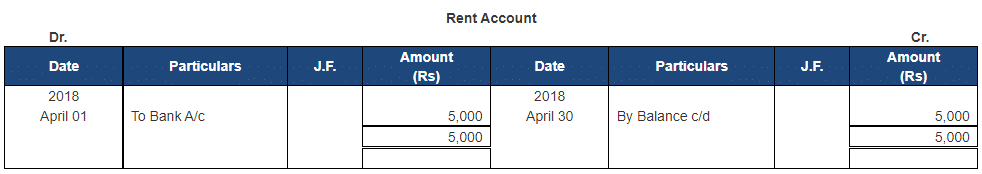

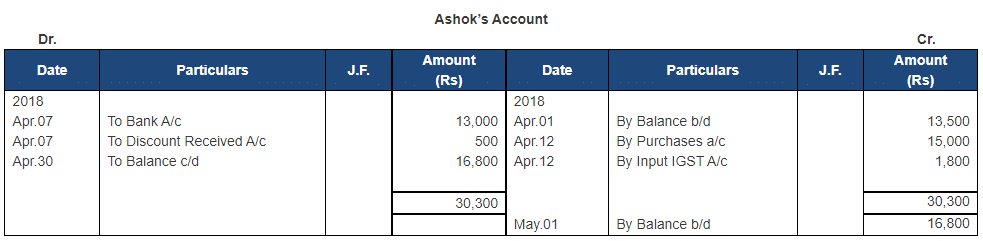

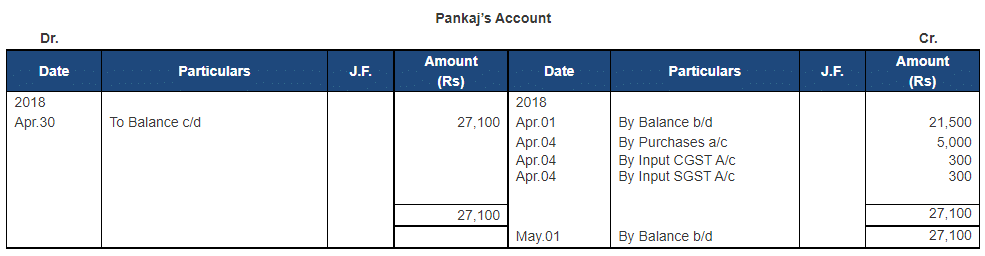

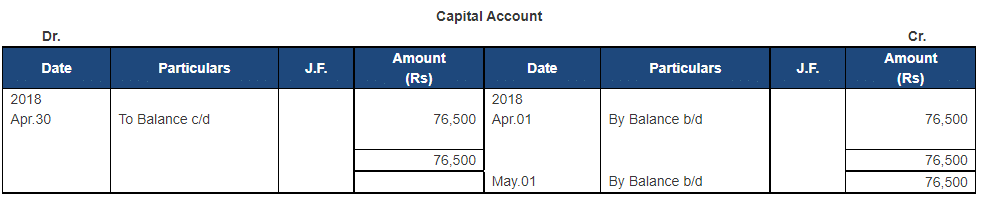

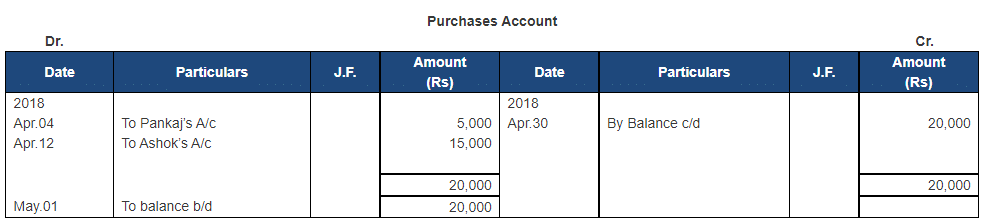

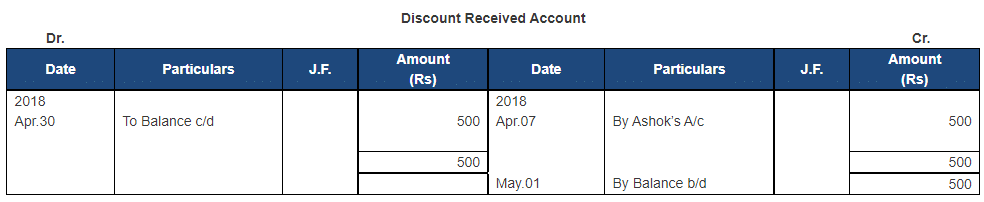

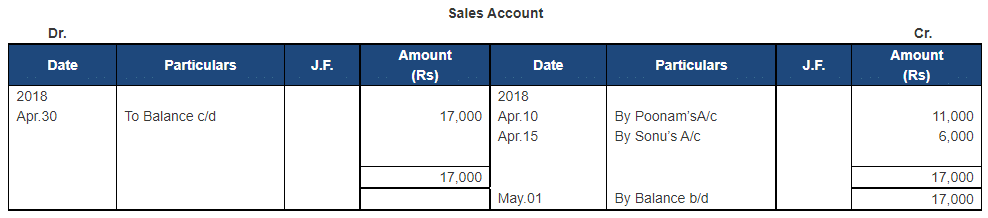

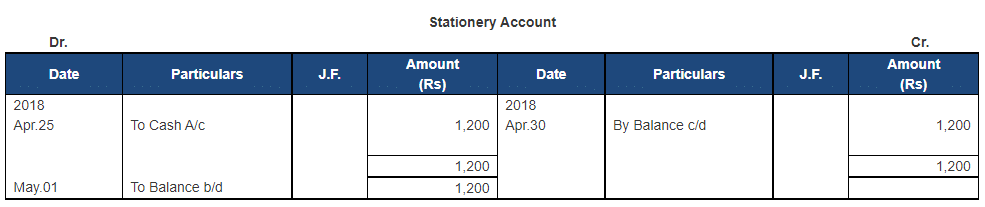

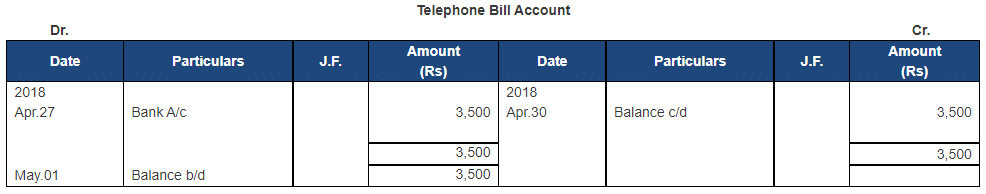

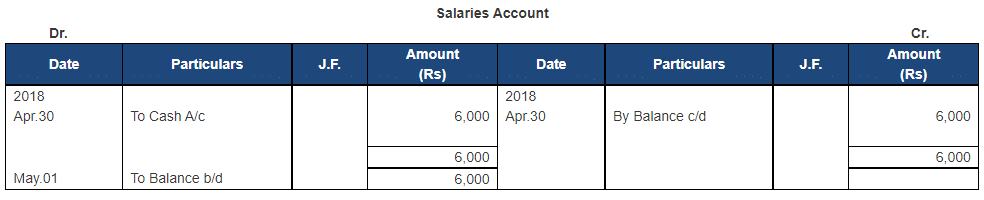

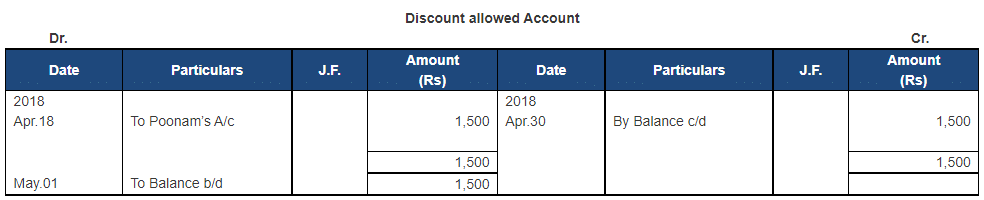

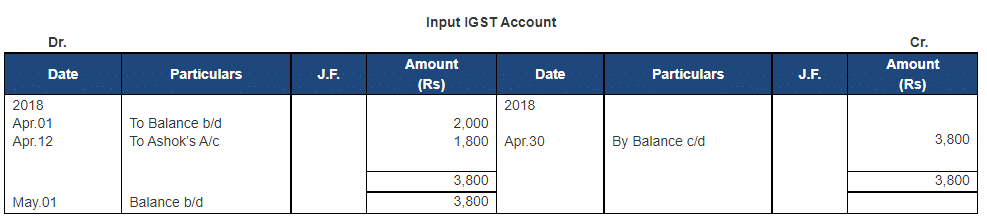

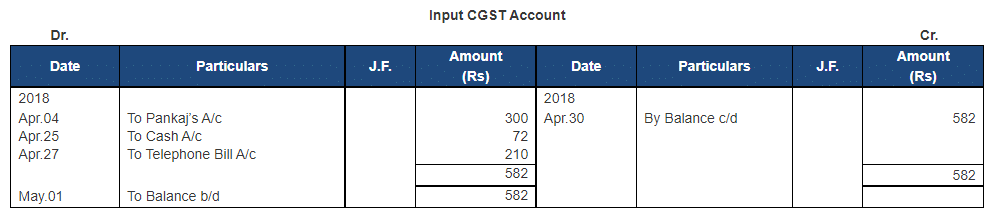

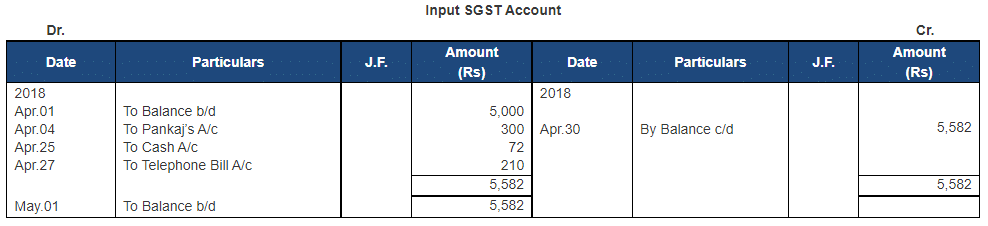

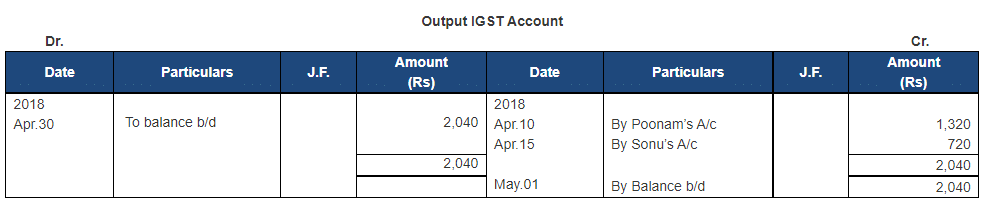

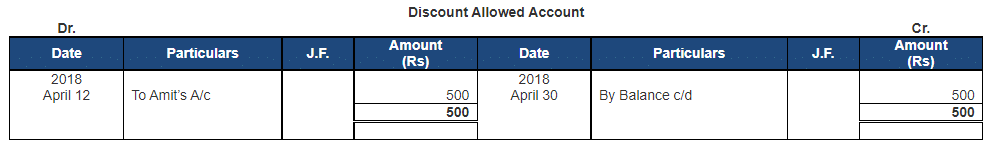

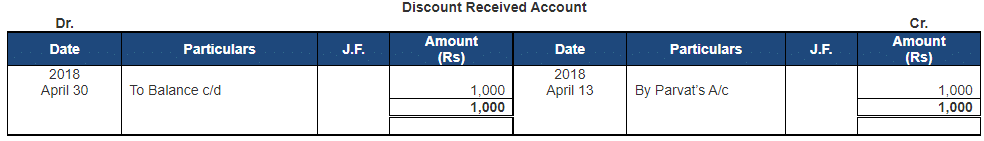

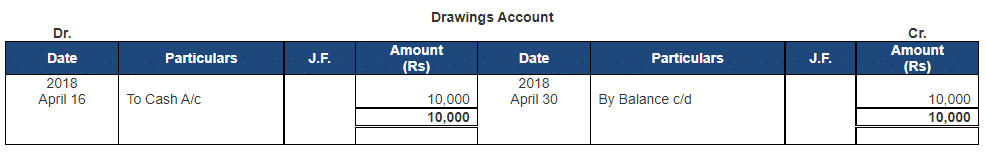

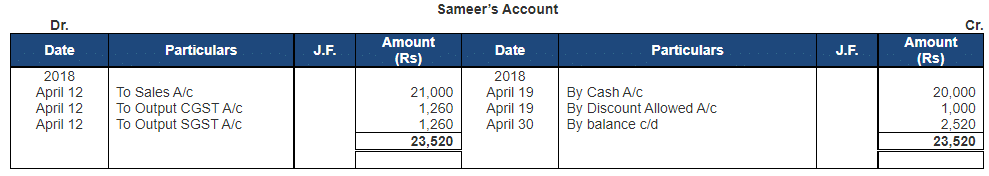

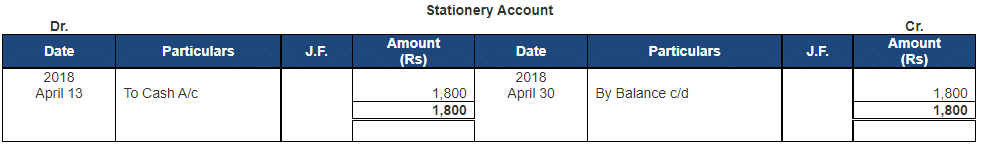

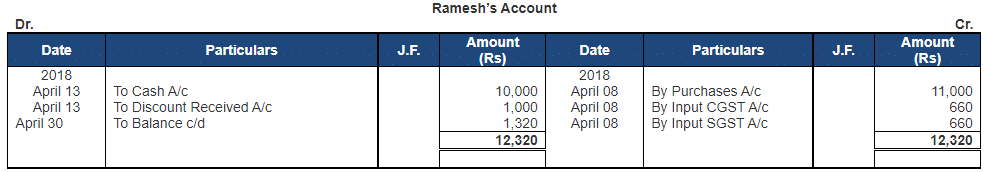

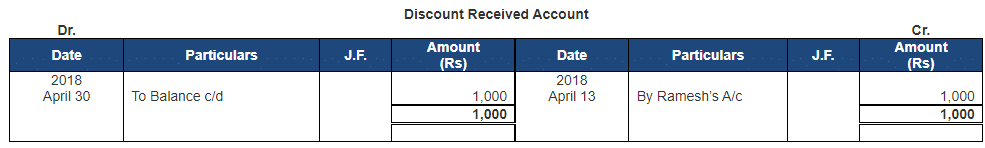

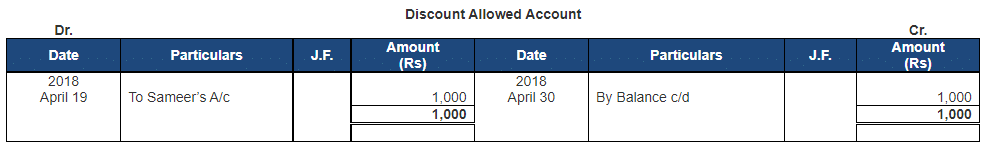

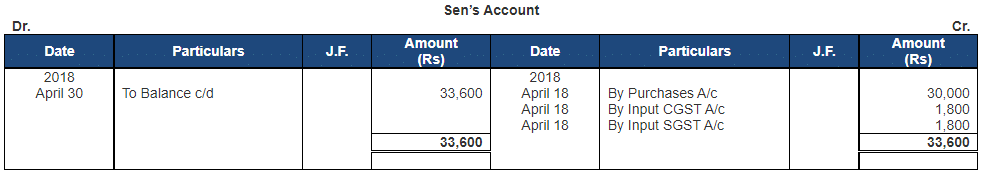

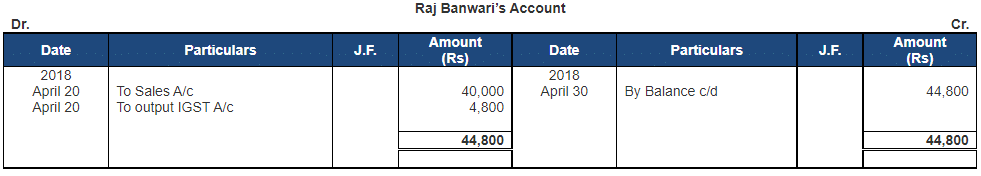

Following are the ledgers shown in the books of Ashok, Delhi

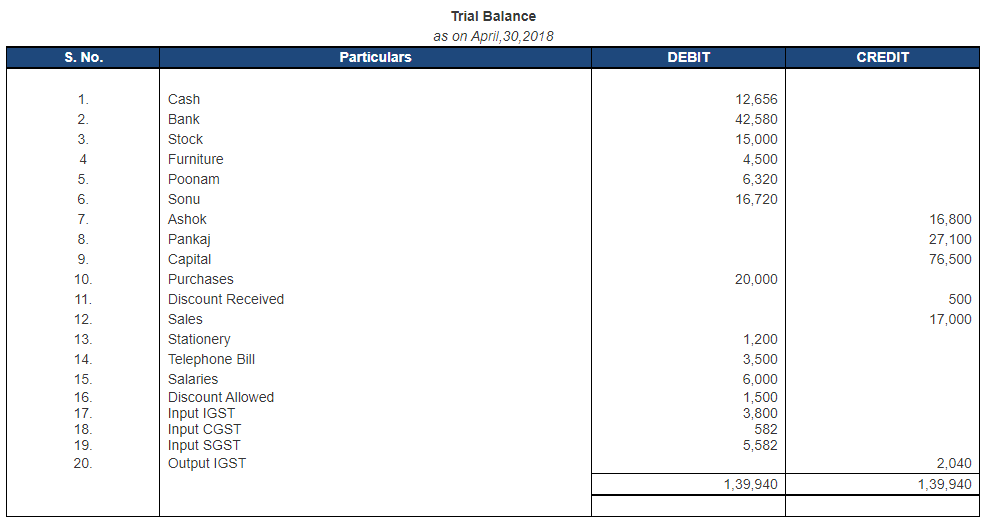

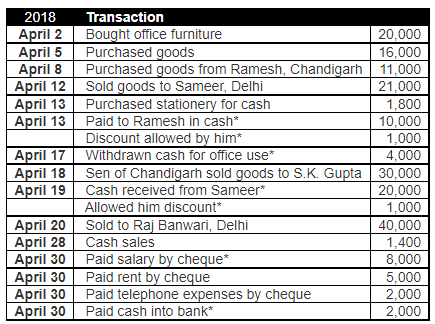

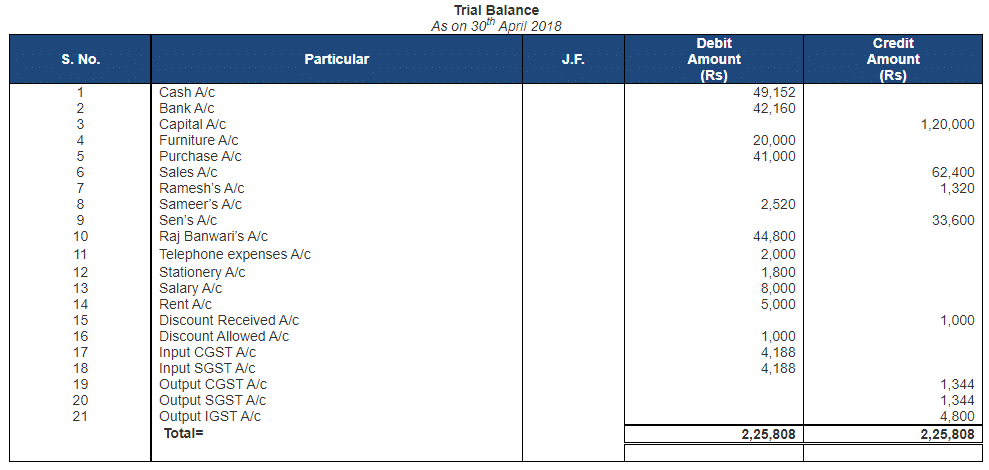

Statement of Trial Balance of M/s. Ashok, Delhi, as on April 30, 2018

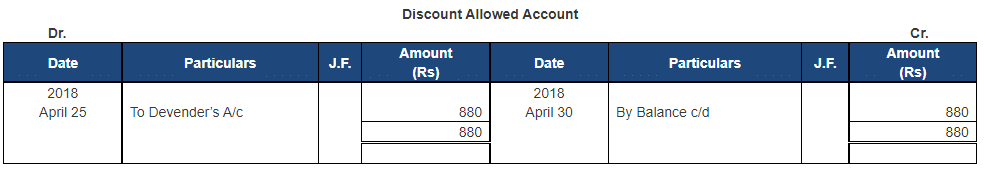

Point of Knowledge:

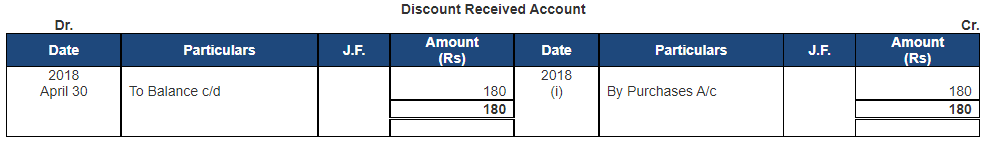

- Discount allowed when a payment is made. Discount received when payment is received. Discount allowed is an expense for business so it should be debited and discount received is a gain so it should be credited.

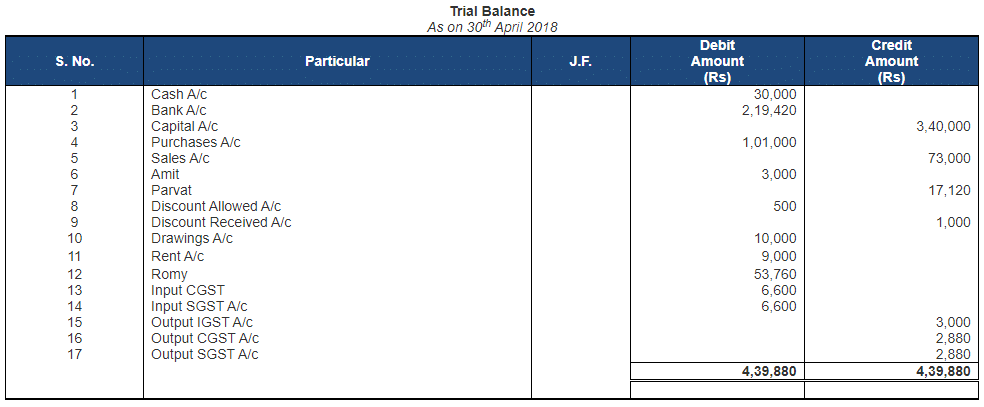

Q.11. Shri S. K. Gupta, Chandigarh commenced business on 1st April, 2018 with a capital of Rs. 1,20,000 of which Rs. 60,000 was paid into his Bank Account and Rs. 60,000 retained as cash . His other transactions during the month were as follows:

Inter-state transactions are subject to levy of IGST @ 12% and Intra-state transactions are subject to levy of CGST and SGST @ 6% each. GST is not levied on transactions marked with (*).

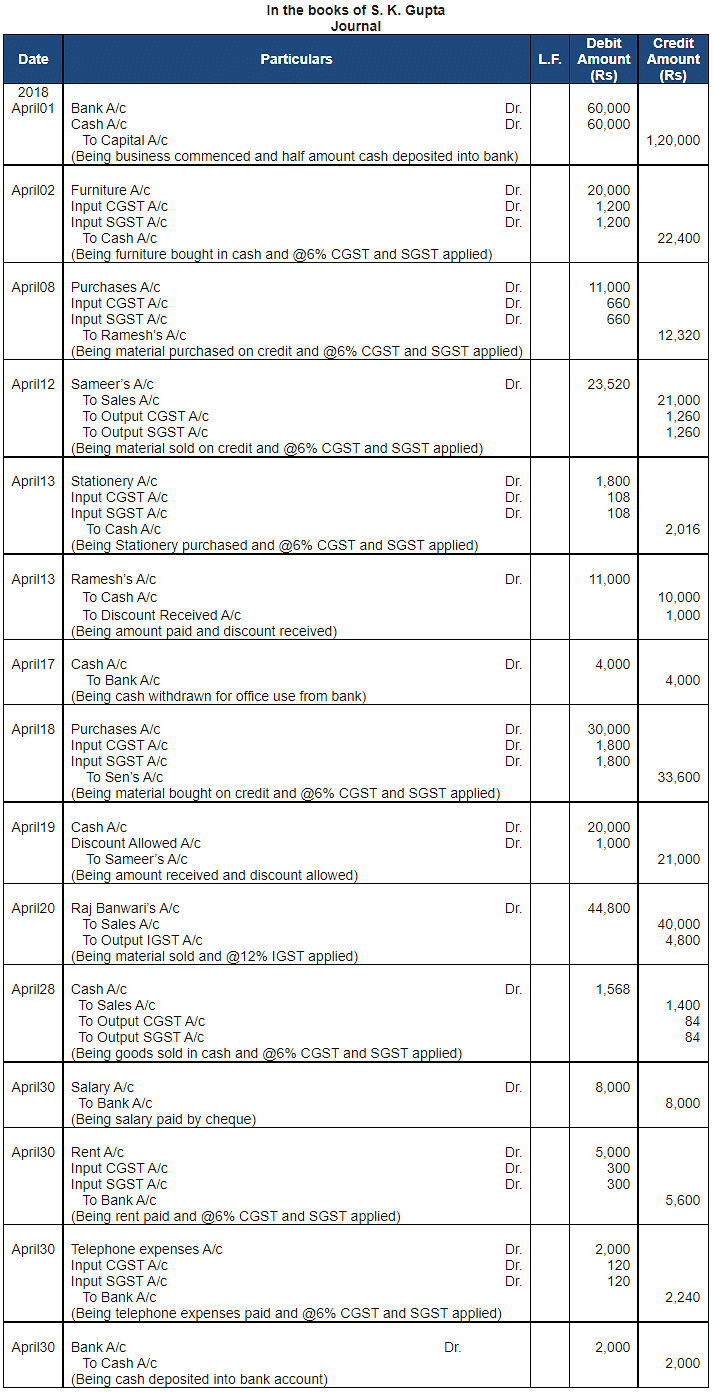

Journalise the above transactions and post them to the Ledger.

Ans. Statement showing Journal of S. K. Gupta, Chandigarh

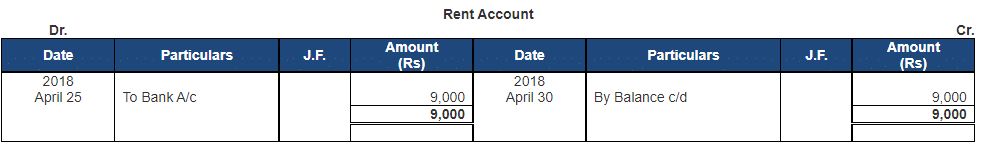

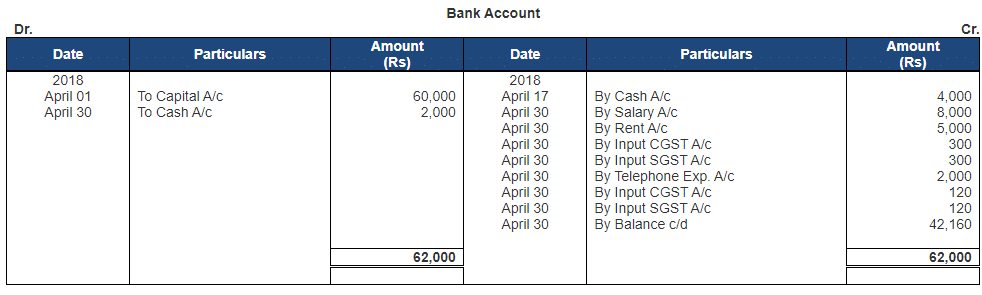

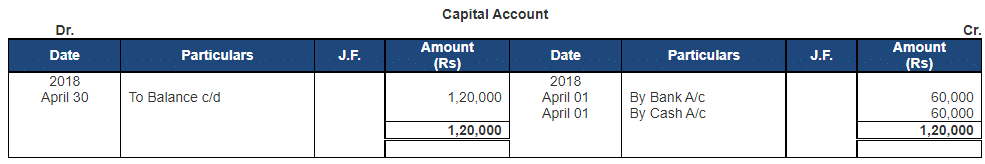

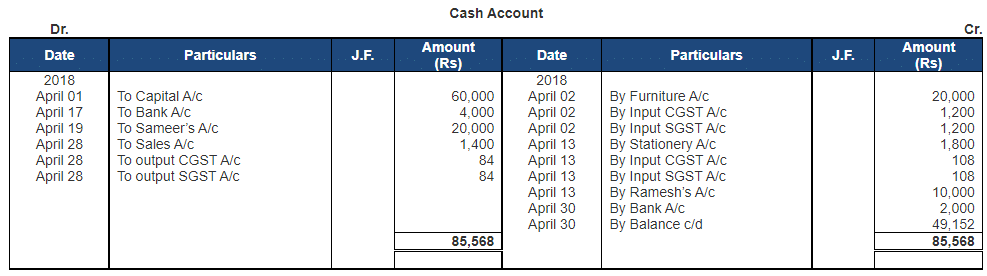

Following are the ledgers shown in the books of S. K. Gupta, Chandigarh

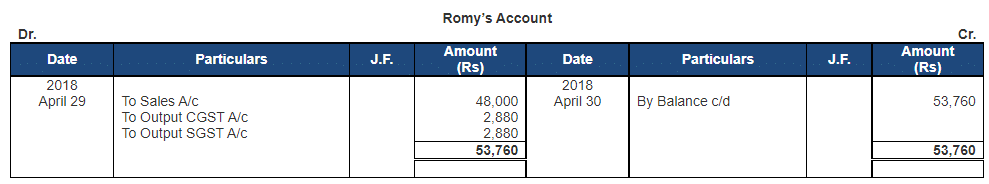

Statement of Trial Balance of S. K. Gupta, Chandigarh, as on April 30, 2018

Point of Knowledge:

- All Assets are showing a Debit Balance So Account will be opened and amount will written on the debit side as To Balance b/d.

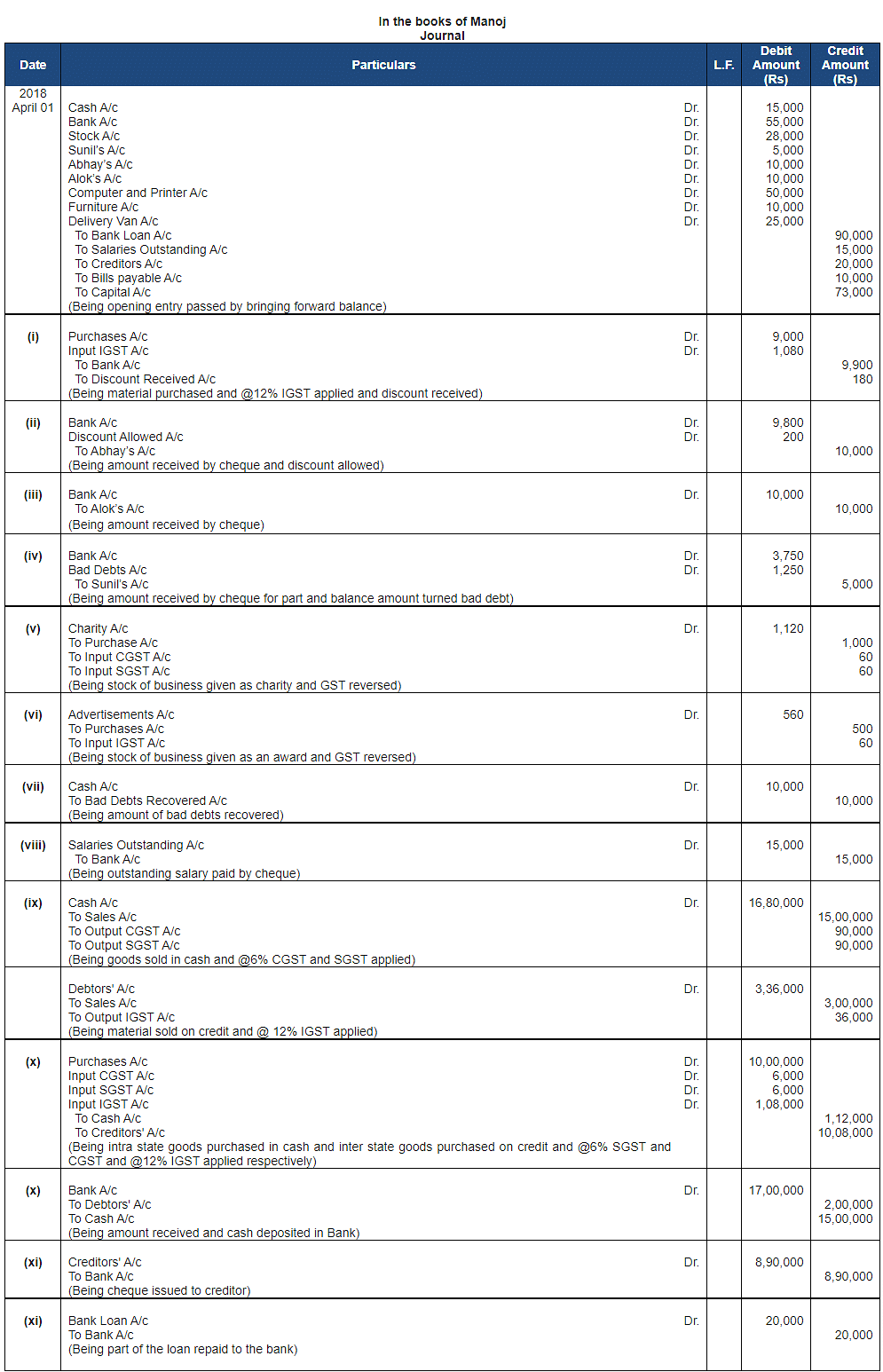

Q.12. Journalise the following transactions in the books of Shri Manoj, Kolkata and prepare Ledger Accounts.

Opening Debit Balances:

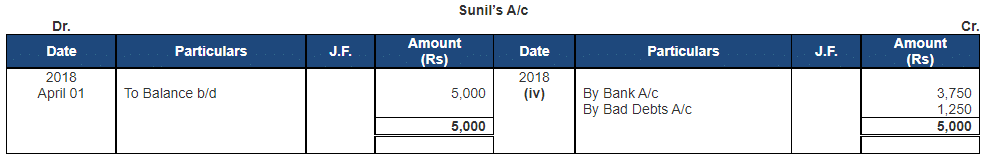

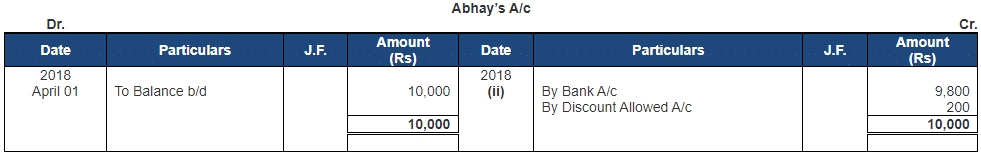

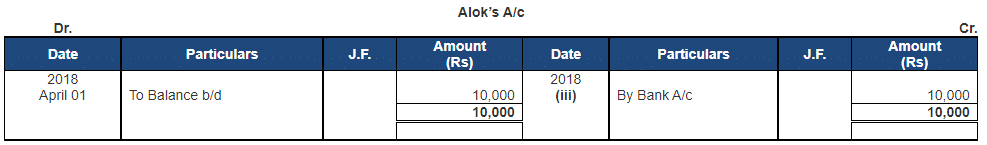

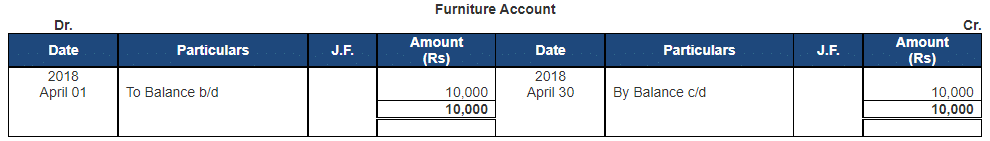

Cash in Hand Rs15,000; Cash at Bank Rs 55,000; Stock Rs 28,000; Debtors Rs 25,000 (Sunil Rs 5,000; AbhayRs10,000 and Alok Rs 10,000); Fixed Assets : Computer and Printer

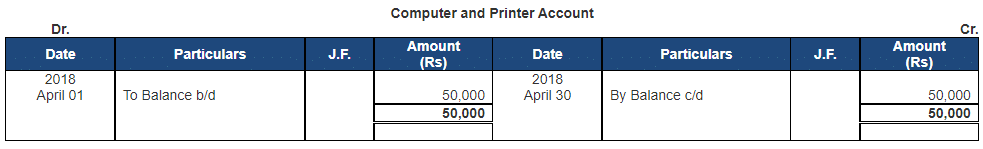

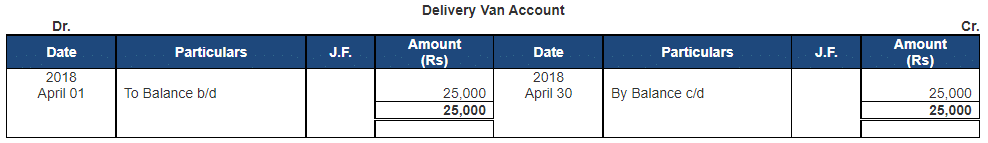

Rs50,000; Furniture Rs 10,000; Delivery Van Rs 25,000.

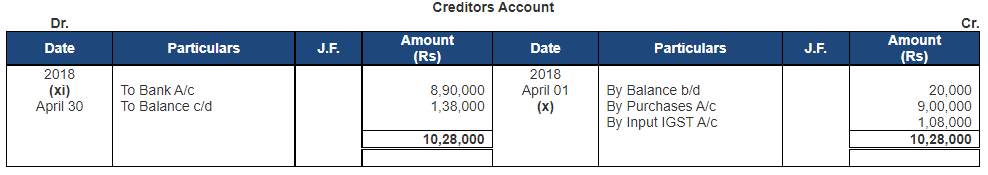

Opening Credit Balances:

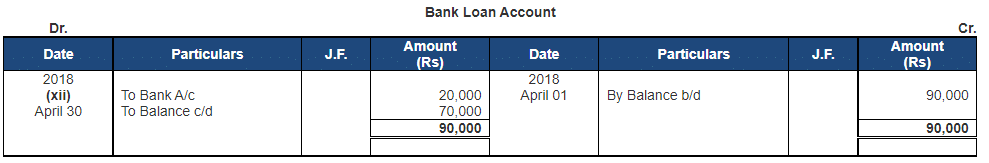

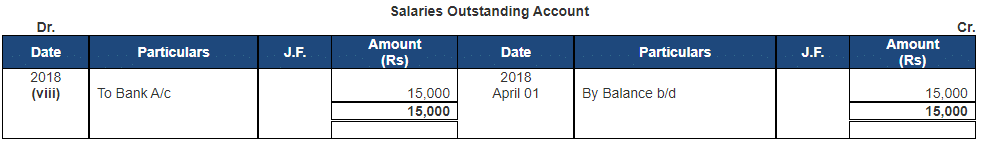

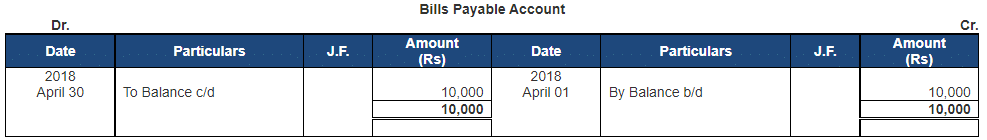

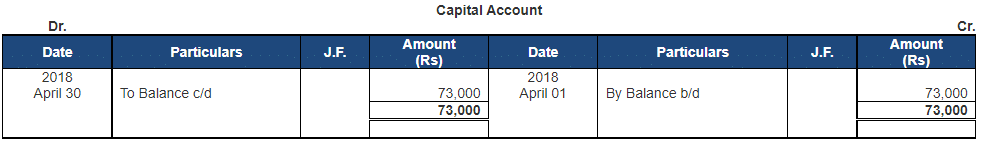

Bank Loan Rs 90,000; Salaries Outstanding Rs 15,000; Creditors Rs 20,000; Bills Payable Rs 10,000; Capital Rs 73,000.

Transactions for the month of April, 2018 were :

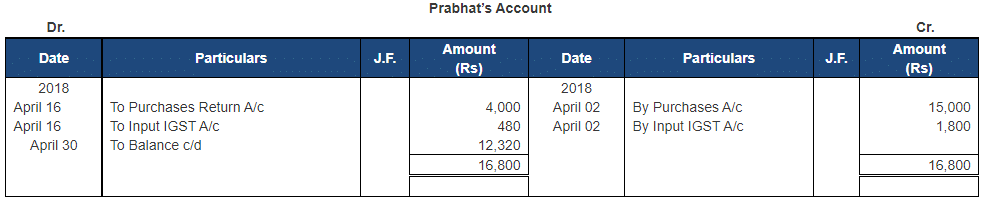

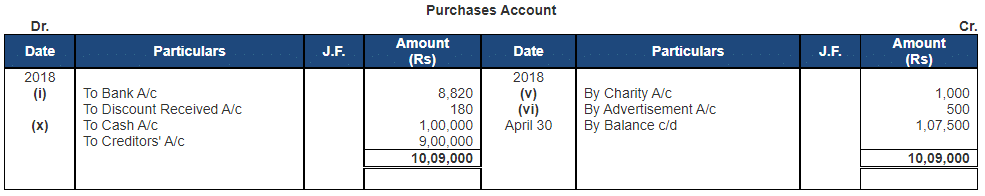

(i) Purchased goods from M/s Prabhat Electricals Rs 10,000 less 10% Trade Discount. Cheque was issued immediately and availed 2% Cash Discount on purchase price.

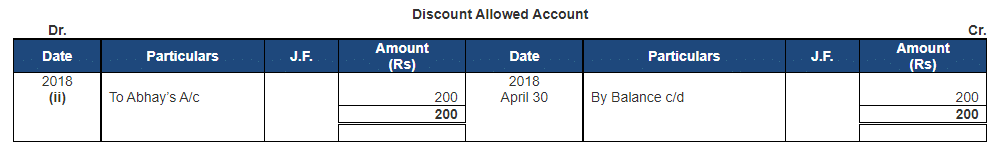

(ii) Cheque was received from Abhay for the balance allowing him discount of 2%*.

(iii) Cheque was received from Alok for the balance due* .

(iv) Sunil was unable to pay the full dues and offered to pay 75%, which was accepted. Cheque was duly received*.

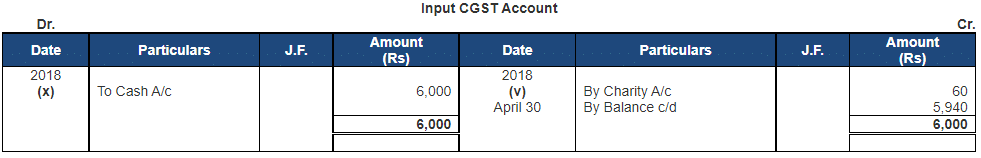

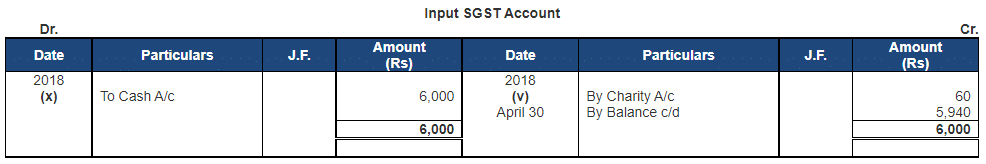

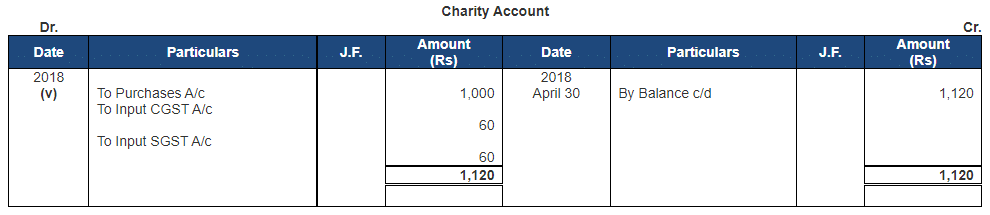

(v) Gave goods costing Rs 1,000 as charity. These goods were purchased in Kolkata.

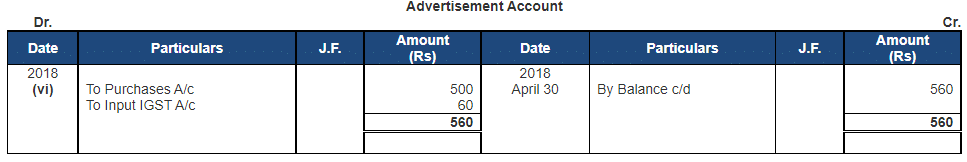

(vi) In a competition held by the RWA where the shop is located an electric iron costing Rs 500 was given as an award. It had been purchased from Prabhat Electricals, Delhi.

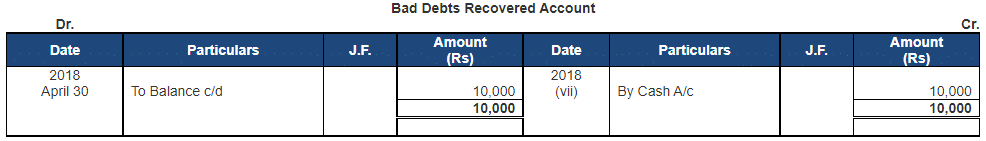

(vii) A debt of Rs 10,000 that was written off as bad debt in the past was received*.

(viii) Salaries amounting to Rs15,000 provided in the books for the month of March, 2018 were paid through cheque*.

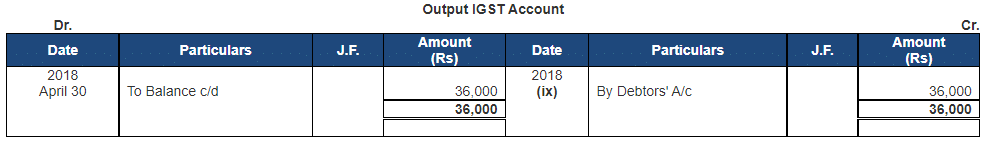

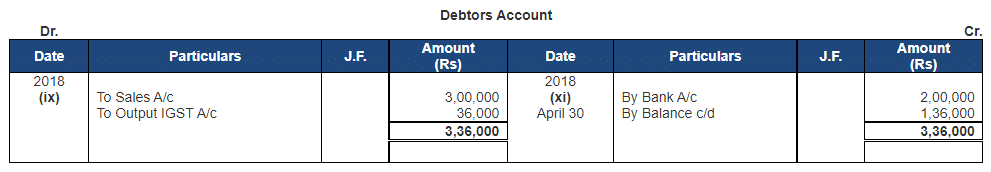

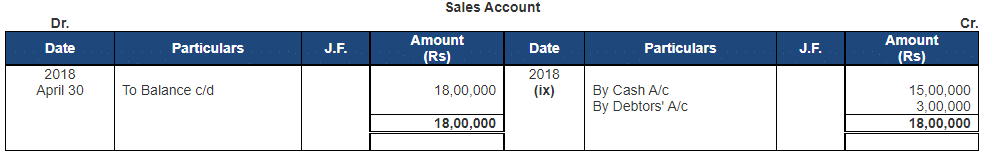

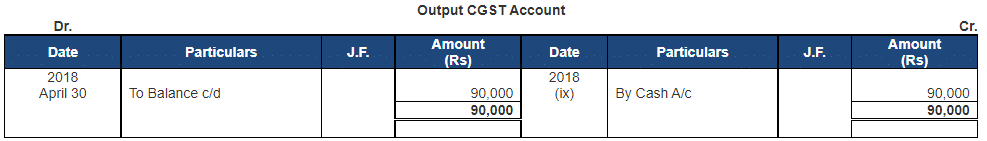

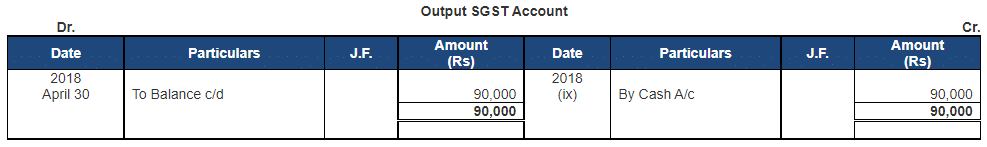

(ix) Sales for the month were: Cash Sales Rs 15,00,000 (Intra-state) and Credit Sales Rs 3,00,000 (Inter-state).

(x) Purchases for the month were: Cash Purchases Rs 1,00,000 (Intra-state) and Credit Purchases (Inter-state) Rs 9,00,000.

Cheques Received from Debtors Rs2,00,000; Deposited Cash Rs 15,00,000.

(xi) Paid to creditors through cheques Rs 8,90,000*.

(xii) Bank Loan repaid during the month Rs 20,000*.

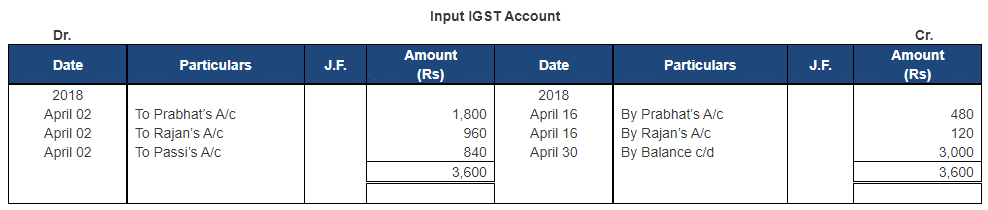

Inter-state transactions are subject to levy of IGST @ 12% and Intra-state transactions are subject to levy of CGST and SGST @ 6% each. GST is not levied on transactions marked with (*).

Ans. Statement showing Journal of Manoj, Kolkata

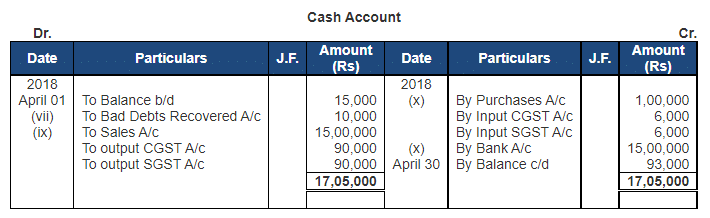

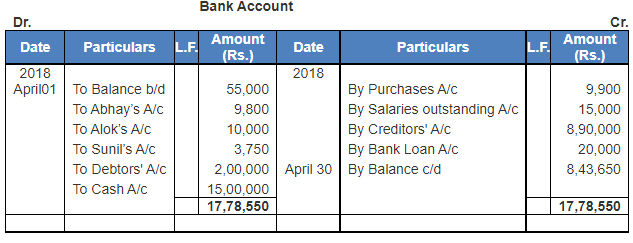

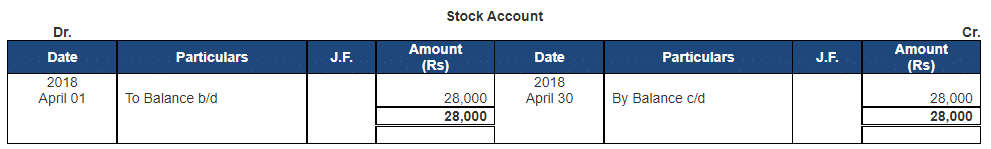

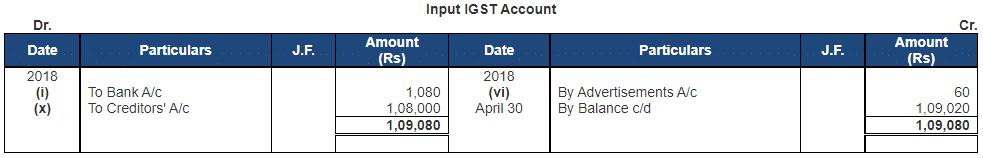

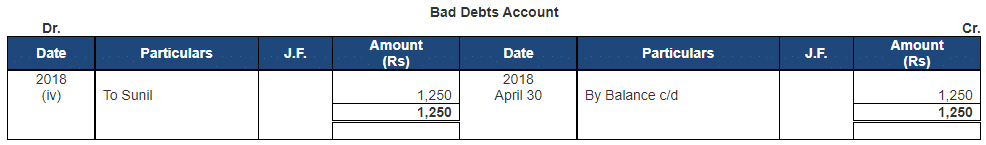

Following are the ledgers shown in the books of Manoj, Kolkata

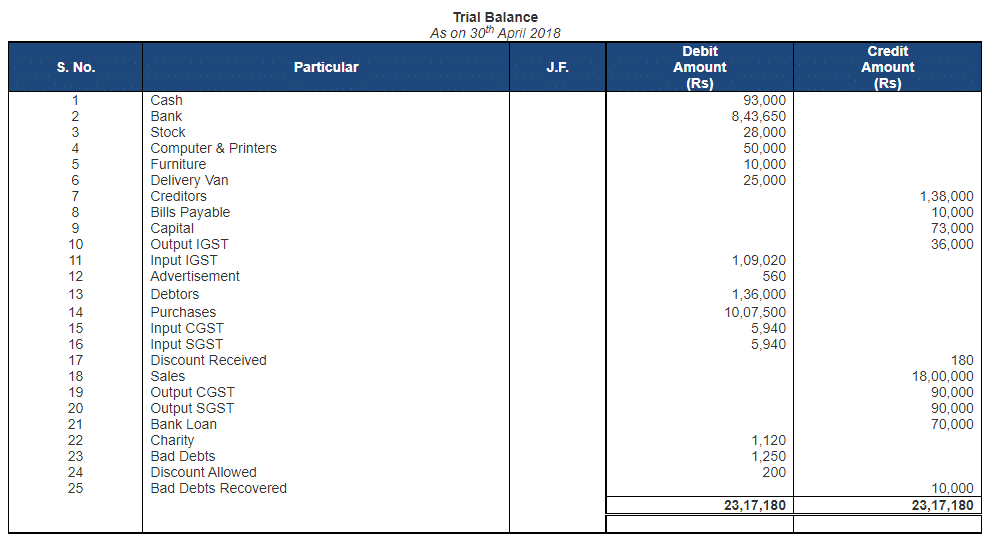

Statement of Trial Balance of Manoj, Kolkata, as on April 30, 2018

Point of Knowledge:

- When the goods given as charity the amount of purchases will decrease with the value of goods given as charity. It happen when goods are not sold, it used for other purposes like Charity, Free Sample, Loss by theft or fire & used for personal.

|

61 videos|226 docs|39 tests

|

FAQs on Ledger - 2 - Accountancy Class 11 - Commerce

| 1. What is a Ledger in commerce? |  |

| 2. How does a ledger help in managing finances? |  |

| 3. What are the different types of ledgers used in commerce? |  |

| 4. How are ledger entries recorded in commerce? |  |

| 5. Can a ledger be computerized or is it always maintained manually? |  |