Accounting for Bills of Exchange - (Part - 4) | Accountancy Class 11 - Commerce PDF Download

Page No 16.37:

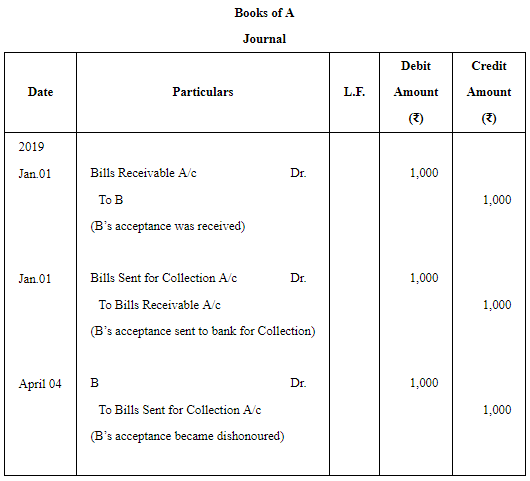

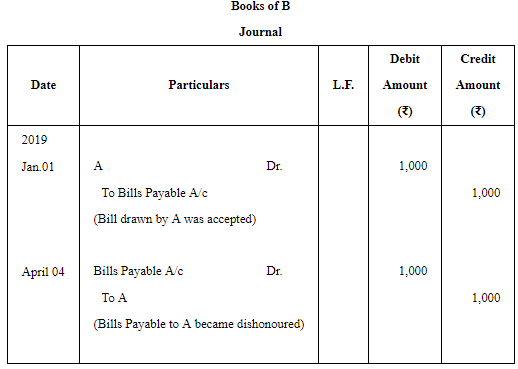

Question 21: On 1st January, 2019, A draws a bill on B for ₹ 1,000 payable after 3 months. Immediately after its acceptance, A sends the bill to his bank for collection. On the due date, the bill was dishonoured. Record the transactions in the Journals of A and B.

ANSWER:

Page No 16.37:

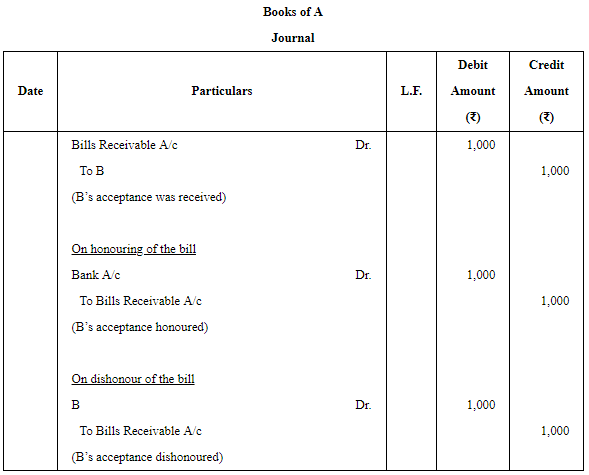

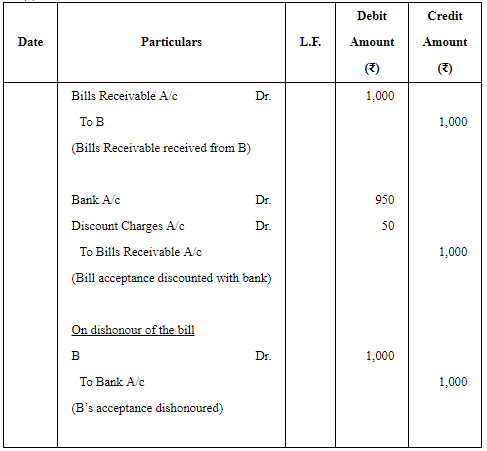

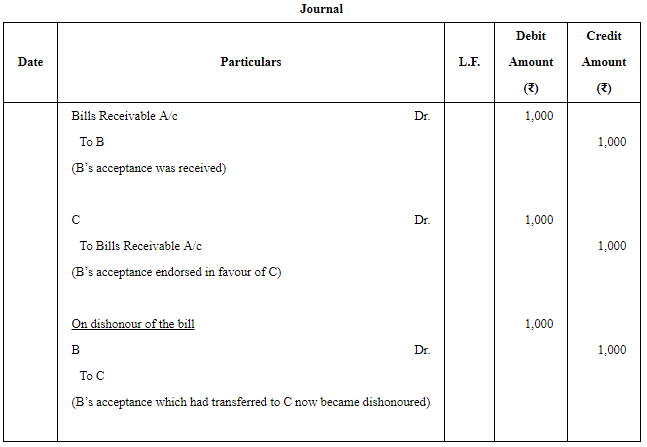

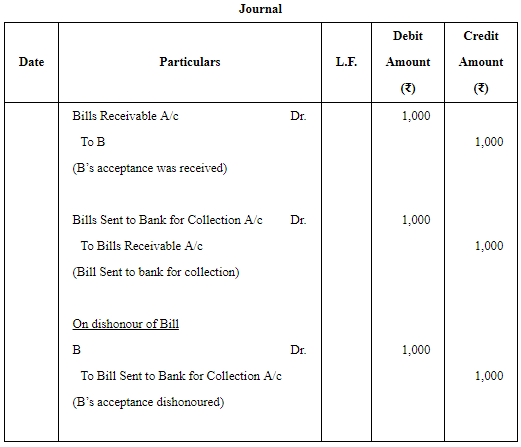

Question 22: A bill for ₹ 1,000 is drawn by A on B and accepted by the latter payable at the New Delhi, Bank of India. Show what entries should be passed in the books of

A under each of the following circumstances:

(a) If A retained the bill till the due date and then realized it on maturity.

(b) If A discounted it with his bank for ₹ 950.

(c) If A endorsed it to his creditor C in full settlement of his debt.

(d) If A sent it to his bank for collection.

Also, give the necessary entries in each of the cases if the bill is dishonoured.

ANSWER:

(a)

(b)

(c)

(d)

Page No 16.37:

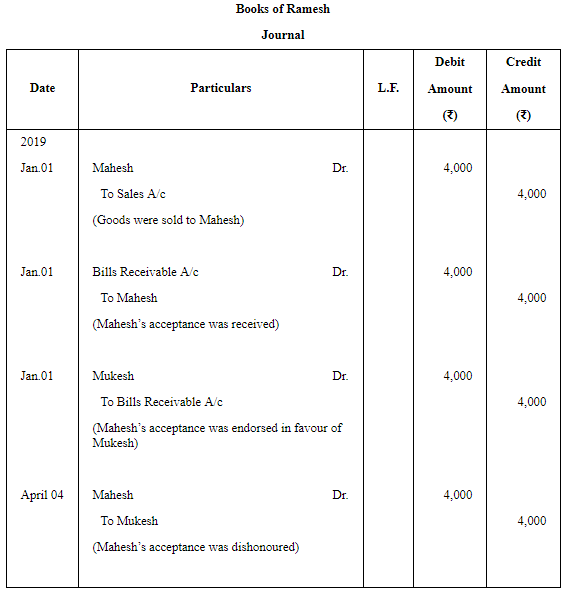

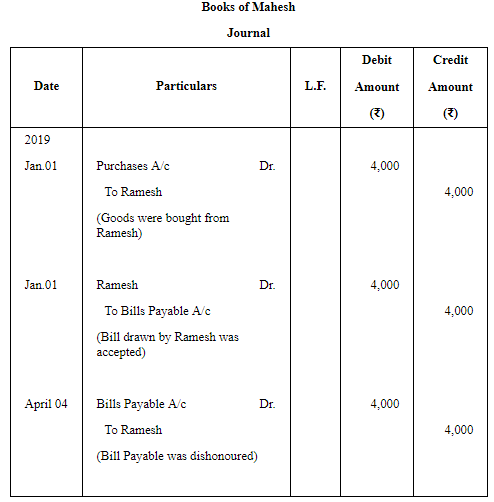

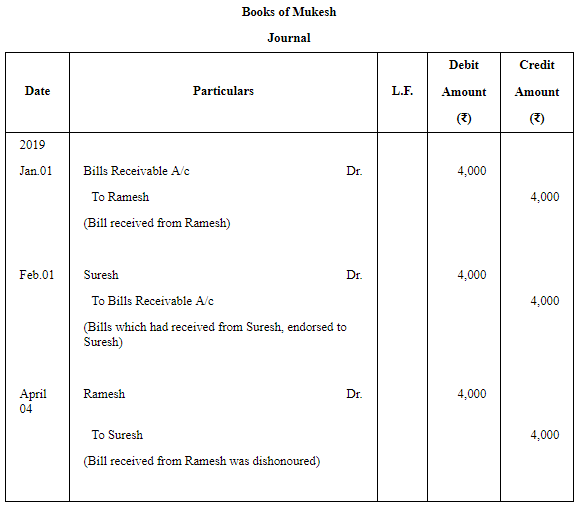

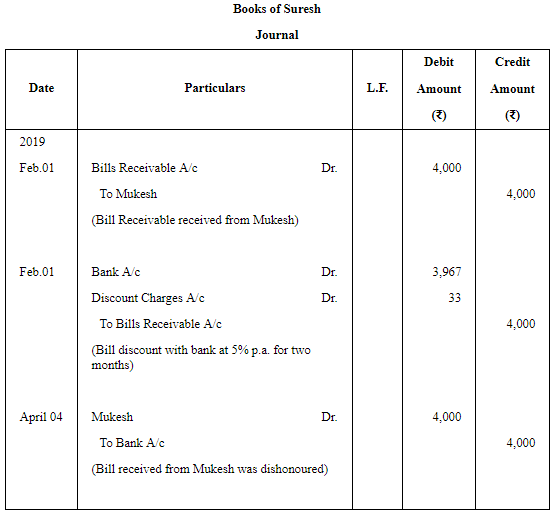

Question 23: On 1st January, 2019 for goods sold, Ramesh drew a Bill of Exchange on Mahesh for ₹ 4,000, for a period of 3 months. Mahesh accepts it and returns to Ramesh. Ramesh then endorses it to Mukesh who in turn endorses it to Suresh on 1st February, 2019. The bill is then discounted by Suresh on the same date with his bank at 5% p.a. On the due date the bill is dishonoured. Pass the necessary Journal entries in the books of all the four parties.

ANSWER:

Page No 16.38:

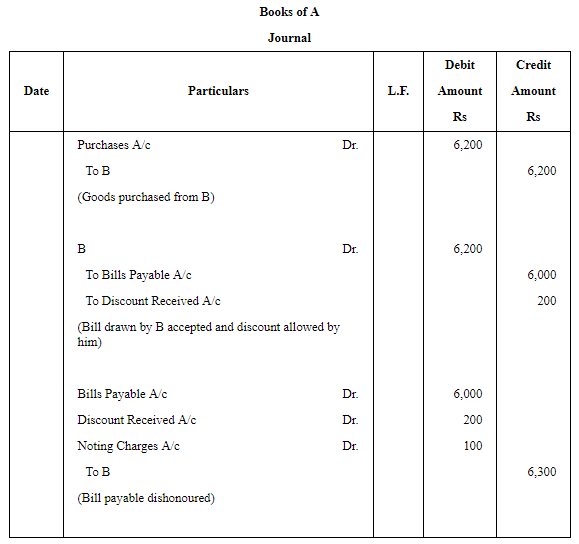

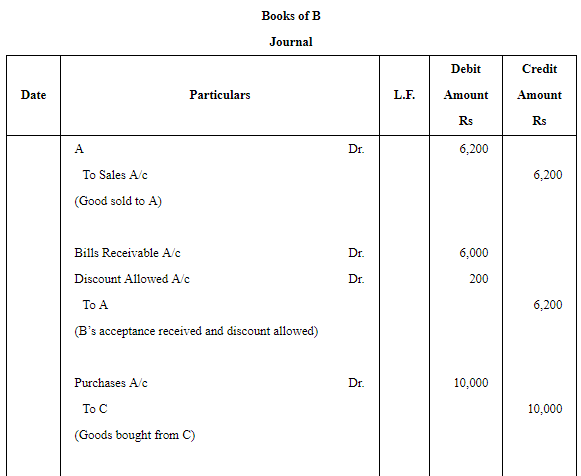

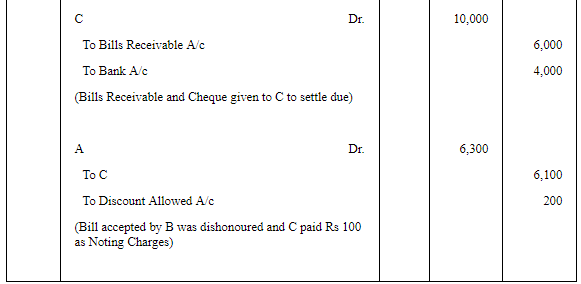

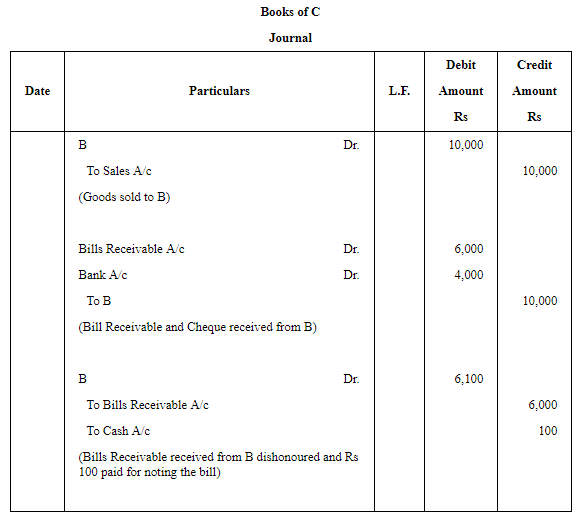

Question 24: A purchases goods worth ₹ 6,200 from B and gives him his acceptance for ₹ 6,000 in full satisfaction. B purchases goods worth ₹ 10,000 from C and endorses the bill to him, paying the balance by cheque. On maturity the bill is dishonoured, noting charges amounted to ₹ 100.

Give the Journal entries in the books of A, B and C.

ANSWER:

Page No 16.38:

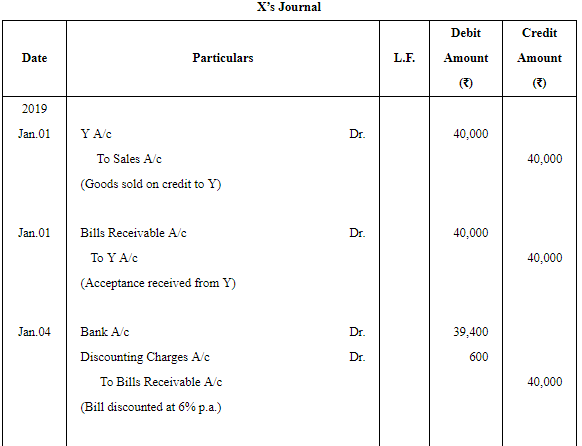

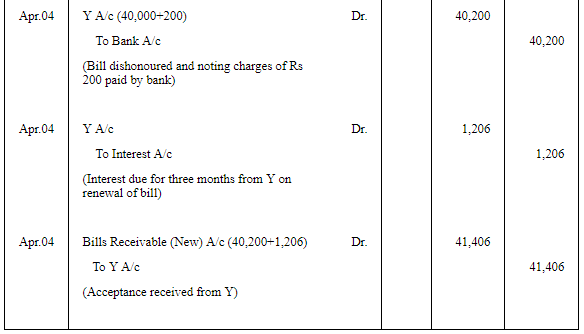

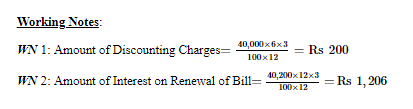

Question 25: X sells goods for ₹ 40,000 to Y on 1st January, 2019 and on the same day draws a bill on Y at three months for the amount. Y accepts it and returns it to X, who discounted it on 4th January, 2019 with his bank at 6% p.a. The acceptance is dishonoured on the due date and the noting charges were paid by bank being ₹ 200.

On 4th April, 2019, Y accepts a new bill at three months for the amount then due to X together with interest at 12% p.a.

Make Journal entries to record these transactions in the books of X.

ANSWER:

|

64 videos|152 docs|35 tests

|

FAQs on Accounting for Bills of Exchange - (Part - 4) - Accountancy Class 11 - Commerce

| 1. What is a bill of exchange in accounting? |  |

| 2. What are the key parties involved in a bill of exchange transaction? |  |

| 3. How is a bill of exchange recorded in accounting books? |  |

| 4. What is the purpose of discounting a bill of exchange? |  |

| 5. What are the accounting entries for dishonor of a bill of exchange? |  |

|

Explore Courses for Commerce exam

|

|