Rectification of Errors - (Part - 2) | Accountancy Class 11 - Commerce PDF Download

Page No 17.35:

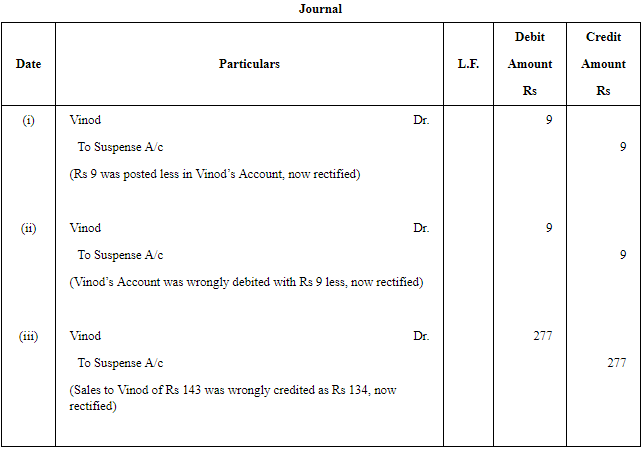

Question 6: Rectify the following errors:

(i) Sales to Vinod of ₹ 143 posted to his account as ₹ 134.

(ii) Sales to Vinod of ₹ 143 debited to his account as ₹ 134.

(iii) Sales to Vinod of ₹ 143 credited to his account as ₹ 134.

ANSWER:

Page No 17.36:

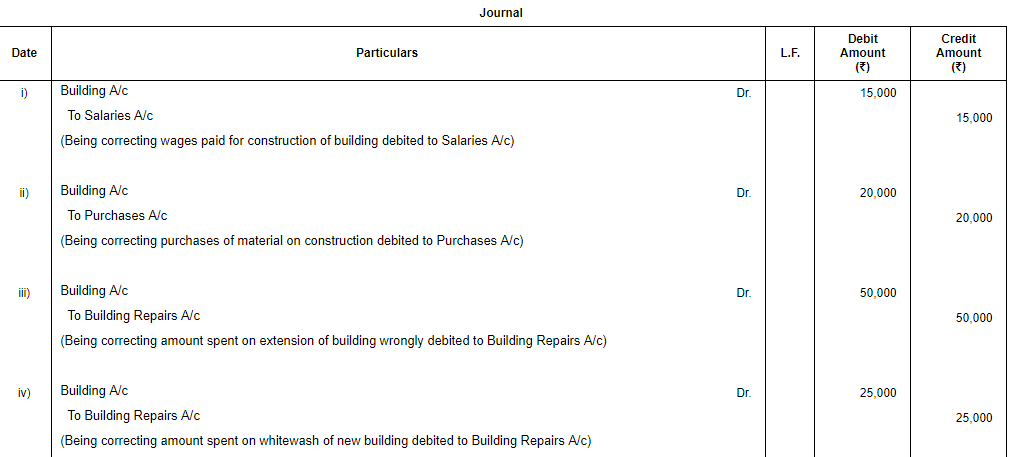

Question 7: Pass the necessary Journal entries to rectify the following errors

(i) ₹ 15,000 paid as wages for the construction of office building debited to Salaries Account.

(ii) ₹ 20,000 spent on the purchases of material for the construction of building debited to Purchases Account.

(iii) ₹ 50,000 spent on the extension of building was debited to Building Repairs Account.

(iv) ₹ 25,000 spent on whitewash of a new building was charged to Building Repairs Account.

(v) ₹ 1,000 paid as installation charges for newly purchased second hand machinery posted to Cartage Account.

(vi) ₹ 10,000 paid as repairing charges on the reconditioning of a newly purchased second hand machinery debited to General Expenses Account.

(vii) ₹ 5,000 paid as repairing charges of an existing machine in use charged to Machinery Account.

(viii) ₹ 10,000 paid by cheque for a printer was charged to the Office Expense Account.

ANSWER:

Page No 17.36:

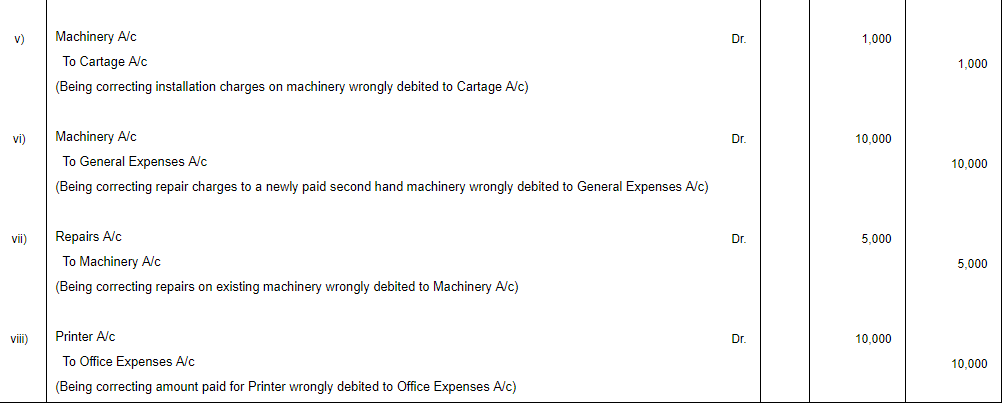

Question 8: Give rectifying Journal entries for the following errors:

(i) Goods returned by Mohan of ₹ 1,500 not recorded in books.

(ii) Goods distributed as free samples for ₹ 5,000 not recorded.

(iii) Depreciation of machinery of ₹ 10,000 not charged.

(iv) Goods costing ₹ 780, selling price ₹ 1,000 given as charity not recorded.

ANSWER:

Page No 17.36:

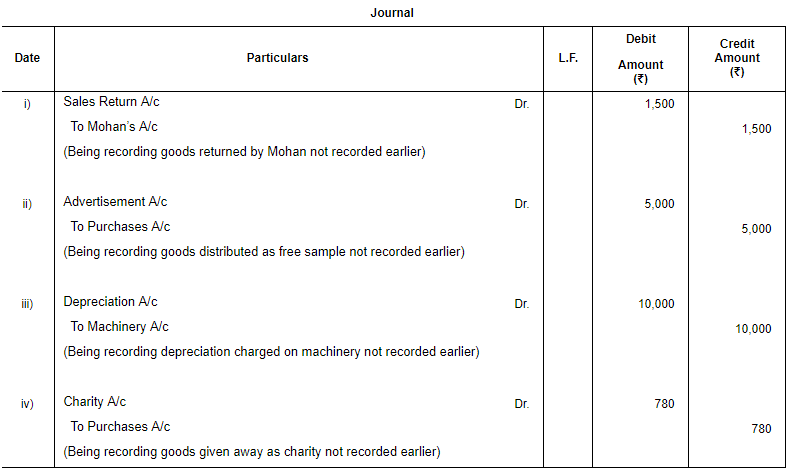

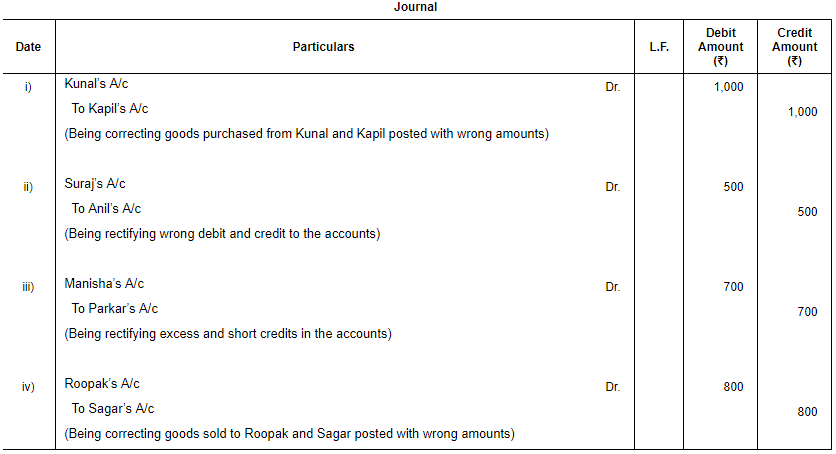

Question 9: Rectify the following errors:

(i) Goods purchased from Kunal for ₹ 8,000 and from Kapil of ₹ 9,000 recorded correctly in the Purchases Book. However, ₹ 9,000 was posted to Kunal and ₹ 8,000 to Kapil.

(ii) Anil's Account was excess debited by ₹ 500 while Suraj's Account was short debited by ₹ 500.

(iii) Parkar's Account was short credited by ₹ 700 while Manisha's Account was excess credited by ₹ 700.

(iv) Goods sold to Roopak for ₹ 1,000 and to Sagar for ₹ 1,800 recorded correctly in the Sales Book. However, ₹ 1,800 was posted to Roopak and ₹ 1,000 to Sagar.

ANSWER:

Page No 17.36:

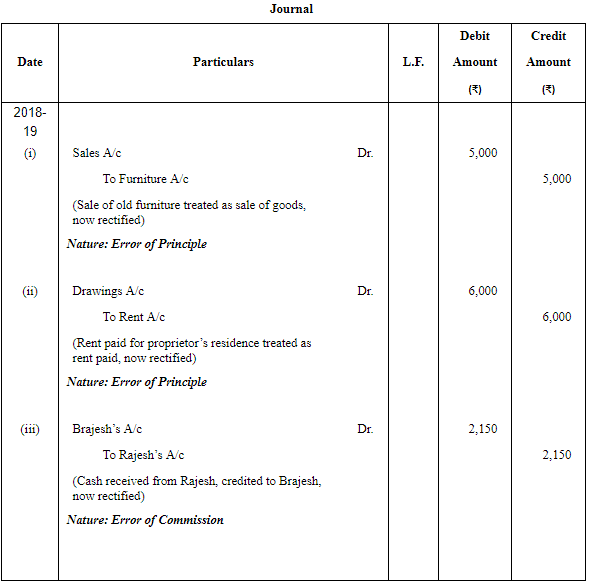

Question 10: Following errors affecting the accounts of the year 2018–19 were detected in the books of Das & Co., Meerut:

(i) Sale of old furniture for ₹ 5,000 was treated as sales of goods.

(ii) Rent of proprietor’s residence ₹ 6,000 was debited to Rent Account.

(iii) Cash received from Rajesh ₹ 2,150 was credited to Brajesh.

Pass the rectifying Journal entries. State the nature of each of these mistakes.

ANSWER:

Page No 17.36:

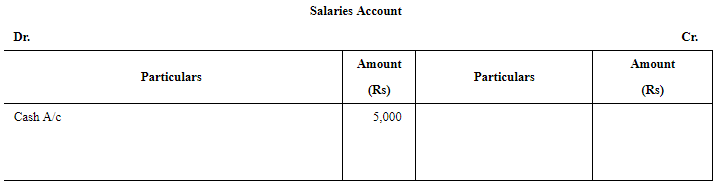

Question 11: Rectify the following errors assuming that there is no Suspense Account:

(i) Salary of ₹ 5,000 paid to Rahul was not posted to Salaries Account.

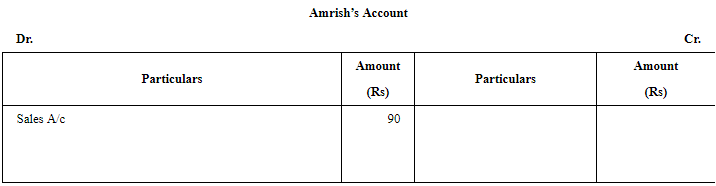

(ii) Sales to Amrish of ₹ 1,430 posted to his account as ₹ 1,340.

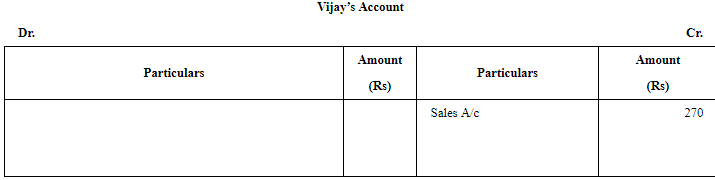

(iii) Sales to Vijay of ₹ 2,470 posted to his account as ₹ 2,740.

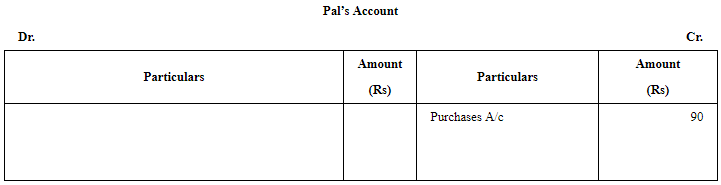

(iv) Purchases from Pal of ₹ 1,430 posted to his account as ₹ 1,340.

ANSWER:

(i) Salary of Rs.5, 000 paid to Rahul was not posted to Salary A/c

(ii) Sales to Amrish of Rs 1,430 posted to his account as Rs 1,340

(iii) Sales to Vijay of Rs 2,470 posted to his account as Rs 2,740

(iv) Purchases from Pal of Rs1,430 posted to his account as Rs 1,340

|

64 videos|153 docs|35 tests

|

FAQs on Rectification of Errors - (Part - 2) - Accountancy Class 11 - Commerce

| 1. What is rectification of errors in commerce? |  |

| 2. Why is rectification of errors important in commerce? |  |

| 3. What are some common types of errors in commerce that require rectification? |  |

| 4. How can errors in commerce be rectified? |  |

| 5. What are the consequences of not rectifying errors in commerce? |  |

|

Explore Courses for Commerce exam

|

|