Rectification of Errors - (Part - 3) | Accountancy Class 11 - Commerce PDF Download

Page No 17.37:

Question 12: Which of the following errors will affect the Trial Balance?

(i) The total of the Sales Book has not been posted to the Sales Account.

(ii) ₹ 1,000 paid as installation charges of a new machine has been debited to Repairs Account.

(iii) Goods costing ₹ 4,000 taken by the proprietor for personal use have been debited to Debtors’ Account.

(iv) ₹ 1,000 paid for repairs to building have been debited to Building Account.

ANSWER:

'Total of Sales book has not been posted to Sales Account' will affect the Trial Balance because due to this Sales Account undercasts, which results in undercasting of credit side of Trial Balance.

Hence, the correct answer is option (i).

Page No 17.37:

Question 13: Rectify the following errors assuming that there is no Suspense Account:

(i) The Returns Inward Book has been overcasted by ₹ 200.

(ii) Purchases Book carried forward ₹ 75 less.

(iii) Sales Book carried forward ₹ 41 less on Page 10 and ₹ 43 more on Page 12

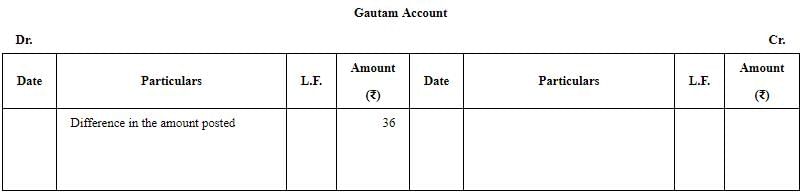

(iv) Goods sold to Gautam were posted as ₹ 215 instead of ₹ 251.

ANSWER:

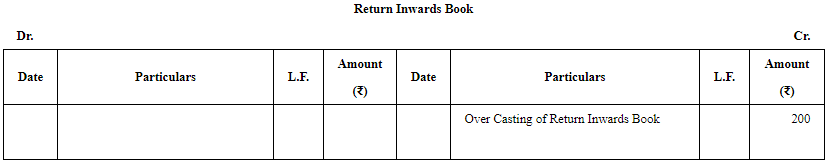

(i)

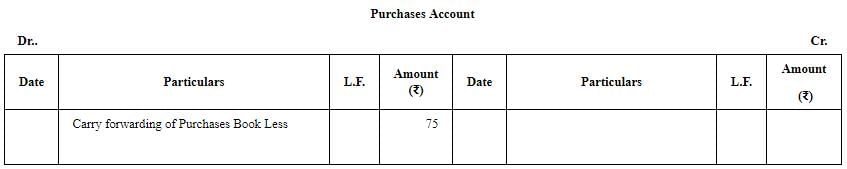

(ii)

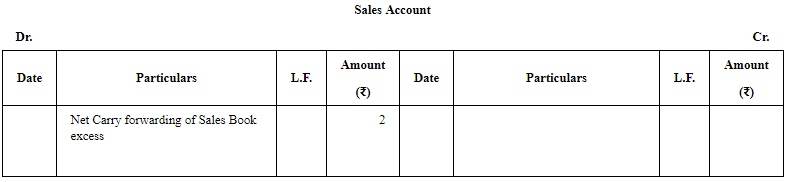

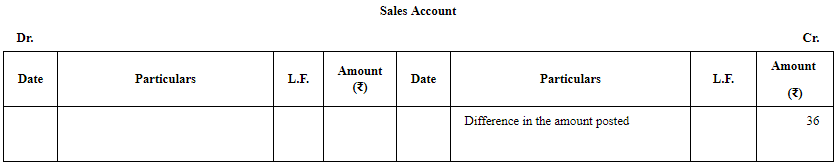

(iii)

(iv)

Page No 17.37:

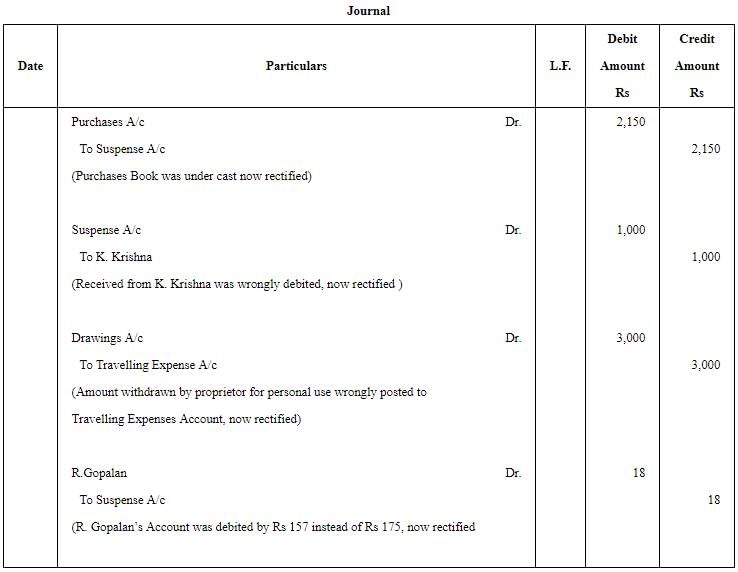

Question 14: Following errors are discovered in the books of Sh. Ram Lal. Make the necessary entries to rectify them:

(i) Purchases Journal was undercasted by ₹ 2,150.

(ii) ₹ 500 received from K. Krishna was debited to his account.

(iii) An amount of ₹ 3,000 withdrawn by the proprietor of the firm for his personal use was posted to the Travelling Expenses Account.

(iv) An amount of ₹ 175 for a credit sale to R. Gopalan correctly entered in the Sales Book, has been debited to his account as ₹ 157.

ANSWER:

Page No 17.37:

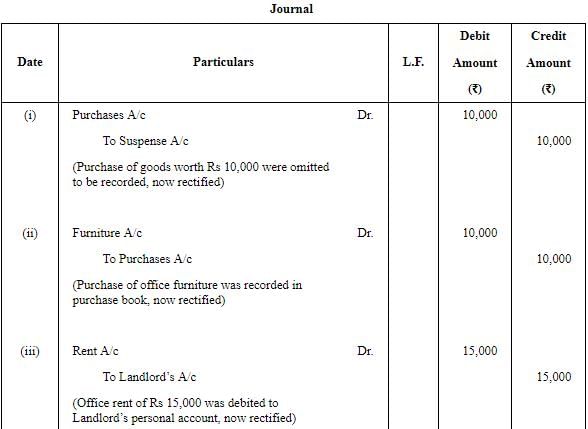

Question 15: Pass the Journal entries rectifying the following errors:

(i) Purchases of ₹ 10,000 was omitted to be recorded.

(ii) Purchases of office furniture of ₹ 10,000 was recorded in Purchases Book

(iii) Office Rent of ₹ 15,000 was debited to the Personal Account of the landlord.

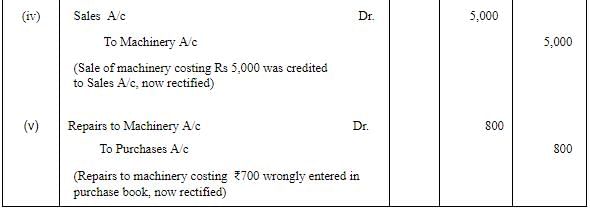

(iv) Old machine sold for ₹ 5,000 was credited to Sales Account.

(v) Bill for ₹ 800 received from Mukesh for repair of machinery was entered in the Purchases Book as ₹ 700.

ANSWER:

Page No 17.37:

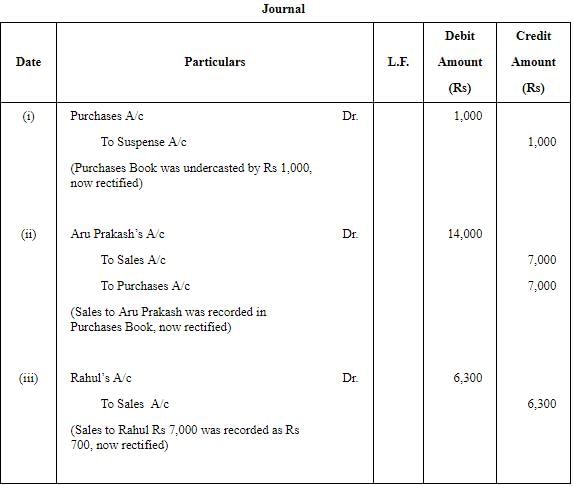

Question 16: Rectify the following errors:

(i) Purchases Book has been undercast by ₹ 1,000.

(ii) Credit sale to Anu Prakash ₹ 7,000 was recorded in Purchases Book.

(iii) Credit sale to Rahul ₹ 7,000 was recorded as ₹ 700.

ANSWER:

Note:In the book, this transaction is incomplete, thus it has been assumed that ‘Credit sales to Rahul was recorded as Rs 700 instead of Rs 7,000’.

Page No 17.37:

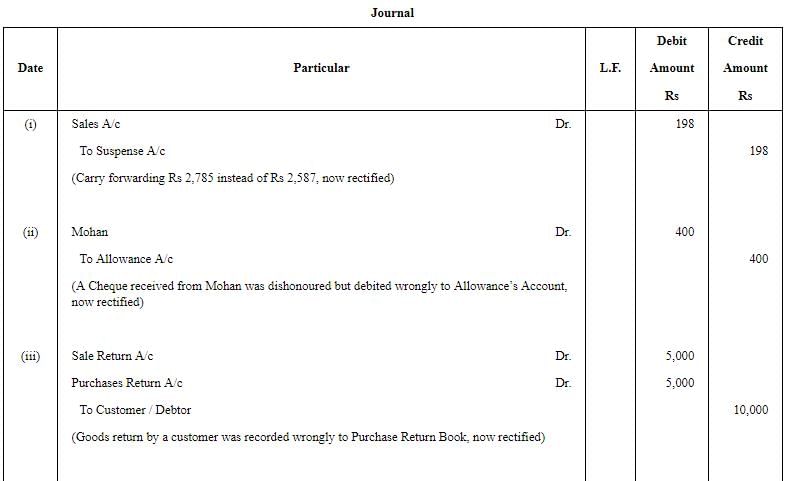

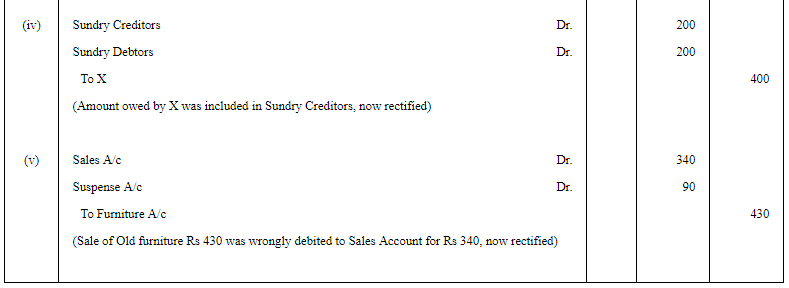

Question 17: Rectify the following errors:

(i) Total of one page of the Sales Book was carried forward to the next page as ₹ 2,785 instead of ₹ 2,587.

(ii) A cheque of ₹ 400 received from Mohan was dishonoured and had been posted to the debit side of the ‘Allowance Account’.

(iii) Return of goods worth ₹ 5,000 by a customer was entered in the Purchases Return Book.

(iv) Sum of ₹ 200 owed by ‘X’ has been included in the list of Sundry Creditors.

(v) Sale of old furniture worth ₹ 430 was credited to the Sales Account as ₹ 340.

ANSWER:

|

64 videos|153 docs|35 tests

|

FAQs on Rectification of Errors - (Part - 3) - Accountancy Class 11 - Commerce

| 1. What is the importance of rectifying errors in commerce? |  |

| 2. What are some common types of errors in commerce? |  |

| 3. How can errors in commerce be detected? |  |

| 4. What are the steps involved in rectifying errors in commerce? |  |

| 5. How can businesses prevent errors in commerce? |  |

|

Explore Courses for Commerce exam

|

|