Financial Statements of Sole Proprietorship - (Part - 2) | Accountancy Class 11 - Commerce PDF Download

Page No 18.63:

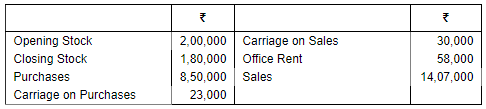

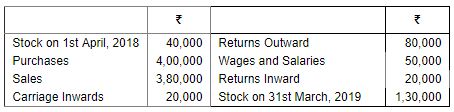

Question 6: Ascertain Gross Profit from the following:

ANSWER:

Note: Carriage on Sales and Office Rent are the Indirect Expenses, therefore, these are not considered to compute the amount of Gross Profit.

Page No 18.63:

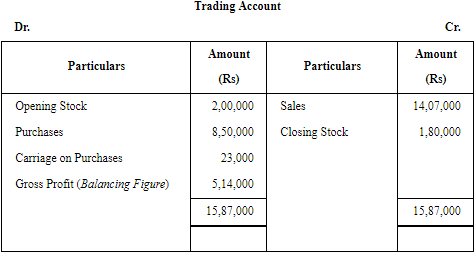

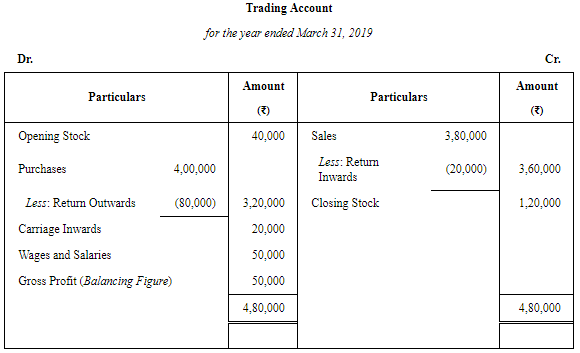

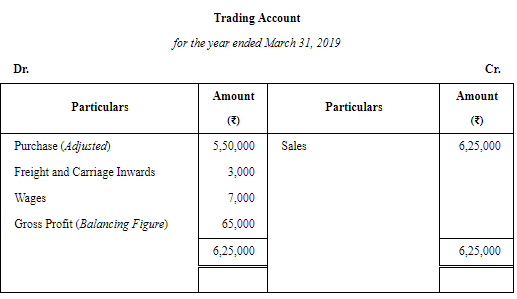

Question 7: From the following information, prepare Trading Account for the year ended 31st March, 2019:

Net Realisable Value (Market Value) of stock as on 31st March, 2019 was ₹ 1,20,000.

ANSWER:

Note: Closing Stock is taken at its Market Price (i.e. Rs 1,20,000) instead of its Cost (i.e. Rs 1,30,000). This is because, as per Principle of Conservatism, Closing stock is taken at Cost or Market Price whichever is less.

Page No 18.63:

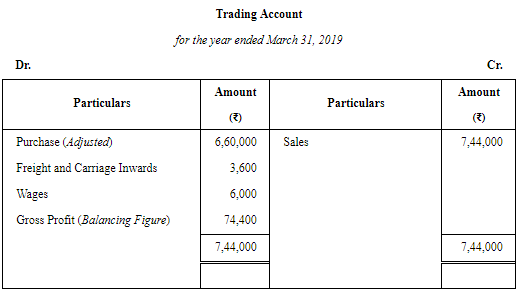

Question 8: From the following information, prepare Trading Account for the year ended 31st March, 2019:

Adjusted Purchases ₹ 6,60,000; Sales ₹ 7,44,000; Closing Stock ₹ 50,400; Freight and Carriage Inwards ₹ 3,600; Wages ₹ 6,000; Freight and Cartage Outwards ₹ 2,000.

ANSWER:

Notes:

1. Freight and Carriage Outwards are indirect expenses, therefore it is not recorded in the Trading Account.

2. Closing Stock (i.e. Rs 50,400) is not recorded in the Trading Account as it is already adjusted in the amount of Adjusted Purchases.

Page No 18.63:

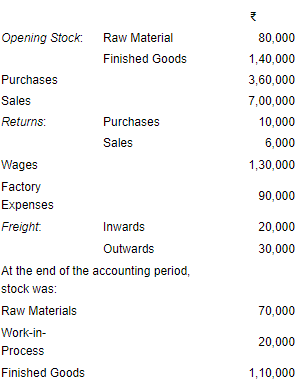

Question 9: Following balances appear in the Trial Balance of a firm as on 31st March, 2019:

Prepare Trading Account of the firm.

ANSWER:

Note: Freight outwards is an indirect expense. It will be recorded in Profit & Loss A/c.

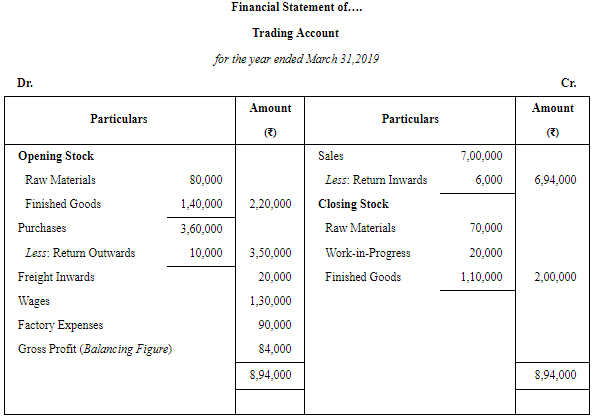

Page No 18.63:

Question 10: From the following information, prepare Trading account for the year ended 31st March, 2019:

Adjusted Purchases ₹ 5,50,000; Sales ₹ 6,25,000; Freight and Carriage Inwards ₹ 3,000; Wages ₹ 7,000; Freight and Cartage Outwards ₹ 2,500; Closing Stock ₹ 50,000.

ANSWER:

Notes:

1. Freight and Carriage Outwards are indirect expenses, therefore it is not recorded in the Trading Account.

2. Closing Stock (i.e. Rs 50,000) is not recorded in the Trading Account as it is already adjusted in the amount of Adjusted Purchases

Page No 18.64:

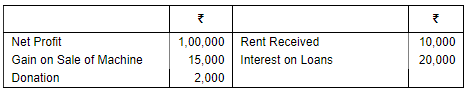

Question 11: From the following figures, calculate Operating Profit:

ANSWER:

Operating Profit=Net Profit−Rent Received−Gain on Sale of Machine+Interest on Loan−Donation =1,00,000−10,000−15,000+20,000−2,000=Rs 93,000

Page No 18.64:

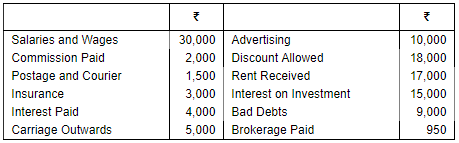

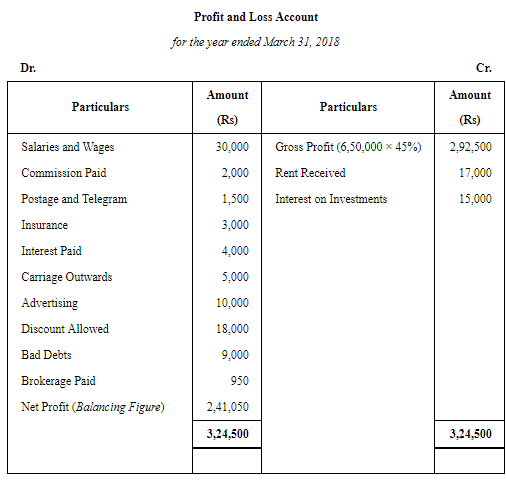

Question 12: From the following, prepare Profit and Loss Account of Sohan Lal as it would appear in the 1st year that ended 31st March, 2019:

The Gross Profit was 45% of sales, which amounted to ₹ 6,50,000.

Also, pass the Journal entries.

ANSWER:

Page No 18.64:

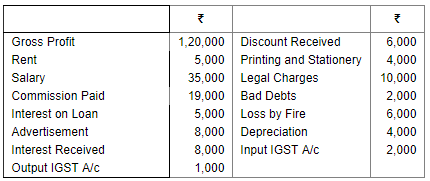

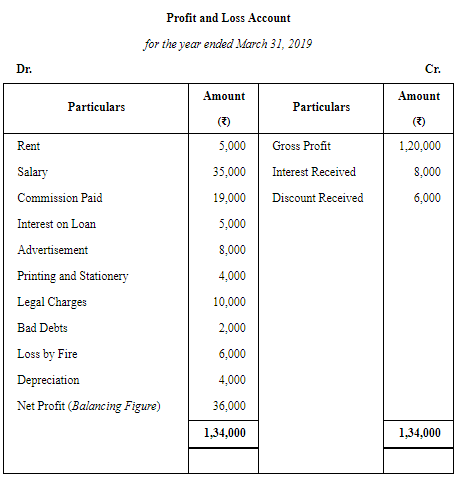

Question 13: From the following information, prepare Profit and Loss Account for the year ended 31st March, 2019:

ANSWER:

Note: ₹1,000 Input IGST after adjusting against Output IGST will be shown on the asset side of the balance sheet.

Page No 18.64:

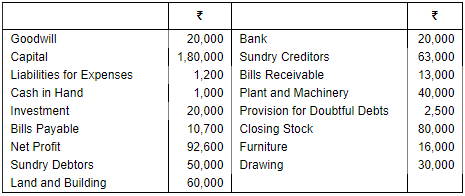

Question 14: From the following particulars, prepare Balance Sheet as at 31st March, 2019:

ANSWER:

Page No 18.65:

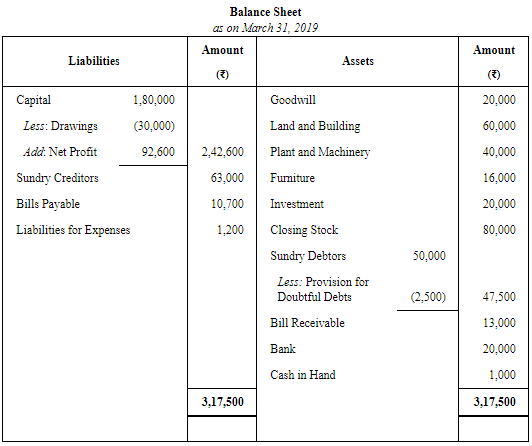

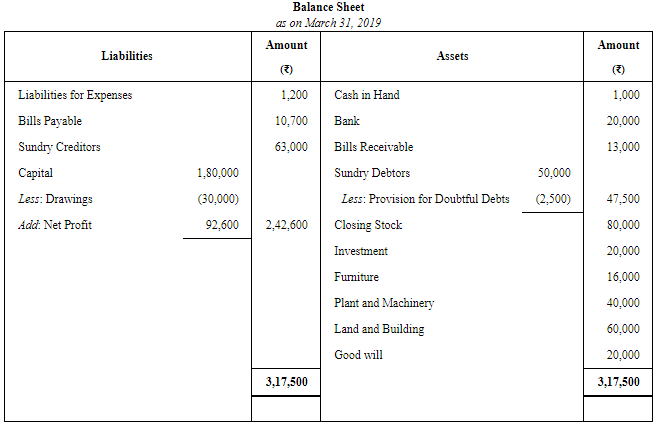

Question 15: From the following information, prepare Balance Sheet of a trader as at 31st March, 2019 arranging the assets and liabilities–(i) in order of permanence and (ii) in order of liquidity:

ANSWER:

(I) Balance Sheet in Order of Permanence

(II) Balance Sheet in Order of Liquidity

Page No 18.65:

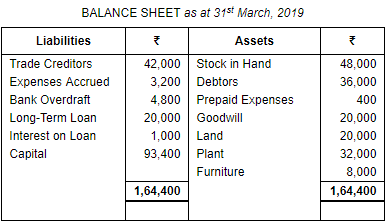

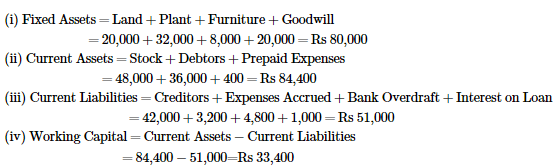

Question 16: From the Balance Sheet given below, calculate:

(i) Fixed Assets

(ii) Current Assets

(iii) Current Liabilities

(iv) Working Capital

ANSWER:

Page No 18.65:

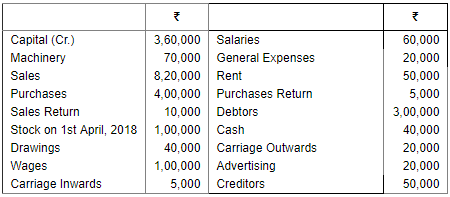

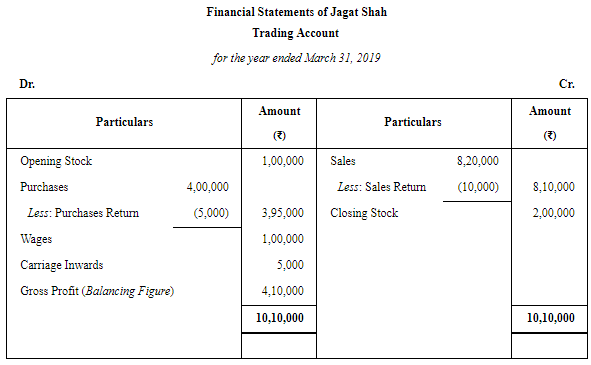

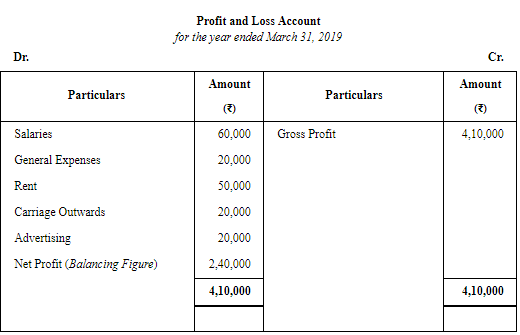

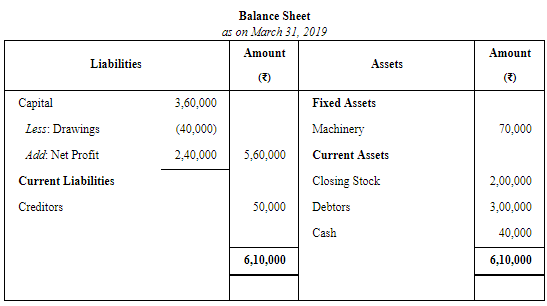

Question 17: Prepare Trading and Profit and Loss Account and Balance Sheet of Jagat Shah as at 31st March, 2019 from the following balances:

The Closing Stock was valued at ₹ 2,00,000.

ANSWER:

Page No 18.66:

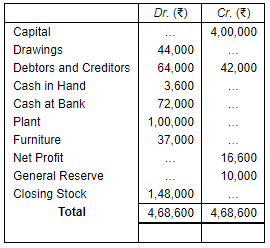

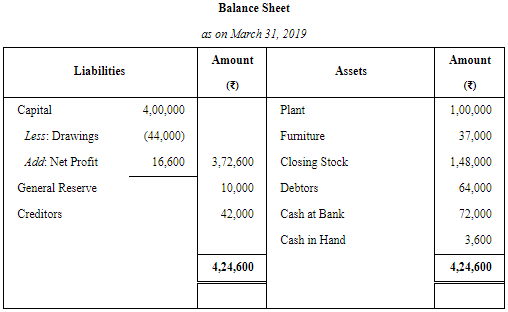

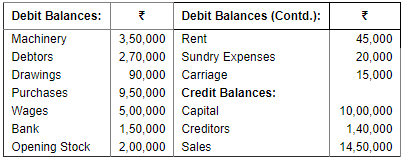

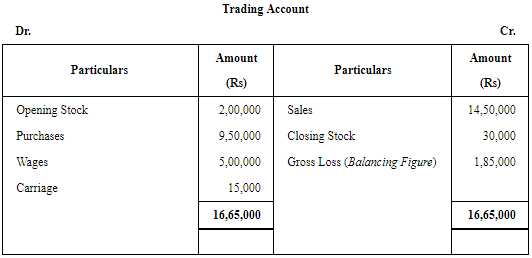

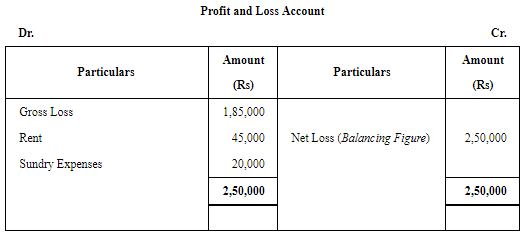

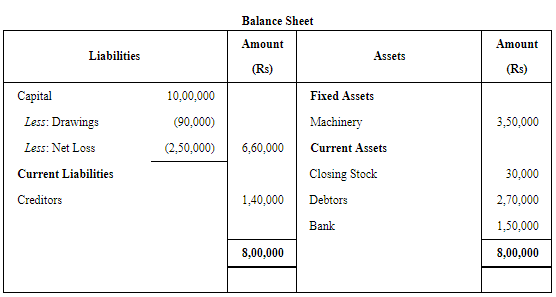

Question 18: From the following balances, prepare Trading and Profit and Loss Account and Balance Sheet:

Closing Stock was valued at ₹ 30,000.

ANSWER:

|

61 videos|226 docs|39 tests

|

FAQs on Financial Statements of Sole Proprietorship - (Part - 2) - Accountancy Class 11 - Commerce

| 1. What are the main financial statements of a sole proprietorship? |  |

| 2. How does an income statement of a sole proprietorship differ from that of a corporation? |  |

| 3. What information does the balance sheet of a sole proprietorship provide? |  |

| 4. How can a sole proprietor use the statement of cash flows to manage their business? |  |

| 5. Can a sole proprietorship have financial statements prepared by a professional accountant? |  |