Financial Statements Of Not For Profit Organisations (Part - 1) | Accountancy Class 12 - Commerce PDF Download

Page No 1.55:

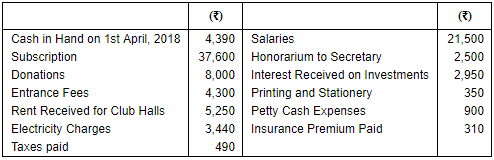

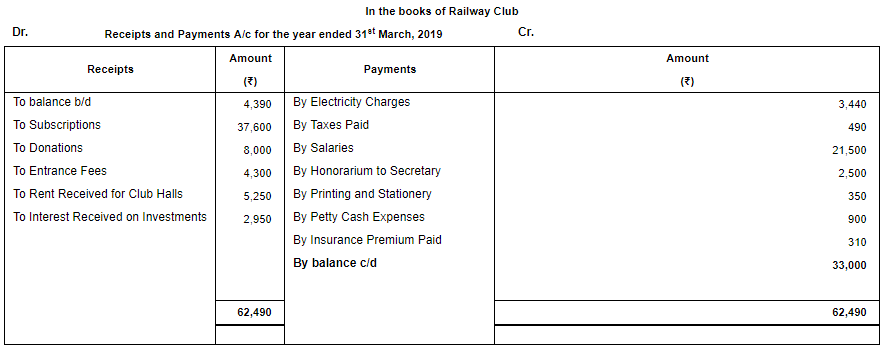

Question 1: From the information given below, prepare Receipts and Payments Account of Railway Club for the year ended 31st march, 2019:

ANSWER:

Page No 1.55:

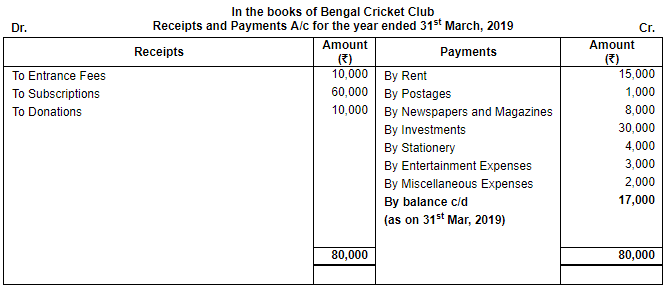

Question 2: Bengal Cricket Club was inaugurated on 1st April, 2018. It had the following Receipts and Payments during the year ended 31st March, 2019:

Receipts: Entrance Fees ₹ 10,000; Subscriptions ₹ 60,000; Donations ₹ 10,000.

Payments: Rent ₹ 15,000; Postages ₹ 1,000; Newspapers and Magazines ₹ 8,000; Investments ₹ 30,000; Stationery ₹ 4,000; Entertainment Expenses ₹ 3,000; Miscellaneous Expenses ₹ 2,000.

Show the Receipts and Payments Account for the year ended 31st March, 2019.

ANSWER:

Page No 1.56:

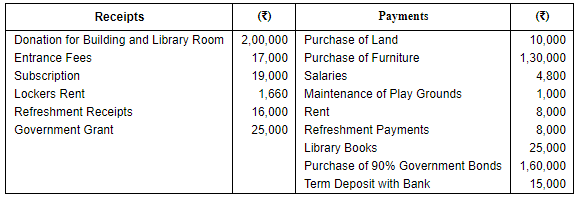

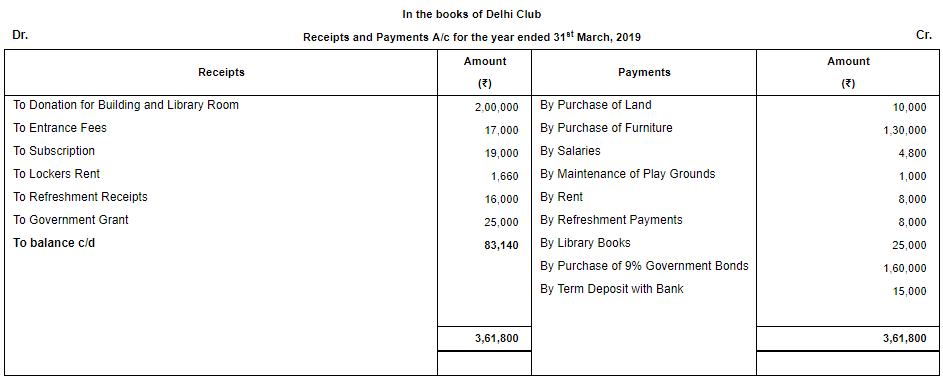

Question 3: The following information were obtained from the books of Delhi Club as on 31st March, 2019 at the end of the first year of the Club, prepare Receipts and Payment Account for the year ending 31st March, 2019:

ANSWER:

Page No 1.56:

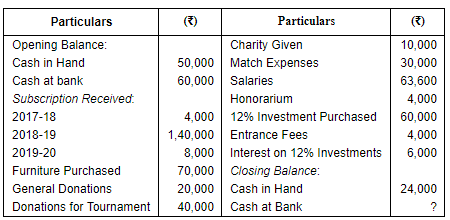

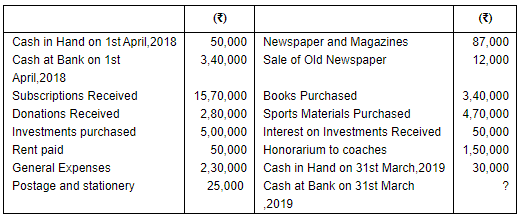

Question 4: From the following information, prepare Receipts and Payments Account of Long-town Sports Club for the year ending 31st March, 2019:

ANSWER:

Working Notes:

Calculation of closing balance of Cash:

Total Receipts = ₹ 3,32,000

Total Payments = ₹ 2,37,600

Cash in Hand = ₹ 24,000

Cash at Bank = Total Receipts – (Total Payments + Closing Balance of Cash)

= ₹ [3,32,000 – 2,61,600] = ₹ 70,400

Page No 1.56:

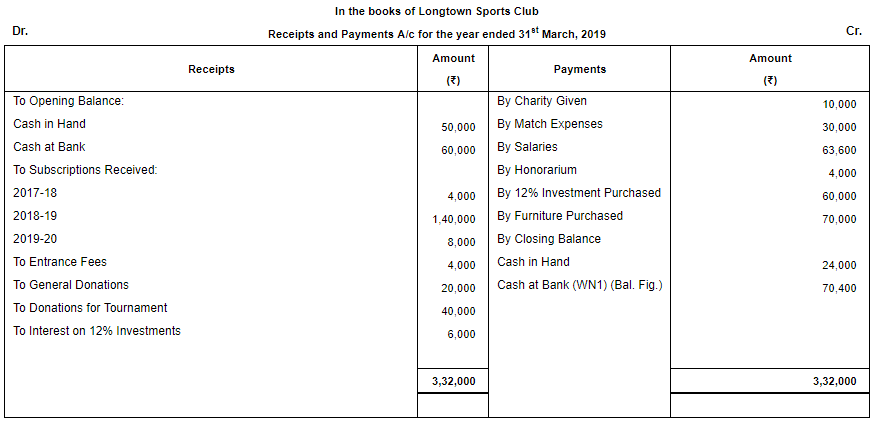

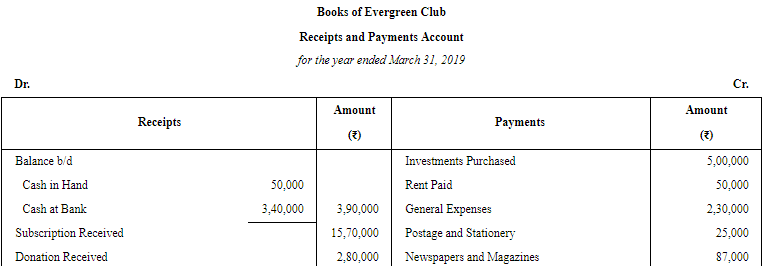

Question 5: From the following particulars of Evergreen club, prepare Receipts and payments Account for the year ended 31st March,2019:

ANSWER:

Page No 1.57:

Question 6: How are the following items shown in the accounts of a Not-for-Profit Organisation ?

ANSWER:

Page No 1.57:

Question 7: How are the following dealt with in the accounts of a Not-for-Profit Organisation ?

ANSWER:

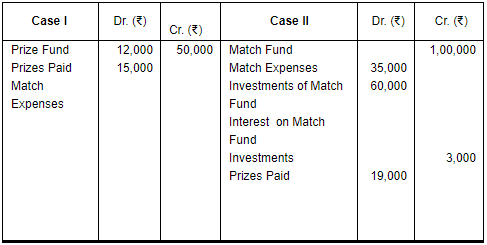

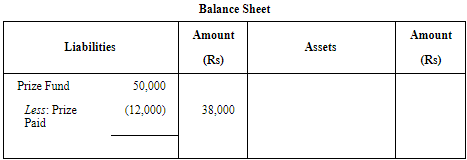

Case 1

Note: Match Expenses of Rs 15,000 are not deductible from the Prize Fund. This is because the Prize Fund is maintained only to meet the expenses relating to the Prize. However, the match expenses (i.e. Rs 15,000) will be debited to the Income and Expenditure Account as there is no specific fund is maintained to meet such expenses.

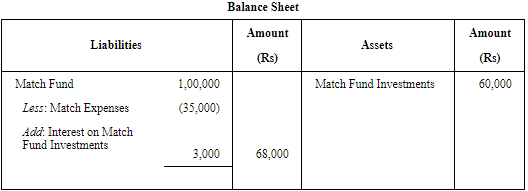

Case 2

Note: Prizes paid worth Rs 19,000 are not deductible from the Match fund because the Match Fund. This is because Match Fund is maintained only to meet the expenses relating to the Match. However, the prizes paid (i.e. Rs 19,000) will be debited to the Income and Expenditure Account as there is no specific fund is maintained for distributing the prizes. Also, the interest on Match Fund Investments is added to the Match Fund because it is an income related to this particular fund.

Page No 1.57:

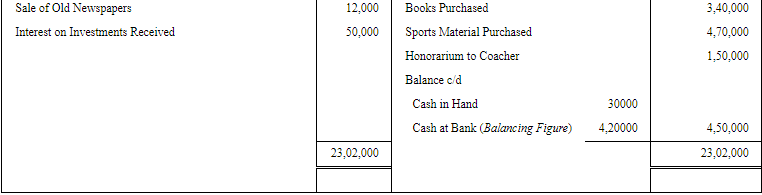

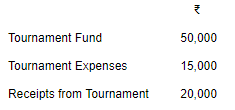

Question 8: How are the following dealt with while preparing the final accounts of a club?

Page No 1.57:

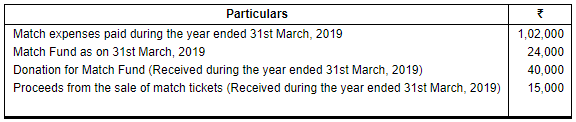

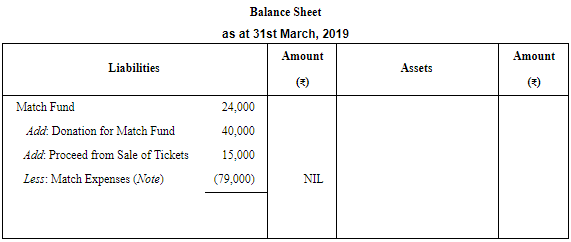

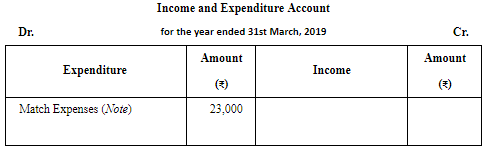

Question 9:

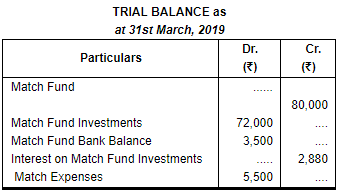

From the following information of a club show the amounts of match expenses and match fund in the appropriate Financial Statements of the club for the year ended on 31st March, 2019:

ANSWER:

Note: The total Match expenses amounts to Rs 1,02,000 whereas the total amount available in the Match Fund is only Rs 79,000 (i.e. Rs 24,000 + Rs 40,000 +Rs 15,000). This implies that expenses of Rs 79,000 is met through the Fund while the remaining expenses of Rs 23,000 (i.e. Rs 1,02,000 – Rs 79,000) are debited to the Income and Expenditure Account.

Page No 1.57:

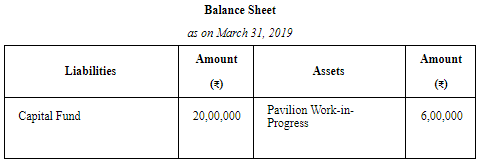

Question 10: Show how are the following items dealt with while preparing the final accounts for the year ended 31st March, 2019 of a Not-for-profit Organisation:

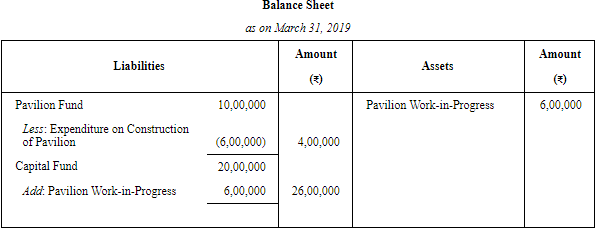

Case I

Expenditure on construction of Pavilion is ₹ 6,00,000. The construction work is in progress and has not yet completed. Capital Fund as at 31st March, 2018 is ₹ 20,00,000.

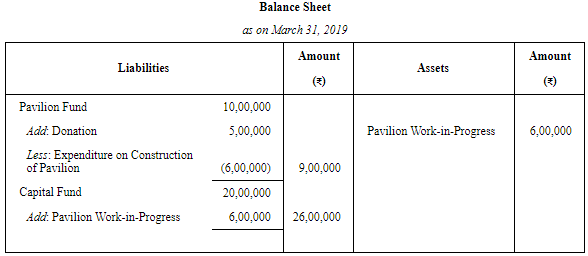

Case II

Expenditure on construction of Pavilion is ₹ 6,00,000. The construction work is in progress and has not yet completed. Pavilion Fund as at 31st March, 2018 is ₹ 10,00,000 and Capital Fund as at 31st March, 2018 is ₹ 20,00,000.

Case III

Expenditure on construction of Pavilion is ₹ 6,00,000. The construction work is in progress and has not yet completed. Pavilion Fund as at 31st March, 2018 is ₹ 10,00,000, and Capital Fund as at 31st March, 2018 is ₹ 20,00,000. Donation Received for Pavilion on 1st January, 2019 is ₹ 5,00,000.

ANSWER:

Case 1

Case 2

Case 3

|

42 videos|168 docs|43 tests

|

FAQs on Financial Statements Of Not For Profit Organisations (Part - 1) - Accountancy Class 12 - Commerce

| 1. What are financial statements of not for profit organisations? |  |

| 2. What is the purpose of financial statements of not for profit organisations? |  |

| 3. What are the components of financial statements of not for profit organisations? |  |

| 4. How are financial statements of not for profit organisations different from those of for-profit organisations? |  |

| 5. Who uses financial statements of not for profit organisations? |  |

|

Explore Courses for Commerce exam

|

|