Preparing Income and Expenditure Accounts - Commerce PDF Download

How to Prepare Income and Expenditure Account from Receipts and Payment Account? – Answered!

Since the Cash Book entries have been summarized into the Receipts and Payments Account, information necessary to prepare Income and Expenditure Account will be largely found in it. A scrutiny of the receipts side will show what items are of revenue nature and also relate to the present period.

These will appear on the credit side of the Income and Expenditure Account. The items should be increased by outstanding amounts. The outstanding amounts will also appear in the Balance Sheet. Suppose, the Receipts and Payments Account shows subscriptions to have been received to the extent of Rs 18,300 including Rs 450 for the next year; but subscriptions for the current year not yet received total Rs 1,100.

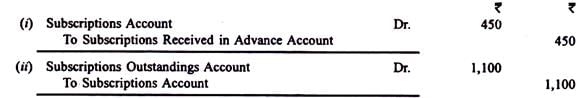

The entries to adjust the subscriptions will be as follows:

The Income and Expenditure Account will be credited in respect of Subscriptions with Rs. 18,950.

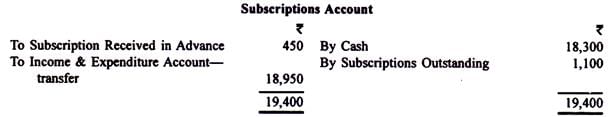

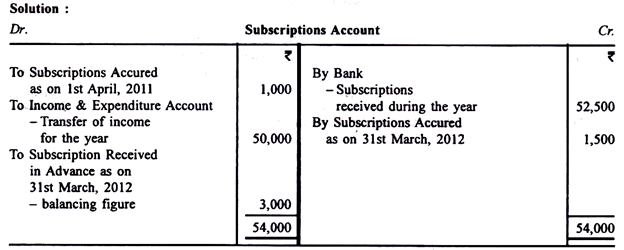

The Subscriptions Account will appear as follows:

The Subscriptions Received in Advance Account will appear in the Balance Sheet on the liabilities side; Subscriptions Outstanding Account will appear on the assets side. Next year, these two accounts will be transferred to the Subscriptions Account.

An examination of the payments side will show which items relate to the present year and are of revenue nature. These will appear on the debit side of the Income and Expenditure Account. Any outstanding expense must be added. Expenses paid in advance must be deducted. Both the outstanding and prepaid amounts will appear in the Balance Sheet.

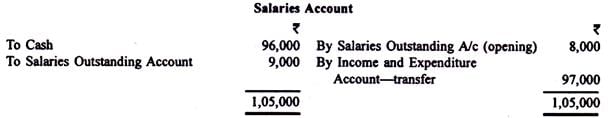

Suppose, salaries paid for the year ended 31st March, 2012 total Rs 96,000 and include Rs 8,000 for the month of March, 2011 paid in April, 2011 and at the end of the accounting year 2011-2012 on 31st March, 2012, a sum of, Rs 9,000 is unpaid in respect of salary for the month of March, 2012.

The Salaries Account will appear as shown below:

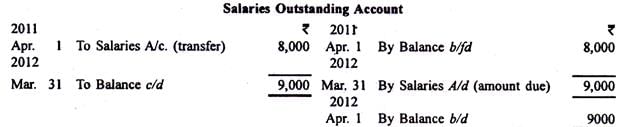

The Salaries Outstanding Account will appear as follows:

The amount of Rs 9,000 will be shown in the Balance Sheet as a liability. Care must be taken to exclude the opening balances of cash and bank and items of capital nature.

Balance Sheet:

In the absence of a regular trial balance, a balance sheet can be prepared only by taking each item in the previous year’s balance sheet and adjusting it for cash paid or received on capital account (i.e., additions or deductions because of cash transactions) and for loss or depreciation. Outstanding expenses and incomes received in advance and also expenses prepaid and outstanding income must also be shown in the balance sheet. Previous year’s General (or Capital) Fund will be adjusted for the current year’s surplus (excess of income over expenditure which will be added) or deficit (which will be deducted).

Notes:

(1) Income against which service has to be rendered for a long time without further payment, such as life membership fees, should be added directly to the General or Capital Fund and not credited to the Income and Expenditure Account.

(2) Donations received for a special purpose, say, for conducting a tournament, should be credited to a separate account and shown on the liabilities side of the balance sheet. Income derived from such an amount should be added to it and the expenses incurred for the specific purpose should be deducted from it. Needless to add, such items will not appear in the Income and Expenditure Account.

(3) Treatment similar to (1) above is sometimes recommended for entrance fees. This would be correct if the amount is large, being in the nature of a capital receipt in lieu of reduced subscriptions in future. But if the amount is small, it does not matter whether it is credited to the Income and Expenditure Account or added to the General (Capital) Fund directly.

Illustration 1:

From the following information, calculate the amount of subscriptions received in advance as on 31st March, 2012:

(i) Subscriptions received during the year 2011-2012 Rs 52,500

(ii) There were 200 members paying subscription at the rate of Rs 250 per annum each.

(iii) Some members have paid their annual subscription in advance during the year.

As on 1st April, 2011 no subscription had been received in advance but subscriptions were outstanding to the extent of? 1,000 as on 31st March, 2011.

Subscriptions accrued as on 31st March, 2012 totaled Rs 1,500.

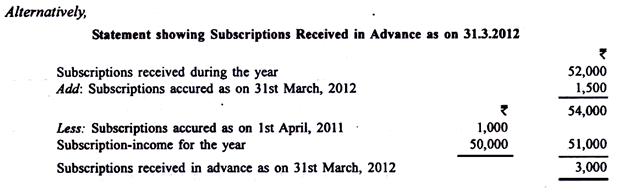

Illustration 2:

Calculate the amount of stationery used during the accounting year ended 31st March, 2010:

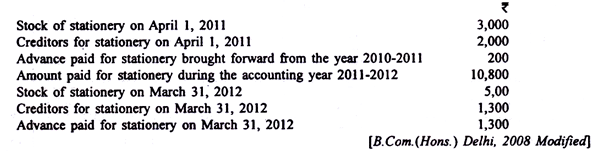

Solution:

Calculation of stationery purchased during the year ended March 31, 2012:

Illustration 3:

Illustration 3:

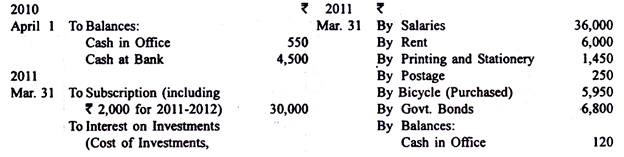

From the following, prepare an Income and Expenditure Account for the year ended 31st March, 2011:

Subscriptions include Rs 1,200 for 2009-10. Also rent includes Rs 500 paid for March, 2010. Subscriptions amounting to Rs 1,500 have still to be collected for the year 2010-2011. Rent for March, 2011 is still to be paid and Rs 250 is outstanding against a stationery bill. The book value of the scooter was Rs 8,200.

Solution:

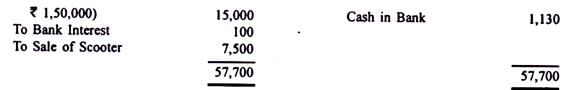

Income and Expenditure Account for the Year ended March 31, 2011:

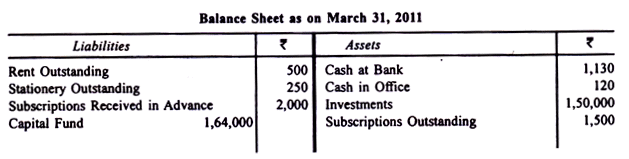

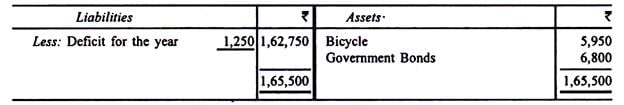

If, in the above illustration, one is required to prepare a Balance Sheet as on March 31, 2011, one will have to first find out the Capital Fund of the institution.

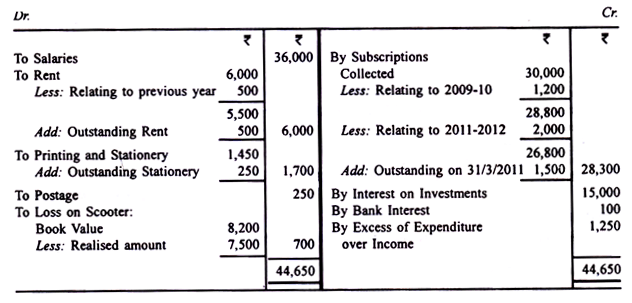

This can be done by preparing Balance Sheet as at March 31, 2010 as follows:

Having determined the Capital Fund in the beginning, one can now prepare the Balance Sheet as at March 31, 2011 as follows:

Illustration 4:

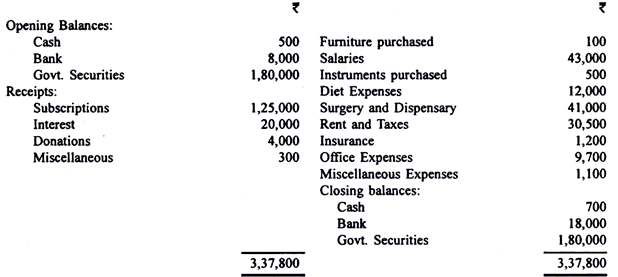

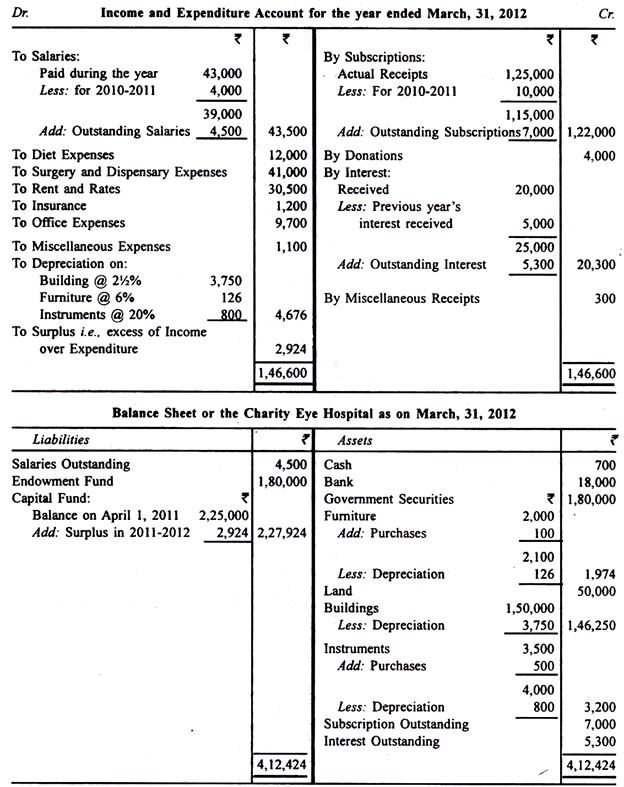

The following is the statement of receipts and payments of the Charity Eye Hospital for the year ending March 31, 2012:

You are asked to prepare the Income and Expenditure Account for the year and the Balance Sheet as on 31st March, 2012. The other assets on 1st April 2011 were—Furniture, Rs 2,000; Land, Rs 50,000; Buildings Rs 1, 50,000; Instruments, Rs 3,500. Write off depreciation at 2 1/2% on Buildings, 6% on Furniture, and 20% on Instruments (including new).

The Government Securities of the face value of Rs 2, 00,000 (cost, Rs 1, 80,000) represent investments of the Endowment Fund. Subscriptions received include Rs 10,000 for the year 2010 – 11 but Rs 7,000 is outstanding for 2011-2012 Salaries paid include Rs 4,000 for 2010-11 but Rs 4,5000 is payable for 2011-2012. Interest received includes Rs 5,000 for 2010-2011 but Rs 5,300 is outstanding for 2011-2012.

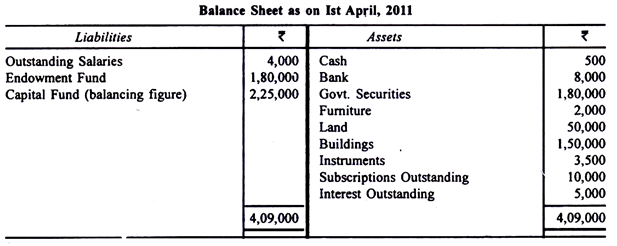

Solution:

First of all, the Capital Fund as on 1st April, 2011 should be determined; this is ascertained by deducting liabilities from assets. For this purpose, the following balance sheet is prepared.

Now Income and Expenditure Account for the year ended 31st March, 2012 and Balance Sheet as at that date can be prepared.

Illustration 5:

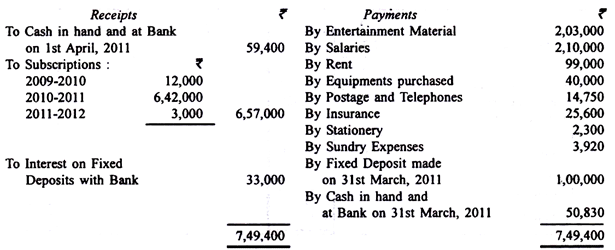

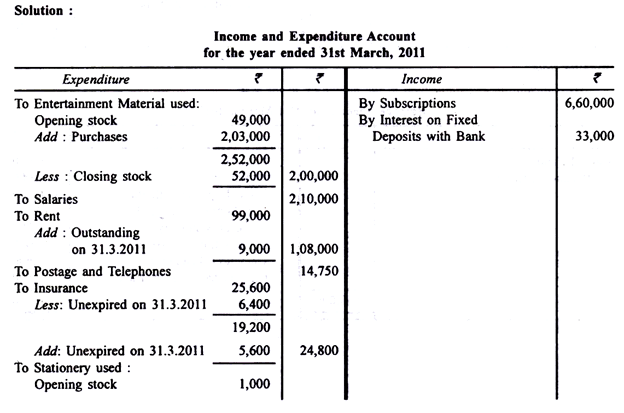

The following is the receipts and payments account of Entertainment Club for the year ended 31st March, 2011:

The following additional information is provided to you:

(i) On 31st March, 2011, apart from cash in hand and at Bank as shown in receipts and payments account, the club held the following assets:

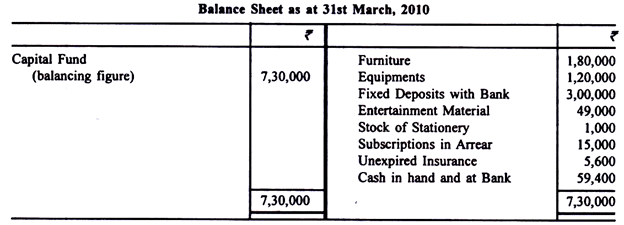

Furniture Rs 1,80,000; Equipment’s Rs 1,20,000; Fixed Deposits with Bank Rs 3,00,000; Entertainment Material Rs 49,000; Stock of Stationery Rs 1,000; Subscriptions in Arrear Rs 15,000 and Unexpired Insurance Rs 5,600.

The club had no liability on that date.

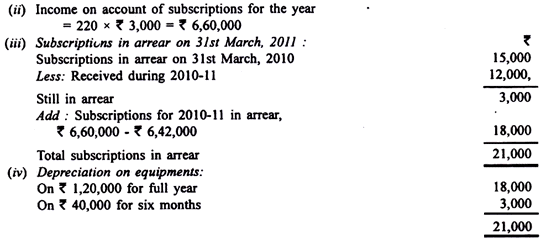

(ii) The club has 220 members, each paying Rs 3,000 as yearly subscription.

(iii) On 31st March, 2011 stock of entertainment material was valued at Rs 52,000. Stock of stationery with the club on that date was Rs 2,100. Rent amounting to Rs 9,000 for March, 2011 was outstanding on that date.

Working Notes:

(i) Calculation of capital fund in the beginning of the year:

Illustration 6:

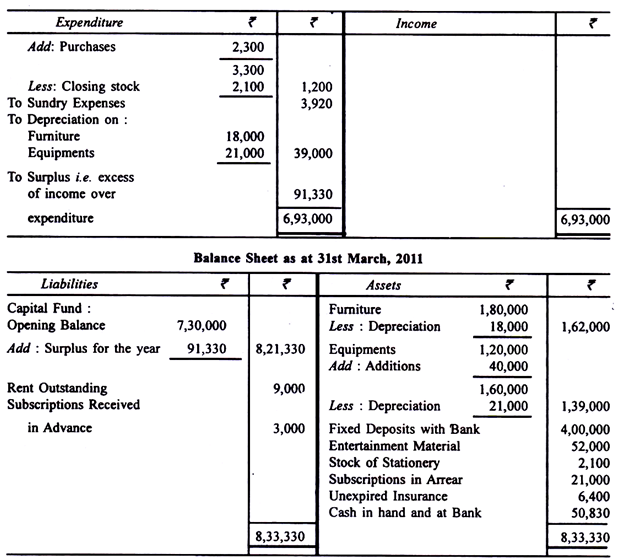

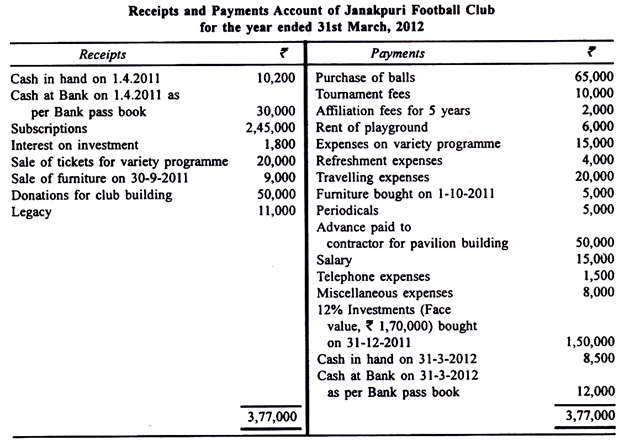

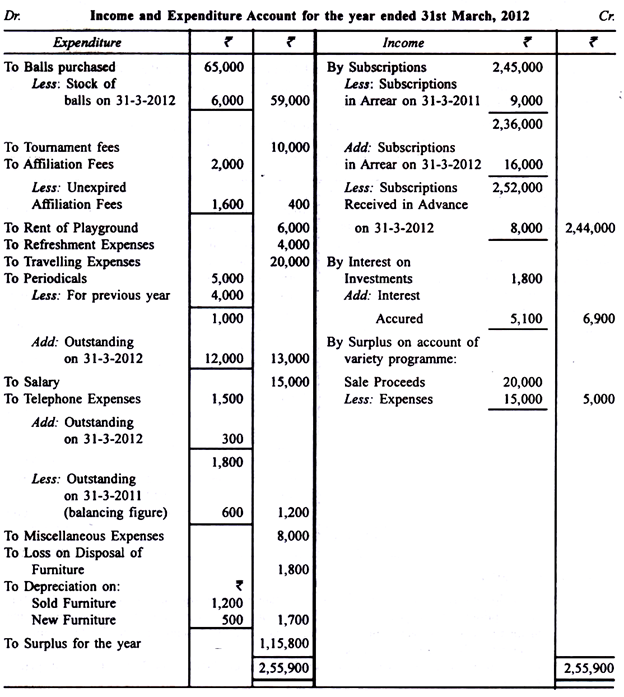

From the following Receipts and Payments Account and the additional information pertaining to Janakpuri Football Club, prepare Income and Expenditure Account for the year ended 31st March, 2012 and Balance Sheet as at that date:

Additional information:

(i) Subscriptions received include Rs 9,000 outstanding subscriptions for the year 2010-2011. Subscriptions for the year 2011-2012 amounting to Rs 16,000 are still outstanding. Some members have paid subscriptions for the year 2012-2013 amounting to Rs 8,000 which is included in the subscriptions received.

(ii) Face value of 12% Investments on 31st March 2011 was Rs 15,000 (cost price, Rs 12,000)

(iii) Book value of furniture sold on 1 April, 2011 was Rs 12,000, depreciation being 20% p.a. Provide depreciation on new furniture at the same rate.

(iv) Telephone bill for one quarter is outstanding, the amount outstanding being Rs 300. The charge for each quarter is the same both for 2010-2011 and 2011-2012.

(v) Un-presented cheques for periodicals being Rs 4,000 for 2010-2011 and Rs 12,000 for 2011-2012

(v) Stock of balls with the club on 31st March, 2012 amounted to Rs 6,000.

Solution:

In the Books of Janakpuri Football Club:

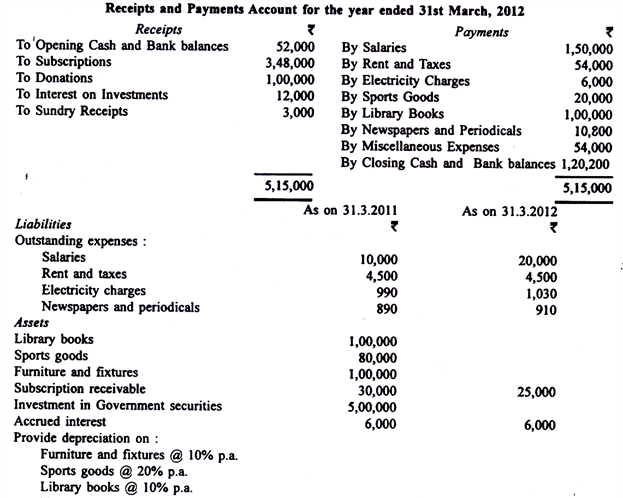

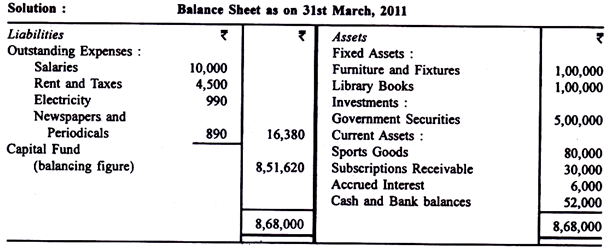

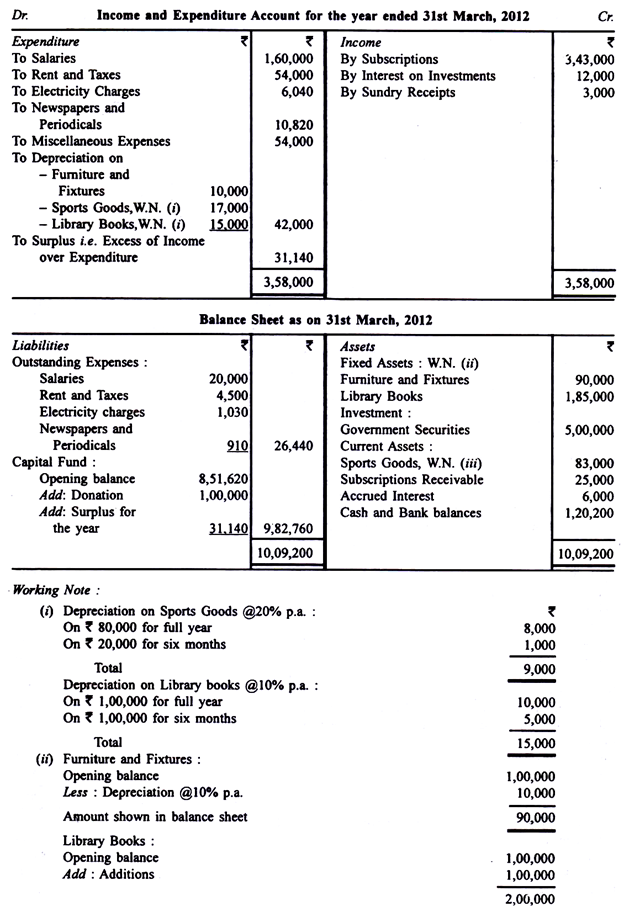

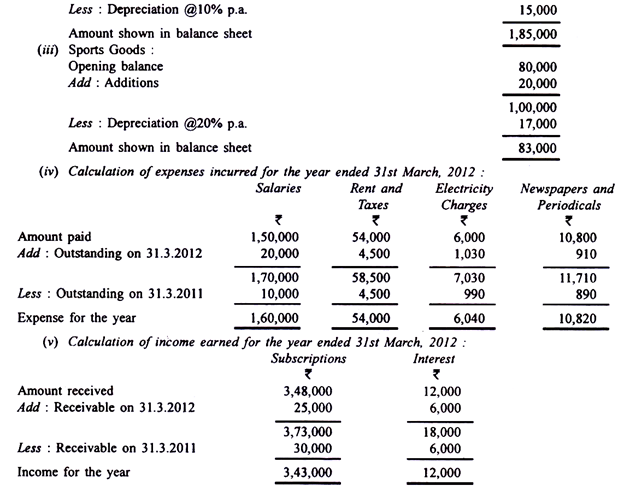

Illustration 7:

Mahaveer Sports Club presents the following information to you:

You are required to prepare Income and Expenditure Account for the year ended 31st March, 2012 and the balance sheets as on 31st March, 2011 and 31st March, 2012. Treat donations as capital receipt. Assume that sports goods and library books have been purchased evenly throughout the year.

Illustration 8:

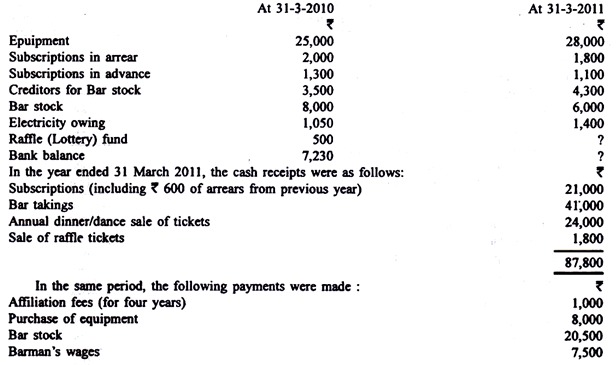

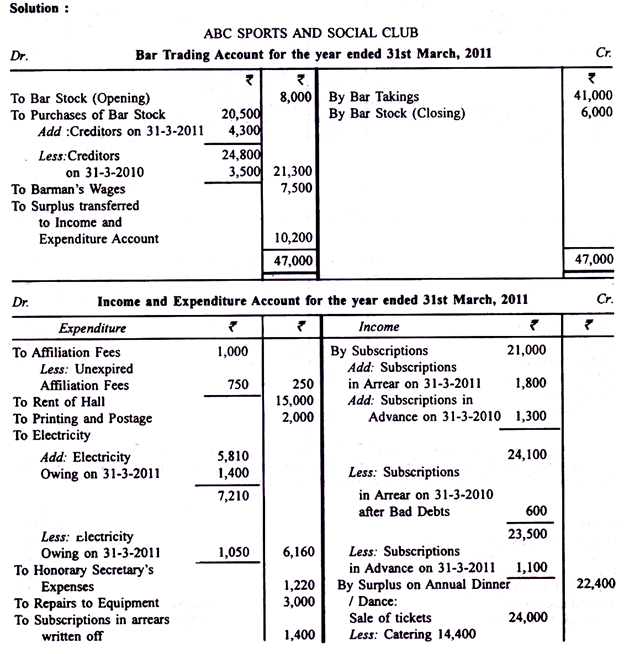

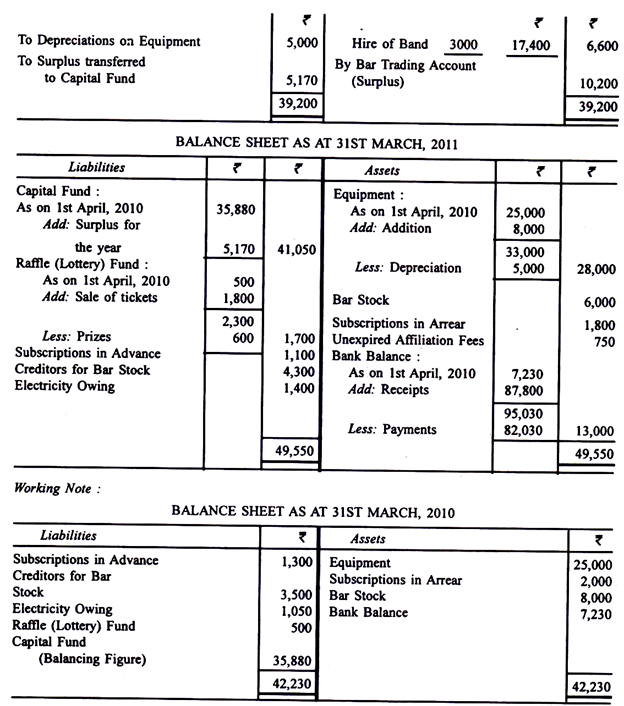

ABC Sports and Social Club’s financial year ends on 31st March. The assets and liabilities of the club at dates stated were as follows:

Note:

Subscription – arrears of previous year written off during the year, Rs 1,400.

Prepare:

(i) Bar Trading Account and

(ii) Income and Expenditure Account for the year ended 31st March, 2011 and Balance Sheet as at that date.

Illustration 9:

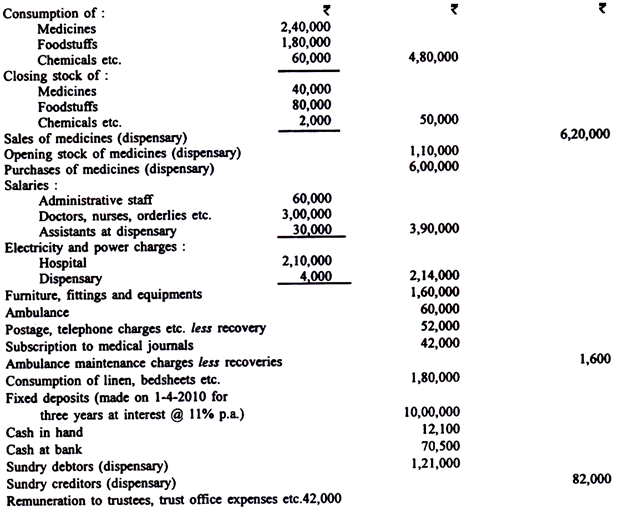

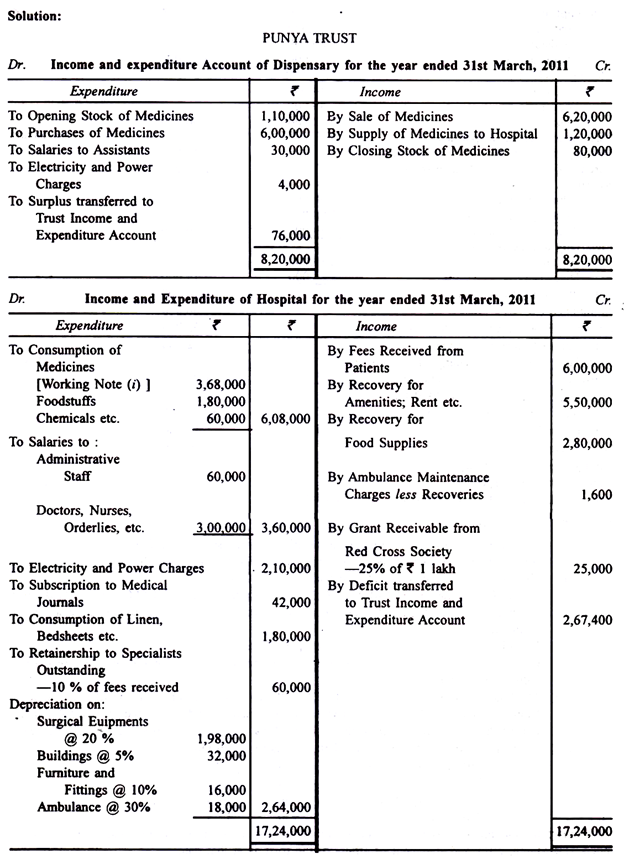

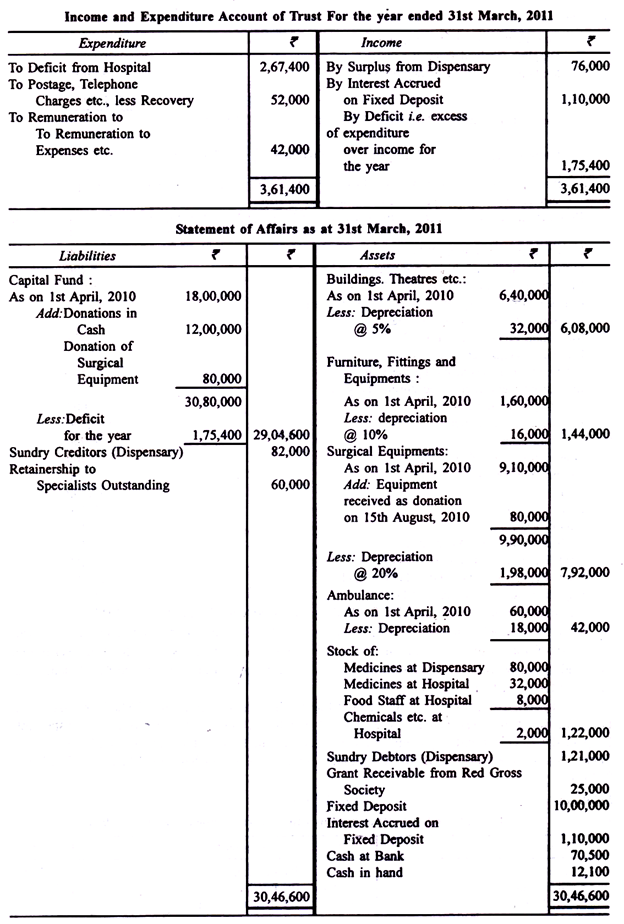

Punya Trust runs a charitable hospital and a dispensary and for the year ended 31st March, 2011, the following balances were extracted from its books:

Additional information:

(i) The dispensary supplies medicines to hospital on requisitions and delivery notes; for which no adjustment has been made in the books. Cost of such supplies in the year was Rs 1, 20,000;

(ii) Closing stock of medicines at dispensary was Rs 80,000;

(iii) Stock of medicines on 31st March, 2011 at the hospital included Rs 8,000 worth of medicines belonging to patients; this has not been considered in arriving at the figure of consumption of medicines;

(iv) Donations were received towards the corpus of the trust;

(v) On 15th August 2010, one of the well-wishers donated surgical equipment, whose market value was Rs 80,000;

(vi) The hospital is to receive a grant of 25% of the amount spent on treatment of poor patients, from the local branch of the Red Cross Society. Such expenditure in the year was Rs 1 lakh;

(vii) Out of the fees recovered from the patients, 10% is to be given to specialists as retained;

(viii) Depreciation on assets, on closing balances, is to be provided on

Surgical equipment’s @ 20%

Buildings @ 5%

Furniture and fittings @ 10%

Ambulance @ 30%

Prepare the income and expenditure statements of the dispensary, trust and the hospital for the year ended 31st March, 2011 and statement of affairs of the trust as at that date.

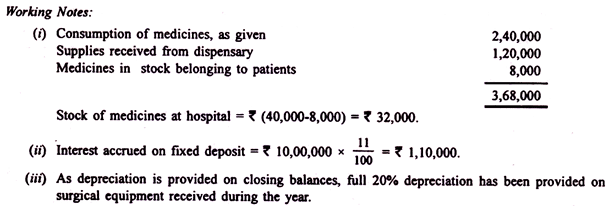

Illustration 10:

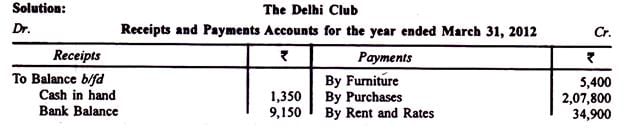

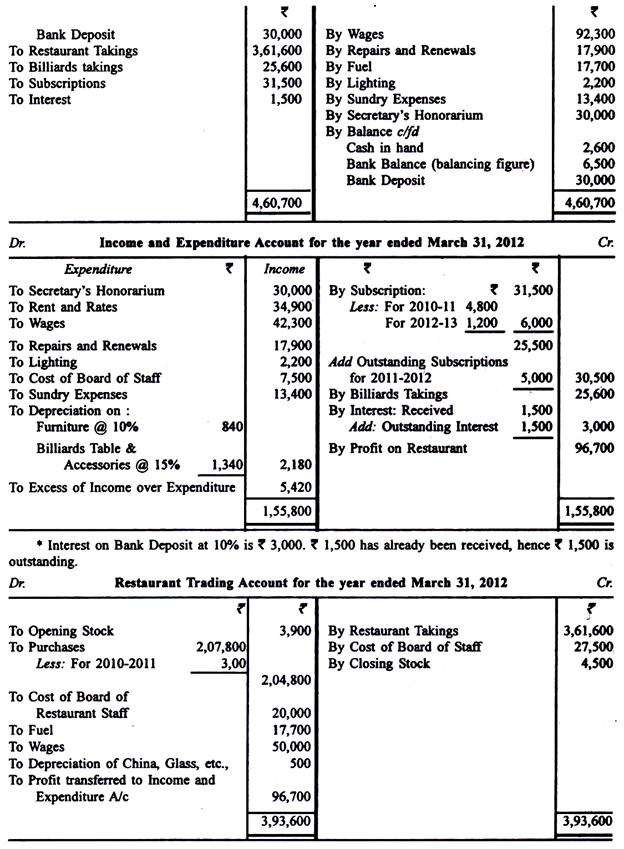

The balances on the books of the Delhi Club on 31st March, 2012 were as follows:

Payment for purchases includes Rs 3,000 for the year ended 31st March, 2011. Restaurant Stocks on March 31, 2012 were Rs 4,500. Included in the subscriptions received were Rs 4,800 for the previous year and Rs 1,200 for the year ended 31st March, 2013. Subscriptions outstanding on March 31, 2012 were Rs 5,000. Depreciation should be provided on balances as at 31st March, 2011 as China, etc., 20%; Furniture, 10% and Billiards Table and Accessories, 15%.

The cost of the board of the staff is estimated at Rs 27,500 of which Rs 20,000 is to be charged to restaurant. Prepare the Receipts and Payments Account, Income and Expenditure Account and the Balance Sheet showing the working of the Restaurant separately, Cash in hand on March 31, 2012 was Rs 2,600.

FAQs on Preparing Income and Expenditure Accounts - Commerce

| 1. What is an income and expenditure account? |  |

| 2. How is revenue calculated in an income and expenditure account? |  |

| 3. What expenses are included in an income and expenditure account? |  |

| 4. How is net income or loss calculated in an income and expenditure account? |  |

| 5. Why is an income and expenditure account important for businesses? |  |