Accounting for Partnership Firms-Fundamentals (Part - 1) | Accountancy Class 12 - Commerce PDF Download

Page No 2.80:

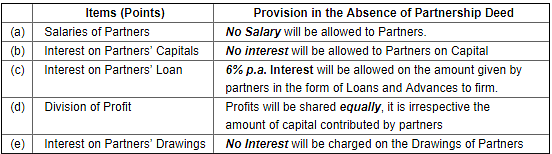

Question 1: In the absence of Partnership Deed, what are the rules relation to :

(a) Salaries of partners,

(b) Interest on partners’ capitals

(c) Interest on partners’ loan

(d) Division of profit, and

(e) Interest on partners’ drawings

ANSWER:

Page No 2.80:

Question 2: Following differences have arisen among P, Q and R. State who is correct in each case:

(a) P used ₹ 20,000 belonging to the firm and made a profit of ₹ 5,000. Q and R want the amount to be given to the firm?

(b) Q used ₹ 5,000 belonging to the firm and suffered a loss of ₹ 1000. He wants the firm to bear the loss?

(c) P and Q want to purchase goods from A Ltd., R does not agree?

(d) Q and R want to admit C as partner, P does not agree?

ANSWER:

(a) P is bound to pay Rs 20,000 together with profit of Rs 5,000 to the firm because this amount belongs to the firm.

Explanation: As per Principal and Agent relationship, P is principal as well as agent to the firm and to Q and R. As per this rule, any profit earned by an agent (P) by using the firm’s property is attributable to the firm.

(b) Q is liable to pay Rs 5,000 to the firm. As per the Partnership Act, 1932, every partner of a partnership firm is liable to the firm for any loss caused by his/her willful negligence.

Explanation: Here Q is solely responsible for the loss of Rs 1,000 because he used the property of the firm and also represented himself as a principal rather than an agent to the other partners and to the firm.

(c) P and Q may buy goods from A Ltd.

Explanation: As per Partnership Act, 1932, a partner has a right to buy and sell goods without consulting the other partners unless a Public Notice has been given by the partnership firm to restrict the partners to buy and sell.

(d) C will not be admitted because one of the partners P has not agreed to admit C.

Explanation: As per Partnership Act, a new partner cannot be admitted into a firm unless all the existing partners agree on the same decision. In other words, a new partner can be admitted in a partnership firm with the consent of all the existing partners.

Page No 2.81:

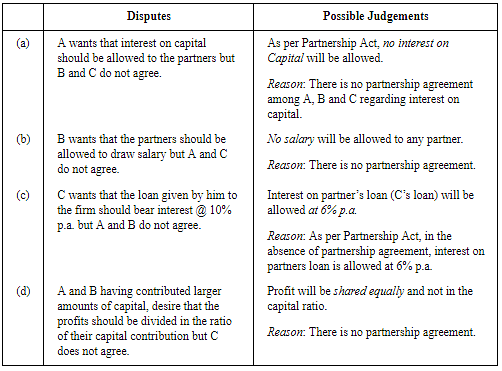

Question 3: A, B and C are partners in a firm. They do not have a Partnership Deed. At the end of the first year of the commencement of the firm, they have faced the following problems :

(a) A wants that interest on capital should be allowed to the partners but B and C do not agree.

(b) B wants that the partners should be allowed to draw salary but A and C do not agree.

(c) C wants that the loan given by him to the firm should bear interest @ 10% p.a. but A and B do not agree.

(d) A and B having contributed larger amounts of capital, desire that the profits should be divided in the ratio of their capital contribution but C does not agree.

State how you will settle these disputes if the partners approach you for purpose.

ANSWER:

Page No 2.81:

Question 4: Jaspal and Rosy were partners with capital contribution of ₹ 10,00,000 and ₹ 5,00,000 respectively. They do not have a Partnership Deed. Jaspal wants that profits of the firm should be shared in their capital ratio. Rosy convinced jaspal that profits should be shared equally. Explain how Rosy would have convinced Jaspal for sharing the profit equally.

ANSWER:

In any partnership firm when there is no partnership deed, then the rule of the Indian Partnership Act of 1932 applies. In the act, when the agreement is not signed then the profit should be distributed equally to all the partners.

In this scenario, Jaspal’s point of view does not align with the partnership Act rule and therefore, Rosy would have convinced her by explaining her the Partnership Act, 1932 provisions.

|

41 videos|168 docs|43 tests

|

FAQs on Accounting for Partnership Firms-Fundamentals (Part - 1) - Accountancy Class 12 - Commerce

| 1. What is accounting for partnership firms? |  |

| 2. What are the fundamentals of accounting for partnership firms? |  |

| 3. What are the financial statements prepared for partnership firms? |  |

| 4. How are profits or losses distributed among partners in a partnership firm? |  |

| 5. What is the importance of accounting for partnership firms? |  |

|

Explore Courses for Commerce exam

|

|