Accounting for Partnership Firms-Fundamentals (Part -2) | Accountancy Class 12 - Commerce PDF Download

Page No 2.81:

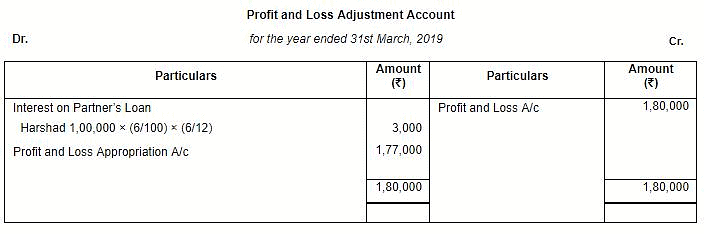

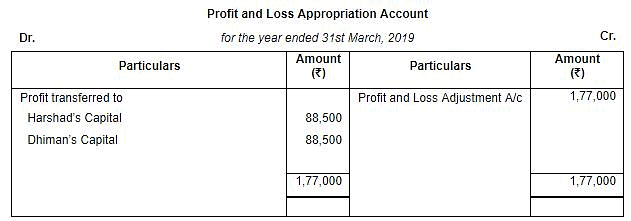

Question 5: Harshad and Dhiman are in partnership since 1st April, 2018. No partnership agreement was made. They contributed ₹ 4,00,000 and ₹ 1,00,000 respectively as capital. In addition, Harshad advanced an amount of ₹ 1,00,000 to the firm on 1st October, 2018. Due to long illness, Harshad could not participate in business activities from 1st August, 2018 to 30th September, 2018. Profit for the year ended 31st March, 2019 was ₹ 1,80,000. Dispute has arisen between Harshad and Dhiman.

Harshad Claims :

(i) He should be given interest @ 10% per annum on capital and loan;

(ii) Profit should be distributed in the ratio of capital;

Dhiman Claims :

(i) Profit should be distributed equally;

(ii) He should be allowed ₹ 2,000 p.m. as remuneration for the period he managed the business in the absence of Harshad;

(iii) Interest on Capital and loan should be allowed @ 6% p.a.

You are required to settle the dispute between Harshad and Dhiman. Also prepare Profit and Loss Appropriation Account.

ANSWER:

DISTRIBUTION OF PROFITS

Harshad Claims:

Decisions

(i) If there is no agreement on interest on partner’s capital, according to Indian partnership act 1932, no interest will be allowed to partners.

(ii) If there is no agreement on the matter of profit sharing, according to partnership act 1932, profit shall be distributed equally.

Dhiman Claims:

Decisions

(i) Dhiman claim is justified, according partnership act 1932 if there is no agreement on the matter of profit distribution, profit shall be distributed equally.

(ii) No salary will be allowed to any partner because there is no agreement on matter of remuneration.

(iii) Dhiman’s claim is not justified on the matter of interest on capital but justified on the matter of interest on loan. If there is no agreement on interest on partner’s loan, Interest shall be provided at 6% p.a.

Page No 2.81:

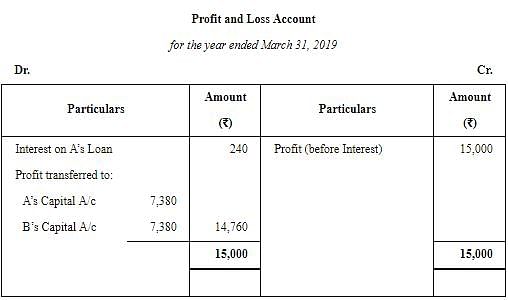

Question 6: A and B are partners from 1st April, 2018, without a Partnership Deed and they introduced capitals of ₹ 35,000 and ₹ 20,000 respectively. On 1st October, 2018, A advanced loan of ₹ 8,000 to the firm without any agreement as to interest. The profit and Loss Account for the year ended 31st March, 2019 shows a profit of ₹ 15,000 but the partners cannot agree on payment of interest and on the basis of division of profits.

You are required to divide the profits between them giving reasons for your method.

ANSWER:

Working Notes:

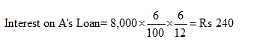

WN 1 Calculation of Interest on Loan

As per the Partnership Act, if there is no partnership agreement regarding rate of interest on loan, it is provided at 6% p.a.

Amount of Loan = Rs 8,000

Time Period (from October 01 to March 31) = 6 months

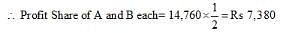

WN 2 Calculation of Profit Share of each Partner

In the absence of partnership deed, profits of a firm are distributed equally among all the partners.

Profit after Interest on A’s loan = 15,000 − 240 = Rs 14,760

Page No 2.81:

Question 7: A and B are partners in a firm sharing profits in the ratio of 3 : 2. They had advanced to the firm a sum of ₹ 30,000 as a loan in their profit-sharing ratio on 1st October, 2017. The Partnership Deed is silent on interest on loans from partners. Compute interest payable by the firm to the partners, assuming the firm closes its books every year on 31st March.

ANSWER:

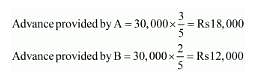

Amount advanced by the Partners = Rs 30,000

Profit sharing ratio = 3 : 2

Time Period (from October 01, 2017 to March 31, 2018) = 6 months

Interest rate = 6% p.a.

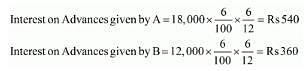

Calculation of Interest on Advances

Note: In the absence of a partnership agreement regarding rate of interest on loans and advances, interest is provided at 6% p.a.

Page No 2.82:

Question 8: X and Y are partners sharing profits and losses in the ratio of 2 : 3 with capitals ₹ 2,00,000 and ₹ 3,00,000 respectively. On 1st October, 2018, X and Y gave loans of ₹ 80,000 and ₹ 40,000 respectively to the firm. Show distribution of profits/losses for the year ended 31st March, 2019 in each of the following alternative cases:

Case 1 : If the profits before interest for the year amounted to ₹ 21,000.

Case 2 : If the profits before interest for the year amounted to ₹ 3,000.

Case 3 : If the profits before interest for the year amounted to ₹ 5,000.

Case 4 : If the loss before interest for the year amounted to ₹ 1,400.

ANSWER:

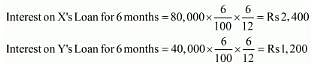

Calculation of Interest on Loan

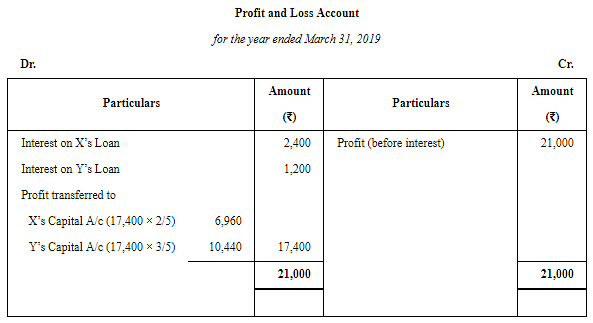

Case 1- If Profits before any interest for the year amounted to ₹ 21,000

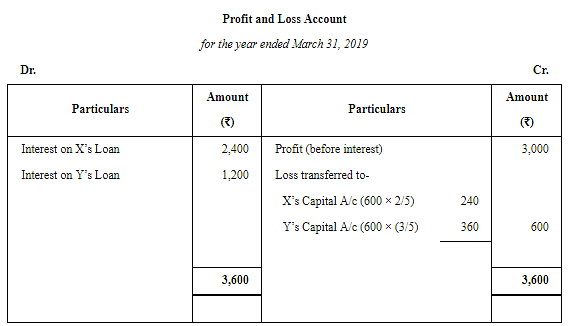

Case 2- If Profits before any interest for the year amounted to ₹ 3,000

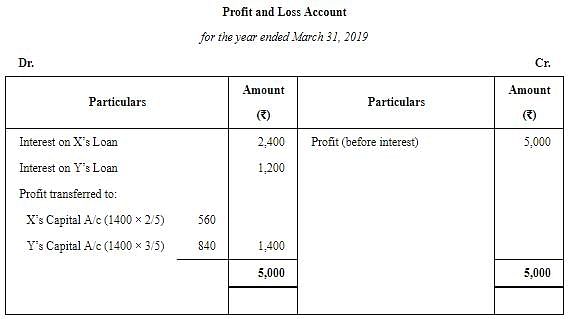

Case 3- If Profits before any interest for the year amounted to ₹ 5,000

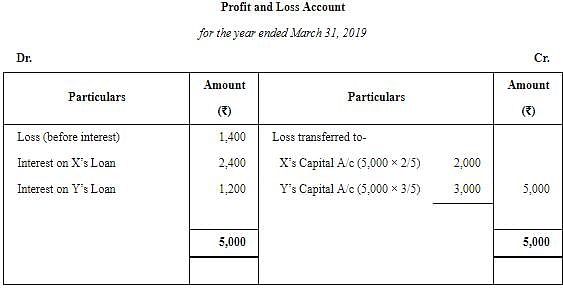

Case 4- If Loss before any interest for the year amounted to ₹ 1,400

|

47 videos|180 docs|56 tests

|

FAQs on Accounting for Partnership Firms-Fundamentals (Part -2) - Accountancy Class 12 - Commerce

| 1. What are the fundamentals of accounting for partnership firms? |  |

| 2. How are capital accounts maintained in partnership firms? |  |

| 3. What is a partnership journal and why is it important in accounting for partnership firms? |  |

| 4. How is the statement of partner's equity prepared in partnership firms? |  |

| 5. How are profits and losses distributed in partnership firms? |  |

|

Explore Courses for Commerce exam

|

|