Accounting for Share Capital (Part - 2) | Accountancy Class 12 - Commerce PDF Download

Page No 8.116:

Question 20:

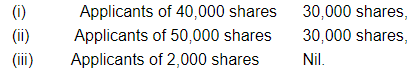

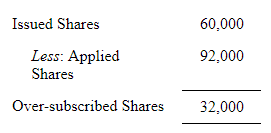

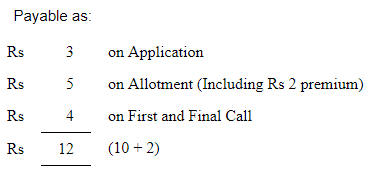

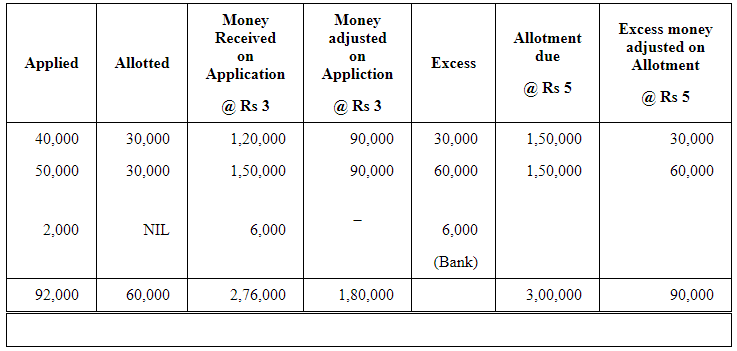

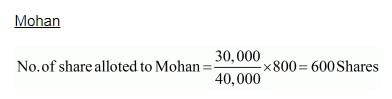

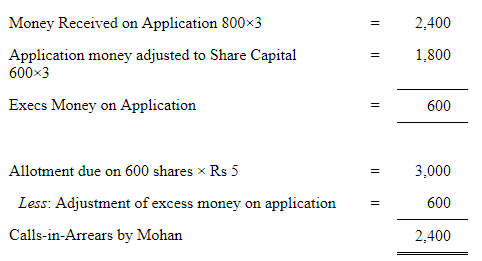

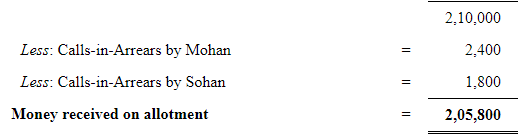

Sugandh Ltd. issued 60,000 shares of ₹10 each at a premium of ₹2 per share payable as ₹3 on application, ₹5(including premium) on allotment and the balance on first and final call. Applications were received for 92,000 shares. The Directors resolved to allot as:

Mohan, who had applied for 800 shares in Category

(i) and Sohan, who was allotted 600 shares in Category

(ii) failed to pay the allotment money. Calculate amount received on allotment.

ANSWER:

Question 21:

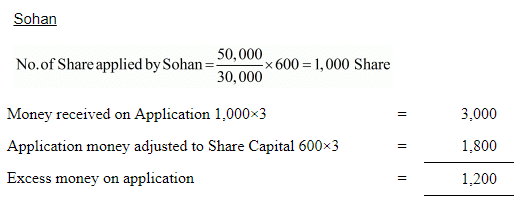

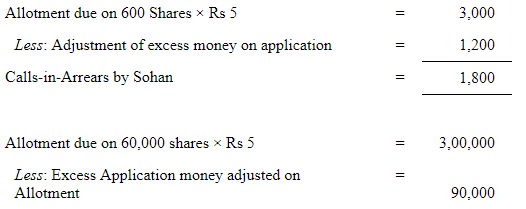

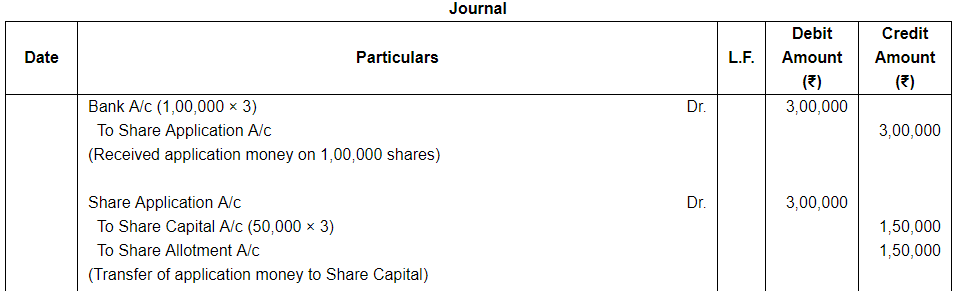

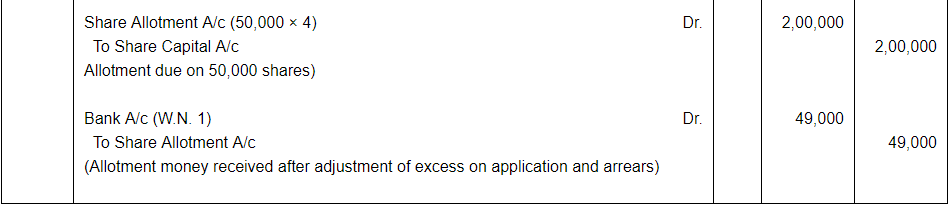

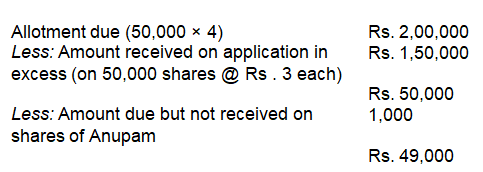

Sony Media Ltd.issued 50,000 shares of ₹10 each payable ₹3 on application , ₹4 on allotment and balance on first and final call . Applications were received for 1,00,000 shares and allotment was made as follows :

(i) Applicants for 60,000 shares were allotted 30,000 shares,

(ii) Applicants for 40,000 shares were allotted 20,000 shares,

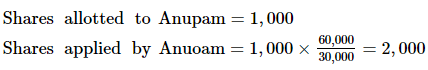

Anupam to whom 1,000 shares were allotted from category

(i) failed to pay the allotment money.

Pass journal entries up to allotment.

ANSWER:

Working Notes:

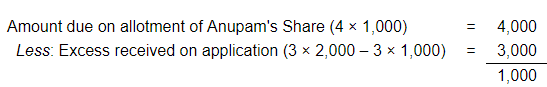

2) Calculation of Amount not Received on the shares of Anupam

Question 22:

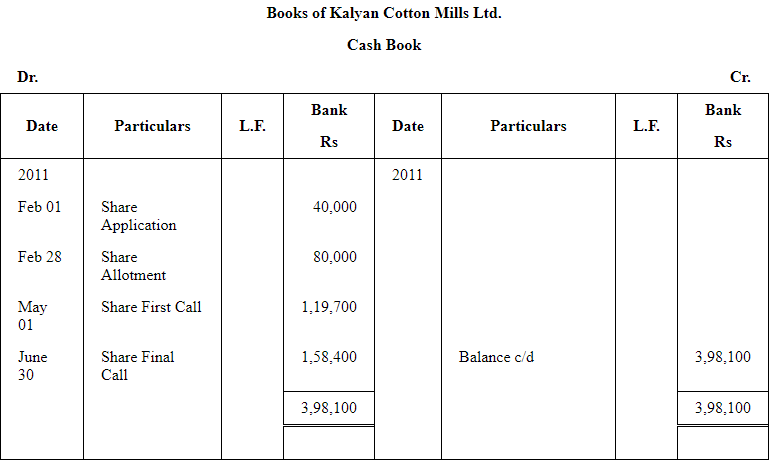

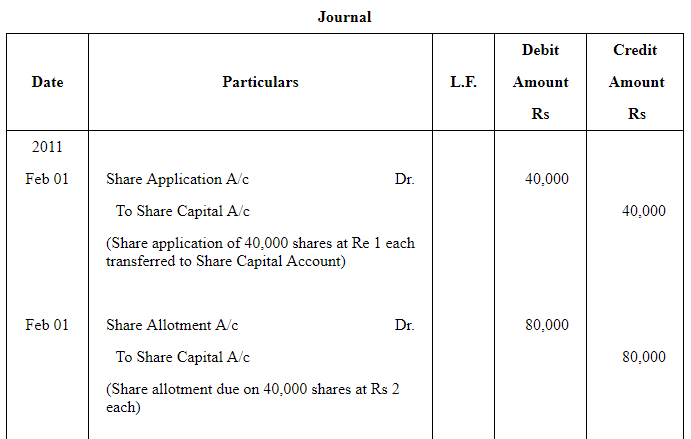

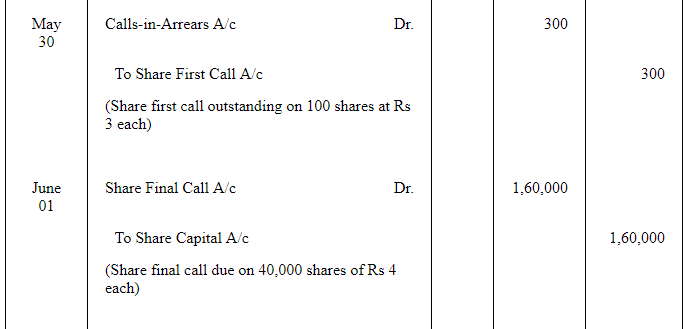

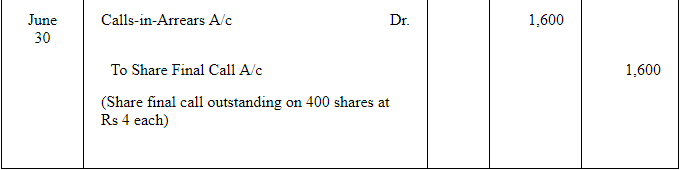

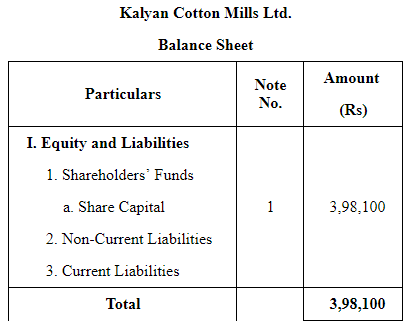

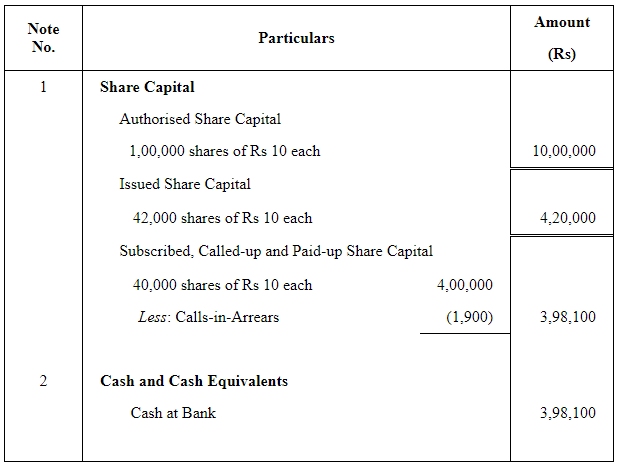

The Kalyan Cotton Mills Ltd.was registered on 1st January,2011 with a capital of ₹10,00,000 divided into 1,00,000 shares of ₹10 each. The company issued 42,000 shares of which 40,000 shares were taken up by the public and ₹1 per share was received with application. On 1st February, these shares were allotted and ₹2 per share was duly received on 28th February as allotment money. A first call of ₹3 per share was made on 1st March and the call money on all shares with the exception of 100 shares was received. The final call of ₹4 per share was made on 1st June and the amount due, with the exception of 400 shares, was received by 30th June. Pass necessary journal ands Cash Book entries and prepare the Balance Sheet as at 30th June, 2011.

ANSWER:

Authorised Capital 1,00,000 shares of Rs 10 each

Issued Capital 42,000 shares of Rs 10 each

Applied 40,000 shares

Payable as:

Rs 1 on application

Rs 2 on allotment

Rs 3 on first call

Rs 4 on final call

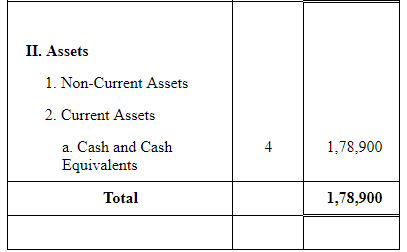

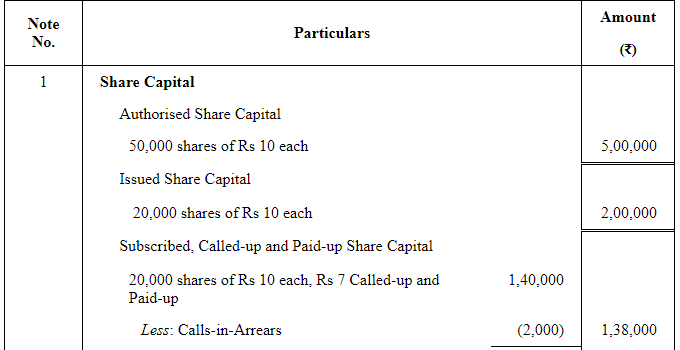

As per the Schedule III of Companies Act, 2013, the Company's Balance Sheet is presented as follows.

NOTES TO ACCOUNTS

Page No 8.117:

Question 23:

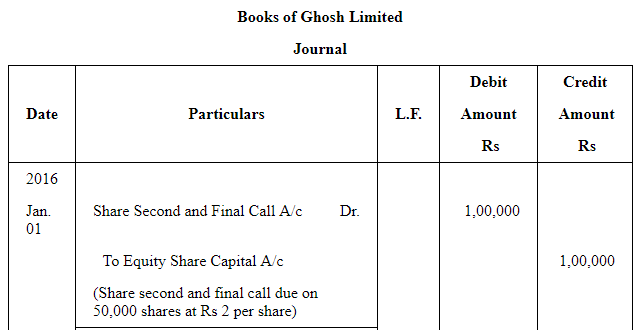

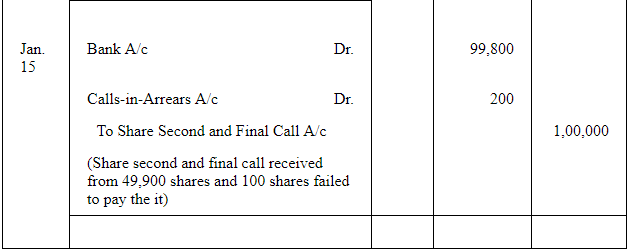

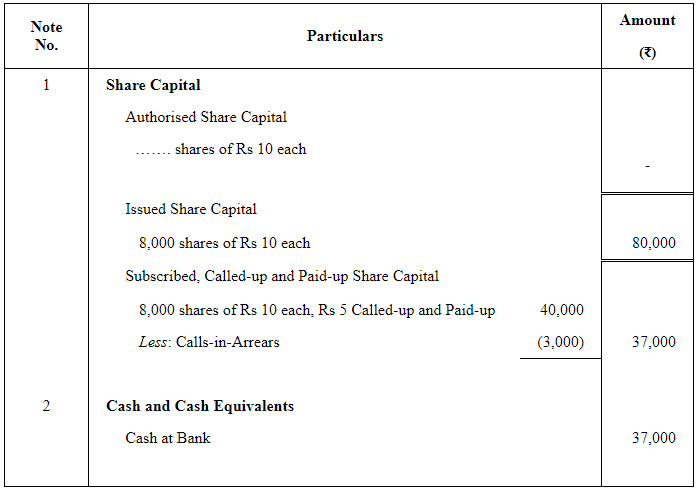

Ghosh Ltd. made the second and final call on its 50,000 Equity Shares @ ₹2 per share on 1st January, 2016. The entire amount was received on 15th January, 2016 except on 100 shares allotted to Venkat. Pass necessary journal entries for the call money due and received by opening Calls-in-Arrears Account.

ANSWER:

Question 24:

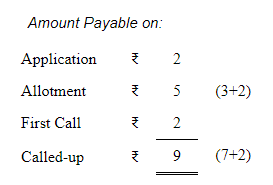

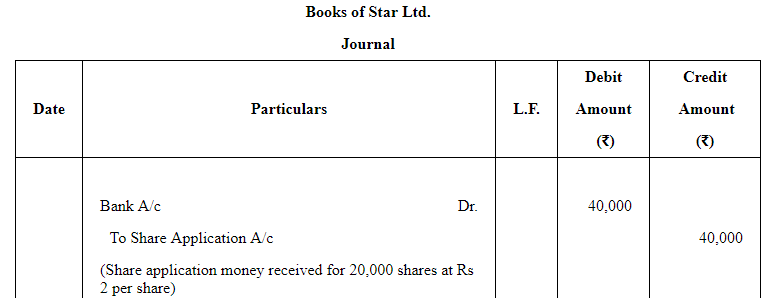

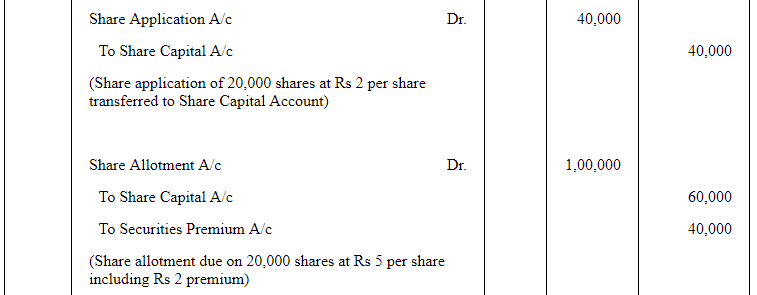

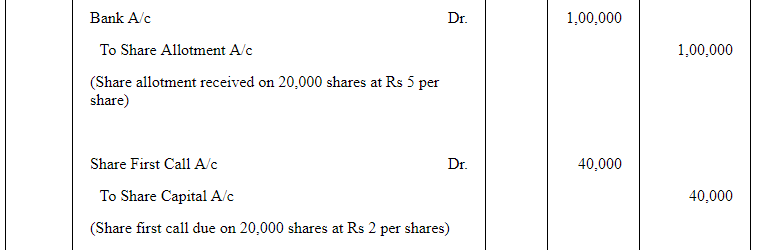

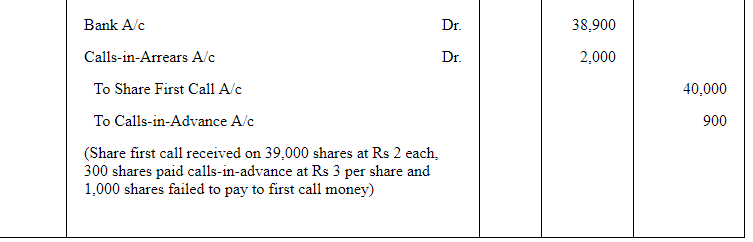

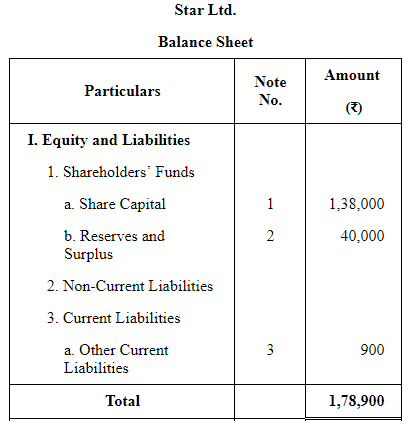

Star Ltd was registered with a capital of ₹5,00,000 in shares of ₹10 each and issued 20,000 such shares at a premium of ₹2 per share, payable as ₹2 per share on application, ₹5 per share on allotment (including premium) and ₹2 per share on first call made three months later. All the money payable on application and allotment was duly received but when the first call was made, one shareholder paid the entire balance on his holding of 300 shares and another shareholder holding 1,000 shares failed to pay the first call money.

Pass journal entries to record the above transactions and show how they will appear in the company's Balance Sheet.

ANSWER:

As per the Schedule III of Companies Act, 2013, the Company's Balance Sheet is presented as follows.

NOTES TO ACCOUNTS

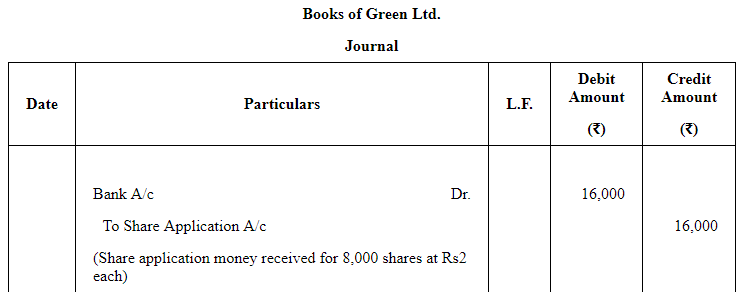

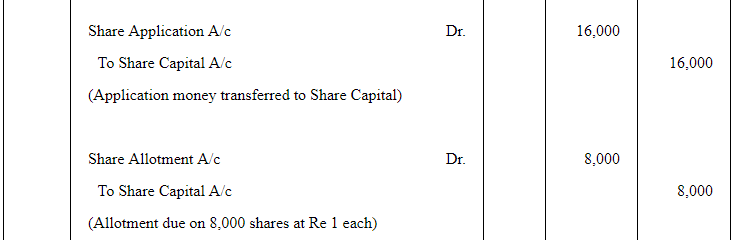

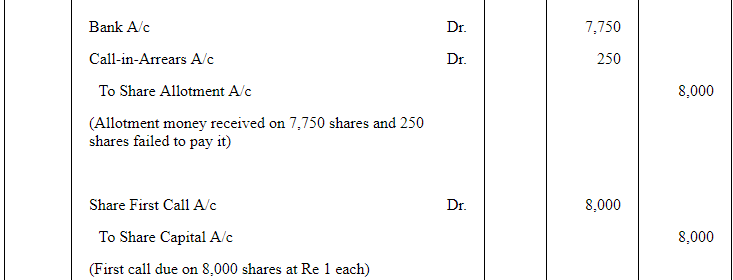

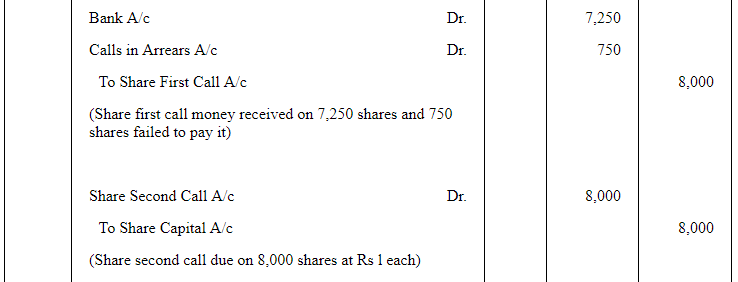

Question 25:

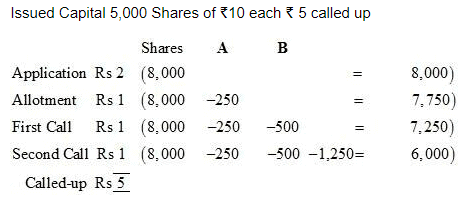

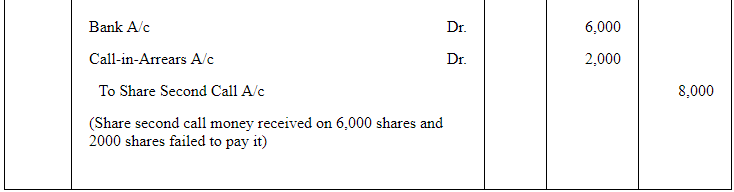

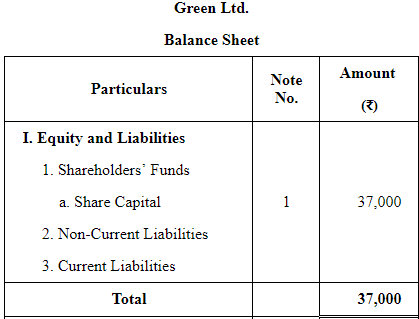

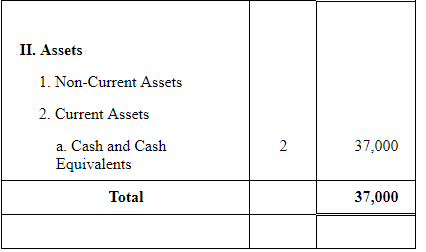

Green Ltd. issued 8,000 Equity Shares of ₹10 each. ₹5 per share was called, payable ₹2 on application, ₹1 on allotment, ₹1 on first call and ₹1 on second call. All the money was duly received with the following exceptions:

A who holds 250 shares paid nothing after application.

B who holds 500 shares paid nothing after allotment.

C who holds 1,250 shares paid nothing after first call.

Prepare Journal and the Balance Sheet.

ANSWER:

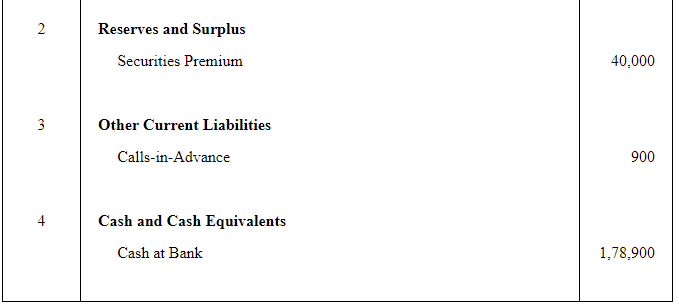

As per the Schedule III of Companies Act, 2013, the Company's Balance Sheet is presented as follows

NOTES TO ACCOUNTS

Question 26:

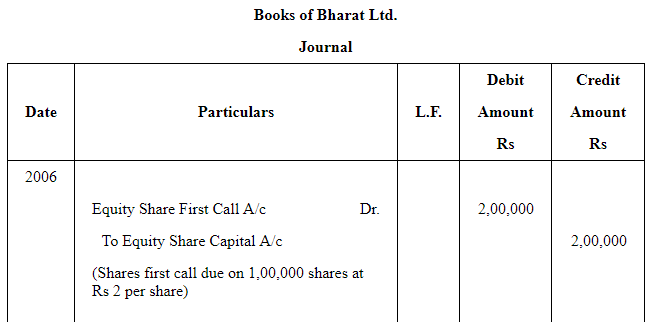

Bharat Ltd made the first call of ₹2 per share on its 1,00,000 Equity Shares on 1st March , 2006. Ashok, a shareholder, holding 800 shares paid the second and final call amount along with the first call money. The second and final call amount was ₹3 per share. Pass necessary journal entries for recording the above using the Calls-in Advance Account.

ANSWER:

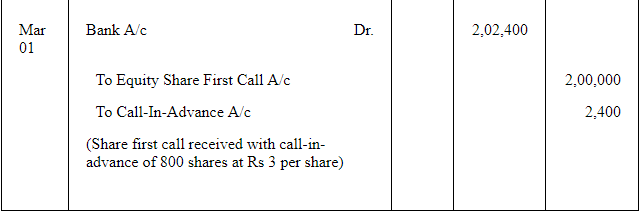

Question 27:

2,000 Equity Shares of ₹10 each were issued to Limited from whom assets of ₹25,000 were acquired .

Pass Journal entry.

ANSWER:

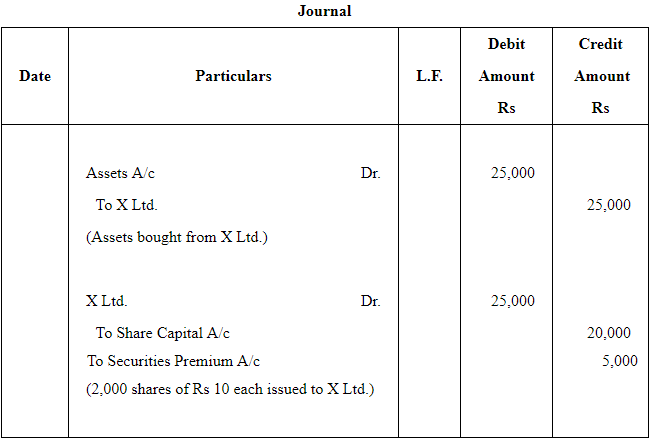

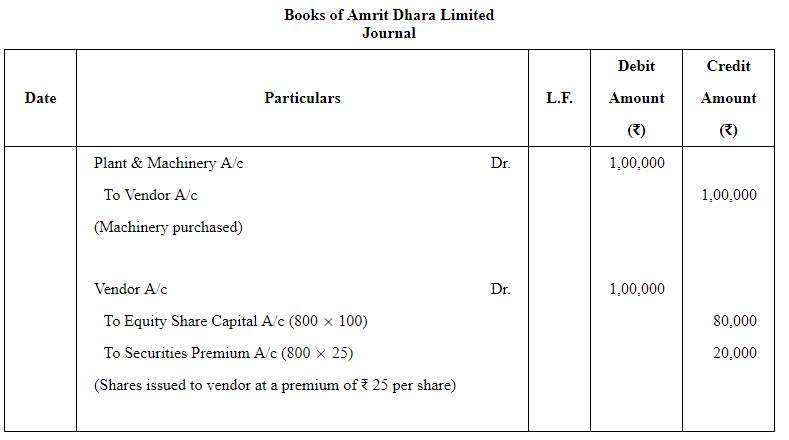

Question 28:

'Amrit Dhara Ltd.' issued 800 Equity Shares of ₹100 each at a premium of 25% as fully paid-up in consideration of the purchase of plant and machinery of ₹1,00,000.

Pass entries in company's Journal.

ANSWER:

Question 29:

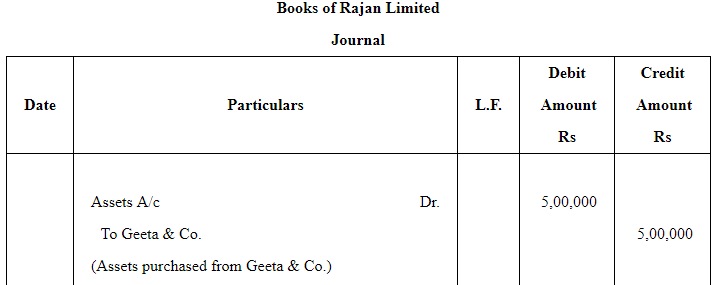

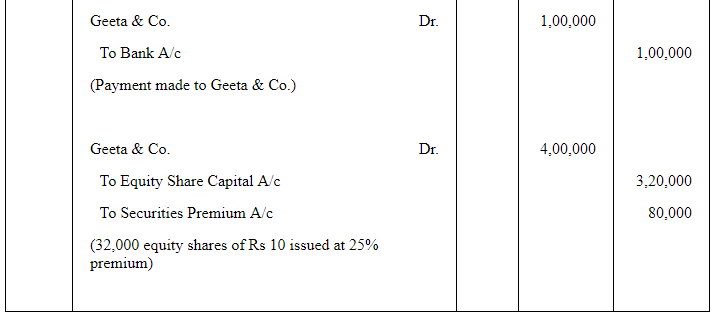

Rajan Ltd . purchased assets from Geeta & Co . for ₹5,00,000. A sum of ₹1,00,000 was paid by means of a bank draft and for the balance due Rajan Ltd. issued equity Shares of ₹10 each at a premium of 25%. journalise the above transactions in the books of the company.

ANSWER:

Question 30:

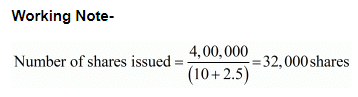

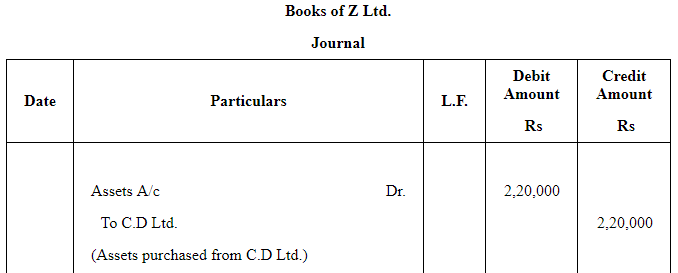

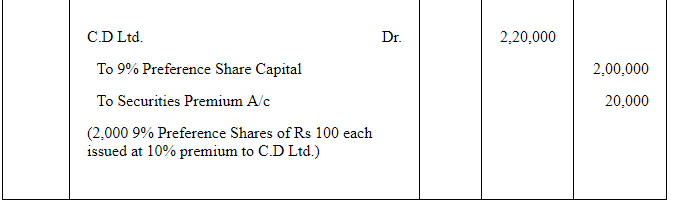

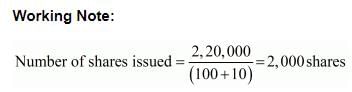

Z Ltd . purchased furniture costing ₹2,20,000 from C.D Ltd. The payment was to be made by issue of 9% Preference Shares of ₹100 each ata premium of ₹10 per share . Pass necessary Journal entries in the books of Z Ltd.

ANSWER:

Question 31:

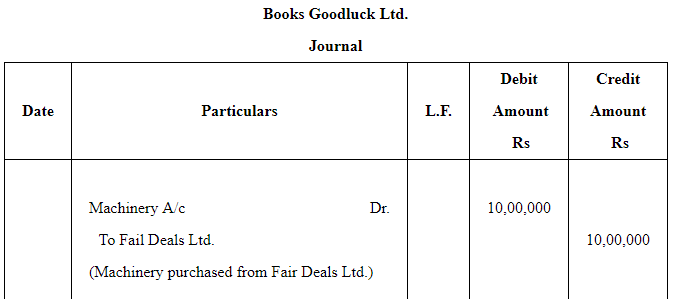

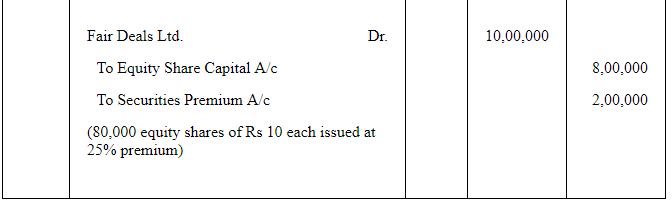

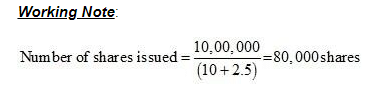

Goodluck Ltd purchased machinery costing ₹10,00,000 from Fair Deals Ltd. The company paid the price by issue of Equity Shares of ₹10 each at a premium of 25%.

Pass necessary Journal entries for the above transactions in the books of Goodluck Ltd.

ANSWER:

Page No 8.118:

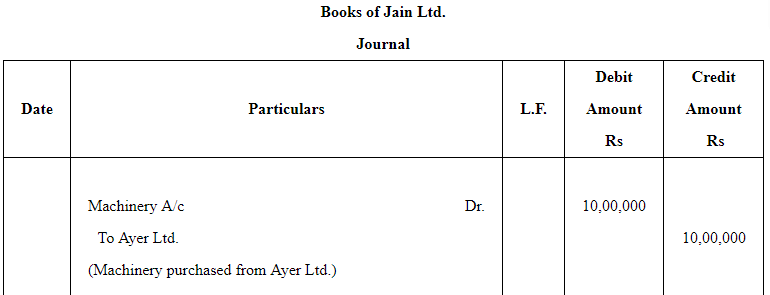

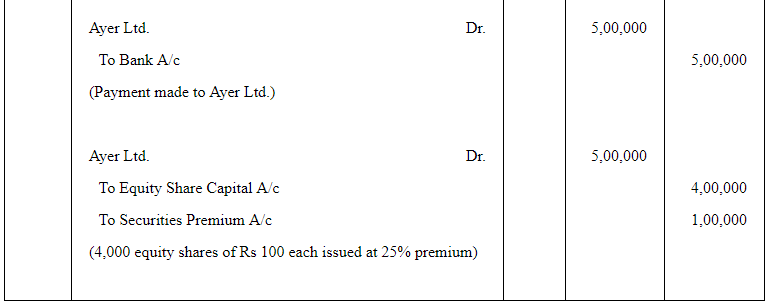

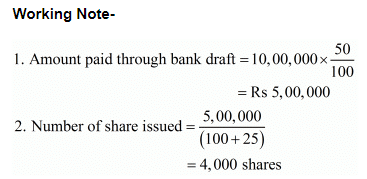

Question 32:

Jain Ltd purchased machinery costing ₹10,00,000 from Ayer Ltd. 50% of the payment was made by cheque and for the remaining 50% , the company issued Equity Shares of ₹100 each at a premium of 25% . Pass necessary Journal entries in the books of Jain Ltd . for the above transaction.

ANSWER:

Question 33:

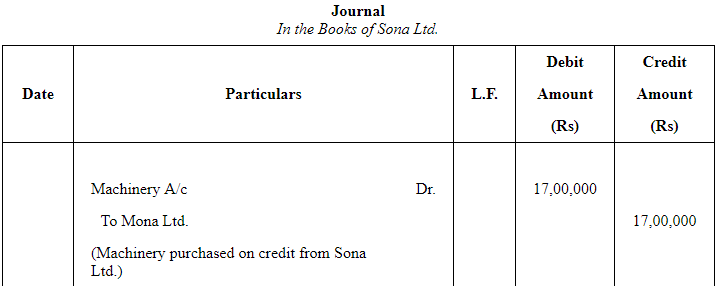

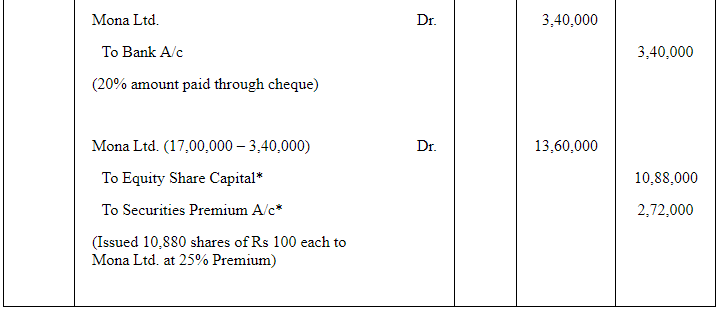

Sona Ltd. purchased machinery costing ₹17,00,000 from Mona Ltd. Sona Ltd. paid 20% of the amount by cheque and for the balance amount issued Equity Shares of ₹100 each at a premium of 25% . Pass necessary Journal entries for the above transactions in the books of Sona Ltd .Show your working notes clearly.

ANSWER:

Question 34:

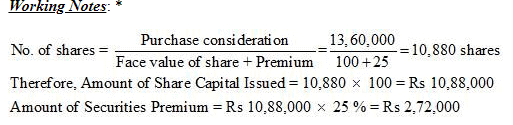

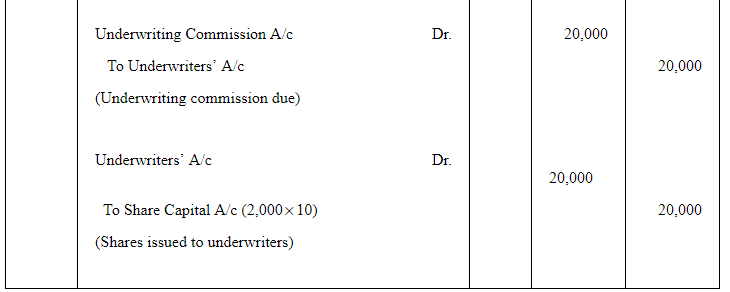

Light Lamps Ltd. issued 50,000 shares of ₹10 each as fully paid-up to the promoters for their services to set-up the company . It also issued 2,000 shares of ₹10 each credited as fully paid-up to the underwriters of shares for their services . journalise these transactions.

ANSWER:

Question 35:

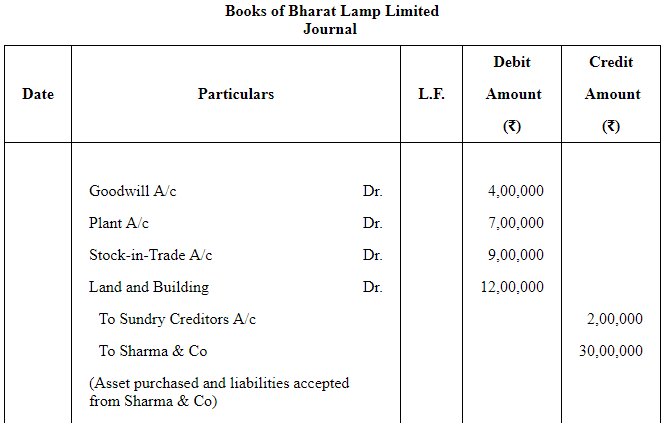

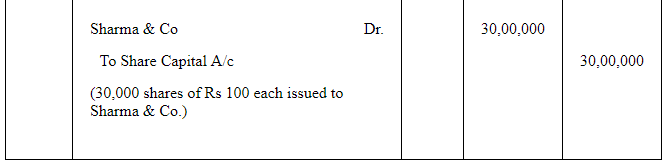

Bharat Lamp Ltd. issued 30,000 fully paid-up shares of ₹100 each for purchase of the following assets and liabilities from Sharma & Co:

Plant - ₹7,00,000

Stock-in-Trade - ₹9,00,000

Land and Building - ₹12,00,000

Sundry Creditors - ₹2,00,000

You are required to pass necessary Journal entries.

ANSWER:

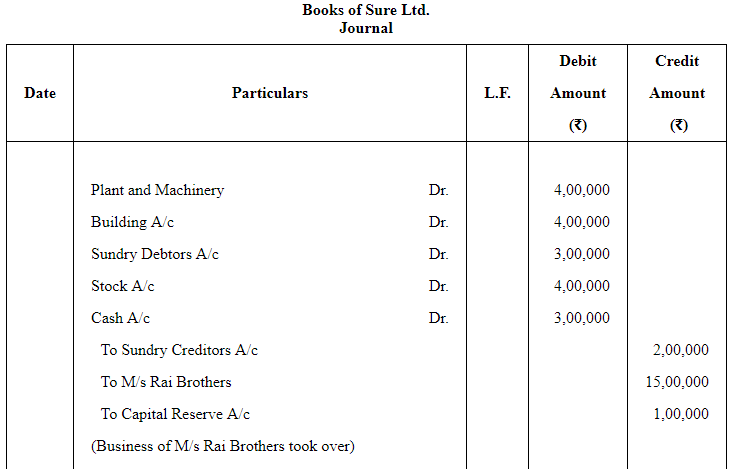

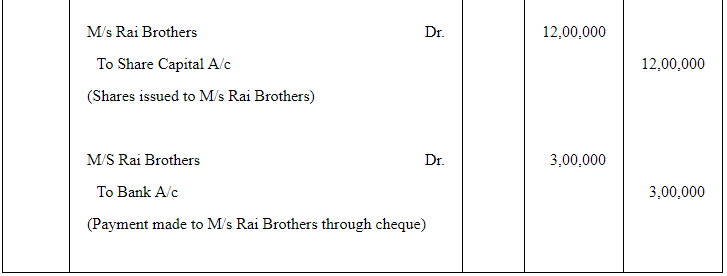

Question 36:

Sure Ltd. purchased a running business from M/s. Rai Brothers for a sum of ₹15,00,000 payable ₹12,00,000 in fully paid shares of ₹10 each and balance through cheque.

The assets and liabilities consisted of the following:

Plant and Machinery ₹4,00,000

Stock ₹4,00,000

Building ₹4,00,000

Cash ₹3,00,000

Sundry Debtors ₹3,00,000

Sundry Creditors ₹2,00,000

You are required to pass necessary Journal entries in the company's books.

ANSWER:

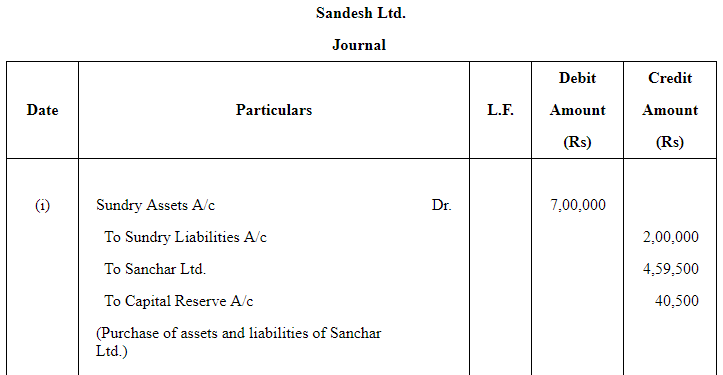

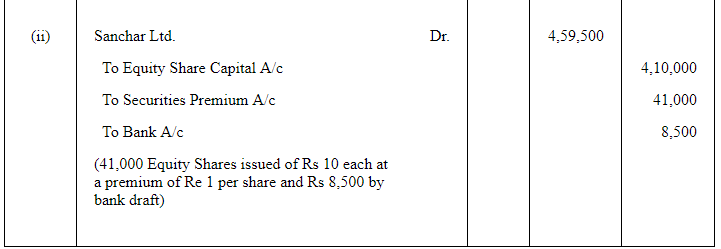

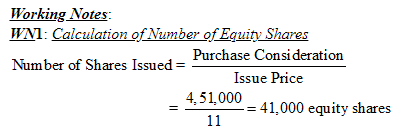

Question 37:

Sandesh Ltd. took over the assets of ₹7,00,000 and liabilities of ₹2,00,000 from Sanchar Ltd. for a purchase consideration of ₹4,59,500. ₹8,500 were paid by accepting a draft in favour of Sanchar Ltd. payable after three months and the balance was paid by issue of equity shares of ₹10 each at a premium of 10% in favour of Sanchar Ltd.

Pass necessary journal entries for the above transactions in the books of Sandesh Ltd.

ANSWER:

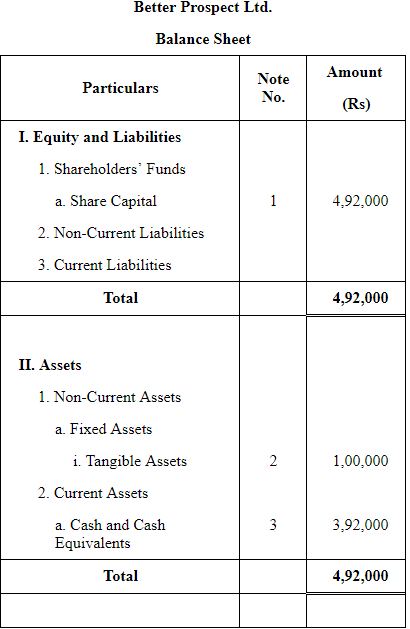

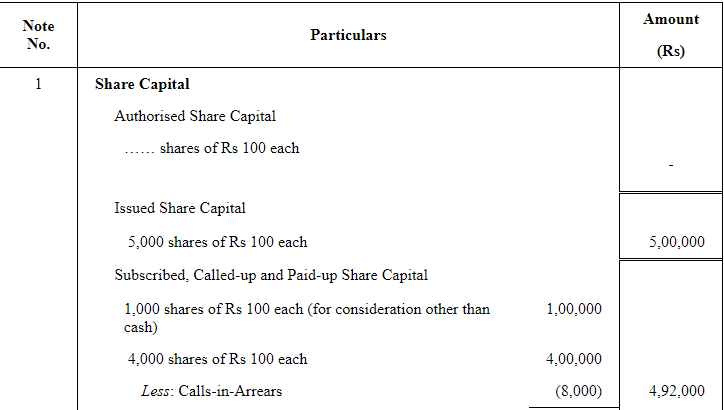

Question 38:

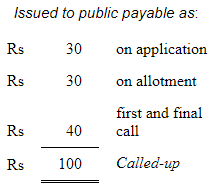

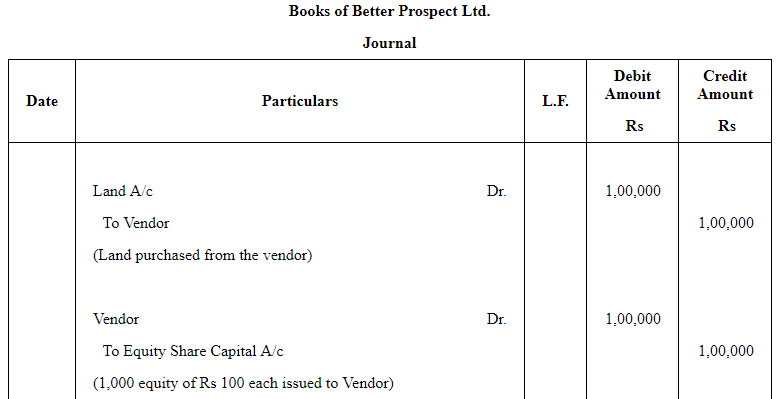

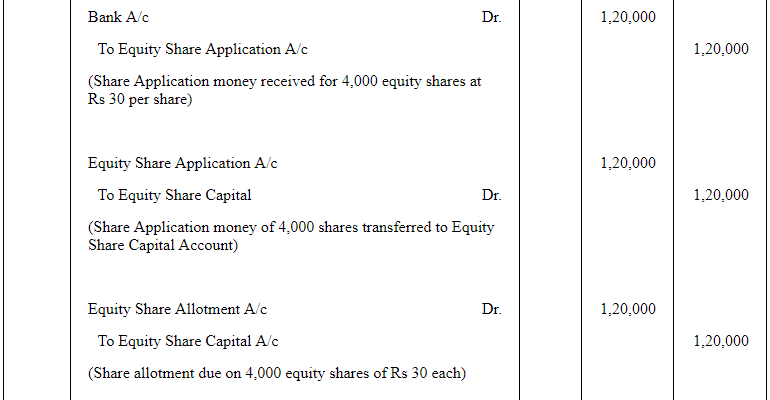

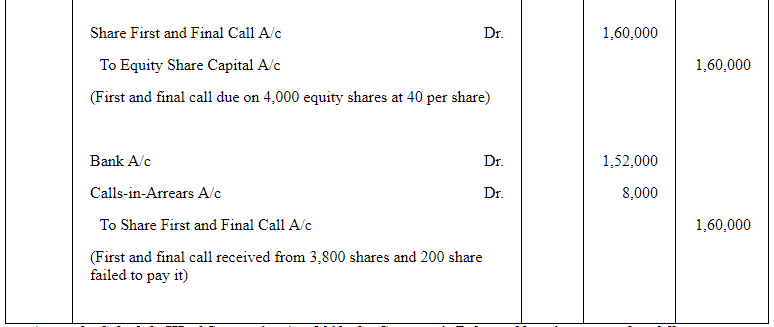

Better Prospect Ltd. acquired land costing ₹1,00,000 and in payment allotted 1,000 Equity Shares of ₹100 each as fully paid. Further, the company issued 4,000 Equity Shares to public . The shares were payable as: ₹30 on application ; ₹30 on allotment; ₹40 on first and final call.

Applications were received for all shares which were allotted . All the money was received except the call on 200 shares.

Pass journal entries and prepare Balance Sheet of the company.

ANSWER:

As per the Schedule III of Companies Act, 2013, the Company's Balance Sheet is presented as follows.

NOTES TO ACCOUNTS

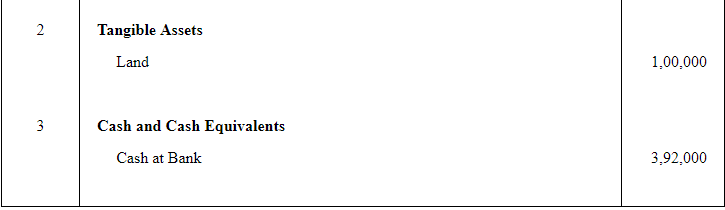

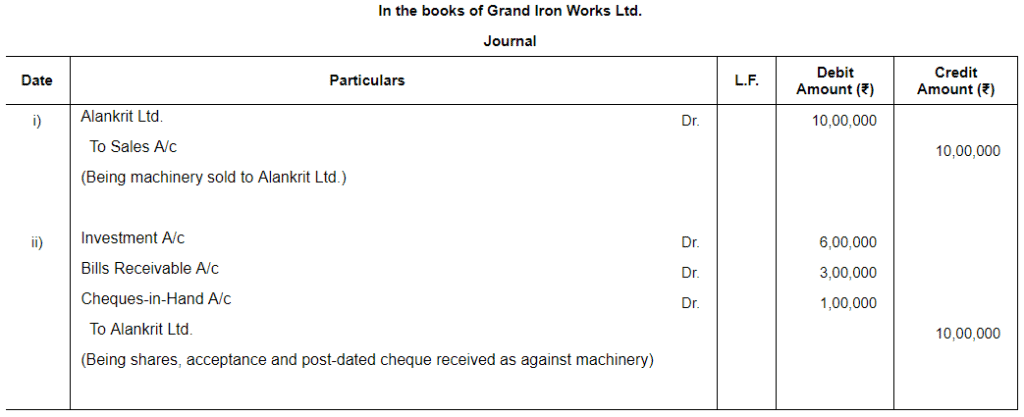

Question 39:

Alankrit Ltd. purchased machinery of ₹10,00,000 from Grand Iron Works Ltd. and paid as follows:

(a) Issued 50,000 Equity Shares of ₹10 each at a premium of ₹2.

(b) Gave an acceptance of ₹3,00,000 payable after 3 months; and

(c) Balance by issuing post-dated cheque of two months of ₹1,00,000.

Pass the Journal entries in the books of Alankrit Ltd. and Grand Iron Works Ltd.

ANSWER:

Page No 8.119:

Question 40:

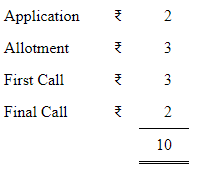

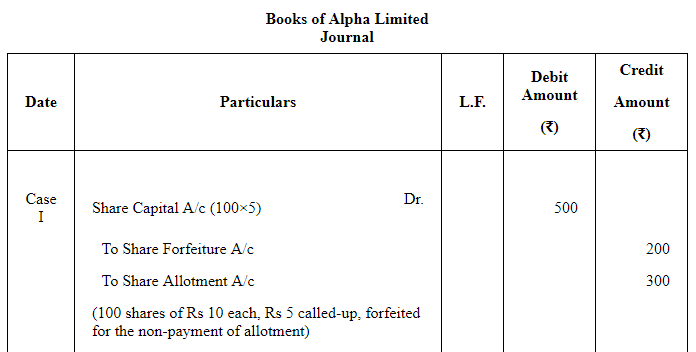

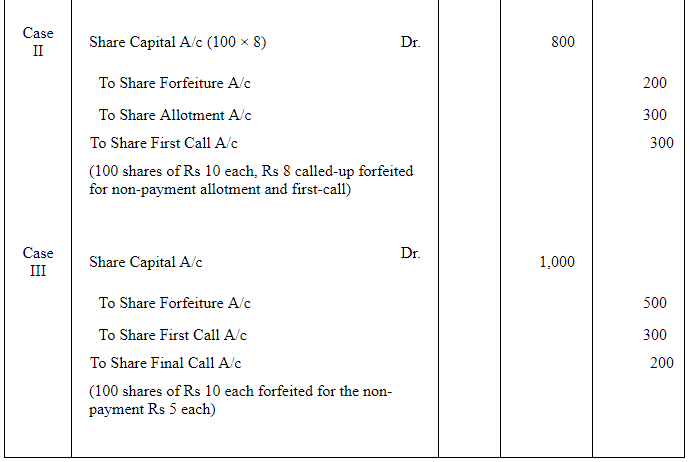

Alpha Ltd. issued 20,000 Equity Shares of ₹10 each at par payable: On application ₹2 per share; on allotment ₹3 per share; on first call ₹3 per share; on second and final call ₹2 per share.

Mr. Gupta was allotted 100 shares. Pass necessary Journal entry relating to the forfeiture of shares in each of the following alternative cases:

Case I If Mr. Gupta failed to pay the allotment money and his shares were immediately forfeited.

Case II If Mr. Gupta failed to pay allotment money and on his subsequent failure to pay the first call, his shares were forfeited.

Case III If Mr. Gupta failed to pay the first call and on his subsequent failure to pay the second and final call, his shares were forfeited.

ANSWER:

Question 41:

Ankit Ltd. issued 20,000 equity shares of 10 each at a premium of ₹2 per share, payable as:

On Application : ₹3

On Allotment : ₹5 (including premium)

On First Call : ₹2

On Second and Final Call : ₹2

Vijay was allotted 500 shares. Pass the necessary Journal entries relating to the forfeiture of shares in following cases.

Case I Vijay did not pay allotment money and his shares were immediately forfeited.

Case II Vijay did not pay allotment and first call, his shares were forfeited after first call.

Case III Vijay failed to pay first call and his shares were forfeited immediately.

Case IV Vijay failed to pay both the calls and his shares were forfeited.

ANSWER:

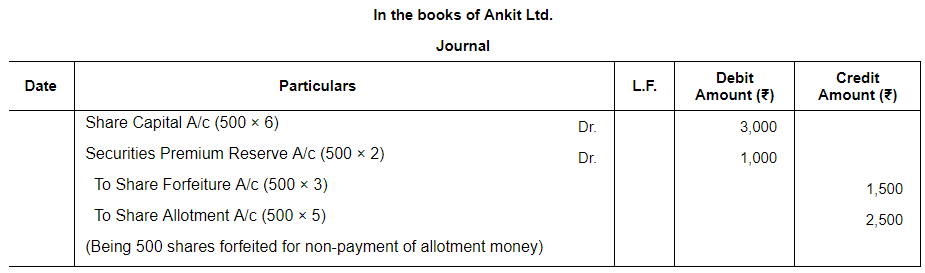

Case I:

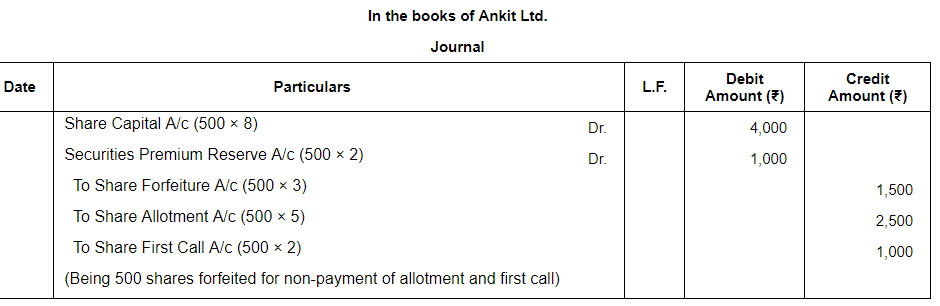

Case II:

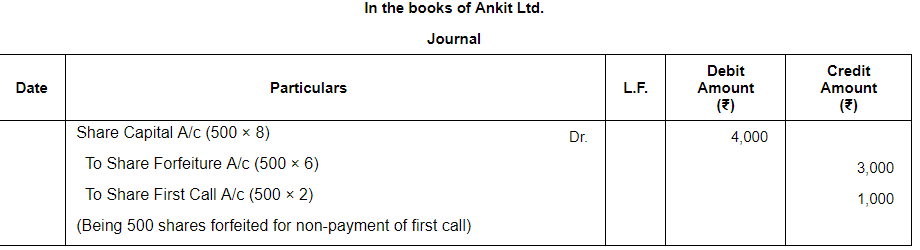

Case III:

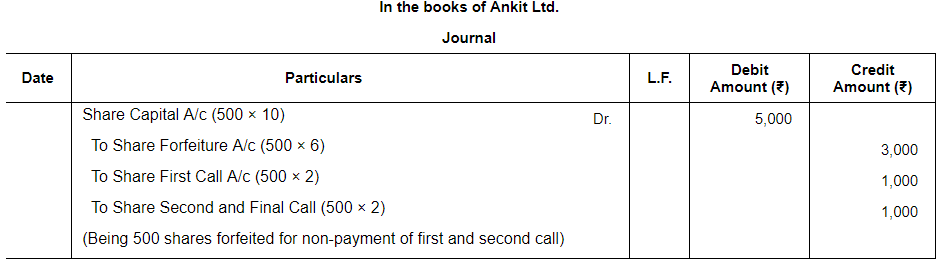

Case IV:

Question 42:

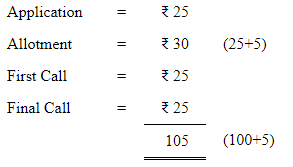

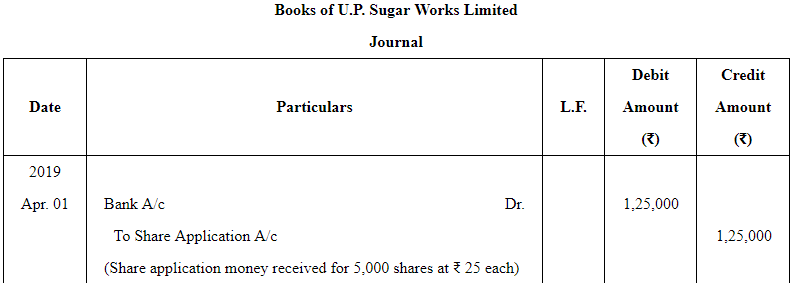

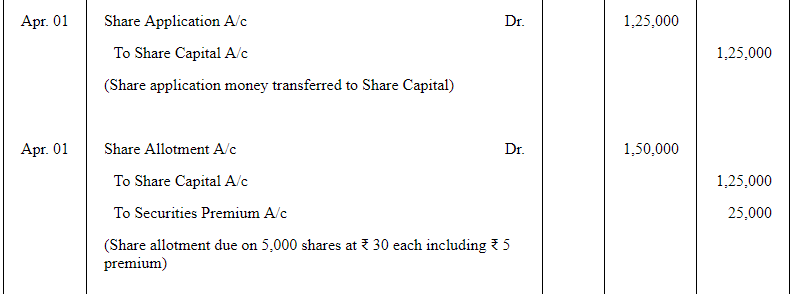

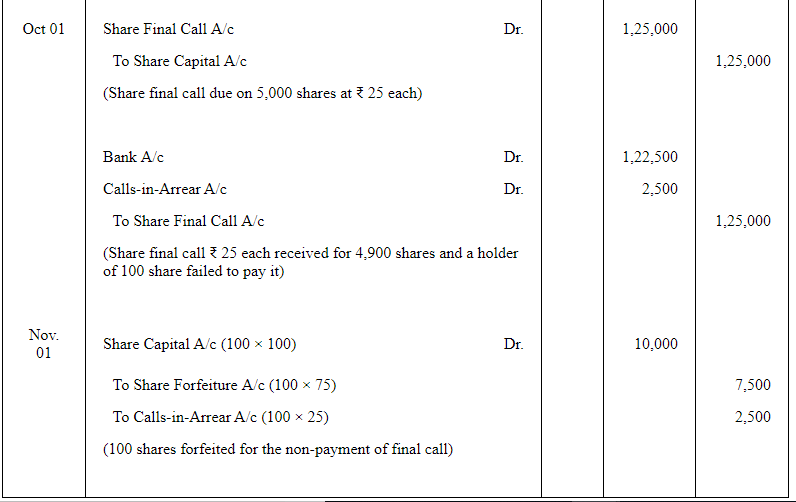

U.P. Sugar Works Ltd. was registered on 1st January, 2019 with an authorised capital of ₹15,00,000 divided into 15,000 shares of ₹100 each. The company issued on 1st April, 2019, 5,000 shares of ₹100 each at a premium of ₹5 per share payable ₹25 per share on application , ₹30 (including premium) on allotment and the balance in two equal installments of ₹25 each on 1st July and 1st October respectively. All the allotments and call moneys were paid when due, except in case of one shareholder who failed to pay the final call on 100 shares held by him. His shares were forfeited on 1st November after giving him a due notice. Show necessary entries in the books of the company to record these transactions.

ANSWER:

Authorised capital 15,000 shares of 100 each

Issued and applied capital 5,000 shares of ₹100 each at a premium ₹5

Page No 8.120:

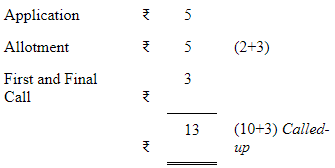

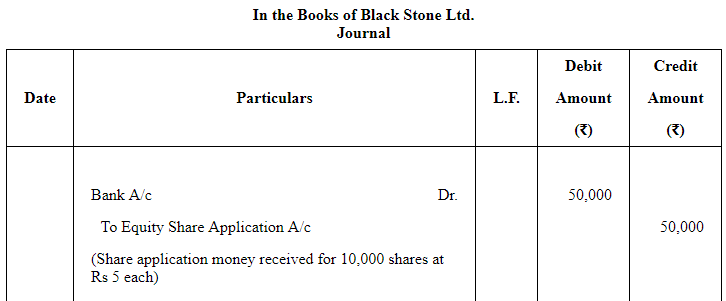

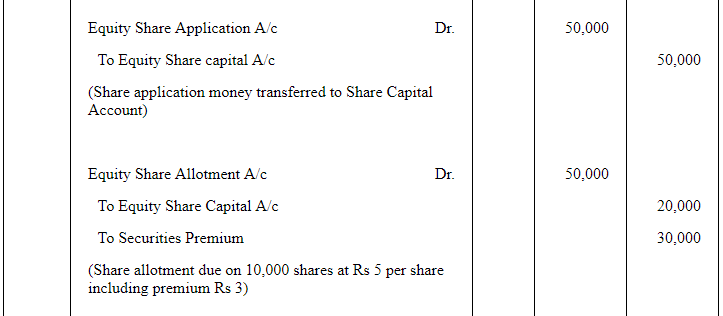

Question 43:

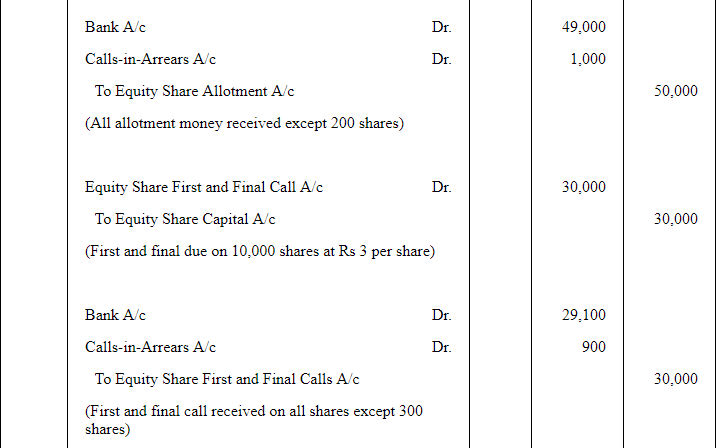

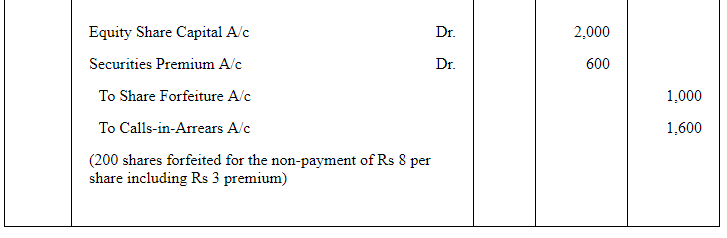

Black Stone Ltd. issued 10,000 Equity Shares of ₹10 each at a premium of ₹3 per share payable ₹5 on application, ₹5 (including premium) on allotment and the balance on first call. All the shares offered were applied for and allotted. All the money due on allotment was received except on 200 shares. Call was made. All the amount due thereon was received except on 300 shares. Directors forfeited 200 shares on which both allotment and call money were not received.

Pass necessary Journal entries to record the above.

ANSWER:

Issued and Applied 10,000 Shares at ₹10 each at a premium of ₹3 per share

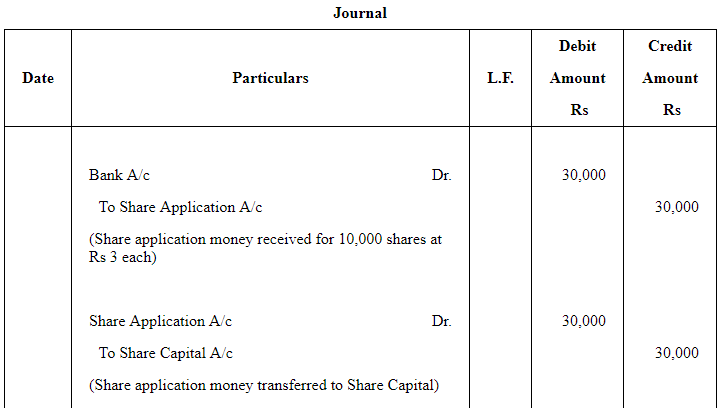

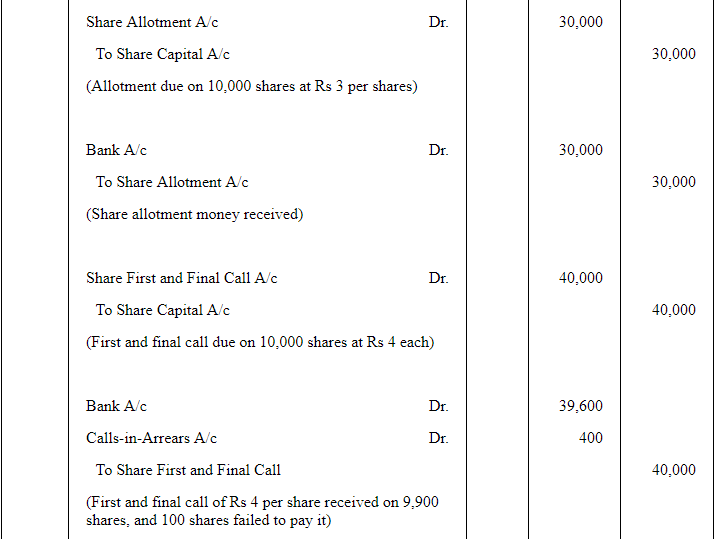

Question 44:

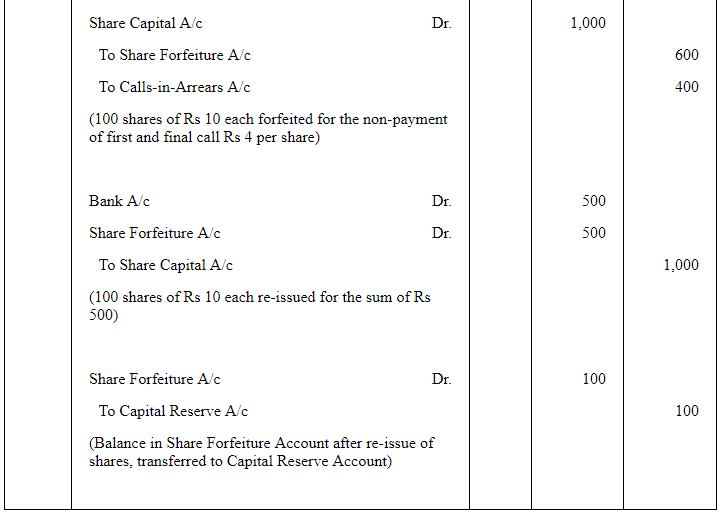

A company issued 10,000 shares of the value of ₹10 each , payable ₹3 on application, ₹3 on allotment and ₹4 on the first and final call . All amounts are duly received except the call money on 100 shares . These shares are subsequently forfeited by Directors and are resold as fully paid-up for ₹500 .

Give necessary journal entries for the transactions.

ANSWER:

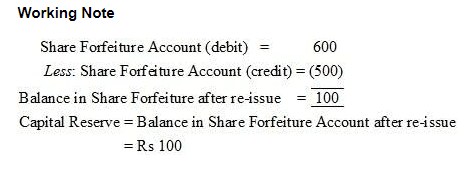

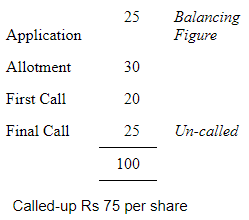

Question 45:

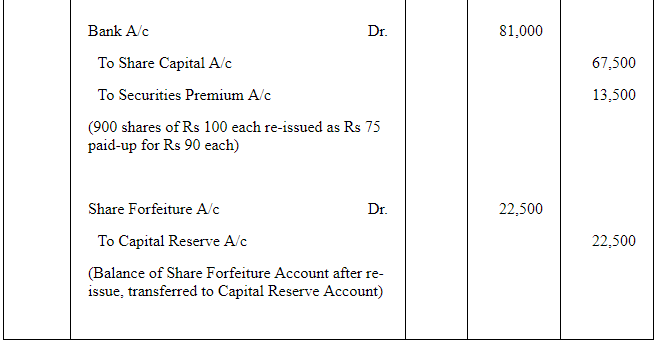

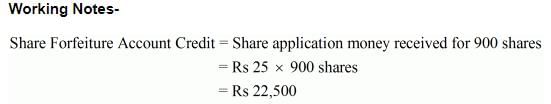

X Ltd. forfeited 900 Equity Shares of ₹100 each for the non-payment of allotment money of ₹30 per share and the first call of ₹20 per share. The second and final call of ₹25 per share has not been made . The forfeited shares were reissued for ₹90 per share , ₹75 paid-up. Journalise the above.

ANSWER:

Question 46:

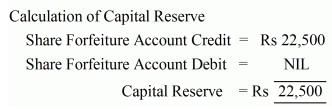

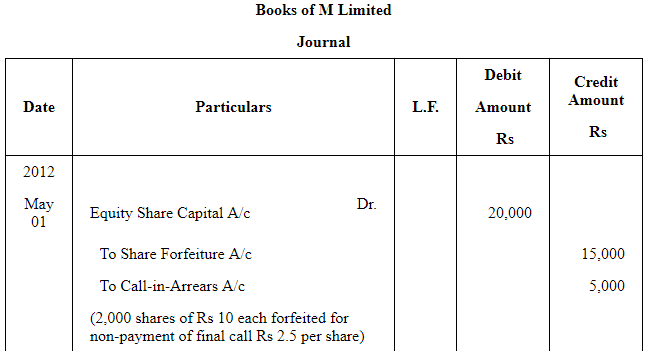

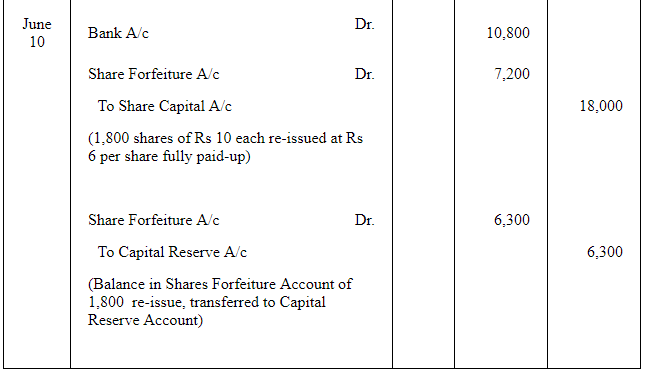

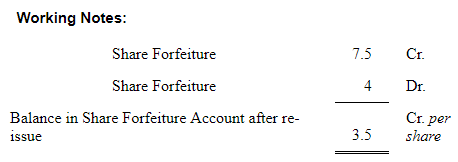

The Directors of M Ltd resolved on 1st May, 2015 that 2,000 Equity Shares of ₹10 each , ₹7.50 paid be forfeited for non-payment of final call of ₹2.50. On 10th June, 2015, 1,800 of these shares were reissued for ₹6 per share. Give necessary Journal entries .

ANSWER:

Capital Reserve = No. of Shares reissued × Balance in Share Forfeiture Account after reissue (per share)

= 1,800 × Rs 3.5 (per share)

= Rs 6,300

Question 47:

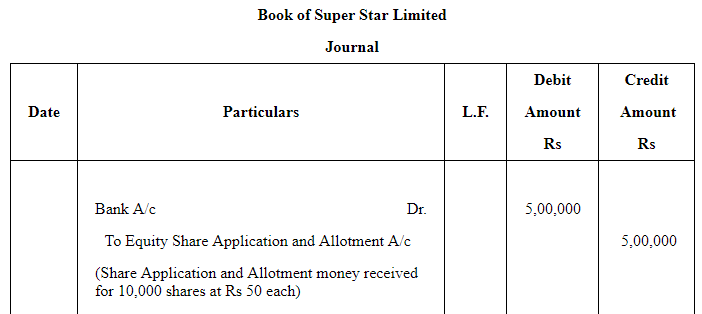

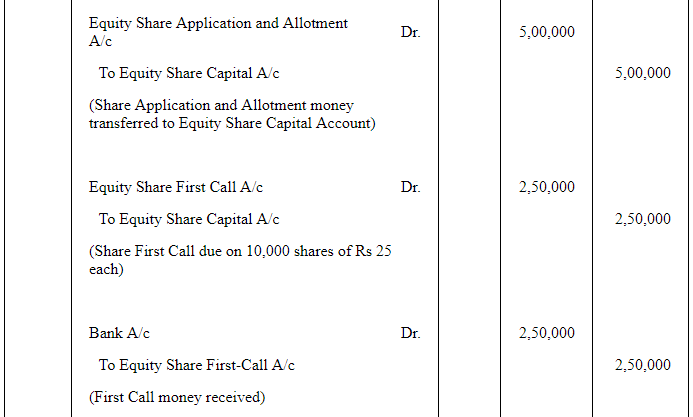

Super Star Ltd. makes an issue of 10,000 Equity Shares of ₹100 each, payable as:

On application and allotment ₹50 per share,

On first call ₹25 per share,

On second and final call ₹25 per share.

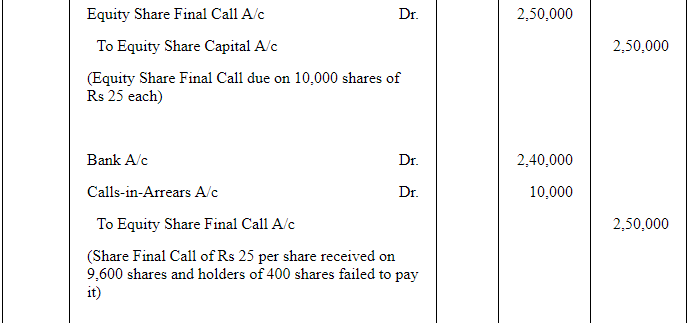

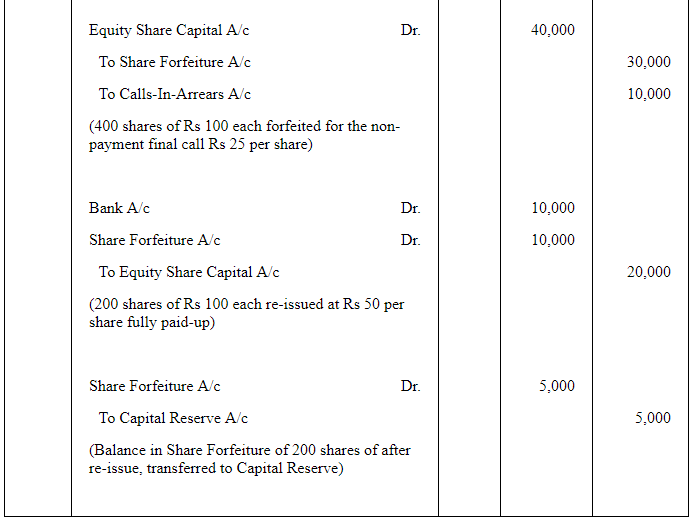

Members holding 400 shares did not pay the second and final call and the shares are duly forfeited, 200 of which are reissued as fully paid-up @₹50 per share. Pass journal entries in the books of the company.

ANSWER:

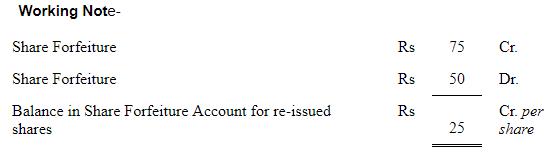

Capital Reserve = Balance in Share Forfeiture Account for re-issued shares × Number of Share reissued = Rs 25 × 200 = Rs 5,000

|

42 videos|198 docs|43 tests

|

FAQs on Accounting for Share Capital (Part - 2) - Accountancy Class 12 - Commerce

| 1. What is share capital in accounting? |  |

| 2. How is share capital calculated? |  |

| 3. What is the difference between authorized share capital and issued share capital? |  |

| 4. What are the types of share capital? |  |

| 5. How does share capital impact a company's financial position? |  |