Accounting for Partnership Firms-Fundamentals ( Part - 6) | Accountancy Class 12 - Commerce PDF Download

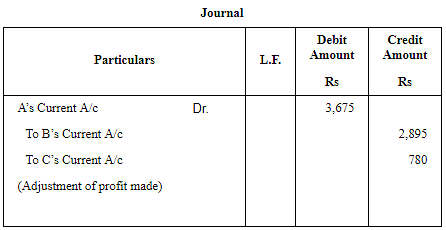

Page No 2.92:

Question 68: A, B and C were partners. Their capitals were A–₹ 30,000; B–₹ 20,000 and C–₹ 10,000 respectively. According to the Partnership Deed, they were entitled to an interest on capital @ 5% p.a. In addition, B was also entitled to draw a salary of ₹ 500 per month. C was entitled to a commission of 5% on the profits after charging the interest on capital, but before charging the salary payable to B. The net profit for the year were ₹ 30,000 distributed in the ratio of capitals without providing for any of the above adjustments. The profits were to be shared in the ratio of 5 : 3 : 2.

Pass necessary adjustment entry showing the workings clearly.

ANSWER:

Working Notes:

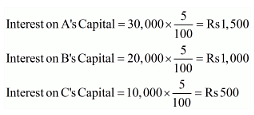

WN 1 Calculation of Interest on Capital

WN 2 Salary to B = Rs 500 × 12 = Rs 6,000

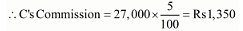

WN 3 Calculation of Commission to C

Commission to C = 5% on profit after interest on capital but before salary

Profit after Interest on Capital but before Salary = 30,000 − 3,000 = Rs 27,000

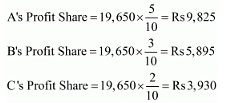

WN 4 Calculation of Profit Share of each Partner

Profit available for Distribution = 30,000 − 3,000 − 6,000 − 1,350 = Rs 19,650

WN 5

Page No 2.92:

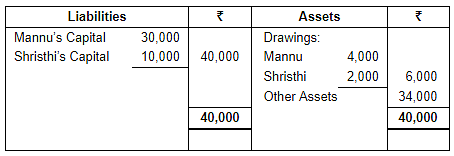

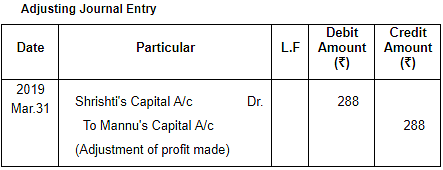

Question 69: Mannu and Shristhi are partners in a firm sharing profit in the ratio of 3 : 2. Following information is of the firm as on 31st March 2019:

Profit for the year ended 31st March, 2019 was ₹ 5,000 which was divided in the agreed ratio, but interest @ 5% p.a. on capital and @ 6% p.a. on drawings was inadvertently omitted. Adjust interest on drawings on an average basis for 6 months. Give the adjustment entry.

ANSWER:

Page No 2.92:

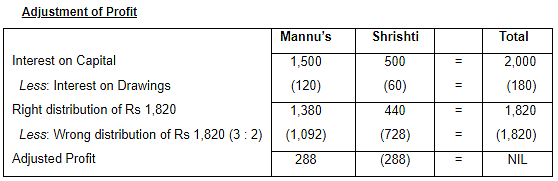

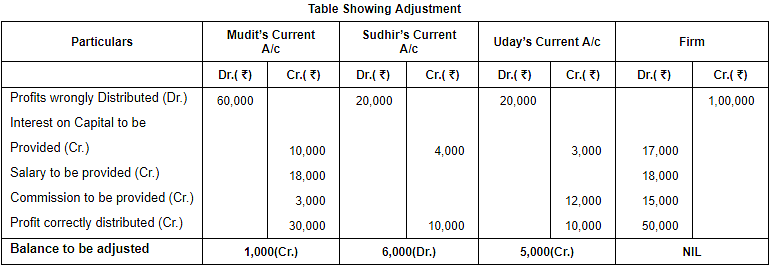

Question 70: Mudit, Sudhir and Uday are partners in a firm sharing profits in the ratio of 3 : 1 : 1. Their fixed capital balances are ₹ 4,00,000, ₹ 1,60,000 and ₹ 1,20,000 respectively. Net profit for the year ended 31st March, 2018 distributed amongst the partners was ₹ 1,00,000, without taking into account the following adjustments:

(a) Interest on capitals @ 2.5% p.a.;

(b) Salary to Mudit ₹ 18,000 p.a. and commission to Uday ₹ 12,000.

(c) Mudit was allowed a commission of 6% of divisible profit after charging such commission.Pass a rectifying Journal entry in the books of the firm. Show workings clearly.

ANSWER:

Working Notes:

Page No 2.93:

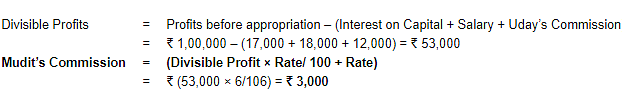

Question 71: A, B and C are partners in a firm. Net profit of the firm for the year ended 31st March, 2019 is ₹ 30,000, which has been duly distributed among the partners, in their agreed ratio of 3 : 1 : 1. It is noticed on 10th April, 2019 that the undermentioned transactions were not passed through the books of account of the firm for the year ended 31st March, 2019.

(a) Interest on Capital @ 6% per annum, the capital of A, B and C being ₹ 50,000; ₹ 40,000 and ₹ 30,000 respectively.

(b) Interest on drawings: A ₹ 350; B ₹ 250; C ₹ 150.

(c) Partners' Salaries: A ₹ 5,000; B ₹ 7,500.

(d) Commission due to A (for some special transaction) ₹ 3,000.

You are required to pass a Journal entry, which will not affect Profit and Loss Account of the firm and rectify the position of partners inter se.

ANSWER:

Page No 2.93:

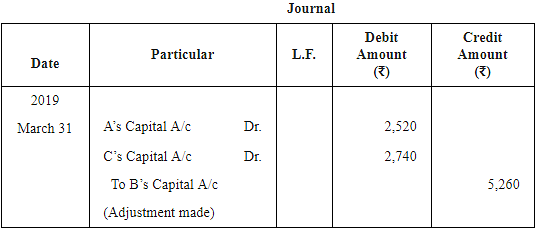

Question 72: On 31st March, 2014, the balances in the Capital Accounts of Saroj, Mahinder and Umar after making adjustments for profits and drawings, etc., were ₹ 80,000, ₹ 60,000, ₹ 40,000 respectively. Subsequently, it was discovered that the interest on capital and drawings has been omitted.

(a) The profit for the year ended 31st March, 2014 was ₹ 80,000.

(b) During the year Saroj and Mahinder each withdrew a sum of ₹ 24,000 in equal instalments in the end of each month and Umar withdrew ₹ 36,000.

(c) The interest on drawings was to be charged @ 5% p.a. and interest on capital was to be allowed @ 10% p.a.

(d) The profit-sharing ratio among partners was 4 : 3 : 1.

Showing your workings clearly, pass the necessary rectifying entry.

ANSWER:

Working Notes:

Page No 2.93:

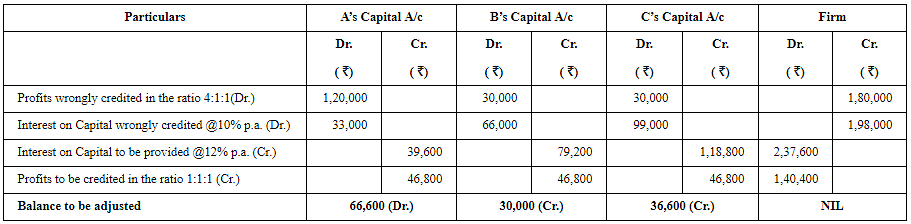

Question 73: Capitals of A, B and C as on 31st March, 2019 amounted to ₹ 90,000, ₹ 3,30,000 and ₹ 6,60,000 respectively. Profit of ₹ 1,80,000 for the year ended 31st March, 2019 was distributed in the ratio of 4 : 1 : 1 after allowing interest on Capital @ 10% p.a. During the year, each partner withdrew ₹ 3,60,000. The Partnership Deed was silent as to profit-sharing ratio but provided for interest on capital @ 12%.

Pass the necessary adjustment entry showing the working clearly.

ANSWER:

Statement Showing Adjustment:

Note: Since, there is no provision of interest on drawings in the partnership deed so we will not provide it.

Note: Interest on Capital is always computed on the opening capitals.

Page No 2.93:

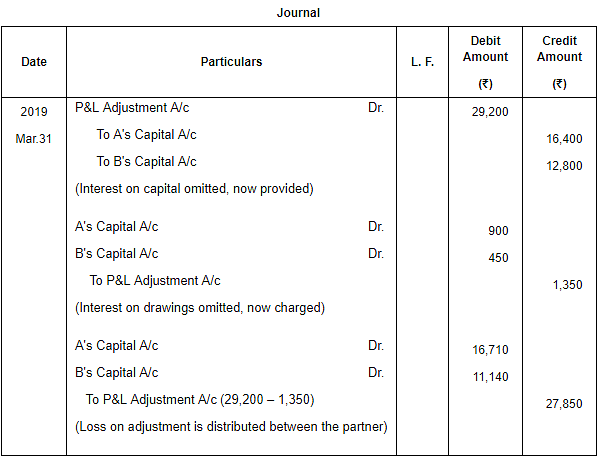

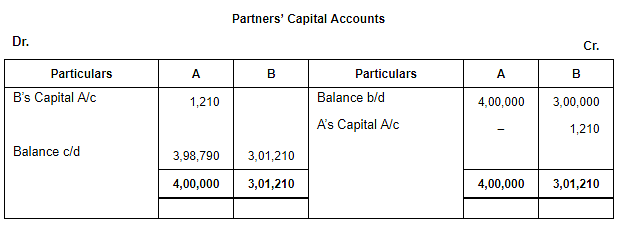

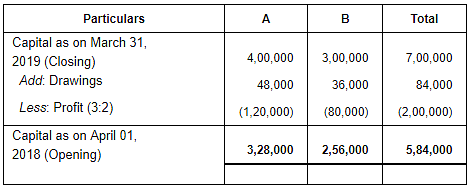

Question 74:Capital Accounts of A and B stood at ₹ 4,00,000 and ₹ 3,00,000 respectively after necessary adjustments in respect of the drawings and the net profit for the year ended 31st March, 2019. It was subsequently noticed that 5% p.a. interest on capital and also drawings were not taken into account in arriving at the distributable profit. The drawings of the partners had been: A – ₹ 12,000 drawn at the end of each quarter and B – ₹ 18,000 drawn at the end of each half year.

The profit for the year as adjusted amounted to ₹ 2,00,000. The partners share profits in the ratio of 3 : 2. You are required to pass Journal entries and show adjusted Capital Accounts of the partners.

ANSWER:

Working Notes:

WN 1 Calculation of Capital as on April 01, 2018 (Opening Capital)

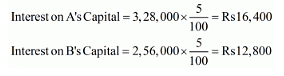

WN 2 Calculation on Interest on Capital

WN 3 Calculation of Interest on Drawings

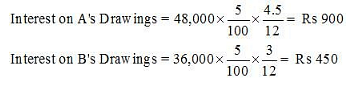

If instead of all entries, adjustment entry is asked in the question

Working Notes: Statement Showing Adjustment

Page No 2.94:

Question 75: X and Y are partners sharing profits and losses in the ratio of 3 : 2. They employed Z as their Manager to whom they paid a salary of ₹ 7,500 per month. Z had deposited ₹ 2,00,000 on which interest was payable ₹ 9% p.a. At the end off the accounting year (i.e., 31st March, 2018) 2017-18 (after division of the year's profits), it was decided that Z should be treated as a partner with effect from 1st April, 2014 with 1/6th share of profits, his deposit being considered as capital carrying interest @ 6% p.a. like capitals of other partners. The firm's profits and losses after allowing interest on capitals were – 2014-15:

Profit ₹ 5,90,000; 2015-16: Profit ₹ 6,26,000; 2016-17: Loss ₹ 40,000 and 2017-18: Profit ₹ 7,80,000.

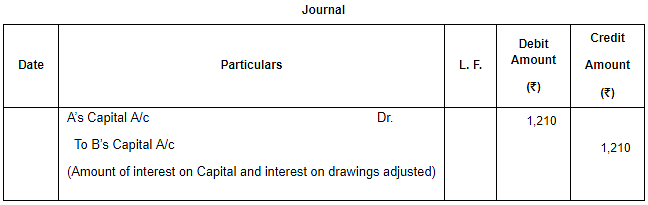

Record necessary Journal entries to give effect to the above.

ANSWER:

Working Notes:

WN 1 Profit before Z’s Salary and Interest on Loan.

WN 2 Calculation of Interest on Capital

Interest on Z’s Capital for 4 years = 12,000 × 4 = Rs 48,000

WN 3 Calculation of Z’s Share of Profit as a Partner

Profit after Interest on Z’s Capital = Profit before Interest on Z’s Capital − Interest on Z’s Capital

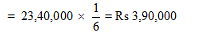

= 23,88,000 − 48,000 = Rs 23,40,000

Z’s Profit Share as a Partner for 4 years

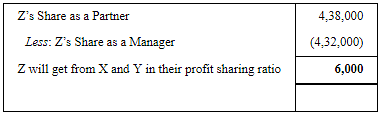

∴ Z’s Share of Interest on Capital and Profit Share as a Partner = 48,000 + 3,90,000 = Rs 4,38,000

Z’s Salary and Interest on Loan as Manager = 72,000 + 3,60,000 = Rs 4,32,000

Adjustment of Z's share of Profit

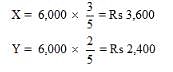

Profit to be transferred by X and Y in favour of Z

Page No 2.94:

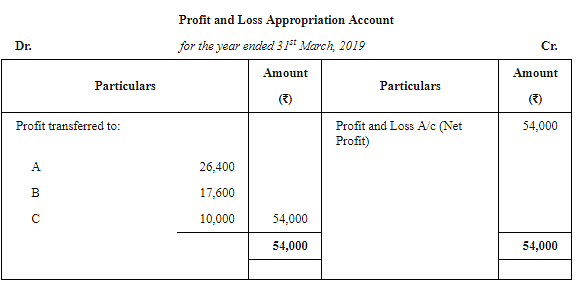

Question 76: A and B are partners sharing profits in the ratio of 2 : 1. They admitted C, their manager, as a partner form 1st April, 2018, for 1/5th share of profit C, while being manager, was getting salary of ₹ 50,000 p.a. plus commission of 10% of net profit after charging such salary and commission. It was also agreed that any excess amount which C receives as a partner (over his salary and commission) will be borne by A. Profit for the year ended 31st March, 2019 was ₹ 6,44,000, before payment of salary and commission. Prepare Profit and Loss Appropriation Account.

ANSWER:

Working Notes:

WN 1 Calculation of Remuneration to C as a Manager

Salary to C = Rs 50,000

Commission to C = 10% of Net Profit after Salary and Commission

Net Profit after Salary and Commission = 6,44,000 − 50,000 = Rs 5,94,000

C’s remuneration as Manager = Salary + Commission = 50,000 + 54,000 = Rs 1,04,000

WN 2 Calculation of Profit Share of C as a Partner

Profit = Rs 6,44,000

Part of C’s Profit Share to be borne by A = 1,28,800 − 1,04,000 = Rs 24,800

Profit available for distribution between A and B = 6,44,000 − 1,04,000 = Rs 5,40,000

A’s Profit share after adjusting C’s deficiency = 3,60,000 − 24,800 = Rs 3,35,200

Page No 2.94:

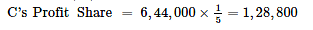

Question 77: A, B and C were in partnership sharing profits and losses in the ratio of 4 : 2 : 1. It was provided that C's share in profit for a year would not be less then ₹ 7,500. Profit for the year ended 31st March, 2019 amounted to ₹ 31,500. You are required to show the appropriation among the partners. The profit and Loss Appropriation Account is not required.

ANSWER:

Working Notes:

Profit for the year = Rs 31,500

Profit sharing ratio = 4 : 2 : 1

C is given a guarantee of minimum profit of Rs 7,500

C’s Actual Profit Share (i.e. Rs 4,500) is less than his Minimum Guaranteed Profit (i.e. Rs 7,500)

∴ Deficiency in C’s Profit Share = 7,500 − 4,500 = Rs 3,000

This deficiency is to be borne by A and B in their profit sharing ratio i.e. 4 : 2

Therefore,

Final Profit Share of A = 18,000 − 2,000 = Rs 16,000

Final Profit Share of B = 9,000 − 1,000 = Rs 8,000

Final Profit Share of C = 4,500 + 3,000 = Rs 7,500

Page No 2.94:

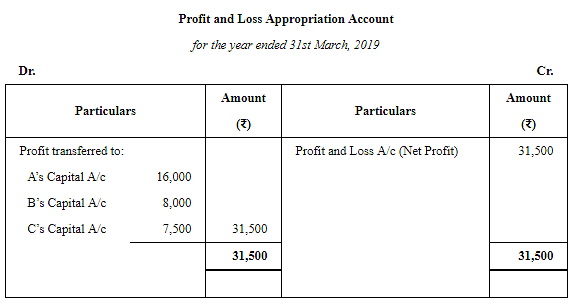

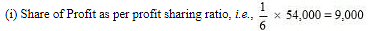

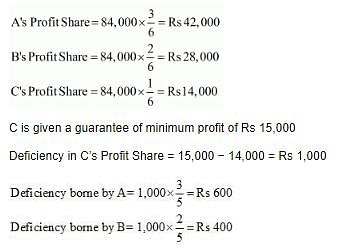

Question 78: A and B are partners sharing profits in the ratio of 3 : 2. C was admitted for 1/6th share of profit with a minimum guaranteed amount of ₹ 10,000. At the close of the first financial year the firm earned a profit of ₹ 54,000. Find out the share of profit which A, B and C will get.

ANSWER:

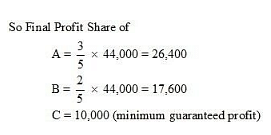

Working Note

C will get higher of the two:

(ii) Minimum guaranteed profit, i.e. Rs 10,000

Thus from net profit of Rs 54,000, minimum guaranteed profit to C of Rs 10,000 is to be adjusted first.

And the balance profit of Rs 44,000 (54,000 – 10,000) is to be shared by A and B in the ratio 3:2

Page No 2.94:

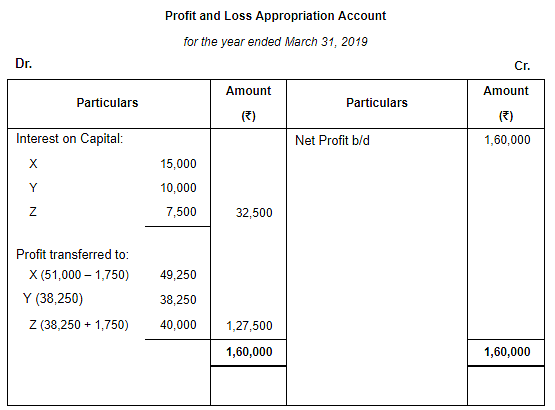

Question 79: X, Y and Z entered into partnership on 1st October, 2018 to share profits in the ratio of 4 : 3 : 3. X, personally guaranteed that Z's share of profit after charging interest on capital @ 10% p.a. would not be less then ₹ 80,000 in any year. Capital contributions were: X – ₹ 3,00,000, Y – ₹ 2,00,000 and Z – ₹ 1,50,000.

Profit for the year ended 31st March, 2019 was ₹ 1,60,000. Prepare Profit and Loss Appropriation Account.

ANSWER:

Note: Since Z is admitted on 1st October, 2018 and Profit is ascertained on March 31, 2019, therefore, interest on capital is calculated for 6 months and guaranteed amount is considered as Rs 40,000 (half of the total amount).

Page No 2.94:

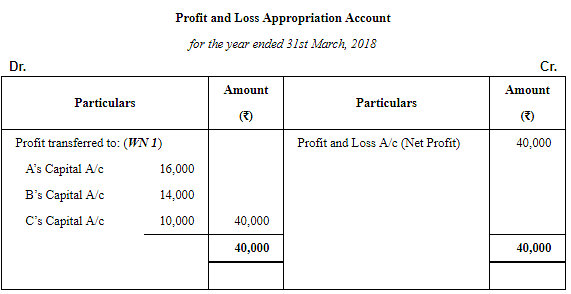

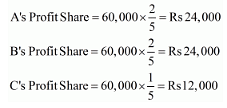

Question 80: A, B and C are partners in a firm. Their profit-sharing ratio is 2 : 2 : 1. C is guaranteed a minimum of ₹ 10,000 as share of profit every year. Any deficiency arising on that amount shall be met by B. The profits for the two years ended 31st March, 2018 and 2019 were ₹ 40,000 and ₹ 60,000 respectively. Prepare Profit and Loss Appropriation Account for the two years.

ANSWER:

Working Notes:

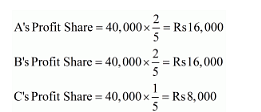

WN 1 Distribution of Profit for the year 2017-18

Profit for 2018 = Rs 40,000

Profit sharing ratio = 2 : 2 : 1

C is given a guarantee of minimum profit of Rs 10,000

Deficiency in C’s Profit Share = 10,000 − 8,000 = Rs 2,000

This deficiency is to be borne by B.

Therefore,

Final Profit Share of A = 16,000

Final Profit Share of B = 16,000 − 2,000 = Rs 14,000

Final Profit Share of C = 8,000 + 2,000 = Rs 10,000

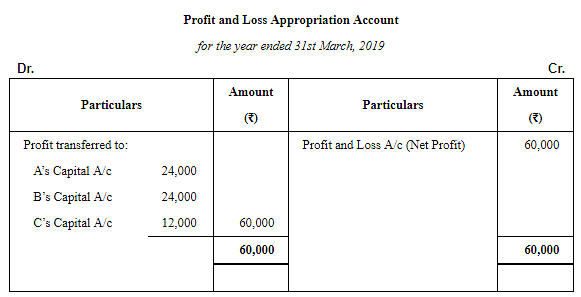

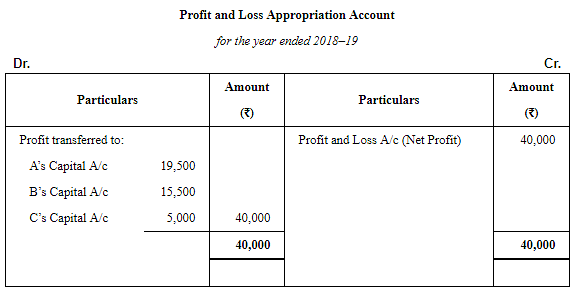

WN 2 Distribution of Profit for the year 2018-19

Profit for 2019 = Rs 60,000

Profit sharing ratio = 2 : 2 : 1

C is given a guarantee of minimum profit of Rs 10,000

Page No 2.95:

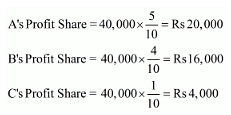

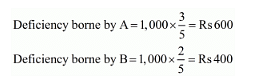

Question 81: A, B and C are partners sharing profits in the ratio of 5 : 4 : 1. C is given a guarantee that his minimum share of profit in any given year would be at least ₹ 5,000. Deficiency, if any, would be borne by A and B equally. Profit for the year ended 31st March 2019 was ₹ 40,000.

Pass necessary Journal entries in the books of the firm.

ANSWER:

Working Notes:

Profit for the year = Rs 40,000

Profit sharing ratio = 5 : 4 : 1

C is given a guarantee of minimum profit of Rs 5,000

Deficiency in C’s share = 5,000 − 4,000 = Rs 1,000

This deficiency is to be borne by A and B equally.

Therefore,

Final Profit Share of A = 20,000 − 500 = Rs 19,500

Final Profit Share of B = 16,000 − 500 = Rs 15,500

Final Profit Share of C = 4,000 + 1,000 = Rs 5,000

Page No 2.95:

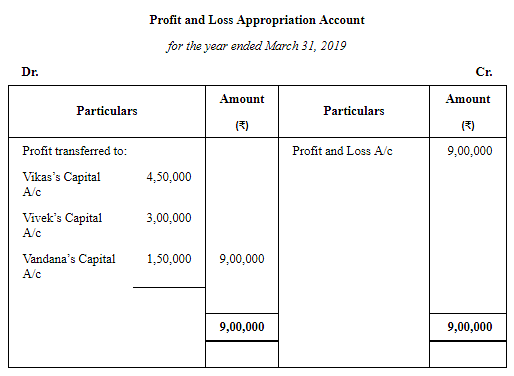

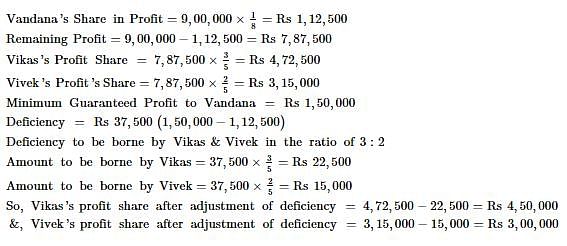

Question 82: Vikas and Vivek were partners in a firm sharing profits in the ratio of 3 : 2. On 1st April, 2018, they admitted Vandana as a new partner for 1/8th share in the profits with a guaranteed profit of ₹ 1,50,000. New profit-sharing ratio between Vikas and Vivek will remain same but they decided to bear any deficiency on account of guarantee to Vandana in the ratio 3 : 2. Profit of the firm for the year ended 31st March, 2019 was ₹ 9,00,000. Prepare Profit and Loss Appropriation Account of Vikas, Vivek and Vandana for the year ended 31st March, 2019.

ANSWER:

Working Notes:

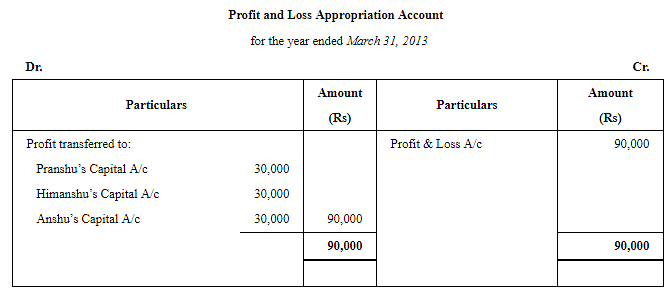

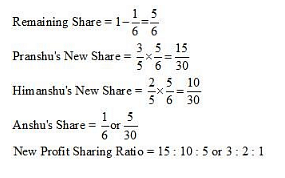

Page No 2.95:

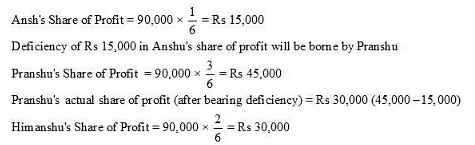

Question 83: Pranshu and Himanshu are partners sharing profits and losses in the ratio of 3 : 2 respectively. They admit Anshu as partner with 1/6 share in the profits of the firm. Pranshu personally guaranteed that Anshu's share of profit would not be less than ₹ 30,000 in any year. The net profit of the firm for the ear ending 31st March, 2013 was ₹ 90,000 .

Prepare Profit and Loss Appropriation Account.

ANSWER:

Working Notes:

WN1: Calculation of New Profit Sharing Ratio

Old ratio = 3 : 2

Let the total share of the firm be Re 1

Anshu is admitted for 1/6th share in profits

WN2:Distribution of Profit

Page No 2.95:

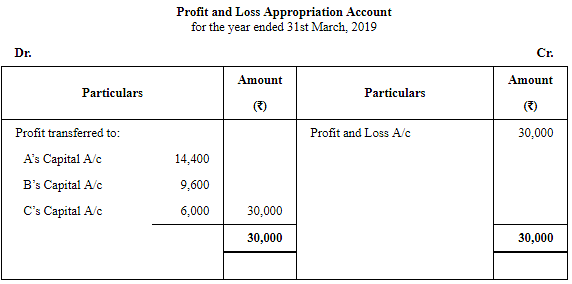

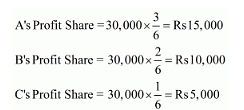

Question 84: A, B and C are partners in a firm sharing profits in the ratio of 3 : 2 : 1. They earned a profit of ₹ 30,000 during the year ended 31st March, 2019. Distribute profit among A, B and C if:

(a) C's share of profit is guaranteed to be ₹ 6,000 Minimum.

(b) Minimum profit payable to C amounting to ₹ 6,000 is guaranteed by A.

(c) Guaranteed minimum profit of ₹ 6,000 payable to C is guaranteed by B.

(d) Any deficiency after making payment of guaranteed ₹ 6,000 will be borne by A and B in the ratio of 3 : 1.

ANSWER:

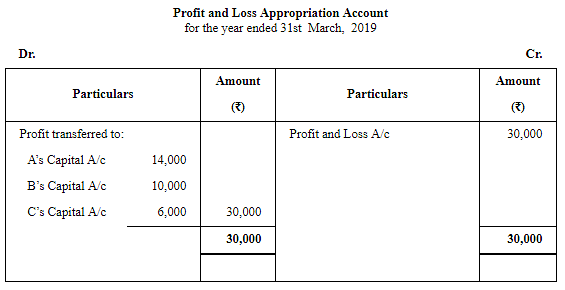

Case (a)

Working Notes:

Profit = Rs 30,000

Profit sharing ratio = 3 : 2 : 1

C is given a guarantee of minimum profit of Rs 6,000

Deficiency in C’s Profit Share = 6,000 − 5,000 = Rs 1,000

This deficiency is to be borne by A and B in their profit sharing ratio i.e. 3 : 2

Therefore,

Final Profit Share of A = 15,000 − 600 = Rs 14,400

Final Profit Share of B = 10,000 − 400 = Rs 9,600

Final Profit Share of C = 5,000 + 1,000 = Rs 6,000

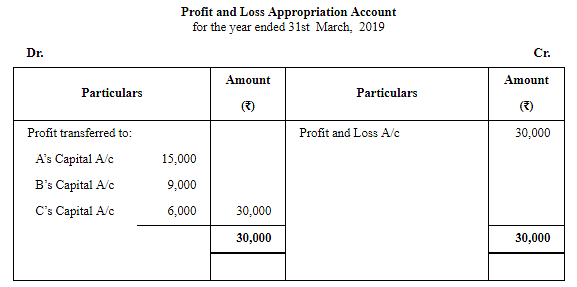

Case (b)

Working Notes:

Deficiency in C’s Profit Share = 6,000 − 5,000 = Rs 1,000

This deficiency is to be borne by A only.

Therefore,

Final Profit Share of A = 15,000 − 1,000 = Rs 14,000

Final Profit Share of B = 10,000

Final Profit Share of C = 5,000 + 1,000 = Rs 6,000

Case (c)

Working Notes:

Deficiency in C’s Profit Share = 6,000 − 5,000 = Rs 1,000

This deficiency is to be borne by B only.

Therefore,

Final Profit Share of A = 15,000

Final Profit Share of B = 10,000 − 1,000 = Rs 9,000

Final Profit Share of C = 5,000 + 1,000 = Rs 6,000

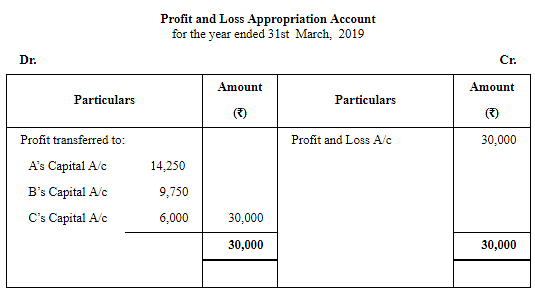

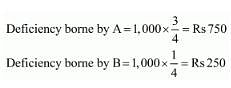

Case (d)

Working Notes:

Deficiency in C’s Profit Share = 6,000 − 5,000 = Rs 1,000

This deficiency is to be borne by A and B in the ratio of 3 : 1.

Therefore,

Final Profit Share of A = 15,000 − 750 = Rs 14,250

Final Profit Share of B = 10,000 − 250 = Rs 9,750

Final Profit Share of C = 5,000 + 1,000 = Rs 6,000

Page No 2.95:

Question 85: A and B are in partnership sharing profits and losses in the ratio of 3 : 2. They admit C, their Manager, as a partner with effect from 1st April, 2018, for 1/4th share of profits. C, while a Manager, was in receipt of a salary of ₹ 27,000 p.a. and a commission of 10% of the net profits after charging such salary and commission.

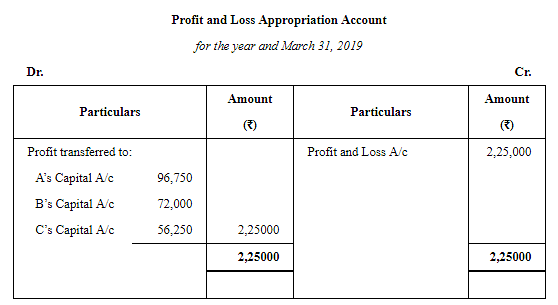

In terms of the Partnership Deed, any excess amount, which C will be entitled to receive as a partner over the amount which would have been due to him if he continued to be the manager, would have to be personally borne by A out of his share of profit. Profit for the year ended 31st March, 2019 amounted to ₹ 2,25,000. You are required to show Profit and Loss Appropriation Account for the year ended 31at March, 2019.

ANSWER:

Working Notes:

WN 1 Calculation of Remuneration to C as a Manager

Salary to C = Rs 27,000

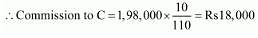

Commission to C = 10% of Net Profit after Salary and Commission

Net Profit after Salary and Commission = 2,25,000 − 27,000 = Rs 1,98,000

C’s remuneration as Manager = Salary + Commission = 27,000 + 18,000 = Rs 45,000

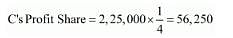

WN 2 Calculation of Profit Share of C as a Partner

Profit = Rs 2,25,000

Part of C’s Profit Share to be borne by A = 56,250 − 45,000 = Rs 11,250

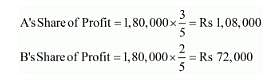

Profit available for distribution between A and B = 2,25,000 − 45,000 = Rs 1,80,000

A’s Profit share after adjusting C’s deficiency = 1,08,000 − 11,250 = Rs 96,750

Page No 2.95:

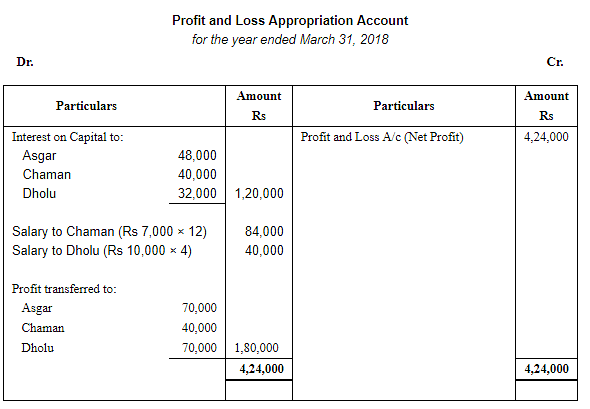

Question 86: Asgar, Chaman and Dholu are partners in a firm. Their Capital Accounts stood at ₹ 6,00,000; ₹ 5,00,000 and ₹ 4,00,000 respectively on 1st April, 2017. They shared Profits and Losses in the proportion of 4 : 2 : 3. Partners are entitled to interest on capital @ 8% per annum and salary to Chaman and Dholu @ ₹ 7,000 per month and ₹ 10,000 per quarter respectively as per the provision of the Partnership Deed. Sholu's share of profit ( excluding interest on capital but including salary) is guaranteed at a minimum of ₹ 1,10,000 p.a. Any deficiency arising on that account shall be met by Asgar. The profit for the year ended 31st March, 2018 amounted to ₹ 4,24,000.

Prepare Profit and Loss Appropriation Account for the year ended 31st March, 2018.

ANSWER:

Working Notes:

Profit available for distribution = 4,24,000 – (1,20,000 + 84,000+ 40,000) = Rs 1,80,000

Profit sharing ratio = 4 : 2 : 3

Dholu’s Minimum Guaranteed Profit = Rs 1,10,000 (excluding interest on capital, but including salary)

Dholu’s Minimum Guaranteed Profit (excluding salary) = 1,10,000 – 40,000 = Rs 70,000

But, Dholu’s Actual Profit Share = Rs 60,000

Deficiency in Dholu’s Profit Share = 70,000 – 60,000 = 10,000

This deficiency is to be borne by Asgar alone.

Therefore,

Asgar’s New Profit Share = 80,000 – 10,000 = Rs 70,000

Page No 2.96:

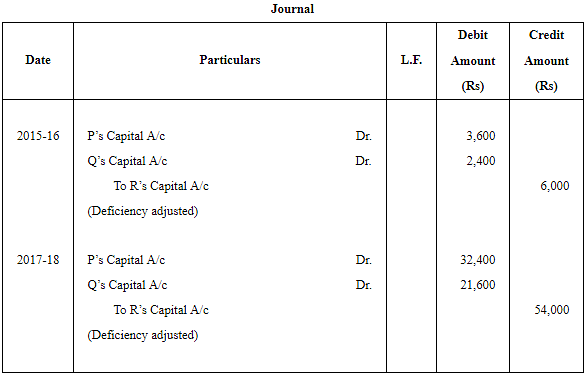

Question 87: P, Q and R entered into partnership on 1st April, 2015 to share profits and losses in the ratio of 12 : 8 : 5. It was provided that in no case R's share in profit be less then ₹ 30,000 p.a. The profits and losses for the period ended 31st March were: 2015-16 Profit ₹ 1,20,000 2016-17 Profit ₹ 1,80,000; 2017-18 Loss ₹ 1,20,000.

Pass the necessary Journal entries in the books of the firm.

ANSWER:

Working Notes:

Page No 2.96:

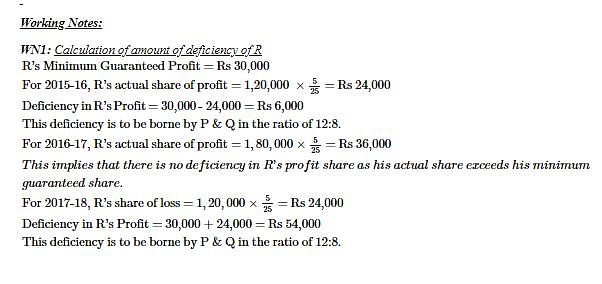

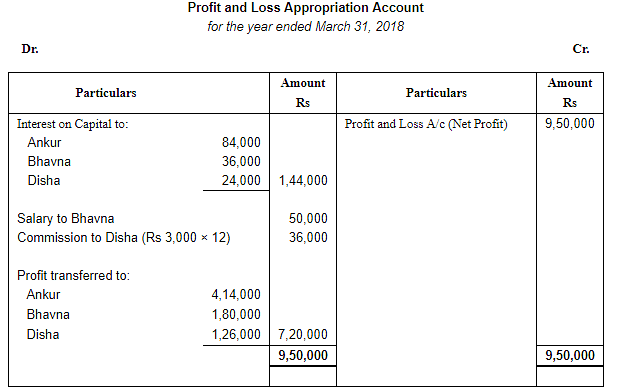

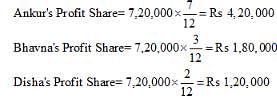

Question 88: Ankur, Bhavns and Disha are partners in a firm. On 1st April, 2017, the balance in their Capital Accounts stood at ₹ 14,00,000, ₹ 6,00,000 and ₹ 4,00,000 respectively. They shared profits in the proportion of 7 : 3 : 2 respectively. Partners are entitled to interest on capital @ 6% per annum and salary to Bhavna @ ₹ 50,000 p.a. and a commission of ₹ 3,000 per month to Disha as per the provisions of the partnership Deed. Bhavna's share of profit (excluding interest on capital) is guaranteed at not less than ₹ 1,70,000 p.a. Disha's share of profit (including interest on capital but excluding commission) is guaranteed at not less than ₹ 1,50,000 p.a. Any deficiency arising on that account shall be met by Ankur. The profit of the firm for the year ended 31st March, 2018 amounted to ₹ 9,50,000.

Prepare Profit and Loss Appropriation Account for the year ended 31st March, 2018.

ANSWER:

Working Notes:

Profit available for distribution = 9,50,000 – (1,44,000 + 50,000 + 36,000) = Rs 7,20,000

Profit sharing ratio = 7 : 3 : 2

Bhavna’s Minimum Guaranteed Profit = Rs 1,70,000 (excluding interest on capital)

But, Bhavna’s Actual Profit Share = Rs 1,80,000

This implies that there is no deficiency in Bhavna’s profit share as her actual profit share

(i.e. Rs 1,80,000) exceeds his minimum guaranteed profit share (i.e. Rs 1,70,000).

Disha’s Minimum Guaranteed Profit = Rs 1,50,000 (including interest on capital but excluding salary)

Disha’s Minimum Guaranteed Profit (excluding interest) = 1,50,000 – 24,000 = Rs 1,26,000

But, Disha’s Actual Profit Share = 1,20,000

Deficiency in Disha’s Profit Share = 1,26,000 – 1,20,000 = 6,000

This deficiency is to be borne by Ankur alone.

Therefore,

Ankur’s New Profit Share = 4,20,000 – 6,000 = Rs 4,14,000

Page No 2.96:

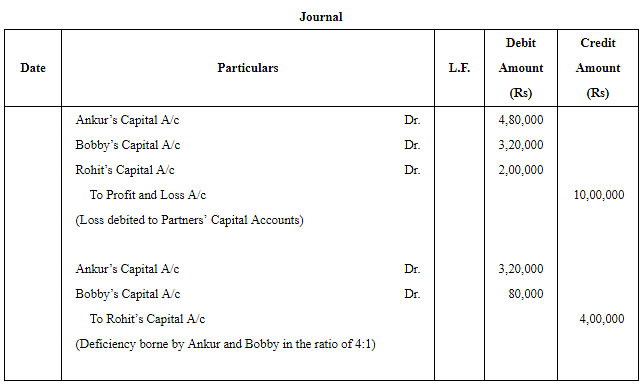

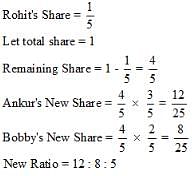

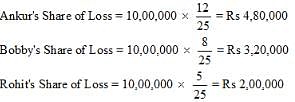

Question 89: Ankur and Bobby were into the business of providing software solutions in India. They were sharing profits and losses in the ratio 3 : 2. They admitted Rohit for a 1/5 share in the firm. Rohit, an alumni or IIT, Chennai would help them to expand their business to various South African countries where he had been working earlier. Rohit is guaranteed a minimum profit of ₹ 2,00,000 for the year. Any deficiency in Rohit's share is to be borne by Ankur and Bobby in the ratio 4 : 1. Loss for the year was ₹ 10,00,000. Pass the necessary Journal entries.

ANSWER:

Working Notes:

WN 1: Calculation of New Ratio

WN 2: Calculation of Share of Loss

WN 3: Calculation of Deficiency

Amount payable to Rohit = Guaranteed Profit Amount + Loss transferred to Rohit’s Capital A/c

Amount payable to Rohit = 2,00,000 + 2,00,000 = Rs 4,00,000

Deficiency is to be borne by Ankur and Bobby in the ratio of 4 : 1

Page No 2.96:

Question 90: Ajay, Binay and Chetan were partners sharing profits in the ratio of 3 : 3 : 2. The Partnership Deed provided for the following:

(i) Salary of ₹ 2,000 per quarter to Ajay and Binay.

(ii) Chetan was entitled to a commission of ₹ 8,000

(iii) Binay was guaranteed a rofit of ₹ 50,000 p.a.

The profit of the firm for the year ended 31st March, 2015 was ₹ 1,50,000 which was distributed among Ajay, Binay and Chetan in the ratio of 2 : 2 : 1, without taking into consideration the provisions of Partnership Deed. Pass necessary rectifying entry for the above adjustments in the books of the firm. Show your workings clearly.

ANSWER:

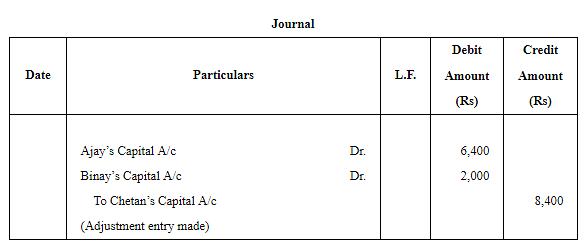

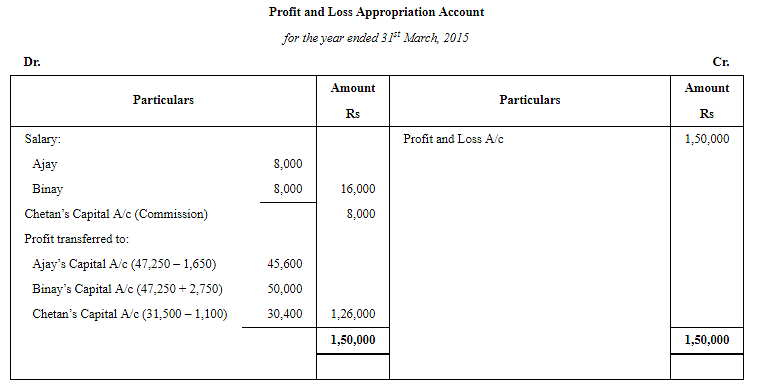

Working Notes:

WN1: Profit & Loss Appropriation A/c

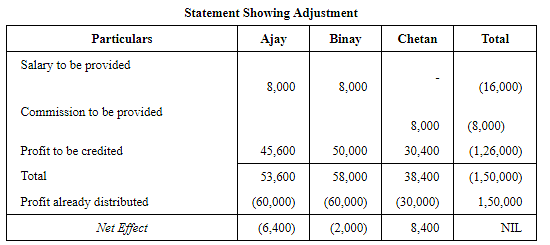

WN2: Statement Showing Adjustment

Page No 2.96:

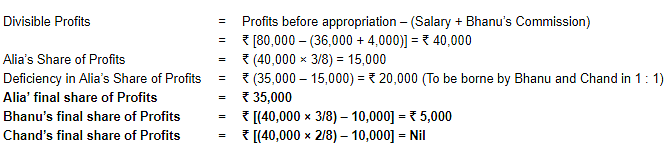

Question 91: The partners of a firm, Alia, Bhanu and Chand distributed the profits for the year ended 31st March, 2017, ₹ 80,000 in the ratio of 3 : 3 : 2 without providing for the following adjustments:

(a) Alia and Chand were entitled to a salary of ₹ 1,500 each p.a.

(b) Bhanu was entitled for a commission of ₹ 4,000.

(c) Bhanu and Chand had guaranteed a minimum profit of ₹ 35,000 p.a. to Alia any deficiency to borne equally by Bhanu and Chand.

Pass the necessary Journal entry for the above adjustments in the books of the firm. Show workings clearly.

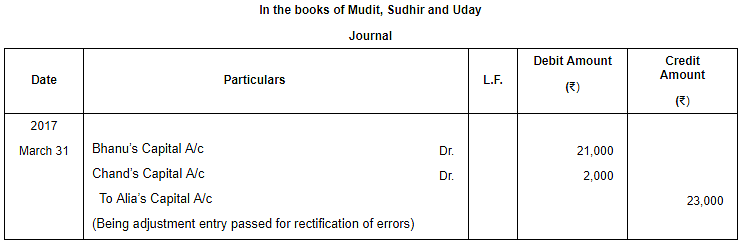

ANSWER:

Working Notes:

Page No 2.97:

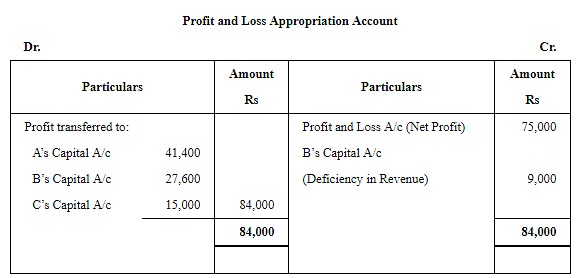

Question 92: Three Chartered Accountants A, B and C form a partnership, profits being shared in the ratio of 3 : 2 : 1 subject to the following:

(a) C's share of profit guaranteed to be not less than ₹ 15,000 p.a.

(b) B gives a guarantee to the effect that gross fee earned by him for the firm shall be equal to his average gross fee of the preceeding five years when he was carrying on profession alone, which on an average works out at ₹ 25,000.

The profit for the first year of the partnership are ₹ 75,000. The gross fee earned by B for the firm is ₹ 16,000. You are required to show Profit and Loss Appropriation Account after giving effect to the above.

ANSWER:

Working Notes:

Deficiency in revenue guaranteed by B = 25,000 − 16,000 = Rs 9,000

∴Profit to be distributed among Partners = 75,000 + B’s deficiency in guaranteed interest

= 75,000 + 9,000 = Rs 84,000

Profit sharing ratio = 3 : 2 : 1

Therefore, Final Profit Share of A = 42,000 − 600 = Rs 41,400

Final Profit Share of B = 28,000 − 400 = Rs 27,600**

Final Profit Share of C =14,000 + 1,000 = Rs 15,000

** In the book, the final profit to B is given as Rs 18,600, however, as per the solution it should be Rs 27,600. The deficiency of Rs 9,000 that was guaranteed by B to the firm would not be deducted from his share as he is bearing it in form of profit.

|

41 videos|168 docs|43 tests

|

FAQs on Accounting for Partnership Firms-Fundamentals ( Part - 6) - Accountancy Class 12 - Commerce

| 1. What is the concept of accounting for partnership firms? |  |

| 2. What are the fundamental principles of accounting for partnership firms? |  |

| 3. What are the key financial statements prepared for partnership firms? |  |

| 4. How are profits and losses shared among the partners in a partnership firm? |  |

| 5. How are partner's capital accounts maintained in a partnership firm? |  |

|

Explore Courses for Commerce exam

|

|