Change in Profit-Sharing Ratio Among the Existing Partners (Part - 2) | Accountancy Class 12 - Commerce PDF Download

Page No 4.38:

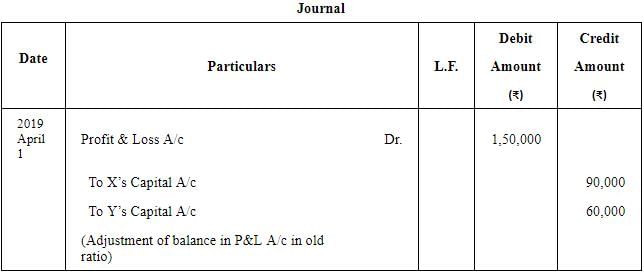

Question 11: X and Y are partners in a firm sharing profits and losses in the ratio of 3 : 2. With effect from 1st April, 2019, they decided to share future profits equally. On the date of change in the profit-sharing ratio, the Profit and Loss Account showed a credit balance of ₹ 1,50,000. Record the necessary Journal entry for the distribution of the balance in the Profit and Loss Account immediately before the change in the profit-sharing ratio.

ANSWER:

Working Notes:

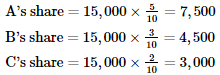

WN1 Calculation of Share of Profit and Loss A/c

Page No 4.39:

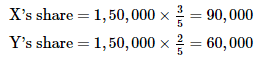

Question 12: A and B are partners in a firm sharing profits in the ratio of 4 : 1. They decided to share future profits in the ratio of 3 : 2 w.e.f. 1st April, 2019. On that day, Profit and Loss Account showed a debit balance of ₹ 1,00,000. Pass Journal entry to give effect to the above.

ANSWER:

Page No 4.39:

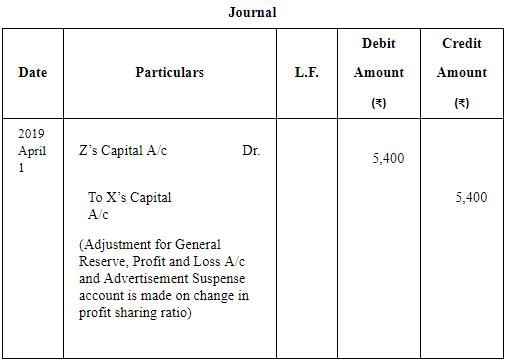

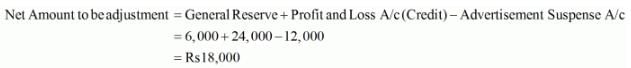

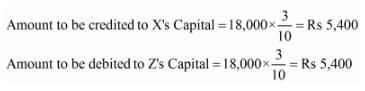

Question 13: X, Y and Z are sharing profits and losses in the ratio of 5 : 3 : 2. They decide to share future profits and losses in the ratio of 2 : 3 : 5 with effect from 1st April, 2019. They also decide to record the effect of the following accumulated profits, losses and reserves without affecting their book values by passing a single entry .

ANSWER:

Working Notes:

WN 1

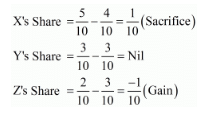

WN 2 Calculation of Sacrificing (or Gaining) Ratio

Old Ratio (X, Y and Z) = 5 : 3 : 2

New Ratio (X, Y and Z) = 2 : 3 : 5

Sacrificing (or Gaining) Ratio = Old Ratio − New Ratio

Page No 4.39:

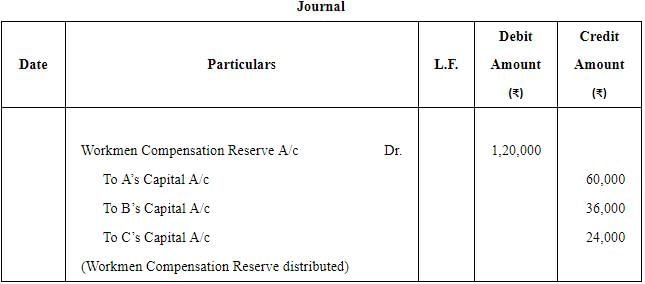

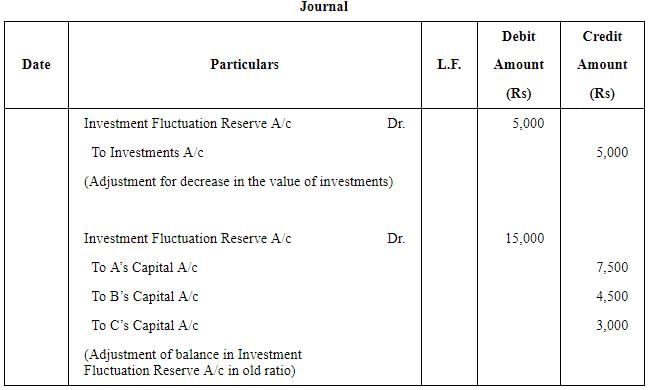

Question 14: A, B and C who are presently sharing profits and losses in the ratio of 5 : 3 : 2 decide to share future profits and losses in the ratio of 2 : 3 : 5. Give the Journal entry to distribute 'Workmen Compensation Reserve' of ₹ 1,20,000 at the time of change in profit-sharing ratio, when:

(i) no information is given; (ii) there is no claim against it.

ANSWER:

(i) & (ii)

Note:

In the both the cases, Workmen Compensation Reserve should be distributed in old ratio i.e., 5:3:2.

Page No 4.39:

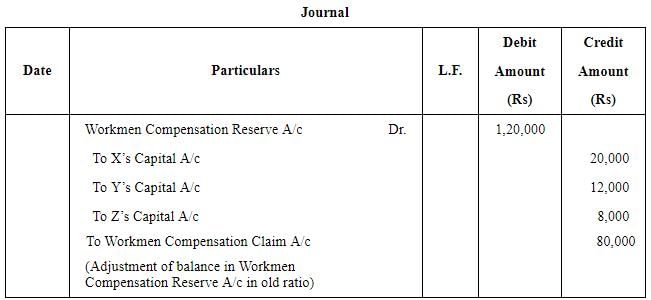

Question 15: X, Y and Z who are presently sharing profits and losses in the ratio of 5 : 3 : 2 decide to share future profits and losses in the ratio of 2 : 3 : 5. Give the journal entry to distribute 'Workmen Compensation Reserve' of ₹ 1,20,000 at the time of change in profit-sharing ratio, when there is a claim of ₹ 80,000 against it.

ANSWER:

Working Notes:

WN1 Calculation of Share of Workmen Compensation Reserve

Page No 4.39:

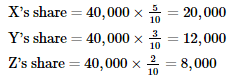

Question 16: X, Y and Z who are sharing profits in the ratio of 5 : 3 : 2, decide to share profits in the ratio of 2 : 3 : 5 with effect from 1st April, 2019. Workmen Compensation Reserve appears at ₹ 1,20,000 in the Balance Sheet as at 31st March, 2019 and Workmen Compensation Claim is estimated at ₹ 1,50,000. Pass Journal entries for the accounting treatment of Workmen Compensation Reserve.

ANSWER:

Page No 4.39:

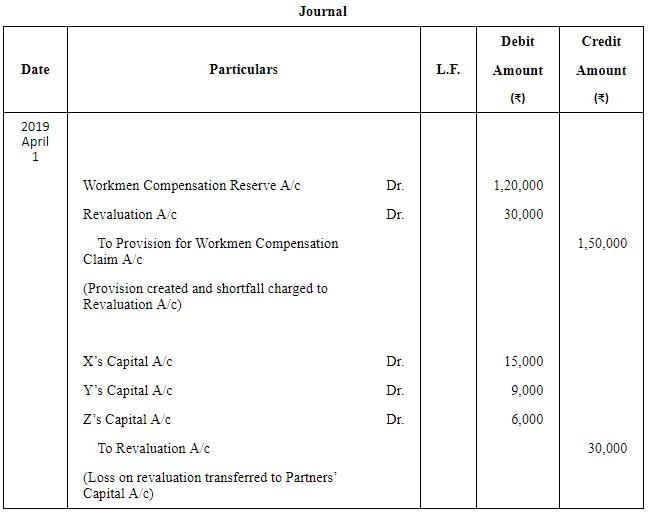

Question 17: A, B and C who are presently sharing profits and losses in the ratio of 5 : 3 : 2 decide to share future profits and losses in the ratio of 2 : 3 : 5. Give the journal entry to distribute 'Investments Fluctuation Reserve' of ₹ 20,000 at the time of change in profit-sharing ratio, when investment (market value ₹ 95,000) appears in the books at ₹ 1,00,000.

ANSWER:

Working Notes:

WN1 Calculation of Share of Investment Fluctuation Reserve

Page No 4.39:

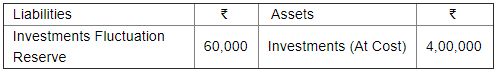

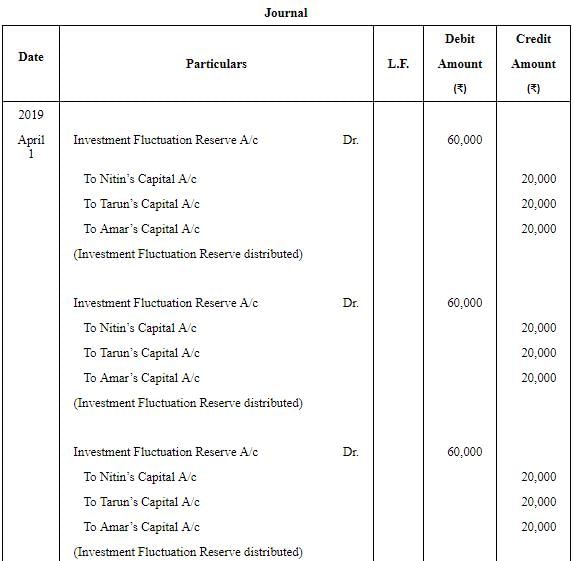

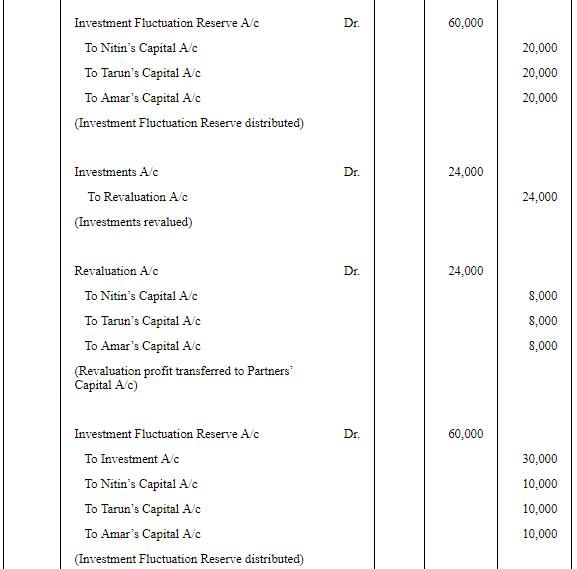

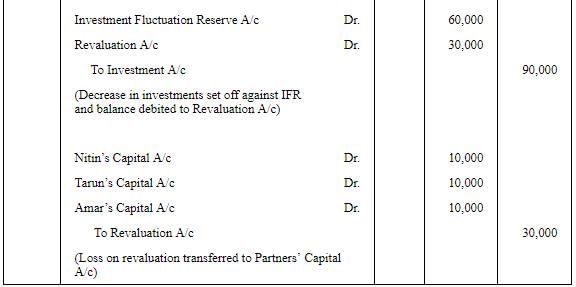

Question 18: Nitin, Tarun and Amar are partners sharing profits equally and decide to share profits in the ratio of 2 : 2 : 1 w.e.f. 1st April, 2019. The extract of their Balance Sheet as at 31st March, 2019 is as follows:

Pass the Journal entries in each of the following situations:

(i) When its Market Value is not given;

(ii) When its Market Value is ₹ 4,00,000;

(iii) When its Market Value is ₹ 4,24,000;

(iv) When its Market Value is ₹ 3,70,000

(v) When its Market Value is ₹ 3,10,000.

ANSWER:

Page No 4.40:

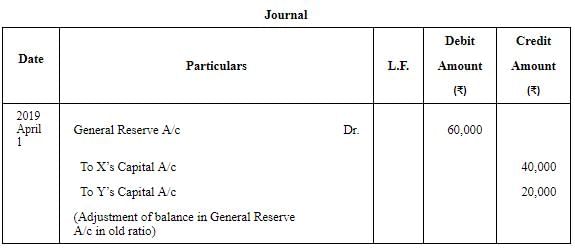

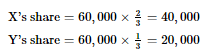

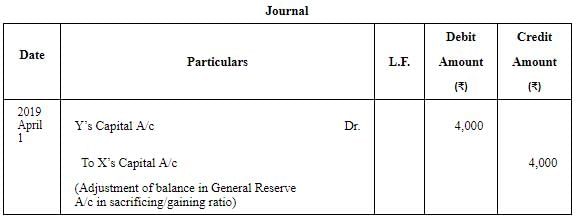

Question 19: X and Y are partners sharing profits in the ratio of 2 : 1. On 31st March, 2019, their Balance Sheet showed General Reserve of ₹ 60,000. It was decided that in future they will share profits and losses in the ratio of 3 : 2. Pass necessary Journal entry in each of the following alternative cases:

(i) When General Reserve is not to be shown in the new Balance Sheet.

(ii) When General Reserve is to be shown in the new Balance Sheet.

ANSWER:

(i) If they do not want to show General Reserve in the new Balance Sheet

Working Notes:

WN1 Calculation of Share of General Reserve

(ii) If they want to show General Reserve in the new Balance Sheet

Working Notes:

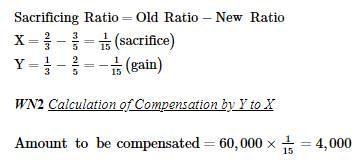

WN1 Calculation of Gain/Sacrfice

Page No 4.40:

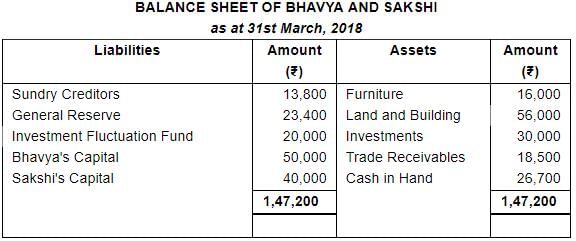

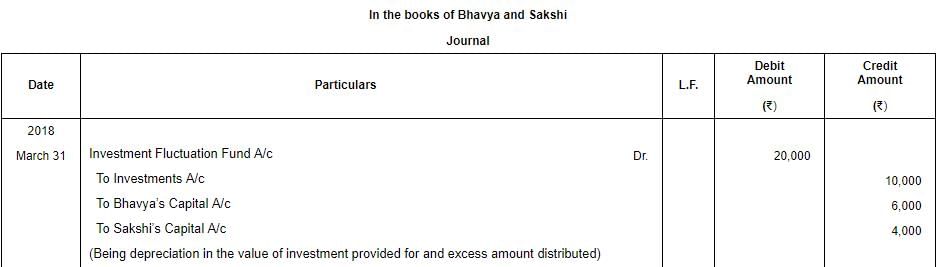

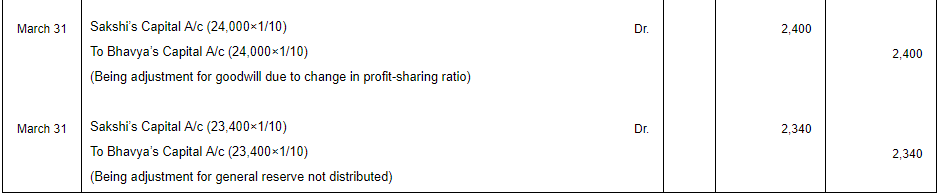

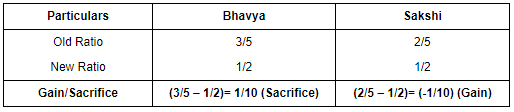

Question 20: Bhavya and Sakshi are partners in a firm, sharing profits and losses in the ratio of 3 : 2. On 31st March, 2018 their Balance Sheet was as under:

The partners have decided to change their profit sharing ratio to 1 : 1 with immediate effect. For the purpose, they decided that:

(i) Investments to be valued at ₹ 20,000.

(ii) Goodwill of the firm be valued at ₹ 24,000.

(iii) General Reserve not to be distributed between the partners.

You are required to pass necessary Journal entries in the books of the firm. Show workings.

ANSWER:

Working Notes:

Page No 4.40:

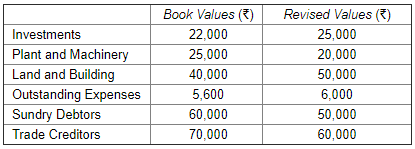

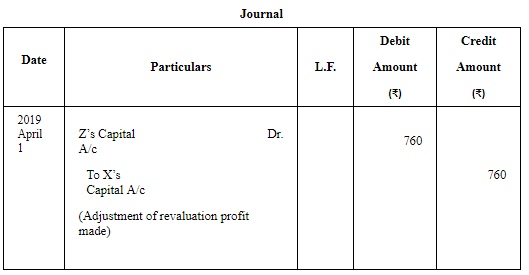

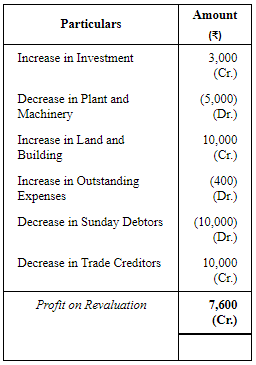

Question 21: X, Y and Z share profits as 5 : 3 : 2. They decide to share their future profits as 4 : 3 : 3 with effect from 1st April, 2019. On this date the following revaluations have taken place:

Pass necessary adjustment entry to be made because of the above changes in the values of assets and liabilities. However, old values will continue in the books .

ANSWER:

Working Notes:

WN 1 Calculation of Net Profit or Loss on Revaluation

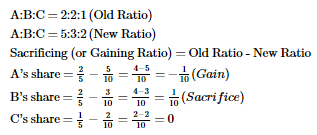

WN 2 Calculation of Sacrificing (or Gaining) Ratio

Old Ratio (X, Y and Z) = 5 : 3 : 2

New Ratio (X, Y and Z) = 4 : 3 : 3

Sacrificing (or Gaining) Ratio = Old Ratio − New Ratio

WN 3 Adjustment of Revaluation Profit

Page No 4.41:

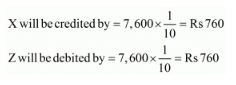

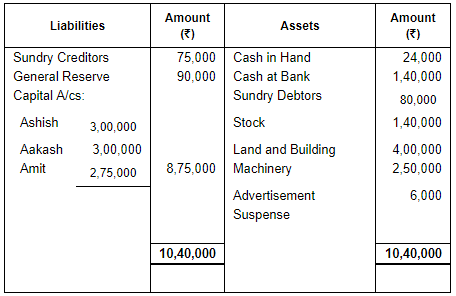

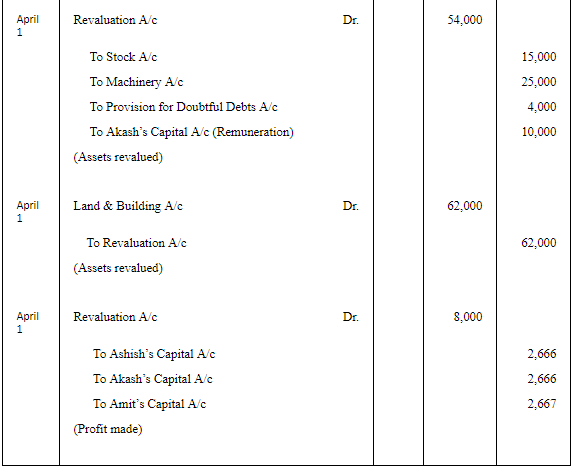

Question 22: Ashish, Aakash and Amit are partners sharing profits and losses equally. The Balance Sheet as at 31st March, 2019 was as follows:

The partners decided to share profits in the ratio of 2 : 2 : 1 w.e.f. 1st April, 2019. They also decided that:

(i) Value of stock to be reduced to ₹ 1,25,000.

(ii) Value of machinery to be decreased by 10%.

(iii) Land and Building to be appreciated by ₹ 62,000.

(iv) Provision for Doubtful Debts to be made @ 5% on Sundry Debtors.

(v) Aakash was to carry out reconstitution of the firm at a remuneration of ₹ 10,000.

Pass necessary Journal entries to give effect to the above.

ANSWER:

Page No 4.41:

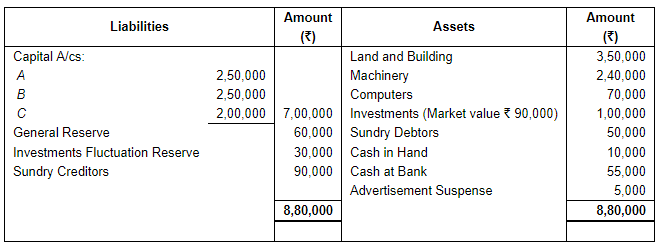

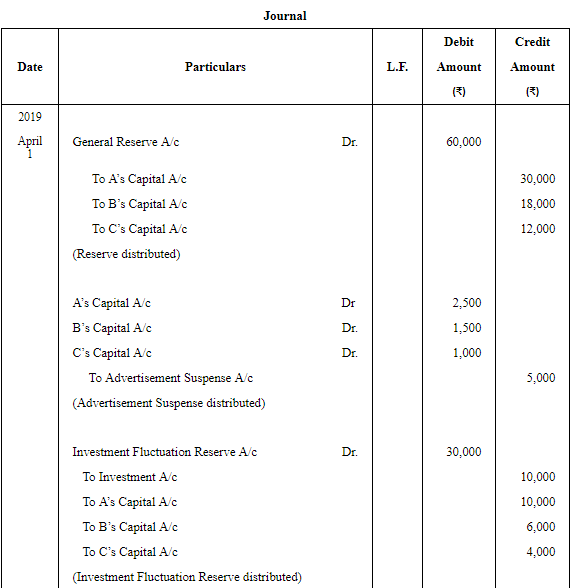

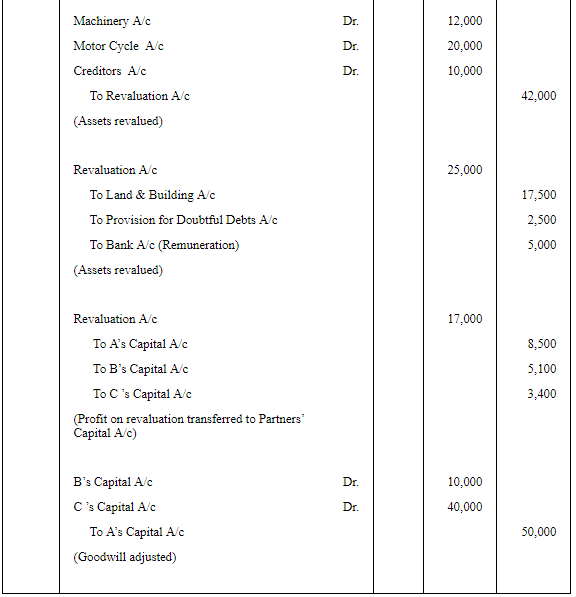

Question 23: A, B and C are partners sharing profits and losses in the ratio of 5 : 3 : 2. Their Balance Sheet as at 31st March, 2019 stood as follows:

They decided to share profits equally w.e.f. 1st April, 2019. They also agreed that:

(i) Value of Land and Building be decreased by 5%.

(ii) Value of Machinery be increased by 5%.

(iii) A Provision for Doubtful Debts be created @ 5% on Sundry Debtors.

(iv) A Motor Cycle valued at ₹ 20,000 was unrecorded and is now to be recorded in the books.

(v) Out of Sundry Creditors, ₹ 10,000 is not payable.

(vi) Goodwill is to be valued at 2 years' purchase of last 3 years profits. Profits being for 2018-19 − ₹ 50,000 (Loss); 2017-18 − ₹ 2,50,000 and 2016-17 − ₹ 2,50,000.

(vii) C was to carry out the work for reconstituting the firm at a remuneration (including expenses) of ₹ 5,000. Expenses came to ₹ 3,000.

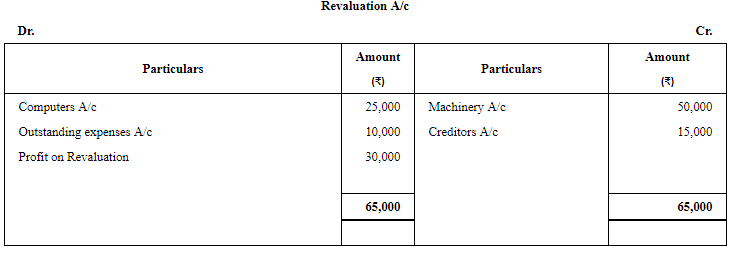

Pass Journal entries and prepare Revaluation Account.

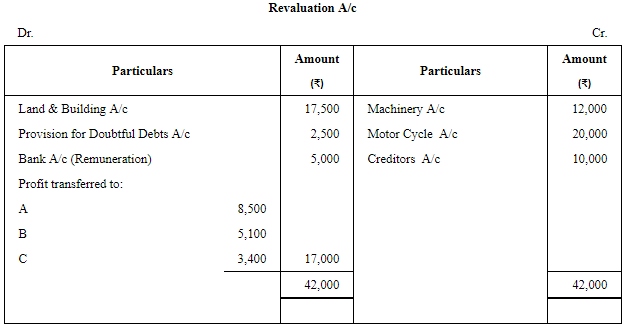

ANSWER:

Working Notes:

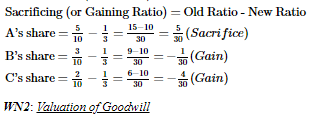

WN1: Calculation of sacrifice or gain

A:B:C=5:3:2(Old Ratio)A:B:C=1:1:1(New Ratio)

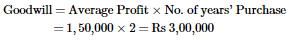

WN2: Valuation of Goodwill

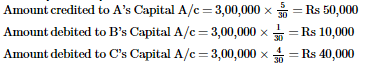

WN3: Adjustment of Goodwill

Page No 4.42:

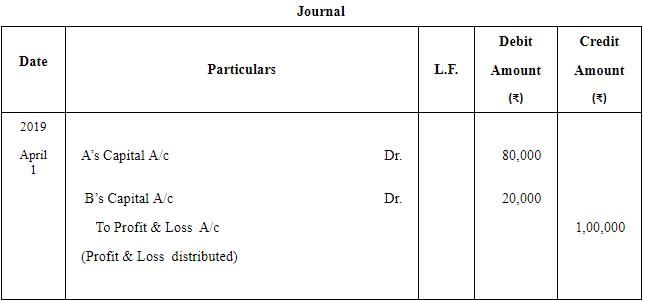

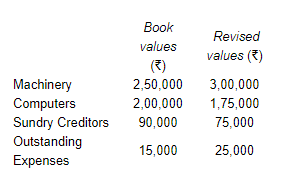

Question 24: A, B and C are sharing profits and losses in the ratio of 2 : 2 : 1. They decided to share profit w.e.f. 1st April, 2019 in the ratio of 5 : 3 : 2. They also decided not to change the values of assets and liabilities in the books of account. The book values and revised values of assets and liabilities as on the date of change were as follows:

Pass an adjustment entry.

ANSWER:

Working Notes:

WN1: Calculation of Sacrifice or Gain

WN2: Calculation of Profit or Loss on Revaluation

|

42 videos|199 docs|43 tests

|

FAQs on Change in Profit-Sharing Ratio Among the Existing Partners (Part - 2) - Accountancy Class 12 - Commerce

| 1. What is a profit-sharing ratio among partners? |  |

| 2. How is the profit-sharing ratio decided among partners? |  |

| 3. Can the profit-sharing ratio be changed among existing partners? |  |

| 4. What could be the reasons for changing the profit-sharing ratio among existing partners? |  |

| 5. How does changing the profit-sharing ratio affect the partners and the partnership? |  |