Q.1. Explain with the help of an example, the basis of classifying goods into final goods and intermediate goods. [ Delhi Set-I, 2010, OD SET I 2017]

OR

Explain the basis of classifying goods into intermediates and final goods. Give suitable examples. [Delhi Set-I 2010]

Ans. Goods are classified as final goods and intermediate goods on the basis of the end use. If goods are purchased for consumption or investment, these would be classified as final goods. For example, machine purchased for use in a factory is a final good. Milk purchased by households is also final good as it is purchased for consumption. When a good is purchased for resale or for using it up completely in production during the year, it is called intermediate good. For example, raw material purchased for producing goods.

Q.2. Giving reasons, classify the following into intermediate and final goods.

(i) Machine purchased by a dealer of machines.

(ii) A car purchased by a household. [OD Set-I, II, III 2010]

Ans. (i) Machine purchased by a dealer of machines is an intermediate good because it is meant for resale to someone.

(ii) A car purchased by a household is a final good as it is used for consumption.

Q.3. Which among the following are final goods and which are intermediate goods? Give reasons.

(i) Milk purchased by a tea stall

(ii) Bus purchased by a school

(iii) Juice purchased by a student from the school canteen. [Delhi & OD 2018]

Ans. (i) Milk purchased by a tea stall is an intermediate good because it is purchased from another production unit for resale indirectly.

(ii) Bus purchased by a school is a final good because expenditure on school bus is on investment expenditure.

(iii) Jucie purchased by a student from the school canteen is a final good because it is purchased by consumer for own use and not for resale.

Q. 4. Distinguish between :

(i) Final good and intermediate good.

(ii) Consumption good and capital good. [OD Set-I, II, III Comptt. 2016]

Ans. (i) Goods purchased for consumption or investment are final goods and goods purchased for completely using up in production during the year or for resale are intermediate goods.

(ii) Goods purchased for satisfaction of wants are consumer goods. Final goods that are used for producing other goods are capital good.

Detailed Answer :

(i) Consumer goods are those goods which satisfy the consumer’s wants directly. Consumer goods are used as final goods by their final users.

Example : Pen, bread, butter, vegetables, etc. Capital goods, on the other hand, are those goods which are used as fixed assets by the producers in the production of other goods and services. These goods are repeatedly used in the production of other goods and services. Example : Building, machinery, tractors, etc. Capital goods, are fixed assets of the producers, and are to be treated as final goods whereas in case of consumer goods, it depends on their ‘end use’. Example : Kerosene oil used by households is a final good but when used by the firms to clean their machinery is to be treated as intermediate good.

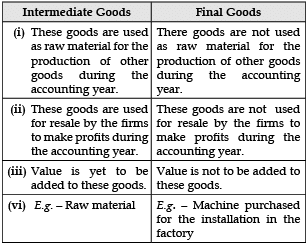

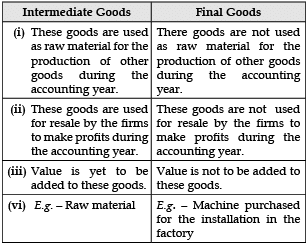

Q.5. Distinguish between intermediate goods and final goods. Give an example of each. [Delhi Set-I, II, III Comptt. 2015, Delhi Set I, II, III 2017]

Ans. Goods purchased by a production unit from other production units for resale or for using them completely during the same year are intermediate goods, whereas goods purchased for consumption / investment are final goods.

Intermediate goods : Raw material, etc.

Final goods : Machine purchased for installation in a factory, etc.

Detailed Answer :

Q. 6. Define intermediate goods and final goods. Can milk be an intermediate good? Give reasons for your answer. [OD Set-III Comptt. 2015]

Ans. Goods purchased by a production unit from other production units for resale or for using them completely during the same year are intermediate goods. Goods purchased for consumption / investment are final goods.

Milk purchased by a restaurant is an intermediate good, because it is purchased for reselling.

Q .7. Giving reasons, classify the following into intermediate products and final products.

(i) Furniture purchased by a school.

(ii) Chalks, dusters, etc., purchased by school. [Delhi Set-I, 2011]

Ans. (i) Furniture purchased by school : Final Product. Reason : Schools buy furniture for long – term use and it is considered as an investment.

(ii) Chalks, Dusters, etc., purchased by school : Intermediate product.

Reason : These are taken up to be used up completely during the same year.

Q . 8. Giving reasons, classify the following into intermediate products and final products:

(i) Computers installed in an office.

(ii) Mobile sets purchased by a mobile dealer.

Ans. (i) Computers installed in an office : Final Product Reason : Offices buy computers as long term durable products and are investment for them.

(ii) Mobile sets purchased by a mobile dealer : Intermediate products.

Reason : A mobile dealer purchases mobile sets for the purpose of reselling in the market to earn profit. That is why they are considered as intermediate products.

Q.9. Give reason and identify whether the following are final expenditure or intermediate expenditure:

(i) Expenditure on maintenance of an office building.

(ii) Expenditure on improvement of a machine in a factory. [Delhi Set-III 2011]

Ans. (i) Expenditure on maintenance of an office building—Final Expenditure.

Reason – It is for consumption purpose, so it is considered as final expenditure.

(ii) Expenditure on improvement of a machine in a factory : Final expenditure.

Reason – It is a kind of capital investment. So it is considered as final expenditure.

Q .10 Should the following be treated as final expenditure or intermediate expenditure? Give reasons for your answer.

(i) Purchase of furniture by a firm

(ii) Expenditure on maintenance by a firm.

Ans. Reason : (i) It is a final expenditure because it is an investment expenditure.

(ii) It is an inter mediate expenditure because it is an expenditure on single use producer goods.

Q . 11 . Distinguish between domestic product and national product. [Foreign Set-II 2017]

Ans. Sum of the value of final products that take place within the domestic territory of a country is called domestic product whereas the sum of contribution of residents of a country both within domestic territory or abroad is called national product.

Q.12. Explain ‘mixed income of self-employed’ and give an example. [Foreign III 2017]

Ans. There are some incomes which cannot be conveniently divided into distinctive factor incomes. Such income arises to the self-employed like practicing lawyers, doctors, etc. Take for example a practicing lawyer. The fees charged by the lawyer is not only his wages but also interest of capital employed by him, rent of his office and profit of his entrepreneurship. Since no data is available to sub-divide the lawyer’s fees into wages, rent, interest and profit, it is called mixed income.

Q.13. Why are net exports included in National Income? [Delhi Comptt. Set-I, II, III 2012]

Ans. Exports form a part of National Income because exports are provided by the producers of the domestic territory of the country. Exports are as a matter of fact, part of domestic production.

Q.14. Giving reasons, state how the following are treated in the estimation of national income.

(i) Payment of interest by banks to its depositors.

(ii) Expenditure on old age pensions by government.

(iii) Expenditure on engine oil by car service station. [OD Comptt., Set-I, II, III 2017]

Ans. (i) Payment of interest by banks to its depositors is included in national income because it is factor income paid by a production unit.

(ii) Expenditure on old age pensions by government is not included because it is a transfer payment.

(iii) Expenditure on engine oil by car service station is not included because it is an intermediate cost.

Q.15. Giving reasons, state how the following are treated in the estimation of national income :

(i) Payment of interest by an individual to a bank on a loan to buy a car.

(ii) Expenditure by government on providing free educational services.

(iii) Expenditure on purchasing a machine installed in a production unit. [Delhi Comptt., Set-I, II, III 2017]

Ans. (i) Payment of interest by an individual to a bank is not included because the individual is a consumer.

(ii) Expenditure by government on providing free educational services is included because it is a final expenditure.

(iii) Expenditure on purchasing a machine installed in a production unit is included because it is an investment expenditure.

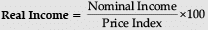

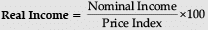

Q.16. Given nominal income, how can we find real income? Explain. [Delhi & OD 2018]

Ans. Given nominal income other than base year, we can find real income by eliminating changes in price index. The effect of change in prices on the nominal income of current year can be eliminated in the following way :

Price Index plays the role of deflator deflating current price estimates into constant price estimate.

Q. 17. Describe the expenditure method of calculating Gross Domestic Product at Market Price.

Ans. To calculate GDPmP by the expenditure method, we add up final expenditures on the goods and services produced by all the economic sectors of an economy. Expenditures incurred on consumption and investment are final expenditures. These are classified into:

(i) Private final consumption expenditure.

(ii) Government final consumption expenditure.

(iii) Gross domestic capital formation.

(iv) Net exports = Exports less Imports

The sum total of these expenditures is GDP

Q. 18. State the various components of the Expenditure Method that are used to calculate National Income. [SQP 2016]

Ans. Components of Expenditure method :

(i) Private Final Consumption Expenditure

(ii) Government Final Consumption Expenditure

(iii) Investment Expenditure

(iv) Net Exports (X – m).

(i) Private Final Consumption Expenditure (C) : It refers to expenditure on final goods and services by the individuals, households and Non-profit Institution Serving Society.

(ii) Government Final Consumption Expenditure (G) : It refers to expenditure on final goods and services by the government, like expenditure on the purchase of goods for consumption by the defence personnel.

(iii) Investment Expenditure (I) : It refers to expenditure on the purchase of final goods by the producers.

(iv) Net Exports (X – M) : It is the difference between exports and imports during an accounting year.

Q.19. What is meant by problem of Double Counting? How this problem can be avoided. [SQP 2018-19]

Ans. The problem of double counting arises when the value of certain goods and services are counted more than once while estimating National Income by Value Added method. This happens when the value of intermediate goods is counted in the estimation of National Income along with the final value of goods and services. Two methods to avoid the problem of double counting :

(i) To consider only the final value of output produced.

(ii) To consider only the value added of the output produced.

Q.20. How should the following be treated while calculating national income? Give reasons for your answer.

(i) Profits earned by a branch of foreign bank in India.

(ii) Salary received by Indian employees working in American embassy in India. [OD Set-II, Comptt., 2016]

Ans. (i) It is factor income to abroad, so it is not included.

(ii) It is included as factor income from aborad.

Q.21. Explain the concepts of Real GDP and Nominal GDP, using a suitable numerical example. [SQP 2016]

Ans. (i) Real GDP : When GDP is measured at constant price or the base year’s prices, it is known as Real GDP. GDP at constant prices will only increase when there is an increase in the flow of goods and services in the economy.

(ii) Nominal GDP : When GDP is measured at the prevailing or the current year’s price, it is known as Nominal GDP. GDP at current prices may increase even if there is no increase in flow of goods and services in the economy. 1 Any suitable numerical example.

Q.22. How should the following be treated while calculating national income ? Give reasons for your answer.

(i) Interest received by households from banks.

(ii) Dividend received by shareholders. [OD Set-III Comptt. 2016]

Ans. (i) Bank is a production unit so this is a factor income and hence should be included.

(ii) It is a part of the profits of production units which is distributed to the owners so it is included.

Q.23. How should the following be treated in the calculation of national income? Give reasons for your answer.

(i) Government expenditure on street lighting.

(ii) Sale of an old house. [OD Set-I Comptt. 2016]

Ans. (i) Included, because it is final expenditure of the government.

(ii) Not included, because it does not result in any production. Its value was already included when it was newly constructed.

Q.24. How should the following be treated while calculating national income? Give reasons for your answer.

(i) Purchases by foreign tourists.

(ii) Purchase of shares by a domestic firm.

[OD Set-II Comptt. 2016]

Ans. (i) Included because such an expenditure is treated as exports.

(ii) Not included, because it is merely a financial transaction not resulting in any production.

Q.25. How should the following be treated in the calculation of national income? Give reasons for your answer.

(i) Interest on public debt.

(ii) Bonus given to railway employees. [OD Set-III Comptt. 2016]

Ans. (i) Not included, because public debt interest is interest on loan taken by government to meet its day to day consumption expenditure, and not for investment.

(ii) Included, because it is compensation of employees.

Q.26. How will you treat the following while calculating domestic product of India? Give reasons for your answer.

(i) Profits earned by a foreign company in India.

(ii) Salary of Indian residents working in Russian Embassy in India.[Foreign Set-I, II, III 2013]

Ans. (i) Profits earned by a foreign company in India is a part of domestic product of India because the company is within the domestic territory of India. Hence, it is included in domestic product of India.

(ii) Salary of Indian residents working in Russian Embassy in India is not included in domestic product of India because Russian Embassy is not a part of domestic territory of India.

Q.27. Giving reason, explain how should the following be treated in estimating national income :

(i) Expenditure on fertilizers by a farmer.

(ii) Purchase of tractor by a farmer. [Delhi Set-I 2012]

Ans. (i) Expenditure on Fertilizers— It is intermediate cost for the farmer and deducted from the value of output while arriving at National Income. Therefore, not included.

(ii) Purchase of Tractor— It is included because it is capital formation / investment by the farmer.

Q.28. Giving reason, explain how should the following be treated in estimating national income :

(i) Payment of bonus by a firm.

(ii) Payment of interest on a loan taken by an employee from the employer. ([Delhi Set-II, 2012])

Ans. (i) Payment of bonus : It will be included in national income as it is a part of compensation of employees.

(ii) Payment of Interest : It will not be included in the national income accounting as it is assumed that the loan is taken for consumption purpose and therefore, treated as a transfer in cause.

Q.29. Giving reason, explain how should the following be treated in estimating national income :

(i) Interest paid by banks on deposits by individuals.

(ii) National Debt interest. [Delhi Set III, 2012]

Ans. (i) Interest paid by banks : It will be included as it is a factor income.

(ii) National Debt Interest : It will not be included as it is assumed that Government borrows for consumption purpose. Therefore, it is treated as transfer income.

Q.30. Giving reason, explain how should the following be treated while estimating national income :

(i) Expenditure on free services provided by government.

(ii) Payment of interest by a Government firm. [OD Set-I, II, III 2012]

Ans. (i) Expenditure on free services provided by Government should be included in the estimation of national income because expenditure on these services is a part of Government Final Consumption Expenditure.

(ii) Payment of interest by a Government firm should be included while estimating national income because it is a kind of factor payment.