Dissolution of a Partnership Firm ( Part - 1) | Accountancy Class 12 - Commerce PDF Download

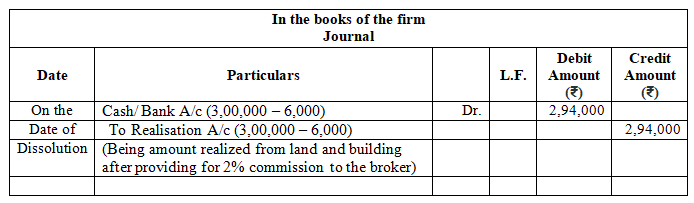

Page No 7.51:

Question 1:

Land and Building (book value) ₹ 1,60,000 sold for ₹ 3,00,000 through a broker who charged 2% commission on the deal. Journalise the transaction, at the time of dissolution of the firm.

ANSWER:

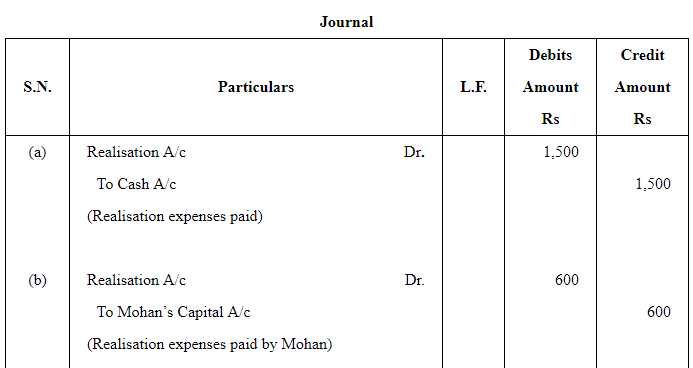

Question 2:

Pass Journal entries in the following cases?

(a) Expenses of realisation ₹ 1,500.

(b) Expenses of realisation ₹ 600 but paid by Mohan, a partner.

(c) Mohan, one of the partners of the firm, was asked to look into the dissolution of the firm for which he was allowed a commission of ₹ 2,000.

(d) Motor car of book value ₹ 50,000 taken over by creditors of the book value of ₹ 40,000 in full settlement.

ANSWER:

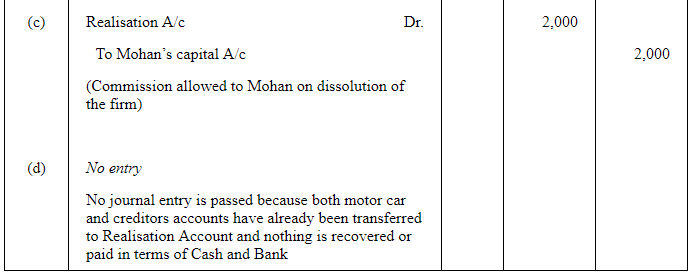

Question 3:

Pass Journal entries for the following:

(a) Realisation expenses of ₹ 15,000 were to be met by Rahul, a partner, but were paid by the firm.

(b) Ramesh, a partner, was paid remuneration of ₹ 25,000 and he was to meet all expenses.

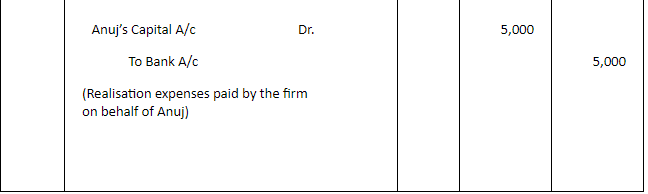

(c) Anuj, a partner, was paid remuneration of ₹ 20,000 and he was to meet all expenses. Firm paid an expense of ₹ 5,000.

ANSWER:

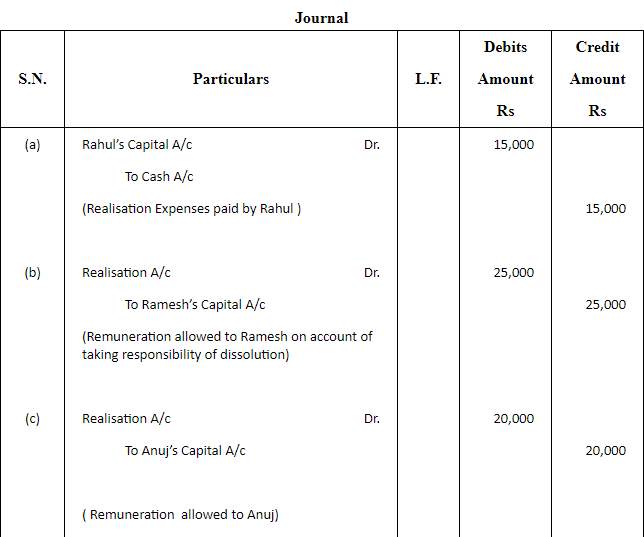

Question 4:

Pass Journal entries for the following:

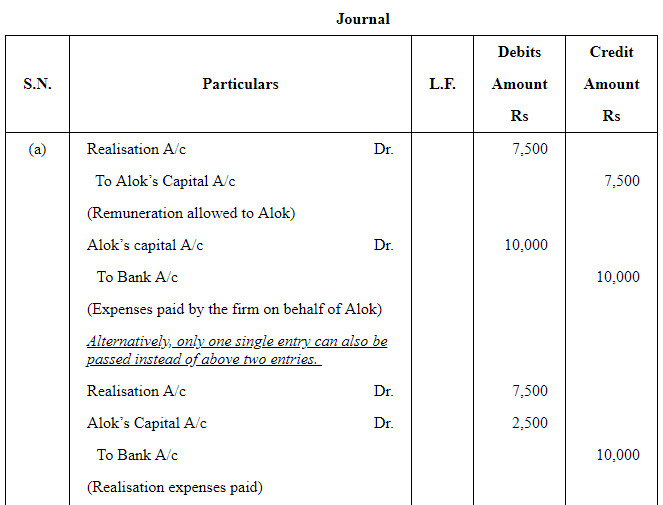

(a) Realisation expenses amounted to ₹ 10,000 were paid by the firm on behalf of Alok, a partner, with whom it was agreed at ₹ 7,500.

(b) Realisation expenses amounted to ₹ 5,000. It was agreed that the firm will pay ₹ 2,000 and balance by Ravinder, a partner.

(c) Dissolution expenses amounted to ₹ 10,000 were paid by Amit, a partner, on behalf of the firm.

ANSWER:

Page No 7.52:

Question 5:

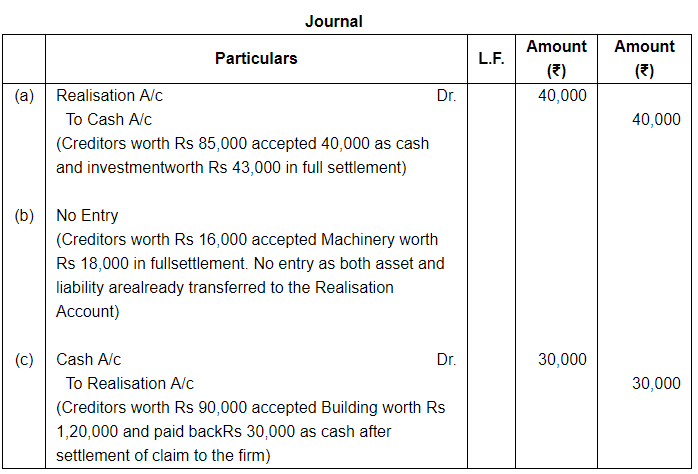

Record necessary Journal entries in the following cases:

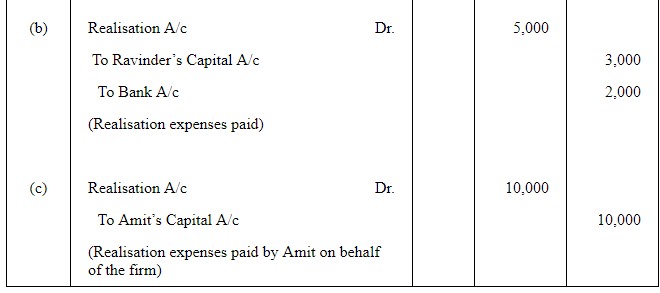

(a) Creditors worth ₹ 85,000 accepted ₹ 40,000 as cash and Investment worth ₹ 43,000, in full settlement of their claim.

(b) Creditors were ₹ 16,000. They accepted Machinery valued at ₹ 18,000 in settlement of their claim.

(c) Creditors were ₹ 90,000. They accepted Building valued at ₹ 1,20,000 and paid cash to the firm ₹ 30,000.

ANSWER:

Question 6:

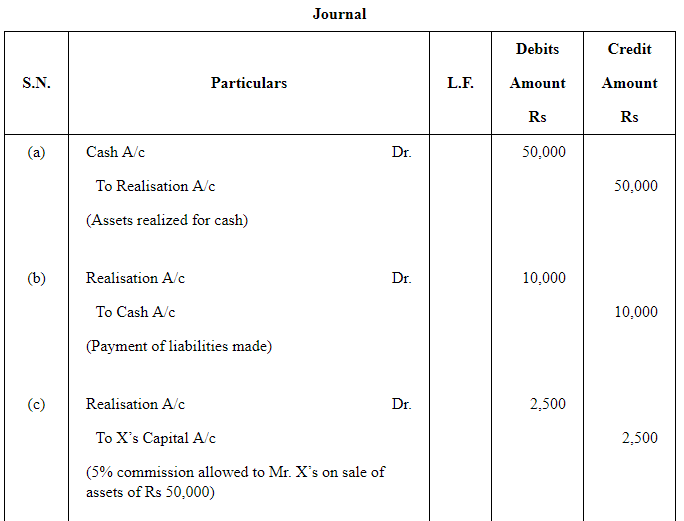

Pass Journal entries for the following at the time of dissolution of a firm:

(a) Sale of Assets − ₹ 50,000.

(b) Payment of Liabilities − ₹ 10,000.

(c) A commission of 5% allowed to Mr. X, a partner, on sale of assets.

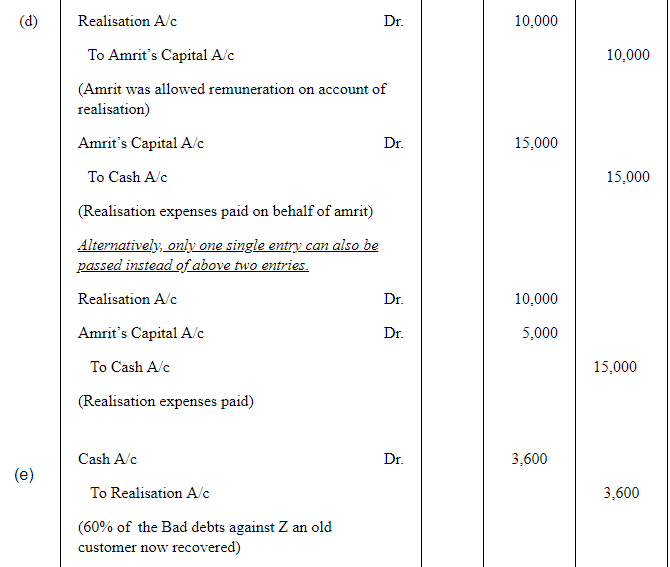

(d) Realisation expenses amounted to ₹ 15,000. The firm had agreed with Amrit, a partner, to reimburse him up to ₹ 10,000.

(e) Z, an old customer, whose account for ₹ 6,000 was written off as bad in the previous year, paid 60% of the amount written off.

(f) Investment (Book Value ₹ 10,000) realised at 150%.

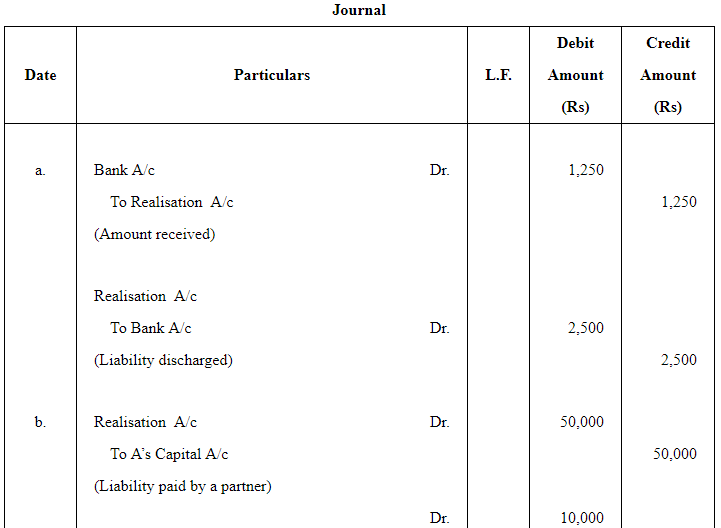

ANSWER:

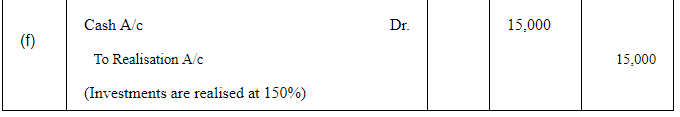

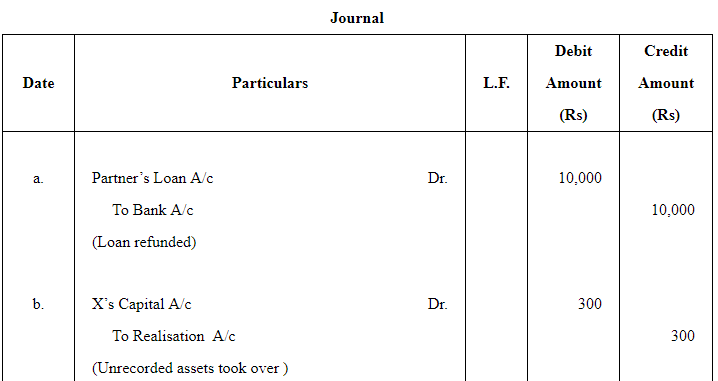

Question 7:

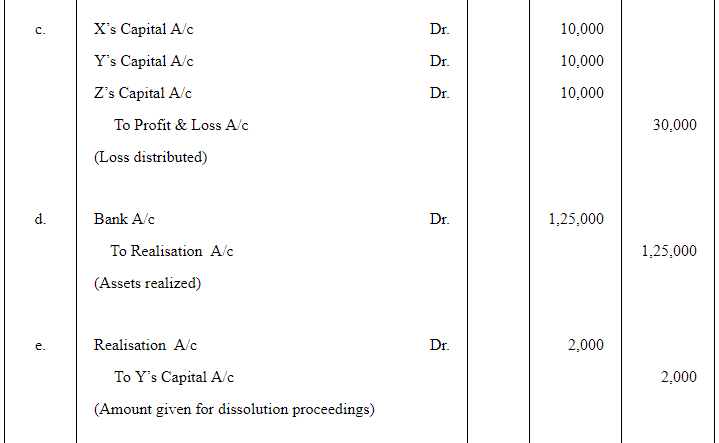

Pass Journal entries for the following transactions at the time of dissolution of the firm:

(a) Loan of ₹ 10,000 advanced by a partner to the firm was refunded.

(b) X, a partner, takes over an unrecorded asset (Typewriter) at ₹ 300.

(c) Undistributed balance (Debit) of Profit and Loss Account ₹ 30,000. The firm has three partners X,Y and Z.

(d) Assets of the firm realised ₹ 1,25,000.

(e) Y who undertakes to carry out the dissolution proceedings is paid ₹ 2,000 for the same.

(f) Creditors are paid ₹ 28,000 in full settlement of their account of ₹ 30,000.

ANSWER:

Page No 7.52:

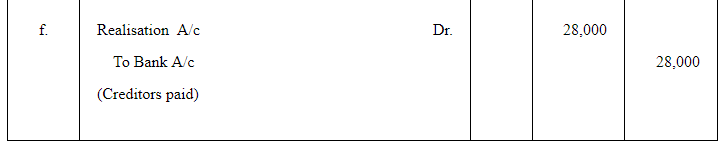

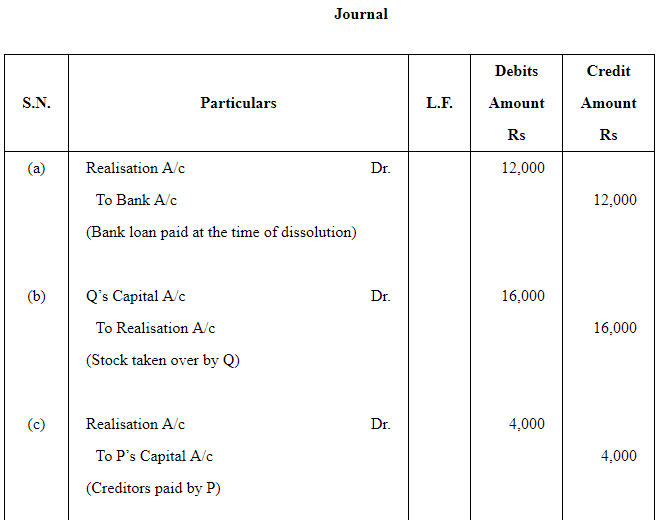

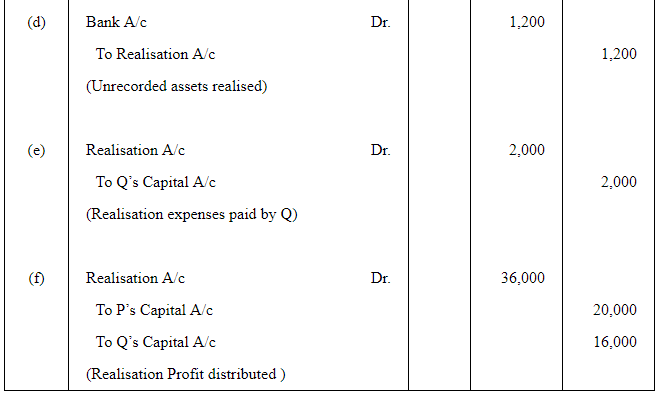

Question 8:

Pass necessary Journal entries for the following transactions on the dissolution of the firm P and Q after the various assets (other than cash) and outside liabilities have been transferred to Realisation Account:

(a) Bank Loan ₹ 12,000 was paid.

(b) Stock worth ₹ 16,000 was taken over by partner Q.

(c) Partner P paid a creditor ₹ 4,000.

(d) An asset not appearing in the books of accounts realised ₹ 1,200.

(e) Expenses of realisation ₹ 2,000 were paid by partner Q.

(f) Profit on realisation ₹ 36,000 was distributed between P and Q in 5 : 4 ratio.

ANSWER:

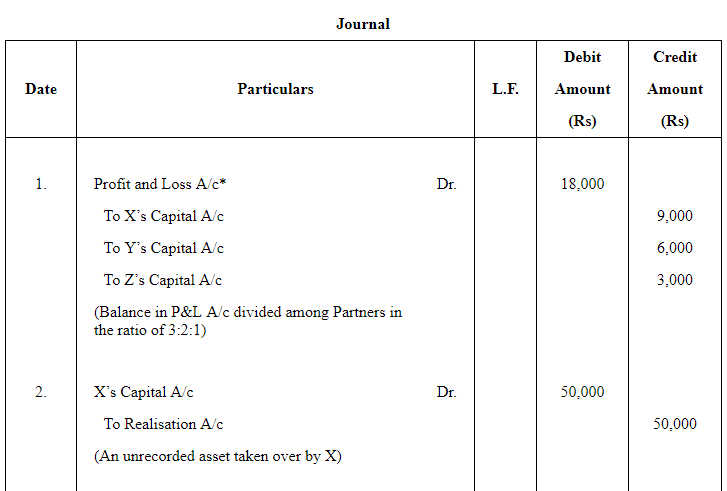

Question 9:

X, Y and Z are partners in a firm sharing profits in the ratio of 3 : 2 : 1 respectively. The firm was dissolved on 1st March, 2013. After transferring assets (other than cash) and third party liabilities to the 'Realisation Account' you are provided with the following information:

(a) There was a balance of ₹ 18,000 in the firm's Profit and Loss Account.

(b) There was an unrecorded bike of ₹ 50,000 which was taken over by X.

(c) Creditors of ₹ 5,000 were paid ₹ 4,000 in full settlement of accounts.

Pass necessary Journal entries for the above at the time of dissolution of firm.

ANSWER:

*Balance in Profit and Loss A/c always mean positive balance i.e. credit balance.

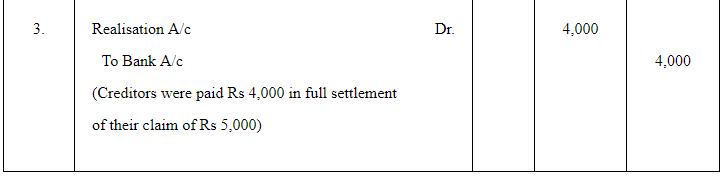

Question 10:

Pass necessary Journal entries to record the following unrecorded assets and liabilities in the books of Paras and Priya:

(a) There was an old furniture in the firm which had been written off completely in the books. This was sold for ₹ 3,000.

(b) Ashish, an old customer whose account for ₹ 1,000 was written off as bad in the previous year, paid 60%, of the amount.

(c) Paras agreed to takeover the firm's goodwill (not recorded in the books of the firm), at a valuation of ₹ 30,000.

(d) There was an old typewriter which had been written off completely from the books. It was estimated to realise ₹ 400. It was taken by Priya at an estimated price less 25%.

(e) There were 100 shares of ₹ 10 each in Star Limited acquired at a cost of ₹ 2,000 which had been written-off completely from the books. These shares are valued @ ₹ 6 each and divided among the partners in their profit-sharing ratio.

ANSWER:

Page No 7.53:

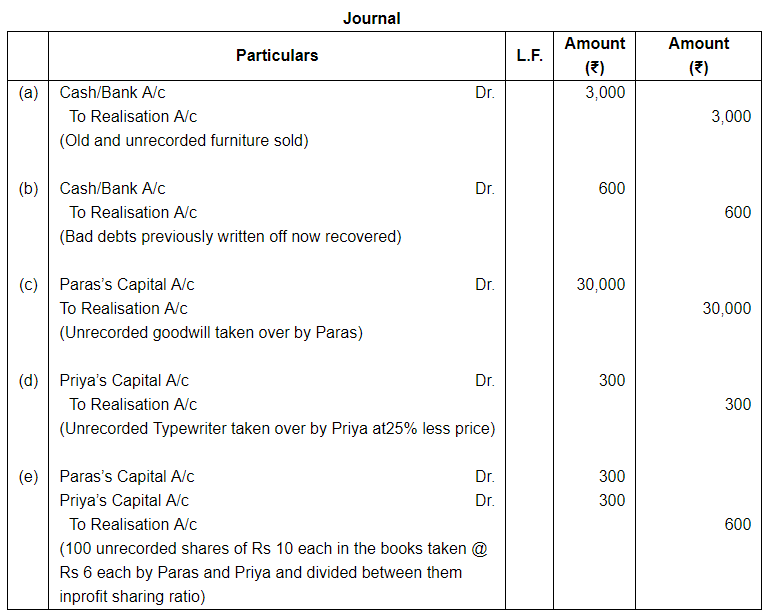

Question 11:

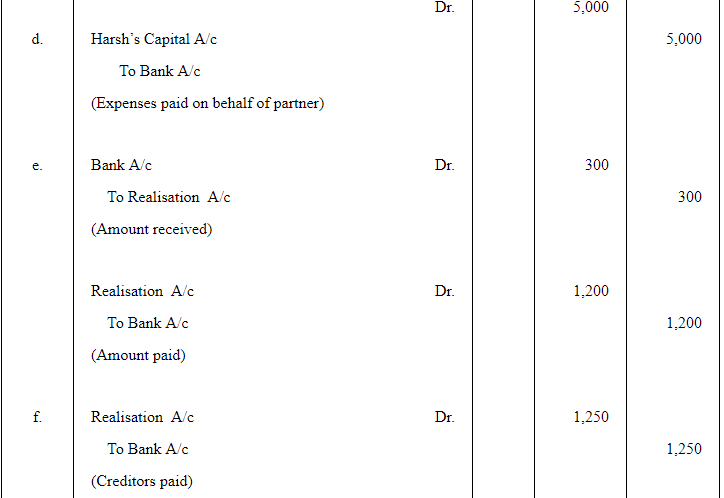

Aman and Harsh were partners in a firm. They decided to dissolve their firm. Pass necessary Journal entries for the following after various assets (other than Cash and Bank) and third party liabilities have been transferred to Realisation Account:

(a) There was furniture worth ₹ 50,000. Aman took over 50% of the furniture at 10% discount and the remaining furniture was sold at 30% profit on book value.

(b) Profit and Loss Account was showing a credit balance of ₹ 15,000 on the date of dissolution.

(c) Harsh's loan of ₹ 6,000 was discharged at ₹ 6,200.

(d) The firm paid realisation expenses amounting to ₹ 5,000 on behalf of Harsh who had to bear these expenses.

(e) There was a bill for 1,200 under discount. The bill was received from Soham who proved insolvent and a first and final dividend of 25% was received from his estate.

(f) Creditors, to whom the firm owed ₹ 6,000, accepted stock of ₹ 5,000 at a discount of 5% and the balance in cash.

ANSWER:

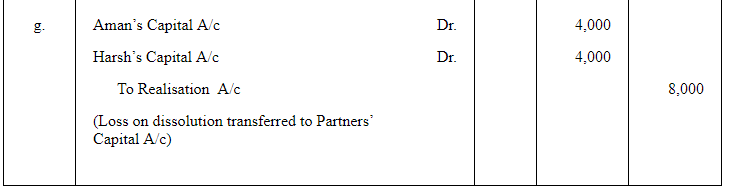

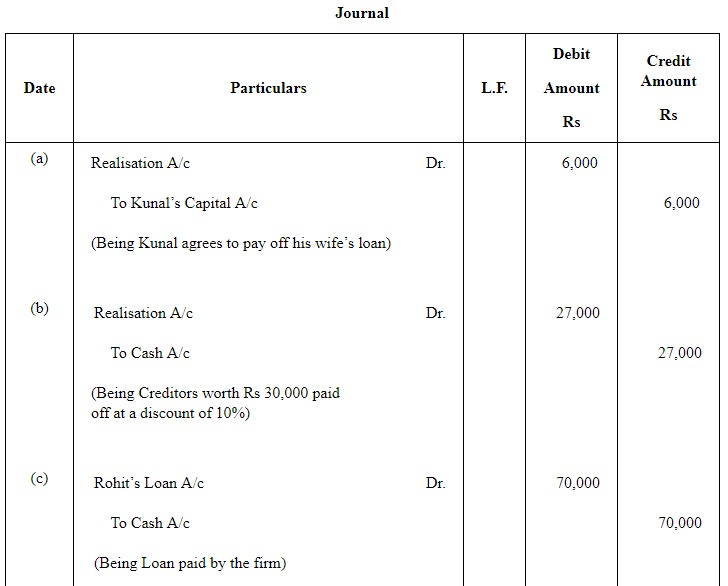

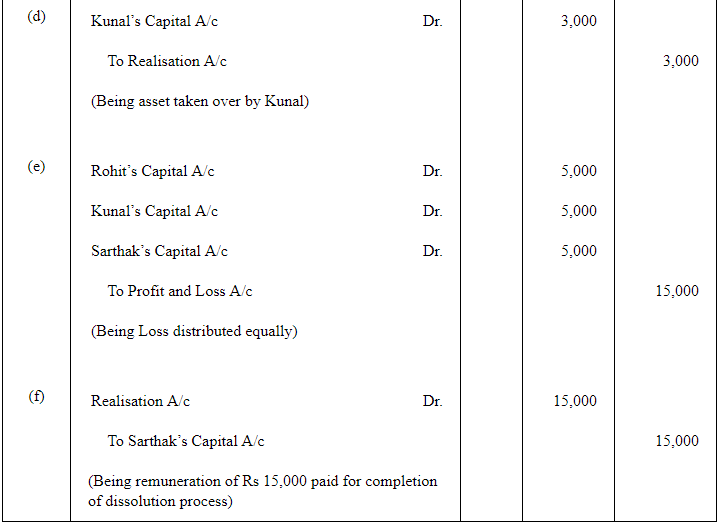

Question 12:

Rohit, Kunal and Sarthak are partners in a firm. They decided to dissolve their firm. Pass necessary Journal entries for the following after various assets (other than Cash and Bank) and the third party liability have been transferred to Realisation Account:

(a) Kunal agreed to pay off his wife's loan of ₹ 6,000.

(b) Total Creditors of the firm were ₹ 40,000. Creditors worth ₹ 10,000 were given a piece of furniture costing ₹ 8,000 in full and final settlement. Remaining Creditors allowed a discount of 10%.

(c) Rohit had given a loan of ₹ 70,000 to the firm which was duly paid.

(d) A machine which was not recorded in the books was taken over by Kunal at ₹ 3,000, whereas its expected value was ₹ 5,000.

(e) The firm had a debit balance of ₹ 15,000 in the Profit and Loss Account on the date of dissolution.

(f) Sarthak paid the realisation expenses of ₹ 16,000 out of his private funds, who was to get a remuneration of ₹ 15,000 for completing dissolution process and was responsible to bear all the realisation expenses.

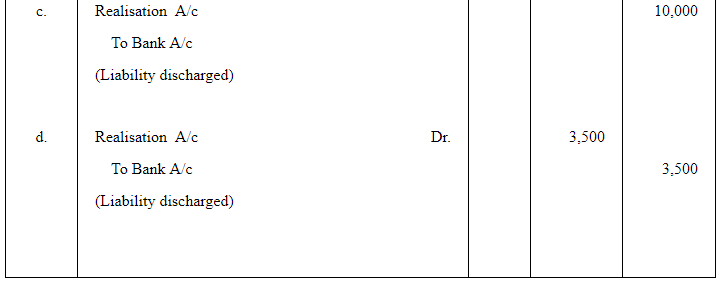

ANSWER:

Question 13:

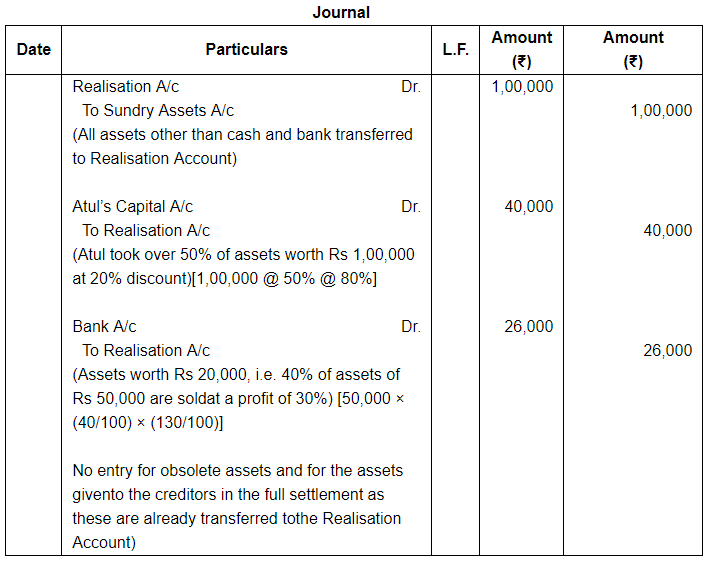

Book Value of assets (other than cash and bank) transferred to Realisation Account is ₹ 1,00,000. 50% of the assets are taken over by a partner Atul, at a discount of 20%; 40% of the remaining assets are sold at a profit of 30% on cost; 5% of the balance being obsolete, realised nothing and remaining assets are handed over to a Creditor, in full settlement of his claim.

You are required to record the Journal entries for realisation of assets.

ANSWER:

Page No 7.54:

Question 14:

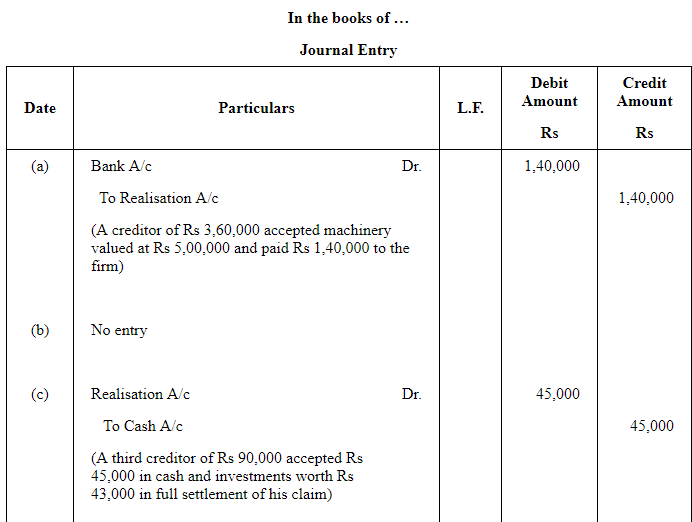

Lal and Pal were partners in a firm sharing profits in the ratio of 3 : 7. On 1st April, 2015 their firm was dissolved. After transferring assets (other than cash) and outsider's liabilities to Realisation Account, you are given the following information:

(a) A creditor of ₹ 3,60,000 accepted machinery valued at ₹ 5,00,000 and paid to the firm ₹ 1,40,000.

(b) A second creditor for ₹ 50,000 accepted stock at ₹ 45,000 in full settlement of his claim.

(c) A third creditor amounting to ₹ 90,000 accepted ₹ 45,000 in cash and investments worth ₹ 43,000 in full settlement of his claim.

(d) Loss on dissolution was ₹ 15,000.

Pass necessary Journal entries for the above transactions in the books of firm assuming that all payments were made by cheque.

ANSWER:

Question 15:

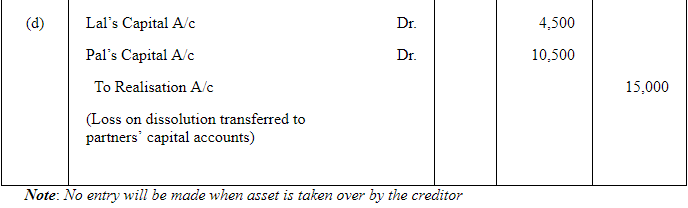

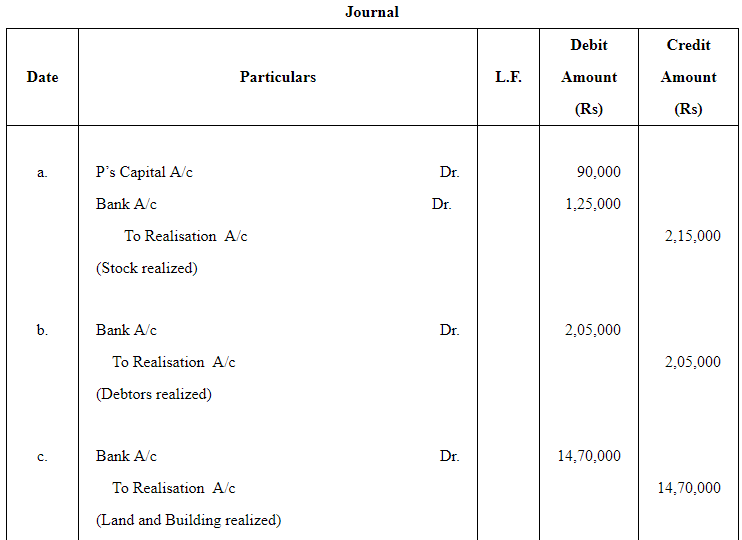

Pass the Journal entries for the following transactions on the dissolution of the firm of P and Q after various assets (other than cash) and outside liabilities have been transferred to Realisation Account:

(a) Stock ₹ 2,00,000. 'P' took over 50% of stock at a discount of 10%. Remaining stock was sold at a profit of 25% on cost.

(b) Debtors ₹ 2,25,000. Provision for Doubtful Debts ₹ 25,000. ₹ 20,000 of the book debts proved bad.

(c) Land and Building (Book value ₹ 12,50,000) sold for ₹ 15,00,000 through a broker who charged 2% commission.

(d) Machinery (Book value ₹ 6,00,000) was handed over to a creditor at a discount of 10%.

(e) Investment (Book value ₹ 60,000) realised at 125%.

(f) Goodwill of ₹ 75,000 and prepaid fire insurance of ₹ 10,000.

(g) There was an old furniture in the firm which had been written off completely in the books. This was sold for ₹ 10,000.

(h) 'Z' an old customer whose account for ₹ 20,000 was written off as bad in the previous year, paid 60%.

(i) 'P' undertook to pay Mrs. P's loan of ₹ 50,000.

(j) Trade creditors ₹ 1,60,000. Half of the trade creditors accepted Plant and Machinery at an agreed valuation of ₹ 54,000 and cash in full settlement of their claims after allowing a discount of ₹ 16,000. Remaining trade creditors were paid 90% in final settlement.

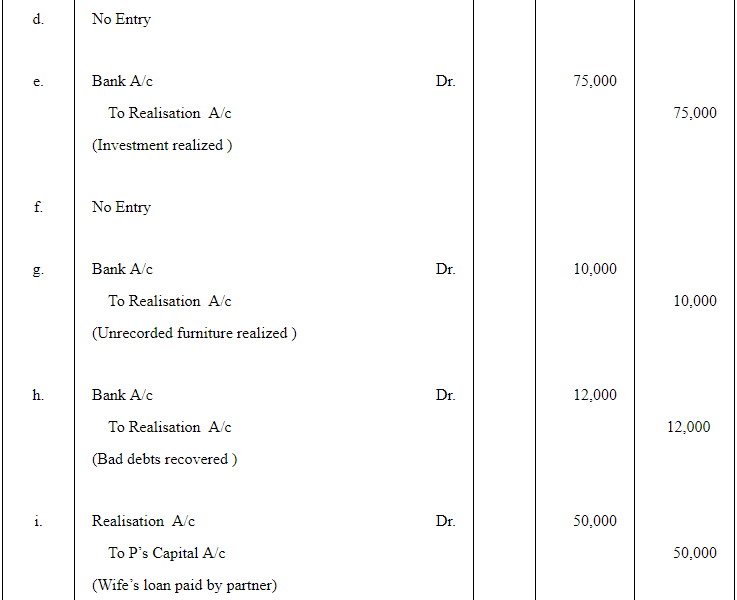

ANSWER:

Question 16:

What Journal entries would be passed for discharge of following unrecorded liabilities on the dissolution of a firm of partners A and B:

(a) There was a contingent liability in respect of bills discounted but not matured of ₹ 18,500. An acceptor of one bill of ₹ 2,500 became insolvent and fifty paise in a rupee was recovered. The liability of the firm on account of this bill discounted and dishonoured has not so far been recorded.

(b) There was a contingent liability in respect of a claim for damages for ₹ 75,000, such liability was settled for ₹ 50,000 and paid by the partner A.

(c) Firm will have to pay ₹ 10,000 as compensation to an injured employee, which was a contingent liability not accepted by the firm.

(d) ₹ 5,000 for damages claimed by a customer has been disputed by the firm. It was settled at 70% by a compromise between the customer and the firm.

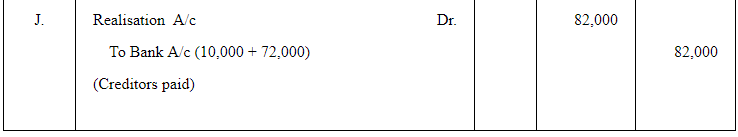

ANSWER:

Page No 7.55:

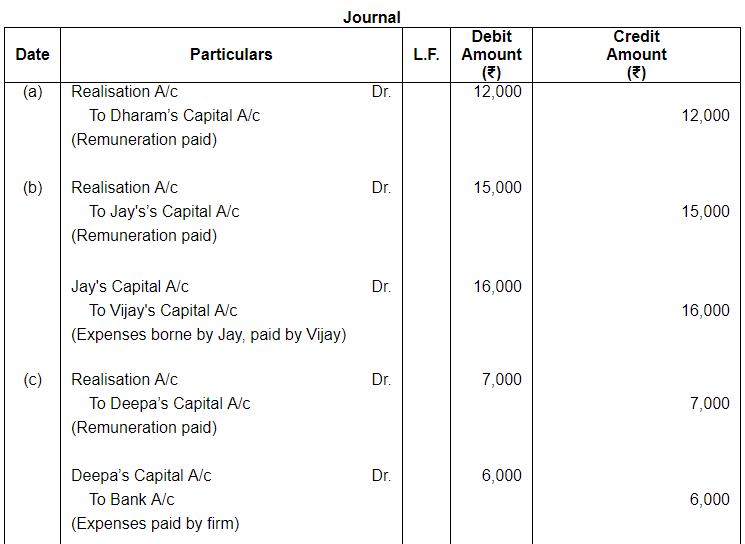

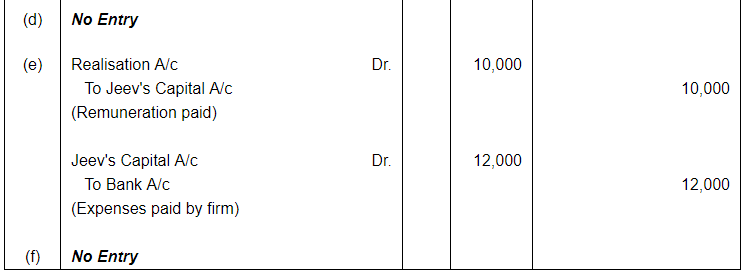

Question 17:

Pass necessary Journal entries on the dissolution of a firm in the following cases:

(a) Dharam, a partner, was appointed to look after the process of dissolution at a remuneration of ₹ 12,000 and he had to bear the dissolution expenses. Dissolution expenses ₹ 11,000 were paid by Dharam.

(b) Jay, a partner, was appointed to look after the process of dissolution and was allowed a remuneration of ₹ 15,000. Jay agreed to bear dissolution expenses. Actual dissolution expenses ₹ 16,000 were paid by Vijay, another partner on behalf of Jay.

(c) Deepa, a partner, was to look after the process of dissolution and for this work she was allowed a remuneration of ₹ 7,000. Deepa agreed to bear dissolution expenses. Actual dissolution expenses ₹ 6,000 were paid from the firm's bank account.

(d) Dev, a partner, agreed to do the work of dissolution for ₹ 7,500. He took away stock of the same amount as his commission. The stock had already been transferred to Realisation Account.

(e) Jeev, a partner, agreed to do the work of dissolution for which he was allowed a commission of ₹ 10,000. He agreed to bear the dissolution expenses. Actual dissolution expenses paid by Jeev were ₹ 12,000. These expenses were paid by Jeev by drawing cash from the firm.

(f) A debtor of ₹ 8,000 already transferred to Realisation Account agreed to pay the realisation expenses of ₹ 7,800 in full settlement of his account.

ANSWER:

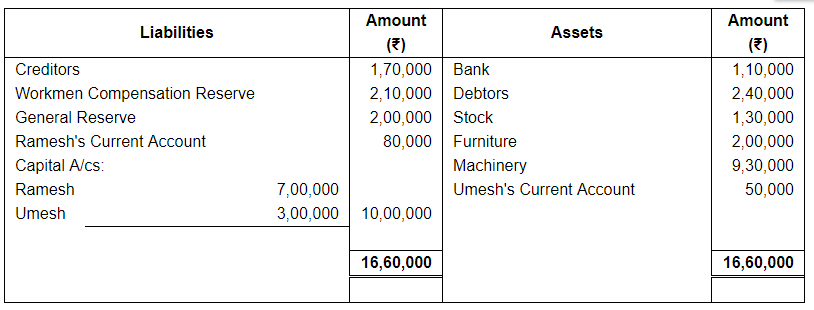

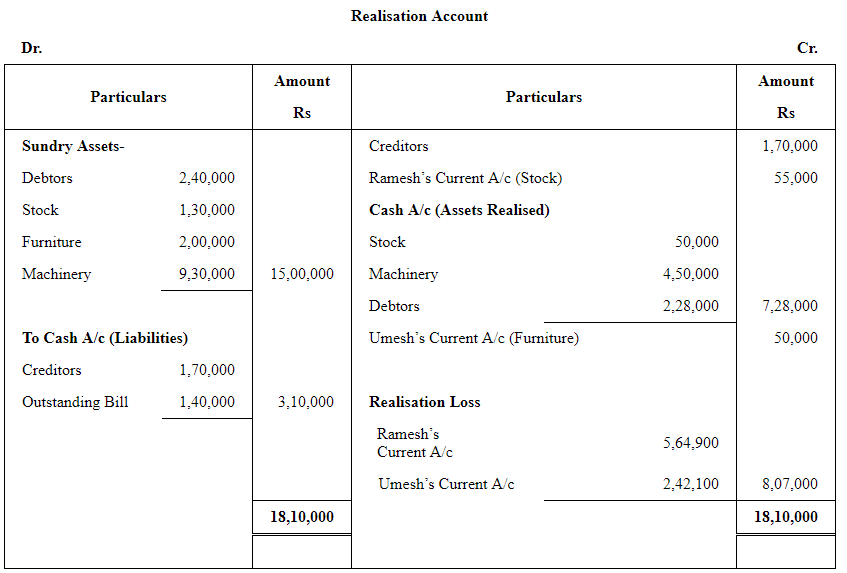

Question 18:

Ramesh and Umesh were partners in a firm sharing profits in the ratio of their capitals. On 31st March, 2013, their Balance Sheet was as follows:

On the above date the firm was dissolved.

(a) Ramesh took over 50% of stock at ₹ 10,000 less than book value. The remaining stock was sold at a loss of ₹ 15,000. Debtors were realised at a discount of 5%.

(b) Furniture was taken over by Umesh for ₹ 50,000 and machinery was sold for ₹ 4,50,000.

(c) Creditors were paid in full.

(d) There was an unrecorded bill for repairs for ₹ 1,60,000 which was settled at ₹ 1,40,000.

Prepare Realisation Account.

ANSWER:

Question 19:

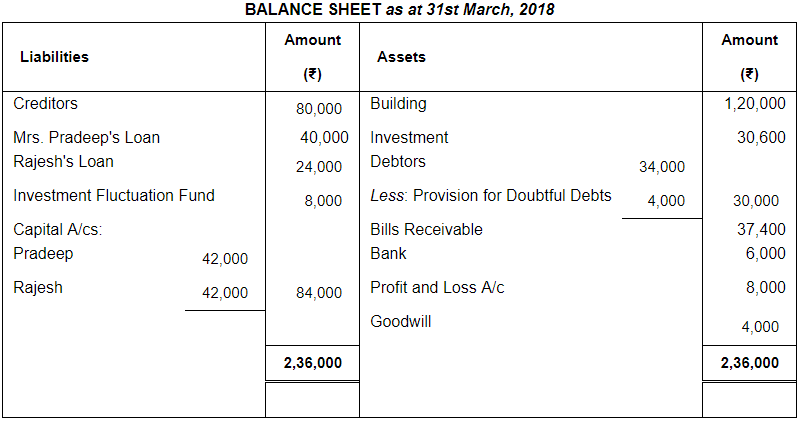

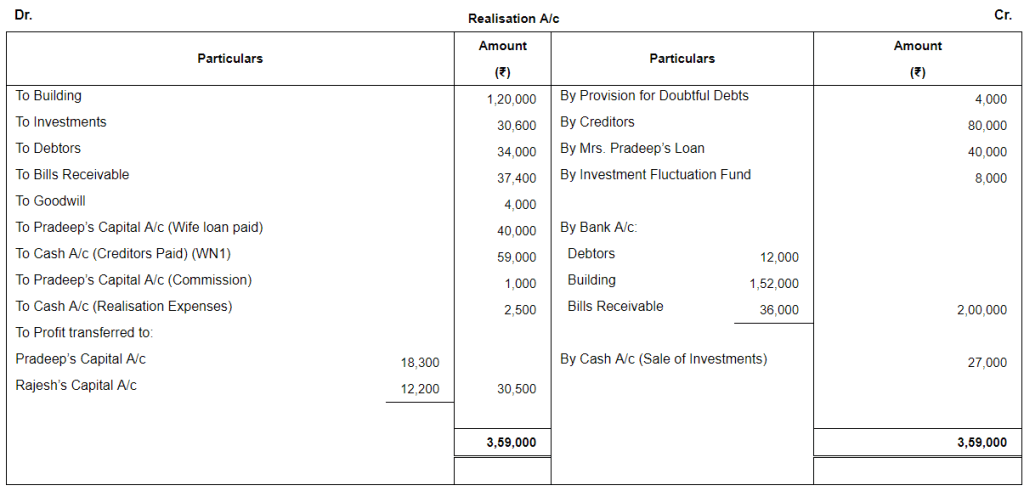

Pradeep and Rajesh were partners in a firm sharing profits and losses in the ratio of 3 : 2. They decided to dissolve their partnership firm on 31st March, 2018. Pradeep was deputed to realise the assets and to pay off the liabilities. He was paid ₹ 1,000 as commission for his services. The financial position of the firm on 31st March, 2018 was as follows:

Following terms and conditions were agreed upon:

(a) Pradeep agreed to pay off his wife's loan.

(b) Half of the debtors realised ₹ 12,000 and remaining debtors were used to pay off 25% of the creditors.

(c) Investment sold to Rajesh for ₹ 27,000.

(d) Building realised ₹ 1,52,000.

(e) Remaining creditors were to be paid after two months, they were paid immediately at 10% p.a. discount.

(f) Bill receivables were settled at a loss of ₹ 1,400.

(g) Realisation expenses amounted to ₹ 2,500.

Prepare Realisation Account.

ANSWER:

Working Notes:

Remaining Creditors to be paid = ₹ (80,000 × 75/100) = ₹ 60,000

Discount Received on Creditors = ₹ (60,000 × 10/100 × 2/12) = ₹ 1,000

Amount paid to the Creditors = ₹ (60,000 – 1,000) = ₹ 59,000

Page No 7.56:

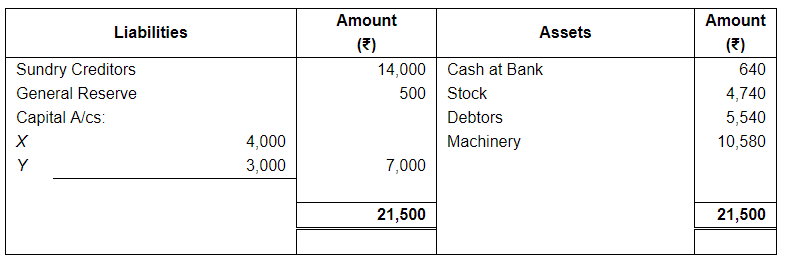

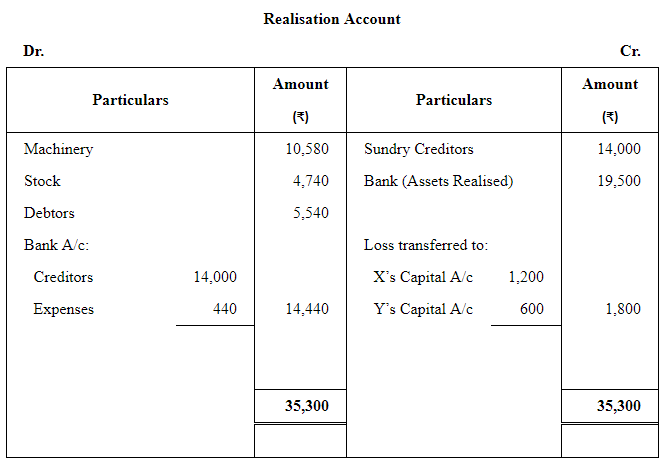

Question 20:

Balance Sheet of a firm as at 31st March, 2019, when it was decided to dissolve the same, was:

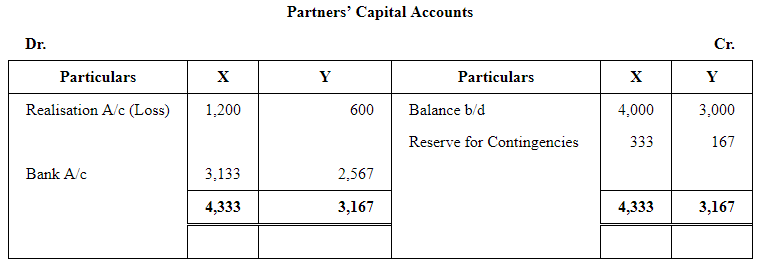

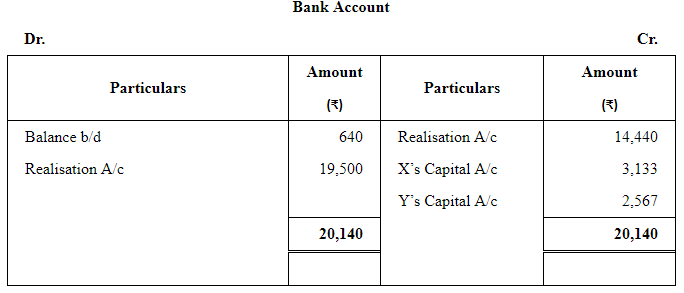

₹19,500 were realised from all assets except Cash at Bank. The cost of winding up came to ₹ 440. X and Y shared profits in the ratio of 2 : 1 respectively.

Prepare Realisation Account and Capital Accounts of Partners.

ANSWER:

Question 21:

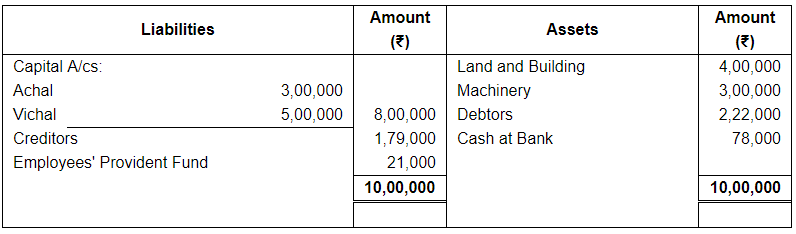

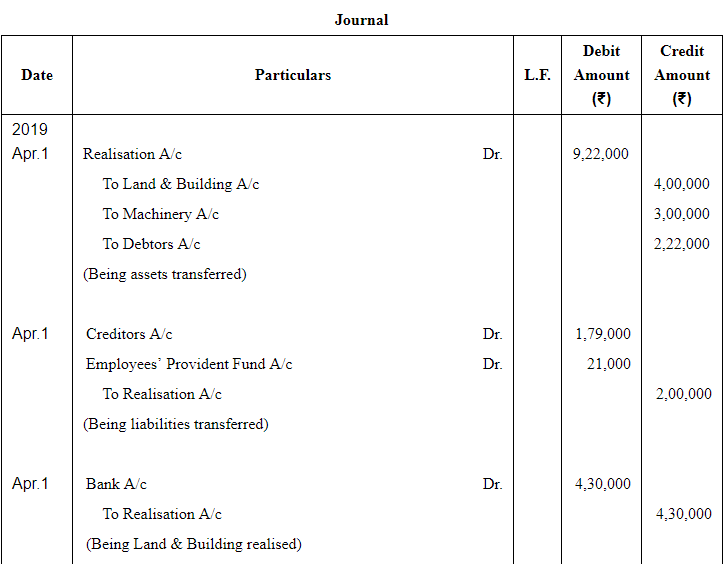

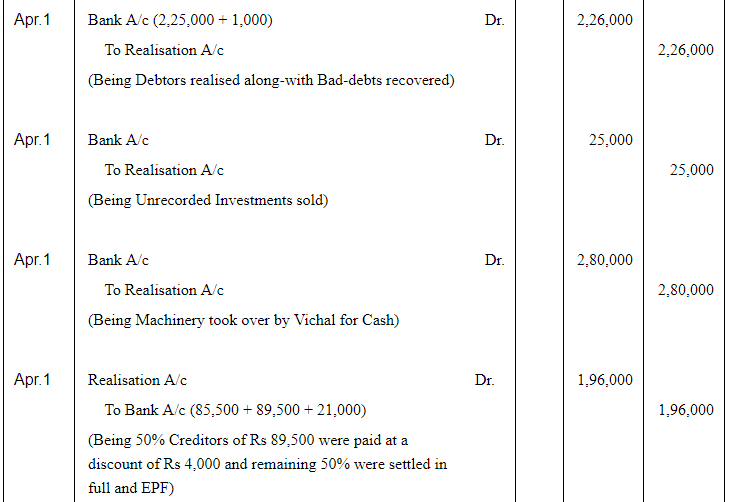

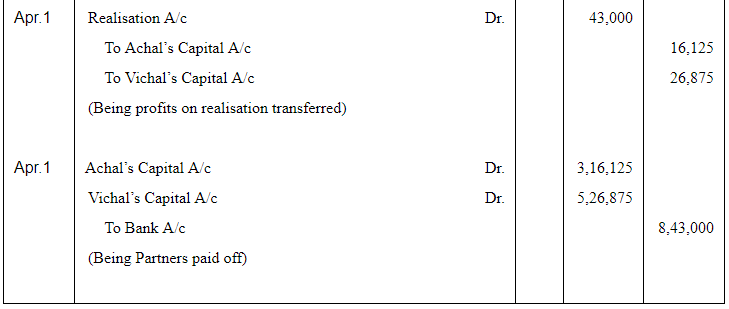

Achal and Vichal were partners in a firm sharing profits in the ratio of 3 : 5. On 31st March, 2019, their Balance Sheet was as follows:

The firm was dissolved on 1st April, 2019 and the Assets and Liabilities were settled as follows:

(a) Land and Building realised ₹ 4,30,000.

(b) Debtors realised ₹ 2,25,000 (with interest) and ₹ 1,000 were recovered for Bad Debts written off last year.

(c) There was an Unrecorded Investment which was sold for ₹ 25,000.

(d) Vichal took over Machinery at ₹ 2,80,000 for cash.

(e) 50% of the Creditors were paid ₹ 4,000 less in full settlement and the remaining Creditors were paid full amount.

Pass necessary Journal entries for dissolution of the firm.

ANSWER:

|

42 videos|168 docs|43 tests

|

FAQs on Dissolution of a Partnership Firm ( Part - 1) - Accountancy Class 12 - Commerce

| 1. What is the meaning of dissolution of a partnership firm? |  |

| 2. What are the reasons for the dissolution of a partnership firm? |  |

| 3. What is the process of dissolution of a partnership firm? |  |

| 4. What are the implications of the dissolution of a partnership firm? |  |

| 5. Can a partnership firm be dissolved without the consent of all partners? |  |

|

Explore Courses for Commerce exam

|

|