Dissolution of a Partnership Firm ( Part - 3) | Accountancy Class 12 - Commerce PDF Download

Page No 7.63:

Question 35:

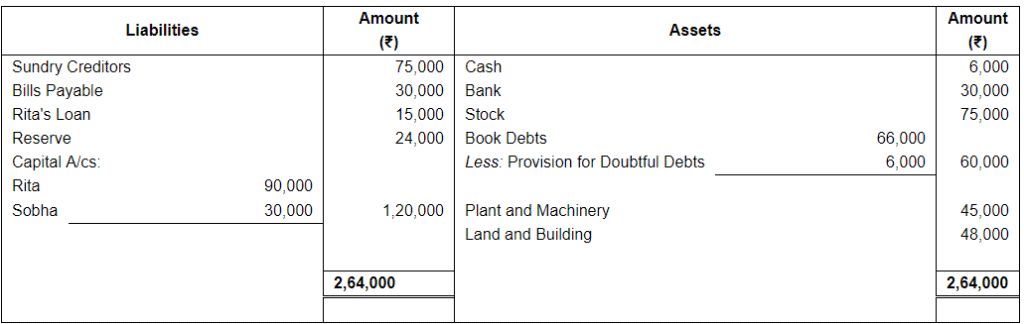

Rita and Sobha are partners in a firm, Fancy Garments Exports, sharing profits and losses equally. On 1st April, 2019, the Balance Sheet of the firm was:

The firm was dissolved on the date given above. The following transactions took place:

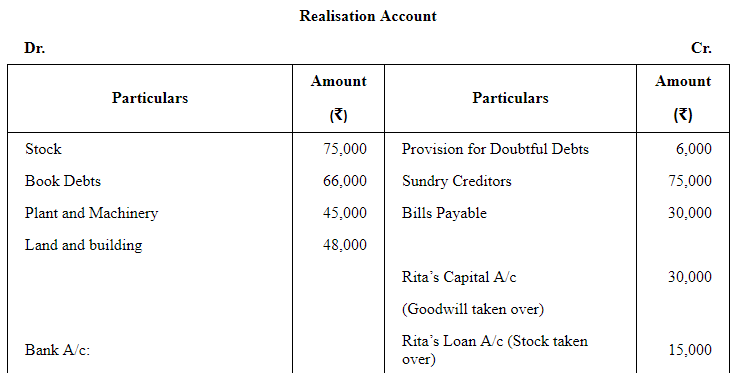

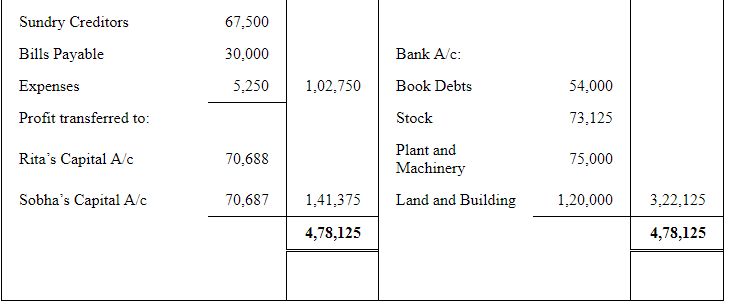

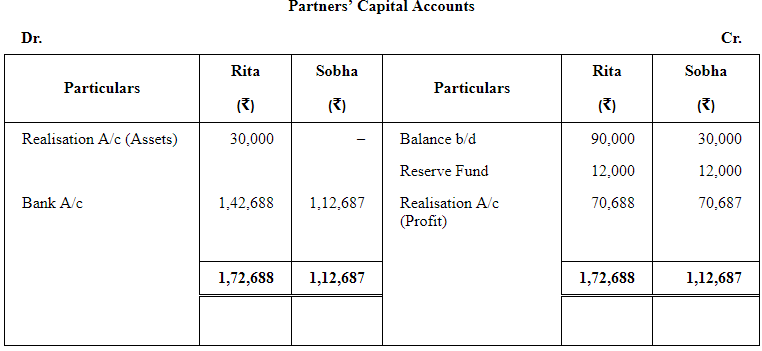

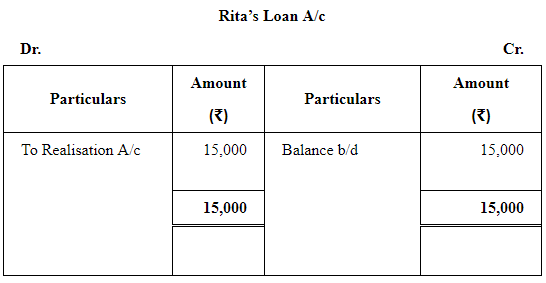

(a) Rita took 25% of the Stock at a discount of 20% in settlement of her loan.

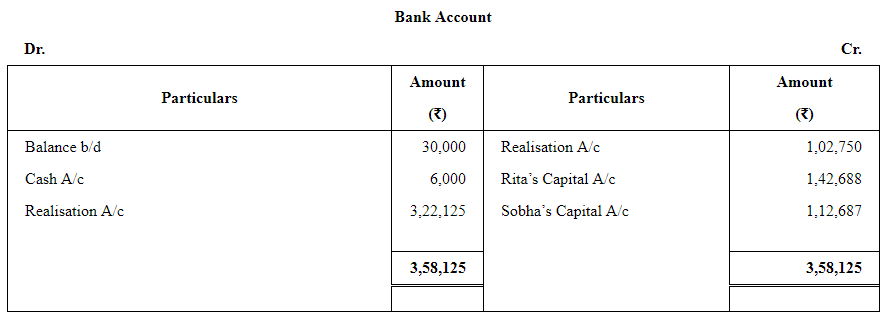

(b) Book Debts realised ₹ 54,000; balance of the Stock was sold at a profit of 30% on cost.

(c) Sundry Creditors were paid out at a discount of 10%. Bills Payable were paid in full .

(d) Plant and Machinery realised ₹ 75,000. Land and Building ₹ 1,20,000.

(e) Rita took the goodwill of the firm at a value of ₹ 30,000.

(f) An unrecorded asset of ₹ 6,900 was handed over to an unrecorded liability of ₹ 6,000 in full settlement.

(g) Realisation expenses were ₹ 5,250.

Show Realisation Account, Partners' Capital Accounts and Bank Account in the books of the firm.

ANSWER:

Working Notes:

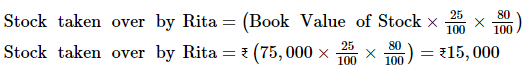

WN1: Value of Stock Taken Over by Rita

[Since stock is taken over at a discount of 20%]

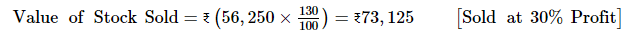

WN2: Value of Stock Sold

Book Value of Balance of Stock Sold=Value of Stock − Stock Taken over by Rita

Book Value of Balance of Stock Sold=₹(75,000 − 18,750)= ₹56,250

Page No 7.63:

Question 36:

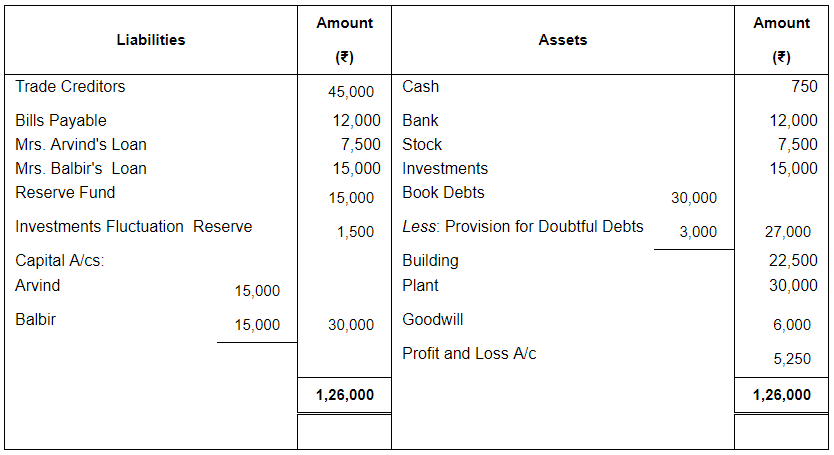

Following is the Balance Sheet of Arvind and Balbir as at 31st March, 2019:

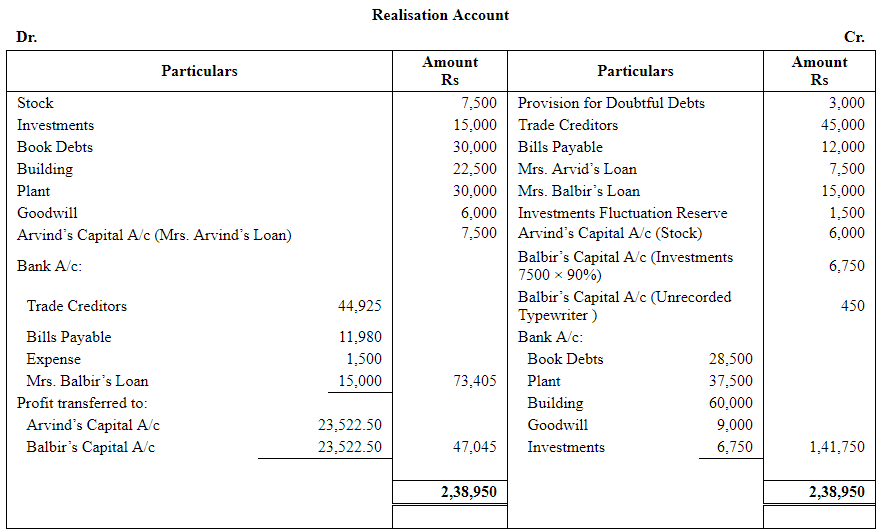

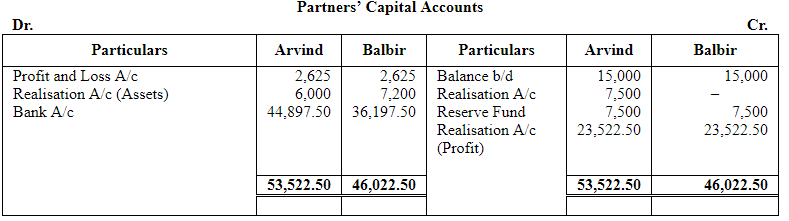

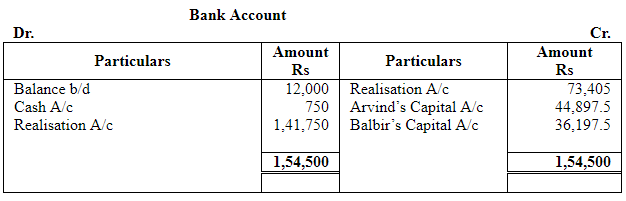

The firm was dissolved on the above date under the following arrangement:

(a) Arvind promised to pay off Mrs. Arvind's Loan and took Stock at ₹ 6,000.

(b) Balbir took half the Investments @ 10% discount.

(c) Book Debts realised ₹ 28,500.

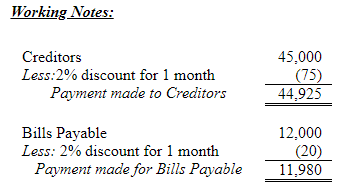

(d) Trade Creditors and Bills Payable were due on average basis of one month after 31st March, but were paid immediately on 31st March @ 2% discount per annum.

(e) Plant realised ₹ 37,500; Building ₹ 60,000; Goodwill ₹ 9,000 and remaining Investments ₹ 6,750.

(f) An old typewriter, written off completely from the firm's books, now estimated to realise ₹ 450. It was taken by Balbir at this estimated price.

(g) Realisation expenses were ₹ 1,500.

Show Realisation Account, Capital Accounts of Partners and Bank Account.

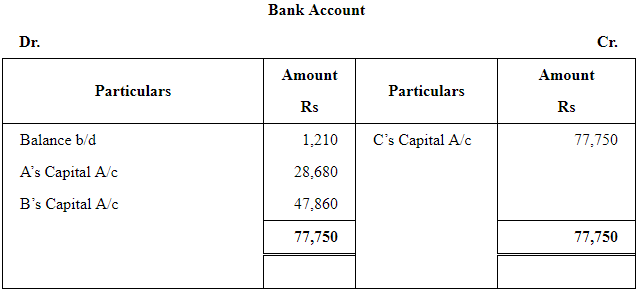

ANSWER:

Page No 7.64:

Question 37:

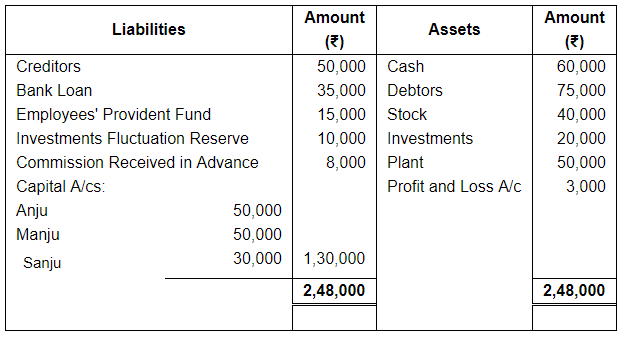

Anju, Manju and Sanju were partners in a firm sharing profits in the ratio of 2 : 2 : 1. On 31st March, 2019, their Balance Sheet was:

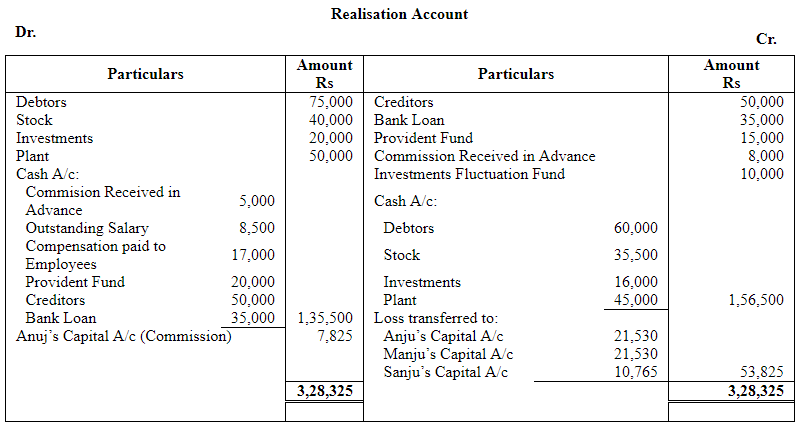

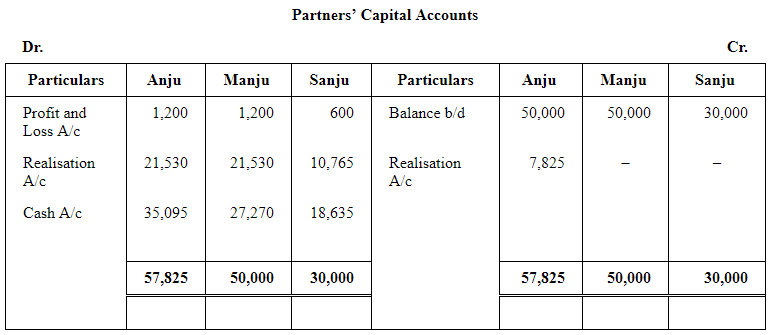

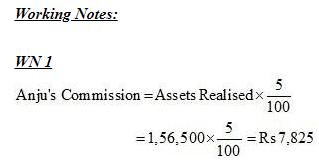

On this date, the firm was dissolved. Anju was appointed to realise the assets. Anju was to receive 5% commission on the sale of assets (except cash) and was to bear all expenses of realisation.

Anju realised the assets as follows: Debtors ₹ 60,000; Stock ₹ 35,500; Investments ₹ 16,000; Plant 90% of the book value. Expenses of Realisation amounted to ₹ 7,500. Commission received in advance was returned to customers after deducting ₹ 3,000.

Firm had to pay ₹ 8,500 for Outstanding Salary, not provided for earlier, Compensation paid to employees amounted to ₹ 17,000. This liability was not provided for in the above Balance Sheet. ₹ 20,000 had to be paid for Employees' Provident Fund.

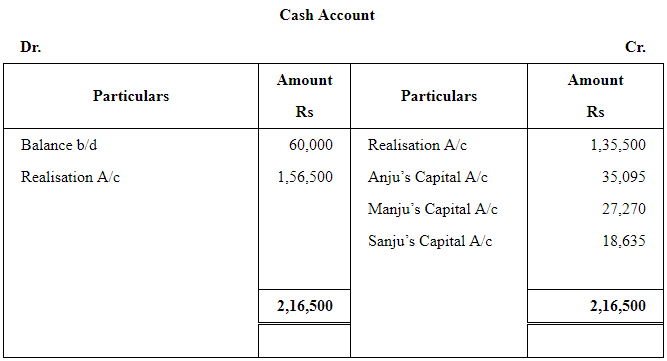

Prepare Realisation Account, Capital Accounts of Partners and Cash Account.

ANSWER:

Page No 7.64:

Question 38:

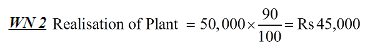

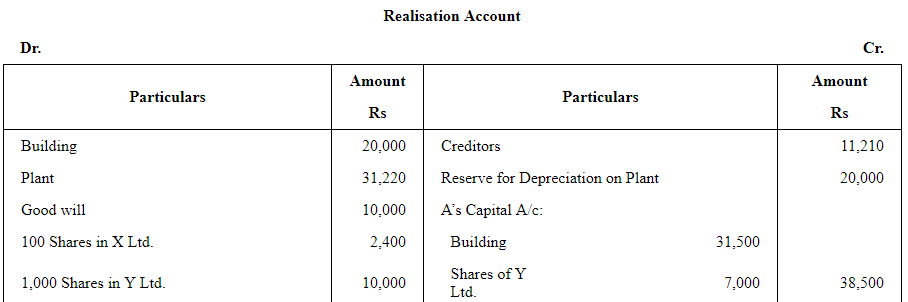

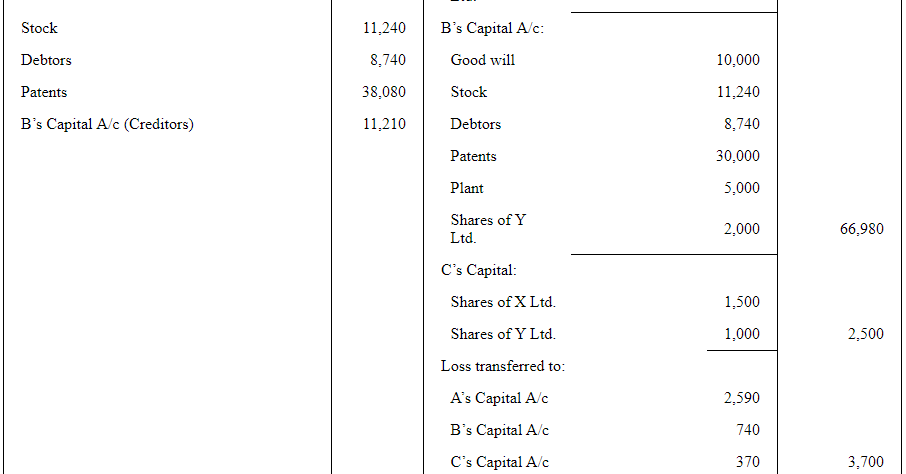

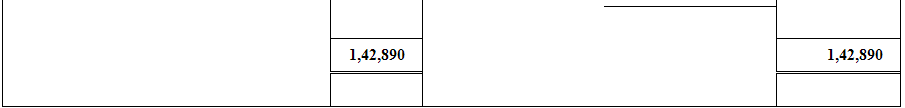

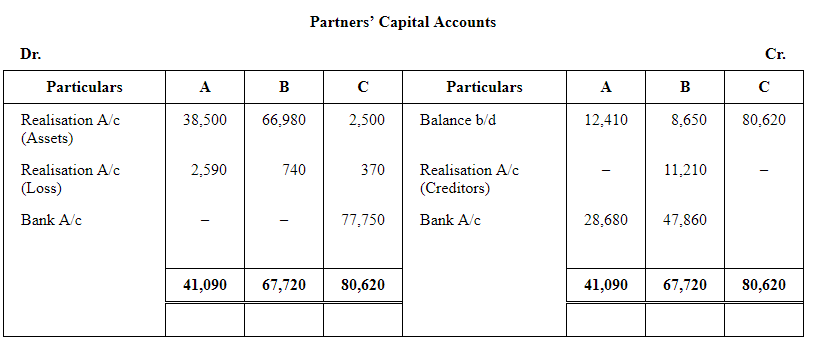

A, B and C were in partnership sharing profits in the ratio of 7 : 2 : 1 and the Balance Sheet of the firm as at 31st March, 2019 was:

It was agreed to dissolve the partnership as on 31st March, 2019 and the terms of dissolution were−

(a) A to take over the Building at an agreed amount of ₹ 31,500.

(b) B, who was to carry on the business, to take over the Goodwill, Stock and Debtors at book value, the Patents at ₹ 30,000 and Plant at ₹ 5,000. He was also to pay the Creditors.

(c) C to take over shares in X Ltd. at ₹ 15 each.

(d) The shares in Y Ltd. to be divided in the profit-sharing ratio.

Show Ledger Accounts recording the dissolution in the books of the firm.

ANSWER:

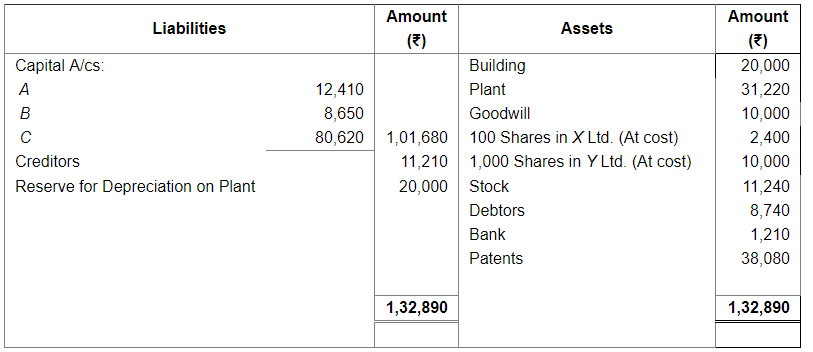

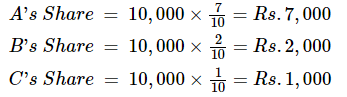

Working Notes:

Distribution of Shares in Y Ltd.

Distribution of shares in Y Ltd. among the partners

Page No 7.65:

Question 39:

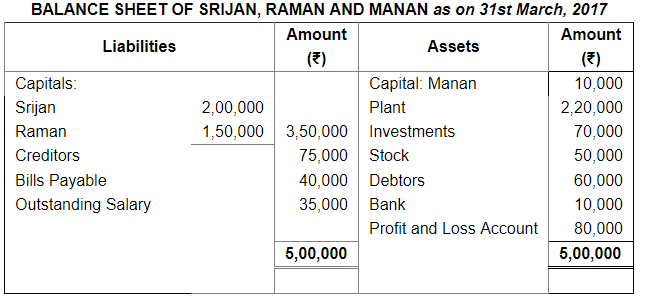

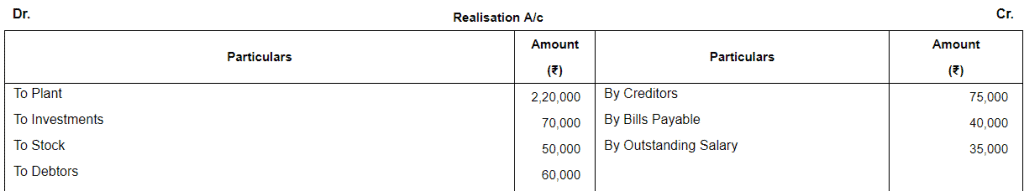

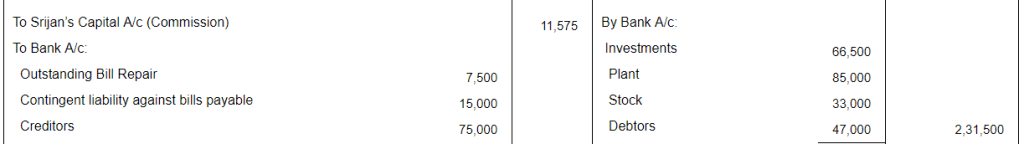

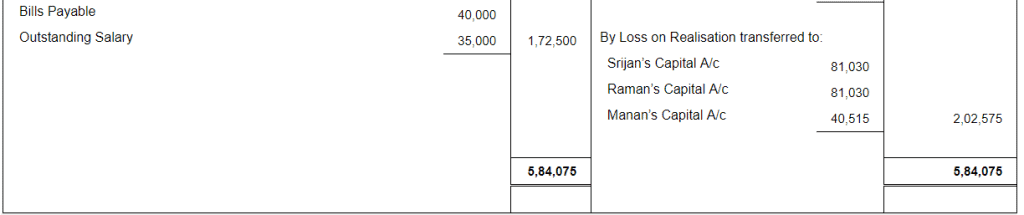

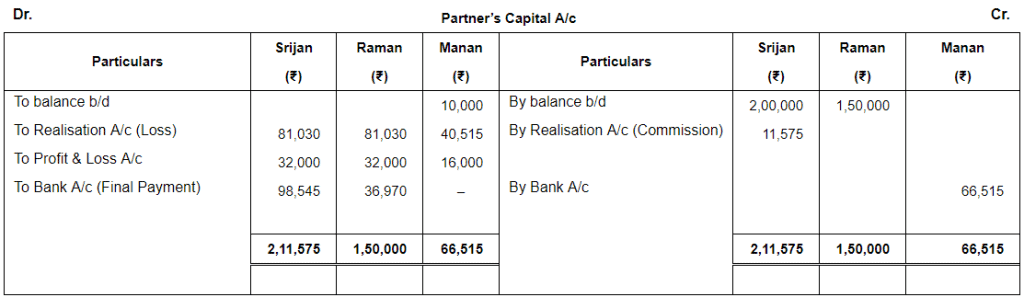

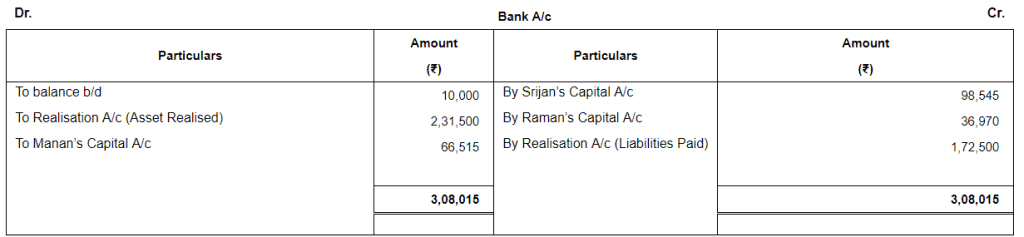

Srijan, Raman and Manan were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. On 31st, March, 2017 their Balance Sheet was as follows:

On the above date they decided to dissolve the firm.

(a) Srijan was appointed to realise the assets and discharge the liabilities. Srijan was to receive 5% commission on sale of assets (except cash) and was to bear all expenses of realisation.

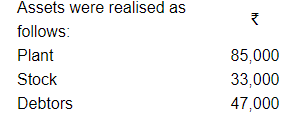

(b)

(c) Investments were realised at 95% of the book value.

(d) The firm had to pay ₹ 7,500 for an outstanding repair bill not provided for earlier.

(e) A contingent liabillity in respect of bills receivable, discounted with the bank had also materialised and had to be discharged for ₹ 15,000.

(f) Expenses of realisation amounting to ₹ 3,000 were paid by Srijan.

Prepare Realisation Account, Partners' Capital Accounts and Bank Account.

ANSWER:

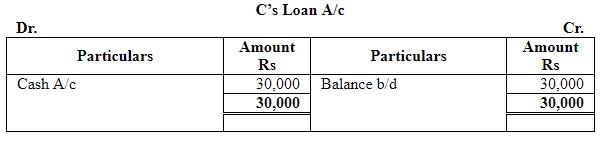

Question 40:

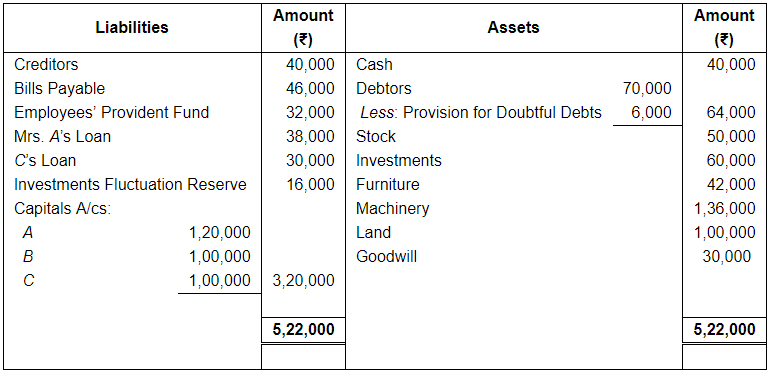

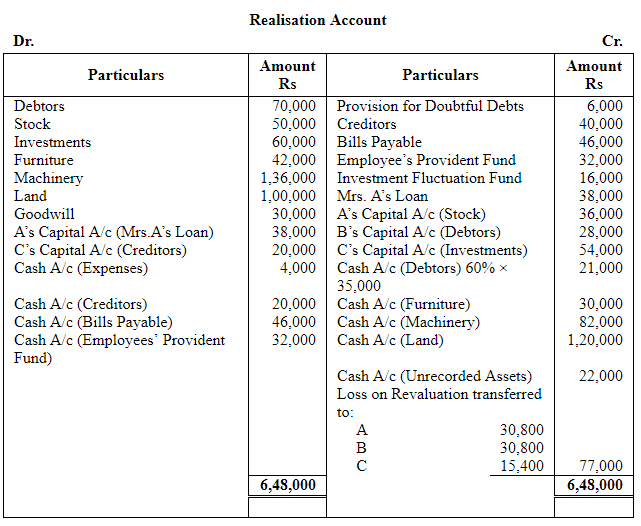

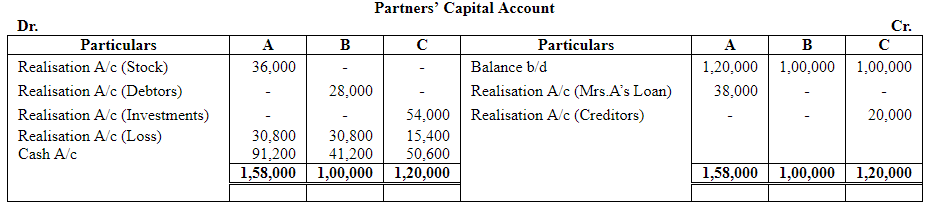

A, B and C were partners sharing profits in the ratio of 2 : 2 : 1. They decided to dissolve their firm on 31st March, 2019 when the Balance Sheet was:

Following transactions took place:

(a) A took over Stock at ₹ 36,000. He also took over his wife's loan.

(b) B took over half of Debtors at ₹ 28,000.

(c) C took over Investments at ₹ 54,000 and half of Creditors at their book value.

(d) Remaining Debtors realised 60% of their book value. Furniture sold for ₹ 30,000; Machinery ₹ 82,000 and Land ₹ 1,20,000.

(e) An unrecorded asset was sold for ₹ 22,000.

(f) Realisation expenses amounted to ₹ 4,000.

Prepare necessary Ledger Accounts to close the books of the firm.

ANSWER:

Page No 7.66:

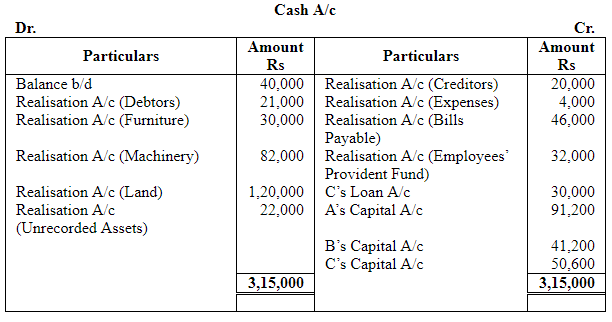

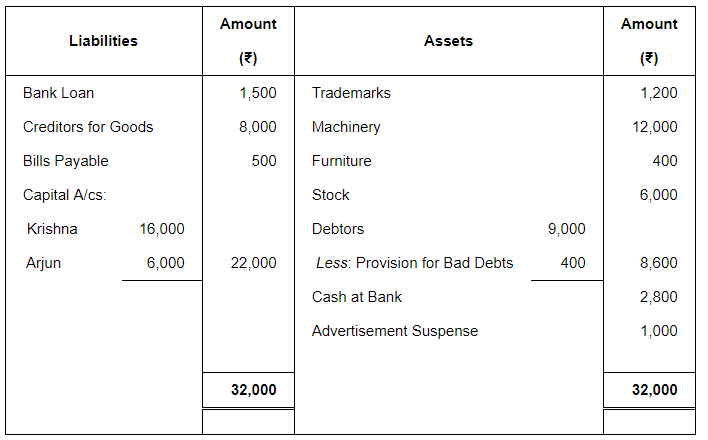

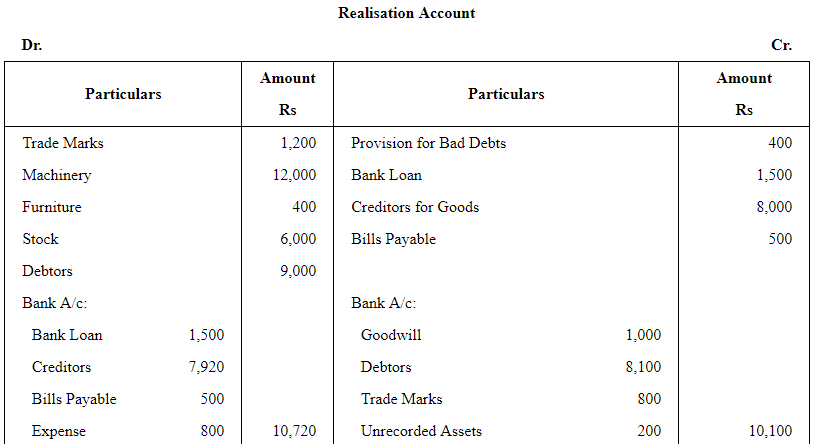

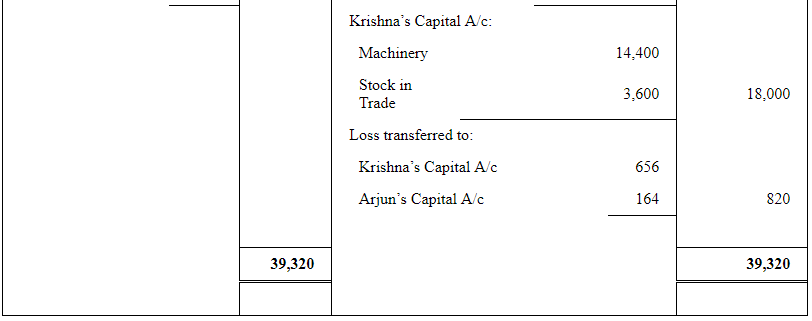

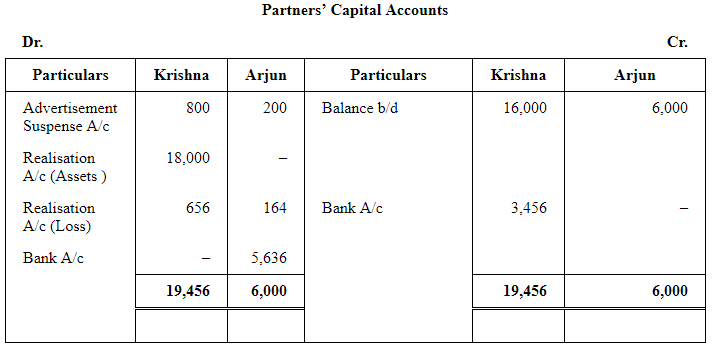

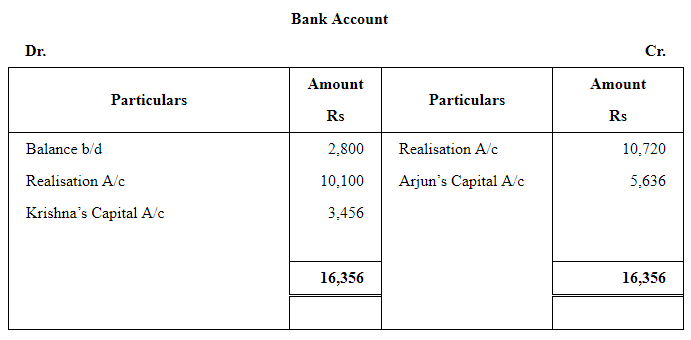

Question 41:

Krishna and Arjun are partners in a firm. They share profits in the ratio of 4 : 1. They decide to dissolve the firm on 31st March, 2019 at which date their Balance Sheet stood as:

The realisation shows the following results:

(a) Goodwill was sold for ₹ 1,000.

(b) Debtors were realised at book value less 10%.

(c) Trademarks realised ₹ 800.

(d) Machinery and Stock-in-Trade were taken by Krishna for ₹ 14,400 and ₹ 3,600 respectively.

(e) An unrecorded asset estimated at ₹ 500 was sold for ₹ 200.

(f) Creditors for goods were settled at a discount of ₹ 80. The expenses on realisation were ₹ 800.

Prepare Realisation Account, Partners' Capital Accounts and Bank Account.

ANSWER:

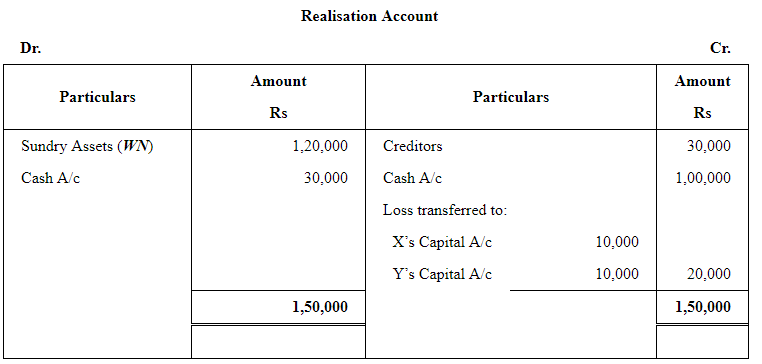

Question 42:

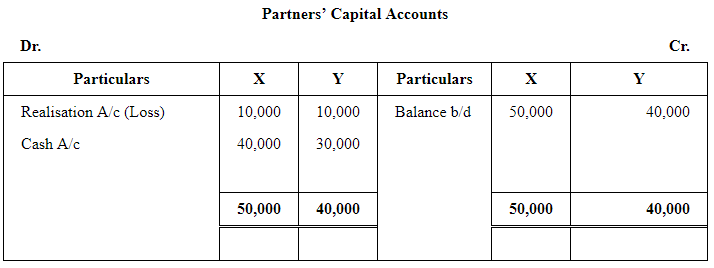

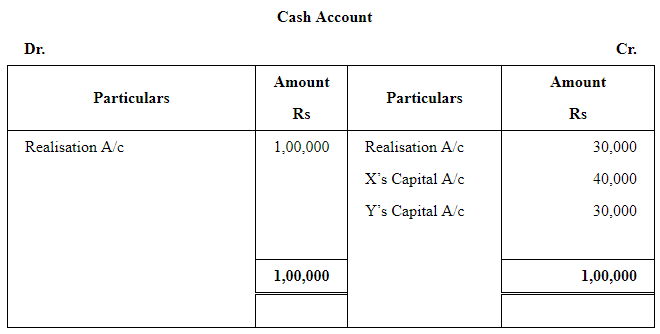

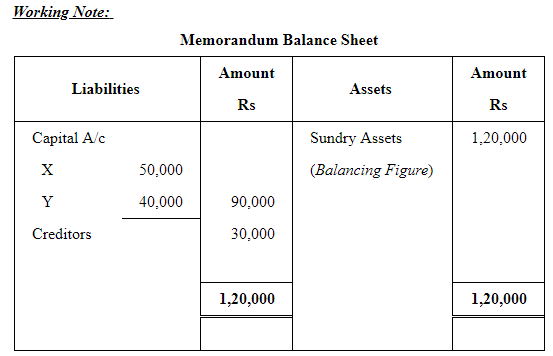

There are two partners X and Y in a firm and their capitals are ₹ 50,000 and ₹ 40,000. The creditors are ₹ 30,000. The assets of the firm realise ₹ 1,00,000. How much will X and Y receive?

ANSWER:

Question 43:

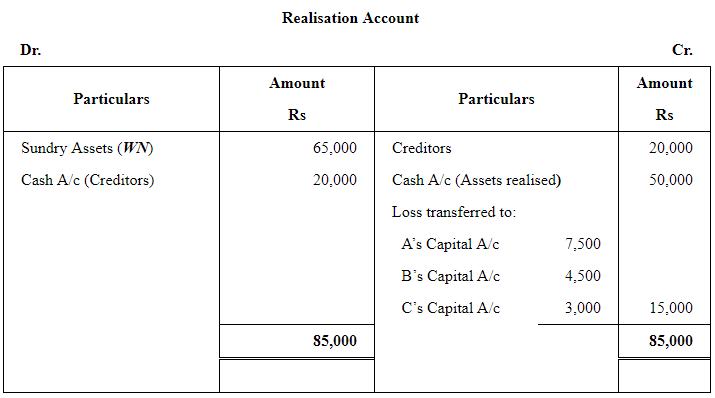

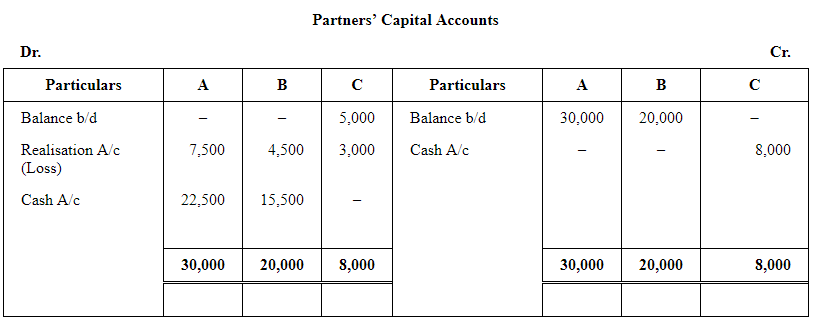

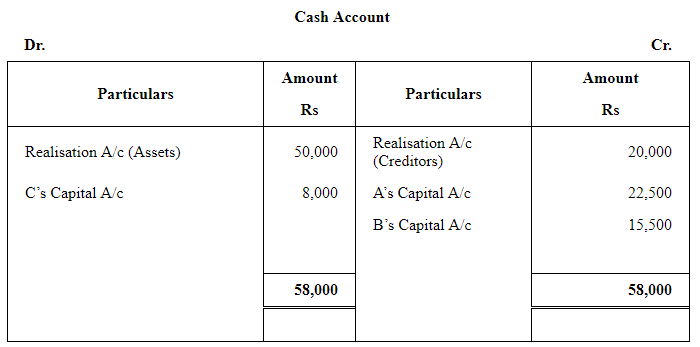

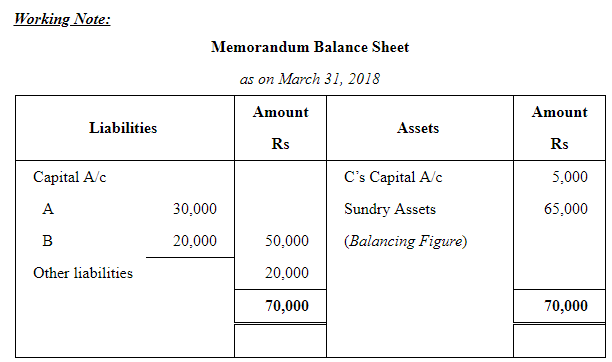

A, B and C were partners sharing profits in the ratio of 5 : 3 : 2. On 31st March, 2019, A's Capital and B's Capital were ₹ 30,000 and ₹ 20,000 respectively but C owed ₹ 5,000 to the firm. The liabilities were ₹ 20,000. The assets of the firm realised ₹ 50,000.

Prepare Realisation Account, Partner's Capital Accounts and Bank Account.

ANSWER:

WN 2

Question 54:

X, Y and Z entered into partnership on 1st April, 2016. They contributed capital ₹ 40,000, ₹ 30,000 and ₹ 20,000 respectively and agreed to share profits in the ratio of 3 : 2 : 1. Interest on capital was to be allowed @ 15% p.a. and interest on drawings was to be charged at an average rate of 5%. During the two years ended 31st March, 2018, the firm made profit of ₹ 21,600 and ₹ 25,140 respectively before allowing or charging interest on capital and drawings. The drawings of each partner were ₹ 6,000 per year.

On 31st March, 2018, the partners decided to dissolve the partnership due to difference of opinion. On that date, the creditors amounted to ₹ 20,000. The assets, other than cash ₹ 2,000, realised ₹ 1,21,000. Expenses of dissolution amounted to ₹ 760.

Draw up necessary Ledger Accounts to close the books of the firm.

ANSWER:

|

42 videos|168 docs|43 tests

|

FAQs on Dissolution of a Partnership Firm ( Part - 3) - Accountancy Class 12 - Commerce

| 1. What is the process of dissolving a partnership firm? |  |

| 2. How can disputes among partners be resolved during the dissolution of a partnership firm? |  |

| 3. What are the legal formalities required for the dissolution of a partnership firm? |  |

| 4. Can a partnership firm be dissolved without the consent of all partners? |  |

| 5. What are the tax implications of dissolving a partnership firm? |  |

|

Explore Courses for Commerce exam

|

|