Q.1. What is depreciation?

Ans. Depreciation is the loss in the value of fixed capital due to normal wear and tear, foreseen obsolescence and normal rate of accidental damage. It is also known as consumption of fixed capital.

Q.2. Define intermediate goods.

Ans. Intermediate goods are those goods, which are not meant for final consumption. These are raw materials used in the production of other goods and services.

Q.3. Define net exports.

Ans. Net exports refer to the difference between the value of exports (X) and the value of imports (M) of a country during an accounting year.

Q.4. What is saving?

Ans. Saving is defined as that part of National Income, which is not spent on final consumption expenditure.

Q.5. Give two examples of indirect taxes.

Ans. Examples of indirect tax:

(i) Custom Duty

(ii) Excise Duty

(iii) Sales Tax

Q.6. Define corporation tax.

Ans. Corporation tax is a tax on the income of the corporations.

Q.7. Define indirect tax.

Ans. Indirect tax is a tax collected by an intermediary (seller) from the person who bears the ultimate economic burden of the tax (buyer). Its burden can be shifted by the tax payer on someone else.

Q.8. Give two examples of intermediate goods.

Ans. Following are the two examples of intermediate goods:

(i) Cloth: Cloth is used as an intermediate good for manufacturing garments.

(ii) Steel: Steel is used as an intermediate good for manufacturing, say, bicycle.

Q.9. Distinguish between goods and services.

Ans. Goods are physical products, capable of being delivered to a purchaser. It involves the transfer of ownership from seller to buyer. For example: television, computers, car, etc.

Services are all those economic activities essentially intangible that provide satisfaction of wants and are not necessarily linked to the sale of a product. For example: transportation, banking, insurance, etc.

Q.10. What is the difference between final and intermediate good?

Ans. Final goods are those goods which are ready for consumption or capital formation by final users. Intermediate goods, on the other hand, are those goods which not meant for final consumption. These are raw materials used in the production of other goods and services.

For example: A chair is a final good, but wood, cane, foam, cloth, etc. used to produce chair are all intermediary goods.

Q.11. Distinguish between consumer goods and capital goods.Which of these are final goods?

Ans. Consumer goods are those goods which directly satisfy the wants of the consumer. These are used as final consumption goods. Consumer goods may be durable items, semi-durable items, non durable and services. Capital goods, on the other hand, are those goods which are producer’s fixed assets, and are used in the production of other goods and services.

Both, consumer goods and capital goods are final goods as these are meant for final use by the user.

Q.12. Giving reasons, classify the following into intermediate and final goods:

(i) Machines purchased by a dealer of machines

(ii) A car purchased by a household

Ans. (i) Machine purchased by a dealer of machines is a intermediate goods because this machine is used to produce other goods.

(ii) A car purchased by a household is a final good because this car is ready for the final consumption.

Q.13. Giving reasons classify the following into intermediate products and final products:

(i) Furniture purchased by a school

(ii) Chalks, dusters etc. purchased by a school

Ans. (i) Furniture purchased by a school is a final product because it is used by the students and staff for final consumption. It is a kind of investment by the school as the school will use the furniture for several years.

(ii) Chalks, dusters, etc. purchased by a school are final products as they are used by the final users, that is, teachers.

Q.14. Giving reasons classify the following into intermediate products and final products:

(i) Computers installed in an office

(ii) Mobile sets purchased by a mobile dealer

Ans. (i) Computers installed in an office are final products as they are ready for final use and directly satisfy the users in the office.

(ii) Mobile sets purchased by a mobile dealer are intermediate products as they are purchased for resale.

Q.15. Should the following be treated as final expenditure or intermediate expenditure? Give reason for your answer.

(i) Purchase of furniture by a firm

(ii) Expenditure on maintenance by a firm

Ans. (i) Purchase of furniture by a firm will be treated as final expenditure because it is the expenditure on final goods.

(ii) Expenditure on maintenance of a firm is an intermediate expenditure as building will be used further for production activities.

Q.16. Should the following be treated as final expenditure or intermediate expenditure? Give reason for your answer.

(i) Purchase of furniture by a firm

(ii) Expenditure on maintenance by a firm

Ans. (i) Purchase of furniture by a firm will be treated as final expenditure because it is the expenditure on final goods.

(ii) Expenditure on maintenance of a firm is an intermediate expenditure as building will be used further for production activities.

Q.17. Define a stock.

Ans. Stock is an economic variable that is measured at a specific point of time. It is a static concept.

Q.18. Define flow concept.

Ans. Flow is an economic variable that is measured over a specific period of time. It is a dynamic concept.

Q.19. Define a closed economy.

Ans. A closed economy is the one, which does not undertake economic transactions with the rest of the world.

Q.20. Define an open economy.

Ans. An open economy is the one, which undertakes economic transactions with the rest of the world.

Q.21. Is National Income a stock or flow variable?

Ans. National Income is a flow variable because it is measured over a period of time.

Q.22. What do you mean by money flow?

Ans. Money flow refers to the flow of money value across different sectors in an economy.

Q.23. State which of the following is a stock and which is a flow?

(i) Wealth

(ii) Cement Production

Ans. (i) Wealth is a stock concept because it is measured at a point of time.

(ii) Cement production is a flow concept because it is measured over a period of time.

Q.24. State whether the following is a stock or flow:

(i) Population of a country

(ii) Number of births

Ans. (i) Population of a country is a stock concept because it is measured at a point of time.

(ii) Number of births is a flow concept because it is measured over a period of time.

Q.25. Define flow variable.

Ans. Flow variables are the variables which are measured over a specific period of time.

Q.26. What are stock variables?

Ans. Stock variables are those variables which are measured at a specific point of time.

Q.27. What do you mean by circular flow?

Ans. Circular flow is a pictorial illustration showing the flow of receipts of and payments for goods and services, and factor of production across different sectors in an economy.

Q.28. Name any two sectors in the circular flow of income.

Ans. Sectors in the circular flow of income:

(i) Household Sector

(ii) Production Sector

(iii) Government Sector

Q.29. What are leakages in circular flow?

Ans. Leakages in the economy refer to the withdrawal of income from the process circular flow in the form of savings, taxes and imports from the foreign sector. For example: Savings.

Q.30. What are injections into circular flow?

Ans. Injections in the economy refer to the contribution of income into the process circular flow in the form of investment, government spending and exports to the foreign sector.

For example: Investment.

Q.31. Who supplies factor services in the circular flow?

Ans. Household sector supplies factor services in the circular flow.

Q.32. Explain the circular flow with two-sector economy.

Or

Explain the circular flow of income.

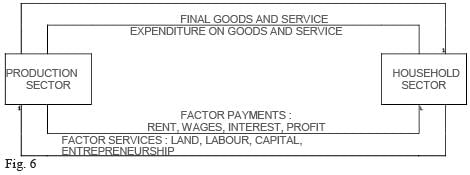

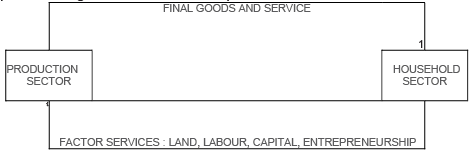

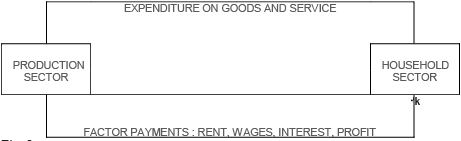

Ans. The circular flow with two-sector economy can be explained with the help of the following diagram:

The above diagram shows the two sectors in the economy-the household sector and the production sector. Household sector has the endowment of factors of production (land, labour, capital and entrepreneurship) and it sells them to the production sector which produces goods and services by using these factor inputs. Production sector sells the goods and services it produces to the household sector. Thus, the output produced by the production sector is consumed by the household sector. It is called real flow, which involves flow of goods and services.

The production sector makes factor payment to the household sector in terms of wages for labour services, rent for land, interest for capital and profits to entrepreneurship. The household sector uses this income to incur expenditure on purchase of consumer goods and services produced by the production sector. This flow of money payments and expenditure is known as money flow.

Q.33. What is real flow and money flow?

Ans. Real flow refers to the flow of goods and services across different sectors in an economy. Households provide factors of production such as land, labour, capital and entrepreneur to the firms. The firms, in turn, provide the goods and services so produced to the households.

Money flow refers to the flow of money value across different sectors in an economy. Factor incomes such as rent, wages, interest and profit flow from production sector to household sector and the payment for consumption of final goods and services or consumption expenditure flow from household sector to production sector.

Q.34. Giving reason, categorise the following into stock and flow:

(i) Capital

(ii) Saving

(iii) Gross Domestic Product

(iv) Wealth

Ans. ( i) Capital is a stock concept because it is measured at a point of time.

(ii) Saving is a flow concept because it is measured over a period of time.

(iii) Gross Domestic Product (GDP) is a flow concept because GDP is measured over a period of time.

(iv) Wealth is a stock concept because it is measured at a point of time.