The Legal Effects of Demonetisation | Famous Books for UPSC Exam (Summary & Tests) PDF Download

The government under the prime ministership of Narendra Modi on November 8, 2016, had announced that the largest denominations of Rs 500 and Rs 1000 were demonetised with immediate effect ceasing to be a legal tender. Even though people suffered during demonetisation to get cash and exchange the bann.

What is Demonetisation?

Demonetisation means taking back of legal currency of the country. In India, demonetization take place three times. The recent demonetization took place on 8 November 2016. The main objective of demonetization is to reduce corruption, black money and fake currency. In 1946, as the world was just out of the jolt of the Second World War and India was at the peak of anti-colonial struggle, the British Raj conducted its version of demonetisation. This was the first instance of demonetisation in India.

- November 8, 2016: A Distinctive Day for Indians

- On this day, the world was grappling with Donald Trump's election as the 45th President of the United States, but in India, a different narrative unfolded.

- Around 8:00 – 8:30 p.m. on November 7th, 2016, the government's sudden announcement of demonetization shook the nation.

- The move targeted the elimination of high-denomination notes, specifically Rs. 500 and Rs. 1000.

- Nationwide Impact

- The announcement brought the entire nation to a standstill as local vendors and restaurants swiftly stopped accepting the invalidated notes within half an hour.

- Social media platforms were flooded with posts and memes depicting the transformation of two powerful nations from "black to white" overnight.

- Creative Responses and Satire

- Internet users shared humorous content, suggesting alternative uses for the obsolete notes, such as using them for packing peanuts, as toilet paper, or even for making paper boats.

- Positive Outlook on Demonetization

- Despite initial disruptions, the move was seen as a positive step in combating widespread corruption.

- The Rs. 500 and Rs. 1000 notes, constituting nearly 80% of black money, were a primary target, aiming to reduce the prevalence of tax evasion.

- Eradication of Black Money

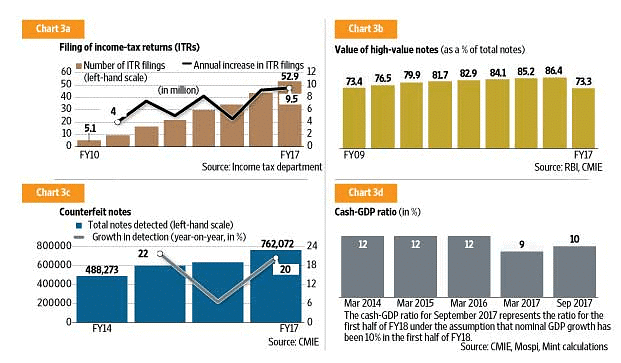

- The elimination of these high-denomination notes was expected to reduce the hoarding of black money and consequently diminish the number of tax evaders in the country.

Effect of Demonetisation

- Definition of Black Money in India:

- Black money refers to unaccounted funds held by individuals in India to evade taxes. It is often kept hidden and not deposited in banks. It can also include money earned through illegal means such as bribes.

- Impact of High Currency Notes Elimination:

- The elimination of high currency notes renders black money held in cash worthless, prompting individuals to deposit it in banks to avoid losses.

- This move aims to compel people to account for their black money, leading to increased tax payments and subsequently boosting the National Income of the country.

- Rationale Behind Demonetization:

- Eliminating high-value currency notes serves as a strategy to curb the illicit use of money, particularly in activities like terrorist funding and cross-border commerce.

- Unexplored Negative Aspects of Demonetization:

- While the positive impacts of demonetization are acknowledged, it is crucial to consider the negative consequences, both economically and legally.

- Economic Consequences:

- The elimination of high currency notes can have adverse economic effects, affecting individuals and businesses.

- Legal Implications:

- Demonetization may lead to legal challenges and complications that need to be addressed and considered alongside its positive outcomes.

- Comprehensive Evaluation Required:

- It is imperative to conduct a thorough assessment of both the positive and negative aspects of demonetization to understand its full impact on the economy and legal framework.

How is demonetisation legally unsound?

- Lack of Consideration for Diverse Issues:

- The decision to ban high currency notes lacked thorough consideration of its impact.

- Overlooked the consequences for the general public while targeting black money and terrorism support.

- Urban vs. Remote Disparities:

- City dwellers with electronic payment options can manage daily needs, but rural areas lack proper banking facilities.

- Neglects citizens without bank accounts and local vendors, potentially leading to exploitation.

- Implications on Justice System:

- Difficulty hiring lawyers due to cash dependency, particularly affecting the economically disadvantaged.

- Challenges in paying court fees, hindering litigation processes and leading to case delays.

- Unfnded Withdrawal Restrictions:

- Imposed restrictions on cash withdrawals without legal basis.

- Banning 84% of the cash without adequate compensation measures, causing money scarcity.

- Lack of government arrangements exacerbates the situation.

- Infringement of Fundamental Rights:

- Many occupations in India rely heavily on cash transactions, violating Article 19 (1) (g) and Article 21 of the Constitution.

- Restrictions on cash usage impact livelihoods, especially for those dependent on non-banking systems.

- Violation of Right to Property:

- Demonetization infringes on the right to property by not providing alternatives for non-banking individuals.

- Unreasonable restrictions on exchanging cash, particularly affecting the middle class and rural residents.

- Reversal of Intended Benefits:

- Supposedly aimed at benefiting the public, demonetization has caused significant suffering.

- The cash crunch among the common population raises questions about the duration of the suffering.

The Legality of Demonetisation

On November 8, 2016, the Government of India demonetised ₹500 and ₹1,000 banknotes as legal tender through a Gazette Notification issued by the Ministry of Finance, pursuant to Section 26(2) of the Reserve Bank of India Act, 1934. This move, aimed at curbing black money and terror financing, led to widespread chaos due to the sudden shortage of cash, restrictions on withdrawals, and severe economic disruptions, particularly impacting small businesses.

- The announcement led to several legal challenges questioning the validity of the demonetisation, with arguments ranging from the lack of legislative backing to violations of fundamental rights.

- These concerns were raised in petitions before the Supreme Court of India (SC), which referred the matter to a Constitutional Bench. The SC’s majority decision on January 2, 2023, upheld the government's action, sparking renewed debates on the separation of powers between the executive, legislature, and judiciary.

Aftermath of the Announcement

Editorials published after the demonetisation announcement expressed mixed reactions:

Support for the Move:

- The Times of India published an article by Jagdish Bhagwati and other economists, lauding the government’s bold action, countering criticisms by highlighting the legitimacy of the move taken by duly elected officials.

- Similarly, Hindu Businessline praised the government's commitment to fighting corruption and increasing transparency.

Criticism of the Process:

- Indira Jaising, writing for National Herald, argued that the lack of legislative backing made demonetisation unconstitutional. Since currency in circulation represents public debt, its abolition, according to Article 300A of the Constitution, should be supported by an Act of Parliament, not just a notification.

- The Wire critiqued excessive delegation, arguing that the executive’s unilateral decision to demonetise was a legislative function, requiring broader consultation and public notice.

Counterarguments:

- Alok Prasanna Kumar from the Quint and Economic and Political Weekly contended that Section 26(2) of the RBI Act was sufficient, as the notification merely invalidated the currency as legal tender and did not criminalise holding it. He argued that no further legislation was needed.

- Some also speculated that, while the SC had taken a minimalist approach in reviewing the policy, it might become more active in scrutinizing future executive actions.

Post-Judgment Analysis

The Supreme Court’s judgment in Vivek Narayan Sharma v. Union of India addressed the legal challenges:

Majority Opinion:

- Justice Gavai’s opinion for the majority upheld the government's action, stating that the practical interpretation of Section 26(2) allowed for the demonetisation of all denominations of currency, not just certain series of banknotes.

- The Centre and the RBI were found to be accountable through their chain of executive responsibility to the legislature, and no constitutional flaw was found in the process.

Criticism of the Judgment:

- Pratap Bhanu Mehta raised concerns about the lack of parliamentary oversight and ex-post facto political accountability for the executive’s decision.

- Gautam Bhatia criticized the judgment for conflating democratic legitimacy with the separation of powers and questioned the judiciary's deference to executive decisions.

- Justice Nagarathna’s dissent stressed that wholesale demonetisation of all currency should have been backed by an Act of Parliament or at least an ordinance, rather than relying solely on an executive notification.

The Evolving Separation of Powers

- The separation of powers in India is a complex blend of Westminster parliamentary supremacy and American-style judicial review. This unique model leads to debates on who holds the legitimate authority to make significant policy decisions like demonetisation.

- Democratic Legitimacy: Supporters of the move argue that the executive, being directly answerable to the people through elections, had sufficient democratic legitimacy to undertake such a decision, especially with the RBI's technical input.

- Role of Parliament: Critics argue that such an important policy decision should have been debated in Parliament, considering the potential long-term consequences. While executive surprise is understandable, there could have been a presidential ordinance that was then subject to parliamentary scrutiny.

Theoretical Framework: Bruce Ackerman’s Separation of Powers

Bruce Ackerman’s theory of a “new separation of powers” posits three principles:

- Democracy: The move aligns with democratic principles by having been endorsed by elected representatives.

- Professional Competence: The RBI’s involvement in advising on the demonetisation was seen as enhancing the competence of the decision-making process.

- Protection of Fundamental Rights: Ackerman emphasizes that a strong separation of powers requires ensuring the protection of citizens' rights, which was arguably undermined by the hardships faced during demonetisation.

- Scholars like Cynthia Farina suggest that administrative decisions could be more consultative and transparent, but India lacks a self-regulating framework like the U.S. Administrative Procedure Act, making unchecked delegation problematic.

Judicial Review and the Role of the Court

- Minimalist Approach: The SC’s minimalist approach to economic policy, deferring to executive decisions, has been criticized, especially in light of societal hardships such as loss of livelihoods and economic strain caused by demonetisation.

- Judicial Activism: Critics argue that the judiciary should adopt a more active role in reviewing executive decisions that affect citizens’ fundamental rights. This would align with the need to uphold constitutional principles while ensuring accountability in the face of executive overreach.

|

743 videos|1444 docs|633 tests

|

FAQs on The Legal Effects of Demonetisation - Famous Books for UPSC Exam (Summary & Tests)

| 1. What is the concept of demonetisation? |  |

| 2. What are the main effects of demonetisation on the economy? |  |

| 3. Why is demonetisation considered legally unsound by some critics? |  |

| 4. What are the legal effects of demonetisation on individuals and businesses? |  |

| 5. How can citizens protect themselves from the adverse effects of demonetisation? |  |