Cost Accounting Solved Question Papers (Part - 1) | Cost Accounting - B Com PDF Download

Ques 1: (a) Fill in the blanks:

(1) Fixed cost per unit _____ when volume of production increases.

(2) In printing industries, the method of ______ costing is applied.

(3) In process costing, the output of the each process in the ____ of the next process.

(4) In Cost Accounting, _____ are the combination of indirect material, indirect labour and indirect expenses.

Ans:

(1) decreases

(2) process

(3) input

(4) overheads

(b) Choose and write the correct answer:

(1) Under the ABC analysis of material control, A stands for low value/moderate value/_______.

(2) In a chemical industry, the method of ______/contract costing is applied.

(3) Variable overhead cost is a period cost/______.

(4) Cost of abnormal idle time and overtime is transferred to _____/General Profit and Loss Account.

Ans:

(1) high value items.

(2) process costing

(3) an output cost

(4) costing Profit and Loss Account

Ques 2: Write on the following (any four):

(a) Distinction between Cost Accounting and Financial Accounting (any four points)

Basis | Financial Accounting | Cost Accounting |

1. Nature | Financial accounts are maintained on the basis of historical records. | Cost accounts lay emphasis on both historical and predetermined costs. |

2. Use | Financial Accounting is used even by outside entities. | Cost Accounting is used only the management of the concern. |

3. System | Financial Accounting uses the double-entry system for recording financial data. | Cost Accounting does not use the double-entry for collecting cost data. |

4. Scope | Financial Accounting covers all items of income and expenditure whether related to the cost centers or not, | Cost Accounting covers all items related to a cost centre. |

5. Reports | Financial Accounting results are shown P&L A/c and balance sheet. | Cost Accounting results are shown in Cost Sheet/ Coating Profit & Loss A/c/ Reports Contract A/c/ Process A/c. |

(b) Causes of labour turnover.

Ans: Meaning: Labour turnover may be defined as change in labour force i.e., percentage change in the labour force during a specific period. High labour turnover indicates that labour is not stabilised and there are frequent changes by way of workers leaving the organization. High labour turnover is to be avoided. At the same time very low labour turnover indicates inefficient workers are being retained in the organization.

Causes of Labour turnover: The causes for labour turnover can be broadly classified under three heads.

(1) Personal Causes

(2) Unavoidable Causes

(3) Avoidable Causes

(i) Personal Causes: Some of the employees may leave the organization on account of personal reasons as given below:

(a) Circumstances of family.

(b) Retirement on reaching the prescribed age.

(c) Change in material status in case of women employees.

(d) Dislike for the job or place;

(e) Death of the employee.

(f) Employee getting recruited in a better job.

(g) Permanent disability due to accidents.

(h) Involvement of employee in activities of moral turpitude.

(ii) Unavoidable Causes: In certain instances the organization may discharge the employees due to unavoidable reasons as mentioned below:

(a) Termination of workers on account of insubordination or inefficiency

(b) Discharge of workers on account of irregularity or long absence.

(c) Retrenchment of workers by the company on account of shortage of work.

(iii) Avoidable Causes: Some of the employees may leave the organization account of the following reasons:

(a) Non availability of promotion opportunities

(b) Dissatisfaction with incentive schemes

(c) Unhappy with remuneration

(d) Unsuitable to job due to wrong placement

(e) Unhappy with working conditions

(f) Non availability of accommodation, health and recreational facilities

(g) Lack of stability of Tenure.

(c) Allocation and absorption of overheads.

Ans: Allocation of Overhead Expenses: Allocation is the process of identification of overheads with cost centres. An expense which is directly identifiable with a specific cost centre is allocated to that centre. So it is the allotment of whole item of cost to a cost centre or cost unit or refers to the charging of expenses which can be identified wholly with a particular department. For example, the whole of overtime wages paid to the workers relating to a particular department should be charged to that department. So, the term allocation means the allotment of the whole item without division to a particular department or cost centre.

Absorption of Overheads: The most important step in the overhead accounting is ‘Absorption’ of overheads. CIMA defines absorption as, ‘the process of absorbing all overhead costs allocated or apportioned over a particular cost center or production department by the units produced.’ In simple words, absorption means charging equitable share of overhead expenses to the products. As the overhead expenses are indirect expenses, the absorption is to be made on some suitable basis. The basis is the ‘absorption rate’ which is calculated by dividing the overhead expenses by the base selected. A base selected may be any one of the basis given below. The formula used for deciding the rate is as follows,

Overhead Absorption Rate = Overhead Expenses/ Units of the base selected.

(d) Reconciliation of Cost Account and Financial Account.

Ans: Reconciliation of Cost Accounting and Financial Accounting: When cost accounts and financial accounts are maintained in two different sets of books, there will be prepared two profit and loss accounts - one for costing books and the other for financial books. The profit or loss shown by costing books may not agree with that shown by financial books. Such a system is termed as, ‘Non-Integral System’ whereas under the integral system of accounting, there are no separate cost and financial accounts. Consequently, the problem of reconciliation does not arise under the integral system.

However, where two sets of accounting systems, namely, financial accounting and cost accounting are being maintained, the profit shown by the two sets of accounts may not agree with each other. Although both deal with the same basic transactions like purchases consumption of materials, wages and other expenses, the difference of purpose leads to a difference in approach in a collection, analysis and presentation of data to meet the objective of the individual system.

Financial accounts are concerned with the ascertainment of profit or loss for the whole operation of the organisation for a relatively long period, usually a year, without being too much concerned with cost computation, whereas cost accounts are concerned with the ascertainment of profit or loss made by manufacturing divisions or products for cost comparison and preparation and use of a variety of cost statements. The difference in purpose and approach generally results in a different profit figure from what is disclosed by the financial accounts and thus arises the need for the reconciliation of profit figures given by the cost accounts and financial accounts.

(e) Perpetual inventory system.

Ans: Perpetual Inventory System: Perpetual Inventory system means continuous stock taking. CIMA defines perpetual inventory system as ‘the recording as they occur of receipts, issues and the resulting balances of individual items of stock in either quantity or quantity and value’. Under this system, a continuous record of receipt and issue of materials is maintained by the stores department and the information about the stock of materials is always available. Entries in the Bin Card and the Stores Ledger are made after every receipt and issue and the balance is reconciled on regular basis with the physical stock. The main advantage of this system is that it avoids disruptions in the production caused by periodic stock taking. Similarly it helps in having a detailed and more reliable check on the stocks. The stock records are more reliable and stock discrepancies are investigated and appropriate action is taken immediately.

(f) Salient features of perpetual inventory system

(a) It requires more efforts to maintain inventory under this method.

(b) Quantity balances shown by the store ledger and bin cards are reconciled.

(c) A number of items are physically checked systematically and by rotation.

(d) The method is comparatively costly as compared to periodical inventory system.

(e) Store ledger and bin cards keeps inventory record up-to date and decent.

Ques 3: (a) The following data have been extracted from the books of M/s, ABC Industries Ltd. For the calendar year, 2017:

Particulars | (Rs.) |

Opening stock of raw materials Purchase of raw materials Closing stock of raw materials Carriage inwards Wages: Direct Indirect Other direct charges Rent and rates: Factory Office Indirect consumption of materials Depreciation: Plant Office Furniture Salary: Office Salesman Other factory expenses Other office expenses Managing Director’s remuneration Other selling expenses Travelling expenses of salesman Carriage and freight outward Sales Advance income-tax paid Advertisement | 25,000 85,000 40,000 5,000 75,000 10,000 15,000 5,000 500 500 1,500 400 2,500 2,000 5,700 700 12,000 1,000 1,100 1,400 2,50,000 15,000 2,000 |

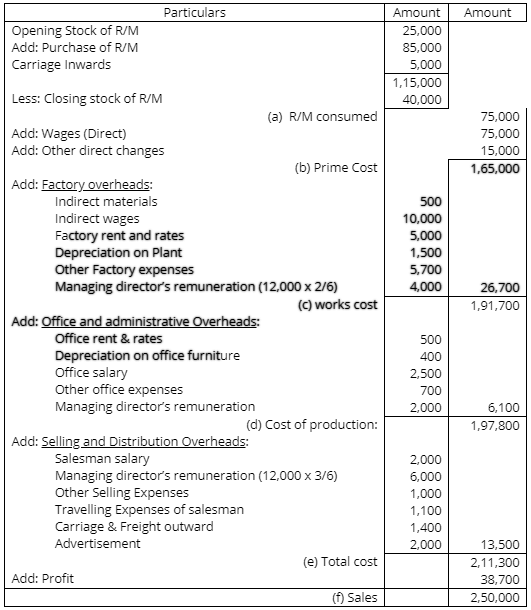

Managing Director’s remuneration is to be allocated in the ratio of 2 : 1 : 3 for factory, office and sales departments respectively. From the above information, prepare the different phases of cost and net profit.

Cost Sheet of M/S ABC Industries

(b) What do you mean by material control? What are its techniques? Discuss its significances.

Ans: Inventory or Store Control: Inventory control means to monitor the stock of goods used for production, distribution and captive (self) consumption. For a specific time period, stocks of goods are placed at some particular location. Stock of goods includes raw-materials, work in progress, finished goods, packaging, spares, components, consumable items, etc. Inventory Control means maintaining the inventory at a desired level. The desired-level keeps on fluctuating as per the demand and supply of goods.

According to Gordon Carson, "Inventory control is the process where by the investment in materials and parts carried in stocks is regulated, within pre-determined limits set in accordance with the inventory policy established by the management."

Simply "Inventory control is a method to identify those stocks of goods, which can be used for the production of finished goods. It shall be supported by a schedule which gives details regarding; opening stock, receipt of raw-materials, issue of materials, closing stock, and scrap generated."

(C) Significance/Advantages of Inventory control

Ans. 1. Protects from fluctuations in demand: There are always chances of fluctuations in the demand of a material. These fluctuations can be adjusted if there are sufficient items in the stock of inventory. Therefore, proper inventory control protects the company from fluctuations in demand.

2. Better services to customers: If the company maintains a proper inventory of raw-materials, then it can complete its production in time. So, it can deliver the finished goods to the customers in time. Similarly, if the company has a proper inventory of finished goods, then it can satisfy the additional demand of the customers.

3. Continuity of production operations: Proper inventory control helps to maintain continuity of production operations. This is because it maintains a smooth flow of raw materials. So, there are no shortages of raw-materials required for production process.

4. Reduces the risk of loss: Proper inventory control helps to reduce the risk of loss due to obsolescence (outdated) or deterioration of items. This is because it checks all the items regularly.

5. Minimizes the administrative workload: Proper inventory control helps to minimize the administrative work load of purchasing, inspection, warehousing, etc. This will reduce the manpower requirement and will minimize the labour cost too.

6. Protects fluctuation in output: Inventory control tries to reduce the gap between planned production and actual production. There are cases where the production schedule cannot be followed because of Sudden breakdown of machines, Problems in supply of materials, Sudden labour strikes, Loss due to failure of power supply, etc.

In such cases, the difference between planned production and actual production can be bridged by inventories held in stock.

7. Effective use of working capital: Proper inventory control helps to make effective use of working capital. Inventory control helps in maintaining the right amount of stocks of materials, components, etc. Over stocking is avoided. Therefore, the working capital will not be blocked in excess inventory.

8. Check on loss of materials: Inventory control helps to maintain a check on the loss of materials due to carelessness or pilferage. If there is no proper inventory control, then there are more chances of carelessness and pilferage by the employees, especially in the store-keeping department.

9. Facilitates cost accounting activities: Inventory control facilitates cost accounting activities. This is because, inventory control provides a means of allocating materials cost of products, departments or other operating accounts.

10. Avoids duplication in ordering: Inventory control avoids duplication in ordering of stock. This is done by maintaining a separate purchase department.

Ques 4: EXPLAIN INVENTORY CONTROL TECHNIQUES

Ans: Techniques of Inventory Control

The techniques or the tools generally used to effect control over the inventory are the following:

(1) Budgetary techniques for inventory planning;

(2) A-B-C. System of inventory control;

(3) Economic Order Quantity (E.O.Q.) i.e., how much to purchase at one time economically;

(4) VED Analysis;

(5) Perpetual inventory system and the system of store verification;

(1) Budgetary Techniques: For the purchase of raw materials and stocks, what we required is a purchase Budged to be prepared in terms of quantities and values involved. The sales stipulated as per sales Budget of the corresponding period generally works out to be the key factor to decide the production quantum during the budget period, which ultimately decides the purchases to be made and the inventories to be planned.

(2) ABC Analysis: ABC System: In this technique, the items of inventory are classified according to the value of usage. Materials are classified as A, B and C according to their value.

Items in class ‘A’ constitute the most important class of inventories so far as the proportion in the total value of inventory is concerned. The ‘A’ items constitute roughly about 5-10% of the total items while its value may be about 80% of the total value of the inventory.

Items in class ‘B’ constitute intermediate position. These items may be about 20-25% of the total items while the usage value may be about 15% of the total value.

Items in class ‘C’ are the most negligible in value, about 65-75% of the total quantity but the value may be about 5% of the total usage value of the inventory.

The numbers given above are just indicative, actual numbers may vary from situation to situation. The principle to be followed is that the high value items should be controlled more carefully while items having small value though large in numbers can be controlled periodically.

Advantages of ABC analysis

a. Reduction in investment: under ABC analysis, the materials from group 'A' are purchase in lower quantities as much as possible. With this, the effort to reduce the delivery period is also made. These in turn help to reduce the investment in material.

b. Optimization of Inventory management function: Each class of the inventory gets management attention as per its value and accordingly, manpower is allocated and expenses are incurred to manage it. It ensures that most important items are regularly monitored and closely observed whereas such efforts are expended with for the less important items.

c. Control on high value material: under ABC analysis, strict control can be exercised to the materials in group 'A' that have higher value.

d. Reduction in Storage cost: Since Class “A” material is of high value and are purchase in lower quantities as much as possible, it reduces the total storage cost.

e. Saving in time and cost: Since a signification effort is made for management of the material from group 'A', it helps to save time as well as cost.

f. Opportunity to convert Class B items into Class A: As Class B items hold potential for growth, the business may tap into this opportunity and convert it frequent yet low-value customers into regular, high-value customers to Class A.

Disadvantage of ABC analysis

(a) No Proper classification of material: ABC analysis will not be effective if the material are not classified into the groups properly.

(b) Not suitable if materials are of same value: It is not suitable for the organization where the costs of materials do not vary significantly.

(c) No scientific base: There is no any scientific base for the classification of material under ABC analysis.

(d) Not suitable for small organisation: The classification of the materials into different groups may lead to extra cost. Hence, it may not be suitable for small organization.

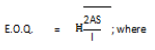

(3) Economics order quantity: Economics order quantity represents the size of the order for which both order, ordering and carrying costs together are minimum. If purchases are made in large quantities, inventory carrying cost will be high. If the order size is small, ordering cost will be high. Hence, it is necessary to determine the order quantity for which ordering and carrying costs are minimum. The formula used for determining economics order quantity is a s follows:

Where,

A is the annual consumption of material in units.

S is the cost of placing an order (ordering cost per unit)

I is the cost of interest and storing one unit of material for the one year (carrying cost per unit per annum).

(4) VED Analysis: VED – Vital, Essential, Desirable – analysis is used primarily for control of spare parts. The spare, parts can be divided into three categories – vital, essential or desirable – keeping in view the critically to production.

(5) Perpetual Inventory System: Perpetual Inventory system means continuous stock taking. CIMA defines perpetual inventory system as ‘the recording as they occur of receipts, issues and the resulting balances of individual items of stock in either quantity or quantity and value’. Under this system, a continuous record of receipt and issue of materials is maintained by the stores department and the information about the stock of materials is always available. Entries in the Bin Card and the Stores Ledger are made after every receipt and issue and the balance is reconciled on regular basis with the physical stock. The main advantage of this system is that it avoids disruptions in the production caused by periodic stock taking. Similarly it helps in having a detailed and more reliable check on the stocks. The stock records are more reliable and stock discrepancies are investigated and appropriate action is taken immediately.

|

106 videos|173 docs|18 tests

|

FAQs on Cost Accounting Solved Question Papers (Part - 1) - Cost Accounting - B Com

| 1. What is cost accounting and why is it important in business? |  |

| 2. What are the main objectives of cost accounting? |  |

| 3. What are the different methods used in cost accounting to allocate overhead costs? |  |

| 4. How does cost accounting differ from financial accounting? |  |

| 5. What are the advantages and limitations of cost accounting? |  |

|

Explore Courses for B Com exam

|

|