Valuation of Inventory:

Method 2.

Cost or Market Price, Whichever is Lower:

The conventional method of valuation of inventories, which is universally applicable at present is ‘historical cost price or the market price/value whichever is lower.’ The term ‘market price/value’ is used to designate the ‘replacement price/value’ and ‘net realisable value’. As such, at present, inventories are valued at the lowest of

(i) Historical cost,

(ii) Net realisable value, and

(iii) Replacement price/value. If this method is used as a method of valuation of inventories, Profit and Loss Account will automatically be adjusted when historical cost will be more than the net realisable or replacement value.

However, market value is to be determined on the following two basis:

1. Net Realisable Value’ Basis, and

2. Replacement Value’ Basis.

1. Net Realisable Value Basis:

Under this concept, ‘market prices/value’ is considered as the ‘net realisable value’ which is equal to the estimated selling price in the ordinary course of business minus the cost of completion. This method of valuation of inventories is particularly followed where the inventories are damaged or partially obsolete.

In this case, inventories are to be valued below the historical cost since the selling price of the same items will be reduced.

As a result, historical cost for the items will not be realised and the difference will, however, be adjusted in Profit and Loss Account by writing down the inventories to the net realisable value. That is why value of inventories must not be shown at a higher figure than its expected realisable value in future.

It should be remembered that the estimated realisable value must not be determined on the basis of temporary fluctuation of prices but on the basis of most reliable evidence.

2. Replacement Value Basis:

Under this concept, the market value is considered to be the current replacement cost which is equal to the current cost of acquisition either by purchases or by production together with the incidental acquisition cost.

This basis usually applies more appropriately to materials or purchased merchandise since calculation of replacement cost of work-in-progress or finished goods will not be an easy task. Current cost of each element of total cost of inventory will be determined.

However, current cost of raw materials and labour should be determined (with tolerable precision) by incorporating current rate of wages and materials to be multiplied by actual quantity of material or labour related to finished or semi-finished product.

It may be noted that there is a difference between replacement value and realisable value. The former represents a sacrificial value whereas the latter represents a beneficial value. At the same time, historical cost represents a sacrificial value and realised value is beneficial value. Sometimes, market value on reproductive basis should be determined on the basis of market price of raw materials, labour and overheads.

However, the AICPA has approved certain limits for inventory valuation which have been stated by the Committee on Accounting Procedure, Bulletin 29, as under:

‘As used the phrase ‘lower of cost or market’ the term ‘market’ means current replacement cost (by purchase or by production, as the case may be) except that:

1. Market should not exceed the net realisable value (i.e. estimated selling price in the ordinary course of business less reasonably predictable costs of completion and disposal), and

2. Market should not be less than net realisable value reduced by an allowance for an approximately normal profit margin’.

From the above, exception (ii) states not to reduce value until there is a clear apparent loss. The AICPA prefers to use ‘market value’ only to the ‘replacement or reproduction value’ and ‘net realisable value’ is treated as a separate item.

But, the Institute of Chartered Accountants of England and Wales prefers to use ‘lower of cost and net realisable value’, ‘at the lowest of cost, net realisable value and replacement including reproduction price’ or ‘at cost less provision to reduce to net realisable value’.

Therefore, after considering the recommendations of both the Institutes, valuation should be made on the basis of the lowest of the three (stated above), with one exception imposed by AICPA. That is, if market price is found to be so lower than the net realisable value less normal profit, the latter should be considered.

Valuation of Inventory:

Method 3.

Under Periodic Inventory System and Under Perpetual Inventory System:

1. Periodic Inventory System:

Under this method stock-takings usually done periodically, i.e., once or twice in a year. This method is particularly applicable where the materials are of small value and also for determining the physical movement of stock and its closing balance as on a particular date.

losing inventory is ascertained on the basis of physical counting and cost of goods is calculated on such basis at periodic intervals on the basis of the following (which has already been explained earlier while discussing the Methods of Recording Inventory, Method II) viz.:

Cost of Goods Sold = Opening Inventory + Purchases – Closing Inventory.

Accounting under this method is done as:

1. Trading Account is debited with the opening inventory which was the closing one at the end of last year.

2. Trading Account is debited with the amount of purchases of inventory made during the year i.e., purchase account is transferred to Trading Account.

3. Trading Account is credited with the closing inventory (calculated on the basis of physical counting) by passing the usual entry viz. closing Inventory Account is debited and Trading Account is credited.

4. The difference between the two sides of Trading Account is known as Cost of Goods Sold.

2. Perpetual Inventory System:

Perpetual inventory system is a system of records which is maintained by the Controlling Department. It reveals the physical movement of stocks and their current balance. Store balances are recorded whenever any receipt or issue is made i.e., up-to-date recording is maintained. Under this method, an inventory account is opened which reveals the cost of goods sold during an accounting cycle — whenever is required.

A perpetual inventory system is usually checked by a programme of continuous stock-taking. This system is intended as an aid to material control. In short, when the up-to-date record is maintained the balance shown by the store ledger must agree with the physical balance. If any discrepancies arise, proper investigation must be made and a report also have to be submitted.

Determining the More Appropriate Method:

The method of valuation of inventory discussed so far are suitable to specific circumstances, i.e., all methods are not applicable in all cases. The method which is most suitable to the specific case should be adopted.

The Recommendations of the Institute of Chartered Accountants of England and Wales are helpful in this context. According to them: ‘No particular basis of valuation is suitable for all types of business but whatever the basis adopted, it should be applied consistently year after year.

But before applying the same, the following points should be considered:

1. In what way does the product actually (physically) flow into production and sales, that is, the oldest units disposed off first, or the newest units disposed off first, or the items acquired at different times mixed together in such a way as to make them indistinguishable from the standpoint of disposal priority ?

2. Which method or methods have the tendency to ‘smooth out’ the reported periodic progress figures for the individual business firm?

3. Which method provides the most conservative (lowest in amount) inventory figure for the end-of-period Balance Sheet?

4. Which method provides the most useful type of cost of production and cost of sales figures for control and internal management purposes?

5. What method provides the most useful figure for the aid in determining selling prices in so far as selling prices may be influenced by expired costs and expenses?

6. Which method comes closest to carrying out the concept of historical accounting?

Some accountants prefer to use ‘Unit Cost’ or ‘FIFO’ method for valuation while others are favouring ‘LIFO’ method. The ‘Average Cost’ method may also be suggested by some other accountants.

In making a selection between FIFO and LIFO, it becomes necessary to decide first whether current costs should be applied to the inventory (under FIFO method) or the same should be matched against current revenues (under LIFO method). That is, FIFO method places emphasis on the Balance Sheet while LIFO method places emphasis on Profit and Loss Account. During periods of changing costs and prices, more meaningful statements of profits are produced if current costs are applied to current sales, thus achieving a better matching of costs and revenues.

On the contrary, if LIFO method is followed, closing inventory will be valued at replacement price. Therefore, like FIFO, it does not lead to a misstatement of working capital position in the Balance Sheet. Although the LIFO advocates a more appropriate matching of costs against revenues it is such an important objective as it offsets the ‘incorrect’ Balance Sheet results, the fact remains that, conceivably inventory qualities might eventually be priced at such ‘old’ costs as to produce a misstatement of working capital position that would be seriously misleading.

The average cost method may be applied during periods of price fluctuations and the same is most suitable where several production process are involved in manufacturing concerns. However, whatever method a firm adopts, the same should be applied consistently year after year.

Valuation under Cost Accounting Records Rules:

Under the Cost Accounting Records Rules, the actual cost of production of the articles to which the rules apply is to be arrived at. But, if there are joint products or multi-products or multi-process, proper allocation and accumulation of cost procedures are to be adopted in order to find out the actual cost of the products.

If the Balance Sheet value of stock is different from the value which is determined in accordance with Cost Accounting Records Rules, a Reconciliation Statement is to be prepared between the financial accounts and the cost accounts which will reveal the difference in the valuation of stock and the reasons therefor.

And, where a firm maintains cost records on the basis of standard cost, the records must indicate clearly the procedures followed in determining the cost of the product under such a system. The method which is adopted for adjusting the cost variances in working out the actual cost of the product must be indicated.

Cost records must indicate the method that is followed for ascertaining the cost of the work-in- progress and finished goods in order to show the elements of cost which are to be taken into account.

Inventory Valuation Problems and Solutions

Problem 1:

Use the following information of Fatima Malik and Co.

A company just starting business made the following four inventory purchases in June 2016:

June 1

| 150 units Rs. 6.60/unit cost

| Rs. 990

|

June 10

| 200 units Rs. 6.30/unit cost

| 1,260

|

June 15

| 200 units Rs. 5.85/unit cost

| 1,170

|

June 28

| 150 units Rs. 5.20/unit cost

| 780

|

|

| Rs. 4,200

|

A physical count of merchandise inventory on June 30 reveals that there are 250 units on hand.

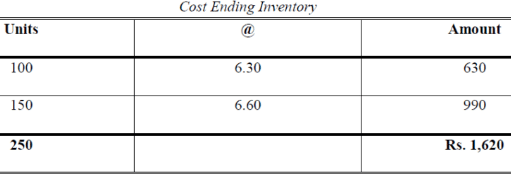

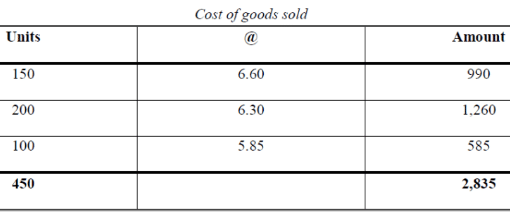

Requirement (a): Using the periodic LIFO inventory method, the value of the ending inventory on June 30 is?

Solution:

Requirement (b): Using the periodic FIFO inventory method, the amount allocated to cost of goods sold for June is?

Solution:

Problem 2:

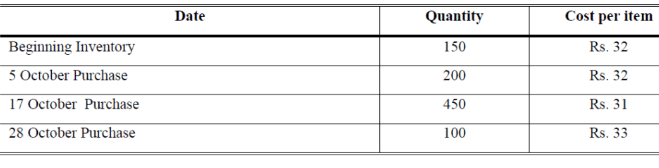

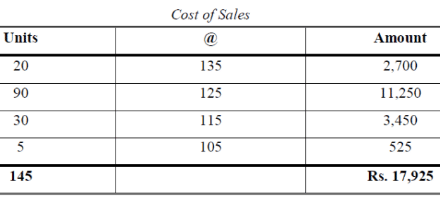

Adnan Naeem Imports, Ltd has the following information about the inventory of electronic components for October 2016.

At the end of October, 220 components remained in inventory.

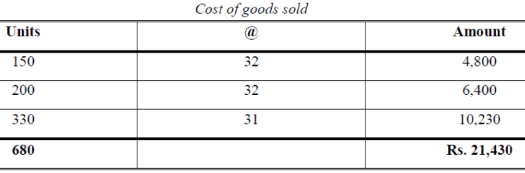

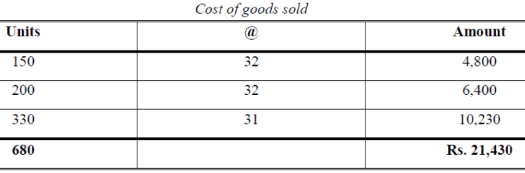

Requirement (a): If uses the FIFO method of allocating inventory, what would is the cost of goods sold for October?

Solution:

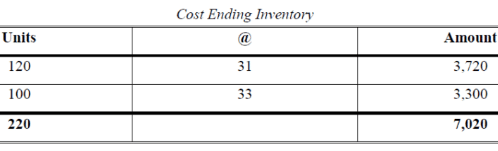

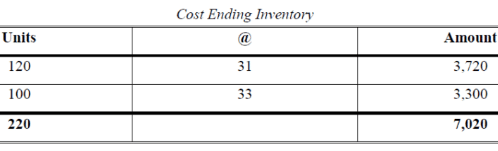

Requirement (b): If company uses the FIFO method of allocating inventory costs, what would is the ending inventory?

Solution:

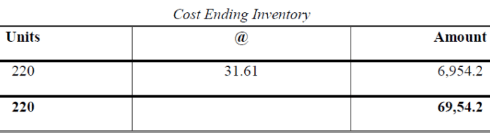

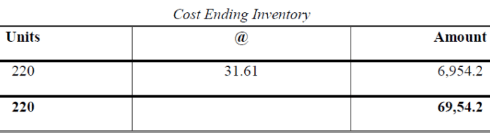

Requirement (c): If company uses the average cost method of allocating inventory costs, what would is the ending inventory for October?

Solution:

Avg Rate = 28,450 / 900 = Rs. 31.61 per unit

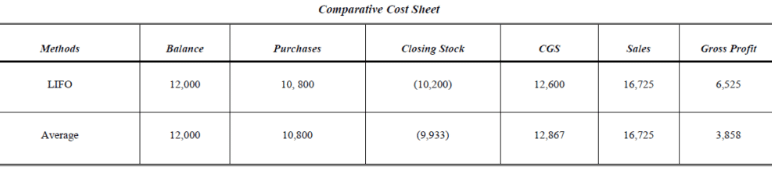

Problem 3:

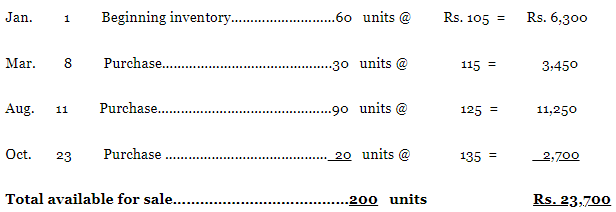

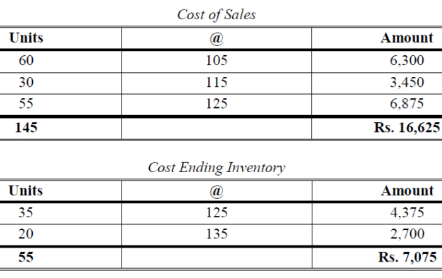

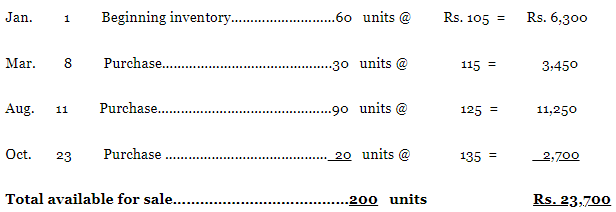

Malik Company uses a periodic inventory system. The beginning inventory of a particular product, and the purchases during the current year, were as follows:

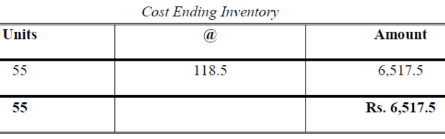

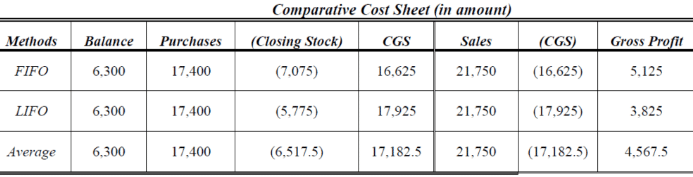

At December 31, the ending inventory of this product consisted of 55 and selling price during year was Rs. 150

Using periodic costing procedures, determine:

(1) Cost of goods sold relating to this product and

(2) Cost of the year-end inventory under each (LIFO, FIFO and W. Avg.) of the flow assumptions?

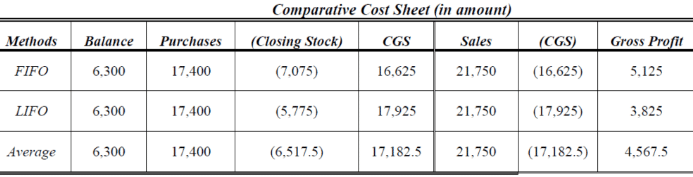

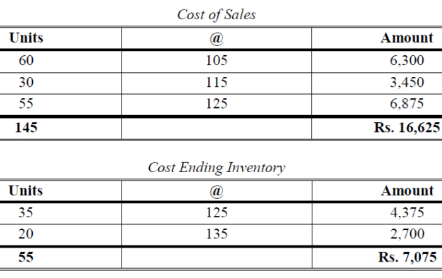

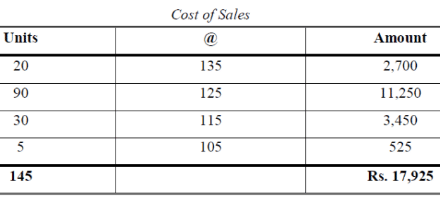

Solution: FIFO

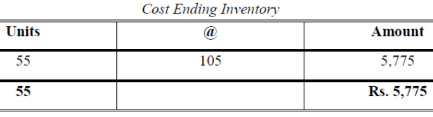

Solution: LIFO

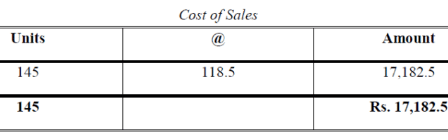

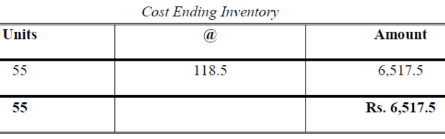

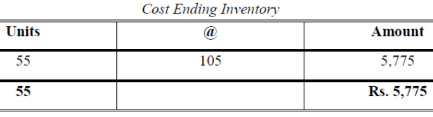

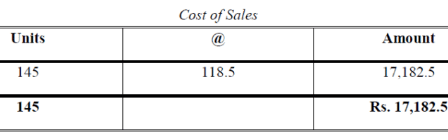

Solution: W. Ag

Avg Rate = 23,700 / 200 = Rs. 118.5 per unit

Problem 4:

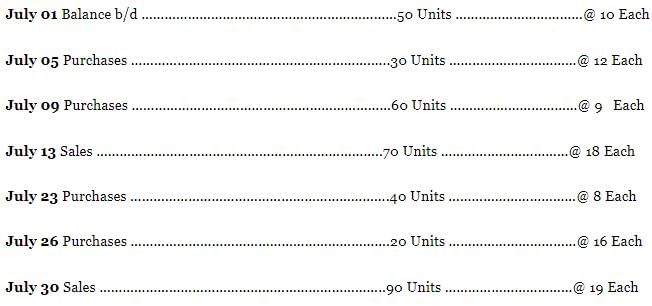

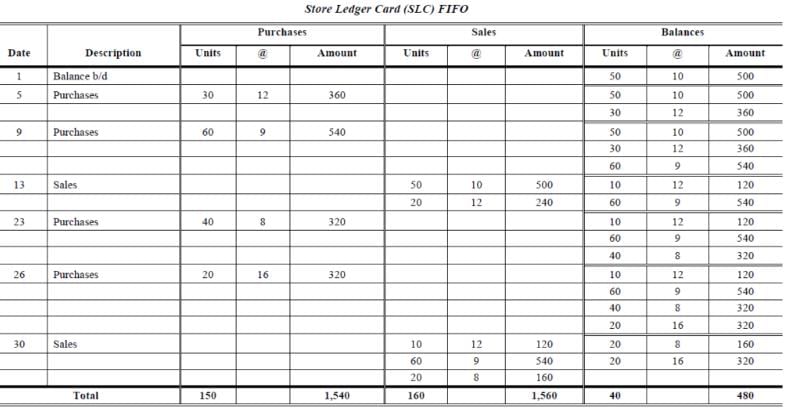

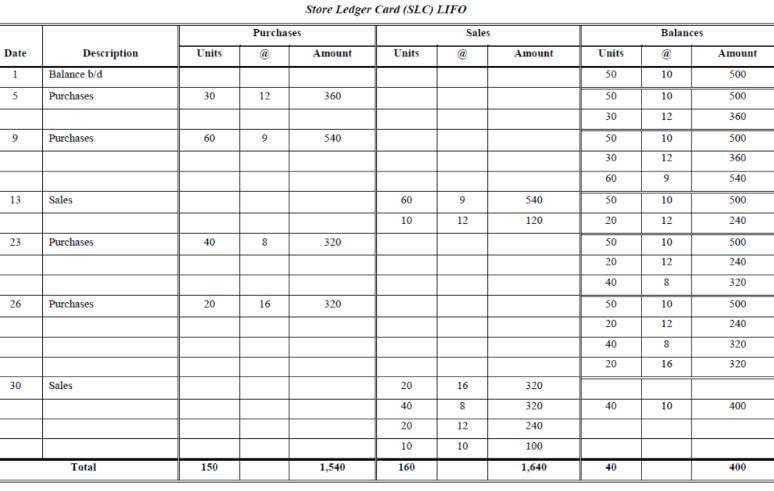

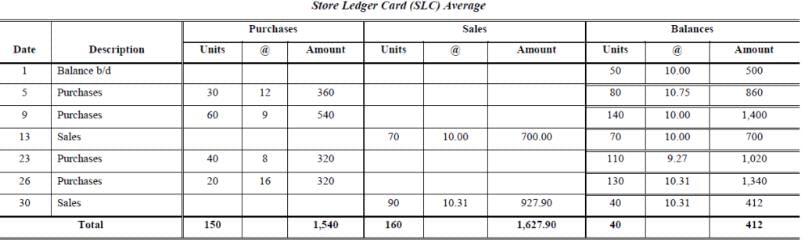

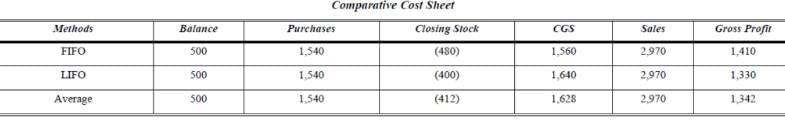

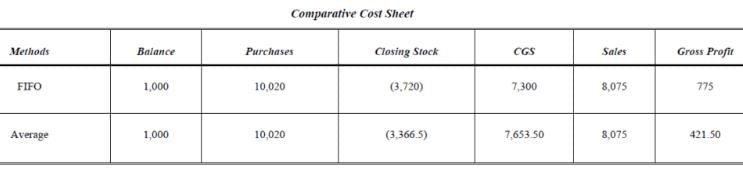

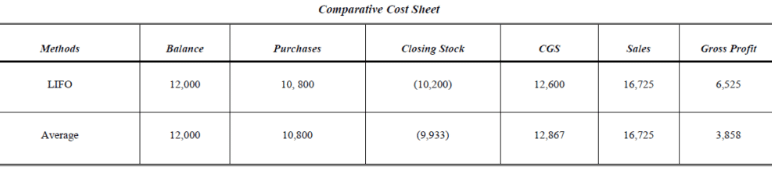

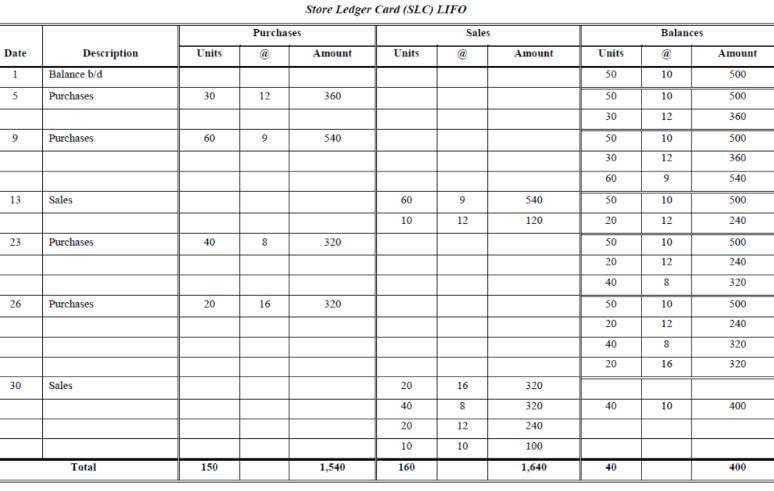

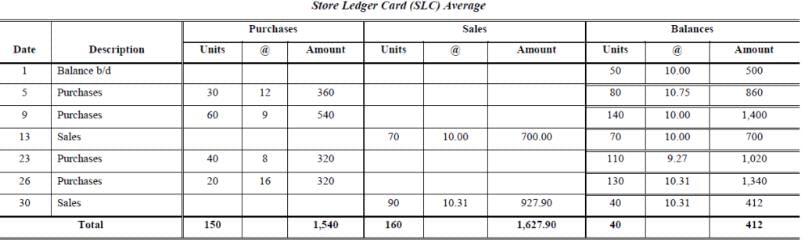

Prepare Store Leger Card (FIFO, LIFO and Average) and Comparative Cost Sheet from the following data.

Solution:

Problem 5:

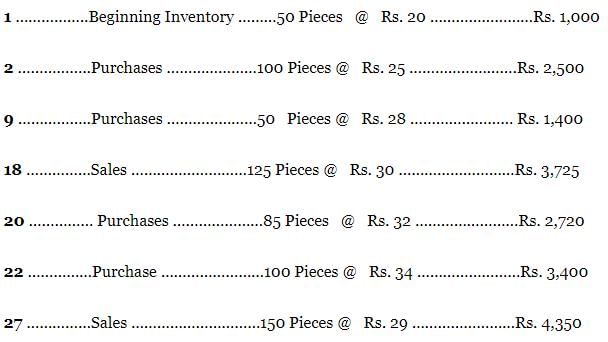

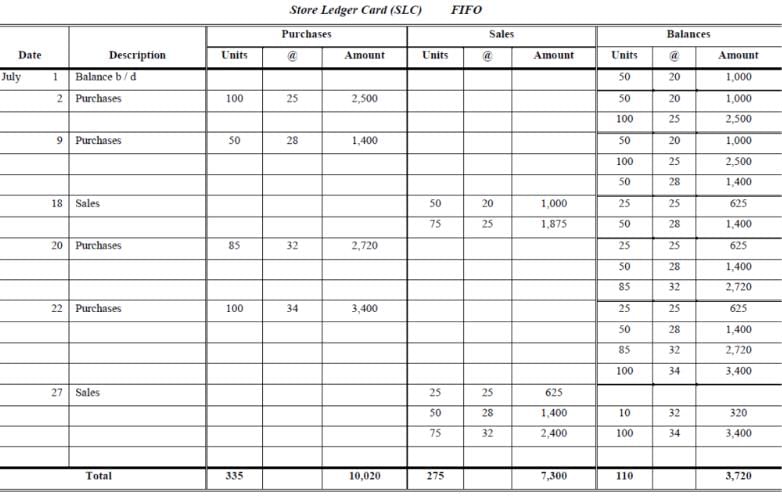

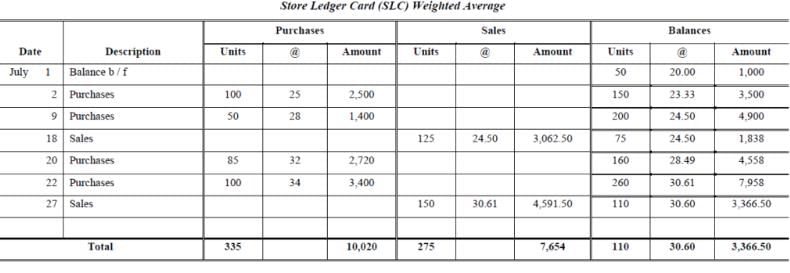

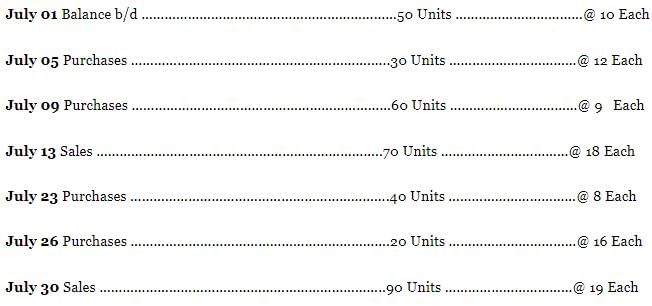

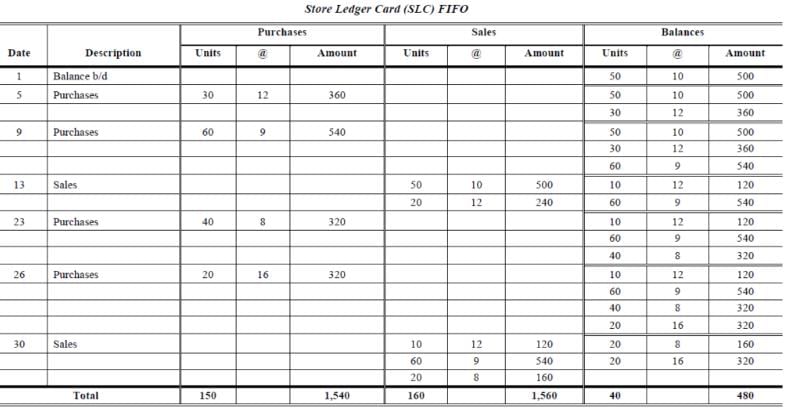

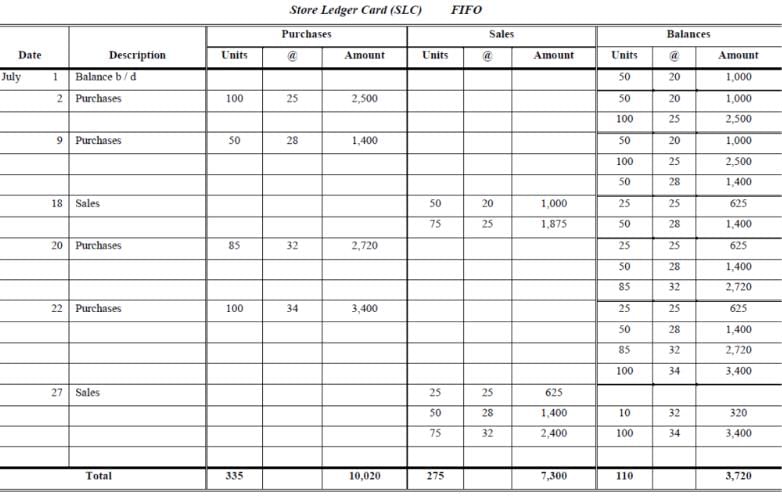

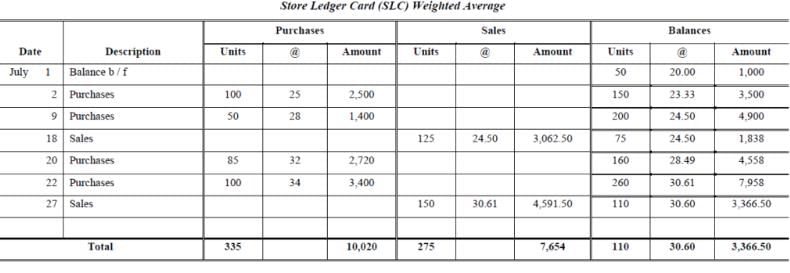

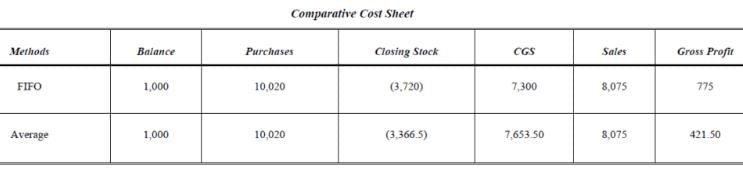

Prepare Store Ledger Card (SLC) from the following information for July.

Required: Determine the Cost of Sales, Cost of Closing Stock, Sales and Gross profit / loss under each of the following method by using perpetual inventory system, Cost are assigned on the basis of FIFO and Cost are assigned on the basis of Weighted Average

Solution:

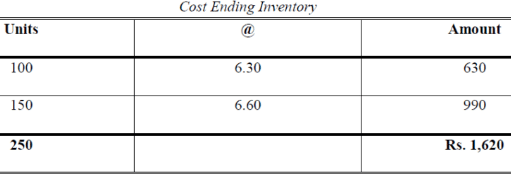

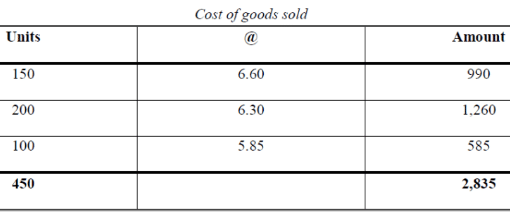

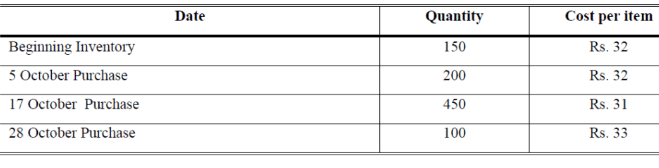

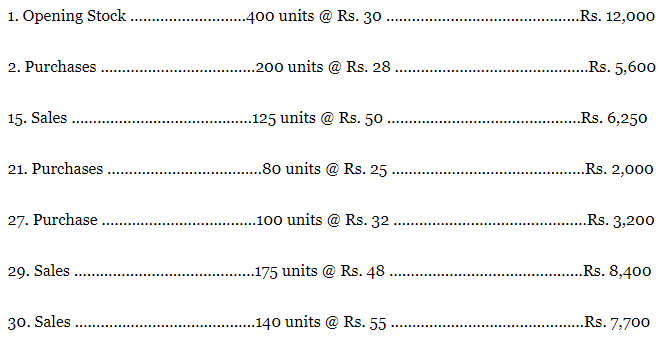

Problem 6:

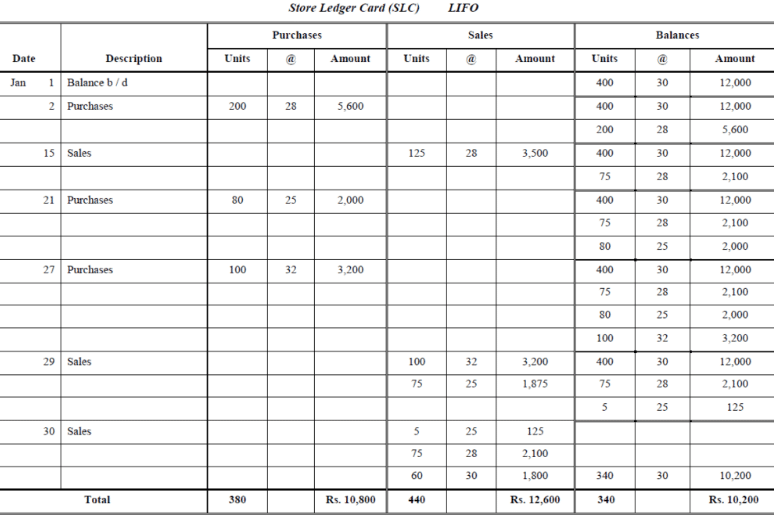

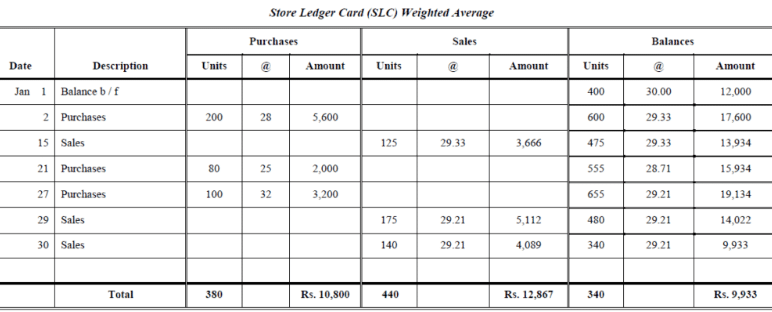

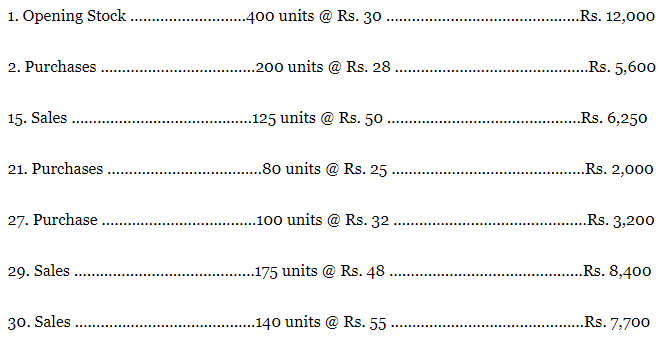

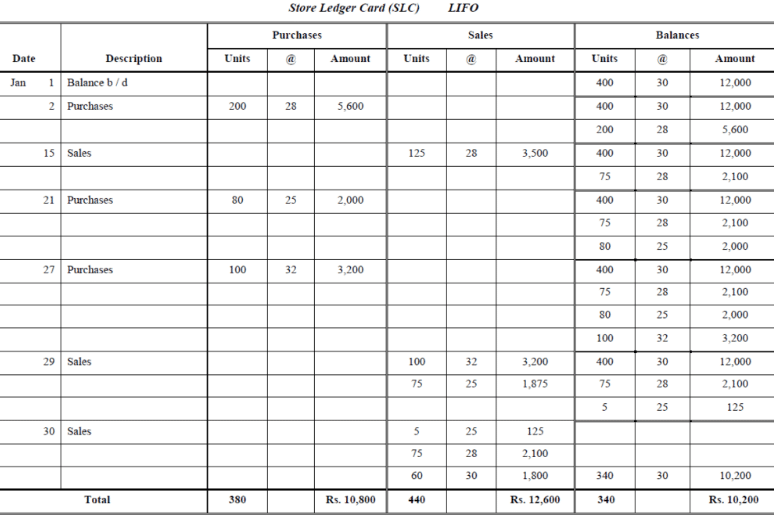

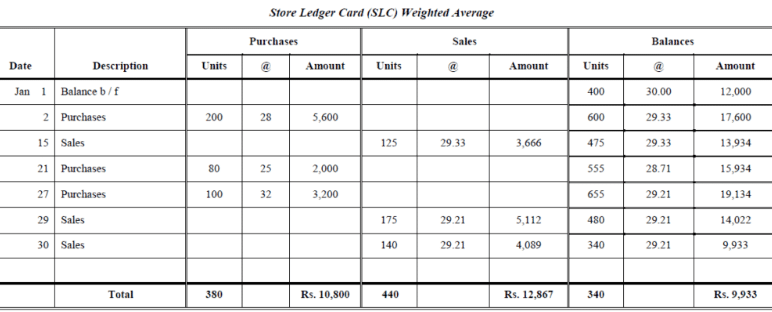

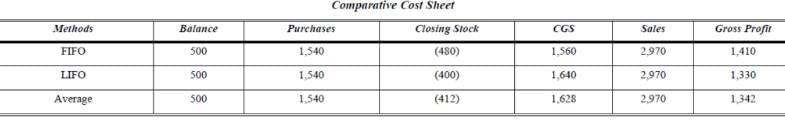

Prepare Store Ledger Card (SLC) form the following information on Jan 2017:

Required

Determine the Cost of Sales, cost of Closing Stock and Gross profit under each of the following method by using perpetual inventory system.

1. Cost are assigned on the basis of LIFO

2. Cost are assigned on the basis of Weighted Average

Solution: