Accountancy: CBSE Sample Question Papers (2020-21)- 1 | Sample Papers for Class 12 Commerce PDF Download

Class - XII

Accountancy

TIME: 3 Hrs.

M.M: 80

General Instructions :

Read the following instructions very carefully and strictly follow them :

(i) This question paper comprises two Parts—A and B. There are 32 questions in the question paper. All Questions are compulsory.

(ii) Heading of the option opted must be written on the Answer-Book before attempting the questions of that particular option.

(iii) Question numbers 1 to 13 and 23 to 29 are very short answer type questions carrying 1 mark each.

(iv) Question numbers 14 and 30 are short answer type-I questions carrying 3 marks each.

(v) Question numbers 15 to 18 and 31 are short answer type-II questions carrying 4 marks each.

(vi) Question numbers 19, 20 and 32 are long answer type-I questions carrying 6 marks each.

(vii) Question numbers 21 and 22 are long answer type-II questions carrying 8 marks each.

(viii) There is no overall choice. However, an internal choice has been provided in 2 questions of three marks, 2 questions of four marks and 2 questions of eight marks. You have to attempt only one of the choices in such questions.

PART - A

(Accounting for Not-For-Profit Organizations, Partnership Firms and Companies)

Q.1. Which of the following items is not dealt through Profit and Loss Appropriation Account ?Which of the following items is not dealt through Profit and Loss Appropriation Account ? (1 Mark)

(a) Interest on Partner ’s Loan

(b) Partner ’s Salary

(c) Interest on Partner ’s

(d) Partner ’s Commission

Ans: a

Q.2. The Agreement of Partnership may be : (1 Mark)

(a) Oral

(b) Written

(c) Both (a) and (b)

(d) None of these

Ans: c

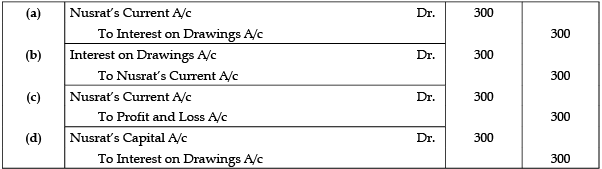

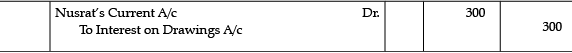

Q.3. Nusrat and Sonu were partners in a firm sharing profits in the ratio of 3 : 2. During the year ended 31st March, 2015, Nusrat had withdrawn ₹ 15,000. Interest on her drawings amounted to ₹ 300. The journal entry for charging interest on drawings assuming that the capitals of the partners were fixed would be : (1 Mark)

Ans: a

Q.4. Identify the average period in months for charging interest on drawings for the same amount withdrawn at the end of each quarter : (1 Mark)

(a) 6.5 months

(b) 7.5 months

(c) 4.5 months

(d) 6 months

Ans: c

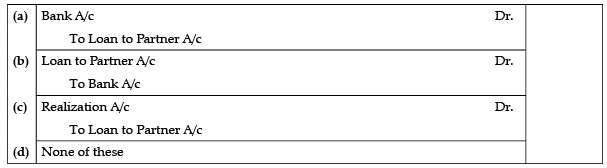

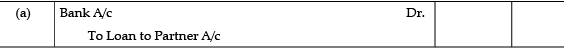

Q.5. At the time of dissolution of partnership firm, journal entry for the settlement of loan advanced by the firm to a partner would be : (1 Mark) 1

1

Ans:

Q.6. Mohit and Rohit were partners in a firm with capitals of ₹ 80,000 and ₹ 40,000 respectively. The firm earned a profit of ₹ 30,000 during the year. Mohit’s share in the profit will be : (1 Mark)

(a) ₹ 20,000

(b) ₹ 10,000

(c) ₹ 15,000

(d) ₹ 18,000

Ans: c

Q.7. A, B and C were partners sharing profits in the ratio of 5 : 3 : 2. B retires on January 1, 2016 with A and C agreeing to share the profit in future in the ratio of 6 : 4. What will be the gaining ratio : (1 Mark)

(a) 4 : 1

(b) 2 : 1

(c) 1 : 2

(d) 3 : 1

Ans: c

Q.8. General Reserve at the time of admission of a Partner is transferred to : (1 Mark)

(a) Revaluation Account

(b) Old Partners’ Capital Accounts

(c) Neither of the two

(d) Both (a) and (b)

Ans: b

Q.9. Rex, Tex and Flex are partners in a firm in the ratio of 5 : 3 : 2. As per their partnership agreement, the share of decreased partner is to be calculated on the basis of profits and turnover of previous accounting year. Tex expired on 31st December, 2019. Turnover till the date of death was ₹ 18,00,000. Their profits and turnover for the year 2018-19 amounted to ₹ 4,00,000 and ₹ 20,00,000 respectively.

An amount of will be given to his executors as his share of profit till the date of death. (1 Mark)

Ans: ₹ 1,08,000

Q.10. Sundry debtors are appearing at ₹ 2,16,000 and provision for doubtful debts at ₹ 12,000 in the Balance Sheet before dissolution. The sundry debtors will be transferred at which figure in realisation account : (1 Mark)

(a) ₹ 1,16,000

(b) ₹ 2,36,000

(c) ₹ 2,16,000

(d) ₹ 2,00,000

Ans: c

Q.11. Pick odd one out :

(a) General Reserve

(b) Undistributed Profits

(c) Contingency Reserve

(d) Employee Provident Fund

Ans: d

Q.12. When forfeited shares are re-issued, the amount of discount allowed on these shares cannot exceed : (1 Mark)

(a) 10% of called-up capital per share

(b) 6% of paid-up capital per share

(c) The amount received per share on forfeited shares

(d) The unpaid amount per share on forfeited shares

Ans: c

Q.13. Pick the odd one out : (1 Mark)

(a) Rent to Partner

(b) Manager ’s Commission

(c) Interest on Partner ’s Loan

(d) Interest on Partner ’s Capital

Ans: d

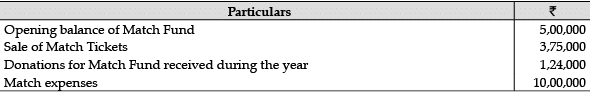

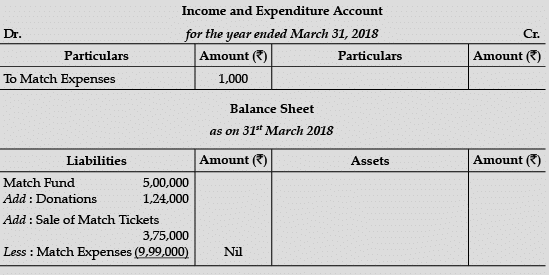

Q.14. Present the following information for the year ended 31st March, 2018 in the financial statements of a Not-for-Profit Organisation : (3 Mark)

OR

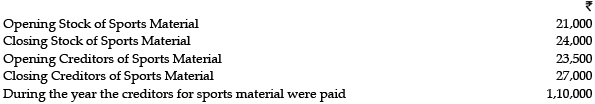

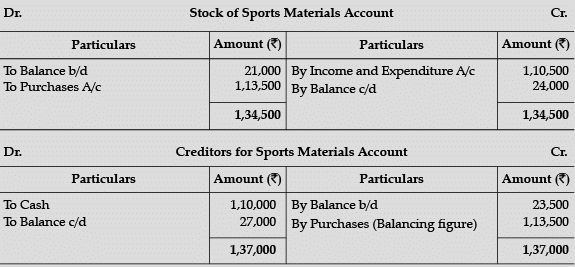

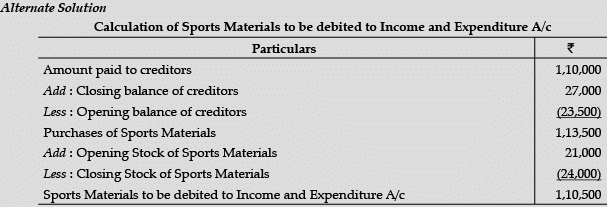

From the following information, calculate the amount of ‘Sports Material’ to be debited to Income and Expenditure Account of Young Football Club for the year ended 31st March, 2018 : (3 Mark)

Ans:

OR

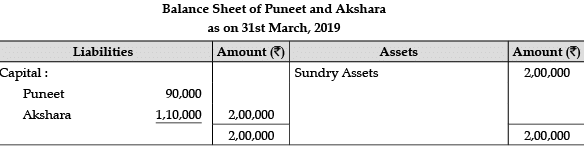

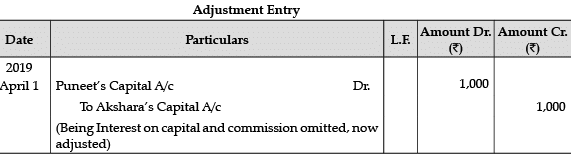

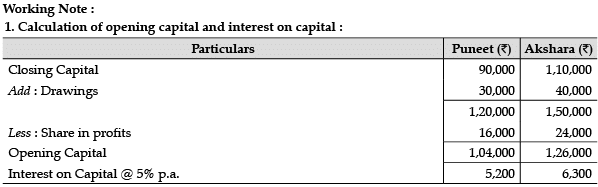

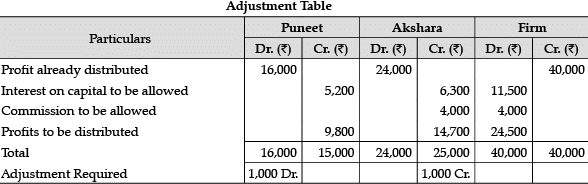

Q.15. Puneet and Akshara were partners in a firm sharing profits and losses in the ratio of 2 : 3. The following was the balance sheet of the firm as on 31st March, 2019 : (4 Mark)

The profits of ₹ 40,000 for the year ended 31st March, 2019 were divided between the partners without allowing interest on capital @ 5% p.a. and commission to Akshara @ ` 1,000 per quarter.

The drawings of the partners during the year were :

Puneet ₹ 2,500 per month

Akshara ₹ 10,000 per quarter

Showing your workings clearly, pass necessary adjustment entry in the books of the firm.

Ans:

Q.16. On 1.4.2016, Sahil and Charu entered into partnership for sharing profits in the ratio of 4 : 3. They admitted Tanu as a new partner of 1-4-2018 for 1/5th share which she acquired equally from Sahil and Charu. Sahil, Charu and Tanu earned profits at a higher rate than the normal rate of return for the year ended 31.3.2019. Therefore, they decided to expand their business. To meet the requirements of the additional capital, they admitted Puneet as a new partner on 1.4.2019 for 1/7th share in profits which he acquired from Sahil and Charu in 7 : 3 ratio.

Calculate :

(i) New profit sharing ratio of Sahil, Charu and Tanu for the year 2018-19.

(ii) New profit sharing ratio of Sahil, Charu, Tanu and Puneet on Puneet’s admission.

OR

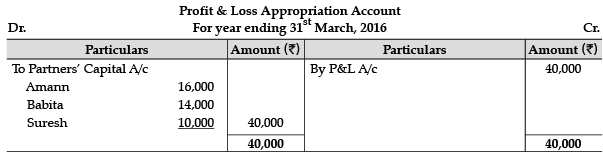

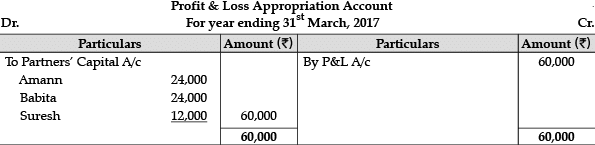

Amann, Babita and Suresh are partners in a firm. Their profit sharing ratio is 2:2:1. Suresh is guaranteed a minimum amount of ₹ 10,000 as share of profit, every year. Any deficiency on that account shall be met by Babita. The profits for two years ending March 31, 2016 and March 31, 2017 were ₹ 40,000 and ₹ 60,000, respectively. Prepare the Profit and Loss Appropriation Account for the two years. (4 Mark)

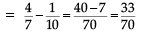

Ans: Calculation of new profit sharing ratio of Sahil, Charu and Tanu for the year 2018-19

Tanu is admitted for 1/5th share :

Tanu acquired profit from Sahil =  Tanu acquired profit from Charu =

Tanu acquired profit from Charu =  Sahil’s new share = Old Share – Sacrificing Share

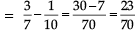

Sahil’s new share = Old Share – Sacrificing Share Charu’s new share = Old Share – Sacrificing Share

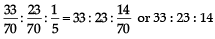

Charu’s new share = Old Share – Sacrificing Share New profit sharing ratio will be =

New profit sharing ratio will be =  (ii) Calculation of New Profit Sharing Ratio on admission of Puneet :

(ii) Calculation of New Profit Sharing Ratio on admission of Puneet :

Puneet is admitted for  share, Old Ratio = 33 : 23 : 14which he acquired from Sahil and Charu in 7 : 3 ratio.Puneet acquired share from Sahil =

share, Old Ratio = 33 : 23 : 14which he acquired from Sahil and Charu in 7 : 3 ratio.Puneet acquired share from Sahil =  Puneet acquired share from Charu =

Puneet acquired share from Charu =  Sahil’s new share =

Sahil’s new share =  Charu’s new share =

Charu’s new share =  New Ratio = 26 : 20 :14 : 10 = 13 : 10 : 7 : 5OR

New Ratio = 26 : 20 :14 : 10 = 13 : 10 : 7 : 5OR

Working Notes :

Working Notes :

2016 ₹ 40,000 (2:2:1) = ₹ 16,000 + ₹ 16,000 + ₹ 8,000

Shortfall = ₹ 10,000 − ₹ 8,000 = ₹ 2,000

Babita’s share = ₹ 16,000 − ₹ 2,000 = ₹ 14,000

2017 ₹ 60000 (2:2:1) = ₹ 24,000 + ₹ 24,000 + ₹ 12,000

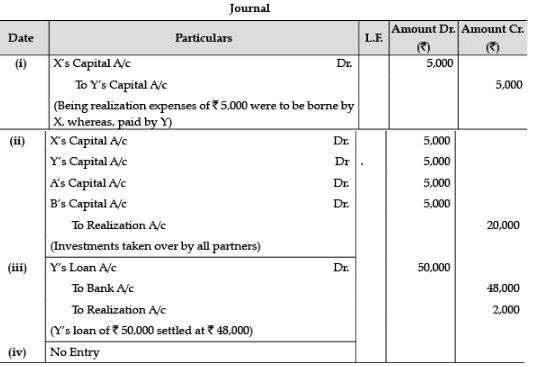

Q.17. Pass necessary journal entries in the following cases on the dissolution of a partnership firm of partners X, Y, A and B : (4 Mark)

(i) Realization expenses of ₹ 5,000 were to borne by X, a partner. However, it was paid by Y.

(ii) Investments costing ₹ 25,000 (comprising 1,000 shares), had been written off from the books completely. These shares are valued at ₹ 20 each and were divided amongst the partners.

(iii) Y’s loan of ₹ 50,000 settled at ₹ 48,000.

(iv) Machinery (book value ₹ 6,00,000) was given to a creditor at a discount of 20%.

Ans:

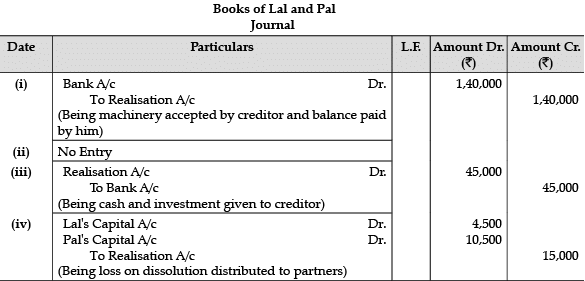

Q.18. Lal and Pal were partners in a firm sharing profits in the ratio of 3 : 7. On 1.4.2019, their firm was dissolved. After transferring assets (other than cash) and outsider’s liabilities to Realisation Account, you are given the following information : (4 Mark)

(i) A creditor of ₹ 3,60,000 accepted machinery valued at ₹ 5,00,000 and paid to the firm ₹ 1,40,000.

(ii) A second creditor for ₹ 50,000 accepted stock at ₹ 45,000 in full settlement of his claim.

(iii) A third creditor amounting to ₹ 90,000 accepted ₹ 45,000 in cash and investments worth ₹ 43,000 in full settlement of his claim.

(iv) Loss on dissolution was ₹ 15,000.

Pass necessary Journal Entries for the above transactions in the books of the firm assuming that all payments were made by cheque.

Ans:

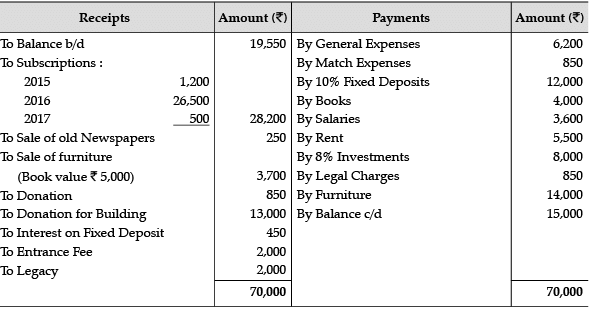

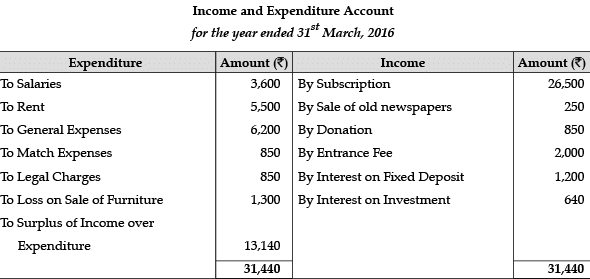

Q.19. From the following Receipts and Payments Account and information given below, you are required to prepare Income and Expenditure Account for the year ending 31st March, 2016 : (6 Mark)

Ans:

Q.20. (a) BGP Ltd. invited applications for issuing 15,000, 11% debentures of ₹ 100 each at premium of ₹ 50 per debenture. The full amount was payable on application. Applications were received for 25,000 debentures. Applications for 5,000 debentures were rejected and the application money was refunded. Debentures were allotted to the remaining applications on pro-rata basis.

Pass the necessary journal entries for the above transactions in the books of BGP Ltd.

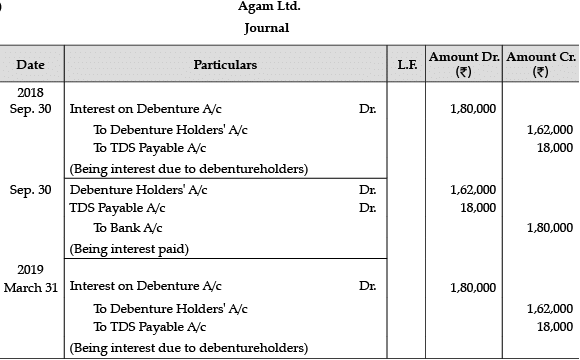

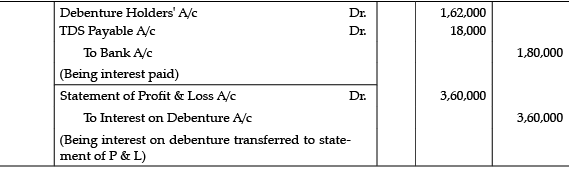

(b) Agam Ltd. issued 40,000 9% debentures of ₹ 100 each on April 1, 2018 at a discount of 10%, redeemable at a premium of 10%.

Assuming that the interest was paid half yearly on September 30 and March 31 and the tax deducted at source was 10%, give journal entries relating to debenture interest for the half year ended March 31, 2019. (6 Mark)

Ans: (a)

(b)

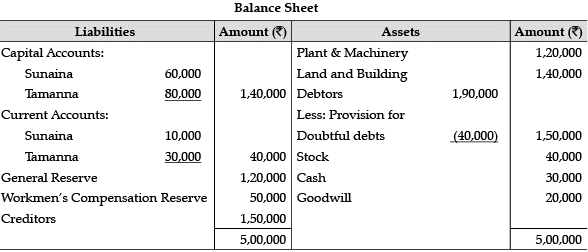

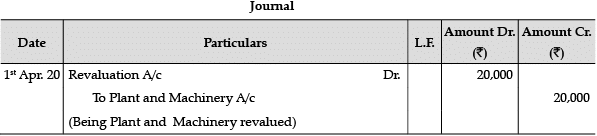

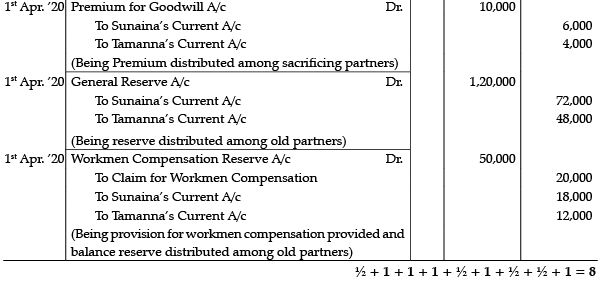

Q.21. Sunaina and Tamanna are partners in a firm sharing profits and losses in the ratio of 3:2. Their Balance Sheet as at 31st March, 2020 stood as follows:

They agreed to admit Pranav into partnership for 1/5th share of profits on 1st April, 2020, on the following terms: (8 Mark)

(a) All debtors are good.

(b) Value of land and building to be increased to ₹ 1,80,000.

(c) Value of plant and machinery to be reduced by ₹ 20,000.

(d) The liability against Workmen’s Compensation Fund is determined at ₹ 20,000 which is to be paid later in the year.

(e) Mr. Anil, to whom ₹ 40,000 were payable (already included in above creditors), drew a bill of exchange for 3 months which was duly accepted.

(f) Pranav to bring in capital of ₹ 1,00,000 and ₹10,000 as premium for goodwill in cash. Journalize.

OR

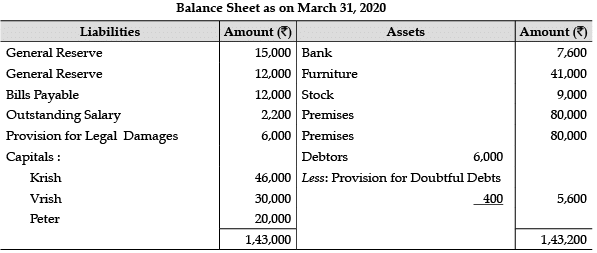

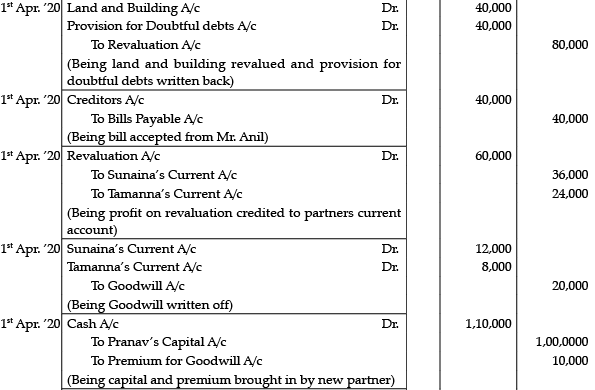

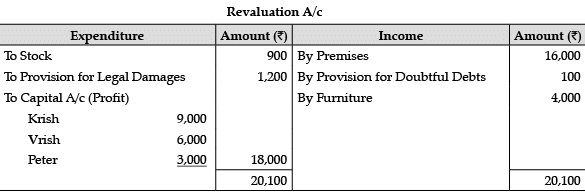

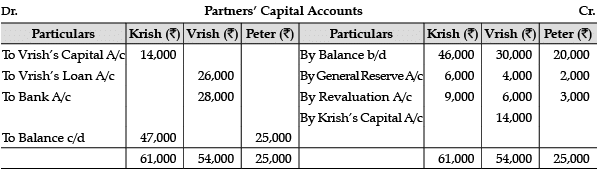

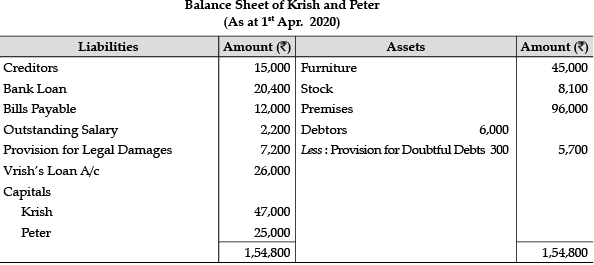

Krish, Vrish and Peter are partners sharing profits in the ratio of 3:2:1. Vrish retired from the firm. On that date the Balance Sheet of the firm was as follows : (8 Mark)

Additional Information :

(i) Premises to be appreciated by 20%, Stock to be depreciated by 10% and Provision for doubtful debts was to be maintained @5% on Debtors. Further, provision for legal damages is to be increased by ₹ 1,200 and furniture to be brought up to ₹ 45,000.

(ii) Goodwill of the firm is valued at ₹ 42,000.

(iii) ₹ 26,000 from Vrish’s Capital account be transferred to his loan account and balance to be paid through bank; if required, necessary loan may be obtained from bank.

(iv) New profit sharing ratio of Krish and Peter is decided to be 5:1.

Prepare Revaluation Account, Partners Capital Accounts and Balance Sheet.

Ans:

OR

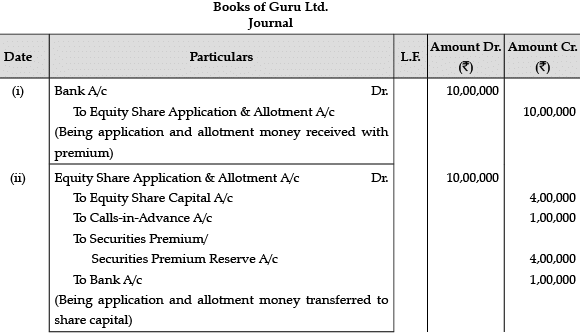

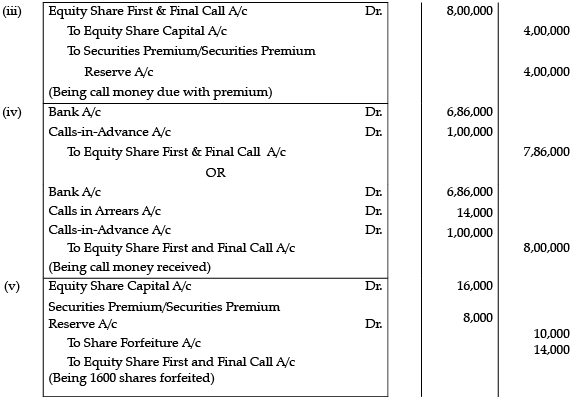

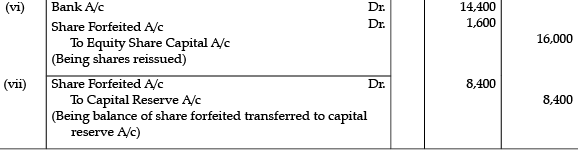

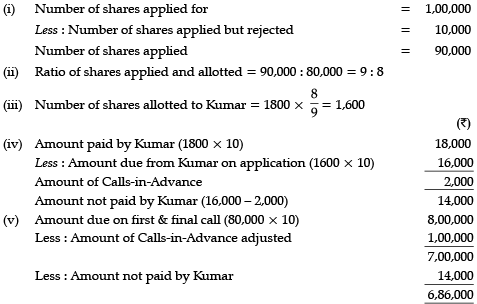

Q.22. ‘Guru Limited’ invited applications for issuing 80,000 equity shares of ₹ 10 each at a premium of ₹ 10 per share. The amount was payable as follows :

On Application and allotment : ₹ 10 ( including ₹ 5 premium)

On First and Final Call : ₹ 10 ( including ₹ 5 premium)

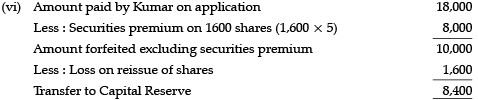

Application for 1,00,000 shares were received. Application for 10,000 shares were rejected and application money was refunded. Shares were allotted on pro-rata basis to the remaining applicants. Excess application money received from applicants to whom shares were allotted on pro-rata basis was adjusted towards sums due on first and final call. All calls were made and were duly received except the first and final call money from Kumar who had applied for 1,800 shares. His shares were forfeited. The forfeited shares were re-issued at 9 per share as fully paid-up.

Pass necessary journal entries for the above transactions in the books of `Guru Limited’. (8 Mark)

OR

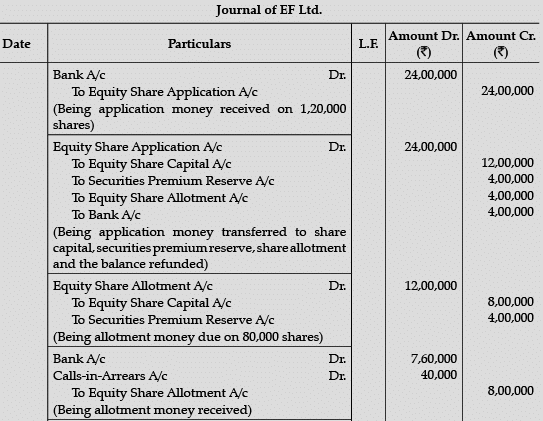

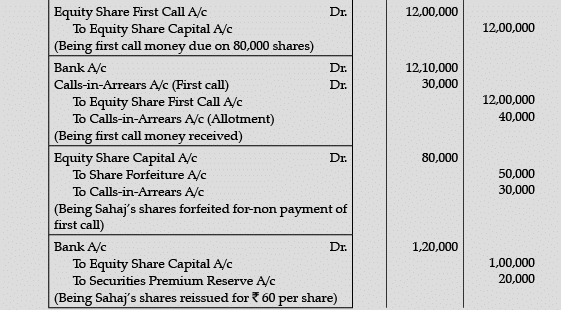

EF Ltd. invited applications for issuing 80,000 equity shares of ₹ 50 each at a premium of 20%. The amount was payable as follows :

On Application : ₹ 20 per share (including premium ₹ 5)

On Allotment : ₹ 15 per share (including premium ₹ 5)

On First Call : ₹ 15 per share

On Second and Final Call : Balance amount

Applications for 1,20,000 shares were received. Applications for 20,000 shares were rejected and prorata allotment was made to the remaining applicants.

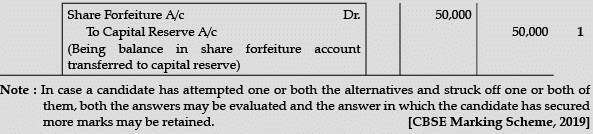

Seema, holding 4,000 shares failed to pay the allotment money. Afterwards the first call was made. Seema paid allotment money along with the first call. Sahaj, who had applied for 2,500 shares failed to pay the first call money. Sahaj’s shares were forfeited and subsequently reissued to Geeta for ₹ 60 per share, ₹ 50 per share paid up. Final call was not made.

Pass necessary journal entries for the above transactions in the books of EF Ltd. by opening calls-inarrears account. (8 Mark)

Ans:

Working Notes :

OR

PART - B

Q.23. __________ratios are a measure of the speed with which various accounts are converted into revenue from operations or cash. (1 Mark)

(a) Activity

(b) Liquidity

(c) Debt

(d) Profitability

Ans: a

Q.24. Raj Ltd. has a inventory turnover ratio at 3 times. Its management is interested in maintaining this ratio at 4 times. Following options are available : (1 Mark)

(i) To reduce closing inventory

(ii) To reduce closing trade receivable

(iii) To increase credit purchases

Choose the correct option :

(a) Only (i) is correct

(b) Only (ii) is correct

(c) Only (i) and (iii) are correct

(d) Only (ii) and (iii) are correct

Ans: a

Q.25. Which of the following is not a part of Finance Cost (in Statement of Profit and Loss)? (1 Mark)

(a) Bank Charges

(b) Interest Paid on Debentures

(c) Interest Paid on Public Deposits

(d) Loss on Issue of Debentures

Ans: a

Q.26. Current Ratio is calculated by using the formula _________. (1 Mark)

Ans: Current Assets/Current Liabilities

Q.27. Potential lawsuit is a ___________ liability. (1 Mark)

Ans: Contingent

Q.28. Mention the net amount of source or use of cash when a company acquires shares in Reliance Ltd. by paying ₹ 3,00,000 and received a dividend of 50,000 after acquition of shares. (1 Mark)

(a) ₹ 2,50,000

(b) ₹ 3,00,000

(c) ₹ 50,000

(d) None of these

Ans: d

Q.29. Current ratio of Vidur Pvt. Ltd. is 3:2. Accountant wants to maintain it at 2:1. Following options are available : (1 Mark)

(i) He can repay Bills Payable

(ii) He can purchase goods on credit

(iii) He can take short term loan

Choose the correct option :

(a) Only (i) is correct

(b) Only (ii) is correct

(c) Only (i) and (iii) are correct

(d) Only (ii) and (iii) are correct

Ans: a

Q.30. Calculate Revenue from Operations of BN Ltd. from the following information : (3 Mark)

OR

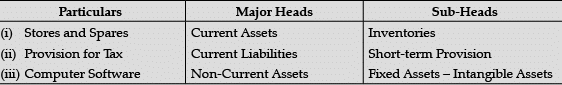

Under what heads and sub-heads will the following items appear in the Balance Sheet of a company as per Revised Schedule III, Part-I of the Companies Act, 2013 :

(i) Stores and Spares

(ii) Provision for Tax

(iii) Computer Software

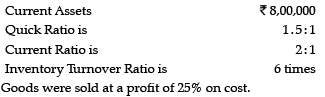

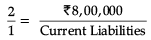

Ans: Current ratio = 2 : 1 and Current Assets = ₹ 8,00,000

Current Ratio = Current Assets/Current Liabilities

Therefore, Current Liabilities = ₹ 4,00,000

Quick Ratio = Quick Assets/Current Liabilities

= 1.5 : 1

Therefore, Quick Assets = ₹ 6,00,000

Inventory = Current Assets – Quick Assets

= ₹ 8,00,000 – ₹ 6,00,000

= ₹ 2,00,000

Inventory Turnover Ratio = 6 times

Cost of Revenue from Operations/ Average Inventory = 6 times

Cost of Revenue from Operations/ ₹ 2,00,000 = 6

∴ Cost of Revenue from Operations = ₹ 12,00,000

Gross Profit is 25% on cost = 25% of ₹ 12,00,000

= ₹ 3,00,000

So, Revenue from Operations = ₹ 12,00,000 + ₹ 3,00,000

= ` 15,00,000

OR

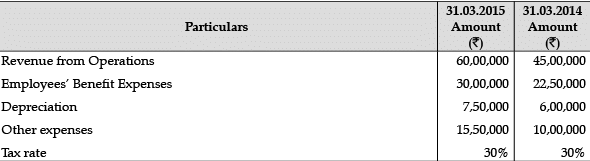

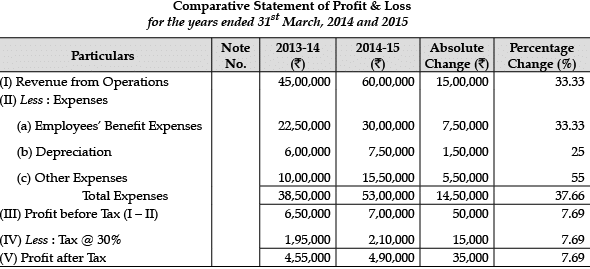

Q.31. Following information is extracted from the Statement of Profit & Loss of Gold Coin Ltd. for the year ended 31st March, 2015 : (4 Mark)

Prepare Comparative Statement of Profit and Loss.

OR

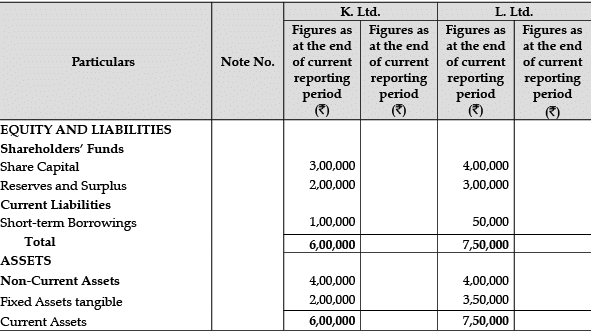

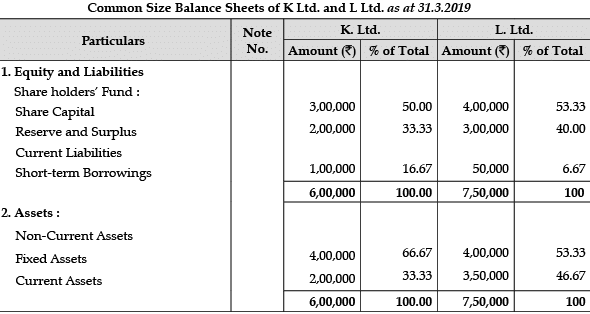

Prepare the Common-size Balance Sheet and comment on the financial position of K Ltd. and L. Ltd. The Balance Sheet of K. Ltd. as at 31.3.2019 are given below : (4 Mark)

Ans:

OR

Interpretation : The following differences may be observed in the financial position of both the companies on the basis of above Common-size Balance Sheets of K Ltd. and L Ltd :

(i) The short-term financial position of L Ltd., is definitely better as compared to K Ltd. The current liabilities of L Ltd. are 6.67% of total funds invested whereas proportion of current assets in these funds is 46.67%. On the other hand, the current liabilities of K Ltd. are 16.67% of total funds and current assets are 33.33% of total funds. Thus, the creditors are more secured in L Ltd.

(ii) The long-term financial position also of L Ltd. is better than K Ltd. because Net worth (Share Capital+Reserves and Surplus) is 93.33% of total funds, in case of L Ltd. while it is 83.33% in K Ltd.

(iii) K Ltd. has invested more 66.67% in fixed assets as compared to 53.33% by L Ltd.

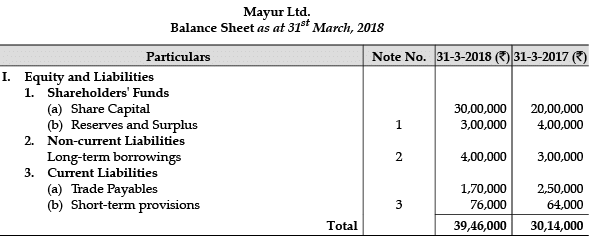

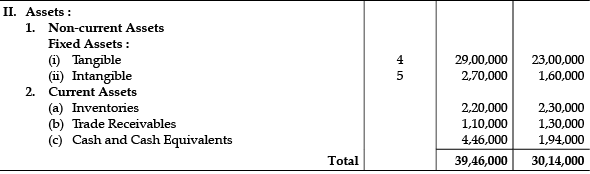

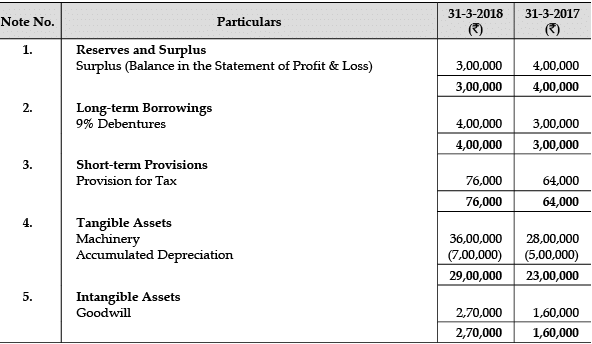

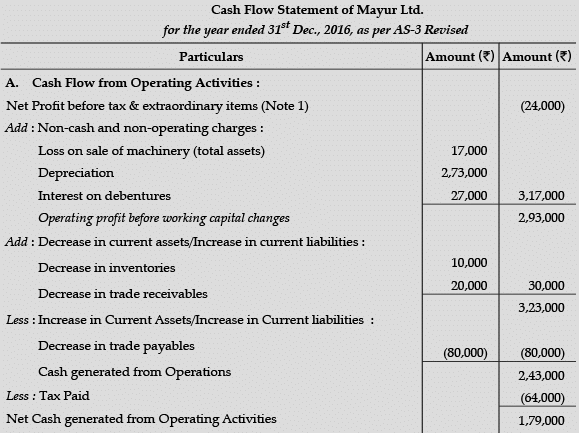

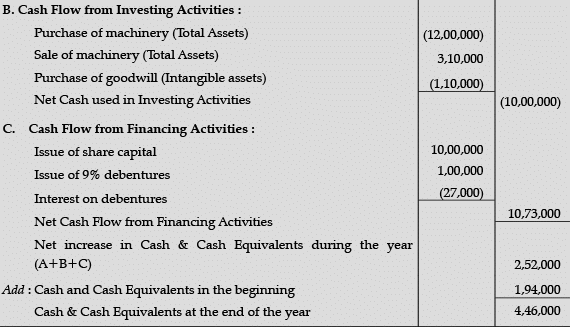

Q.32. From the following Balance Sheet of Mayur Ltd. and the additional information as at 31st March, 2018, prepare a Cash Flow Statement : (6 Mark)

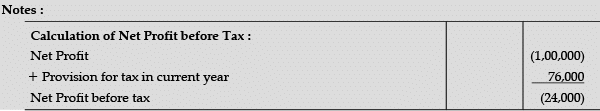

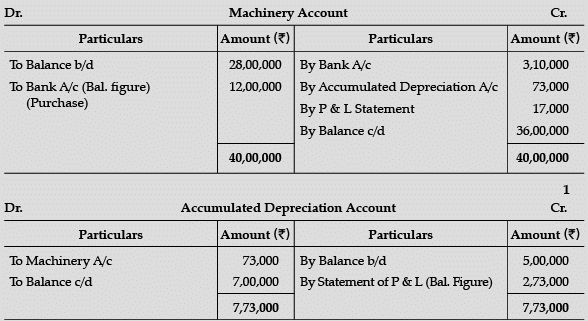

Notes to Accounts :

Additional Information:

(i) During the year, a piece of machinery costing ₹ 4,00,000 on which accumulated depreciation was ₹ 73,000 was sold for ₹ 3,10,000.

(ii) 9% Debentures of ₹ 1,00,000 were issued on 31st March, 2018.

Ans:

|

130 docs|5 tests

|

FAQs on Accountancy: CBSE Sample Question Papers (2020-21)- 1 - Sample Papers for Class 12 Commerce

| 1. What are CBSE sample question papers for Accountancy? |  |

| 2. How can CBSE sample question papers help in preparing for the Accountancy exam? |  |

| 3. Are CBSE sample question papers for Accountancy similar to the actual exam papers? |  |

| 4. Where can I find CBSE sample question papers for Accountancy? |  |

| 5. How should I use CBSE sample question papers effectively for Accountancy preparation? |  |