Accountancy: CBSE Sample Question Papers (2020-21)- 2 | Sample Papers for Class 12 Commerce PDF Download

Class - XII

Accountancy

TIME: 3 Hrs.

M.M: 80

General Instructions :

Read the following instructions very carefully and strictly follow them :

(i) This question paper comprises two Parts—A and B. There are 32 questions in the question paper. All Questions are compulsory.

(ii) Heading of the option opted must be written on the Answer-Book before attempting the questions of that particular option.

(iii) Question numbers 1 to 13 and 23 to 29 are very short answer type questions carrying 1 mark each.

(iv) Question numbers 14 and 30 are short answer type-I questions carrying 3 marks each.

(v) Question numbers 15 to 18 and 31 are short answer type-II questions carrying 4 marks each.

(vi) Question numbers 19, 20 and 32 are long answer type-I questions carrying 6 marks each.

(vii) Question numbers 21 and 22 are long answer type-II questions carrying 8 marks each.

(viii) There is no overall choice. However, an internal choice has been provided in 2 questions of three marks, 2 questions of four marks and 2 questions of eight marks. You have to attempt only one of the choices in such questions.

PART - A

(Accounting for Not-For-Profit Organizations, Partnership Firms and Companies)

Q.1. Mayank Club received life membership fees from its members. Which type of receipt is this ?

Ans: Capital Receipt

Q.2. Geeta, Sunita and Anita were partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 1.1.2015, they admitted Yogita as a new partner for 1/10th share in the profits. On Yogita’s admission, the Profit & Loss Account of the firm was showing a debit balance of Rs. 20,000. This amount should be by the accountant of the firm to the capital accounts of Geeta, Sunita and Anita in their profit sharing ratio :

(a) Debited

(b) Credited

(c) Both (a) and (b)

(d) None of these

Ans: a

Q.3. The partner who provides capital and shares profit and loss in partnership business but does not take active part in the management is known as:

(a) Active Partner

(b) Sleeping Partner

(c) Secret Partner

(d) Limited Partner

Ans: b

Q.4. Sports Star Charitable Club has income of Rs. 16,000 and ‘deficit’ debited to capital fund of Rs. 4,300 for the year 2019-20, then expenditure for 2019-2020 is :

(a) Rs. 11,700

(b) Rs. 4,300

(c) Rs. 20,300

(d) None of these

Ans. (c) Rs. 20,300

Q.5. How much amount will be paid to creditors for Rs. 50,000 if Rs. 10,000 of the creditors are not to be paid and the remaining creditors agreed to accept 5% less amount :

(a) Rs. 28,000

(b) Rs. 38,000

(c) Rs. 37,500

(d) Rs. 36,500

Ans: b

Q.6. Mr. Ram and Sons maintains the Capital Accounts under which it prepares Partners’ Capital Accounts as well as Partners’ Current Accounts. The firm is using which of the following methods of maintaining Capital Accounts :

(a) Fixed Capital Method

(b) Flexible Capital Method

(c) Cash Basis Method

(d) None of these

Ans: a

Q.7. In which ratio the remaining partners acquire the share of profit of the retiring partner ?

(a) Gaining Ratio

(b) Sacrificing Ratio

(c) Old Profit Sharing Ratio

(d) New Profit Sharing Ratio.

Ans: a

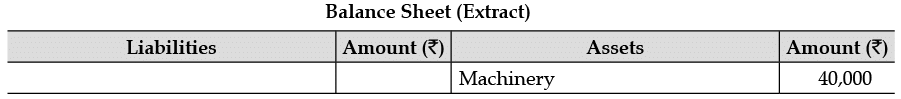

Q.8. Arun and Vijay are partners in a firm sharing profits and losses in the ratio of 5 : 1.

If value of machinery in the balance sheet is undervalued by 20%, then at what value will machinery be shown in new balance sheet :

(a) Rs. 44,000

(b) Rs. 48,000

(c) Rs. 32,000

(d) Rs. 50,000

Ans. (d) Rs. 50,000

Q.9. On the admission of a new partner, increase in the value of assets is debited to :

(a) P & L Adjustment Account

(b) Assets Account

(c) Old Partners’ Capital Accounts

(d) None of these

Ans: b

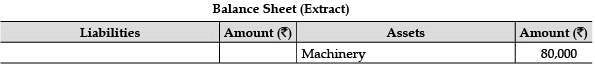

Q.10. Ram and Rohan are partners in a firm sharing profits and losses in the ratio of 3 : 2.

If value of machinery in the balance sheet is undervalued by 20% then at what value will machinery be shown in new balance sheet :

(a) Rs. 96,000

(b) Rs. 64,000

(c) Rs. 1,16,000

(d) Rs. 1,00,000

Ans: d

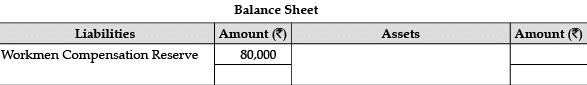

Q.11. An extract of the balance sheet of Rashmi and Suman who share profits in the ratio of 2 : 3 is given below :

Identify the amount of workmen compensation reserve that will be distributed among old partners when claim on account of workmen compensation is estimated at Rs. 65,000 on the admission of Deepa a new partner.

(a) Rs. 15,000

(b) Rs. 50,000

(c) Rs. 80,000

(d) Rs. 1,45,000

Ans: a

Q.12. E, F and G are partners sharing profits in the ratio of 3 : 3 : 2. As per the partnership agreement, G is to get a minimum amount of Rs. 80,000 as his share of profits every year and any deficiency on this account is to be personally borne by E. The net profit for the year ended 31st March, 2020 amounted to Rs. 3,12,000. Calculate the amount of deficiency to be borne by E ?

(a) Rs. 1,000

(b) Rs. 4,000

(c) Rs. 8,000

(d) Rs. 2,000

Ans. (d) Rs. 2,000

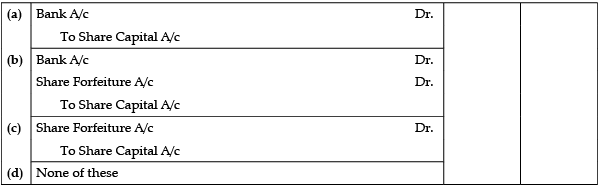

Q.13. Identify the journal entry for the issue of forfeited shares at par :

Ans:

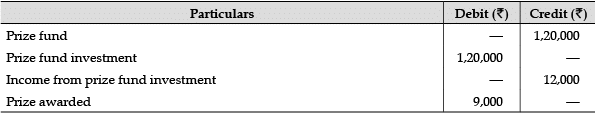

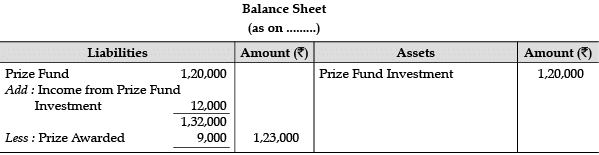

Q.14. Show how you would deal with the following items in the Balance Sheet of a club :

OR

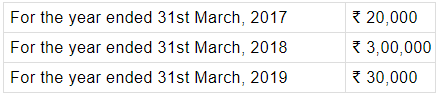

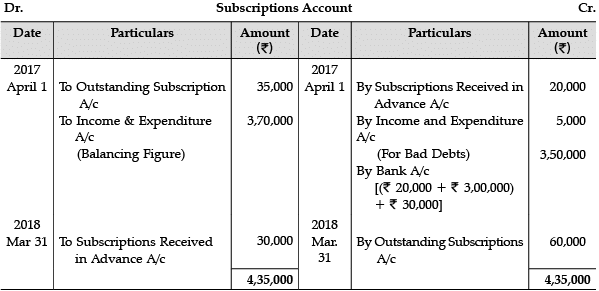

From the following, determine the amount of subscriptions to be credited to Income and Expenditure Account for the year ended 31st March, 2018. Subscriptions received during the year were as follows :

Subscriptions outstanding as at 31st March, 2017 were Rs. 35,000 out of which Rs. 5,000 were not recoverable. On the same date, subscriptions received in advance for the year ended 31st March, 2018 were Rs. 20,000. Subscriptions still outstanding as at 31st March, 2018 amounted to Rs. 60,000.

Ans:

Note: Income from Prize Fund Investment will not be included in Prize Fund Investment but amount received will be debited either in Cash or Bank A/c.

OR

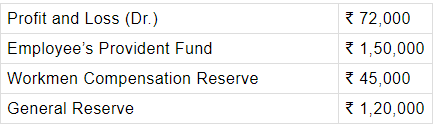

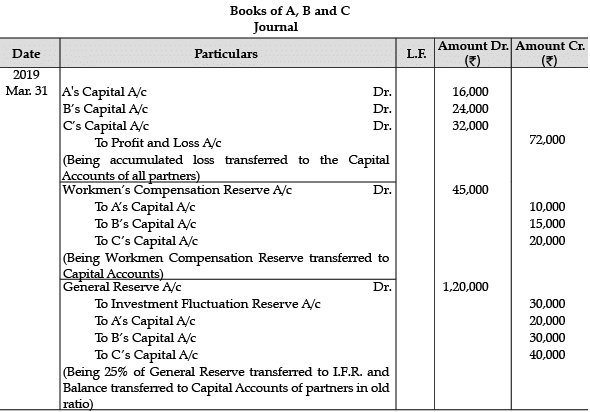

Q.15. A, B and C are partners in a firm sharing profits in the ratio of 2 : 3 : 4. On 31st March, 2019, A retires and B and C decided to share future profits in the ratio of 2 : 1.

Following balances appeared in their books on this date :

It is agreed that (i) Workmen Compensation Reserve is no more required, and (ii) 25% of the General Reserve is to be transferred to Investment Fluctuation Reserve.

Pass Journal entries for the adjustment of these items on A’s retirement.

Ans:

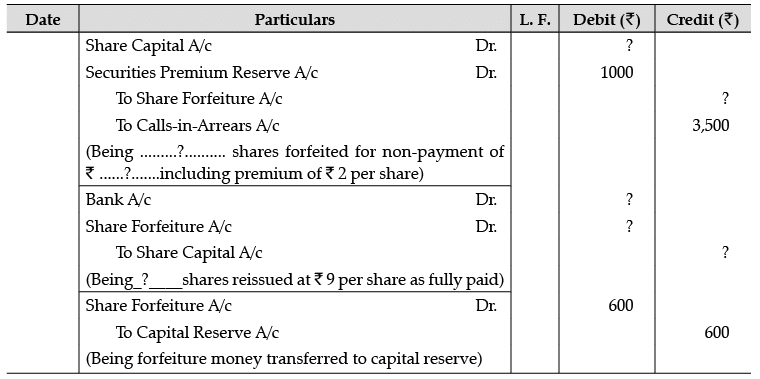

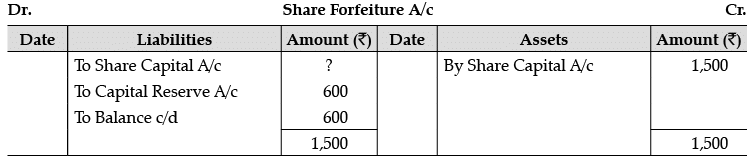

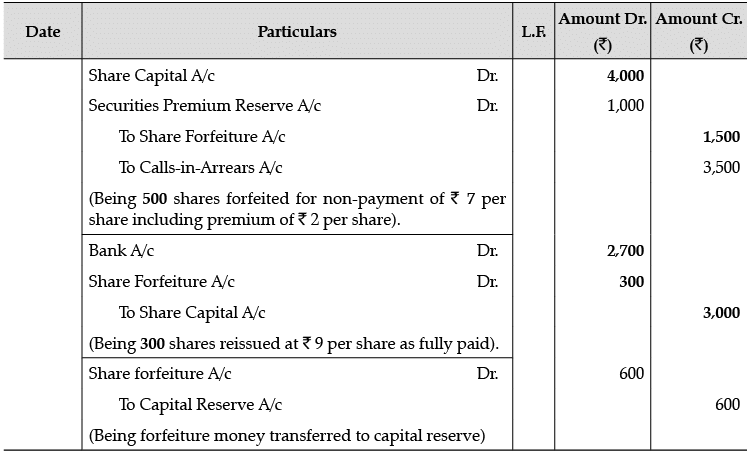

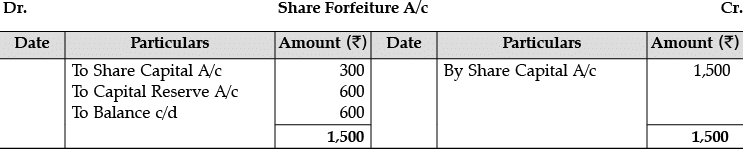

Q.16. From the following information complete Journal entries :

(Face value of share is Rs. 10 each)

Ans.

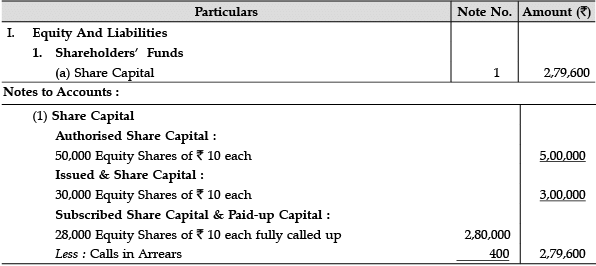

Q.17. Newbie Ltd. was registered with an authorised capital of Rs. 5,00,000 divided into 50,000 equity shares of Rs. 10 each. Since the economy was in robust shape, the company decided to offer to the public for subscription 30,000 equity shares of Rs. 10 each at a premium of Rs. 20 per share. Applications for 28,000 shares were received and allotment was made to all the applicants. All calls were made and duly received except the final call of Rs. 2 per share on 200 shares. Show the ‘Share Capital’ in the Balance Sheet of Newbie Ltd. as per Schedule III of the Companies Act, 2013. Also prepare Notes to Accounts for the same.

Ans: Balance Sheet of Newbie Ltd. as at ......

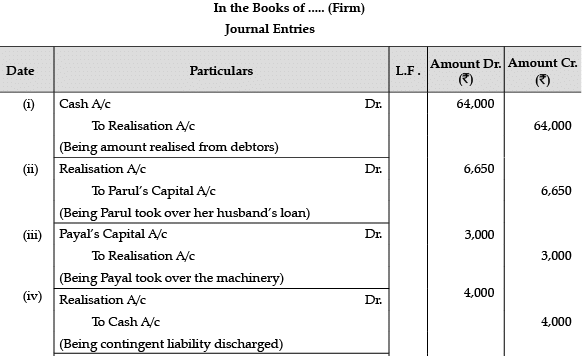

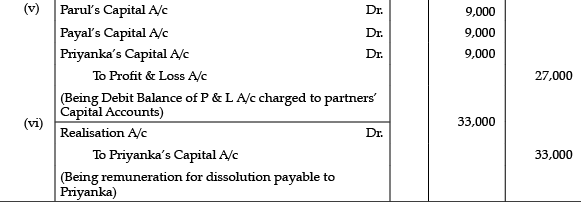

Q.18. Parul, Payal and Priyanka are partners. They decided to dissolve their firm. Pass necessary Journal Entries for the following after various assets (other than cash and bank) and the third party liabilities have been transferred to Realisation Account :

(i) There were total debtors of Rs. 76,000. A provision of bad and doubtful debts also stood in the books Rs. 6,000; Rs. 12,000 debtors proved bad and rest paid the amount due.

(ii) Parul agreed to pay off her husband’s loan of Rs. 7,000 at a discount of 5%.

(iii) A machine which was not recorded in the books was taken over by Payal at Rs. 3,000; whereas its expected value was Rs. 5,000.

(iv) A contingent liability (not provided for) of Rs. 4,000 was also discharged.

(v) The firm had a debit balance of Rs. 27,000 in the Profit & Loss Account on the date of dissolution.

(vi) Priyanka paid the realisation expenses of Rs. 15,000 out of her pocket and she was to get a remuneration of Rs. 18,000 for completing the dissolution process.

Ans:

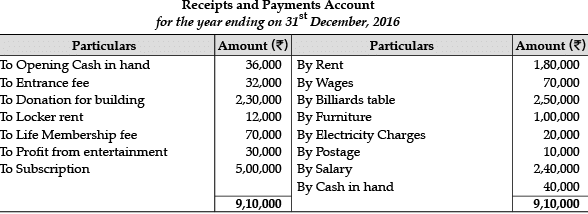

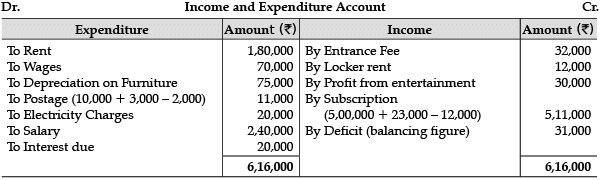

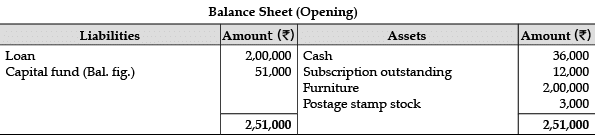

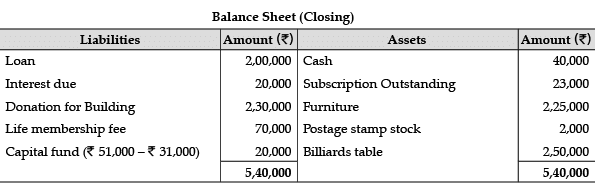

Q.19. Receipts and Payments Account of Ganesh Sports Club is given below, for the year ended 31st December, 2016 :

Prepare Income and Expenditure Account and Balance Sheet with the help of the following information :

(i) Subscription outstanding on 31st December, 2015 is Rs. 12,000 and Rs. 23,000 on 31.12.2016.

(ii) Opening stock of postage stamps is Rs. 3,000 and closing stock is Rs. 2,000.

(iii) On 1st January, 2016, the club owned furniture Rs. 2,00,000, Furniture valued Rs. 2,25,000 on 31.12.2016.

(iv) The club took a loan of Rs. 2,00,000 @ 10% p.a. in 2015.

Ans:

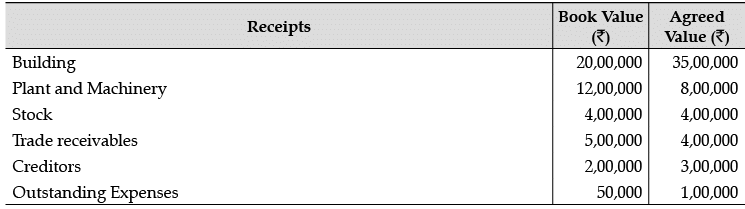

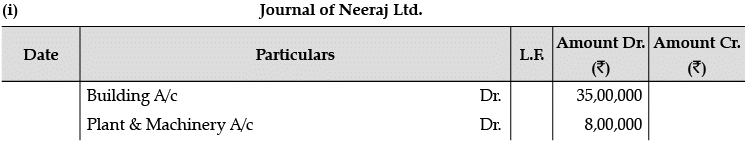

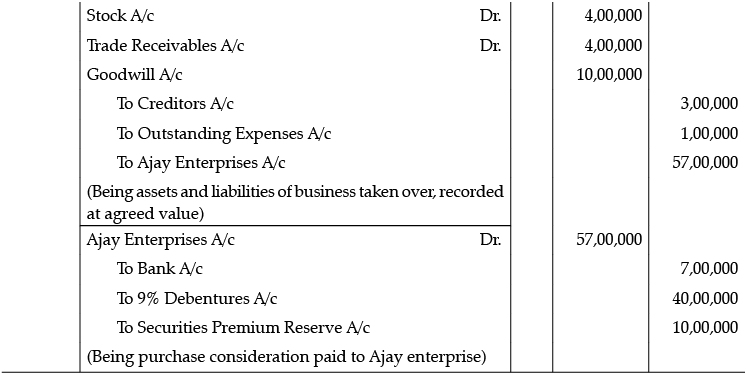

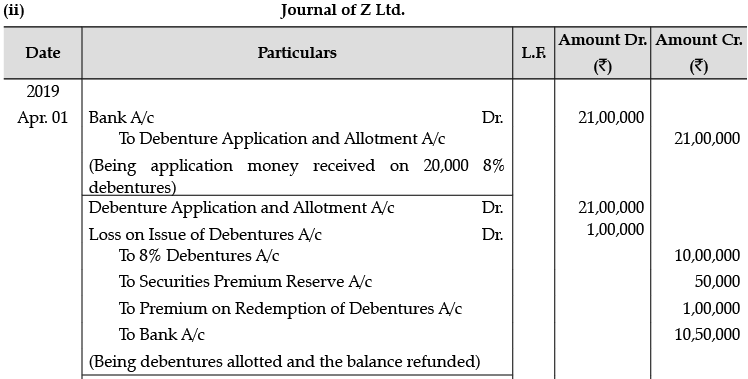

Q.20. (i) Neeraj Ltd. took over business of Ajay enterprises on 1-04-2020. The details of the agreement regarding the assets and liabilities to be taken over are :

It was decided to pay for purchase consideration as Rs. 7, 00,000 through cheque and balance by issue of 2,00,000, 9% Debentures of Rs. 20 each at a premium of 25%. Journalize.

(ii) On April 1, 2019 Z Ltd. issued, 10,000, 8% Debentures of Rs. 100 each at premium of 5%, to be redeemable at a premium of 10%, after 5 years. The entire amount was payable on application. The issue was oversubscribed to the extent of 10,000 debentures and the allotment was made proportionately to all the applicants. The securities premium amount has not been utilized for any other purpose during the year. Give journal entries for the issue of debentures and writing off loss on issue of debentures.

Ans.

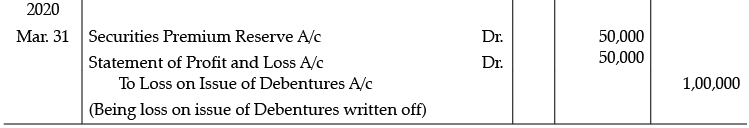

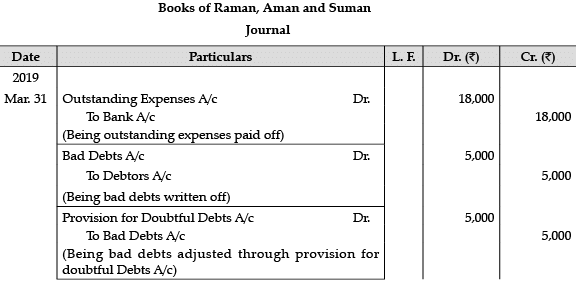

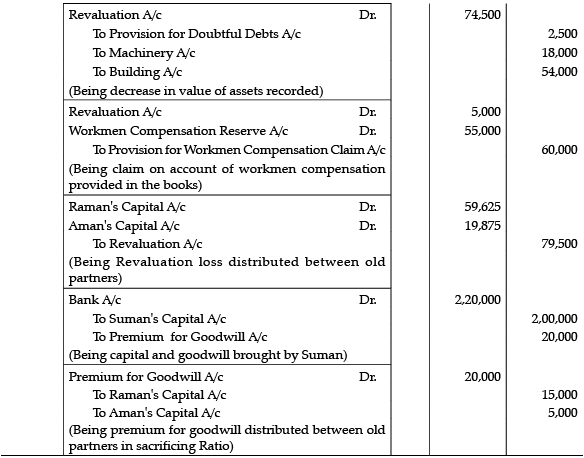

Q.21. Raman and Aman were partners in a firm and were sharing profits in 3 : 1 ratio. On 31.3.2019, their balance sheet was as follows :

On the above date, Suman was admitted as a new partner for 1/5th share in the profits on the following conditions :

(i) Suman will bring Rs. 2,00,000 as her capital and necessary amount for her share of goodwill premium. The goodwill of the firm on Suman’s admission was valued at Rs. 1,00,000.

(ii) Outstanding expenses will be paid off. Rs. 5,000 will be written off as bad debts and a provision of 5% for bad debts on debtors was to be maintained.

(iii) The liability towards workmen compensation was estimated at Rs. 60,000.

(iv) Machinery was to be depreciated by Rs. 18,000 and Land and Building was to be depreciated by Rs. 54,000

Pass necessary journal entries for the above transactions in the books of the firm.

OR

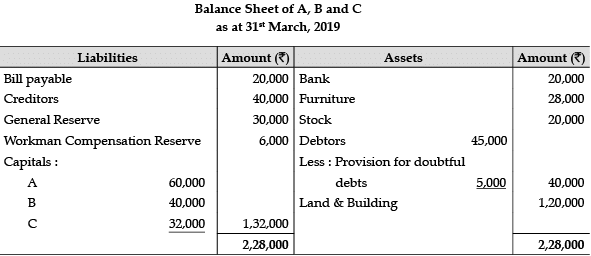

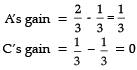

A, B and C were partners in a firm. Their Balance Sheet as at 31st March, 2019 was as follows :

B retired on 1st April, 2019. A and C decided to share profits in the ratio of 2 : 1. The following terms were agreed upon :

(i) Goodwill of the firm was valued at Rs. 30,000.

(ii) Bad-debts Rs. 4,000 were written off. The provision for doubtful debts was to be maintained 10% on debtors.

(iii) Land and Building was to be increased to Rs. 1,32,000.

(iv) Furniture was sold for Rs. 20,000 and the payment was received by cheque.

(v) Liability towards Workmen Compensation was estimated at Rs. 1,500.

(vi) B was to be paid Rs. 20,000 through a cheque and the balance was transferred to his loan account.

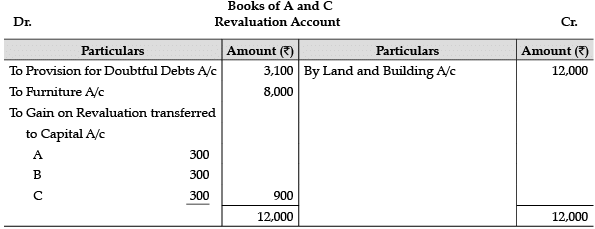

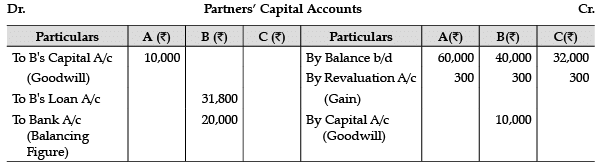

Prepare Revaluation Account, Partners’ Capital Accounts and Bank Account.

Ans:

OR

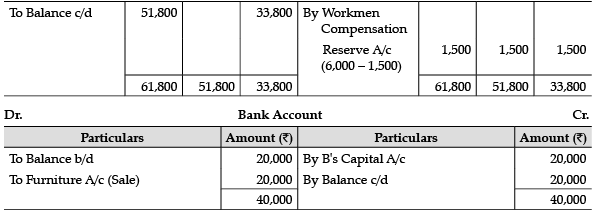

Working Notes :

(1) Calculation of gaining ratio

(2) Treatment of goodwill

B’s share in goodwill = 30,000 × (1/3) = Rs. 10,000

A’s Capital A/c Dr. 10,000

To B’s Capital A/c 10,000

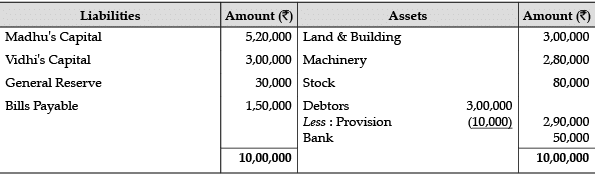

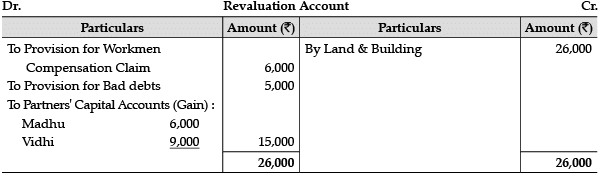

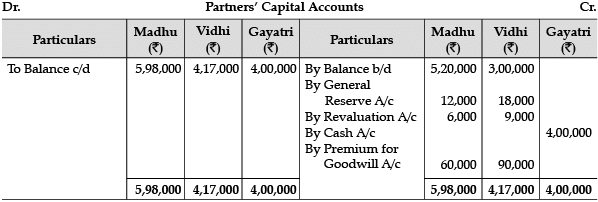

Q.22. The Balance Sheet of Madhu and Vidhi who are sharing profits in the ratio of 2 : 3 as at 31st March, 2016, is given below :

Madhu and Vidhi decided to admit Gayatri as a new partner from 1st April, 2016 and their new profit sharing ratio will be 2 : 3 : 5. Gayatri brought Rs. 4,00,000 as her capital and her share of goodwill premium in cash.

(i) Goodwill of the firm was valued at Rs. 3,00,000.

(ii) Land and Building was found undervalued by Rs. 26,000.

(iii) Provision for doubtful debts was to be made equal to 5% of the debtors.

(iv) There was a claim of Rs. 6,000 on account of workmen compensation.

Prepare Revaluation Account and Partners’ Capital Accounts of the firm.

OR

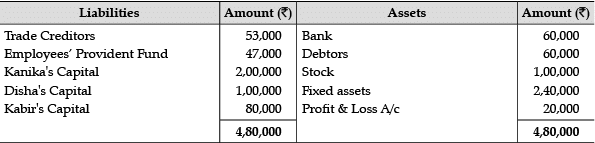

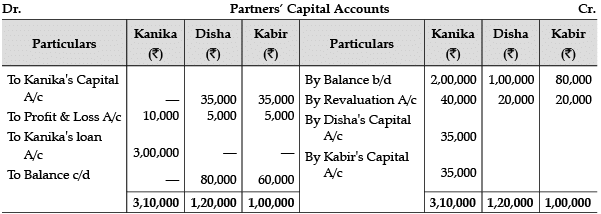

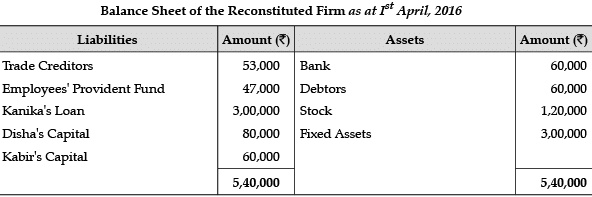

Kanika, Disha and Kabir were partners sharing profits in the ratio of 2 : 1 : 1. On 31-3-2016, their Balance Sheet was as under :

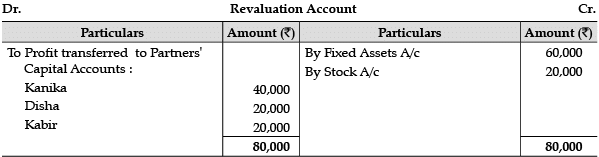

Kanika retired on 1-4-2016. For this purpose, the following adjustments were agreed upon:

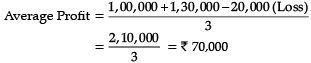

(i) Goodwill of the firm was valued at 2 years’ purchase of average profits of three completed years preceding the date of retirement. The profits for the years 2013-14 were Rs. 1,00,000 and for 2014-15 were Rs. 1,30,000.

(ii) Fixed assets were to be increased to Rs. 3,00,000.

(iii) Stock was to be valued at 120%.

(iv) The amount payable to Kanika was transferred to her loan account.

Prepare Revaluation Account, Capital Accounts of the Partners and the Balance Sheet of the reconstituted firm.

Ans:

OR

Working Notes :

Balance of P & L A/c is given on (Assets) side of the Balance Sheet. So Rs. 5,40,000 will be debited to the Partners’ Capital A/cs : A

Goodwill = 70,000 × 2 = Rs. 1,40,000

Part of Kanika in Goodwill =(2/4) x 1,40,000 = Rs. 70,000

So, Rs. 70,000 will be debited to the Disha’s and Kabir’s Capital A/cs in their gaining ratio.

So, Kanika’s Capital A/c will be credited with Rs. 70,000.

PART - B

Q.23. Pick odd one out :

(a) Debt to Equity Ratio

(b) Proprietary Ratio

(c) Interest Coverage Ratio

(d) Operating Profit Ratio

Ans: d

Q.24. What will be the Current ratio of a company whose Net Working Capital is Zero?

Ans. 1 : 1

Q.25. Hazel Ltd. has been established by the persons who were earlier working as partners. Following options are available :

(i) Follow same balance sheet format

(ii) Follow the format of balance sheet prescribed under Companies Act, 2013

(iii) Follow horizontal format of balance sheet

Choose the correct option :

(a) Only (i) is correct

(b) Only (ii) is correct

(c) Only (i) and (iii) are correct

(d) Only (ii) and (iii) are correct

Ans: b

Q.26. Salaries paid to office staff is shown in the Statement of Profit & Loss under :

(a) Cost of materials consumed

(b) Other expenses

(c) Employees’ benefit expenses

(d) None of these

Ans: c

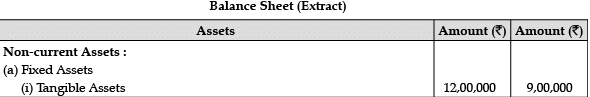

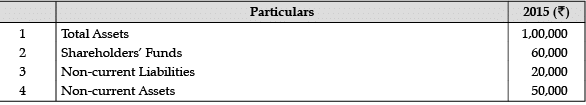

Q.27.

Additional Information :

Description charged on tangible fixed assets was Rs. 1,20,000.

How much amount will be shown in investing activities for purchase of investments ?

(a) Rs. 4,20,000

(b) Rs. 3,00,000

(c) Rs. 1,80,000

(d) Rs. 10,12,000

Ans: a

Q.28. The may indicate that the firm is experiencing stock outs and lost sales.

(a) Average payment period

(b) Inventory turnover ratio

(c) Average collection period

(d) Quick ratio

Ans. (b) Inventory turnover ratio

Q.29. Purchase of treasury bills (investment) will come under which activity while preparing a cash flow statement?

Ans: Investing Activity

Q.30. With the help of the following information, calculate Return on Investment. Net profit after interest and tax : Rs. 6,00,000; 10% Debentures : Rs. 10,00,000; Tax @ 40%; Capital Employed : Rs. 80,00,000.

OR

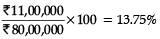

From the following, compute Current Ratio :

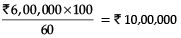

Ans: Return on Investment = Net Profit before Interest, Tax and Dividend / Capital Employed × 100

Net Profit before Tax =

Net Profit before Interest, Tax and Dividend= 10,00,000 + 1,00,000 = Rs. 11,00,000

Capital Employed = Rs. 80,00,000

Return on Investment =

OR

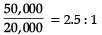

Current Ratio =

Current Assets = Total Assets – Non-current Assets

= Rs. 1,00,000 – Rs. 50,000 = Rs. 50,000

Current Liabilities = Total Assets – Shareholders’ Funds – Non-current Liabilities

= Rs. 1,00,000 – Rs. 60,000 – Rs. 20,000 = Rs. 20,000

Current Ratio =

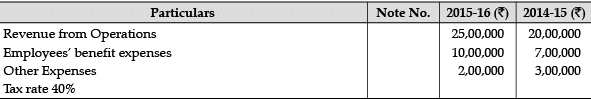

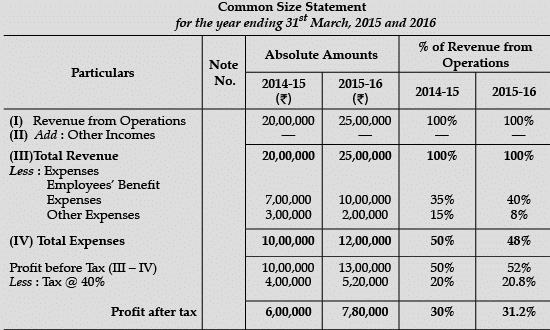

Q.31. From the following Statement of Profit & Loss of Star Ltd., for the years ended 31st March, 2015 and 2016, prepare a common size statement :

OR

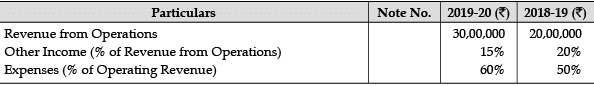

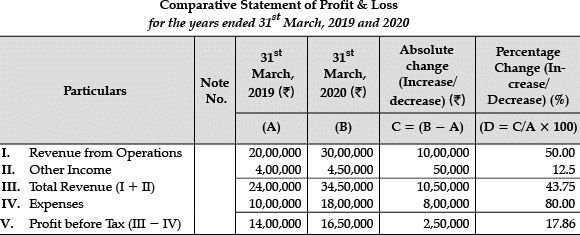

Prepare Comparative Statement of Profit & Loss from the following :

Ans:

OR

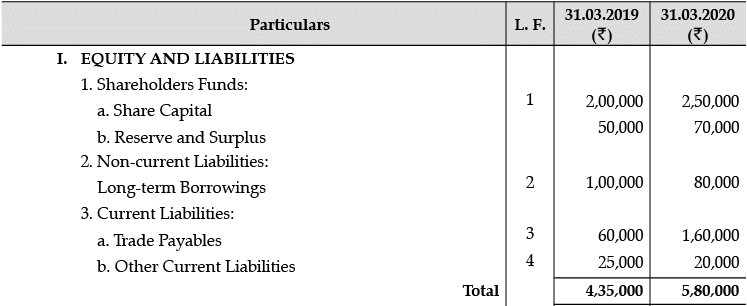

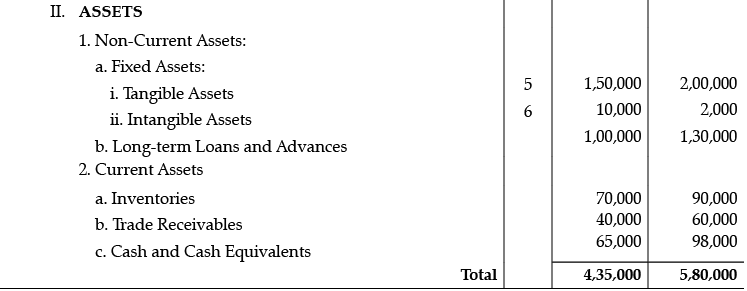

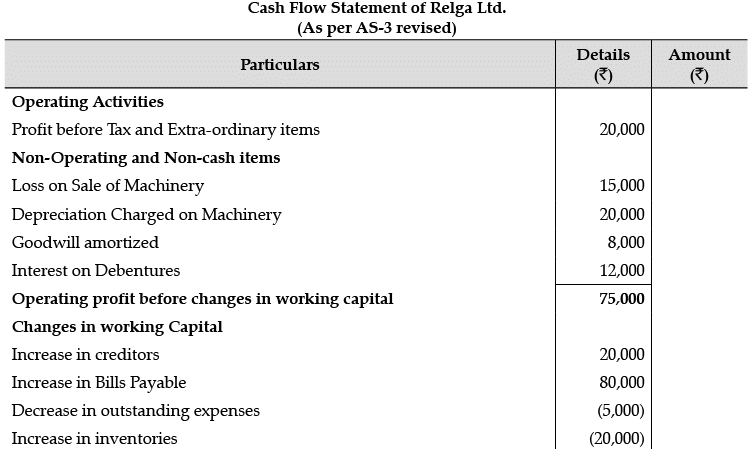

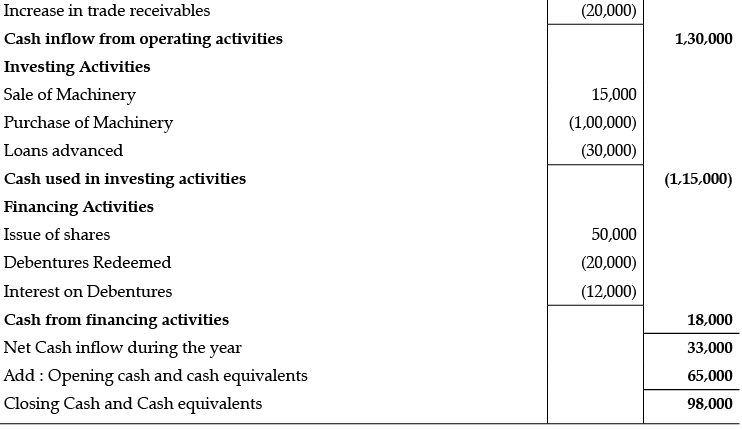

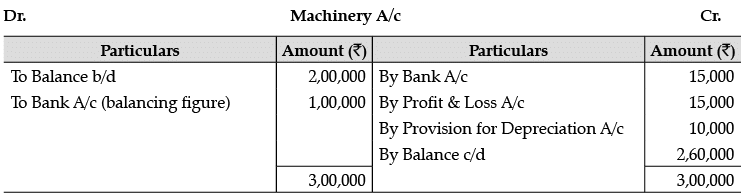

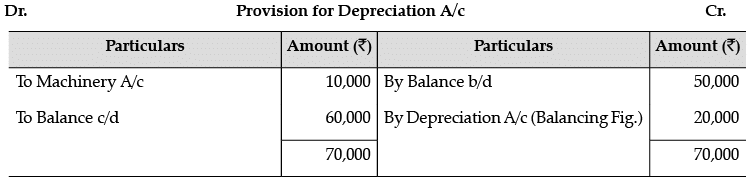

Q.32. Prepare Cash Flow Statement on the basis of information given in the Balance Sheet of Relga Ltd. as at 31st March, 2019 and 31st March, 2020 :

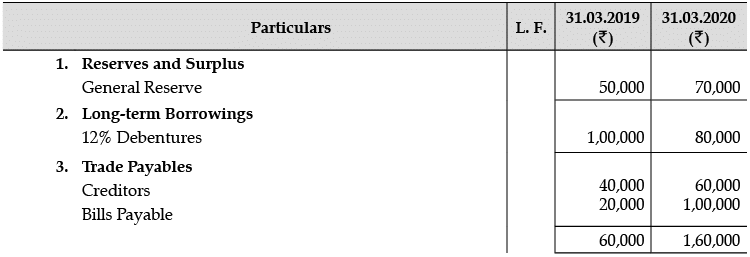

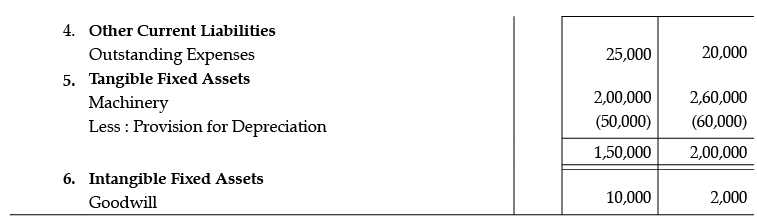

Notes to Accounts :

Additional Information:

1. During the year a piece of machinery with a book value of Rs. 30,000; provision for depreciation on it Rs. 10,000 was sold at a loss of 50% on book value.

2. Debentures were redeemed on 31st March, 2020.

Ans.

|

130 docs|5 tests

|

FAQs on Accountancy: CBSE Sample Question Papers (2020-21)- 2 - Sample Papers for Class 12 Commerce

| 1. What is the format of CBSE Sample Question Papers for Accountancy Class 12? |  |

| 2. How can I access CBSE Sample Question Papers for Accountancy Class 12? |  |

| 3. Are CBSE Sample Question Papers for Accountancy Class 12 helpful for exam preparation? |  |

| 4. Can I rely solely on CBSE Sample Question Papers for Accountancy Class 12 for exam preparation? |  |

| 5. Are CBSE Sample Question Papers for Accountancy Class 12 similar to the actual board exam question paper? |  |