Class - XII

Economics

TIME: 3 Hrs.

M.M: 80

General Instructions :

1. This question paper contains two parts :

Part A : Macro Economics (40 marks)

Part B : Indian Economic Development (40 marks).

2. All questions in both sections are compulsory. Marks for questions are indicated against each question.

3. Question No. 1-10 and 18-27 (including two Case Based Questions) are very short answer questions carrying 1 mark each. They are required to be answered in one word or one sentence each.

4. Case Based Questions (CBQ’s) are Question No. 7-10 and Question No. 25-27.

5. Question No. 11-12 and 28-29 are short answer questions carrying 3 marks each. Answers to them should not normally exceed 60-80 words each.

6. Question No. 13-15 and 30-32 are also short answer questions carrying 4 marks each. Answers to them should not normally exceed 80-100 words each.

7. Question No. 16-17 and 33-34 are long answer questions carrying 6 marks each. Answers to them should not normally exceed 100-150 words each.

8. Answers should be brief and to the point and the above word limit be adhered to as far as possible.

9. There is no overall choice. However, an internal choice has been provided in 2 questions of one mark, 2 questions of three marks, 2 questions of four marks and 2 questions of six marks. Only one of the questions have to be attempted.

10. In addition to this, separate instructions are given with each section and question, wherever necessary

PART — A

Q.1. The study of National Income is related to:

(i) Microeconomics

(ii) Macroeconomics

(iii) Both Micro & Macro

(iv) None of the above

Ans. (ii) Macroeconomics.

OR

State the definition of an intermediate good.

(i) An intermediate good refers to that good which is purchased during the year by a firm for personal use.

(ii) An intermediate good refers to that good which is purchased during the year by a firm to decorate the shop.

(iii) An intermediate good refers to that good which is purchased during the year by a firm from another for the purpose of further production/ resale

(iv) An intermediate good is sold to other countries.

Ans. (iii) An intermediate good refers to that good which is purchased during the year by a firm from another for the purpose of further production/ resale.

Q.2. For the commercial banks, the source of profit is _______________.

(i) Interest

(ii) Loans

(iii) Deposits

(iv) Spread

Ans. (iv) Spread

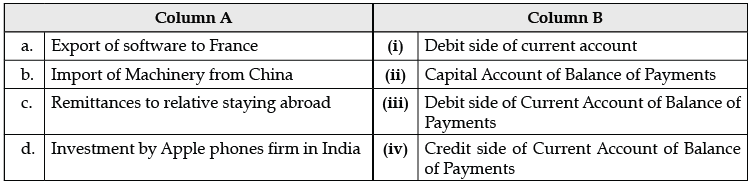

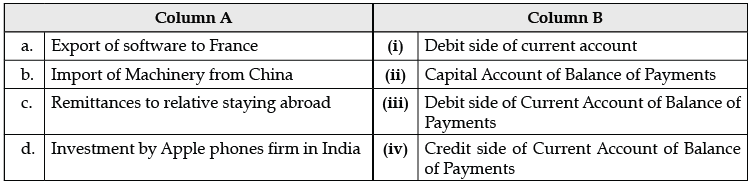

Q.3. From the set of statements given in Column I and Column II, choose the correct pair of statements:

Ans. (iii) (c) Remittances to relative staying abroad -(iii) Debit side of current Account of Balance of Payments

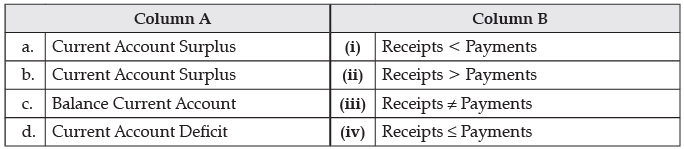

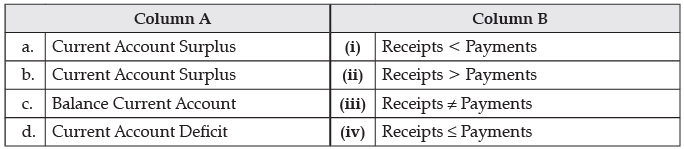

Q.4. Identify the correct pair of formula from the following column I and II :

Alternatives :

(i) a - i

(ii) b - ii

(iii) c - iii

(iv) d - iv

Ans. (ii) b. - ii

Q.5. A company located in India receives a loan from a company located abroad. How this transaction is recorded in India’s balance of payment account?

(i) Credit side of current account

(ii) Debit side of current account

(iii) Credit side of capital account

(iv) Debit side of capital account

Ans. (iii) Credit side of capital account.

Q.6. Foreign exchange refers to:

(i) the price of one currency in terms of gold in the domestic market

(ii) the price of one currency determined by government of other country

(iii) the price of one currency in relation to other currencies in the international money market

(iv) none of these

Ans. (iv) none of these.

Q.7. AD schedule shows the relationship between:

(i) AD and Y

(ii) AD and AS

(iii) C and S

(iv) All of these

Ans. (i) AD and Y.

Q.8. Decrease in Cash Reserve Ratio will lead to…...........… (choose the correct alternative)

(i) fall in aggregate demand

(ii) rise in aggregate demand

(iii) no change in aggregate demand

(iv) fall in general price level

Ans. (ii) rise in aggregate demand

Q.9. What other options does the RBI have to increase the savings and consumption in the economy:

(i) Increasing Reverse Repo Rate

(ii) Decrease in the Repo Rate

(iii) Open Market Operations

(iv) Increase in Repo rate.

Ans. (iv) Increase in Repo Rate

Q.10. Aggregate Demand is the sum total of:

(i) Consumption

(ii) Expenditure by Government.

(iii) Net Exports

(iv) All of the Above.

Ans. (iv) All of the Above

Q.11. By giving reasons, classify the following into intermediate products or final products. (i) Furniture purchased by a school

(ii) Chalks, dusters, etc., purchased by school

OR

Explain ‘non-monetary exchanges’ as a limitation of using gross domestic product as an index of welfare of a country.

Ans. (i) Furniture purchased by school: Final Product.

Reason : School buy furniture for long term use and it is considered as an investment.

(ii) Chalks, Dusters, etc., purchased by school: Intermediate product.

Reason : These are taken up to be used up completely during the same year or for providing educational services.

OR

Non-Monetary Exchanges: These are those activities in an economy which cannot be evaluated in terms of money due to non-availability of data, e.g. domestic services provided by family members at home, barter exchanges etc. Although these activities contribute to welfare, they are a major cause of understanding of GDP in the economy. Therefore, GDP may not give the true picture of welfare of a country.

Q.12. State, giving valid reasons, whether the following statements are true or false :

(i) Current account in Balance of Payments records only the exports and imports of goods and services.

(ii) Borrowings from abroad are recorded in the Capital Account of the Balance of Payments on the debit side.

OR

‘Trade Deficit must exist if a country is facing a situation of Current Account Deficit’.

Defend or refute the statement, with valid argument.

Ans. (i) The given statement is false as the Current Account of Balance of Payments records unilateral transfers along with exports and imports of goods and services.

(ii) The given statement is false as the borrowings from abroad are recorded in the Capital Account of Balance of Payments on the credit side as it results in an inflow of foreign currency in the economy.

or

The given statement is refuted as the Current Account Deficit (CAD) is a broader concept. CAD occurs when the foreign exchange payments on account of visible, invisibles and current transfers are in excess over the receipts of visible, invisibles and current transfers.

A country may face a situation of CAD, even if the country has trade surplus, with greater negative balances on account of services and unilateral transfers.

Q.13. Distinguish between the following:

(a) Revenue Receipt and Capital Receipt,

(b) Revenue Deficit and Fiscal Deficit.

Ans. (a) (i) Revenue Receipts: Revenue receipts are receipts that neither reduce assets nor create liability. Revenue receipts are divided into two heads, namely, receipts from tax revenue(e.g.,income Tax service tax, corporation tax etc.) and from non-tax revenue (e.g., interest payments,dividend and etc.)

(ii) Capital Receipts: Capital Receipts are receipts that create liability or reduce assets It includes recovery of loans and advances market loans, provident funds, external assistance disinvestment proceeds, external assistance etc.

(b) (i) Revenue Deficit: It is the excess of revenue expenditure over revenue receipts. It means that government will not be able to meet its revenue expenditure from its revenue receipts.

Revenue Deficit = Revenue Expenditure – Revenue Receipts.

(ii) Fiscal Deficit: It is the excess of total expenditure over total receipts excluding borrowings. It increases the liability of government in form of repayment of loans with interest.

Q.14. Differentiate between Aggregate Demand and Aggregate Supply.

Or

Explain the meaning of Investment Multiplier. What can be its minimum and maximum value?

Ans. Aggregate Demand: It refers to total value of final goods and services which all the sectors of an economy are planning to buy at a given level of income during a period of an accounting year.

Aggregate Supply: It refers to money value of goods and services that all the producers are willing to supply in an economy in a given time period.

OR

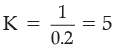

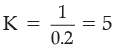

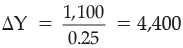

When investment expenditure increases, there is multiple increase in income. The rates of increase in income to increase in investment expenditure are the value of multiplier. Its value equals  or

or  or

or

Its minimum value is ‘one’ while the maximum value is infinity.

Q.15. Calculate change in final income, if Marginal Propensity to Consume (MPC) is 0.8 and change in initial investment is Rs. 1,000 crore.

Or

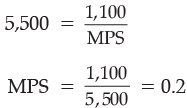

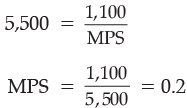

In an economy, investment increased by 1,100 and as a result of it, income increased by 5,500. Had the marginal propensity to save been 25 percent, what would have been the increase in income?

Ans. Investment Multiplier (K) =

Also

ΔY = Rs. 5,000 crore

Change in final income = Rs. 5,000 crore

ΔY = ΔI

(No marks if only the final answer is given)

Q.16. (i) ‘Domestic/household services performed by a woman may not be considered as an economic activity’.

Defend or refute the given statement with valid reason.

(ii) ‘Compensation to the victims of a cyclone is an example of a welfare measure taken by the government’.

State with valid reason, should it be included/not included in the estimation of national income of India.

OR

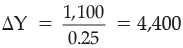

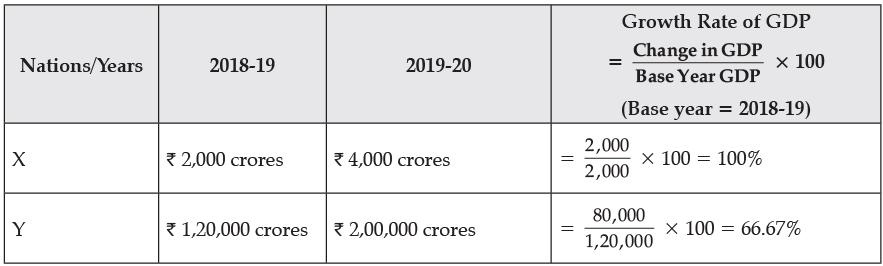

Suppose the Gross Domestic Product (GDP) of Nation X was Rs. 2,000 crores in 2018-19, whereas the Gross Domestic Product of Nation Y in the same year was Rs. 120,000 crores.

If the Gross Domestic Product of Nation X rises to Rs. 4,000 crores in 2019-20 and the Gross Domestic Product of Nation Y rises to Rs. 200,000 crores in 2019-20.

Compare the rate of change of GDP of Nations X and Y, taking 2018-19 as base year.

Ans. (i) The given statement is defended; as it is difficult to measure the monetary value of the services performed by a woman (homemaker). Therefore, these activities may not be considered as an economic activity.

(ii) Compensation given to the victims of a cyclone is an example of a social welfare measure taken by the government.

However, it is not included in estimation of national income as it is a transfer payment which does not lead to corresponding flow of goods and services.

OR

Nation X has registered a GDP growth rate of 100% and has performed better on the front of GDP rise as compared to Nation Y that has registered a GDP growth rate of 66.67%.

Q.17. (a) Suppose in an imaginary economy GDP at Market Price in a particular fiscal year was Rs. 4,000 crore, National Income was Rs. 2,500 crore, Net Factor Income paid by the economy to rest of the world was Rs. 400 crore and the value of Net Indirect Taxes is Rs. 450 crore. Estimate the value of consumption of fixed capital for the economy from the given data.

(b) Bread made in the factory and sold to the Restaurant to be made a sandwich, will be treated as Intermediate or Final Good. Give Reason for your answer.

OR

(i) State any two precautions that must be taken into consideration while estimating national income by value added method.

(ii) In any economy, following transactions took place. Calculate total consumption expenditure of households and value added by Firm B:

(a) Firm A sold to firm B goods of Rs. 80 crore; to firm C Rs. 50 crore; to household Rs. 30 crore and goods of value Rs. 10 crore remains unsold.

(b) Firm B sold to firm C goods of Rs. 70 crore; to firm D Rs. 40 Crore; goods of value Rs. 30 crore were exported and goods of value Rs. 5 crore was sold to government.

Ans. (a) NNPFC= GDPMP - Consumption of Fixed Capital - Net Factor Income to Abroad- Net Indirect Taxes

2,500 =4,000 -CFC - 450 –400

2,500 = 3,150 –CFC

CFC=650 (in Rs. crore)

Part - B

Q.18. Small scale industry is that industry in which investment in the fixed capital can be up to ______________ (Rs. 5 crore/ Rs. 10 crore).

Or

First Industrial policy was declared in 1956. (True / False).

Ans. Rs. 5 crore

Or

False

Q.19. What does Green Revolution imply?

(i) Decrease in production of food grains

(ii) Increase in production of food grains

(iii) Increase in green cover

(iv) Decrease in green cover

Ans. (ii) Increase in production of food grains.

Q.20. Read the following statements - Assertion (A) and Reason (R). Choose one of the correct alternatives given below :

Assertion (A) : India became an exporter of primary products and an importer of finished consumer and capital goods produced in Britain.

Reason (R) : Restrictive policies of commodity production, trade and tariff pursued by the colonial government adversely affected the structure, composition and volume of India’s foreign trade.

Alternatives :

(i) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(ii) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A)

(iii) Assertion (A) is true but Reason (R) is false.

(iv) Assertion (A) is false but Reason (R) is true.

OR

Read the following statements - Assertion (A) and Reason (R). Choose one of the correct alternatives given below :

Assertion (A) : The major policy initiatives i.e. land reforms and green revolution helped India to become self-sufficient in food grains production.

Reason (R) : The proportion of people depending on agriculture did not decline as expected Alternatives :

(i) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(ii) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

(iii) Assertion (A) is true but Reason (R) is false.

(iv) Assertion (A) is false but Reason (R) is true.

Ans. Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

OR

Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

Q.21. With which the disparity of income and its distribution is associated with?

(i) Relative Population

(ii) Relative Poverty

(iii) Relative Employment

(iv) Relative Unemployment

Ans. (ii) Relative Property.

Q.22. The country having maximum population of the world is:

(i) India

(ii) China

(iii) Pakistan

(iv) None of these.

Ans. (ii) China

Q.23. Among China, Pakistan and India, which country has the largest contribution of the service sector to the GDP?

Ans. India has the largest contribution of the service sector to the GDP.

Q.24. Uncertainty of income for farmers in India is majorly caused by _________ (irregular rainfall/ unavailability of loans).

Ans. irregular rainfall

Q.25. In economy, labour force and work force are equal in a situation, when the:

(i) Population grows at slower rate

(ii) No growth in population

(iii) No unemployment

(iv) Growth rate of population is greater than growth rate of employment

Ans. (iii) No unemployment

Q.26. The production process engaged in transforming one good to another is known as:

(i) Primary Sector

(ii) Secondary Sector

(iii) Tertiary Sector

(iv) None

Ans. (ii) Secondary Sector

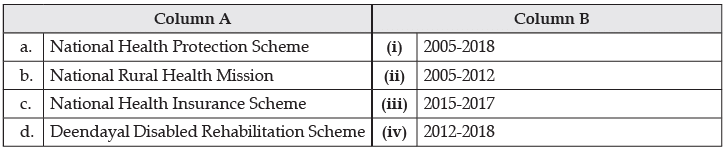

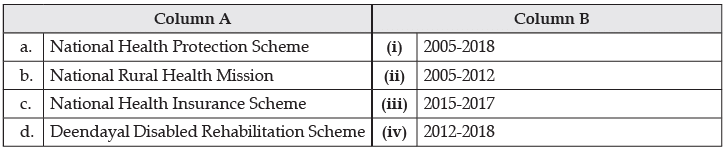

Q.27. Identify the correctly matched pair of the items in Column A (Government Schemes) to that of Column B (Period they were active):

Ans. (ii) National Rural Health Mission – (b) 2005-2012

Q.28. ‘India has emerged as a hotspot for medical tourism’. Defend the statement with valid arguments.

OR

Discuss any two steps taken by the government in the direction of improving agricultural marketing system in India, since independence.

Ans. The given statement is defended as in the recent past India has witnessed many foreign nationals visiting for surgeries, organ transplant, dental and even cosmetic care. The prime reason for this phenomenon can be quoted as:

(i) Health services in India offer latest medical technologies with qualified professionals.

(ii) All these medical services are less costly in India as compared to similar health care services in other countries.

OR

Two major steps taken by the government in the direction of improving agricultural marketing system in India, since independence are:

(i) Regulation of markets: This step was necessary in the post- independence period so as to create an orderly and transparent marketing condition across India. This policy benefitted both farmers as well as consumers.

(ii) Physical Infrastructure: This is another important aspect tackled by the government. Improvement of physical infrastructure facilities like roads, railways, warehouses, godowns, cold storages, processing units etc. has been the target of the government since decades.

Q.29. Compared to the 1970s, there has hardly been any change in the distribution of workforce across various industries. Comment.

Ans. India being as agrarian economy, has majority of population dependent on the agricultural sector to earn their livelihood. Although, the development strategies in India have aimed at the reduction of population dependence on agriculture, yet the reduction in the population engaged in agricultural sector has not been significant.

In 1972-73, about 74% of the work force was engaged in primary sector which reduced to 48.9%in 20112012. On the other hand, the shares of secondary and tertiary sector in employment rose from 11% to 24% and 15% to 27% respectively. The workforce distribution indicates that over the last four decades i.e., from 1972-2012, people have moved from self-employment and regular-salaried employment to casual wage worker.

This particular pattern of moving from self-employment and regular-salaried employment to casual wage work is termed as casualisation of workforce. Thus, it can be concluded that although changes in the distribution of workforce have taken place in reference to casualisation of workforce, yet there has hardly been any change in the distribution of workforce across various industries. Industrial and tertiary sector need to increase their share in the workforce distribution by generating more employment opportunities and absorbing excess labour from the agricultural sector.

Q.30. Is it necessary to generate employment in the formal sector? Why?

Or

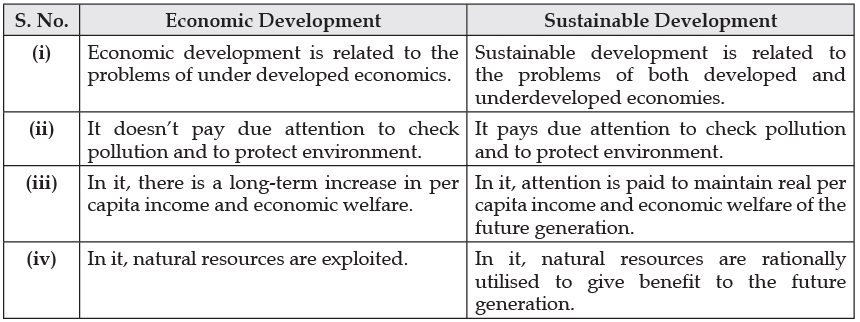

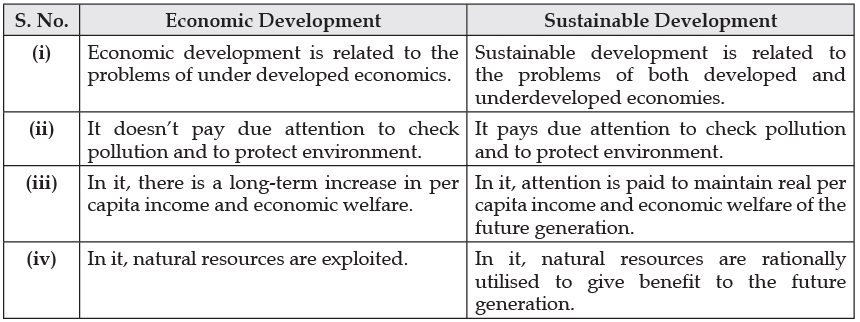

Differentiate between Economic development and Sustainable development.

Ans. Formal sector refers to the organised sector of the economy. It includes government departments,public enterprises and private establishments that hire 10 or more workers. Workers of the formal sectors enjoy social security benefits and also they remain protected by the labour laws.

The informal sector is an unorganised sector of the economy. People engaged in this sector do not enjoy any social security benefits and do not have any trade unions and consequently, have low bargaining power. This makes them more vulnerable to the uncertainties of the market.

Creating more jobs in the formal sector will not only absorb workforce from the informal sector but also help in reducing poverty and income inequalities. In order to safeguard the interests of the informal sector and to utilise this portion of the workforce for achieving economic growth, it is very important to generate more employment opportunities in the formal sector rather than in the informal sector.

OR

The difference between Economic Development and Sustainable Development are :

Q.31. ‘Sustainable development is a paradigm shift in development thinking’. Comment.

Ans. It is true that sustainable development is a paradigm shift in development thinking as sustainable development implies meeting the basic needs of all and extending to all the opportunity their aspirations for a better life, without compromising on the needs of future. The strategies for sustainable development imply the use of non-conventional sources of energy to minimise the adverse environmental impacts. Promotion of natural resources, conservation, preserving regenerative capacity of ecological system and avoiding the imposition of environmental rules on future generations would lead to sustainable development.

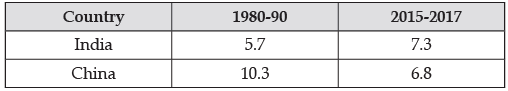

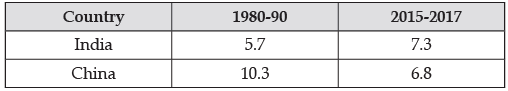

Q.32. Compare and analyse the given data of India and China with valid arguments.

Annual Growth of Gross Domestic Product (%), 1980-2017

Source : Key Indicators for Asia and Pacific 2016, Asian Development Bank, Philippines; World Development Indicators 2018.

Ans. The given data shown that China has gained economic strength over the years. When many developed countries were finding it difficult to maintain a growth rate of even 5%, China was able to maintain near double-digit growth during the decade of 1980s. The growth rate of China has decelerated to an average of 6.8%, over the period 2015-17.

In the recent past India has posted a decent rise in the growth rate. While India had maintained a reasonable growth rate of 5.7% in the decade of 1980’s it has shown great calibre and character in the period 2015-17 by registering an average of 7.3%, over the period 2015-17.

Nevertheless, Indian elephant has to travel a long distance before it could present itself as a real threat to the growth story of the Chinese dragon.

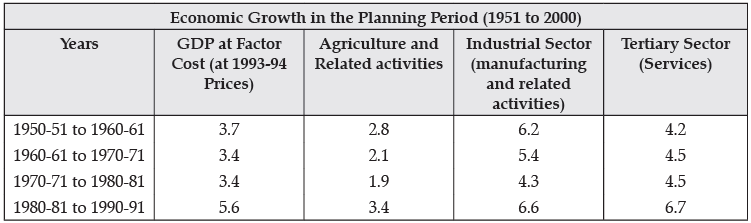

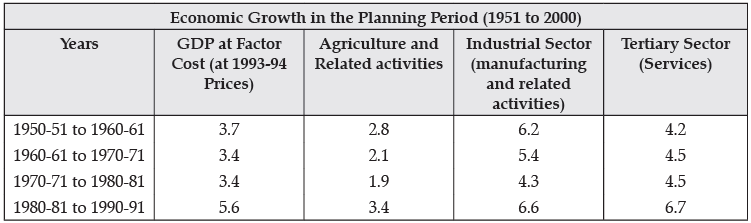

Q.33. With the help of the following table state the causes for the limited success of the planning period.

OR

Why was public sector given a leading role in industrial development during the planning period?

Ans. The table shows the sectoral changes in India during the planning period which marks very little success. The Main causes responsible for the little success of planning in India are :

(i) Inappropriate Development Strategy : India adopted heavy industry centred development strategy with the hope to accelerate the pace of development. But neither the rate of development nor employment could increase, as can be seen in the table the GDP growth rate was in the range of 3.4% to 3.7%.

(ii) Slow Progress of Industrial Sector : Industrial progress was slow as from 6.2% in 1950-51 to just 6.6 % in 1990-91. This is due to power shortage, irregular and insufficient supply of raw materials, lack of capital and infrastructural facilities, etc.

(iii) Slow-down in Agricultural Sector : In the initial phases the agricultural sectors growth fell from 2.8% in 1950-51 to 1.9% in 1980-81. This is due to the use of obsolete technology and weak variety of crops used.

(iv) Traditional Social Structure : It was because of India’s traditional social structure, fruits of planning could not reach to the weaker sections of the society because of the caste system,dowry system, etc. Mobility of labour, inducement to save and invest, work incentives, etc., have been greatly hurt. Family planning could not succeed because of traditional social outlook.

OR

At the time of independence, Indian economic condition was very poor and weak. There was neither much private capital nor did India have international investment credibility so as to attract foreign investment. Moreover, Indian planners did not want to be dependent on foreign capital for economic development. In such a situation, it was only the public sector that could take the initiative.

The following are the reasons that explain the driving role of the public sector in the industrial development :

(i) Lack of Capital with the Private Entrepreneurs : Industrial development in India needed a big push. At the time of independence, the requirement of capital for diversified industrial growth far exceeded its availability with private entrepreneurs (Tata and Birla). Accordingly, it became essential for the state to foster industrial growth through public sector undertakings.

(ii) Lack of Incentive among the Private Entrepreneurs : The private investors lacked incentives as well. Owing to limited size of the market, there was no inducement to invest. Only a big push of public investment could break this vicious circle of low inducement to investment.

(iii) Socialistic Pattern of Society : The government realised that, this objective could be achieved only through direct participation of the state in the process of industrialisation, because it requires investment that generates employment rather than investment that maximises profit. Concentration of wealth was to be discouraged and public investment was considered as the best means to achieve it.

Q.34. Why did India adopt New Economic Policy in 1991?

Ans. In the middle of 1991, need for major economic reforms was felt in the country. These were urgently needed to bring U-turn in the economy. It was mainly due to following reasons:

(i) Excessive fiscal deficit: In our planned economic development, anticipated expenditure was always in excess of anticipated receipts resulting into fiscal deficit. It increased to 8.5% of GDP in 1991 as against 5% in 1981-82. In order to meet this deficit, government had to make public borrowings involving interest burden of borrowing.

(ii) Balance of payment deficit: Deficit in balance of payment means when foreign payments are in excess of foreign receipts. In India, it mounted from ' 2,214 crore in 1980-81 to ' 17,367 crore in 1990-91. To meet this deficit, government had to depend upon external borrowings.

(iii) Rise in prices: After 1960-61, prices of all commodities continued to rise. The situation became serious when the rate of inflation arose from 6.7% to 16.7%.

(iv) Reduction in foreign exchange reserves: At one time, during 1990-91, foreign exchange reserves fell to a lower level of ' 2,400 crore, which was just enough for the payments of three weeks imports. The crisis was so serious that Chandra Shekhar government had to mortgage gold reserves with other countries to pay off interest and foreign debts. It forced India to adopt a newset of measures to accumulate foreign exchange reserves.

(v) Poor performance of public sector: Government of India expanded public sector in a huge way during 1951-1991, but their return was negligible. So, it was the need of the hour to shift it to the private sector instead of public sector.

(vi) Gulf Crisis: Iran-Iraq war in 1990-91, is known as gulf-crisis. It led to a sharp rise in petrol prices in the international market. Our exports to gulf countries fell sharply but there was a steep rise in import bills. It made the balance of payment position further grim. It compelled the government to introduce the new economic policy at this juncture.

or

or  or

or