Class 12 Exam > Class 12 Notes > Additional Study Material for Class 12 > Mindmap: Money and Banking

Mindmap: Money and Banking | Additional Study Material for Class 12 PDF Download

The document Mindmap: Money and Banking | Additional Study Material for Class 12 is a part of the Class 12 Course Additional Study Material for Class 12.

All you need of Class 12 at this link: Class 12

|

12 videos|63 docs

|

FAQs on Mindmap: Money and Banking - Additional Study Material for Class 12

| 1. What is the role of money in the banking system? |  |

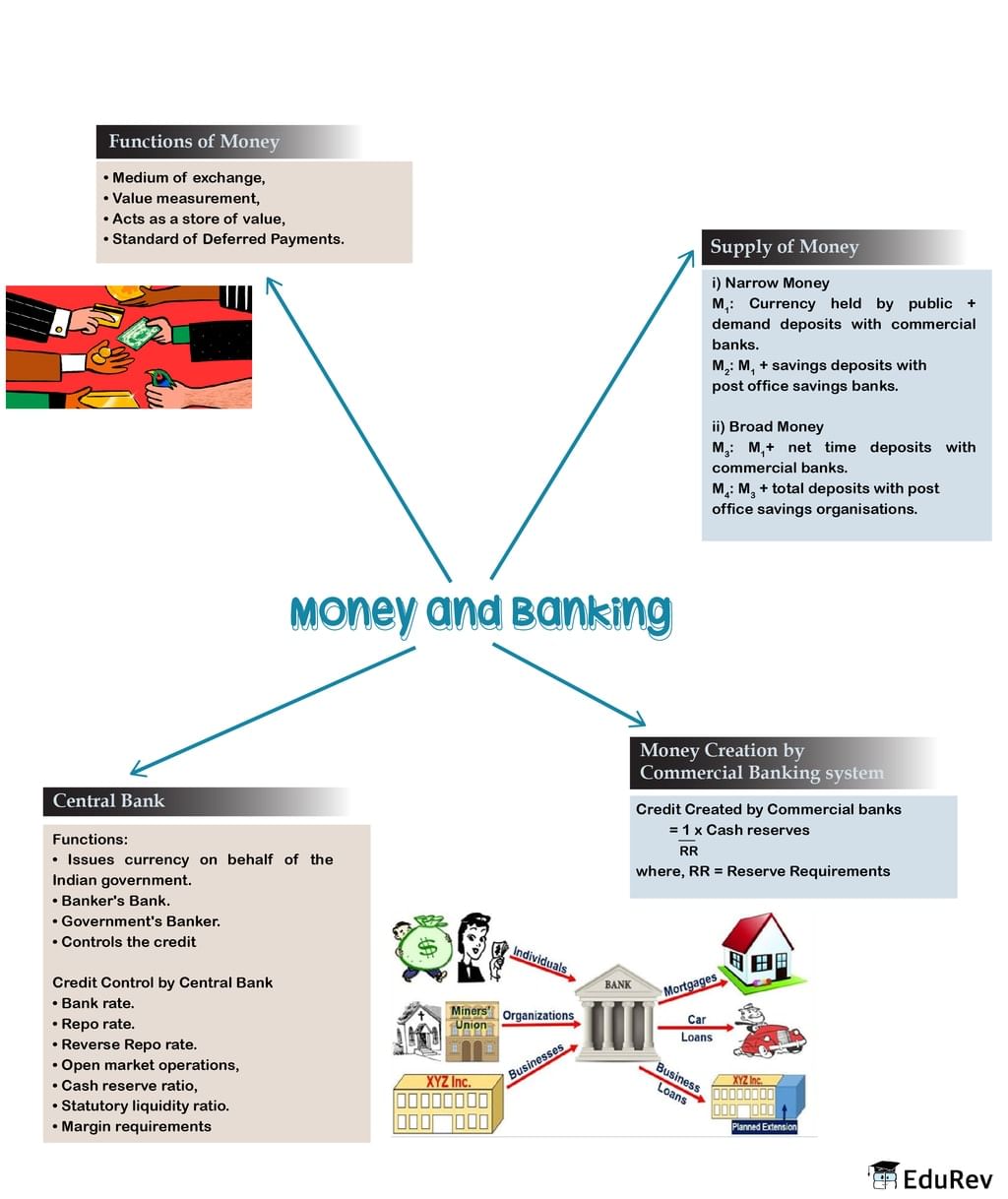

Ans. Money plays a crucial role in the banking system as it serves as a medium of exchange, unit of account, and store of value. It allows individuals and businesses to conduct transactions, measure the value of goods and services, and preserve wealth over time.

| 2. How do banks create money? |  |

Ans. Banks create money through the process of fractional reserve banking. When a bank receives a deposit, it is required to hold only a fraction of that deposit as reserves, while the rest can be lent out to borrowers. By lending out these funds, banks effectively create new money in the form of loans.

| 3. What are the functions of a central bank in a country's monetary system? |  |

Ans. The central bank has several key functions in a country's monetary system. It controls the money supply, acts as a lender of last resort to banks, conducts monetary policy to stabilize the economy, regulates and supervises banks, and manages the foreign exchange reserves.

| 4. What is the difference between commercial banks and investment banks? |  |

Ans. Commercial banks primarily engage in traditional banking activities such as accepting deposits, granting loans, and providing banking services to individuals and businesses. On the other hand, investment banks focus on underwriting securities, facilitating mergers and acquisitions, and providing advisory services to corporations and institutional clients.

| 5. How does the central bank influence interest rates in the economy? |  |

Ans. The central bank influences interest rates through its monetary policy tools. By adjusting the benchmark interest rate, known as the policy rate, the central bank affects the cost of borrowing for banks and, subsequently, for individuals and businesses. Additionally, the central bank can engage in open market operations, buying or selling government securities to affect the money supply and indirectly influence interest rates.

|

Explore Courses for Class 12 exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.

Related Searches