Overview Of Accounting Standards: Notes(Part- 1) | Accounting for CA Intermediate (Old Scheme) PDF Download

Chapter Overview

Practical Application of :

- AS 1 : Disclosure of Accounting Policies

- AS 2 : Valuation of Inventories

- AS 3 : Cash Flow Statements

- AS 10 : Property, Plant and Equipment

- AS 11 : The Effects of Changes in Foreign Exchange Rates

- AS 12 : Accounting for Government Grants

- AS 13 : Accounting for Investments

- AS 16 : Borrowing Costs

Disclosure Of Accounting Policies (AS 1)

Introduction

- Irrespective of extent of standardization, diversity in accounting policies is unavoidable for two reasons. First, accounting standards cannot and do not cover all possible areas of accounting and enterprises have the freedom of adopting any reasonable accounting policy in areas not covered by a standard.

- Second, since enterprises operate in diverse situations, it is impossible to develop a single set of policies applicable to all enterprises for all time.

- The accounting standards therefore permit more than one policy even in areas covered by it. Differences in accounting policies lead to differences in reported information even if underlying transactions are same. The qualitative characteristic of comparability of financial statements therefore suffers due to diversity of accounting policies. Since uniformity is impossible, and accounting standards permit more than one alternative in many cases, it is not enough to say that all standards have been complied with. For these reasons, accounting standard 1 requires enterprises to disclose significant accounting policies actually adopted by them in preparation of their financial statements. Such disclosures allow the users of financial statements to take the differences in accounting policies into consideration and to make necessary adjustments in their analysis of such statements.

- The purpose of Accounting Standard 1, Disclosure of Accounting Policies, is to promote better understanding of financial statements by requiring disclosure of significant accounting policies in orderly manner. As explained in the preceding paragraph, such disclosures facilitate more meaningful comparison between financial statements of different enterprises for same accounting periods. The standard also requires disclosure of changes in accounting policies such that the users can compare financial statements of same enterprise for different accounting periods.

- The standard applies to all enterprises.

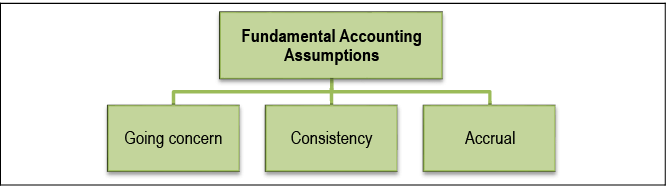

Fundamental Accounting Assumptions

➤ Going Concern: The financial statements are normally prepared on the assumption that an enterprise will continue its operations in the foreseeable future and neither there is intention, nor there is need to materially curtail the scale of operations. Financial statements prepared on going concern basis recognise among other things the need for sufficient retention of profit to replace assets consumed in operation and for making adequate provision for settlement of its liabilities.

➤ Consistency: The principle of consistency refers to the practice of using same accounting policies for similar transactions in all accounting periods. The consistency improves comparability of financial statements through time. An accounting policy can be changed if the change is required (i) by a statute (ii) by an accounting standard (iii) for more appropriate presentation of financial statements.

➤ Accrual basis of accounting:

- Under this basis of accounting, transactions are recognised as soon as they occur, whether or not cash or cash equivalent is actually received or paid. Accrual basis ensures better matching between revenue and cost and profit/loss obtained on this basis reflects activities of the enterprise during an accounting period, rather than cash flows generated by it.

- While accrual basis is a more logical approach to profit determination than the cash basis of accounting, it exposes an enterprise to the risk of recognising an income before actual receipt. The accrual basis can therefore overstate the divisible profits and dividend decisions based on such overstated profit lead to erosion of capital. For this reason, accounting standards require that no revenue should be recognised unless the amount of consideration and actual realisation of the consideration is reasonably certain.

- Despite the possibility of distribution of profit not actually earned, accrual basis of accounting is generally followed because of its logical superiority over cash basis of accounting as illustrated below. Section 128(1)(iii) of the Companies Act makes it mandatory for companies to maintain accounts on accrual basis only. It is not necessary to expressly state that accrual basis of accounting has been followed in preparation of a financial statement. In case, any income/expense is recognised on cash basis, the fact should be stated.

➤ Accounting Policies

- The accounting policies refer to the specific accounting principles and the methods of applying those principles adopted by the enterprise in the preparation and presentation of financial statements.

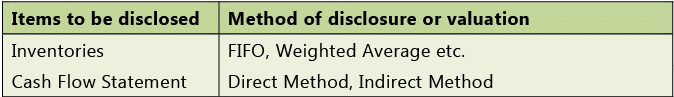

- Accountant has to make decisions from various options for recording or disclosing items in the books of accounts e.g.

- This list is not exhaustive i.e. endless. For every item right from valuation of assets and liabilities to recognition of revenue, providing for expected losses, for each event, accountant need to form principles and evolve a method to adopt those principles. This method of forming and applying accounting principles is known as accounting policies.

- As we say that accounts is both science and art. It is a science because we have some tested accounting principles, which are applicable universally, but simultaneously the application of these principles depends on the personal ability of each accountant. Since different accountants may have different approach, we generally find that in different enterprise under same industry, different accounting policy is followed. Though ICAI along with Government is trying to reduce the number of accounting policies followed in India but still it cannot be reduced to one. Accounting policy adopted will have considerable effect on the financial results disclosed by the financial statements; it makes it almost difficult to compare two financial statements.

Selection of Accounting Policy

Financial Statements are prepared to portray a true and fair view of the performance and state of affairs of an enterprise. In selecting a policy, alternative accounting policies should be evaluated in that light. In particular, major considerations that govern selection of a particular policy are:

Prudence: In view of uncertainty associated with future events, profits are not anticipated, but losses are provided for as a matter of conservatism. Provision should be created for all known liabilities and losses even though the amount cannot be determined with certainty and represents only a best estimate in the light of available information. The exercise of prudence in selection of accounting policies ensure that (i) profits are not overstated (ii) losses are not understated (iii) assets are not overstated and (iv) liabilities are not understated.

Example 1: The most common example of exercise of prudence in selection of accounting policy is the policy of valuing inventory at lower of cost and net realisable value.

Suppose a trader has purchased 500 units of certain article @ ₹ 10 per unit. He sold 400 articles @ ₹ 15 per unit. If the net realisable value per unit of the unsold article is ₹ 15, the trader should value his stock at ₹ 10 per unit and thus ignoring the profit ₹ 500 that he may earn in next accounting period by selling 100 units of unsold articles. If the net realisable value per unit of the unsold article is ₹ 8, the trader should value his stock at ₹ 8 per unit and thus recognising possible loss ₹ 200 that he may incur in next accounting period by selling 100 units of unsold articles.

Profit of the trader if net realisable value of unsold article is ₹ 15

= Sale – Cost of goods sold = (400 x ₹ 15) – (500 x ₹ 10 – 100 x ₹ 10) = ₹ 2,000

Profit of the trader if net realisable value of unsold article is ₹ 8

= Sale – Cost of goods sold = (400 x ₹ 15) – (500 x ₹ 10 – 100 x ₹ 8) = ₹ 1,800

Example 2: Exercise of prudence does not permit creation of hidden reserve by understating profits and assets or by overstating liabilities and losses. Suppose a company is facing a damage suit. No provision for damages should be recognised by a charge against profit, unless the probability of losing the suit is more than the probability of not losing it.

Substance over form: Transactions and other events should be accounted for and presented in accordance with their substance and financial reality and not merely by their legal form.

Materiality: Financial statements should disclose all ‘material items, i.e. the items the knowledge of which might influence the decisions of the user of the financial statement. Materiality is not always a matter of relative size. For example a small amount lost by fraudulent practices of certain employees can indicate a serious flaw in the enterprise’s internal control system requiring immediate attention to avoid greater losses in future. In certain cases quantitative limits of materiality is specified. A few of such cases are given below:

- A company should disclose by way of notes additional information regarding any item of income or expenditure which exceeds 1% of the revenue from operations or ₹1,00,000 whichever is higher (Refer general Instructions for preparation of Statement of Profit and Loss in Schedule III to the Companies Act, 2013).

- A company should disclose in Notes to Accounts, shares in the company held by each shareholder holding more than 5 per cent shares specifying the number of shares held. (Refer general Instructions for Balance Sheet in Schedule III to the Companies Act, 2013).

Manner of disclosure: All significant accounting policies adopted in the preparation and presentation of financial statements should be disclosed The disclosure of the significant accounting policies as such should form part of the financial statements and the significant accounting policies should normally be disclosed in one place.

Note: Being a part of the financial statement, the opinion of auditors should cover the disclosures of accounting policies.

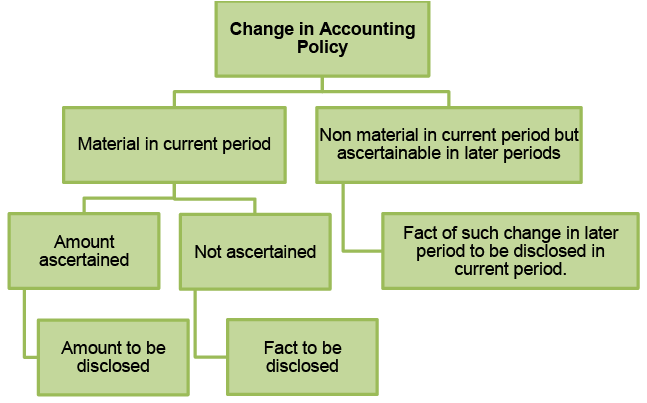

Disclosure of Changes in Accounting Policies

Any change in the accounting policies which has a material effect in the current period or which is reasonably expected to have a material effect in a later period should be disclosed. In the case of a change in accounting policies, which has a material effect in the current period, the amount by which any item in the financial statements is affected by such change should also be disclosed to the extent ascertainable. Where such amount is not ascertainable, wholly or in part, the fact should be indicated.

Example 3:

- A simple disclosure that an accounting policy has been changed is not of much use for a reader of a financial statement. The effect of change should therefore be disclosed wherever ascertainable. Suppose a company has switched over to weighted average formula for ascertaining cost of inventory, from the earlier practice of using FIFO. If the closing inventory by FIFO is ₹ 2 lakh and that by weighted average formula is ₹ 1.8 lakh, the change in accounting policy pulls down profit and value of inventory by ₹ 20,000. The company may disclose the change in accounting policy in the following manner:

- ‘The company values its inventory at lower of cost and net realisable value. Since net realisable value of all items of inventory in the current year was greater than respective costs, the company valued its inventory at cost. In the present year the company has changed to weighted average formula, which better reflects the consumption pattern of inventory, for ascertaining inventory costs from the earlier practice of using FIFO for the purpose. The change in policy has reduced profit and value of inventory by ₹ 20,000’.

- A change in accounting policy is to be disclosed if the change is reasonably expected to have material effect in future accounting periods, even if the change has no material effect in the current accounting period.

- The above requirement ensures that all important changes in accounting policies are actually disclosed. Suppose a company makes provision for warranty claims based on estimated costs of materials and labour. The company changed the policy in 20X1-X2 to include overheads in estimating costs for servicing warranty claims. If value of warranty sales in 20X1-X2 is not significant, the change in policy will not have any material effect on financial statements of 20X1-X2. Yet, the company must disclose the change in accounting policy in 20X1-X2 because the change can affect future accounting periods when value of warranty sales may rise to a significant level. If the disclosure is not made in 20X1-X2, then no disclosure in future years will be required. This is because an enterprise has to disclose changes in accounting policies in the year of change only.

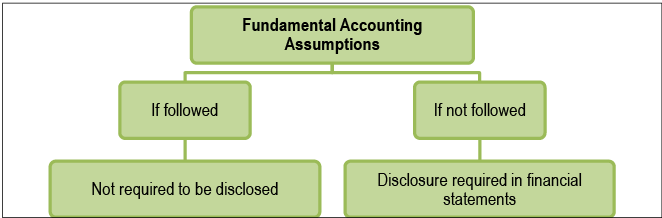

Disclosure of deviations from fundamental accounting assumptions

If the fundamental accounting assumptions, viz. Going concern, Consistency and Accrual are followed in financial statements, specific disclosure is not required. If a fundamental accounting assumption is not followed, the fact should be disclosed. The principle of consistency refers to the practice of using same accounting policies for similar transactions in all accounting periods.

➤ Illustration 1:

In the books of M/s Prashant Ltd., closing inventory as on 31.03.20X2 amounts to ₹ 1,63,000 (on the basis of FIFO method).

The company decides to change from FIFO method to weighted average method for ascertaining the cost of inventory from the year 20X1-X2. On the basis of weighted average method, closing inventory as on 31.03.20X2 amounts to ₹ 1,47,000. Realisable value of the inventory as on 31.03.20X2 amounts to ₹ 1,95,000.

Discuss disclosure requirement of change in accounting policy as per AS-1.As per AS 1 “Disclosure of Accounting Policies”, any change in an accounting policy which has a material effect should be disclosed in the financial statements. The amount by which any item in the financial statements is affected by such change should also be disclosed to the extent ascertainable. Where such amount is not ascertainable, wholly or in part, the fact should be indicated. Thus Prashant Ltd. should disclose the change in valuation method of inventory and its effect on financial statements. The company may disclose the change in accounting policy in the following manner:

‘The company values its inventory at lower of cost and net realizable value. Since net realizable value of all items of inventory in the current year was greater than respective costs, the company valued its inventory at cost. In the present year i.e. 201X1-X2, the company has changed to weighted average method, which better reflects the consumption pattern of inventory, for ascertaining inventory costs from the earlier practice of using FIFO for the purpose. The change in policy has reduced current profit and value of inventory by ₹ 16,000.

➤ Illustration 2:

Jagannath Ltd. had made a rights issue of shares in 20X2. In the offer document to its members, it had projected a surplus of ₹ 40 crores during the accounting year to end on 31st March, 20X2. The draft results for the year, prepared on the hitherto followed accounting policies and presented for perusal of the board of directors showed a deficit of ₹ 10 crores. The board in consultation with the managing director, decided on the following:

(i) Value year-end inventory at works cost (₹ 50 crores) instead of the hitherto method of valuation of inventory at prime cost (₹ 30 crores).

(ii) Provide depreciation for the year on straight line basis on account of substantial additions in gross block during the year, instead of on the reducing balance method, which was hitherto adopted. As a consequence, the charge for depreciation at ₹ 27 crores is lower than the amount of ₹ 45 crores which would have been provided had the old method been followed, by ₹ 18 cores.

(iii) Not to provide for “after sales expenses” during the warranty period. Till the last year, provision at 2% of sales used to be made under the concept of “matching of costs against revenue” and actual expenses used to be charged against the provision. The board now decided to account for expenses as and when actually incurred. Sales during the year total to ₹ 600 crores.

(iv) Provide for permanent fall in the value of investments - which fall had taken place over the past five years - the provision being ₹ 10 crores.

As chief accountant of the company, you are asked by the managing director to draft the notes on accounts for inclusion in the annual report for 20X1-20X2.As per AS 1, any change in the accounting policies which has a material effect in the current period or which is reasonably expected to have a material effect in later periods should be disclosed. In the case of a change in accounting policies which has a material effect in the current period, the amount by which any item in the financial statements is affected by such change should also be disclosed to the extent ascertainable. Where such amount is not ascertainable, wholly or in part, the fact should be indicated. Accordingly, the notes on accounts should properly disclose the change and its effect.

Notes on Accounts:

(i) During the year inventory has been valued at factory cost, against the practice of valuing it at prime cost as was the practice till last year. This has been done to take cognizance of the more capital intensive method of production on account of heavy capital expenditure during the year. As a result of this change, the year-end inventory has been valued at ₹ 50 crores and the profit for the year is increased by ₹ 20 crores.

(ii) In view of the heavy capital intensive method of production introduced during the year, the company has decided to change the method of providing depreciation from reducing balance method to straight line method. As a result of this change, depreciation has been provided at ₹ 27 crores which is lower than the charge which would have been made had the old method and the old rates been applied, by ₹ 18 crores. To that extent, the profit for the year is increased.

(iii) So far, the company has been providing 2% of sales for meeting “after sales expenses during the warranty period. With the improved method of production, the probability of defects occurring in the products has reduced considerably. Hence, the company has decided not to make provision for such expenses but to account for the same as and when expenses are incurred. Due to this change, the profit for the year is increased by ₹ 12 crores than would have been the case if the old policy were to continue.

(iv) The company has decided to provide ₹ 10 crores for the permanent fall in the value of investments which has taken place over the period of past five years. The provision so made has reduced the profit disclosed in the accounts by ₹ 10 crores.

Illustration 3:

XYZ Company is engaged in the business of financial services and is undergoing tight liquidity position, since most of the assets of the company are blocked in various claims/petitions in a Special Court. XYZ has accepted Inter-Corporate Deposits (ICDs) and, it is making its best efforts to settle the dues. There were claims at varied rates of interest, from lenders, from the due date of ICDs to the date of repayment. The company has provided interest, as per the terms of the contract till the due date and a note for non-provision of interest on the due date to date of repayment was affected in the financial statements. On account of uncertainties existing regarding the determination of the amount and in the absence of any specific legal obligation at present as per the terms of contracts, the company considers that these claims are in the nature of "claims against the company not acknowledged as debt”, and the same has been disclosed by way of a note in the accounts instead of making a provision in the profit and loss accounts. State whether the treatment done by the Company is correct or not.AS 1 ‘Disclosure of Accounting Policies’ recognises 'prudence' as one of the major considerations governing the selection and application of accounting policies. In view of the uncertainty attached to future events, profits are not anticipated but recognised only when realised though not necessarily in cash. Provision is made for all known liabilities and losses even though the amount cannot be determined with certainty and represents only a best estimate in the light of available information.

Also as per AS 1, ‘accrual’ is one of the fundamental accounting assumptions. Irrespective of the terms of the contract, so long as the principal amount of a loan is not repaid, the lender cannot be replaced in a disadvantageous position for nonpayment of interest in respect of overdue amount. From the aforesaid, it is apparent that the company has an obligation on account of the overdue interest. In this situation, the company should provide for the liability (since it is not waived by the lenders) at an amount estimated or on reasonable basis based on facts and circumstances of each case. However, in respect of the overdue interest amounts, which are settled, the liability should be accrued to the extent of amounts settled. Non-provision of the overdue interest liability amounts to violation of accrual basis of accounting. Therefore, the treatment, done by the company, of not providing the interest amount from due date to the date of repayment is not correct.

Valuation Of Inventory [As 2(Revised)]

Introduction

The accounting treatment for inventories is prescribed in AS 2 (Revised) ‘Valuation of Inventories’, which provides guidance for determining the value at which inventories, are carried in the financial statements until related revenues are recognised. It also provides guidance on the cost formulas that are used to assign costs to inventories and any write-down thereof to net realisable value.

Inventories

AS 2 (Revised) defines inventories as assets held

- for sale in the ordinary course of business, or

- in the process of production for such sale, or

- for consumption in the production of goods or services for sale, including maintenance supplies and consumables other than machinery spares, servicing equipment and standby equipment meeting the definition of Property, plant and equipment.

Inventories encompass goods purchased and held for resale, for example merchandise (goods) purchased by a retailer and held for resale, or land and other property held for resale. Inventories also include finished goods produced, or work in progress being produced, by the enterprise and include materials, maintenance supplies, consumables and loose tools awaiting use in the production process. Inventories do not include spare parts, servicing equipment and standby equipment which meet the definition of property, plant and equipment as per AS 10 (Revised), Property, Plant and Equipment. Such items are accounted for in accordance with Accounting Standard (AS) (Revised) 10, Property, Plant and Equipment.

Following are excluded from the scope of AS 2 (Revised):

(i) Work in progress arising under construction contracts, i.e. cost of part construction, including directly related service contracts, being covered under AS 7, Accounting for Construction Contracts; Inventory held for use in construction, e.g. cement lying at the site should however be covered by AS 2 (Revised).

(ii) Work in progress arising in the ordinary course of business of service providers i.e. cost of providing a part of service. For example, for a shipping company, fuel and stores not consumed at the end of accounting period is inventory but not costs for voyage-in-progress. Work-in-progress may arise for different other services e.g. software development, consultancy, medical services, merchant banking and so on.

(iii) Shares, debentures and other financial instruments held as stock-in-trade. It should be noted that these are excluded from the scope of AS 13 (Revised) as well. The current Indian practice is however to value them at lower of cost and fair value.

(iv) Producers’ inventories of livestock, agricultural and forest products, and mineral oils, ores and gases to the extent that they are measured at net realisable value in accordance with well established practices in those industries, e.g. where sale is assured under a forward contract or a government guarantee or where a homogenous market exists and there is negligible risk of failure to sell.

- The types of inventories are related to the nature of business. The inventories of a trading concern consist primarily of products purchased for resale in their existing form. It may also have an inventory of supplies such as wrapping paper, cartons, and stationery. The inventories of manufacturing concern consist of several types of inventories: raw material (which will become part of the goods to be produced), parts and factory supplies, work-in-process (partially completed products in the factory) and, of course, finished products.

- At the year end every business entity needs to ascertain the closing balance of Inventory which comprise of Inventory of raw material, work-in-progress, finished goods and miscellaneous items. The cost of closing inventory, e.g. cost of closing stock of raw materials, closing work-in-progress and closing finished stock, is a part of costs incurred in the current accounting period that is carried over to next accounting period. Likewise, the cost of opening inventory is a part of costs incurred in the previous accounting period that is brought forward to current accounting period.

- Since inventories are assets, and assets are resources expected to generate future economic benefits to the enterprise, the costs to be included in inventory costs, are costs that are expected to generate future economic benefits to the enterprise. Such costs must be costs of acquisition and costs incurred in bringing the assets to their present (i) location of the inventory, e.g. freight incurred to carry the materials to factory and (ii) conditions of the inventory, e.g. costs incurred to convert the materials into finished stock. The costs incurred to maintain the inventory, e.g. storage costs, do not generate any extra economic benefits for the enterprise and therefore should not be included in inventory costs unless those costs are necessary in production process prior to a further production stage.

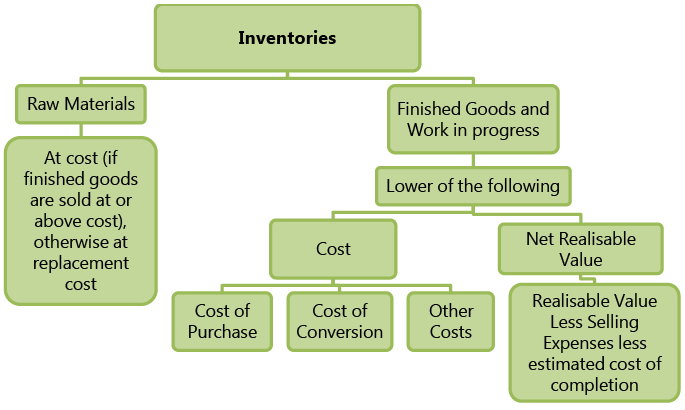

- The valuation of inventory is crucial because of its direct impact in measuring profit/loss for an accounting period. Higher the value of closing inventory lower is the cost of goods sold and hence higher is the profit. The principle of prudence demands that no profit should be anticipated while all foreseeable losses should be recognised. Thus, if net realisable value of inventory is less than inventory cost, inventory is valued at net realisable value to reduce the reported profit in anticipation of loss. On the other hand, if net realisable value of inventory is more than inventory cost, the anticipated profit is ignored and the inventory is valued at cost. In short, inventory is valued at lower of cost and net realisable value. The standard specifies (i) what the cost of inventory should consist of and (ii) how the net realisable value is determined.

- Abnormal gains or losses are not expected to recur regularly. For a meaningful analysis of an enterprise’s performance, the users of financial statements need to know the amount of such gains/losses included in current profit/loss. For this reason, instead of taking abnormal gains and losses in inventory costs, these are shown in the Profit and Loss statement in such way that their impact on current profit/loss can be perceived.

- Part I of Schedule III to the Companies Act, 2013 prescribes that valuation method should be disclosed for inventory held by companies.

Measurement of Inventories

Inventories should be valued at lower of cost and net realisable value. Net realisable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. The valuation of inventory at lower of cost and net realisable value is based on the view that no asset should be carried at a value which is in excess of the value realisable by its sale or use.

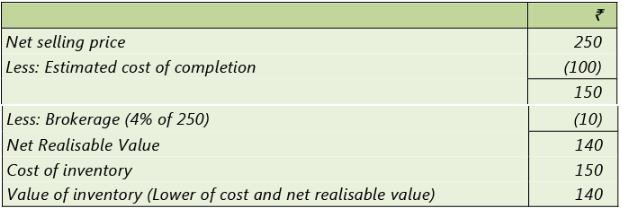

Example 1: Cost of a partly finished unit at the end of 20X1-X2 is ₹ 150. The unit can be finished next year by a further expenditure of ₹ 100. The finished unit can be sold at ₹ 250, subject to payment of 4% brokerage on selling price. The value of inventory is determined below:

Costs of inventory

Costs of inventories comprise all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition.

Costs of purchase

The costs of purchase consist of the purchase price including duties and taxes (other than those subsequently recoverable by the enterprise from the taxing authorities, and other expenditure directly attributable to the acquisition. Trade discounts, rebates, duty drawbacks and other similar items are deducted in determining the costs of purchase.

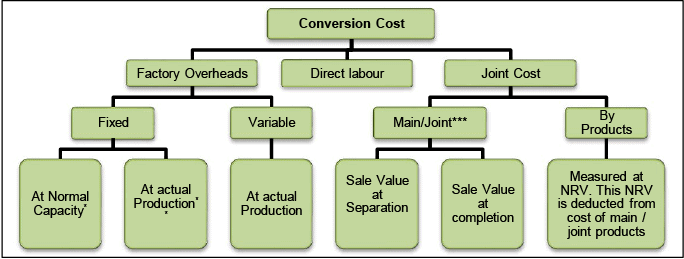

Costs of Conversion

- The costs of conversion include costs directly related to production, e.g. direct labour. They also include overheads, both fixed and variable that are incurred in converting raw material to finished goods.

- The fixed production overheads should be absorbed systematically to units of production over normal capacity. Normal capacity is the production the enterprise expects to achieve on an average over a number of periods or seasons under normal circumstances, taking into account the loss of capacity resulting from planned maintenance. The actual level of production may be used if it approximates the normal capacity. The amount of fixed production overheads allocated to each unit of production should not be increased as a consequence of low production or idle plant. Unallocated overheads (i.e. under recovery) are recognised as an expense in the period in which they are incurred. In periods of abnormally high production, the amount of fixed production overheads allocated to each unit of production is decreased so that inventories are not measured above cost. Variable production overheads are assigned to each unit of production on the basis of the actual use of the production facilities.

Example 2: ABC Ltd. has a plant with the capacity to produce 1 lac unit of a product per annum and the expected fixed overhead is ₹ 18 lacs. Fixed overhead on the basis of normal capacity is ₹ 18 (18 lacs/1 lac).

- Case 1: Actual production is 1 lac units. Fixed overhead on the basis of normal capacity and actual overhead will lead to same figure of ₹ 18 lacs. Therefore, it is advisable to include this on normal capacity.

- Case 2: Actual production is 90,000 units. Fixed overhead is not going to change with the change in output and will remain constant at ₹ 18 lacs, therefore, overheads on actual basis is ₹ 20 per unit (18 lacs/ 90 thousands). Hence by valuing inventory at ₹ 20 each for fixed overhead purpose, it will be overvalued and the losses of ₹ 1.8 lacs will also be included in closing inventory leading to a higher gross profit then actually earned. Therefore, it is advisable to include fixed overhead per unit on normal capacity to actual production (90,000 x 18) ₹16.2 lacs and rest ₹ 1.8 lacs should be transferred to Profit & Loss Account.

- Case 3: Actual production is 1.2 lacs units. Fixed overhead is not going to change with the change in output and will remain constant at ₹ 18 lacs, therefore, overheads on actual basis is ₹ 15 (18 lacs/ 1.2 lacs). Hence by valuing inventory at ₹ 18 each for fixed overhead purpose, we will be adding the element of cost to inventory which actually has not been incurred. At ₹ 18 per unit, total fixed overhead comes to ₹ 21.6 lacs whereas, actual fixed overhead expense is only ₹ 18 lacs. Therefore, it is advisable to include fixed overhead on actual basis (1.2 lacs x 15) ₹ 18 lacs.

Joint or By-Products

In case of joint or by products, the costs incurred up to the stage of split off should be allocated on a rational and consistent basis. The basis of allocation may be sale value at split off point, for example, value of by products, scraps and wastes are usually not material. These are therefore valued at net realisable value. The cost of main product is then valued as joint cost minus net realisable value of by-products, scraps or wastes.

Other Costs

- These may be included in cost of inventory provided they are incurred to bring the inventory to their present location and condition. Cost of design, for example, for a custom made unit may be taken as part of inventory cost.

- Interest and other borrowing costs are usually considered as not relating to bringing the inventories to their present location and condition. These costs are therefore not usually included in cost of inventory. Interests and other borrowing costs however are taken as part of inventory costs, where the inventory necessarily takes substantial period of time for getting ready for intended sale. Example of such inventory is wine.

- The standard is silent on treatment of amortisation of intangibles for ascertaining inventory costs. It nevertheless appears that amortisation of intangibles related to production, e.g. patents right of production or copyright for a publisher should be taken as part of inventory costs.

- Exchange differences are not taken in inventory costs.

(a) When actual production is almost equal or lower than normal capacity.

(b) When actual production is higher than normal capacity.

(c) Allocation at reasonable and consistent basis.

Exclusions from the cost of inventories

In determining the cost of inventories, it is appropriate to exclude certain costs and recognise them as expenses in the period in which they are incurred. Examples of such costs are:

- Abnormal amounts of wasted materials, labour, or other production costs;

- Storage costs, unless the production process requires such storage;

- Administrative overheads that do not contribute to bringing the inventories to their present location and condition;

- Selling and distribution costs.

Cost Formula

Mostly inventories are purchased / made in different lots and unit cost of each lot frequently differs. In all such circumstances, determination of closing inventory cost requires identification of units in stock to have come from a particular lot. This specific identification is best wherever possible. In all other cases, the cost of inventory should be determined by the First-In First-Out (FIFO), or Weighted Average cost formula. The formula used should reflect the fairest possible approximation to the cost incurred in bringing the items of inventory to their present location and condition.

Other techniques of cost measurement

- Instead of actual, the standard costs may be taken as cost of inventory provided standards fairly approximate the actual. Such standards (for finished or partly finished units) should be set in the light of normal levels of material consumption, labour efficiency and capacity utilisation. The standards so set should be regularly reviewed and if necessary, be revised to reflect current conditions.

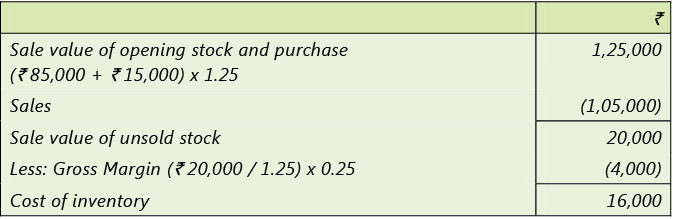

- In retail business, where a large number of rapidly changing items are traded, the actual costs of items may be difficult to determine. The units dealt by a retailer however, are usually sold for similar gross margins and a retail method to determine cost in such retail trades makes use of the fact. By this method, cost of inventory is determined by reducing sale value of unsold stock by appropriate average percentage of gross margin.

Example 3: A trader purchased certain articles for ₹ 85,000. He sold some of articles for ₹ 1,05,000. The average percentage of gross margin is 25% on cost. Opening stock of inventory at cost was ₹ 15,000.

Cost of closing inventory is shown below:

Estimates of Net Realisable Value

Estimates of net realisable value are based on the most reliable evidence available at the time the estimates are made as to the amount the inventories are expected to realise. These estimates take into consideration fluctuations of price or cost directly relating to events occurring after the balance sheet date to the extent that such events confirm the conditions existing at the balance sheet date.

Comparison of Cost and Net Realisable Value

The comparison between cost and net realisable value should be made on item by-item basis. In some cases nevertheless, it may be appropriate to group similar or related items.

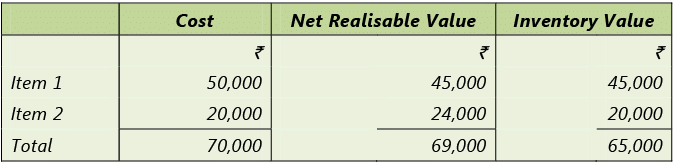

Example 4: The cost, net realisable value and inventory value of two items that a company has in its inventory are given below:

Estimates of NRV should be based on evidence available at the time of estimation.

Net realisable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. AS 2 (Revised) also provides that estimates of net realisable value are to be based on the most reliable evidence available at the time the estimates are made as to the amount the inventories are expected to realise. These estimates take into consideration fluctuations of price or cost directly relating to events occurring after the balance sheet date to the extent that such events confirm the conditions existing at the balance sheet date.

NRV of materials held for use or disposal

Materials and other supplies held for use in the production of inventories are not written down below cost if the selling price of finished product containing the material exceeds the cost of the finished product. The reason is, as long as these conditions hold the material realises more than its cost as shown below.

Review of net realisable value at each balance sheet date

An assessment is made of net realisable value as at each balance sheet date.

Disclosures

The financial statements should disclose:

- The accounting policies adopted in measuring inventories, including the cost formula used; and

- The total carrying amount of inventories together with a classification appropriate to the enterprise.

Information about the carrying amounts held in different classifications of inventories and the extent of the changes in these assets is useful to financial statement users. Common classifications of inventories are

- raw materials and components,

- work in progress,

- finished goods,

- Stock-in-trade (in respect of goods acquired for trading),

- stores and spares,

- loose tools, and

- Others (specify nature).

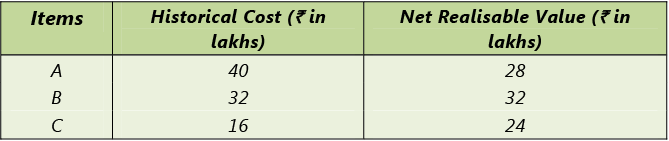

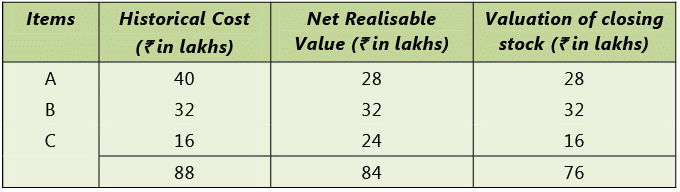

Illustration 1: The company deals in three products, A, B and C, which are neither similar nor interchangeable. At the time of closing of its account for the year 20X1-X2, the Historical Cost and Net Realisable Value of the items of closing stock are determined as follows:

What will be the value of closing stock?

As per AS 2 (Revised) on ‘Valuation of Inventories’, inventories should be valued at the lower of cost and net realisable value. Inventories should be written down to net realisable value on an item-by-item basis in the given case.

Hence, closing stock will be valued at ₹ 76 lakhs.

Illustration 2: X Co. Limited purchased goods at the cost of ₹40 lakhs in October, 20X1. Till March, 20X2, 75% of the stocks were sold. The company wants to disclose closing stock at ₹ 10 lakhs. The expected sale value is ₹ 11 lakhs and a commission at 10% on sale is payable to the agent. Advise, what is the correct closing stock to be disclosed as at 31.3.20X2.

As per AS 2 (Revised) “Valuation of Inventories”, the inventories are to be valued at lower of cost or net realisable value.

In this case, the cost of inventory is ₹ 10 lakhs. The net realisable value is 11,00,000 ₹ 90% = ₹ 9,90,000. So, the stock should be valued at ₹ 9,90,000.

Illustration 3: In a production process, normal waste is 5% of input. 5,000 MT of input were put in process resulting in wastage of 300 MT. Cost per MT of input is ₹ 1,000. The entire quantity of waste is on stock at the year end. State with reference to Accounting Standard, how will you value the inventories in this case?

As per AS 2 (Revised), abnormal amounts of wasted materials, labour and other production costs are excluded from cost of inventories and such costs are recognised as expenses in the period in which they are incurred.

In this case, normal waste is 250 MT and abnormal waste is 50 MT. The cost of 250 MT will be included in determining the cost of inventories (finished goods) at the year end. The cost of abnormal waste (50 MT x 1,052.6315 = ₹ 52,632) will be charged to the profit and loss statement.

Cost per MT (Normal Quantity of 4,750 MT) = 50,00,000 / 4,750 = ₹ 1,052.6315

Total value of inventory = 4,700 MT x ₹ 1,052.6315 = ₹ 49,47,368.

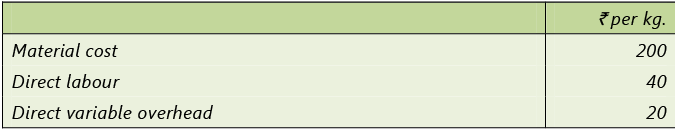

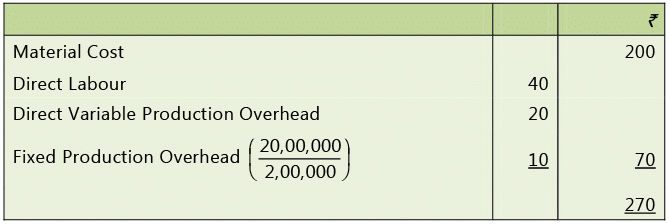

Illustration 4: You are required to value the inventory per kg of finished goods consisting of:

Fixed production charges for the year on normal working capacity of 2 lakh kgs is ₹ 20 lakhs. 4,000 kgs of finished goods are in stock at the year end.In accordance with AS 2 (Revised), the cost of conversion include a systematic allocation of fixed and variable overheads that are incurred in converting materials into finished goods. The allocation of fixed overheads for the purpose of their inclusion in the cost of conversion is based on normal capacity of the production facilities.

Cost per kg. of finished goods:

Hence the value of 4,000 kgs. of finished goods = 4,000 kgs x ₹ 270 = ₹ 10,80,000

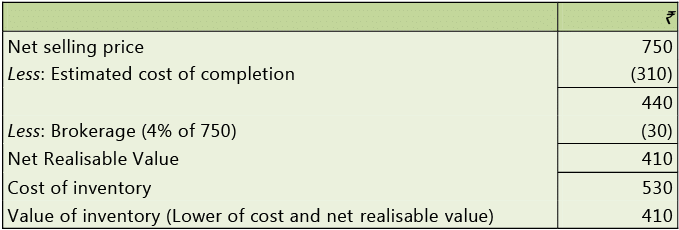

Illustration 5: On 31st March 20X1, a business firm finds that cost of a partly finished unit on that date is ₹ 530. The unit can be finished in 20X1-X2 by an additional expenditure of ₹ 310. The finished unit can be sold for ₹ 750 subject to payment of 4% brokerage on selling price. The firm seeks your advice regarding the amount at which the unfinished unit should be valued as at 31st March, 20X1 for preparation of final accounts. Assume that the partly finished unit cannot be sold in semi-finished form and its NRV is zero without processing it further.

Valuation of unfinished unit

Cash Flow Statement (AS 3)

Introduction

This Standard is mandatory for the enterprises, which fall in the category of level I, at the end of the relevant accounting period. For all other enterprises though it is not compulsory but it is encouraged to prepare such statements. Where an enterprise was not covered by this statement during the previous year but qualifies in the current accounting year, they are not supposed to disclose the figures for the corresponding previous years. Whereas, if an enterprises qualifies under this statement to prepare the cash flow statements during the previous year but now disqualified, will continue to prepare cash flow statements for another two consecutive years.

Note:

- Under Section 129 of the Companies Act, 2013, the financial statement, with respect to One Person Company, small company and dormant company, may not include the cash flow statement. As per the Amendment, under Chapter I, clause (40) of section 2, an exemption has been provided vide Notification dated 13th June, 2017 under Section 462 of the Companies Act 2013 to a startup private company besides one person company, small company and dormant company. As per the amendment, a startup private company is not required to include the cash flow statement in the financial statements.

- Thus the financial statements, with respect to one person company, small company, dormant company and private company (if such a private company is a start-up), may not include the cash flow statement.

Objective

Cash flow Statement (CFS) is an additional information provided to the users of accounts in the form of an statement, which reflects the various sources from where cash was generated (inflow of cash) by an enterprise during the relevant accounting year and how these inflows were utilised (outflow of cash) by the enterprise. This helps the users of accounts:

- To identify the historical changes in the flow of cash & cash equivalents.

- To determine the future requirement of cash & cash equivalents.

- To assess the ability to generate cash & cash equivalents.

- To estimate the further requirement of generating cash & cash equivalents.

- To compare the operational efficiency of different enterprises.

- To study the insolvency and liquidity position of an enterprise.

- As an indicator of amount, timing and certainty of future cash flows.

- To check the accuracy of past assessments of future cash flows

- In examining the relationship between profitability and net cash flow and the impact of changing prices.

➤ Meaning of the term cash and cash equivalents for cash flow statements

Cash and cash equivalents for the purpose of cash flow statement consists of the following:

- Cash in hand and deposits repayable on demand with any bank or other financial institutions and

- Cash equivalents, which are short term, highly liquid investments that are readily convertible into known amounts of cash and are subject to insignificant risk or change in value. A short-term investment is one, which is due for maturity within three months from the date of acquisition. Investments in shares are not normally taken as cash equivalent, because of uncertainties associated with them as to realisable value.

Note: For the purpose of cash flow statement, ‘cash and cash equivalent’ consists of at least three balance sheet items, viz. cash in hand; demand deposits with banks etc. and investments regarded as cash equivalents. For this reason, the AS 3 requires enterprises to give a break-up of opening and closing cash shown in their cash flow statements. This is presented as a note to cash flow statement.

➤ Meaning of the term cash flow

- Cash flows are inflows (i.e. receipts) and outflows (i.e. payments) of cash and cash equivalents. Any transaction, which does not result in cash flow, should not be reported in the cash flow statement. Movements within cash or cash equivalents are not cash flows because they do not change cash as defined by AS 3, which is sum of cash, bank and cash equivalents. For example, acquisitions of cash equivalent investments or cash deposited into bank are not cash flows.

- It is important to note that a change in cash does not necessarily imply cash flow. For example suppose an enterprise has a bank balance of USD 10,000, stated in books at ₹ 4,90,000 using the rate of exchange ₹ 49/USD prevailing on date of receipt of dollars. If the closing rate of exchange is ₹ 50/USD, the bank balance will be restated at ₹ 5,00,000 on the balance sheet date. The increase is however not a cash flow because neither there is any cash inflow nor there is any cash outflow.

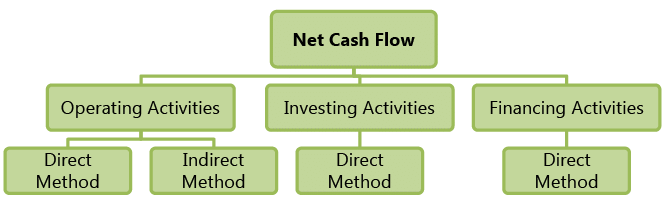

➤ Types of cash flow

- Cash flows for an enterprise occur in various ways, e.g. through operating income or expenses, by borrowing or repayment of borrowing or by acquisition or disposal of fixed assets. The implication of each type of cash flow is clearly different. Cash received on disposal of a useful fixed asset is likely to have adverse effect on future performance of the enterprise and it is completely different from cash received through operating income or cash received through borrowing. It may also be noted that implications of each cash flow types are interrelated. For example, borrowed cash used for meeting operating expenses is not same as borrowed cash used for acquisition of useful fixed assets.

- For the aforesaid reasons, the standard identifies three types of cash flows, i.e. operating cash flows, investing cash flows and financing cash flows. Separate presentation of each type of cash flow in the cash flow statement improves usefulness of cash flow information.

- The operating cash flows are cash flows generated by operating activities or by other activities that are not investing or financing activities. Operating activities are the principal revenue-producing activities of the enterprise. Examples include, cash purchase and sale of goods, collections from customers for goods, payment to suppliers of goods, payment of salaries, wages etc.

- The investing cash flows are cash flows generated by investing activities. The investing activities are the acquisition and disposal of long-term assets and other investments not included in cash equivalents. The examples of investing cash flows include cash flow arising from investing activities include: (a) receipts from disposals of fixed assets; (b) loan given to / recovered from other entities (other than loans by financial enterprises) (c) payments to acquire fixed assets (d) Interests and dividends earned (other than interests and dividends earned by financial institutions).

- The financing cash flows are cash flows generated by financing activities. Financing activities are activities that result in changes in the size and composition of the owners’ capital (including preferences share capital in the case of company) and borrowings of the enterprise. Examples include issue of shares / debentures, redemption of debentures / preference shares, payment of dividends and payment of interests (other than interests paid by financial institutions).

➤ Identifying type of cash flows

Classification of Cash Flows

Cash flow type depends on the business of the enterprise and other factors. For example, since principal business of financial enterprises consists of borrowing, lending and investing, loans given and interests earned are operating cash flows for financial enterprises and investing cash flows for other enterprises. A few typical cases are discussed below.

➤ Loans/Advances given and Interests earned

- Loans and advances given and interests earned on them in the ordinary course of business are operating cash flows for financial enterprises.

- Loans and advances given and interests earned on them are investing cash flows for non-financial enterprises.

- Loans and advances given to subsidiaries and interests earned on them are investing cash flows for all enterprises.

- Loans and advances given to employees and interests earned on them are operating cash flows for all enterprises.

- Advance payments to suppliers and interests earned on them are operating cash flows for all enterprises.

- Interests earned from customers for late payments are operating cash flows for non-financial enterprises.

➤ Loans/Advances taken and interests paid

- Loans and advances taken and interests paid on them in the ordinary course of business are operating cash flows for financial enterprises.

- Loans and advances taken and interests paid on them are financing cash flows for non-financial enterprises.

- Loans and advances taken from subsidiaries and interests paid on them are financing cash flows for all enterprises.

- Advance taken from customers and interests paid on them are operating cash flows for non-financial enterprises.

- Interests paid to suppliers for late payments are operating cash flows for all enterprises.

- Interests taken as part of inventory costs in accordance with AS 16 are operating cash flows.

➤ Investments made and dividends earned

- Investments made and dividends earned on them in the ordinary course of business are operating cash flows for financial enterprises.

- Investments made and dividends earned on them are investing cash flows for non-financial enterprises.

- Investments in subsidiaries and dividends earned on them are investing cash flows for all enterprises.

➤ Dividends Paid

Dividends paid are financing cash outflows for all enterprises.

➤ Income Tax

- Tax paid on operating income is operating cash outflows for all enterprises

- Tax deducted at source against income are operating cash outflows if concerned incomes are operating incomes and investing cash outflows if the concerned incomes are investment incomes, e.g. interest earned.

- Tax deducted at source against expenses are operating cash inflows if concerned expenses are operating expenses and financing cash inflows if the concerned expenses are financing expenses, e.g. interests paid.

➤ Insurance claims received

- Insurance claims received against loss of stock or loss of profits are extraordinary operating cash inflows for all enterprises.

- Insurance claims received against loss of fixed assets are extraordinary investing cash inflows for all enterprises.

AS 3 requires separate disclosure of extraordinary cash flows, classifying them as cash flows from operating, investing or financing activities, as may be appropriate.

Reporting Cash Flows from Operating Activities

- Net cash flow from operating activities can be reported either as direct method or as indirect method.

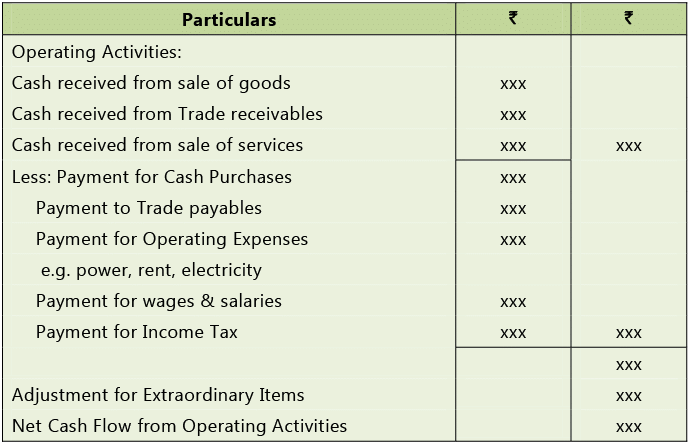

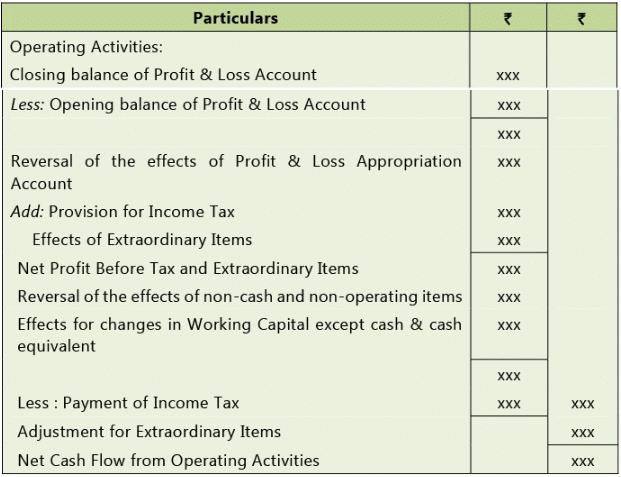

- In ‘Direct method’ we take the gross receipts from sales, trade receivables and other operating inflows subtracted by gross payments for purchases, creditors and other expenses ignoring all non-cash items like depreciation, provisions. In ‘Indirect method’ we start from the net profit or loss figure, eliminate the effect of any non-cash items, investing items and financing items from such profit figure i.e. all such expenses like depreciation, provisions, interest paid, loss on sale of assets etc. are added and interest received etc. are deducted. Adjustment for changes in working capital items are also made ignoring cash and cash equivalent to reach to the figure of net cash flow.

- Direct method is preferred over indirect because, direct method gives us the clear picture of various sources of cash inflows and outflows which helps in estimating the future cash inflows and outflows.

- Below is the format for Cash Flow Statement (Illustrative):

Cash Flow Statement of X Ltd. for the year ended March 31, 20X1 (Direct Method)

Cash Flow Statement of X Ltd. for the year ended March 31, 20X1 (Indirect Method)

➤ Profit or loss on disposal of fixed assets

Profit or loss on sale of fixed asset is not operating cash flow. The entire proceeds of such transactions should be taken as cash inflow from investing activity.

➤ Fundamental techniques of cash flow preparation

A cash flow statement is a summary of cash receipts and payments of an enterprise during an accounting period. Any attempt to compile such a summary from cashbooks is impractical due to the large volume of transactions. Fortunately, it is possible to compile such a summary by comparing financial statements at the beginning and at the end of accounting period.

Reporting Cash Flows on Net Basis

- AS 3 forbids netting of receipts and payments from investing and financing activities. Thus, cash paid on purchase of fixed assets should not be shown net of cash realised from sale of fixed assets. For example, if an enterprise pays ₹ 50,000 in acquisition of machinery and realises ₹ 10,000 on disposal of furniture, it is not right to show net cash outflow of ₹ 40,000. The exceptions to this rule are stated below.

- Cash flows from the following operating, investing or financing activities may be reported on a net basis.

(a) Cash receipts and payments on behalf of customers, e.g. cash received and paid by a bank against acceptances and repayment of demand deposits.

(b) Cash receipts and payments for items in which the turnover is quick, the amounts are large and the maturities are short, e.g. purchase and sale of investments by an investment company. - AS 3 permits financial enterprises to report cash flows on a net basis in the following three circumstances.

(a) Cash flows on acceptance and repayment of fixed deposits with a fixed maturity date

(b) Cash flows on placement and withdrawal deposits from other financial enterprises

(c) Cash flows on advances/loans given to customers and repayments received therefrom.

➤ Interest and Dividends

Cash flows from interest and dividends received and paid should each be disclosed separately. Cash flows arising from interest paid and interest and dividends received in the case of a financial enterprise should be classified as cash flows arising from operating activities. In the case of other enterprises, cash flows arising from interest paid should be classified as cash flows from financing activities while interest and dividends received should be classified as cash flows from investing activities. Dividends paid should be classified as cash flows from financing activities.

➤ Non-Cash transactions

Investing and financing transactions that do not require the use of cash or cash equivalents, e.g. issue of bonus shares, should be excluded from a cash flow statement. Such transactions should be disclosed elsewhere in the financial statements in a way that provides all the relevant information about these investing and financing activities.

Business Purchase

The aggregate cash flows arising from acquisitions and disposals of subsidiaries or other business units should be presented separately and classified as cash flow from investing activities.

- The cash flows from disposal and acquisition should not be netted off.

- An enterprise should disclose, in aggregate, in respect of both acquisition and disposal of subsidiaries or other business units during the period each of the following: (i) The total purchase or disposal consideration; and

(ii) The portion of the purchase or disposal consideration discharged by means of cash and cash equivalents.

➤ Treatment of current assets and liabilities taken over on business purchase

Business purchase is not operating activity. Thus, while taking the differences between closing and opening current assets and liabilities for computation of operating cash flows, the closing balances should be reduced by the values of current assets and liabilities taken over. This ensures that the differences reflect the increases/decreases in current assets and liabilities due to operating activities only.

Exchange gains and losses

- The foreign currency monetary assets (e.g. balance with bank, debtors etc.) and liabilities (e.g. creditors) are initially recognised by translating them into reporting currency by the rate of exchange transaction date. On the balance sheet date, these are restated using the rate of exchange on the balance sheet date. The difference in values is exchange gain/loss. The exchange gains and losses are recognised in the statement of profit and loss.

- The exchange gains/losses in respect of cash and cash equivalents in foreign currency (e.g. balance in foreign currency bank account) are recognised by the principle aforesaid, and these balances are restated in the balance sheet in reporting currency at rate of exchange on balance sheet date. The change in cash or cash equivalents due to exchange gains and losses are however not cash flows. This being so, the net increases/decreases in cash or cash equivalents in the cash flow statements are stated exclusive of exchange gains and losses. The resultant difference between cash and cash equivalents as per the cash flow statement and that recognised in the balance sheet is reconciled in the note on cash flow statement.

Disclosures

AS 3 requires an enterprise to disclose the amount of significant cash and cash equivalent balances held by it but not available for its use, together with a commentary by management. This may happen for example, in case of bank balances held in other countries subject to such exchange control or other regulations that the fund is practically of no use.

AS 3 encourages disclosure of additional information, relevant for understanding the financial position and liquidity of the enterprise together with a commentary by management. Such information may include:

- The amount of undrawn borrowing facilities that may be available for future operating activities and to settle capital commitments, indicating any restrictions on the use of these facilities; and

- The aggregate amount of cash flows required for maintaining operating capacity, e.g. purchase of machinery to replace the old, separately from cash flows that represent increase in operating capacity, e.g. additional machinery purchased to increase production.

Illustration 1: Classify the following activities as (a) Operating Activities, (b) Investing Activities, (c) Financing Activities (d) Cash Equivalents.

(a) Purchase of Machinery.

(b) Proceeds from issuance of equity share capital

(c) Cash Sales.

(d) Proceeds from long-term borrowings.

(e) Proceeds from Trade receivables.

(f) Cash receipts from Trade receivables.

(g) Trading Commission received.

(h) Purchase of investment.

(i) Redemption of Preference Shares.

(j) Cash Purchases.

(k) Proceeds from sale of investment

(l) Purchase of goodwill.

(m) Cash paid to suppliers.

(n) Interim Dividend paid on equity shares.

(o) Wages and salaries paid.

(p) Proceed from sale of patents.

(q) Interest received on debentures held as investment.

(r) Interest paid on Long -term borrowings.

(s) Office and Administration Expenses paid

(t) Manufacturing Overheads paid.

(u) Dividend received on shares held as investments.

(v) Rent Received on property held as investment.

(w) Selling and distribution expense paid.

(x) Income tax paid

(y) Dividend paid on Preference shares.

(z) Underwritings Commission paid.

(aa) Rent paid.

(bb) Brokerage paid on purchase of investments.

(cc) Bank Overdraft

(dd) Cash Credit

(ee) Short-term Deposits

(ff) Marketable Securities

(gg) Refund of Income Tax received.(a) Operating Activities: c, e, f, g, j, m, o, s, t, w, x, aa & gg.

(b) Investing Activities: a, h, k, l, p, q, u, v, bb & ee.

(c) Financing Activities: b, d, i, n, r, y, z, cc & dd.

(d) Cash Equivalent: ff.

Illustration 2: X Ltd. purchased debentures of ₹ 10 lacs of Y Ltd., which are redeemable within three months. How will you show this item as per AS 3 while preparing cash flow statement for the year ended on 31st March, 20X1?

As per AS 3 on ‘Cash flow Statement’, cash and cash equivalents consists of cash in hand, balance with banks and short-term, highly liquid investments*. If investment, of ₹ 10 lacs, made in debentures is for short-term period then it is an item of 'cash equivalents'.

However, if investment of ₹ 10 lacs made in debentures is for long-term period then as per AS 3, it should be shown as cash flow from investing activities.

Illustration 3: Classify the following activities as per AS 3 Cash Flow Statement:

(i) Interest paid by financial enterprise

(ii) Tax deducted at source on interest received from subsidiary company

(iii) Deposit with Bank for a term of two years

(iv) Insurance claim received towards loss of machinery by fire

(v) Bad debts written off(i) Interest paid by financial enterprise

Cash flows from operating activities

(ii) TDS on interest received from subsidiary company

Cash flows from investing activities

(iii) Deposit with bank for a term of two years

Cash flows from investing activities

(iv) Insurance claim received against loss of fixed asset by fire

Extraordinary item to be shown as a separate heading under ‘Cash flow from investing activities’

(v) Bad debts written off

It is a non-cash item which is adjusted from net profit/loss under indirect method, to arrive at net cash flow from operating activity.

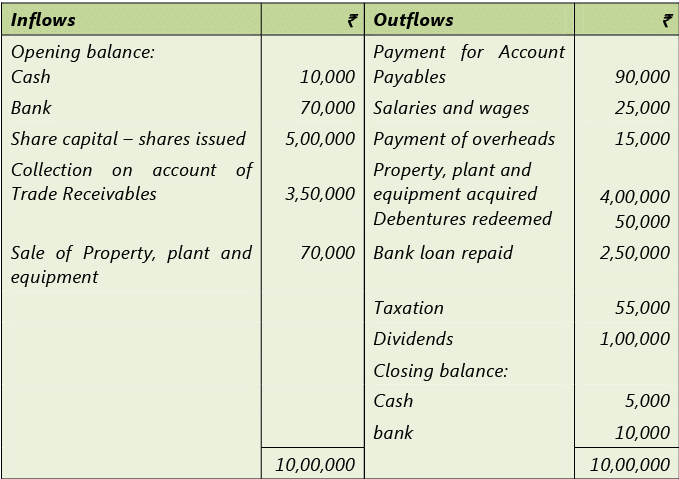

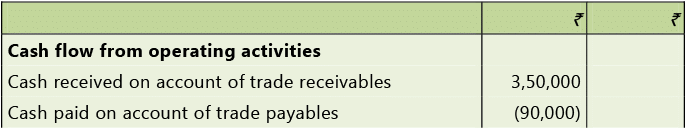

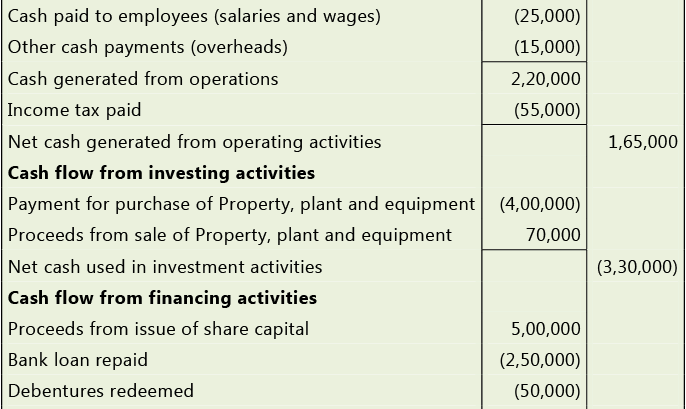

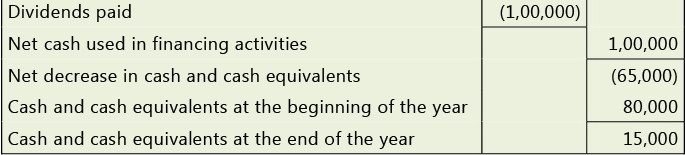

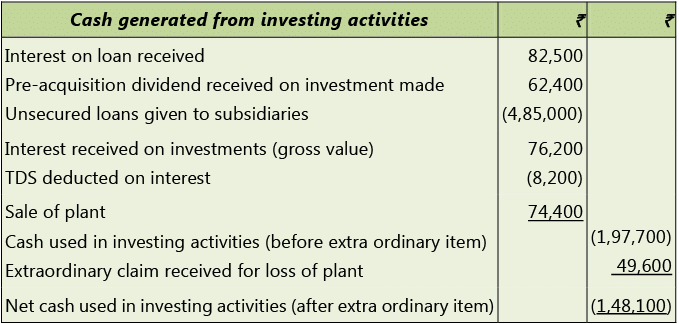

Illustration 4: Following is the cash flow abstract of Alpha Ltd. for the year ended 31st March, 20X1:

Cash Flow (Abstract)

Prepare Cash Flow Statement for the year ended 31st March, 20X1 in accordance with Accounting standard 3.Cash Flow Statement for the year ended 31.3.20X1

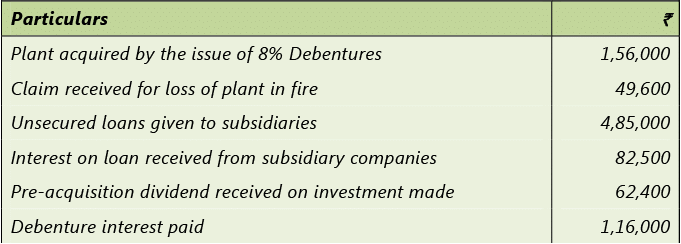

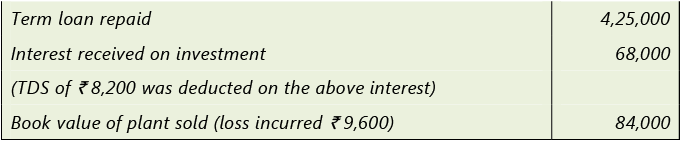

Illustration 5: Prepare Cash Flow from Investing Activities of M/s. Creative Furnishings Limited for the year ended 31-3-20X1.

Cash Flow Statement from Investing Activities of M/s Creative Furnishings Limited for the year ended 31-03-20X1

Note:

- Debenture interest paid and Term Loan repaid are financing activities and therefore not considered for preparing cash flow from investing activities.

- Plant acquired by issue of 8% debentures does not amount to cash outflow, hence also not considered in the above cash flow statement.

Note: For details regarding preparation of Cash Flow Statement and Problems based on practical application of AS 3, students are advised to refer unit 2 of Chapter 4.

Reference: The students are advised to refer the full text of AS 3 “Cash Flow Statement.

|

25 videos|34 docs

|

|

Explore Courses for CA Intermediate exam

|

|