Audit Strategy, Audit Planning and Audit Programme: Notes - CA Intermediate PDF Download

Chapter Overview

Audit Planning

Planning an audit involves:

- Establishing the overall audit strategy

- Developing an audit plan

Audit Plan to Conduct an Effective Audit

“The auditor should plan his work to enable him to conduct an effective audit in an efficient and timely manner. Plans should be based on knowledge of the client’s business”.

➤ Plans should be made to cover, among other things:

- acquiring knowledge of the client’s accounting systems, policies and internal control procedures;

- establishing the expected degree of reliance to be placed on internal control;

- determining and programming the nature, timing, and extent of the audit procedures to be performed; and

- coordinating the work to be performed.

Plans should be further developed and revised as necessary during the course of the audit.

Benefits of Planning in the Audit of Financial Statements

Planning an audit involves establishing the overall audit strategy for the engagement and developing an audit plan. Adequate planning benefits the audit of financial statements in several ways, including the following:

- Helping the auditor to devote appropriate attention to important areas of the audit.

- Helping the auditor identify and resolve potential problems on a timely basis.

- Helping the auditor properly organize and manage the audit engagement so that it is performed in an effective and efficient manner.

- Assisting in the selection of engagement team members with appropriate levels of capabilities and competence to respond to anticipated risks, and the proper assignment of work to them.

- Facilitating the direction and supervision of engagement team members and the review of their work.

- Assisting, where applicable, in coordination of work done by auditors of components and experts.

Audit Strategy

Overall Audit Strategy – Assistance to auditor

Overall audit strategy sets the scope, timing and direction of the audit, and guides the development of the more detailed audit plan.

The auditor shall establish an overall audit strategy that sets the scope, timing and direction of the audit, and that guides the development of the audit plan.

The process of establishing the overall audit strategy assists the auditor to determine, subject to the completion of the auditor’s risk assessment procedures, such matters as:

- The resources to deploy for specific audit areas, such as the use of appropriately experienced team members for high risk areas or the involvement of experts on complex matters;

- The amount of resources to allocate to specific audit areas, such as the number of team members assigned to observe the inventory count at material locations, the extent of review of other auditors’ work in the case of group audits, or the audit budget in hours to allocate to high risk areas;

- When these resources are to be deployed, such as whether at an interim audit stage or at key cut-off dates; and

- How such resources are managed, directed and supervised, such as when team briefing and debriefing meetings are expected to be held, how engagement partner and manager reviews are expected to take place (for example, on-site or off-site), and whether to complete engagement quality control reviews.

Illustration 1: The auditor T of Hand Fab Ltd is worried as to management of key resources to be employed to conduct audit.

Required

How the audit strategy would be helpful to the auditor?Overall audit strategy sets the scope, timing and direction of the audit, and guides the development of the more detailed audit plan.

The auditor shall establish an overall audit strategy that sets the scope, timing and direction of the audit, and that guides the development of the audit plan.

Establishment of Overall Audit Strategy

➤ In establishing the overall audit strategy, the auditor shall

(a) Identify the characteristics of the engagement that define its scope;

Example:

- The expected audit coverage, including the number and locations of components to be included.

- The nature of the business segments to be audited, including the need for specialized knowledge.

- The expected use of audit evidence obtained in previous audits, for example, audit evidence related to risk assessment procedures and tests of controls.

(b) Ascertain the reporting objectives of the engagement to plan the timing of the audit and the nature of the communications required;

Example:

- The entity’s timetable for reporting, such as at interim and final stages.

- The organization of meetings with management and those charged with governance to discuss the nature, timing and extent of the audit work.

- The discussion with management and those charged with governance regarding the expected type and timing of reports to be issued and other communications, both written and oral, including the auditor’s report, management letters and communications to those charged with governance.

- The discussion with management regarding the expected communications on the status of audit work throughout the engagement.

(c) Consider the factors that, in the auditor’s professional judgment, are significant in directing the engagement team’s efforts;

(d) Consider the results of preliminary engagement activities and, where applicable, whether knowledge gained on other engagements performed by the engagement partner for the entity is relevant; and

Example:

- Preliminary identification of areas where there may be a higher risk of material misstatement.

- Results of previous audits that involved evaluating the operating effectiveness of internal control, including the nature of identified deficiencies and action taken to address them.

- Volume of transactions, which may determine whether it is more efficient for the auditor to rely on internal control.

(e) Ascertain the nature, timing and extent of resources necessary to perform the engagement.

Example

- The selection of engagement team and the assignment of audit work to the team members, including the assignment of appropriately experienced team members to areas where there may be higher risks of material misstatement.

- Engagement budgeting, including considering the appropriate amount of time to set aside for areas where there may be higher risks of material misstatement.

Relationship Between Overall Audit Strategy And Audit Plan

Once the overall audit strategy has been established, an audit plan can be developed to address the various matters identified in the overall audit strategy, taking into account the need to achieve the audit objectives through the efficient use of the auditor’s resources. The establishment of the overall audit strategy and the detailed audit plan are not necessarily discrete or sequential processes, but are closely inter-related since changes in one may result in consequential changes to the other.

Development Of Audit Plan

Description of Audit Plan

➤ The auditor shall develop an audit plan that shall include a description of

- The nature, timing and extent of planned risk assessment procedures, as determined under SA 315 “Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and Its Environment”.

- The nature, timing and extent of planned further audit procedures at the assertion level, as determined under SA 330 “The Auditor’s Responses to Assessed Risks”.

- Other planned audit procedures that are required to be carried out so that the engagement complies with SAs.

The audit plan is more detailed than the overall audit strategy that includes the nature, timing and extent of audit procedures to be performed by engagement team members. Planning for these audit procedures takes place over the course of the audit as the audit plan for the engagement develops.

Example:

- Planning of the auditor’s risk assessment procedures occurs early in the audit process.

- However, planning the nature, timing and extent of specific further audit procedures depends on the outcome of those risk assessment procedures. In addition, the auditor may begin the execution of further audit procedures for some classes of transactions, account balances and disclosures before planning all remaining further audit procedures.

Knowledge of the Client’s Business

It is one of the important principles in developing an overall audit plan. In fact without adequate knowledge of client’s business, a proper audit is not possible. As per SA-315, “Identifying and Assessing the Risk of Material Misstatement through Understanding the Entity and Its Environment”, the auditor shall obtain an understanding of the following:

(a) Relevant industry, regulatory and other external factors including the applicable financial reporting framework.

Example:

- The competitive environment, including demand, capacity, product and price competition as well as cyclical or seasonal activity.

- Supplier and customer relationships, such as types of suppliers and customers (e.g., related parties, unified buying groups) and the related contracts with those entities.

- Technological developments, such as those related to the entity’s products

- energy supply and cost.

- The effect of regulation on entity operations.

(b) The nature of the entity, including:

- its operations;

- its ownership and governance structures;

- the types of investments that the entity is making and plans to make, including investments in special-purpose entities; and

- the way that the entity is structured and how it is financed;

to enable the auditor to understand the classes of transactions, account balances, and disclosures to be expected in the financial statements.

Example:

- Understanding the sources of an entity’s earnings can help us identify risks of material misstatement related to valuation of certain products or lines of businesses or areas that may be more susceptible to management fraud.

- Understanding key supplier and customer relationships can help us identify potential related parties or risks related to revenue recognition.

- An entity with components in multiple tax jurisdictions, resulting in additional risk of misstatement in the tax accounts.

- An acquisition may result in a complex structure of holding companies to achieve benefits to the shareholders giving rise to significant intercompany transactions which may give rise to material misstatements due to fraud or error.

- Transactions outside the entity’s normal course of business may include: complex equity transactions, transactions regarding the leasing of premises, or the rendering of management services by the entity to another party, when no consideration is exchanged, transactions under contracts with terms that change before expiration should be studied in depth.

(c) The entity’s selection and application of accounting policies, including the reasons for changes thereto. The auditor shall evaluate whether the entity’s accounting policies are appropriate for its business and consistent with the applicable financial reporting framework and accounting policies used in the relevant industry.

Example:

- We use our understanding of the entity’s accounting principles, financial reporting policies or disclosures to help us determine:

➤ The need to involve a specialist to help perform audit procedures related to particular disclosures, such as pension disclosures.

➤ The effect on our audit of significant new or revised disclosures that may be required as a result of changes in the entity’s environment, financial condition or activities, such as a change in the segments for the reporting of segment information arising from a significant business combination. - Management determines that most of the entity’s competitors have adopted an accounting policy that is different from that adopted by the entity. After evaluation, management determines that the alternative accounting policy is generally accepted and further determines that the alternative accounting policy preferable as it will result in greater comparability and result in reliable and more relevant information. Management therefore decides to change the entity’s accounting policy.

(d) The entity’s objectives and strategies, and those related business risks that may result in risks of material misstatement.

Example:

- If one of management’s objectives is to grow the business, management may develop a strategy of steady but regular growth through specific marketing campaigns and development of new markets. Alternatively, management may develop a more aggressive, complex strategy of acquiring competitors. Each of these strategies gives rise to differing business risks and potentially differing risks of material misstatement.

- Examples of potential business risks include:

➤ Failure to keep up to date with new products, technologies or services.

➤ Excessive reliance on a key supplier, product or individual, such as the owner.

➤ Lack of personnel with expertise to react to changes in the industry.

➤ Insufficient or excessive production capacity caused by inaccurate estimation of demand.

➤ Loss of financing due to the entity’s inability to meet financial covenants

(e) The measurement and review of the entity’s financial performance.

Example: External information such as analysts’ reports and credit rating agency reports may be useful information for us to obtain an understanding of an entity’s performance measures. Such reports can often be obtained from the entity.

In addition to the importance of knowledge of the client’s business in establishing the overall audit plan, such knowledge helps the auditor to identify areas of special audit consideration, to evaluate the reasonableness both of accounting estimates and management representations and to make judgements regarding the appropriateness of accounting policies and disclosures.

Audit Planning - A Continuous Process

In the context of recurring audits, as per SA-300, “Planning an Audit of Financial Statements”, Planning is not a discrete phase of an audit, but rather a continual and iterative process that often begins shortly after (or in connection with) the completion of the previous audit and continues until the completion of the current audit engagement. Planning, however, includes consideration of the timing of certain activities and audit procedures that need to be completed prior to the performance of further audit procedures. For example, planning includes the need to consider, prior to the auditor’s identification and assessment of the risks of material misstatement, such matters as:

- The analytical procedures to be applied as risk assessment procedures.

- Obtaining a general understanding of the legal and regulatory framework applicable to the entity and how the entity is complying with that framework.

- The determination of materiality.

- The involvement of experts.

- The performance of other risk assessment procedures.

Additional Considerations in Initial Audit Engagements

(As per SA-300, “Planning an Audit of Financial Statements”)

The auditor shall undertake the following activities prior to starting an initial audit:

- Performing procedures required by SA 220 regarding the acceptance of the client relationship and specific audit engagement, and

- Communicating with the predecessor auditor, where there has been a change of auditors, in compliance with relevant ethical requirements

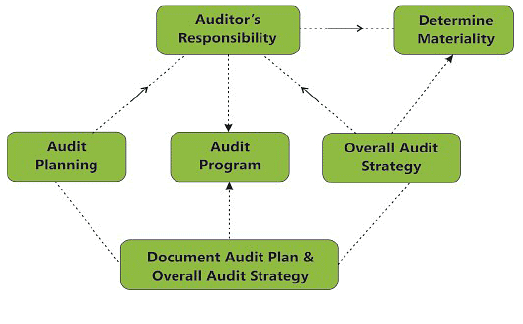

Overall Audit Strategy And The Audit Plan - The Auditor's Responsibility

The auditor may decide to discuss elements of planning with the entity’s management to facilitate the conduct and management of the audit engagement.

Example: To coordinate some of the planned audit procedures with the work of the entity’s personnel.

Although these discussions often occur, the overall audit strategy and the audit plan remain the auditor’s responsibility. When discussing matters included in the overall audit strategy or audit plan, care is required in order not to compromise the effectiveness of the audit.

Example: Discussing the nature and timing of detailed audit procedures with management may compromise the effectiveness of the audit by making the audit procedures too predictable.

The involvement of the engagement partner and other key members of the engagement team in planning the audit draws on their experience and insight, thereby enhancing the effectiveness and efficiency of the planning process.

Illustration 2: W, the auditor of SKM Ltd asks its finance and audit head to prepare audit strategy for conducting audit of SKM Ltd. W, also insist him to draw detailed audit procedures also. On the request of auditor W, complete audit strategy as well as audit procedures are prepared by finance head of the company. Subsequently, auditor realizes that effectiveness of the audit is compromised and it was his responsibility to prepare the overall audit strategy. Comment.

Refer paragraph - Overall Audit Strategy And The Audit Plan - The Auditor's Responsibility, Keeping in view the content given in paragraph, approach of W was wrong and he should have prepared overall audit strategy and detailed audit procedures.

Changes To Planning Decisions During The Course Of The Audit

The auditor shall update and change the overall audit strategy and the audit plan as necessary during the course of the audit. As a result of unexpected events, changes in conditions, or the audit evidence obtained from the results of audit procedures, the auditor may need to modify the overall audit strategy and audit plan and thereby the resulting planned nature, timing and extent of further audit procedures, based on the revised consideration of assessed risks. This may be the case when information comes to the auditor’s attention that differs significantly from the information available when the auditor planned the audit procedures.

For example, audit evidence obtained through the performance of substantive procedures may contradict the audit evidence obtained through tests of controls.

Direction, Supervision And Review

The auditor shall plan the nature, timing and extent of direction and supervision of engagement team members and the review of their work.

The nature, timing and extent of the direction and supervision of engagement team members and review of their work vary depending on many factors, including:

- The size and complexity of the entity.

- The area of the audit.

- The assessed risks of material misstatement

Example: An increase in the assessed risk of material misstatement for a given area of the audit ordinarily requires a corresponding increase in the extent and timeliness of direction and supervision of engagement team members, and a more detailed review of their work. - The capabilities and competence of the individual team members performing the audit work.

Example: We may have identified a problem related to the production process that raised concerns about inventory obsolescence. After obtaining an understanding of the entity’s process that raised concerns about inventory obsolescence (which we had identified as a significant class of transactions), we concluded that additional tests of details were required. Therefore, the senior will likely take part, along with the team, in the discussions with management about the provision for obsolescence and examine related documentation supporting the provision, rather than just reading the memo on file. These procedures should be completed as the work is being performed rather than as an after the fact review. The extent of the senior’s involvement requires judgment, taking into consideration the complexity of the area and the experience of the team.

Documentation

The auditor shall document:

- the overall audit strategy;

- the audit plan; and

- any significant changes made during the audit engagement to the overall audit strategy or the audit plan, and the reasons for such changes.

The documentation of the overall audit strategy is a record of the key decisions considered necessary to properly plan the audit and to communicate significant matters to the engagement team.

Example: The auditor may summarize the overall audit strategy in the form of a memorandum that contains key decisions regarding the overall scope, timing and conduct of the audit.

- The documentation of the audit plan is a record of the planned nature, timing and extent of risk assessment procedures and further audit procedures at the assertion level in response to the assessed risks. It also serves as a record of the proper planning of the audit procedures that can be reviewed and approved prior to their performance. The auditor may use standard audit programs and/or audit completion checklists, tailored as needed to reflect the particular engagement circumstances.

- A record of the significant changes to the overall audit strategy and the audit plan, and resulting changes to the planned nature, timing and extent of audit procedures, explains why the significant changes were made, and the overall strategy and audit plan finally adopted for the audit. It also reflects the appropriate response to the significant changes occurring during the audit.

Example: The following things should form part of auditor’s documentation:

- A summary of discussions with the entity’s key decision makers.

- Documentation of audit committee pre-approval of services, where required.

- Audit documentation access letters.

- Other communications or agreements with management or those charged with governance regarding the scope, or changes in scope, of our services.

- Auditor’s report on the entity’s financial statements.

- Other reports as specified in the engagement agreement (e.g., debt covenant compliance letter).

Audit programme

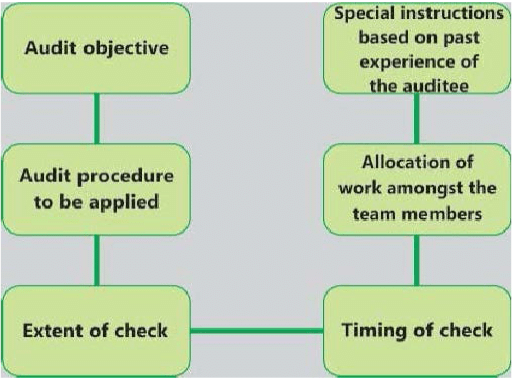

It is desirable that in respect of each audit and more particularly for bigger audits an audit programme should be drawn up. Audit programme is a list of examination and verification steps to be applied and set out in such a way that the inter-relationship of one step to another is clearly shown and designed, keeping in view the assertions discernible in the statements of account produced for audit or on the basis of an appraisal of the accounting records of the client.

Definition : An audit programme consists of a series of verification procedures to be applied to the financial statements and accounts of a given company for the purpose of obtaining sufficient evidence to enable the auditor to express an informed opinion on such statements.

In other words, an audit programme is a detailed plan of applying the audit procedures in the given circumstances with instructions for the appropriate techniques to be adopted for accomplishing the audit objectives.

Evolving One Audit Programme – Not Practicable For All Businesses

Businesses vary in nature, size and composition; work which is suitable to one business may not be suitable to others; efficiency and operation of internal controls and the exact nature of the service to be rendered by the auditor are the other factors that vary from assignment to assignment. On account of such variations, evolving one audit programme applicable to all business under all circumstances is not practicable. However, it becomes a necessity to specify in detail in the audit programme the nature of work to be done so that no time will be wasted on matters not pertinent to the engagement and any special matter or any specific situation can be taken care of.

The Assistant Engaged - Be Encouraged To Keep An Open Mind

To start with, an auditor having regard to the nature, size and composition of the business and the dependability of the internal control and the given scope of work, should frame a programme which should aim at providing for a minimum essential work which may be termed as a standard programme. As experience is gained by actually carrying out the work, the programme may be altered to take care of situations which were left out originally, but are found relevant for the particular concern. Similarly, if any work originally provided for proves beyond doubt to be unnecessary or irrelevant, it may be dropped. The assistant engaged in the job should be encouraged to keep an open mind beyond the programme given to him. He should be instructed to note and report significant matters coming to his notice, to his seniors or to the partners or proprietor of the firm engaged for doing the audit.

Periodic Review of The Audit Programme

There should be periodic review of the audit programme to assess whether the same continues to be adequate for obtaining requisite knowledge and evidence about the transactions. Unless this is done, any change in the business policy of the client may not be adequately known, and consequently, audit work may be carried on, on the basis of an obsolete programme and, for this negligence, the whole audit may be held as negligently conducted and the auditor may have to face legal consequences.

Example: If the audit programme for the audit of a branch of a financing house, drawn up a number of years ago, fails to take into consideration that the previous policy of financing of a vehicle has been changed to financing of real estate acquisition, the whole audit conducted thereunder would be entirely misdirected and may even result into nothing more than a farce. [Pacific Acceptance Corporation Ltd. v. Forsyth and Others.]

The utility of the audit programme can be retained and enhanced only by keeping the programme as also the client’s operations and internal control under periodic review so that inadequacies or redundancies of the programme may be removed.

However, as a basic feature, audit programme not only lists the tasks to be carried out but also contains a few relevant instructions, like the extent of checking, the sampling plan, etc. So long as the programme is not officially changed by the principal, every assistant deputed on the job should unfailingly carry out the detailed work according to the instructions governing the work. Many persons believe that this brings an element of rigidity in the audit programme. This is not true provided the periodic review is undertaken to keep the programme as up-to-date as possible and by encouraging the assistants on the job to observe all salient features of the various accounting functions of the client.

Constructing an Audit Programme

For the purpose of programme construction, the following points should be kept in mind:

- Stay within the scope and limitation of the assignment.

- Determine the evidence reasonably available and identify the best evidence for deriving the necessary satisfaction.

- Apply only those steps and procedures which are useful in accomplishing the verification purpose in the specific situation.

- Consider all possibilities of error.

- Co-ordinate the procedures to be applied to related items.

Audit Programme- Designed to provide Audit Evidence

Audit Evidence may be defined as the information used by the auditor in arriving at the conclusions on which the auditor’s opinion is based. Audit evidence includes both information contained in the accounting records underlying the financial statements and other information.

Evidence is the very basis for formulation of opinion and an audit programme is designed to provide for that by prescribing procedures and techniques. What is best evidence for testing the accuracy of any assertion is a matter of expert knowledge and experience. This is the primary task before the auditor when he draws up the audit programme. Transactions are varied in nature and impact; procedures to be prescribed depend on prior knowledge of what evidence is reasonably available in respect of each transaction.

Example: Sales are evidenced by:

- invoices raised by the client;

- price list;

- forwarding notes to client;

- inventory-issue records;

- sales managers’ advice to the inventory section;

- acknowledgements of the receipt of goods by the customers; and

- collection of money against sales by the client.

In most of the assertions much of the evidence be drawn and each one should be considered and weighed to ascertain its weight to prove or disprove the assertion. In this process, an auditor would be in a position to identify the evidence that brings the highest satisfaction to him about the appropriateness or otherwise of the assertion.

An auditor picks up evidence from a variety of fields and it is generally of the following broad types:

- Documentary examination,

- Physical examination,

- Statements and explanation of management, officials and employees,

- Statements and explanations of third parties,

- Arithmetical calculations by the auditor,

- State of internal controls and internal checks,

- Inter-relationship of the various accounting data,

- Subsidiary and memorandum records,

- Minutes,

- Subsequent action by the client and by others.

Example:

- For cash in hand, the best evidence is ‘count’

- For investment pledged with a bank, the banker’s certificate.

- For verifying assertions about book debts, the client’s ledger invoices, debit notes, credit notes, monthly accounts statement sent to the customers are all evidence: some of these are corroborative, other being complementary. In addition, balance confirmation procedure is often resorted to, to obtain greater satisfaction about the reliability of the assertion.

The auditor, however, has to place appropriate weight on each piece of evidence and accordingly should prescribe the priority of verification. It is true that in all cases one procedure may not bring the highest satisfaction and it may be dangerous for the auditor to ignore any evidence that is available. By the word “available” we do not mean that the evidence available with the client is the only available evidence. The auditor should know what normally should be available in the context of the transaction having regard to the circumstances and usage.

Developing the Audit Programme

- Written Audit Programme: The auditor should prepare a written audit programme setting forth the procedures that are needed to implement the audit plan.

- Audit Objective and Instruction to Assistants: The programme may also contain the audit objectives for each area and should have sufficient details to serve as a set of instructions to the assistants involved in the audit and as a means to control the proper execution of the work.

- Reliance on Internal Controls: In preparing the audit programme, the auditor, having an understanding of the accounting system and related internal controls, may wish to rely on certain internal controls in determining the nature, timing and extent of required auditing procedures. The auditor may conclude that relying on certain internal controls is an effective and efficient way to conduct his audit. However, the auditor may decide not to rely on internal controls when there are other more efficient ways of obtaining sufficient appropriate audit evidence. The auditor should also consider the timing of the procedures, the coordination of any assistance expected from the client, the availability of assistants, and the involvement of other auditors or experts.

- Timings of Performance of Audit Procedures: The auditor normally has flexibility in deciding when to perform audit procedures. However, in some cases, the auditor may have no discretion as to timing, for example, when observing the taking of inventories by client personnel or verifying the securities and cash balances at the year-end.

- Audit Planning: The audit planning ideally commences at the conclusion of the previous year’s audit, and along with the related programme, it should be reconsidered for modification as the audit progresses. Such consideration is based on the auditor’s review of the internal control, his preliminary evaluation thereof, and the results of his compliance and substantive procedures.

Advantages and Disadvantages of an Audit Programme

The advantages of an audit programme are:

- It provides the assistant carrying out the audit with total and clear set of instructions of the work generally to be done.

- It is essential, particularly for major audits, to provide a total perspective of the work to be performed.

- Selection of assistants for the jobs on the basis of capability becomes easier when the work is rationally planned, defined and segregated.

- Without a written and pre-determined programme, work is necessarily to be carried out on the basis of some ‘mental’ plan. In such a situation there is always a danger of ignoring or overlooking certain books and records. Under a properly framed programme, such danger is significantly less and the audit can proceed systematically.

- The assistants, by putting their signature on programme, accept the responsibility for the work carried out by them individually and, if necessary, the work done may be traced back to the assistant.

- The principal can control the progress of the various audits in hand by examination of audit programmes initiated by the assistants deputed to the jobs for completed work.

- It serves as a guide for audits to be carried out in the succeeding year.

- A properly drawn up audit programme serves as evidence in the event of any charge of negligence being brought against the auditor. It may be of considerable value in establishing that he exercised reasonable skill and care that was expected of professional auditor.

Some disadvantages are also there in the use of audit programmes but most of these can be removed by following some concrete steps.

The disadvantages are:

- The work may become mechanical and particular parts of the programme may be carried out without any understanding of the object of such parts in the whole audit scheme.

- The programme often tends to become rigid and inflexible following set grooves; the business may change in its operation of conduct, but the old programme may still be carried on. Changes in staff or internal control may render precaution necessary at points different from those originally decided upon.

- Inefficient assistants may take shelter behind the programme i.e. defend deficiencies in their work on the ground that no instruction in the matter is contained therein.

- A h ard and fast audit programme may kill the initiative of efficient and enterprising assistants.

All these disadvantages may be eliminated by imaginative supervision of the work carried on by the assistants; the auditor must have a receptive attitude as regards the assistants; the assistants should be encouraged to observe matters objectively and bring significant matters to the notice of supervisor/principal.

Quality Control For Audit Work-Delegation And Supervision Of Audit Work

An audit is a complex task involving number of people at different levels. As we observed in the preparation and development of audit programme, the auditor would naturally have to depend upon number of technical experts as well. During the course of his work, the auditor is also likely to use the work performed by other auditors also.

A lot of work is delegated by auditor to his assistants. The auditor should carefully direct, supervise and review work delegated to assistants. The auditor should obtain reasonable assurance that work performed by other auditors or experts is adequate for his purpose. SA 220, “Quality Control for an Audit of Financial Statements” lays down standards on the quality control.

The objective of the auditor is to implement quality control procedures at the engagement level that provides the auditor with reasonable assurance that:

Audit Planning And Materiality

- Materiality is an important consideration for an auditor to evaluate whether the financial statements reflect a true and fair view or not. SA 320 on “Materiality in Planning and Performing an Audit” requires that an auditor should consider materiality and its relationship with audit risk while conducting an audit. When planning the audit, the auditor considers what would make the financial information materially misstated. The auditor’s preliminary assessment of materiality related to specific account balances and classes of transactions helps the auditor decide such questions as what items to examine and whether to use sampling and analytical procedures. This enables the auditor to select audit procedures that, in combination, can be expected to support the audit opinion at an acceptably low degree of audit risk. It may be noted that the auditor’s assessment of materiality and audit risk may be different at the time of initially planning of the audit as against at the time of evaluating the results of audit procedures.

- At the planning stage, the auditor needs to consider the materiality for the financial statements as a whole. The auditor has to carry out a preliminary identification of significant components and material classes of transactions, account balances and disclosure which he plans to examine. What could be considered material for all situations cannot be defined precisely and an amount or transaction material in one situation may not be material in other situation. For example, ₹ 5,000 may be material for a small entity, but even ₹ 100,000 may not be material for a large entity.

- The auditor has to apply his professional judgement in determining materiality, choosing appropriate benchmark and determining level of benchmark. Materiality forms the basis for determination of audit scope and the levels of testing the transactions. As per SA 320, Materiality in Planning and Performing an audit, Misstatements, including omissions, are considered to be material if they, individually or in the aggregate, could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements.

- If there is any statutory requirement of disclosure, it is to considered material irrespective of the value of amount.

Example: As per new Division I schedule III of Companies Act, 2013, any item of income or expenditure which exceeds one percent of the revenue from operations or ₹ 1,00,000, whichever is higher, needs to be disclosed separately While judging materiality, the significance of an item has to be viewed from different perspectives. Materiality of an item may be judged by considering the impact on the profit and loss, or on the balance sheet, or in the total of the category of expenditure or income to which it pertains, and on its comparison with the corresponding figure for the previous year.

Determining Materiality and Performance Materiality when Planning the Audit

When establishing the overall audit strategy, the auditor shall determine materiality for the financial statements as a whole. If, in the specific circumstances of the entity, there is one or more particular classes of transactions, account balances or disclosures for which misstatements of lesser amounts than the materiality for the financial statements as a whole could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements, the auditor shall also determine the materiality level or levels to be applied to those particular classes of transactions, account balances or disclosures.

Performance Materiality defined : Performance materiality means the amount or amounts set by the auditor at less than materiality for the financial statements as a whole to reduce to an appropriately low level the probability that the aggregate of uncorrected and undetected misstatements exceeds materiality for the financial statements as a whole. If applicable, performance materiality also refers to the amount or amounts set by the auditor at less than the materiality level or levels for particular classes of transactions, account balances or disclosures.

➤ Use of Benchmarks in Determining Materiality for the Financial Statements as a Whole

Determining materiality involves the exercise of professional judgment. A percentage is often applied to a chosen benchmark as a starting point in determining materiality for the financial statements as a whole. Factors that may affect the identification of an appropriate benchmark include the following:

- The elements of the financial statements

Example: Assets, liabilities, equity, revenue, expenses; - Whether there are items on which the attention of the users of the particular entity’s financial statements tends to be focused

Example: For the purpose of evaluating financial performance users may tend to focus on profit, revenue or net assets - The nature of the entity, where the entity is at in its life cycle, and the industry and economic environment in which the entity operates; The entity’s ownership structure and the way it is financed and

Example: If an entity is financed solely by debt rather than equity, users may put more emphasis on assets, and claims on them, than on the entity’s earnings; - The relative volatility of the benchmark.

➤ Examples of appropriate benchmarks depending on entity’s circumstances

Examples of benchmarks that may be appropriate, depending on the circumstances of the entity, include categories of reported income such as :

- profit before tax,

- total revenue,

- gross profit and total expenses,

- total equity or net asset value.

Profit before tax from continuing operations is often used for profit-oriented entities. When profit before tax from continuing operations is volatile, other benchmarks may be more appropriate, such as gross profit or total revenues.

➤ Chosen Benchmark – Relevant financial data

In relation to the chosen benchmark, relevant financial data ordinarily includes –

- prior periods’ financial results and financial positions,

- the period to-date financial results and financial position, and

- budgets or forecasts for the current period,

- adjusted for significant changes in the circumstances of the entity (for example, a significant business acquisition) and relevant changes of conditions in the industry or economic environment in which the entity operates.

Example: When, as a starting point, the materiality for the financial statements as a whole is determined for a particular entity based on a percentage of profit before tax from continuing operations, circumstances that give rise to an exceptional decrease or increase in such profit may lead the auditor to conclude that the materiality for the financial statements as a whole is more appropriately determined using a normalized profit before tax from continuing operations figure based on past results.

➤ Determining a percentage to be applied to a chosen benchmark involves the exercise of professional judgment.

There is a relationship between the percentage and the chosen benchmark, such that a percentage applied to profit before tax from continuing operations will normally be higher than a percentage applied to total revenue.

Example: The auditor may consider five percent of profit before tax from continuing operations to be appropriate for a profit oriented entity in a manufacturing industry, while the auditor may consider one percent of total revenue or total expenses to be appropriate for a not-for-profit entity. Higher or lower percentages, however, may be deemed appropriate in different circumstances.

Materiality Level or Levels for Particular Classes of Transactions, Account Balances or Disclosures

Factors that may indicate the existence of one or more particular classes of transactions, account balances or disclosures for which misstatements of lesser amounts than materiality for the financial statements as a whole could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements include the following:

- Whether law, regulations or the applicable financial reporting framework affect users’ expectations regarding the measurement or disclosure of certain items.

Example: Related party transactions, and the remuneration of management and those charged with governance. - The key disclosures in relation to the industry in which the entity operates.

Example: Research and development costs for a pharmaceutical company. - Whether attention is focused on a particular aspect of the entity’s business that is separately disclosed in the financial statements.

Example: A newly acquired business.

Revision in Materiality level as the Audit Progresses

Materiality for the financial statements as a whole (and, if applicable, the materiality level or levels for particular classes of transactions, account balances or disclosures) may need to be revised as a result of a change in circumstances that occurred during the audit (for example, a decision to dispose of a major part of the entity’s business), new information, or a change in the auditor’s understanding of the entity and its operations as a result of performing further audit procedures.

Example: If during the audit it appears as though actual financial results are likely to be substantially different from the anticipated period end financial results that were used initially to determine materiality for the financial statements as a whole, the auditor revises that materiality.

If the auditor concludes that a lower materiality for the financial statements as a whole (and, if applicable, materiality level or levels for particular classes of transactions, account balances or disclosures) than that initially determined is appropriate, the auditor shall determine whether it is necessary to revise performance materiality, and whether the nature, timing and extent of the further audit procedures remain appropriate.

Documenting the Materiality

The audit documentation shall include the following amounts and the factors considered in their determination:

- Materiality for the financial statements as a whole;

- If applicable, the materiality level or levels for particular classes of transactions, account balances or disclosures ;

- Performance materiality ; and

- Any revision of (a)-(c) as the audit progressed

Summary:

After establishment of the overall audit strategy, an audit plan can be developed to address the various matters identified in the overall audit strategy, taking into account the need to achieve the audit objectives through the efficient use of the auditor’s resources.

In establishing the overall audit strategy, the auditor shall:

Planning is not a discrete phase of an audit, but rather a continual and iterative process that often begins shortly after (or in connection with) the completion of the previous audit and continues until the completion of the current audit engagement.

Development of an Overall Plan:

- The terms of his engagement and statutory responsibilities.

- Nature and timing of reports

- Applicable legal or statutory requirements.

- Accounting policies adopted by the client

- Effect of new accounting or auditing pronouncements on the audit.

- Identification of significant audit areas.

- Setting of materiality levels for audit purposes.

- The degree of reliance on accounting system and internal control

- Possible rotation of emphasis on specific audit areas.

- The nature and extent of audit evidence to be obtained.

- The work of internal auditors and the extent of their involvement

- The involvement of other auditors

- The involvement of experts.

- The allocation of work between joint auditors

- Establishing and coordinating staffing requirements.

The auditor shall document (a) the overall audit strategy;(b) the audit plan; and (c) any significant changes made during the audit engagement to the overall audit strategy or the audit plan, and the reasons for such changes.

AN AUDIT PROGRAMME is a detailed plan and consists of a series of verification procedures to be applied to the financial statements and accounts of a given company for the purpose of obtaining sufficient evidence to enable the auditor to express an informed opinion on such statements.

For framing an audit programme the following points should be kept in view:

SA 320 on “Materiality in Planning and Performing an Audit” requires that an auditor should consider materiality and its relationship with audit risk while conducting an audit. The auditor’s preliminary assessment of materiality related to specific account balances and classes of transactions helps the auditor decide such questions as what items to examine and whether to use sampling and analytical procedures.

What you've learned?

- Understand the Audit Planning and Overall Audit Strategy for an audit.

- Draft audit programme.

- Understand Audit Planning and Materiality.

- Learn to develop the Audit Plan and Program.

- Gain the knowledge of control of quality of audit work w.r.t delegation and supervision of audit work.

FAQs on Audit Strategy, Audit Planning and Audit Programme: Notes - CA Intermediate

| 1. What is the purpose of audit planning? |  |

| 2. What is the relationship between overall audit strategy and audit plan? |  |

| 3. Is audit planning a continuous process? |  |

| 4. What are some additional considerations in initial audit engagements? |  |

| 5. What is the auditor's responsibility regarding the overall audit strategy and the audit plan? |  |

|

Explore Courses for CA Intermediate exam

|

|