NCERT Solution- Resource Mobilization- 2 | Entrepreneurship Class 12 - Commerce PDF Download

| Table of contents |

|

| Section C - Stock Exchange |

|

| High Order Thinking Skill |

|

| Section D- Sebi and Others |

|

| Section E - Specialised Financial Institutions |

|

Section C - Stock Exchange

Very Short Answer Type Questions

Question 1. What are the responsibilities of governing body?

The governing body is responsible for policy formulation and proper functioning of the exchange, having wide range of powers:

- Elect the office bearers and set up committees

- Interpret rules, regulations and by-laws

- Admit and expel members

- Adjudicate disputes

- Manage the properties and finance of the exchange

- Conduct the affairs of the exchange.

Question 2. Name the stock exchanges where most of the stock trading in India is done.

Most of the stock trading in India is done on NSE and BSE.

The BSE is the Bombay Stock Exchange and the NSE is the National Stock Exchange.

The BSE is situated at Bombay and the NSE is situated at Delhi.

These are the major stock exchanges in the country.

Question 3. What is a secondary capital market?

Any transaction in shares or debentures subsequent to its primary offering is called “Secondary Transaction”. Thus, the secondary capital market, which is also known as old securities market or stock exchange deals- with buying and selling of old securities i.e. the market securities issued earlier are sold by existing investors in this market.

Short Answer Type Questions

Question. What is the alternate name of stock used by different people?

The word “stock” is called by different names with different people like shares, equity, scrip and so on but all these words have same meaning.

Long Answer Type Questions

Question 1. Explain the importance of Stock Exchange from the companies point of view.

From the companies point of view:

- Widespread market

- High share value

Question 2. Explain the importance of Stock Exchange from the viewpoint of investors.

From the investor’s point of view:

- Dissemination of useful Information: It publishes useful information regarding price lists, quotations, etc., of securities through newspapers and journals.

- Ready Market: It will be easy way platform for all those for buying and selling shares and convert it into cash through a member of stock exchange.

- Investors’ Interests Protected: Stock exchanges formulate rules and regulations so that members may not exploit the investors.

- Genuine guidance about the securities listed.

- Barriers of distance removed.

- Knowledge of profit or loss on investments and ensures a measure of safety and fair dealings to the investors.

Question 3. Explain the importance of Stock Exchange from the viewpoint of society.

From the societies point of view:

- Rapid Capital Formation

- Economic Development

- National Projects

Question 4. Rahil (Finance) and Anushk (HR) are doing MBA (IIM Indore). While reading the newspaper Anushk saw the heading Sensex goes up. But last week the heading was different that Sensex goes down now some confusion was going on her mind, immediately she asked her Friend Rahil the same? Now according to you how Rahil will clear the confusion of Anushk? Explain and give some value points.

Rahil explains him in this way: The Sensex is an “index”.

An index is basically an indicator. It gives you a general idea about whether most of the stocks have gone up or most of the stocks have gone down.

The Sensex is an indicator of all the major listed companies of the BSE.

The BSE, is the Bombay Stock Exchange and the NSE is the National Stock Exchange. The BSE is situated at Bombay and the NSE is situated at Delhi. These are the major stock exchanges in the country.

If the Sensex goes up, it indicates that the prices of the stocks (shares) of most of the major companies on the BSE have gone up.

If the Sensex goes down, this tells you that the stock price of most of the major stocks on the BSE have gone down.

In this way Rahil cleared the confusion of Anushk.

Value Points:

- Quest for knowledge

- Helpfulness

- Consideration for others

- Awareness of responsibility

- Readiness to cooperate

- Friendship.

Very Long Answer Type Questions

Very Long Answer Type Questions

Question 1. Write down the features of stock exchanges.

- Association of persons: A stock exchange is an association of persons or body of individuals which may be registered or unregistered.

- Recognition from central government: Stock exchange is an organized market. It requires recognition from the Central Government.

- Market for securities: Stock exchange is a market, where securities of corporate bodies, government and semi-government bodies are bought and sold.

- Deals in second hand securities: It deals with shares, debentures, bonds and such securities already issued by the companies. In short, it deals with existing or second hand securities and hence it is called secondary market.

- Regulates trade in securities: Stock exchange does not buy or sell any securities on its own account. It merely provides the necessary infrastructure and facilities to its members and brokers who trade in securities. It regulates the trade activities so as to ensure free and fair trade.

- Allow dealings only in listed securities: In fact, stock exchanges maintain an official list of securities that could be purchased and sold on its floor. Securities which do not figure in the official list of stock exchange are called unlisted securities. Such unlisted securities cannot be traded in the stock exchange.

- Transactions effected only through members: All the transactions in securities at the stock exchange are effected only through its authorized brokers and members. Outsiders or direct investors are not allowed to enter in the trading circles of the stock exchange. Investors have to buy or sell the securities at the stock exchange through the authorized brokers only.

- Working as per rules: Buying and selling transactions in securities at the stock exchange are governed by the rules and regulations of stock exchange as well as SEBI Guidelines. No deviation from the rules and guidelines is allowed in any case.

- Specific location: Stock exchange is a particular market place where authorized brokers come together daily (i.e. on working days) on the floor of market called trading circles and conduct trading activities. The price of different securities traded are shown on electronic boards. After the working hours market is closed. All the working of stock exchange is conducted and controlled through computers and electronic system.

- Financial barometers: Stock exchanges are the financial barometers and development indicators of national economy of the country. Industrial growth and stability is reflected in the index of stock exchange.

Question 2. Explain the functions of stock exchange.

Stock exchange performs a number of functions in respect of marketability of different types of securities for investors and borrowing companies. It’s important functions are:

- Continuous and ready market for securities:

- Stock exchange provides a central market for purchase and sale of securities.

- It provides ready and continuous outlet for buying and selling of securities.

- It facilitates and helps all buyers to buy and sell securities as and when they want.

- Facilitates evaluation of securities:

- It is useful for the correct evaluation of industrial securities.

- It publishes price quotation of the shares of the companies that have been listed with them after thorough analysis of demand and supply position.

- This enables investors to know the true worth of their holdings at any time.

- Checks on brokers: It checks and controls the activities of brokers and protect the investors from being deceived.

While dealing,’if any broker is found indulging in malpractices as overcharging or giving wrong information, his/her licence may be cancelled.- Provides safety and security in dealings:

- All activities of the stock exchange are controlled by the provisions of the Securities Control (Regulation) Act and this creates confidence in the mind of investors.

- Each and every dealings and transactions are conducted as per well defined rules and regulations, fraudulent practices stands checked effectively ensuring safety, security and justice in dealings.

- Regulates company management: All listed companies in the stock exchange, compulsorily have to follow with rules and regulations of concerned stock exchange and work under the vigilance of their authorities.

High Order Thinking Skill

High Order Thinking Skill

Question 1. Stock exchange performs a number of functions in respect of marketability of different types of securities for investors and borrowing companies. Explain the important functions of stock exchanges.

- Continuous and ready market for securities: Stock exchange provides a central market for purchase and sale of securities. It provides ready and continuous outlet for buying and selling of securities. Buyers and sellers strongly believe that they would be able to buy and sell securities as and when they want.

- Facilitates evaluation of securities: Stock exchange is useful for the evaluation of industrial securities. It publishes price quotation of the shares of the companies that have been listed with them after thorough analysis of demand and supply position. This enables investors to know the true worth of their holdings at any time.

- Checks on brokers: Stock exchanges control the activities of brokers and protect the investors from being deceived. Now, if any broker is found indulging in malpractices as overcharging or giving wrong information, his/her licence may be cancelled.

- Provides safety and security in dealings: Activities of the stock exchange are controlled by the provisions of the Securities Control (Regulation) Act and all this creates confidence in the minds of investors. As transactions are conducted as per well defined rules and regulations, fraudulent practices stands checked effectively ensuring safety, security and justice in dealings.

- Regulates company management: Listed companies have to comply with rules and regulations of concerned stock exchange and work under the vigilance of stock exchange authorities.

- Intensifying capital formation: Stock exchange accelerates the process of capital formation through creating the habit of saving, investing and risk taking among the investing class by converting their savings into profitable, safe investments.

- Facilitates raising of new capital: Because of stock exchange, for either development, organisation or expansion, the need for more capital by the existing companies is easily met out.

- Facilitates public borrowing: Stock exchange serves as a platform for marketing government securities. It enables government to raise public debt easily and quickly.

- Facilitates healthy speculation: Healthy speculation keeps the exchange active. Normal speculation is not dangerous but provides more business to the exchange. However, excessive speculation is undesirable as it is dangerous to investors and the growth of corporate sector.

- Serves as economic barometer: Stock exchange indicates the state of health of companies and the national economy. It acts as a barometer of the economic situation/conditions and is thus referred to as ‘pulse of economy’ or ‘economic mirror’.

- Facilitates bank lending: Banks easily know the prices of quoted securities. They offer loans to customers against corporate securities. This gives convenience to the owners of securities.

Section D- Sebi and Others

Very Short Answer Type Questions

Question 1. What do you mean by stock exchange?

A stock exchange means anybody of individuals, whether incorporated or not, constituted for the purpose of assisting, regulating or controlling the business of buying and selling or dealing in securities,

Question 2. What is SEBI?

The Securities and Exchange Board of India or SEBI is the regulator for the securities market in India. It was established on 12 April, 1992 through the SEBI Act, 1992.

Question 3. State three functions of SEBI rolled into one body.

SEBI has three functions rolled into one body: quasi-legislative, quasi-judicial and quasi-executive.

Question 4. “Humorously, they were once given the acronym FFF for Angel Investors”. What does FFF stand for?

Friends, Family and Fools.

Question 5. What do you understand by angel investors?

Business angel or informal investor or an angel investor, is an individual who provides capital for a business start-up and early stage companies in exchange for convertible debt or ownership equity.

Short Answer Type Questions

Question 1. What is SEBI and what is its role?

The Securities and Exchange Board of India or SEBI is the regulator for the securities market in India.

Role of SEBI:

- It is a supervising and regulatory body to check certain malpractices and works for promoting the securities markets in India.

- It has three functions rolled into one body: quasi-legislative, quasi-judicial and quasi executive.

- It drafts regulations in its legislative capacity, it conducts investigation and enforcement action in its executive function and it passes rulings and orders.

Question 2. Who manages SEBI?

SEBI is managed by its members, which consists of following:

- Chairman who is nominated by Union Government of India.

- Two members, i.e. Officers from Union Finance Ministry.

- One member from Reserve Bank of India.

- The remaining 5 members are nominated by Union Government of India, out of them at least 3 shall be whole-time members.

Question 3. Explain briefly the three functions of SEBI rolled into one body.

SEBI has quasi-legislative capacity as it makes rules and regulations. It has rule-making authority related to the matters of securities in India.

SEBI is a quasi-judicial body as it has an entity such as an arbitrator or tribunal board, and has powers and procedures resembling those of a court. SEBI is quasi-executive as it functions like an executive but that is not really an executive.

Question 4. What do you understand by venture capital?

- Venture capital is a type of private equity capital provided as seed funding to early-stage.

- The investors provide funds to give shape to their ideas.

- It aims at avoiding death of an enterprise even before they could be tried.

- This investment enables the investors to accomplish objectives, in return for minority shareholding in the business or the irrevocable right to acquire.

- It is more accurate to view venture capital broadly as a professionally managed pool of equity capital.

- It is a way by which investors support entrepreneurial talent with finance and business skills for obtaining long-term capital gains.

Question 5. Enlist several categories of financing possibilities in which smaller ventures sometimes rely on.

Following are several categories of financing possibilities in which smaller ventures sometimes rely on:

- Venture capital

- Seed Capital Finance

- Start up finance

- Loan from various financial institutions like, IDBI, SIDBI, IFCI, ICICI, NABARD, IIBI, SFCs, TFCI, AND SIDC.

Question 6. Why are venture capitalists typically very selective in deciding while doing the investment?

- Venture capital involves high risk as its is done for entrepreneurs who lack the necessary experience and funds to give shape to their ideas.

- The proposal of a new venture involves new or untried technology put forward by professionally or technically qualified persons involving high risk factors. This may fail to attract investments from public, which may result in their death even before they could be tried.

- Also the investments of venture capitalists are illiquid and require the time period to give returns. Venture capitalists thus have to carry out detailed due diligence prior to investment.

Long Answer Type Questions

Long Answer Type Questions

Question 1. Explain the powers SEBI has been vested with for discharging of its functions efficiently.

SEBI has been vested with the following powers:

- To make and approve by-laws of stock exchanges.

- To enquire the stock exchange to amend their by-laws.

- Inspect the books of accounts and call for periodical returns from recognized stock exchanges.

- Inspect the books of accounts of financial intermediaries.

- Compel certain companies to list their shares in one or more stock exchanges.

- Levy fees and other charges on the intermediaries for performing its functions.

- Grant license to any person for the purpose of dealing in certain areas.

- Delegate powers exercisable by it.

- Prosecute and judge directly the violation of certain provisions of the Companies Act.

- Power to impose monetary penalties.

Question 2. What are the features of venture capital finance?

Venture capital finance has the following features:

- Equity: It is equity finance in relatively new ventures and new companies.

- Long term: It is long-term investment in growth-oriented small or medium firms.

- Skills: Venture capitalist also business skills to investee firms. This raises the chances of success of the emerging firm.

- Risk: It involves high risk-return spectrum.

- Private equity: It is a subset of private equity.

- Involvement: The venture capital institutions make a continuous involvement in the business.

Question 3. When can an entrepreneur seek venture capital financing?

An entrepreneur seeks venture capital financing under following circumstances:

- High risk: Ventures which involve high risk due to various reasons like technological, creativity and innovation, etc. are subjected to high risk related to returns. Here the venture capitalist comes forward.

- Seed funding: Seed money, is a form of securities offering in which an venture investor purchases part of a business. Interest of the venture capitalist for purchase of security is also a reason.

- Expansion: If the entrepreneur wants to expand then he goes for venture capital.

- Business skills: Lack of business skills also forces the entrepreneur to go for venture capital.

Very Long Answer Type Questions

Very Long Answer Type Questions

Very Long Answer Type Questions

Question. Explain the characteristics of angle investors.

Following are the characteristics of angle investors:

- High net worth: Most angle investors are current or retired executives, business owners, etc. They have the knowledge, expertise, and funds to help start-ups.

- High risk: Angle investors bear extremely high risk. They expect a very high return on investment which they are making.

- Guidance: Most angle investors provide proactive advice, guidance, or mentoring services for the start-ups in its early days of the enterprises.

- High returns: Angle investors also have objective to create successful companies by providing value creation, and guiding investors realize a high return on investments.

- Experience: Angle investors have a sharp inclination to keep themselves updated to current developments in a particular business area and then mentor another group of entrepreneurs by making use of their precious experience.

- Type of Investments: Most angles invest in small, start-up businesses with fewer employees. The arrangements are informal.

- An individual investor: Angle investors are usually individuals.

High Order Thinking Skill

High Order Thinking Skill

Question. Why it is said that “A venture capitalists investments are illiquid”. Give reason.

Illiquid describes an asset or security that cannot be sold quickly. Uncertainly the asset value is associated with the investment. This can be due to economic instability or issues relating to the asset. If the asset value declines, it becomes an illiquid asset due to the unclear value. It can be hard to locate a market for these products. This may lead to loss of the money.

Section E - Specialised Financial Institutions

Very Short Answer Type Questions

Question 1. What is the role of Specialized Financial Institutions in India?

The role of Specialized Financial Institutions (SFIs) also called development banks make an important source of medium and long-term financing amongst all the financial institutions in India.

They generally provide finances to the business and they help in promotion of new industries/new entrepreneur.

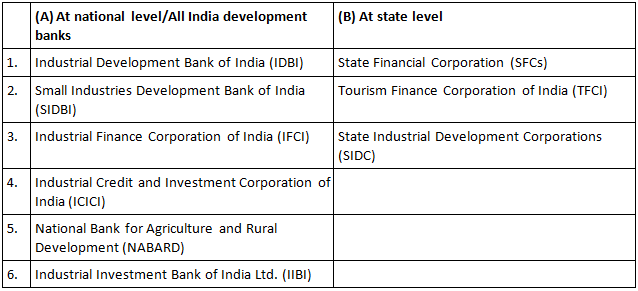

Question 2. Enumerate the types of Specialised Financial Institutions from where entrepreneur can access capital according to their need and requirements.

- At national level/All India development banks

- Industrial Development Bank of India (IDBI)

- Small Industries Development Bank of India (SIDBI)

- Industrial Finance Corporation of India (IFCI)

- Industrial Credit and Investment Corporation of India (ICICI)

- National Bank for Agriculture and Rural Development (NABARD)

- Industrial Investment Bank of India Ltd. (IIBI)

- At state level

- State Financial Corporation (SFCs)

- Tourism Finance Corporation of India (TFCI)

- State Industrial Development ,Corporations (SIDC)

Question 3. When was SIDBI established?

SIDBI was established in April 1990, as a wholly owned subsidiary of IDBI, under the Small Industries Development Bank of India Act, 1990.

Short Answer Type Questions

Question 1. Explain the need and importance of Specialized Financial Institutions in India.

As SFIs provide developmental finance, that is, finance for investment in fixed assets, they are also known as ‘development banks’ or ‘development financial institutions’. Establishing of SFIs facilitated:

- Provision of sufficient long-term funds in the desired sectors in accordance with planned priorities to the industrial units and entrepreneurs.

- New and small entrepreneurs in setting up industry.

- Development of:

(i) Small scale industry, and

(ii) Projects in backward areas.- Provision of technical and managerial advice to the entrepreneurs, facilitating thus, in identification, evaluation and execution of new investment enterprises.

- Underwriting of and direct subscription to the issue of shares and debentures in the capital market of the upcoming ventures.

- Establishment of enterprises which require extraordinarily large amount of finance for their projects with a long-gestation period.

Question 2. Explain the objectives and functions of SIDC.

- SIDCs: The State Industrial Development Corporations (In-corporated under the Companies Act, 1956) were set up in different states as state government as companies wholly owned by them, the main objectives of SIDCs was promoting industrial development in all states of the countries.

- At present, 22 such SIDCs are functioning in India.

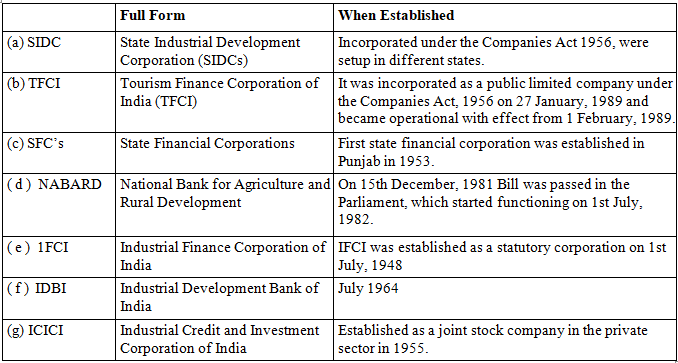

Question 3. Write the full form of and when it was established.

(a)SIDC

(b) TFCI

(c) SFC’s

(d) NABARD

(e) IFCI

(f) IDBI

(g) ICICI

Long Answer Type Questions

Long Answer Type Questions

Question 1. Apoorva wants to start a new business near to her locality, for which she requires capital. State different types of national level and state level financial institutions from where Apoorva can access capital according to her needs and requirements.

Types of Specialised Financial Institutions: Entrepreneurs have access to any of the following SFIs to choose from, according to their needs and requirements:

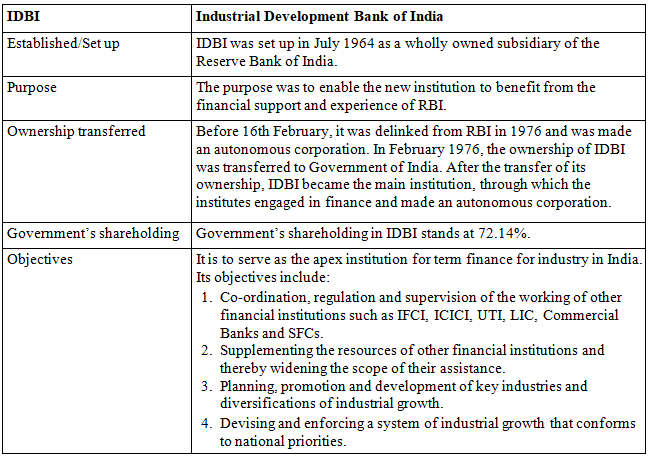

Question 2. Write down the objectives of IDBI.

The main objectives of IDBI:

Question 3. Write an explanatory note on the financing schemes of state level financial institutions and their importance in promotion of an entrepreneur in India.

At State Level State Financial Corporation (SFCs):

To meet the financial needs of small and medium enterprises, the government of India passed the State Financial Corporation Act in 1951, empowering the state governments to establish development banks for their respective I regions. There are 18 SFCs at present.

Objectives: The objectives of State Financial Corporations are as under:

- Provide financial assistance to small and medium industrial concerns.

These may be from corporate or co-operative sectors as in case of IFCI or may be partnership, individual or Joint Hindu family business, engaged not only in the manufacture, preservation or processing of goods.- Provide long and medium-term loan repayment ordinarily within a period not exceeding 20 years.

- Grant financial assistance to any single industrial concern under corporate or co-operative sector with an aggregate upper limit of r rupees Sixty lakhs. In any other case(partnership, sole proprietorship or Joint Hindu family) the upper limit is rupees thirty lakhs.

- Provide financial assistance generally to those industrial concerns whose paid up share capital and free reserves do not exceed Rs 3 crore.

- To lay special emphasis on the development of backward areas and small scale industries.

Functions:

- Grant of loans and advances to or subscribe to debentures of, industrial concerns repayable within a period not exceeding 20 years.

- Guaranteeing deferred payments due from an industrial concern for purchase of capital goods in India.

- Underwriting of the issue of stock, bonds or debentures by industrial concerns.

- Subscribing to, or purchasing of, the stock, shares, bonds or debentures of an industrial concern subject to a maximum of 30 per cent of the subscribed capital, or 30 per cent of paid up share capital and free reserve, whichever is less.

- Act as agent of the Central government, State government, IDBI, IFCI or any other financial institution in the matter of grant of loan or business of IDBI, IFCI or financial institution. Tourism Finance Corporation of India (TFCI): The Tourism Finance Corporation of India (TFCI) was born as a result of the Government of India’s decision, in 1987, to promote a separate all- India financial institution for providing financial assistance to tourism-related activities/projects.

Functions:

- TFCI provides financial assistance to enterprises for setting up or the development of tourism-related projects, facilities and services such as hotels, restaurants, holiday resorts, amusement parks, entertainment centres, education and sports, rope ways, cultural centres, convention halls, transport, travel and tour operating agencies, air services, tourism emporia and sports facilities.

- It also provides advisory and merchant banking services in this field.

- The projects with a capital cost of Rs 1 crore or above are generally eligible for assistance from TFCI. Smaller projects would also be considered.

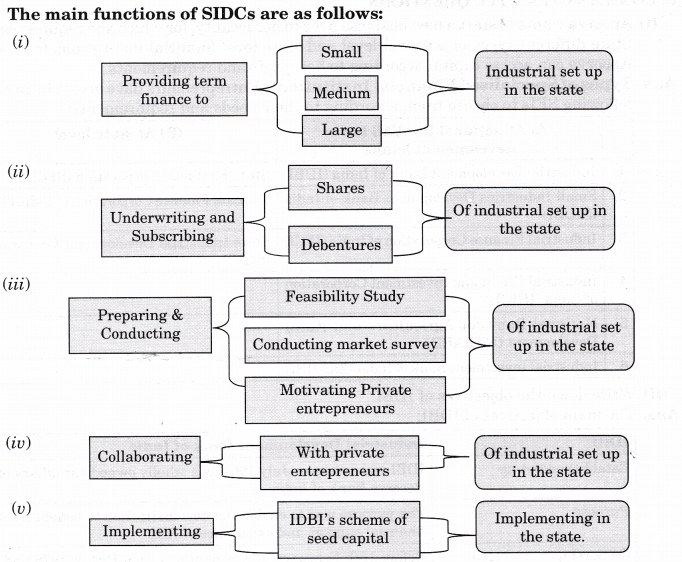

State Industrial Development Corporation (SIDCs): Incorporated under the Companies Act, 1956 SIDCs were set up in different states as wholly owned companies for promoting industrial development in their respective states. The main functions of SIDCs are as follows:

- Providing term finance to all small, medium, and large industrial enterprises set up in the state.

- Underwriting and directly subscribing to shares, and debentures of industrial enterprises being set up in the state.

- Preparing feasibility studies, conducting market surveys and motivating private entrepreneurs to set up their industrial ventures in the state.

- Collaborating with private entrepreneurs to set up industrial ventures in joint and assisted sectors.

- Implementing IDBI’s scheme of seed capital in the state.

Finance can be procured, just like any other resource, against a cost. Procurement of finance involves risk and formalities to comply with. Entrepreneurs need a careful attitude, to sensibly make a choice of sources to generate funds. No one source can be deemed to be the best source. Thus, it is always advisable to select a combination of sources so that both cost and risk can be kept at lowest.

- Tourism Finance Corporation of India (TFCI)

- State Industrial Development Corporations (SIDC)

Question 4. Write a short note on IIBI.

Industrial Investment Bank of India Ltd. (IIBI): The Industrial Investment Bank of India Ltd. (IIBI) was formed by transforming the Industrial Reconstruction Bank of India (IRBI). It was set up by IDBI at the instance of the Government of India in April 1971 for rehabilitation of sick industrial companies. IRBI was incorporated under the Companies Act, 1956 and renamed as the Industrial Investment Bank of India Ltd. in March 1997.

Functions: IIBI offers a wide range of products and services such as:

- Term-loan assistance for project finance

- Short duration non-project asset – backed financing working capital/ other short term loans to companies

- Equity Subscription Asset Credit

- Equipment finance

- Investments in Capital Market and Money market instruments.

Question 5. Describe the form of assistance provided by SIDBI to the industrial concern.

The financial assistance of SIDBI to the small scale sector is channelised through the following two routes:

- Indirect Assistance: Under its indirect schemes, SIDBI extends refinance of loans to small scale sector by Primary Lending Institutions (PLIs) viz. SFCs, SIDCs and Banks. At present, such refinance assistance is extended to 892 PLIs and these PLIs extend credit through a net work of more than 65,000 branches all over the country. All the Schemes of SIDBI both direct and indirect assistance are in operation in all the States of the country through 39 regional/branch offices of SIDBI.

- Direct Assistance: SIDBI directly assists SSIs under:

- Project Finance Scheme

- Equipment Finance Scheme

- Marketing Scheme

- Vendor Development Scheme

- Infrastructural Development Scheme

- ISO-9000

- Technology Development & Modernisation Fund.

Very Long Answer Type Questions

Very Long Answer Type Questions

Very Long Answer Type Questions

Question 1. Explain the main objectives and functions of ICICI.

The ICICI has been established to achieve the following objectives:

- To assist in the formation, expansion and modernization of industrial units in the private sector.

- To stimulate and promote the participation of private capital (both Indian and foreign) in such industrial units.

- To furnish technical and managerial aid so as to increase production and expand employment opportunities.

Question 2. Explain in detail objectives and three important Primary functions of NABARD.

National Bank for Agriculture and Rural Development (NABARD): On 15th December, 1981, National Bank for Agriculture and Rural Development (NABARD) Bill was passed in the Parliament, which started functioning on 1st July, 1982. NABARD was established according to the Preamble to the Act, for providing credit for the promotion of:

- Agriculture

- Small-scale Industries

- Cottage and Village Industries

- Handicrafts and other rural crafts

- Other economic activities in rural areas with a view for promoting IRDP.

Objectives:

- The bank will serve as a financing institution for institutional credit such as long-term, short-term, and for the promotion of activities in rural areas.

- To provide direct lending to any institution as may be approved by the central government.

Functions: The primary functions of NABARD can be classified under three heads:

- Credit Functions: NABARD provides different types of refinance to eligible institutions. They assist entrepreneurs through: Short-term credit to State Cooperative Banks, Regional Rural Banks and Other financial institutions approved by RBI.

- Developmental Functions:

- NABARD coordinates the operations of rural credit institutions.

- It develops expertise to deal with agricultural and rural problems so as to assist in rural development efforts.

- Regulatory Functions:

- NABARD is empowered to undertake inspection of RRBs and Cooperative Banks, other than the Primary Cooperative Banks.

- To open a new branch, are commendation of NABARD is imperative by RRBs or Cooperative Banks to seek permission from RBI.

High Order Thinking Skill

High Order Thinking Skill

Question 1. “TFCI is playing vital role in the development of entrepreneurship in modern economy”. Comment.

The Tourism Finance Corporation of India (TFCI) was born as a result of the Government of India’s decision, in 1987, to promote a separate all- India financial institution for providing financial assistance to tourism-related activities/projects.

It was incorporated as a public limited company under the Companies Act, 1956 on 27 January, 1989. It became operational with effect from 1 February, 1989.It is a specialized all-India development financial institution to cater to the needs of the tourism industry.

Functions:

- It provides financial assistance to enterprises for setting up or the development of tourism- related projects, facilities and services such as hotels, restaurants, holiday resorts, amusement parks, entertainment centres, education and sports, rope ways, cultural centres, convention halls, transport, travel and tour operating agencies, air services, tourism emporia and sports facilities.

- It provides advisory and merchant banking services in this field.

- The projects with a capital cost of Rs 1 crore or above are generally eligible for assistance from TFCI. Smaller projects would also be considered.

- TFCI has sanctioned assistance to 2003 projects aggregating to Rs 5.2 billion during the last five years, resulting in more than 12,217 hotel rooms and direct employment to 22,938 people.

Values:

- Universal and equality

- Resourcefulness

- Services to others

- Readiness to cooperate

- National awareness

- Employment opportunities

- Fulfilling the needs of the people

- Helpfulness and contributing to entrepreneur for the growth of the country.

Question 2. Hari is an entrepreneur who wants to start an amusement park in Indore. He knows that she needs a huge amount of initial capital. According to you, which of the financial institution will be more suitable to him? Suggest and Explain why?

Accordingly Hari should approach to Tourism Finance Corporation of India (TFCI), the financial institution.

TFCI is playing vital role in the development of entrepreneurship in modern economy. The Tourism Finance Corporation of India (TFCI) was born as a result of the Government of India’s decision, in 1987, to promote a separate all-India financial institution for providing financial assistance to tourism-related activities/projects. It was incorporated as a public limited company under the Companies Act, 1956 on 27 January, 1989.It became operational with effect from 1 February, 1989. It is a specialized all- India development financial institution to cater to the needs of the tourism industry.

The various functions:

- It provides financial assistance to enterprises for setting up or the development of tourism- related projects, facilities and services such as hotels, restaurants, holiday resorts, amusement parks, entertainment centres, education and sports, rope ways, cultural centres, convention halls, transport, travel and tour operating agencies, air services, tourism emporia and sports facilities.

- It provides advisory and merchant banking services in this field.

- The projects with a capital cost of? 1 crore or above are generally eligible for assistance from TFCI. Smaller projects would also be considered.

Values:

- Providing employment opportunities

- Cater to the financial needs of the tourism industry.

- To protect national property.

- Awareness of responsibility of citizenship

- Initiative

- Proper utilization of time and resources.

Question 3. Assuming that you wish to start a small scale industry for manufacturing and selling detergent powder, discuss how would you seek support of financial institutions.

Yes, to start with a small scale industries for manufacturing and selling is really a tough job in this competitive world where already many other detergent manufacturing units are there. Detergents are also known as synthetic detergents. They are different from oil-based soap though both soaps and detergents are surfactants. There are a number of varieties of detergents varying in percentages of active matter present in them and also different colours. Manufacturing process is very simple and only mixing is involved. Hence, this product is best suited for manufacturing in small-scale sector.

An entrepreneur can seek support from various financial institutions and others.

- Angle Investors:

- Business angle or an angle investor is an affluent individual who provides capital for a business start-up and early stage companies having a high- risk, high-return matrix usually in exchange for convertible debt or ownership equity.

- Apart from investing funds, most angles provide proactive advice, guidance, industry connections and mentoring start-ups in its early days.

- Venture Capitalist:

- Venture capital is an equity based investment in a growth-oriented small to medium business to enable the investors to accomplish objectives, in return for minority shareholding in the business or the irrevocable right to acquire.

- The private equity capital provided as funding to early-stage, high potential, high risk, growth up companies/entrepreneurs who lack the necessary experience and funds to give shape to their ideas.

- Accordingly, it is more accurate to view and go for venture capital broadly as a professionally managed pool of equity capital.

- Venture capital is a way in which investors support entrepreneurial talent with finance and business skills to exploit market opportunities and obtain long-term capital gains.

State Financial Corporations (SFCs):

- It will be to meet the financial needs of small and medium enterprises, established as development banks for their respective regions. Under the Act, SFCs have been established by state governments to meet the financial requirements of medium and small sized enterprises. There are 18 SFCs at present. According to the location I can easily approach the same.

- Grant of loans and advances to or subscribe to debentures of, industrial concerns repayable within a period not exceeding 20 years.

- Guaranteeing loans raised by industrial concerns which are repayable within a period not exceeding 20 years.

- Guaranteeing deferred payments due from an industrial concern for purchase of capital goods in India.

Question 4. Discuss the advantages and disadvantages of financial institutions for an entrepreneur.

Advantages of financial institutions for an entrepreneur

- Borrowing money from the bank is one of the simplest ways to get needed funds to start or grow your business.

- To grant loans and advances.

- To underwrite or to subscribe to shares or debentures of industrial concerns.

- To guarantee loans raised by industrial concerns in the market.

- To provide consultancy and merchant banking services in or outside India.

- To provide technical, legal, marketing and administrative assistance to any industrial concern or person for promotion, management or expansion of any industry.

- Co-ordination, regulation and supervision of the working of other financial institutions such as IFCI, ICICI.

- To act as trustee for the holders of debentures or other securities.

- To provide long and medium-term credit to industrial concerns engaged in manufacturing, mining, shipping and electricity generation and distribution.

- The bank will serve as a financing institution for institutional credit such as long-term, short-term, and for the promotion of activities in rural areas.

- Provides financial assistance to enterprises for setting up or the development of tourism-related projects.

Disadvantages: Procurement of finance involves risk and formalities to comply:

- State Financial Corporations only provide long and medium-term loan repayment ordinarily within a period not exceeding 20 years.

- Some financial institutions provide financial assistance generally to those industrial concerns whose paid up share capital and free reserves do not exceed Rs 3 crore.

- Rate of interest is too high sometimes not able to pay the debt amount and its interest.

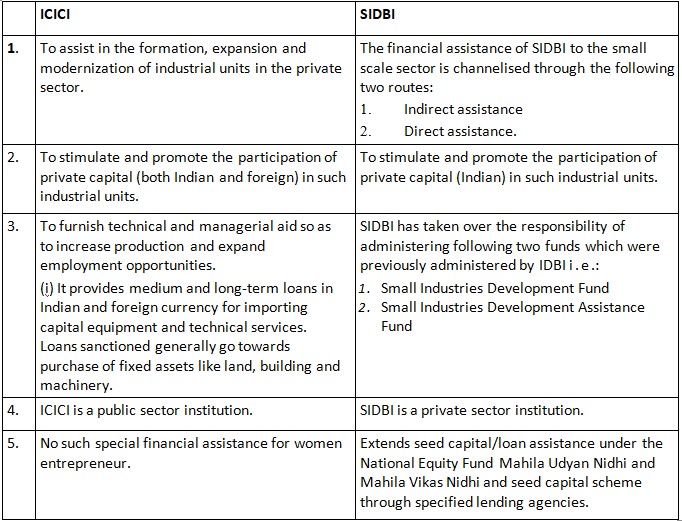

Question 5. Distinguish between ICICI and SIDBI.

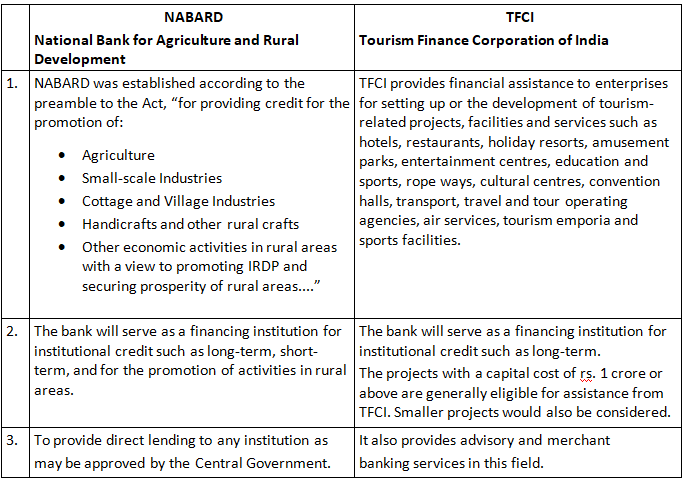

Question 6. How NABARD is different from TFCI?

Question 7. Company A goes for public issue of 10,000 shares @ Rs 10 each. Application were received for only 5,000 shares. Can the company proceed with the process of issuing shares?

In the case of Company A

Issued shares to public — 10,000 Shares @ 10 each.

Applied share public by — 5,000 Shares @ 10 each.

Company receives only 50% of the subscription within 120 days from the date of the issue, then it is called as Minimum subscription.

As per the SEBI guidelines, if the company does not receive 90% of the issue amount from the public subscription including development from underwriters within 120 days from the date of the issue, the amount of subscription received is required to be refunded to the applications. In case of disputed development also, subscription is required to be refunded if 90% of the issued amount plus accepted. Development from underwriters if any is not received within 120 days of the issue of prospectus, all the money received from the applicants for shares is required to be repaid forthwith without interest and if any such money is not so repaid in the next 10 days (after the expiry of 120 days), the directors of the company are jointly and severally liable to repay that money, with interest from the expiry of the 130 days.

The company should refund the amount within 10 weeks of the closing of the subscription list and pay interest, if refunds are delayed by more than 8 days after this period.

|

19 videos|103 docs|12 tests

|