Short Answer Type Question- Business Arithmetic | Entrepreneurship Class 12 - Commerce PDF Download

Unit of Sale, Unit Cost and Break Even Analysis

Question.1: What do you mean by Gross Profit?

Excess of Unit Price over Unit Cost is known as the Unit Gross Profit or Unit Gross Margin. This represents the business profit from selling a product or providing service before deducting fixed expenses such as salaries, rent and other expenses.

Gross Profit = Unit Price – Unit Cost

Question.2: What does Total Cost include ?

Total cost includes variable costs and fixed costs. Variable costs vary directly with the level of output. It includes the expenditure on raw materials, transportation, etc. Fixed costs are not dependent on the level of output. These are period costs. They include interest, rent, salary of permanent workers, etc.

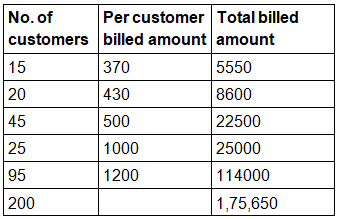

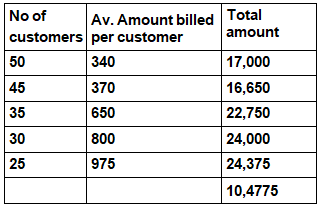

Question.3: Ayush Generic Medicines’, a chemist shop sells generic medicines. On 15.2.2016 medicines as per the details given below were sold:

Calculate the average amount of medicines sold per customer.

Average amount of medicines sold per customer = (per unit of sale / unit price per customer)

175650/200 = 878.25

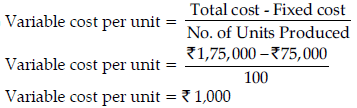

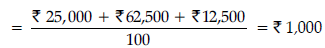

Question.4: A factory is engaged in manufacturing coolers. The following information is available to you:

Sales = ₹ 2,50,000

Direct Labour Cost (for 100 units) = ₹ 25,000

Direct Material Cost (for 100 units) = ₹ 62,500

Direct Expenses (for 100 units) = ₹ 12,500

Fixed cost = ₹ 75,000

Calculate : (i) Variable Cost per unit (ii) T otal Cost (iii) Break-Even

(i)

or

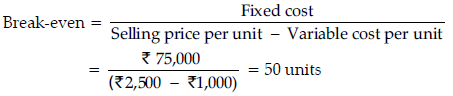

Variable cost per unit = Variable Cost / No. of units produced

(ii) Total Cost = Variable cost + Fixed cost

= (₹ 25,000 + ₹ 62,500 + ₹ 12,500) + ₹ 75,000

= ₹ 1,75,000(iii)

Question.5: What is meant by Break-even point? Why is it important for an entrepreneur to calculate Breakeven point? State any four reasons.

It is the point where in the business in a position of no profit or no loss.

Calculation of BEP is quite useful for the entrepreneur as it helps in assessing:

(a) The minimum level of output to be produced.

(b) The effect of change in quantity of output

upon the profits.

(c) The selling price of the product.

(d) The profitable options in line of production.

Question.6: Is Break-even Analysis useful to achieve the target level of profit?

Yes, Break-even Analysis is useful to achieve target level of profit. Organizations identify those products which yield the highest contribution. Break-even Analysis helps the firm in selecting and ranking those products, based on contribution, to achieve the targeted level of profit.

Question.7: Give the formula of unit price and unit cost.

Unit Price = Total sales / No. of units sold

Unit Cost = Total cost / No. of units

Question.8: What are the assumptions made for calculation of break-even point for sales mix ?

(i) The proportion of sales mix must be predetermined.

(ii) The sales mix must not change within the relevant time period.

(iii) All costs can be categorized as variable or fixed.

(iv) Sales price per unit, variable cost per unit and total fixed cost are constant.

(v) All units produced are sold.

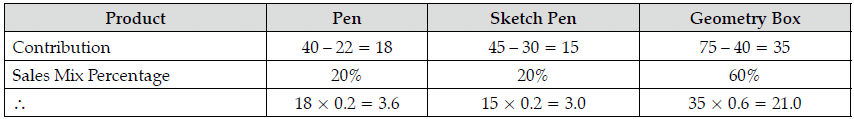

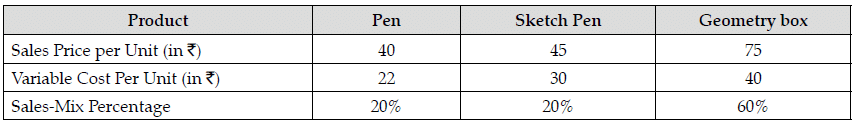

Question.9: Following information is related to Sales-Mix of Pen, Sketch Pen and Geometry Box.

Total Fixed cost is ₹ 90,000

Calculate the Weighted-Average-Contribution per unit for the Sales-Mix.

Contribution = Sales Price Per Unit – Variable Cost Per Unit

∴ Weighted Average Contribution = 3.6 + 3.0 + 21.0 = 27.6

Question.10: Why is it important for an entrepreneur to do break-even analysis?

The calculation of BEP is quite useful for the entrepreneur as it helps in assessing: (Any two)

- The minimum level of output to be produced.

- The effect of change in quantity of output upon the profits.

- The selling price of the product.

- The profitable options in line of production.

- It helps in determining how many units must be sold or how much sales volume must be achieved in order to break–even.

- It helps to indicate the volume of sales needed to cover total variable and fixed expenses by the new enterprise.

Question.11: How does break even analysis help?

It helps in setting profit goals and sales targets. In a manufacturing environment, it helps in determining the products that are not contributing to meet the fixed expenses and thus bring up the item for discussion in management meetings about its continuity.

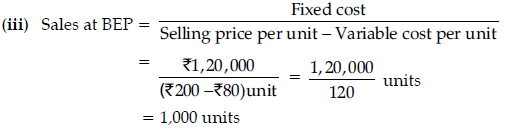

Question.12: A factory is engaged in manufacturing shirts. The following information is available to you:

Sales - ₹ 4,00,000

Direct Labour Cost (2,000 units) - ₹ 40,000

Direct Material Cost (2,000 units) - ₹ 1,00,000

Direct Expenses (2,000 units) - ₹ 20,000

Fixed Cost - ₹ 1,20,000

Find out:

(i) Variable cost per unit (ii) Total cost (iii) Quantity to be sold at Break-Even Point

= ₹ 40,000 + ₹ 1,00,000 + ₹ 20,000 /2,000

= ₹ 1,60,000/ ₹ 2,000

= ₹ 80 per unit

(ii) Total cost = Fixed cost + Variable cost

= ₹ 1,20,000 + ₹ 1,60,000

= ₹ 2,80,000

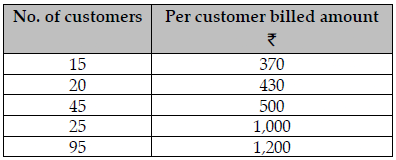

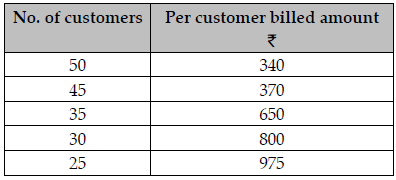

Question.13: ‘H.L. Chemist’ sells medicines at a discount of 5% on list price. On 1.3.2017 medicines as per the details given below were sold by ‘H.L. Chemist’.

Calculate the average amount of medicines sold per customer.

Average amount of medicines sold per customer:

Total Bill Amount

Number of Customers

10,477/185 = 566.35

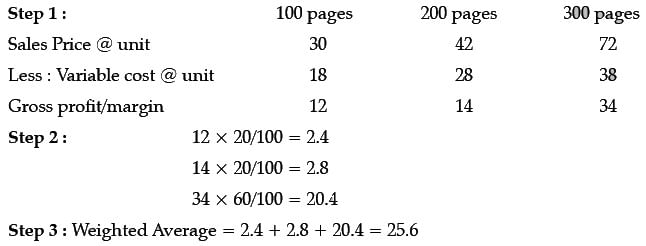

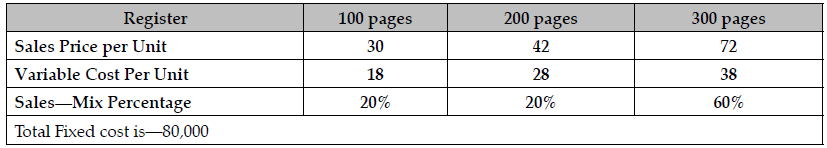

Question.14: Flowing information is related to sales-mix of registers having 100 pages, 200 pages and 300 pages:

Calculate the Weighted-Average-Contribution per unit for the sales-Mix.

Computation of Working Capital

Question.1: What kind of items are included in the working capital ?

Working capital includes salary & wages, cost of raw materials on utilities like water, electricity, fuel, advertising and publicity, transport, commission, rent, taxes, stationery, sales expenses, etc.

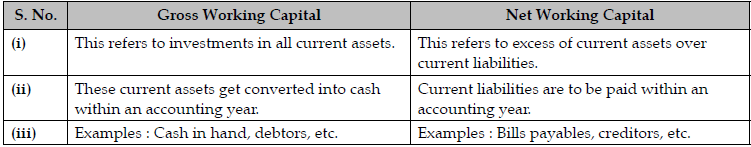

Question.2: Differentiate between Gross working capital and Net working capital.

Question.3: What is operating cycle or cash conversion cycle ?

It is the length of time between a firm’s purchase of inventory and the receipt of cash from accounts receivable.

Question.4: Raja & Co. has the following items in its Balance Sheet:

Stock ₹ 50,000; Trade creditors ₹ 32,000; Debtors ₹ 75,000; Cash ₹ 1,00,000; Dividend Payable ₹50,000; Tax ₹ 44,000; Short term loan ₹ 61,000; Short term investment ₹ 76,000. Calculate gross and net working capital.

Gross working capital = Total current assets

= ₹ 50,000 + ₹ 75,000 + ₹ 1,00,000 + ₹ 76,000 = ₹ 3,01,000

Net working capital = Gross working capital – Current liabilities

= ₹ 3,01,000 – ₹ 32,000 – ₹ 50,000 – ₹ 44,000 – ₹ 61,000

= ₹ 1,14,000

Question.5: What do mean by current liabilities ? Give examples.

Current liabilities represent short-term source of funds which are expected to fall due or would mature for payment in a short period, generally within a year, e.g., trade creditors, outstanding expenses, etc.

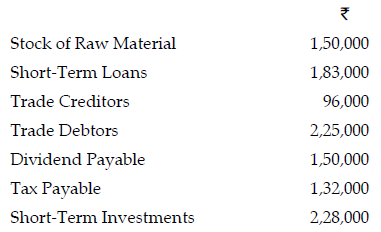

Question.6: 'Janata Foods Ltd.’ is a restaurant situated on a national highway near Hyderabad. The following figures have been extracted from the books of Janata Foods Ltd.:

From the above information, calculate the following:

(a) Gross Working Capital

(b) Net Working Capital

(a) Gross working capital = total current assets

= 1,50,000 + 2,25,000 + 2,28,000

= 6,03,000

(b) Net working capital = Gross working capital – Current liabilities

= 6,03,000 – 1,83,000 – 96,000 – 1,50,000 – 1,32,000

= 42,000

Question.7: 200 brooms are proposed to be produced per week by a firm and for that ₹ 2,000 are needed for raw materials, ₹ 1,000 for wages and other changes. If it takes three weeks to receive the payments on the sales, then calculate working capital.

The money spent during the first week comes only at the end of fourth week.

Working capital is needed for four weeks.

Working capital = (₹ 2,000 + 1,000) × 4 weeks= ₹ 3,000 × 4

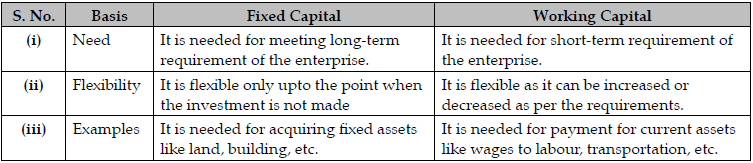

Question.8: Distinguish between Fixed capital and Working capital.

Question.9: Why is working capital called circulating capital?

Working capital is called the “Changing” or “Circulating Capital”, since the money circulates in various forms of current assets in a continued manner. For example, funds once tied up in the form of raw material are later converted into the form of finished goods which are ultimately sold.

Question.10: What are current assets ? Give examples.

Current assets comprise of items that would get converted into cash in the short-run, say within normal operating cycle of the business, e.g., stock, debtors, etc.

Inventory Control, Economic Order Quantity (EOQ), Return on Investment (ROI) and Return on Equity (ROE)

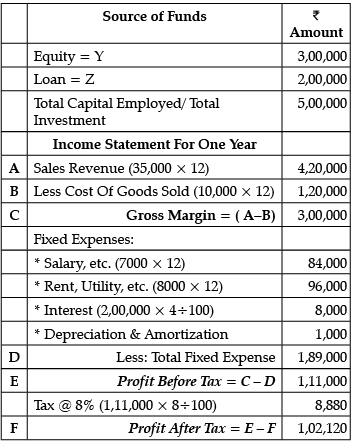

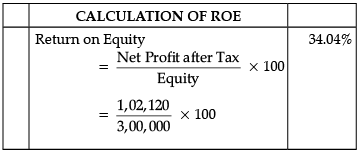

Question.1: You have started a beauty parlour business. You spent ₹5,00,000 to open the parlour of which you invested ₹ 3,00,000/- of your own money and borrowed a loan for ₹2,00,000. Interest rate per annum is 4%. Sales revenue per month is ₹35,000. Cost of goods sold is ₹10,000 per month. Fixed expenses per month is ₹15,000 (salary ₹7,000, rent and utility ₹ 8,000), depreciation ₹ 1,000/- and tax @ 8%. Calculate the Return on Equity.

Question.2: Explain the various categories of inventory used in business.

The three categories of inventory are as follows:

- Raw Material: Those materials which have been purchased and stored in warehouses at a particular time for future production.

- Work-in-Progress: They are the good in the course of manufacture. It consists of material, labour and factory expenses applied to the unit up to the last stage. In these the goods are in semi-finished stage.

- Finished Goods: These are the goods reached at the final stage of production process. These goods are ready for sale.

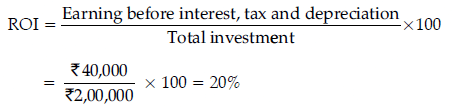

Question.3: If B spends ₹2,00,000 to open a shop and earns a net profit of ₹40,000 in one year, calculate the annual return on investment.

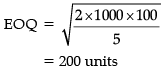

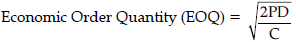

Question.4: Pink & Blue Stores sells 1000 insulated water bottles annually. Demand for the product is uniform. Purchase Cost per bottle is ₹50. Holding cost per annum is 10% of purchase cost. Ordering cost is ₹100 per order.

Calculate the Economic Ordering Quantity for bottles?

Thus as : Annual demand (D) = 1,000 bottles

Order cost (P) = ₹ 100

Annual carrying cost of 1 unit (C/i)

= 10% × 50 = ₹ 5

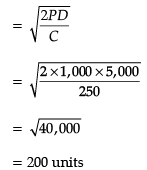

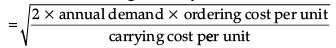

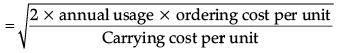

Question.5: ‘The Shop’ a readymade garments retail shop sold 5,000 shirts at ₹200 per shirt during the year ended 31st March, 2014. Cost of placing an order and receiving goods is ₹1,000 per order. Inventory holding cost is ₹250 per year. Calculate the ‘Economic Ordering Quantity’ for ‘The Shop’.

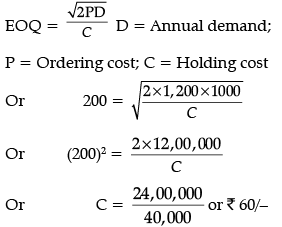

Economic Ordering Quantity formula

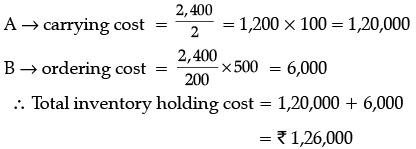

Question.6: pankaj an entrepreneur started a new website ‘SAVO ELECTRICITY’ to sell LED bulbs. In the first year, he sold 2400 bulbs at the rate of ₹100 each. his cost of placing an order and receiving the bulbs is ₹500 per order. If the Economic Order Quantity is 200 bulbs, find out the inventory holding cost per year.

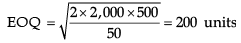

Question.7: Green Smiles Ltd. sells eco-friendly distemper paint pigment in many color options. they sell 2,000 units at the rate of ₹100 per unit per month. It spends ₹500 for placing one order and the cost of holding the stock is ₹50. Calculate Economic Ordering Quantity for Green Smiles Ltd.

Economic Ordering Quantity

Thus as: annual demand (D) = 2,000 kgs

Order cost (P) =₹500

Annual carrying cost of 1 unit (C/i) = 50

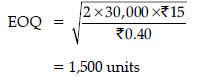

Question.8: A stationery shop sells 30,000 pens per year. Purchase cost in ₹2 per pen, holding cost is 20% of the purchase cost, ordering cost is ₹15. Calculate EOQ from the details for the stationery shop.

Where : D = Annual demand

PC = Ordering cost per unit

C = Carrying cost per unit

Question.9: Give any two advantages of Inventory Control.

The advantages of inventory control are as under:

(i) It ensures adequate supply of materials, stores, spares, etc. There is no shortage of any item at any stage of production.

(ii) It reduces investment in inventories, inventory carrying costs and losses due to

obsolescence.

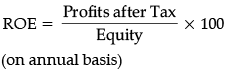

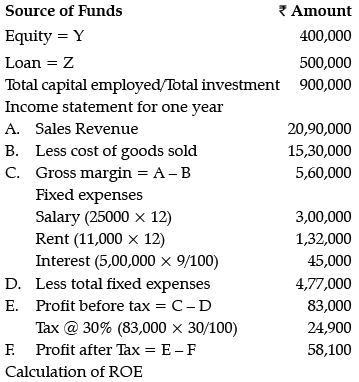

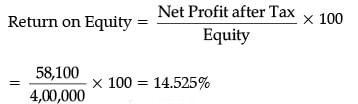

Question.10: Harsha started her herbal beauty products shop in Chandigarh with a capital of ₹9,00,000. She took a loan of ₹ 5,00,000 from the State Bank of India at 9% p.a. interest. During the year ended 31st March, 2016 her sales were ₹ 20,90,000 and the cost of goods sold was ₹15,30,000. She paid monthly rent of the shop ₹ 11,000 and a monthly salary of ₹ 25,000 to the employees. The tax rate is 30%. Calculate the Return on Equity.

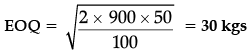

Question.11: Aditya bearings Ltd. are the manufacturers and suppliers of ball bearings to fan manufacturing companies. the company requires 900 kg of wrought iron for its production process. the cost of placing each order is ₹50 and carrying cost is ₹100. Calculate Economic Order Quantity.

Economic Ordering Quantity = EOQ

Annual demand(D)= 900 kgs

Order cost(P) = ₹ 50

Annual carrying cost of 1 unit(C) = ₹100

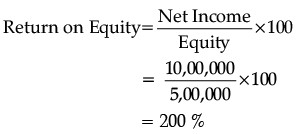

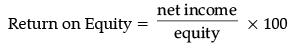

Question.12: From the following information obtained from the financial statements of Bites Ltd., calculate Return on Equity.

Net Income earned: ₹ 10,00,000

Equity: ₹ 5,00,000

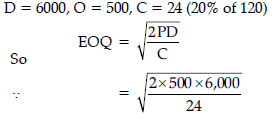

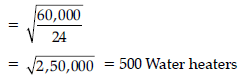

Question.13: An electronic shop sells 6,000 water heaters per year. The demand is uniform throughout the year. Purchase cost per water heater is ₹120. Holding cost per annum is 20% of purchase cost. Ordering cost is ₹500 per order. Calculate ‘Economic-Order- Quantity’.

This divided by = 24 = 2,50,000

Square root of which is = 500

So the EOQ is 500 water heaters.

Question.14: ‘The Fancy Store’ a readymade garments retail shop sold 8,000 shirts at ₹400 per shirt during the year ended 31st March, 2014. Cost of placing an order and receiving goods is ₹2,000 per order. Inventory holding cost is ₹500 per year. Calculate the ‘Economic Ordering Quantity’ for ` The Fancy Store’.

Economic Ordering Quantity Formula

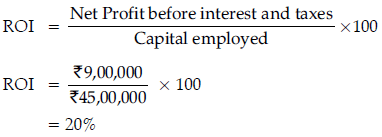

Question.15: Calculate ROI from the following information:

Net profit before interest and taxes = ₹ 9,00,000

Capital employed = ₹ 45,00,000

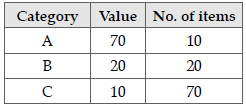

Question.16: From the following information, calculate ‘Return on Equity’.

Capital - ₹ 6,00,000

10% Loan ₹ 2,00,000

Net profit before interest ₹ 1,40,000, Also, state what is this return on rupees per lakh of equity.

Given Capital = ₹ 6,00,000Loan @ 10% = ₹2,00,000

Net profit before interest = ₹ 1,40,000

Interest = ₹ 20,000

So,i.e. for every rupee of own money invested the owner made 30 paisa or 0.30 Rupee.

Rupees per lakh of equity = 0.30 × 1,00,000

= ₹ 30,000

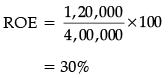

Question.17: What is ABC analysis ?

A firm maintains several types of inventories. The firm adopts a selective approach which is called ABC analysis. In this, the firm classifies all items according to values so that the most valuable items may be paid highly. More attention is given regarding their safety and care as compared to other items. It has been observed that out of the long list of inventory, ‘A’ category list is small in number say 5 to 10 per cent of the total number of items but they are quite valuable of total value. The value being 70-75 per cent of the total value of stocks.

‘B’ category is in between A and C categories having 15 to 20 per cent of the number of items and 15 to 20% of the total value. ‘C’ category items comprise of 70-75% in number but carrying little value ranging from 5-10 percent. We can see following categorization:

The above three categories vary from product to product and organization to organization. Great care and control is to be exercised on items of ‘A’ list, as any loss or breakage or wastage of any item of this list may prove to be very costly. Proper care is to be taken on ‘B’ list items and comparatively less control is needed for ‘C’ list items.

ABC analysis indicates the following:

- About the items to be stocked in more quantities.

- The working capital needed for sustaining an enterprise.

- The relative importance of the various items needed by an enterprise.

Question.18: Jalaji an entrepreneur started a new website ‘Fashionate Shirts’ to sell readymade shirts. In the first year he sold 1200 shirts at the rate of 500 each. His cost of placing an order and receiving the shirts is 1,000 per order. If the Economic order Quantity is 200 shirts, find out the inventory holding cost per year.

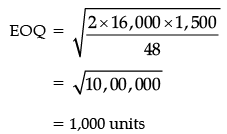

Question.19: Paramveer Singh runs an online business for gym equipments. The annual demand for the Waist Flexers sold by him is 16,000 units. The annual holding cost of Waist Flexers per unit is ₹48 and the cost of placing an order is ₹1,500. Calculate the economic order quantity of Waist Flexers.

Formula:

Thus as : annual demand = ₹16,000

order cost = ₹1,500

annual carrying cost of 1 unit = ₹48

Question.20: A company uses 30 units of an item per day and the order lead time is 5 days. What is the re-order point?

Reorder point = Usage rate × Lead time

Reorder point = 30 × 15 = 450 units

Question.21: Explain any three factors that influence the decisions with regard to order of inventory.

The entrepreneur should keep in mind the following factors while calculating the inventory level:

(i) Order Lead Time: It refers to average time between order placement and receiving of goods. If order lead time is big then large inventory is maintained.

(ii) Usage Rate: It refers to how frequently the material is withdrawn from stores over a period of time. If usage rate is more, then also, inventory should be maintained in large

quantity.

(iii) Reorder Point: It is the time when new order must be placed so that the inventory level is maintained and stock level does not reach to zero.

Reorder Point = Usage Rate × Lead Time

For example, a company uses 10 times per day (usage rate) and order lead time is 7 days, then the new order must be placed when inventory level becomes 70 i.e. 10 × 7

Reorder Point = Usage Rate × lead time

= 10 × 7 = 70

|

23 videos|101 docs|12 tests

|

FAQs on Short Answer Type Question- Business Arithmetic - Entrepreneurship Class 12 - Commerce

| 1. What is the unit of sale and why is it important in business arithmetic? |  |

| 2. How is unit cost calculated and why is it significant for businesses? |  |

| 3. What is break-even analysis and how does it help businesses? |  |

| 4. How is working capital computed and why is it important for businesses? |  |

| 5. What is economic order quantity (EOQ) and why is it crucial for inventory control? |  |