Class 12 Accountancy: CBSE Sample Question Papers- Term II (2021-22)- 4 | Sample Papers for Class 12 Commerce PDF Download

Class-XII

Time: 120 Minutes

Max. Marks: 40

General instructions:

Read the following instructions very carefully and strictly follow them:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. All questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e. (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one of the given options.

- Question nos. 1 to 3 and 10 are short answer type–I questions carrying 2 marks each.

- Question nos. 4 to 6 and 11 are short answer type–II questions carrying 3 marks each.

- Question nos. 7 to 9 and 12 are long answer type questions carrying 5 marks each.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

Part- A

The difference between Income and Expenditure Account and Profit and Loss Account are:

Q.2. Explain any two ways in which the accounts can be settled by partners during the dissolution of the firm.

Section 48 of the Indian Partnership Act, 1932, provides the following rules for the settlement of accounts between the partners:

(i) Payment of Losses: Losses shall be paid first out of profits, next out of capital and at last, if necessary, by the partners individually in their profit sharing ratio.

(ii) Distribution of Assets: Assets of the firm are first to be applied in paying the debts of the firm to the third parties; next in paying to each partner rateably what is due to him from the firm for advances as distinguished from capital; next in paying to each partner rateably what is due to him on account of capital, and the residue to be divided among the partners in the proportion in which they were entitled to share profits.

(iii) Realisation Account: Realisation Account is opened on dissolution of firm to close down the books of accounts of the firm. This account is a nominal account. The purpose of this account is to show the profit or loss on realisation of assets and payment of liabilities.

Q.3. Give reason for the following:

(i) Nisha, Okra and Piya are partners. Nisha retires and her capital account after making adjustments for reserves and profit on revaluation exists at ₹ 90,000. Okra and Piya have agreed to pay her ₹1,30,000 in full settlement of his claim. It implies that ₹ 40,000 (₹ 1,40,000 – ₹ 90,000) is Nisha’s share of goodwill of the firm. This will be treated by debiting ₹ 40,000 in Okra’s and Piya’s Capital Accounts in their gaining ratio and crediting Nisha’s Capital A/c

(ii) When a partner retires, all the unrecorded assets and liabilities, the increase or decrease in the value of assets and liabilities are adjusted through the revaluation account.

(i) In case of hidden goodwill, the amount in excess of the capital paid by the remaining partners to the retiring or deceased partner is treated as his share of goodwill.

(ii) The Revaluation Account is used to adjust the unrecorded assets and liabilities, the increase and decrease in the value of assets and liabilities, to bring the items into firm’s books and transfer the same to the capital account of all partners in the old profit sharing ratio.

Q.4. Calculate the amount of subscription to be credited to Income and Expenditure Account for the year 2019-20:

Out of subscription in arrears on 01-04-2019, ₹ 15,000 are no longer recoverable.

Subscriptions received during the year ended 31st March, 2017 are:

There are 450 members, each paying an annual subscription of ₹ 500. ₹ 4,500 were in arrears for the year ended 31st March, 2016 in the beginning of the year ended 31st March, 2017. Calculate subscriptions to be shown in Income and Expenditure Account for the year ended 31st March, 2017 and also show treatment of subscriptions in the Income and Expenditure Account and Balance sheet.

ORSubscriptions Receivable for the year ended 31st March, 2017 = Number of Members × Annual Subscription

= 450 × ₹ 500 = ₹ 2,25,000

Subscriptions Outstanding = Total Subscriptions receivable – Subscriptions received for the year ended 31st March, 2017

= ₹ 2,25,000 – ₹ 2,11,000 = ₹ 14,000

*Subscriptions in arrears for the year ended 31st March, 2016 in the beginning of 2016–17 was ` 4,500, out of which ₹ 4,000 were received in the year ended 31st March, 2017.

Q.5. Ankit, Bobby and Kartik were partners in a firm sharing profits in the ratio 4 : 3 : 3. The firm was dissolved on 31-3-2018. Pass the necessary journal entries for the following transactions after various assets (other than cash and bank) and third party liabilities had been transferred to Realisation Account:

(i) The firm had stock of ₹ 80,000. Ankit took over 50% of the stock at a discount of 20% while the remaining stock was sold off at a profit of 30% on cost.

(ii) A liability under a suit for damages included in creditors was settled at ₹ 32,000 as against only ₹ 13,000 provided in the books. Total creditors of the firm were ₹ 50,000.

(iii) Bobby ’s sister ’s loan of ₹ 20,000 was paid off along with interest of ₹ 2,000.

(iv) Kartik’s loan of ₹ 12,000 was settled at ₹ 12,500.

(i) X, Y and Z are partners sharing profits in the ratio of 4 : 3 : 2 respectively. Y retired and surrendered 1/9th of his share of profit to X and remaining in favour of Z. Calculate the new profit sharing ratio of X and Z.

(ii) Amar, Vineet and Kamal are partners sharing profits in the ratio of 1/2, 3/10 and 1/5 respectively. Vineet retired from the firm and Amar and Kamal decided to share future profits in 3 : 2 ratio. Calculate gaining ratio of Amar and Kamal.

OR(i) New Share = Old Profit Share + Gaining Share

X =

Z =

New Profit Sharing ratio of X and Z = 13 : 14

(ii) Gaining Ratio = New Profit Share – Old Profit Share

Amar =

Kamal =

Gaining Ratio of Amar and Kamal = 1 : 2

Q.6. BGP Ltd. invited applications for issuing 15,000, 11% debentures of ₹ 100 each at premium of ₹ 50 per debenture. The full amount was payable on application. Applications were received for 25,000 debentures. Applications for 5,000 debentures were rejected and the application money was refunded. Debentures were allotted to the remaining applications on pro-rata basis.

Pass the necessary journal entries for the above transactions in the books of BGP Ltd.

Q.7. How will the following items be treated while preparing the Income and Expenditure Account and Balance Sheet of a Not-for-profit Organization for the year ended 31st March, 2019?

During 2018-19, the payment made to creditors for sports material was ₹ 5,23,000.

Alternatively:

Credit Purchases = Payment made to Creditors + Closing Creditors – Opening Creditors

= ₹ 5,23,000 + ₹ 41,000 – ₹18,000

= ₹ 5,46,000

Sports Materials consumed = Opening Stock of Sports Materials + Purchases – Closing Stock of Sports materials

=₹ 27,000 + ₹ 5,46,000 – ₹ 38,000 = ₹ 5,35,000

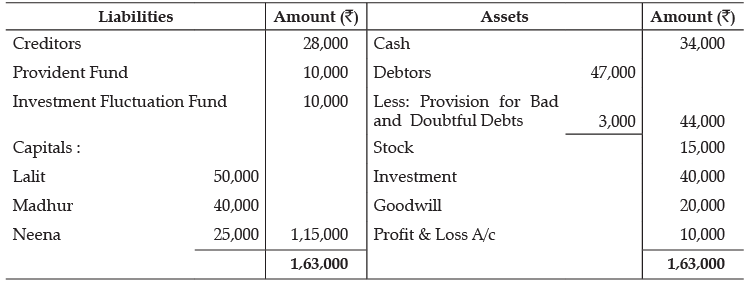

Q.8. Lalit, Madhur and Neena were partners sharing profits as 50%, 30% and 20% respectively. On March 31, 2013, their Balance Sheet was as follows:

On this date, Madhur retired and Lalit and Neena agreed to continue on the following terms:

(i) The Goodwill of the firm was valued at ₹ 51,000.

(ii) There was a claim for Workmen’s Compensation to the extent of ₹ 6,000.

(iii) Investments were brought down by ₹ 15,000.

(iv) Provision for Bad Debts was reduced by ₹ 1,000.

(v) Madhur was paid ₹ 10,300 in cash and the balance was transferred to his loan account payable in two equal installments together with interest @ 12% p.a.

Prepare Revaluation Account, Partners’ Capital Accounts and Madhur’s Loan Account till the loan is finally paid off.

Working Notes: Calculation of interest on loan:

Interest for first year: 30,000 x 12/100 = 3,600.

Interest for second year: 15,000 x 12/100 = 1,800.

Q.9. On 1-4-2015, K.K. Ltd. issued 500, 9% Debentures of ₹ 500 each at a discount of 4%, redeemable at a premium of 5% after three years. Pass the necessary Journal Entries for the issue of debentures and debenture interest for the year ended 31-3-2016 assuming that interest is payable on 30th September and 31st March. The company closes its books on 31st March every year.

Fill in the blanks in the following cases:

OR

Part- B

Q.10. Where will the following items be recorded in a cash flow statement?

(i) Sale of Furniture

(ii) Depreciation on Machinery

(i) Sale of furniture will be recorded as a cash flow from investing activities.

(ii) Depreciation on machinery will be added to the net profit to calculate the cash flow from operations before working capital changes.

Q.11. From the following Balance Sheets of Vinayak Ltd. as at 31st March, 2019, prepare a Comparative Balance Sheet:

From the following data, prepare a common size statement of the profit and loss of Pitambar Ltd.

OR

Q.12. Prepare Cash Flow Statement on the basis of the information given in the Balance Sheets of Relga Ltd. as at 31st March, 2019 and 31st March, 2020:

Notes to Accounts:

Additional Information:

(i) During the year, a piece of machinery with a book value of ₹30,000; provision for depreciation on it ₹10,000 was sold at a loss of 50% on book value.

(ii) Debentures were redeemed on 31st March, 2020.

|

130 docs|5 tests

|

|

Explore Courses for Commerce exam

|

|