Economic Development: March 2022 Current Affairs | Indian Economy for State PSC Exams - BPSC (Bihar) PDF Download

UPI123Pay and Digisaathi

Why in News

The Reserve Bank of India (RBI) has launched new UPI services for feature phones called UPI123Pay for non internet users to make digital payments, also launched a 24x7 helpline for digital payments called ‘Digisaathi’.

- ‘Digisaathi’ has also been set up by the National Payments Corporation of India (NPCI) to provide users with automated responses on information related to digital payment products and services. Presently it is available in English and Hindi language.

What is Unified Payments Interface (UPI)?

- It is an advanced version of Immediate Payment Service (IMPS)- round–the-clock funds transfer service to make cashless payments faster, easier and smoother.

- UPI is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- UPI is currently the biggest among the National Payments Corporation of India (NPCI) operated systems including National Automated Clearing House (NACH), Immediate Payment Service (IMPS), Aadhaar enabled Payment System (AePS), Bharat Bill Payment System (BBPS), RuPay etc.

- The top UPI apps today include PhonePe, Paytm, Google Pay, Amazon Pay and BHIM, the latter being the Government offering.

What is UPI 123 Pay?

1. About

- It will work on simple phones that do not have an internet connection.

- As of now, the UPI features are mostly available only on smartphones.

- The UPI service for feature phones will leverage the RBI’s regulatory Sandbox on Retail Payments.

- A regulatory sandbox usually refers to live testing of new products or services in a controlled/test regulatory environment for which regulators may permit certain regulatory relaxations for the limited purpose of the testing.

- The UPI service will enable digital transactions through a mechanism of ‘on-device’ wallet in UPI applications.”

- The users will be able to undertake a host of transactions based on four technology alternatives including- IVR (interactive voice response) number, missed call-based approach, app functionality in feature phones and proximity sound-based payments.

2. Benefits

- The new service for feature phones will enable individuals to make direct payments to others without smartphones and internet.

- Users can initiate payments to friends and family, pay utility bills, recharge the FAST Tags of their vehicles, pay mobile bills and also allow users to check account balances.

- It will allow customers to use feature phones for almost all transactions except scan and pay.

- UPI123Pay will benefit an estimated 40 crore feature phone users and enable them to undertake digital payments in a secure manner. This will bring non-smartphone users under the digital payment system.

National Land Monetization Corporation

Recently, the Union Cabinet has approved the setting up National Land Monetization orporation (NLMC) as a wholly owned Government of India company.

- The Finance Minister had announced plans to set up a special purpose vehicle for this purpose in the Union Budget 2021-22.

- In August, 2021, the government of India launched the National Monetisation Pipeline (NMP).

What is National Land Monetization Corporation (NLMC)?

1. About

- NLMC will undertake surplus land asset monetisation as an agency function, and assist and provide technical advice to the Centre in this regard.

- NLMC has been announced with an initial authorized share capital of Rs 5000 crore and paid-up share capital of Rs 150 crore.

- The Board of Directors of NLMC will comprise senior Central Government officers and eminent experts to enable professional operations and management of the company.

- The Chairman, non-Government Directors of the NLMC will be appointed through a meritbased selection process. The new company, which will be set up under the administrative jurisdiction of the finance ministry.

- NLMC will hire professionals from the private sector just as in the case of similar specialised

government companies like theNational Investment and Infrastructure Fund (NIIF) and Invest India.

2. Benefits

- This will enable productive utilization of underutilized assets to trigger private sector investments, new economic activities, boost local economy and generate financial resources for economic and social infrastructure.

- NLMC is also expected to own, hold, manage and monetize surplus land and building assets of CPSEs under closure and the surplus non-core land assets of Government owned CPSEs under strategic disinvestment.

- This will speed up the closure process of CPSEs and smoothen the strategic disinvestment process of Government owned CPSEs.

3. Challenges

Among the key challenges that NLMC might face include lack of identifiable revenue streams in particular land assets, dispute resolution mechanism, various litigations and lack of clear titles, and low interest among investors in remote land parcels.

What will be the Function of the NLMC?

- NLMC will undertake monetization of surplus land and building assets of Central Public Sector Enterprises (CPSEs) and other Government agencies. CPSEs are those companies in which the direct holding of the Central Government or other CPSEs is 51% or more.

- At present, CPSEs hold considerable surplus, unused and under-used non-core assets in the nature of land and buildings.

- NLMC will also advise and support other Government entities (including CPSEs) in identifying their surplus non-core assets and monetizing them in a professional and efficient manner to generate maximum value realization.

- NLMC will act as a repository of best practices in land monetization, assist and provide technical advice to the Government in implementation of asset monetization programmes.

What is Asset Monetisation?

1. About

It is the process of creating new sources of revenue for the government and its entities by unlocking the economic value of unutilised or underutilised public assets.

2. Need

- India needs more infrastructure but the public sector simply doesn’t have the resources to build it. There are two possible responses.

- For setting new infrastructure, one can think of bringing in the private sector with a contractual framework for what it has to do, and then let it bring its own resources.

- To recognise that there are more risks in the construction stage and it is perhaps better to let the public sector build the asset and then sell it off to private players or if not an outright sale, let the private sector manage it.

- Building new infrastructure has two constraints for any country including India –

(i) Access to patient, predictable and cheap capital and

(ii) Execution capability, where government and private agencies can take up multiple marquee projects simultaneously.

3. Related Challenges

- Lack of identifiable revenue streams in various assets.

- Slow pace of privatisation in government companies.

- Further, less-than-encouraging bids in the recently launched Public-private partnerships (PPP) initiative in trains indicate that attracting private investors’ interest is not that easy.

- Asset-specific Challenges:

(i) Low Level of capacity utilisation in gas and petroleum pipeline networks.

(ii) Regulated tariffs in power sector assets.

(iii) Low interest among investors in national highways below four lanes.

Way Forward

- The success of the infrastructure expansion plan would depend on other stakeholders playing their due role. These include State governments and their Public Sector Enterprises and the private sector.

- In this context, the Fifteenth Finance Commission has recommended the setting up of a High-Powered Intergovernmental Group to re-examine the fiscal responsibility legislation of the Centre and States.

- Maintaining transparency is the key to adequate realisation of the asset value.

- Recent experience suggests that Public-Private Partnerships (PPP) now involve transparent auctions, a clear understanding of the risks and payoffs, and an open field for any and all interested parties.

Thus, the utility of PPP in greenfield projects can not be neglected.

Indians to Trade in Select US Stocks

Why in News?

Recently, investors in India have been allowed to trade in select US stocks through the NSE International Exchange (NSE IFSC).

- Currently, Indian investors buy US stocks through designated online brokers who have permission from Indian and US regulators to offer such services.

What does this Mean?

- This means domestic investors can purchase US stocks like Amazon, Alphabet, Tesla, etc.

- A stock (also known as equity) is a security that represents the ownership of a fraction of a corporation.

- However, the offering will be in the form of unsponsored depository receipts. For example, one share of Tesla will be equivalent to 100 NSE IFSC receipts.

- The International Financial Services Authority (IFSCA) has already given the approval for the plan.

What is this Exchange?

- NSE IFSC (NSE International Exchange) incorporated on 29th November 2016, is a fully-owned subsidiary of National Stock Exchange of India Limited (NSE)

- Stock exchanges operating in the Gujarat International Finance Tech City (GIFT) city are permitted to offer trading in securities in any currency other than the Indian rupee.

- Accordingly, NSE IFSC which launched trading on 5th June 2017, offers USD denominated trading in various products.

- NSE IFSC offers trading in various products including index derivatives, stock derivatives, currency derivatives, commodity derivatives and debt securities.

What is an NSE IFSC Receipt?

- It is a negotiable financial instrument in the nature of an unsponsored ‘depository receipt’, which means it is a derivative product and investors can directly trade in the stocks without having to do so through registered online brokers.

- Just like shares are purchased domestically, shares can be bought in the US and issue receipts against them, which will be known as NSE IFSC Receipts.

What is the Advantage?

- The business model offered by NSE IFSC will not only provide an additional investment opportunity to the Indian investors but also make the entire process of investment easy and keep it at a low cost.

- When compared to the underlying shares traded in US marketplaces, investors will be able to trade in fractional quantity value.

- Investors will be able to hold the depository receipts in their own GIFT City demat accounts and will be eligible for corporate action benefits on the underlying stock.

- A Demat Account or Dematerialised Account provides the facility of holding shares and securities in an electronic format.

- Corporate actions are benefits given by a company to its investors. These may be either monetary benefits like dividend, interest or non-monetary benefits like bonus, rights, etc.

Who can invest?

- Person resident outside India, Non-resident Indians and Individual resident in India who is eligible under FEMA (Foreign Exchane Management Act) to invest funds offshore, to the extent allowed in the Liberalized Remittance Scheme of Reserve Bank of India.

- The main objective for which FEMA was introduced in India was to facilitate external trade and payments

- Under the LRS framework, the RBI permits the resident individuals to remit up to USD2,50,000 per financial year for any permitted current or capital account transaction.

- However, US and Canadian residents are not allowed to invest through this instrument.

What are the Potential Risks for an Investor?

- Investing in NSE IFSC Receipts carries risks. Some of the significant risks are as follows:

General price and volatility risk, Risk of illiquidity, Underlying Share risk, Risk of Cancellation and Termination of the NSE IFSC Receipt, Tax risks, Other risks such as force majeure, changes in law, settlement, trading, etc.

First Gati Shakti Cargo Terminal

Why in News

Indian Railways’ first Gati Shakti Cargo Terminal commissioned in Asansol Division in pursuance of the Prime Minister’s vision “Gati Shakti”.

- This is the first such GCT commissioned in Indian Railways since the publication of GCT policy in December 2021

- It is expected to enhance Indian Railways’ earnings. The commissioning of this terminal and more such terminals will have a very positive impact on the economy of the nation.

What is the PM Gati Shakti Scheme?

1. About

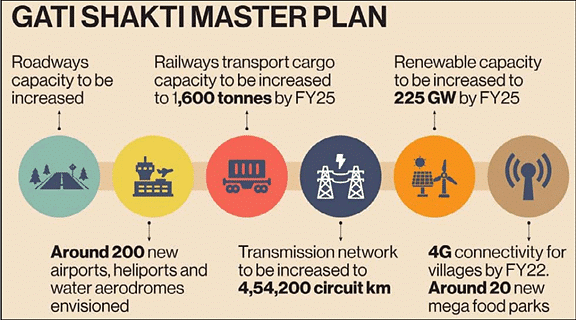

In 2021 the government launched the ambitious Gati Shakti scheme or National Master Plan for multi-modal connectivity plan, with the aim of coordinated planning and execution of infrastructure projects to bring down logistics costs.

2. Aim

- To ensure integrated planning and implementation of infrastructure projects in the next four years, with focus on expediting works on the ground, saving costs and creating jobs. The Gati Shakti scheme will subsume the Rs 110 lakh crore National Infrastructure Pipeline that was launched in 2019. Besides cutting logistics costs, the scheme is also aimed at increasing cargo handling capacity and reducing the turnaround time at ports to boost trade.

- It also aims to have 11 industrial corridors and two new defence corridors - one in Tamil Nadu and other in Uttar Pradesh. Extending 4G connectivity to all villages is another aim. Adding 17,000 kms to the gas pipeline network is being planned.

- It will help in fulfilling the ambitious targets set by the government for 2024-25, including expanding the length of the national highway network to 2 lakh kms, creation of more than 200 new airports, heliports and water aerodromes.

3. Expected Outcomes

- The scheme will help mapping the existing and proposed connectivity projects. Also, there will be immense clarity on how different regions and industrial hubs in the country are linked, particularly for last mile connectivity.

- A holistic and integrated transport connectivity strategy will greatly support Make in India and integrate different modes of transport. It will help India become the business capital of

the world.

Need for Integrated Infrastructure Development:

There exists a wide gap between macro planning and micro implementation due to the lack of coordination and advanced information sharing as departments think and work in silos.

According to a study, the logistical cost in India is about 13% of GDP, which is higher than developed countries.Due to this high logistical cost, the competitiveness of India’s exports is greatly reduced.

It is globally accepted that the creation of quality infrastructure for Sustainable Development is a proven way, which gives rise to many economic activities and creates employment on a large scale. The scheme is in synergy with the National Monetisation Pipeline (NMP).The NMP has been announced to provide a clear framework for monetisation and give

potential investors a ready list of assets to generate investment interest.

What are the Challenges?

- Low Credit Off-take: Although the government had taken up ‘strong’ banking sector reforms and the Insolvency and Bankruptcy Code had yielded about Rs. 2.4 lakh crore of recoveries on bad loans, there are concerns about declining credit offtake trends. Banks give credit off-takes to help businesses acquire financing for future projects through the promise of future income and proof of an existing market.

- Lack of Demand: In the post-Covid-19 scenario,there is a lack of private demand and investment demand.

- Structural Problems: Due to land acquisition delays and litigation issues, the rate of implementation of projects is very slow on global standards. Getting approvals is very difficult in terms of land access, environmental clearances; also impending litigation in court delays the infrastructure projects.

RBI’s Regulatory Framework for Microfinance Loans

Why in News?

Recently, the Reserve Bank of India (RBI) allowed Microfinance Institutions(MFI)the freedom to set interest rates they charge borrowers, with a caveat that the rates should not be usurious.

- The guidelines will take effect 1st April 2022.

- Earlier in 2021, the RBI proposed to lift the interest rate cap on MFI.

What are the Highlights of the Guidelines?

- Definition of a Microfinance Loan: The RBI revised the definition of a microfinance loan to indicate a collateral-free loan given to a household having annual income of up to Rs. 3 lakh.

- Earlier, the upper limits were Rs.1.2 lakh for rural borrowers and Rs.2 lakh for urban borrowers.

- For Regulated Entities (REs): As per the revised norms, Regulated Entities (REs) should put in place a board-approved policy regarding pricing of microfinance loans, a ceiling on interest rate and all other charges applicable to microfinance loans.

- Each RE shall disclose pricing-related information to a prospective borrower in a standardised, simplified factsheet.

- Penalty on Microfinance Loans: There shall be no prepayment penalty on microfinance loans. Penalty, if any, for delayed payment shall be applied on the overdue amount and not on the entire loan amount.

- Any change in interest rate or any other charge shall be informed to the borrower well in advance and these changes shall be effective only prospectively.

- Recovery of Loans: RE would have to put in place a mechanism for identification of the borrowers facing repaymentrelated difficulties, engagement with such borrowers and providing them necessary guidance about the recourse available.

- To ensure due notice and appropriate authorisation, the RE will provide the details of recovery agents to the borrower while initiating the process of recovery.

What will be the Applicability of the Guidelines?

- All Commercial Banks (including Small Finance Banks, Local Area Banks, and Regional Rural Banks) excluding Payments Banks.

- All Primary (Urban) Co-operative Banks/ State Cooperative Banks/ District Central Co-operative Banks.

- All Non-Banking Financial Companies (including Microfinance Institutions and Housing Finance Companies).

What will be the Benefits?

- Expand Market Opportunity: The revision of the income cap to Rs. 3 lakh will expand the market opportunity and interest rate cap removal will promote risk-based underwriting.

- Encourage Healthy Competition: It will go a long way in harmonising the regulatory framework for different types of lenders, encouraging healthy competition and enabling customers to make an informed choice regarding their credit needs.

- Financial Inclusion: The new framework will help scale the industry further, ensure better risk mitigation and financial inclusion.

- Level Playing Field: It will create a level playing field and both borrowers and lenders will now have options.

- Cater the Needy: It will safeguard the interests of the borrowers and help the sector to cater to the needy borrowers.

What is a Microfinance Institution?

- MFI is an organisation that offers financial services to low income populations. These services include microloans, microsavings and microinsurance.

- MFIs are financial companies that provide small loans to people who do not have any access to banking facilities.

- In most cases the so-called interest rates are lower than those charged by normal banks, certain rivals of this concept accuse microfinance entities of creating gain by manipulating the poor people’s money.

- Microfinance sector has grown rapidly over the past few decades and currently it is serving around 102 million accounts (including banks and small finance banks) of the poor population of India.

- Different types of financial services providers for poor people have emerged - Non-Government Organisations (NGOs); cooperatives; communitybased development institutions like self-help groups and credit unions; commercial and state banks; insurance and credit card companies; telecommunications and wire services; post offices; and other points of sale - offering new possibilities.

- NBFC-MFIs in India are regulated by the Non-Banking Financial Company -Micro Finance Institutions (Reserve Bank) Directions, 2011 of the Reserve Bank of India (RBI).

Strengthening of Pharmaceutical Industry Scheme

Why in News?

Recently, the Ministry of Chemicals and Fertilisers has released the guidelines for the scheme “Strengthening of Pharmaceutical Industry (SPI)”, with a total financial outlay of Rs.500 Cr for the period from FY 21-22 to FY 25-26.

What are the Key Points?

1. About

Under the Scheme, financial assistance to pharma clusters will be provided for creation of Common Facilities.

- In order to upgrade the production facilities of SMEs and MSMEs (Micro, Small and Medium Enterprises) so as to meet national and international regulatory standards (World Health OrganizationGood Manufacturing Practice (WHO-GMP) or Schedule-M), interest subvention or capital subsidy on their capital loans will be provided, which will further facilitate the growth in volumes as well as in quality.

- WHO-GMP is the aspect of quality assurance that ensures that medicinal products are consistently produced and controlled to the quality standards appropriate to their intended use and as required by the product specification.

- Schedule M of drugs and cosmetics rules define the GMP requirements for the pharmaceutical industry in India.

2. Components

Assistance to Pharmaceutical Industry for Common Facilities (APICF), to strengthen the existing pharmaceutical clusters’ capacity for their sustained growth by creating common facilities.

- Under this, support for clusters for creation of common facilities with the focus on R&D (Research and Development) Labs, Testing Laboratories, Effluent Treatment Plants, Logistic Centers and Training Centres in this order of priority with an outlay of 178 Cr is proposed. Pharmaceutical Technology Upgradation Assistance Scheme (PTUAS) to facilitate Micro, Small and Medium Pharma Enterprises (MSMEs) of proven track record to meet national and international regulatory standards.

- Under the PTUAS sub-scheme, support for SME Industries is proposed, either through up to a maximum of 5% per annum (6% in case of units owned and managed by SC/STs) of interest subvention or through Credit linked Capital subsidy of 10%.

- An outlay of 300 Cr has been earmarked for sub scheme for the scheme period of five years. Pharmaceutical & Medical Devices Promotion and Development Scheme (PMPDS) to facilitate growth and development of Pharmaceutical and Medical Devices Sectors through study/survey reports, awareness programs, creation of databases, and promotion of industry.

- Under the PMPDS sub-scheme, knowledge and awareness about the Pharmaceutical and MedTech Industry will be promoted.

What is the Significance?

- It will strengthen the existing infrastructure facilities and will make India a global leader in the Pharma Sector.

- This will not only improve the quality but also ensure the sustainable growth of clusters.

- The scheme will address the rising demand in terms of support required to existing Pharma clusters and MSMEs across the country to improve their productivity, quality and sustainability.

What are the Schemes Related to the Pharma Sector?

- Promotion of Bulk Drug Parks Scheme: The government aims to develop 3 mega Bulk Drug parks in India in partnership with States to reduce manufacturing cost of bulk drugs in the country and dependency on other countries for bulk drugs.

- The scheme will also help in providing continuous supply of drugs and ensure delivery of affordable healthcare to the citizens.

- Production Linked Incentive (PLI) Scheme: The PLI scheme aims to promote domestic manufacturing of critical Key Starting Materials (KSMs)/Drug Intermediates and Active Pharmaceutical Ingredients (APIs) in the country

Current Account Deficit

Why in News?

Recently, an American financial services company Morgan Stanley has predicted that the Current Account Deficit will widen to a 10-year high of 3% of GDP in FY23.

What are the Key Points?

- In the wake of continued geopolitical tensions, the surge in oil prices is likely to be sustained, which would lead to deterioration in the current account deficit from a higher oil import bill.

- The Balance of Payments (BoP) to be in deficit of approximately 0.5-1% of GDP (Gross Domestic Product) because capital flows are likely to be lower than the current account deficit.

- The extent of vulnerability to funding risks will be cushioned by the large forex reserves, which stand at USD 681 billion.

- The company expects the April 2022 policy to mark the process of policy normalization with a reverse repo rate hike. However, if the RBI were to delay its normalization process, the risk of disruptive policy rate hikes would rise.

- There is less room for fiscal policy stimulus to support growth given high deficit and debt levels – it is seen that there is a possibility of a modest fuel tax cut and reliance on the national rural employment program as an automatic stabilizer.

What is the Current Account Deficit?

- A current account deficit occurs when the total value of goods and services a country imports exceeds the total value of goods and services it exports. The balance of exports and imports of goods is referred to as the trade balance. Trade Balance is a part of ‘Current Account Balance’.

- According to an earlier report of 2021, High Oil Imports, High Gold Imports are the major driving force, widening the CAD.

What is Balance of Payments?

1. About

BoP of a country can be defined as a systematic statement of all economic transactions of a country with the rest of the world during a specific period, usually one year.

2. Purposes of Calculation of BoP

Reveals the financial and economic status of a country. Can be used as an indicator to determine whether the country’s currency value is appreciating or depreciating. Helps the Government to decide on fiscal and trade policies. Provides important information to analyze and understand the economic dealings of a country with other countries.

3. Components of BoP

For preparing BoP accounts, economic transactions between a country and the rest of the world are grouped under - Current account, Capital account and Errors and Omissions. It also shows changes in Foreign Exchange Reserves.

4. Current Account

It shows export and import of visibles (also called merchandise or goods - represent trade balance) and invisibles (also called non-merchandise).

- Invisibles include services, transfers and income. Capital Account: It shows a capital expenditure and income for a country.

- It gives a summary of the net flow of both private and public investment into an economy.

- External Commercial Borrowing (ECB), Foreign Direct Investment, Foreign Portfolio Investment, etc form a part of capital account. Errors and Omissions: Sometimes the balance of payments does not balance. This imbalance is shown in the BoP as errors and omissions. It reflects the country’s inability to record all international transactions accurately.

- Changes in Foreign Exchange Reserves: Movements in the reserves comprises changes in the foreign currency assets held by the Reserve Bank of India (RBI) and also in Special Drawing Rights (SDR) balances.

- Overall the BoP account can be a surplus or a deficit. If there is a deficit then it can be bridged by taking money from the Foreign Exchange (Forex) Account.

- If the reserves in the forex account are falling short then this scenario is referred to as BoP crisis.

Reforms in FDI Policy ahead of LIC IPO

Why in News?

Recently, the Union Cabinet cleared an amendment to the FDI Policy to allow Foreign Direct Investment (FDI) up to 20% under the “automatic route” in Life Insurance Corporation (LIC) ahead of its proposed Initial Public Offer (IPO).

- The government expects to mobilize Rs 63,000 - 66,000 crore from the proposed share sale to meet its disinvestment target of Rs 78,000 crore for FY 2021-22.

- LIC is fully owned by the government. It was set up in 1956. It has the biggest share in India’s insurance business.

- In most contexts, disinvestment typically refers to sale from the government, partly or fully, of a government-owned enterprise. A company or a government organisation will typically disinvest an asset either as a strategic move for the company, or for raising resources to meet general/specific needs.

What are the Key Points?

- At present, the FDI policy does not prescribe any specific provision for foreign investment in LIC which is a statutory corporation established under LIC Act, 1956.

- The policy permits FDI in insurance companies and intermediaries or insurance intermediaries in the insurance sector.

- The FDI ceiling for public sector banks is 20% on the government approval route. While the government had last year raised the FDI limit in the insurance sector to 74% from 49%, it did not cover LIC that is governed by a specific legislation.

- Since LIC does not fall in any of these categories and no limit is prescribed for foreign investment in LIC under the LIC Act, the government has decided to allow foreign investment up to 20% for LIC and other corporate bodies.

- In order to expedite the capital raising process, such FDI has been kept on the automatic route, as is in the case of the rest of the insurance sector.

What is the Significance of this Move?

- The reform in the FDI policy will facilitate foreign investment in LIC and other corporate bodies, for which the government may have a requirement for disinvestment purposes.

- The change in the FDI policy for LIC will ensure that foreign investors do not face any hurdles while subscribing for the public offer.

- The reform will also facilitate ease of doing business and lead to greater FDI inflows, and at the same time, ensure alignment with the overall intent or objective of FDI policy.

- Increased FDI inflows will supplement domestic capital, technology transfer, skill development for accelerated economic growth and development across sectors, to support the implementation of Atmanirbhar Bharat.

- Allowing FDI will ensure that foreign portfolio investors are able to purchase shares in the secondary market. It also sends a positive signal to investors. What is the Status of FDI Inflows in India?

- FDI inflows in India stood at USD 45.15 billion in 2014-2015 and have increased to USD 81.97 billion during the financial year 2020-21, despite Covid 19 pandemic, which is 10% higher than USD 74.39 billion compared to the previous financial year 2019-20.

Minimum Assured Return Scheme: PFRDA

Why in News?

The Pension Fund Regulatory and Development Authority (PFRDA) has proposed a guaranteed return scheme, Minimum Assured Return Scheme (MARS), which will provide savers and people from the salaried class an option for their investments.

This will be the first scheme from the pension regulator that will offer a guaranteed return to investors.

- India’s pension assets under management have already crossed the Rs 7-lakh crore mark and are expected to touch RS 7.5-lakh crore by end March this fiscal 2021-22.

- PFRDA is aiming for an AUM (Assets Under Management) of Rs 30-lakh crore by 2030.

What is PFRDA’s Proposal under MARS?

1. About

To have a separate scheme that can offer a guaranteed minimum rate of return to NPS (National Pension System) subscribers, especially those who are risk averse.

- Currently, the NPS gives returns annually, based on prevailing market conditions. The actual returns will depend on the market conditions. Any shortfall will be made good by the sponsor, and the surplus will be credited to the subscribers’ account.

2. Options that will be offered

Fixed Guarantee Option: Under the fixed guarantee option, the guaranteed return is fixed along the accumulation phase.

Floating Guarantee Option: Under the floating guarantee option, the guaranteed rate of return

is not fixed along the savings phase.

- The floating guarantee depends on the development of the 1-year interest rate until retirement.

3. Lock-in- Period

The Lock-in may be applicable on each contribution, and will be applied based on the period since that contribution has been made. It may also consider multiple lock-in period options (or staggered guarantee periods) for flexibility. Withdrawals are likely to be directly linked to the

lock-in period. The subscriber may have the option to withdraw or to stay invested after the lock-in period. However, there won’t be any guarantee applied on the investment after lock-in.

4. Limit of Contribution

Minimum and maximum monetary limits on contributions may be prescribed. The attraction for investors will be the minimum guaranteed return.

What is the National Pension System?

1. About

The Central Government introduced the NPS with effect from January 2004 (except for armed forces).

- In 2018 to streamline the NPS and make it more attractive, the Union Cabinet approved changes in the scheme to benefit central government employees covered under NPS. NPS is implemented and regulated by PFRDA. National Pension System Trust (NPST) established by PFRDA is the registered owner of all assets under NPS.

- Structure: NPS is structured into two tiers:

Tier-I account:

(i) This is the non-withdrawable permanent retirement account into which the accumulations are deposited and invested as per the option of the subscriber.

Tier-II account:

(i) This is a voluntary withdrawable account which is allowed only when there is an active Tier I account in the name of the subscriber.

(ii) The withdrawals are permitted from this account as per the needs of the subscriber as and when claimed.

2. Beneficiaries

NPS was made available to all Citizens of India from May 2009. Any individual citizen of India (both resident and Non-resident) in the age group of 18-65 years can join NPS. However, OCI (Overseas Citizens of India) and PIO (Person of Indian Origin) card holders and Hindu Undivided Family (HUFs) are not eligible for opening of NPS accounts.

What is the Pension Fund Regulatory and Development Authority?

1. About

It is the statutory Authority established by an enactment of the Parliament, to regulate, promote and ensure orderly growth of the National Pension System (NPS).

It works under the Department of Financial Services under the Ministry of Finance.

2. Functions

It performs the function of appointing various intermediate agencies like Pension Fund Managers, Central Record Keeping Agency (CRA) etc. It develops, promotes and regulates the pension industry under the NPS and also administers the APY

Securities and Exchange Board of India

Why in News?

Recently, Madhabi Puri Buch, former whole-time member of the Securities and Exchange Board of India (SEBI), has been appointed as its new chairperson — the first woman to head the market regulator. She will hold the position for three years.

- Earlier in January 2022, SEBI launched Saa₹thi – a mobile app on investor education.

What is SEBI?

1. About

SEBI is a Statutory Body (a Non-Constitutional body which is set up by a Parliament) established on 12th April, 1992 in accordance with the provisions of the Securities and Exchange Board of India Act, 1992.

The basic functions of SEBI is to protect the interests of investors in securities and to promote and regulate the securities market.

The headquarters of SEBI is situated in Mumbai. The regional offices of SEBI are located in Ahmedabad, Kolkata, Chennai and Delhi.

2. Background

Before SEBI came into existence, Controller of Capital Issues was the regulatory authority; it derived authority from the Capital Issues (Control) Act, 1947. In April, 1988 the SEBI was constituted as the regulator of capital markets in India under a resolution of the Government of India. Initially SEBI was a non statutory body without any statutory power. It became autonomous and given statutory powers by SEBI Act 1992.

What is SEBIs Structure?

- SEBI Board consists of a Chairman and several other whole time and part time members.

- SEBI also appoints various committees, whenever required to look into the pressing issues of that time.

- Further, a Securities Appellate Tribunal (SAT) has been constituted to protect the interest of entities that feel aggrieved by SEBI’s decision. SAT consists of a Presiding Officer and two other Members.

- It has the same powers as vested in a civil court. Further, if any person feels aggrieved by SAT’s decision or order can appeal to the Supreme Court.

What is SEBIs Power And Functions?

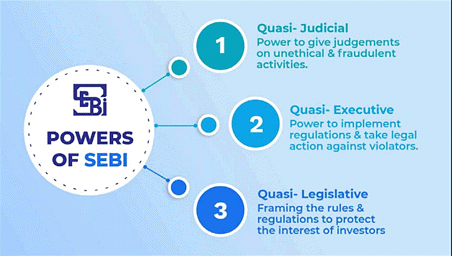

- SEBI is a quasi-legislative and quasi-judicial body which can draft regulations, conduct inquiries, pass rulings and impose penalties.

- It functions to fulfill the requirements of three categories:

(i) Issuers: By providing a marketplace in which the issuers can increase their finance.

(ii) Investors: By ensuring safety and supply of precise and accurate information.

(iii) Intermediaries: By enabling a competitive professional market for intermediaries. - By Securities Laws (Amendment) Act, 2014, SEBI is now able to regulate any money pooling scheme worth Rs. 100 cr. or more and attach assets in cases of non-compliance.

- SEBI Chairman has the authority to order “search and seizure operations”. SEBI board can also seek information, such as telephone call data records, from any persons or entities in respect to any securities transaction being investigated by it.

- SEBI performs the function of registration and regulation of the working of venture capital funds and collective investment schemes including mutual funds.

- It also works for promoting and regulating self regulatory organizations and prohibiting fraudulent and unfair trade practices relating to securities markets.

What are the Issues and Related Concerns?

- In recent years SEBI’s role became more complex, the capital markets regulator is at a crossroads.

- There is excessive focus on regulation of market conduct and lesser emphasis on prudential regulation.

- SEBI’s statutory enforcement powers are greater than its counterparts in the US and the UK as it is armed with far greater power to inflict serious economic injury.

- It can impose serious restraints on economic activity, this is done based on suspicion, leaving it to those affected to shoulder the burden of disproving the suspicion, somewhat like preventive detention.

- Its legislative powers are near absolute as the SEBI Act grants wide discretion to make subordinate legislation.

- The component of prior consultation with the market and a system of review of regulations to see if they have met the articulated purpose is substantially missing. As a result, the fear of the regulator is widespread.

- Regulation, either rules or enforcement, is far from perfect, particularly in areas like insider trading.

- The Securities offering documents are extraordinarily bulky and have substantially been reduced to formal compliance rather than resulting in substantive disclosures of high quality.

|

113 videos|387 docs|113 tests

|

FAQs on Economic Development: March 2022 Current Affairs - Indian Economy for State PSC Exams - BPSC (Bihar)

| 1. What is UPI123Pay and Digisaathi? |  |

| 2. What is the National Land Monetization Corporation? |  |

| 3. What is the RBI's Regulatory Framework for Microfinance Loans? |  |

| 4. What is the Minimum Assured Return Scheme: PFRDA? |  |

| 5. What are the reforms in FDI Policy ahead of LIC IPO? |  |