Bank Exams Exam > Bank Exams Notes > SBI PO Prelims & Mains Preparation > Priority Sector Lending - RBI

Priority Sector Lending - RBI | SBI PO Prelims & Mains Preparation - Bank Exams PDF Download

Background

A large portion of the population in India doesn't have access to funds. Therefore RBI has adopted Priority Sector Lending norms which relaxes the lending norms for poor and small businesses.

Priority Sector includes the following categories

- Agriculture

- Micro, Small and Medium Enterprises

- Export Credit

- Education

- Housing

- Social Infrastructure

- Renewable Energy

- Startups

- Others

Foreign banks with less than 20 branches

Total Priority Sector: 40 per cent of Adjusted Net Bank Credit or Credit Equivalent Amount of Off-Balance Sheet Exposure, whichever is higher, to be achieved in a phased manner by 2020.

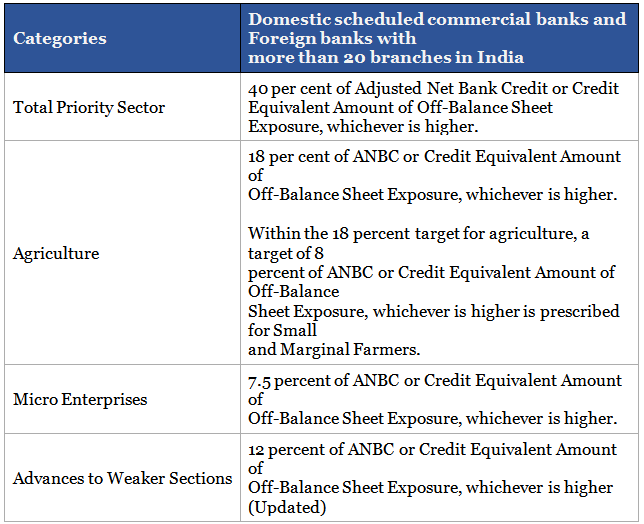

Limits on priority sector lending

Weaker section categories

- Small and Marginal Farmers

- Artisans, village and cottage industries where individual credit limits do not exceed Rs. 0.1 million

- Beneficiaries under Government Sponsored Schemes such as National Rural Livelihoods Mission (NRLM), National Urban Livelihood Mission (NULM) and Self Employment Scheme for Rehabilitation of Manual Scavengers (SRMS)

- Scheduled Castes and Scheduled Tribes

- Beneficiaries of Differential Rate of Interest (DRI) scheme

- Self Help Groups

- Distressed farmers indebted to non-institutional lenders

- Distressed persons other than farmers, with loan amount not exceeding Rs. 0.1 million per borrower to prepay their debt to non-institutional lenders

- Individual women beneficiaries up to Rs. 0.1 million per borrower

- Persons with disabilities

- Overdraft limit to PMJDY account holder upto Rs.10,000/- with age limit of 18-65 years.

- Minority communities as may be notified by Government of India from time to time.

Updation of RBI Circulars related to Priority Sector Lending

UCB’s PSL target shortfall- With effect from March 31, 2021, all UCBs (excluding those under all-inclusive directions) will be required to contribute to Rural Infrastructure Development Fund (RIDF) established with NABARD and other Funds with NABARD / NHB / SIDBI / MUDRA Ltd., against their priority sector lending (PSL) shortfall.

Lending by banks to NBFCs for On-Lending (March 23, 2020)

- It has been decided to extend the priority sector classification for bank loans to NBFCs for on-lending for FY 2020-21. Further, existing loans disbursed under the on-lending model will continue to be classified under Priority Sector till the date of repayment/maturity.

- Bank credit to registered NBFCs (other than MFIs) and HFCs for on-lending will be allowed up to an overall limit of five percent of individual bank’s total priority sector lending.

Target for priority sector lending – UCBs

- The overall priority sector lending (PSL) target for UCBs stood at 40% of the adjusted net bank credit (ANBC) or credit equivalent amount of off-balance sheet exposure (CEOBSE), whichever is higher. On a review, it has been decided that the overall PSL target for UCBs shall stand increased to 75 per cent of ANBC or CEOBSE, whichever is higher.

- UCBs shall comply with the above target by March 31, 2024 as per the following milestones:

Classification of Exports under priority Sector

- In order to boost credit to the needy segment of borrowers, it has been decided that bank credit to registered NBFCs (other than MFIs) for on-lending will be eligible for classification as priority sector under respective categories subject to the following conditions:

- Agriculture: On-lending by NBFCs for ‘Term lending’ component under Agriculture will be allowed up to Rs 10 lakh per borrower.

- Micro & Small enterprises: On-lending by NBFC will be allowed up to Rs 20 lakh per borrower.

- Housing: Enhancement of the existing limits for on-lending by HFCs vide para 10.5 of our Master Direction on Priority Sector lending, from Rs 10 lakh per borrower to Rs 20 lakh per borrower.

Priority Sector Lending – Small Finance Banks and RRBs – Target

Update 4 September 2020

Following loans under ancillary services will be subject to limits prescribed as under:- Loans up to Rs.5 crore to co-operative societies of farmers for purchase of the produce of members (Not applicable to UCBs)

- Loans up to Rs.50 crore to Start-ups, as per definition of Ministry of Commerce and Industry, Govt. of India that are engaged in agriculture and allied services.

- Loans for Food and Agro-processing up to an aggregate sanctioned limit of Rs.100 crore per borrower from the banking system.

Adjustments for weights in PSL Achievement

To address regional disparities in the flow of priority sector credit at the district level, it has been decided to rank districts on the basis of per capita credit flow to priority sector and build an incentive framework for districts with the comparatively lower flow of credit and a dis-incentive framework for districts with comparatively higher flow of priority sector credit.

- Accordingly, from FY 2021-22 onwards, a higher weight (125%) would be assigned to the incremental priority sector credit in the identified districts where the credit flow is comparatively lower (per capita PSL less than Rs.6000),

- and a lower weight (90%) would be assigned for incremental priority sector credit in the identified districts where the credit flow is comparatively higher (per capita PSL greater than Rs.25,000).

The document Priority Sector Lending - RBI | SBI PO Prelims & Mains Preparation - Bank Exams is a part of the Bank Exams Course SBI PO Prelims & Mains Preparation.

All you need of Bank Exams at this link: Bank Exams

|

628 videos|824 docs|280 tests

|

|

628 videos|824 docs|280 tests

|

Download as PDF

|

Explore Courses for Bank Exams exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.

Related Searches