Short and Long Question Answers: Business Finance and Arithmetic | Entrepreneurship Class 11 - Commerce PDF Download

Q.1. Answer the following in about 15 words:

(i) What do you mean by Unit of Sale?

Unit of Sale can be defined as the measure of product/service sold. It is basically used for billing the buyer.

(ii) What do you mean by Gross Profit?

Gross profit is the profit that a business can make by selling a product or service before deducting the fixed expenses. It is also know as Gross Margin.

It is calculated as follows: Gross Profit per unit = Unit Price – Unit cost

(iii) “When you sell your product but the buyer does not pay your money immediately” It is known as?

This is called selling on credit where in the buyer pays the seller at a later date.

Q.2. Answer the following in about 50 words:

(i) Give 4 examples of Fixed Costs.

- Building or office maintenance

- Depreciation

- Electricity

- Equipment maintenance

- External Consultant charges

- Housekeeping

- Internet and Telephone

- Marketing and promotional

- Property tax

- Rent for the building/equipment/vehicles

- Research and development

- Salary to the employees

- Stationery

- Utility

- Wages

(ii) Give 2 examples of Start-up Cost.

The following are the examples of Start-up Cost:

- Appliances (like refrigerator/air conditioner/ water dispenser/TV etc for employees)

- Advance paid towards lease/rent

- Building

- Business Registration expenses

- License expenses

- Computers, Software & hardware

- Electricity and electrical wiring setup expenses

- Furniture and Interior decoration

- Infrastructure

- Initial payment for procuring electricity, telephone, internet etc

- Land

- Raw materials, Machinery, tools and equipment

- Recreation (providing a gym TV room, or table tennis or caroms facility for the employees)

- Utensils

- Vehicles for business purpose

- Salary to the employees in the start-up period

(iii) Give four examples of Inflow and Outflow of cash.

The following are the examples of Inflow of cash:

- Claims Received

- Franchise payments received

- Investor equity

- Legal settlements’ amount received

- Loans from banks/family/friends

- Owner’s equity

- Rent received

- Sale of Assets or Scrap

- Sales Receipts

- Sale of shares

- Subsidy from the government

The following are the examples of outflow of cash:

- Building maintenance and other expenses

- Building

- Computers and related hardware

- Electricity, Telephone, Internet expenses

- Employee recreational expenses

- Employee salaries and other perks/benefits

- Employee training expenses

- External consultant charges

- Interior decoration

- Marketing and promotional expenses

- Money paid for legal settlements

- Raw material

- Software purchases and other related license renewal charges

- Stationery

- Tools, Equipment and machinery

- Utility expenses

(iv) What do you mean by Cash Inflow and Cash Outflow?

The following are the meanings of Cash Inflow and Cash outflow:

Cash Inflow: The cash that gets into the business or receipts of cash is called as cash inflow. This will usually results from

- Operations performed by the organization.

- Various investments flowing into the business.

- As a result of financing.

Cash Outflow: The cash that goes out of the business or payments of cash is called as cash outflow. This will usually results from

- Expenditure incurred by the organization.

- Various investments made by the organizations in the other businesses.

- The organization provides the required finance for other enterprises/businesses.

Q.3. Answer the following in about 75 words:

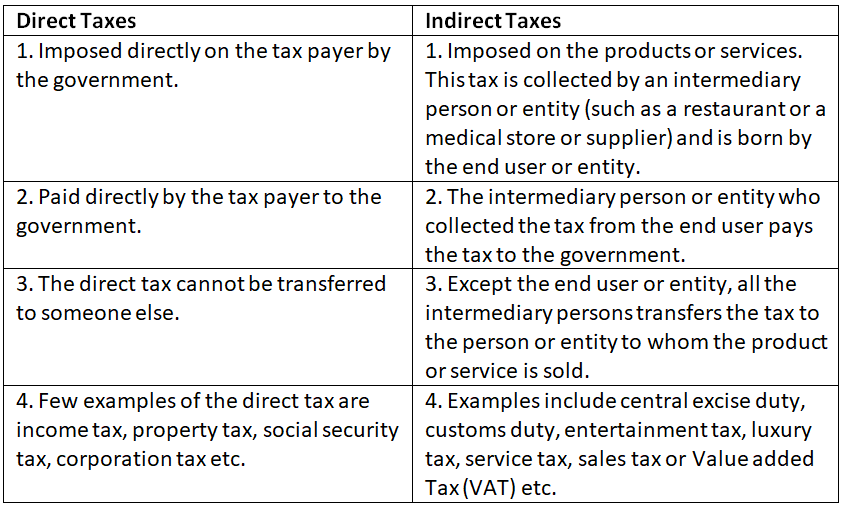

(i) Give one difference between Direct Tax and Indirect tax.

The following are the differences between the direct tax and indirect tax:

(ii) Why motive of Business is to learn profit and not Loss?

The motive of the business is to learn/earn profit and not loss as per the analysis provided below:

When it comes to the economy stand point, earning significant profit is the primary motive of almost all the businesses. They always strive to earn profit and work with this as their primary objective. Everyone in the enterprise should work towards the goal of fulfilling this objective. Only through profits the company can sustain a business and does not fall into the bankruptcy. For continuous sustenance in the business, it should start earning money to meet the expenses like salaries to the employees etc. The moment the business start seeing losses, it should spend the amount from investment to meet these expenses. This will be against the objective of the business.

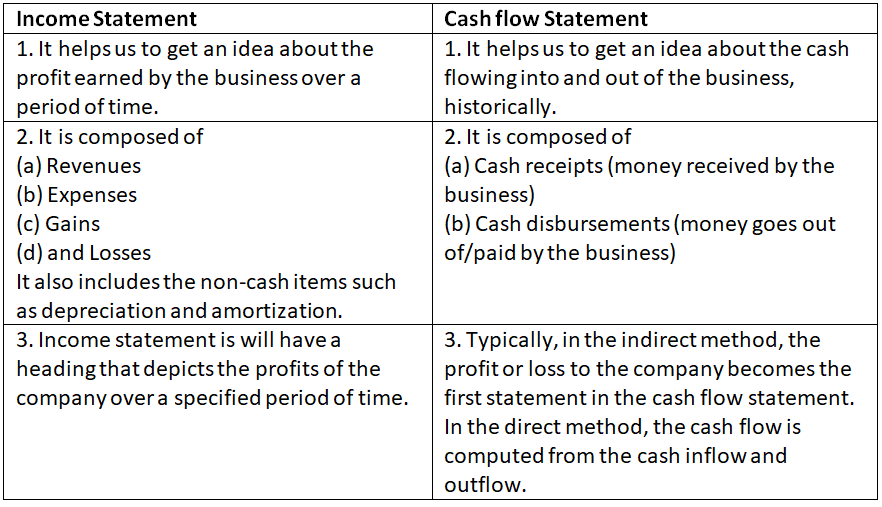

(iii) Give one difference between Cash flow and Income statement.

The following are the differences between cash flow and income statements:

(iv) What do you mean by Non-Cash Expenses?

The expenses like depreciation and amortization do not involve any cash outflow and hence are referred to as non-cash expenditure. However, they are reported as expenses in the income statement. They usually represent the decrease in the value of a tangible(ex. machinery) or intangible(ex. license) asset, over a period of time.

Depreciation represents the decrease in the value of the asset over a period of time. This value is computed on an yearly basis and projected as expense in the income statement for a given accounting period, till the asset is completely deprecated.

Similarly, when a payment is paid towards amortization, for instance towards procuring a license to perform a business or partial loan repayment. The total cost of the renewal/payment is computed and distributed over the period for which the license expires or loan is completely paid. This partial expense is then projected as expense in the income statement.

(v) What do you mean by Startup Cost?

Start up cost is the cost incurred when setting up the business. Usually for starting an enterprise the entrepreneurs need to acquire the

- assets

- raw materials

- any other items

To acquire these they need to invest money at the time of starting the business. All these expenses incurred are known as start-up expenses. It is also known as working capital. These expenses occur much before the enterprise starts actually producing the products or delivering the services. Usually these expenses start occurring from the time the planning and preparation starts. The expenses occur during the start up might repeat again. For instance, a business that incurs the start up expenses to purchases might have to spend again to purchase the same machinery once the old one is depreciated.

Few of the expenses that the business need to incur are as follows:

- Acquisition of land

- Building

- Computers

- Dealing with registration

- Equipment

- Furniture and Fixtures

- Goods and Services (that will be input to the products or services offered by the business)

- Installation of machinery and other equipment/appliances

- Hiring expenses (hiring of employees, equipment etc)

- Judicial expenses

- Key resources acquisition (employees, raw materials etc)

- Licenses

- Machinery

- Operational expenses (salaries/rent etc)

- Purchase of software, utilities etc

(vi) Explain Cost, Expenses and Expenditure.

The following is the explanation of cost, expenses and expenditure:

- Cost: Cost is the monetary value that is incurred to produce a good or provide a service. The cost provide the business a measure of how the capital is being consumed. This helps them to make key decision regarding how to improve profits. A cost does not necessarily represent a cash flow. They are usually computed relatively based on the volume of consumption. All the costs summed up will be equal to an expense.

For instance when the expense towards electricity is ₹ 12,000/- per month. If there were 1000 products produced then the cost of electricity to produce each product would be ₹ 12/-. Here there is no cash outflow of ₹ 12/- every time a product is produced. However, there is a total cash flow of ₹ 12,000 at the end of the month, which is recorded as an expense.- Expense: An expense occurs whenever there is a cash flow in or out of the business. All the expenses are recorded in the accounts. They are useful to keep track various sources and events of cash flow. They occur by consuming goods and services. Examples include the maintenance or operational expenses that are incurred in the business.

- Expenditure: Expenditure represents payment or disbursement of money and hence represents the outflow of money. The payment or disbursement can be in the form of cash payment or cheque payment. The business incurs expenditure when the payment is made for

(a) Assets like machinery, land and building.

(b) Marketing and promotional expenditure

(c) Payment of dues.

(d) Payment to the suppliers to procure the raw material

(e) Payments to the stakeholders

(vii) What is a Cash Register? Why is it important for any business?

Cash register refers to the book or register used to record all the monetary transactions either in the form of cash or in the form of cheque or in the form of credit or loan. From the accounting point of view this is also known as the book of original entry. A cash book has prominent significance in the business.

It helps the business to get an understanding of various elements like

- Costs

- Expenses

- Income

- Profit

- Loss

- Loans to be recovered

- Credit sales

Earlier accounts department was using a book to maintain these entries. Now a days various softwares are available to maintain the cash registers which are more accurate and faster in nature and help in generating various reports related to the monetary transactions done by the business.

Q.4. Answer the following in about 150 words:

(i) Why do we pay taxes?

Taxes are levied by the government from the tax payers as a financial charge. The tax payer can be an individual or a legal entity such as a business or organization or institution. Evading taxes is illegal. The tax is usually levied on an activity (such as entertainment) or income or product.The functioning of the government needs money. Taxes are a means to collect money. The taxes thus collected are used for implementing various welfare activities such as building infrastructure, national security, health care, education, salaries to the government employees. By paying the tax, a citizen is contributing to the development or welfare of the nation. So, it is the responsibility of every citizen to ensure that they pay the tax without failure. Every citizen experiences many of the social welfare and development activities implemented by the government. So, it is a way of paying back or contributing to the nation and is the responsibility of the citizens.

(ii) What do you mean by Break Even Point?

Break Even Point refers to the stage at which the business is able to generate the revenues or sales to meet its expenses. At this stage, the business is neither making profits nor incurring losses. It is just making enough revenues to meet its expenses.

The business performs the Break Even Analysis to find the Break Even Point as it is a significant measure of how the business is performing. It helps them to determine whether a product or service is worth continuing. This is determined whether the associated costs with a product or service are covered by the revenue generated from that product or service.

Thus after performing the Break Even Analysis and determining the bream even point, the business can make key decisions regarding the subsequent measures to be taken. Few of these decisions could be like altering the prices, ensuring that the bids are competitive and start preparations to procure additional funds through various resources. One of the key decisions taken after the break even analysis is the Goal/Target Setting and Profit Planning.

Mathematically, we can say that when the break even point is reached

Total Revenue/Income = Total Expenses

The break even point is computed by using the following formula.

(iii) How much profit can we earn? Is there any policy of the Government for Maximum Profit earning?

Profit is the monetary reward gained in a business and a business results in a profit when the total revenue generated is in excess of costs, expenses and taxes incurred during the course of business. The profits(or losses) are usually projected through the Income statement also known as Profit and Loss statement.

Mathematically it can represented as

Profit = Total Revenue from Sales – Total Sales Expenses

Thus the way one can increase profits is by increasing the revenue from the sales or by decreasing the overall expenses or both.

Increase in the revenue through sales can be achieved either through increasing the number of sales as much as possible or increasing the price of the product.

Decrease in the sales expenses can be done by optimizing the sales process and ensuring that there are minimum possible expenses at each stage.

Thus we can say that there is no limit to the profit earned by an organization. The maximum profit earned by a business is dependent on the sales price, sales volume and the expenses. Thus it can go to any levels.The government did not lay out any policies to restrict the amount of profit made by any business. If the product or service is innovative and effectively takes care of peoples’ needs, its sales volume is high and hence the business makes more profits.

If the product or service has lot of value to offer, it is priced at high margin and the business can make more money even from low sales volumes.

Another way of increasing the profits is to reduce the expenses by optimizing the profits.

Thus in any case it is well adopted by the public and hence the government does not intervene in these matters.

However, one can not make more than a specified percentage of profit on certain items like essential medicines etc. Only in this case the government has laid down a policy to restrict the amount of profit a company can make on a product (not on overall profit which again depends on the sales volume).

Also, the more the profits made by a business, the more it is beneficial to the government, as the government then gets revenue in the form of taxes.

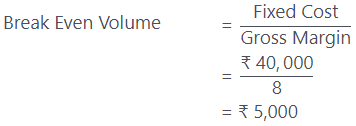

(iv) A company makes a product with a selling price of ₹ 20 per unit and variable costs of ₹ 12 per unit. The fixed costs for the period are ₹ 40,000/. What is the required output level to make a target profit of ₹ 0,000/-?

As you know, the point at which the company will be making a profit of ₹ 0,000/- i.e. neither profit not loss is the break even point.

Fixed Cost = ₹ 40,000

Unit Sale Price = ₹ 20

Variable cost per product = ₹ 12

Gross margin (per unit) = Sale Price – Variable Cost

= ₹ 20 – ₹ 12

= ₹ 8

∴ The output level should be 5,000 units to make a target profit of ₹ 0,000/- i.e. to reach break even point.

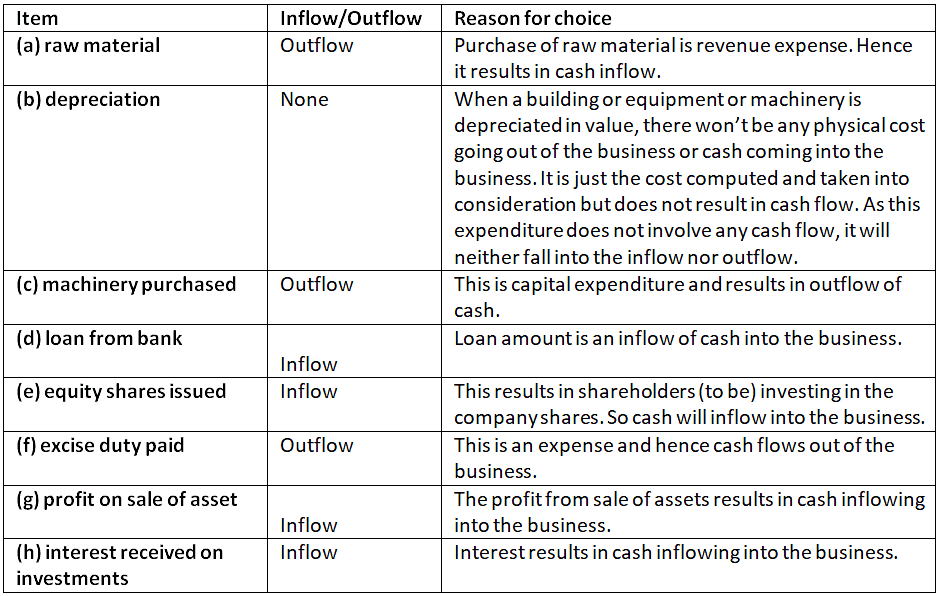

(v) Identify the following items as inflow/outflow. Also give reason for your choice.

(a) raw material

(b) depreciation

(c) machinery purchased

(d) loan from bank

(e) equity shares issued

(f) excise duty paid

(g) profit on sale of asset

(h) interest received on investments

The following is the identification of the items as inflow/outflow. The reason of my choice are also provided.

Q.5. Answer the following in about 250 words:

(i) Define the term ‘break-even’.

In a business, Break-even refers to the situation where in the business is able to generate the sales or revenues so as to meet the expenses of the business. When the business has reached the state of break-even, it will be neither profits nor in losses. Its revenues and profits will be evenly matched. Break even plays a critical role in the business, as it is a major mile stone and from then on the business will start making its profits.

(ii) Explain why break-even analysis is of reduced value to a multi-product firm? Analyse the factors that any business should take into consideration before using break-even analysis as a basis for decision making.

A multi-product firm will be producing more than one product. These products may vary in size, appearance and purpose. As it is difficult to calculate the break-even point by considering only one product, the company has to consider a common unit to calculate the break-even point. Usually this occurs when the business is allocating budget and provided that it has already started the sales.In order to calculate the break-even point, the company should first calculate the product mix. The product mix is the cumulative range of products produced by the company. Also, the expenses are spread across multiple products and hence the overall cost on each product will be less than that if it was produced as a single unit.

Also, in case of multi-product firm, the various costs are not associated with a single product but distributed across all the products offered by the business. Thus the business will be able to reach the break-even point much before as compared to a business that is offering a single product or service.

Thus we can say that the in a business engaged in the product of multiple products the break-even analysis is of reduced value in a multi-product firm.

|

37 videos|52 docs|15 tests

|