B Com Exam > B Com Notes > Interdisciplinary Issues in Indian Commerce > Difference Between FDI and FPI- Interdisciplinary Issues in Indian Commerce

Difference Between FDI and FPI- Interdisciplinary Issues in Indian Commerce | Interdisciplinary Issues in Indian Commerce - B Com PDF Download

What is Foreign Direct Investment (FDI)?

FDI occurs when a company invests heavily in another company by acquiring controlling ownership and becoming involved in the company's operations. With its investment, the company also brings in expertise, skill, and technical know-how, allowing it to exert a great deal of control over decision-making.

- Foreign companies often invest in countries that they believe will have strong economic growth, as well as in countries with a skilled workforce.

- A foreign company can establish a presence in a new country in several ways, such as acquiring assets or establishing new businesses. It is also common for companies to expand their operations into new countries. Additionally, a company may merge with or form a joint venture with a foreign company.

- An FDI can lead to horizontal expansion (investing in companies with similar businesses), vertical expansion (investing in companies that complement the investing company's business), or conglomerate expansion (investing in a company unrelated to the investing company's core business).

- The Indian economy was opened to foreign investment in 1991, and since then, it has been attracting investment from all over the world.

What is Foreign Portfolio Investment (FPI)?

Foreign Portfolio Investment (FPI) refers to investments in foreign financial assets that do not involve any active management by the investor. These assets can include stocks, bonds, and other financial assets.

- Foreign portfolio investors typically invest money in foreign markets to generate quick returns. This usually involves buying securities that can be easily bought and sold.

- Foreign portfolio investors typically do not seek to gain control over the managerial operations of the businesses they invest in. Rather, they are more interested in generating short-term financial gains.

- Foreign portfolio investors are often seen as less favorable than direct investors because their investments are often more easily liquidated. This may be because foreign portfolio investors are often more interested in earning short-term gains than long-term investments in a foreign country.

- In October 2018 and July 2020, India experienced the highest foreign portfolio investor withdrawals. This may indicate that foreign investors are looking to invest in other developing nations that offer higher returns.

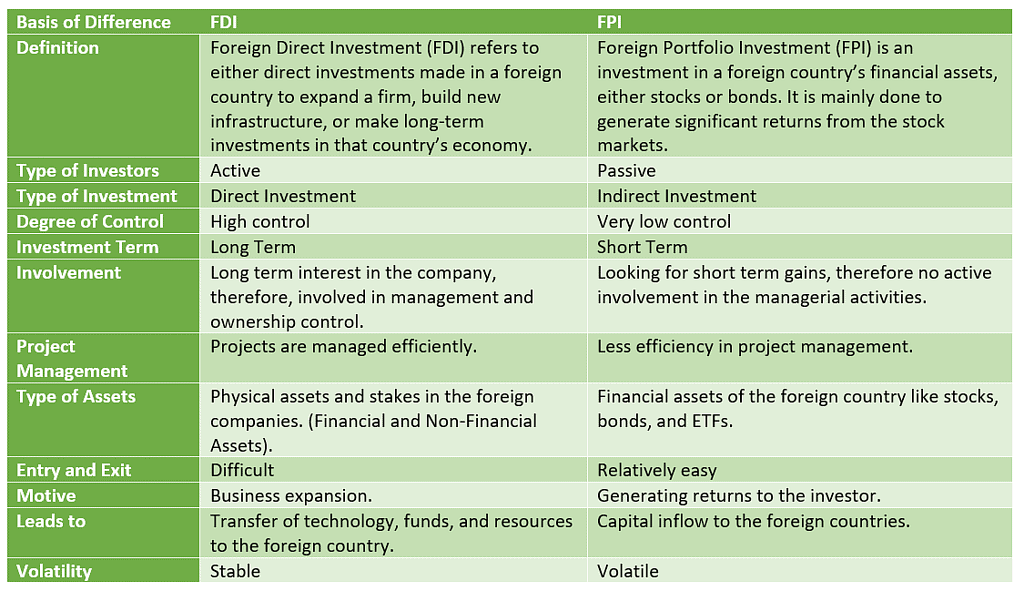

Comparison between FDI and FPI

The document Difference Between FDI and FPI- Interdisciplinary Issues in Indian Commerce | Interdisciplinary Issues in Indian Commerce - B Com is a part of the B Com Course Interdisciplinary Issues in Indian Commerce.

All you need of B Com at this link: B Com

|

49 videos|45 docs|14 tests

|

|

49 videos|45 docs|14 tests

|

Download as PDF

|

Explore Courses for B Com exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.

Related Searches