Special Purpose Books I- Other Book (Part-1) | Accountancy Class 11 - Commerce PDF Download

Page No 10.40:

Question 1: Without Goods and Services Tax (GST)

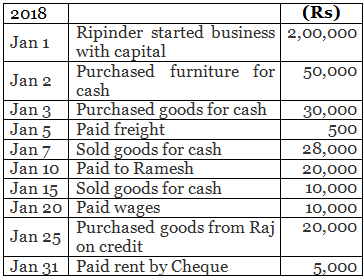

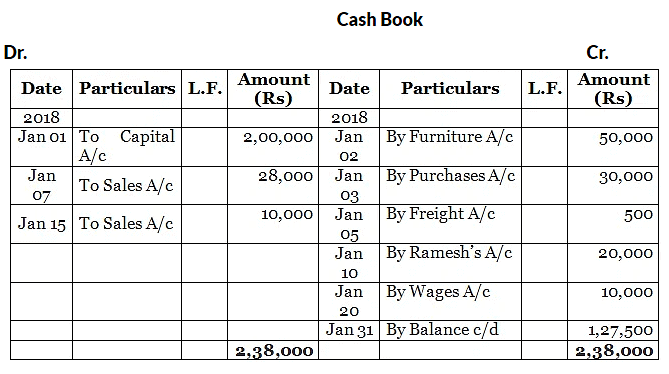

Enter the following transactions of Mr. Ripinder, Delhi in a Single Column Cash Book and balance it:

ANSWER: Format of Single Column Cash Book on the basis of given transactions

Point of Knowledge:

In the cash book only cash transaction are recorded. Credit transactions are not recorded.

The debit side is always greater than the credit as payments are never exceeds the cash available.

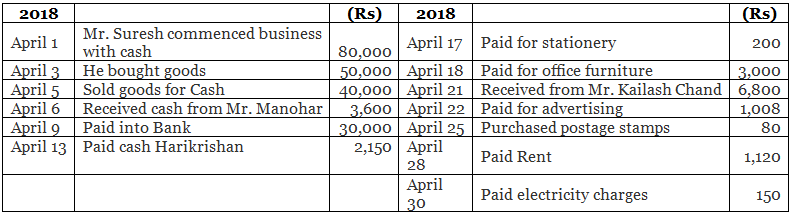

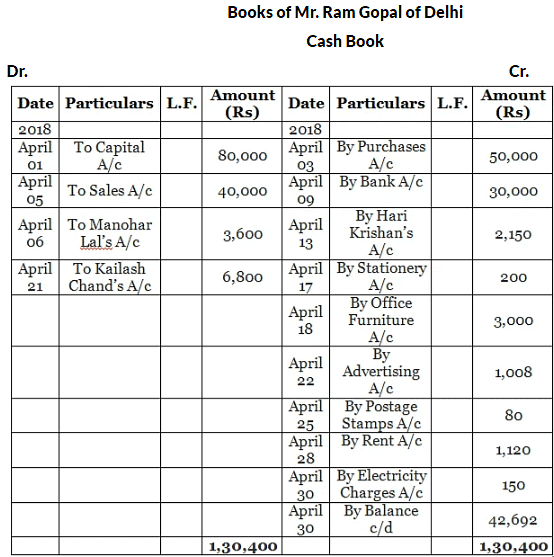

Question 2: Prepare Simple Cash Book from the following transactions of Mr. Suresh, Delhi:

ANSWER: Format of Simple Cash Book on the basis of given transactions

Point of Knowledge:

The Balancing of cash book done like any other account. Debit Column(Receipt column) is always greater than the Credit Column(payment column).

Question 3: With Goods and Services Tax (GST)

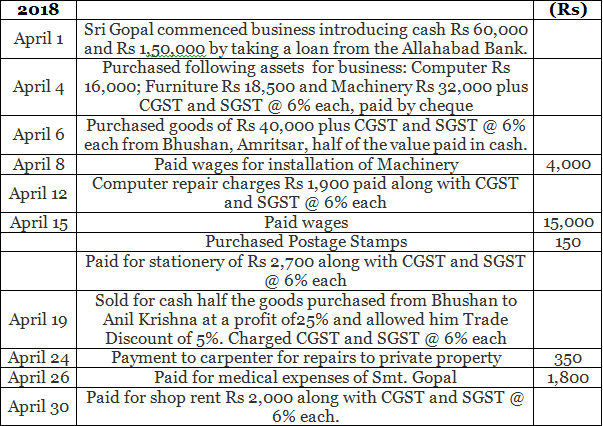

Prepare Simple Cash book of Sri Gopal of Amritsar from the following transactions:

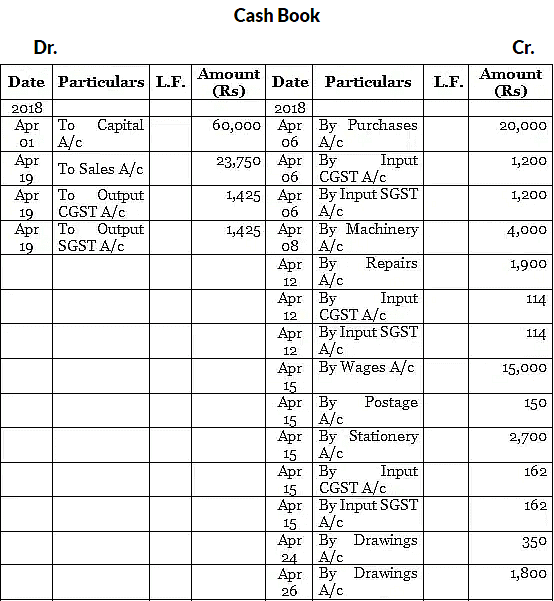

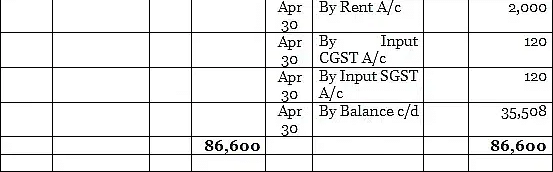

ANSWER: Format of Simple Cash Book on the basis of given transactions

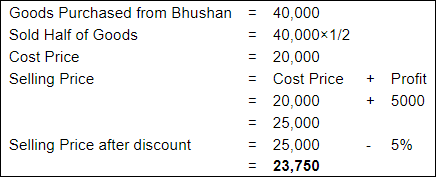

Working Note:

Page No 10.41:

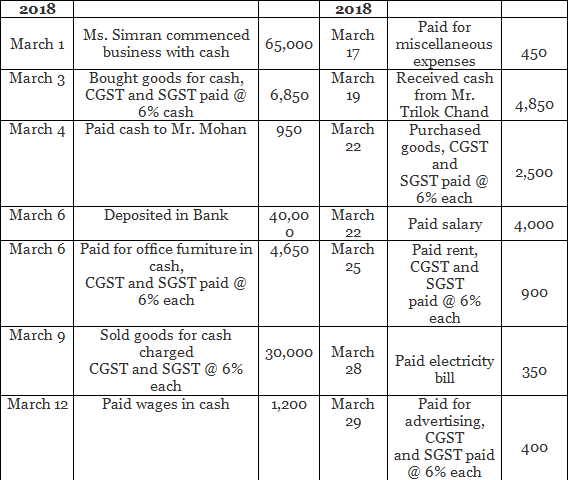

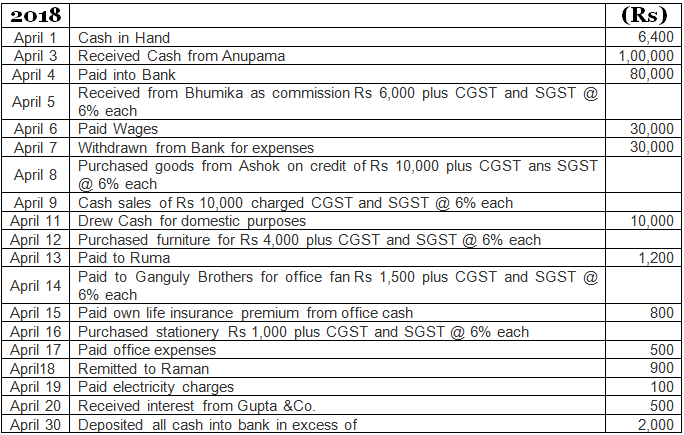

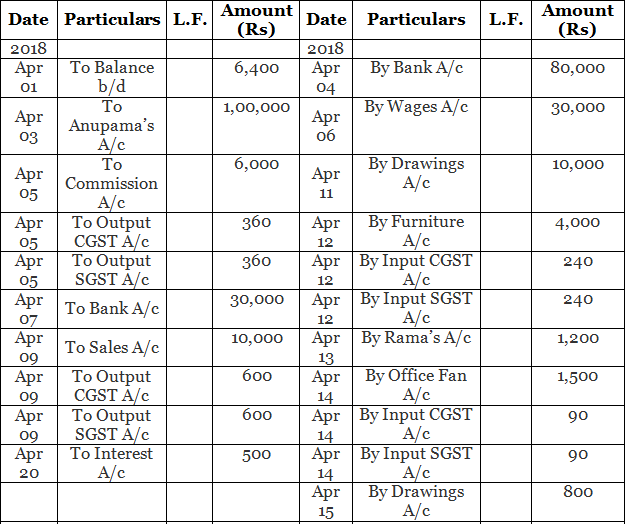

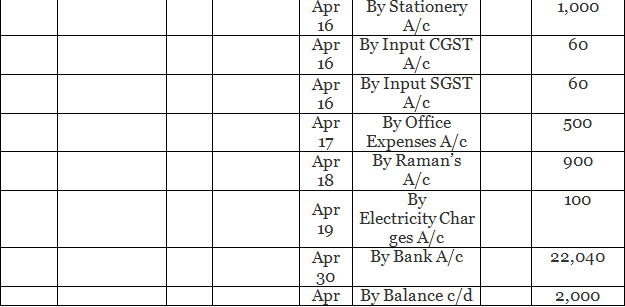

Question 4: Prepare Simple Cash Book from the following transactions of Simran, Delhi:

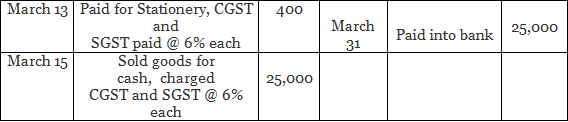

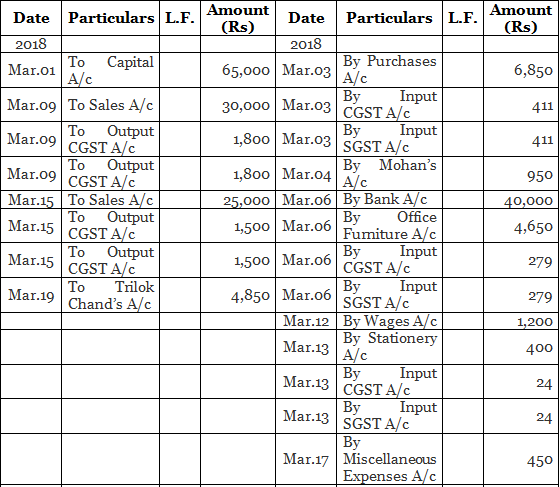

ANSWER: Format of Simple Cash Book on the basis of given transactions

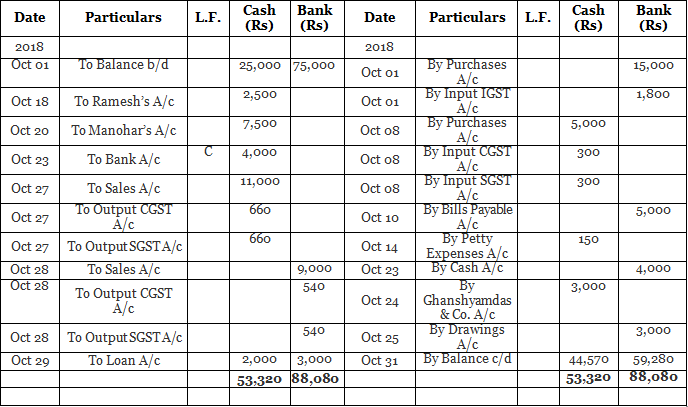

Books of Ganesh Lal

Cash Book

Dr. Cr.

Point of Knowledge:

If a firm maintained Cash Book then it need not to make cash account separately.

Question 5: From the following prepare Single Column Cash Book of Suresh, Chennai and post them into ledger accounts:

ANSWER: Format of Single Column Cash Book on the basis of given transactions

Cash Book

Dr. Cr.

Point of Knowledge:

Cash book is maintained to record only cash transaction so, the credit purchases are not recorded in the cash book.

Question 6: Without Goods and Services Tax (GST)

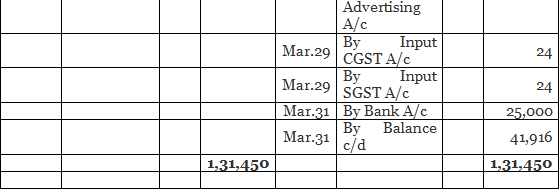

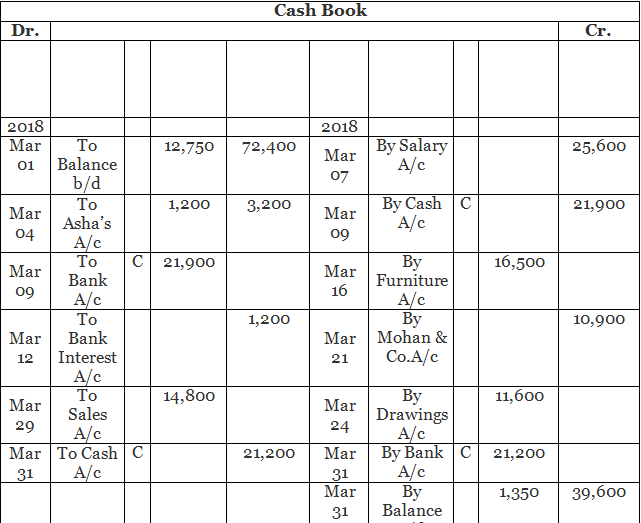

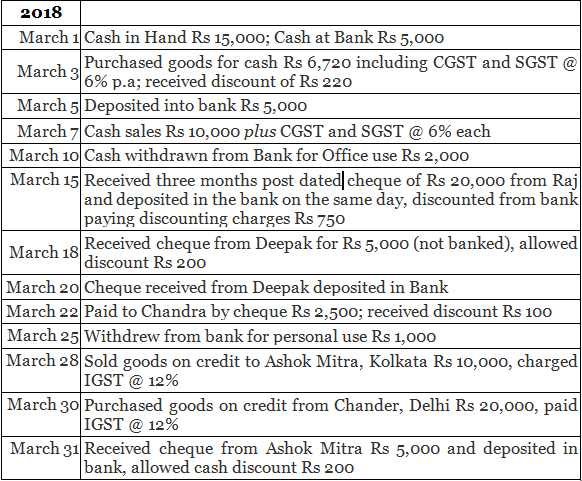

Record the following transactions in Double Columns Cash Book and balance the book on 31st March, 2018:

ANSWER: Format of Double Column Cash Book on the basis of given transactions

Point of Knowledge:

- Contra Entry is an entry which includes both Cash & Bank Account and it is recorded in both debit & credit side of the double column cash book. When a contra entry posted in cash book there is a reference column, the letter “C” is written this denotes that the entry is a contra entry.

- This entry will not be posted to any ledger account.

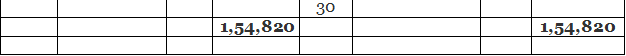

Page No 10.42:

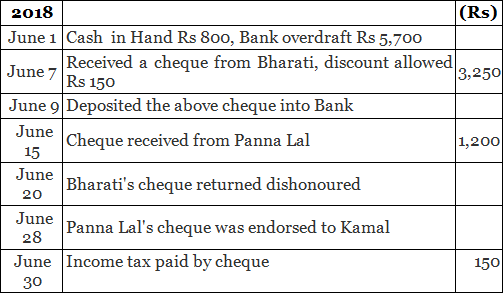

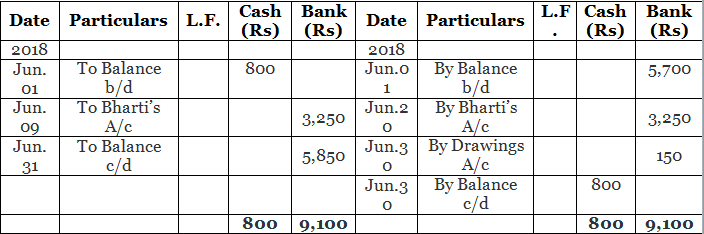

Question 7: Enter the following transactions in the Double Column Cash Book of M/s. Gupta Store:

ANSWER: Format of Double Column Cash Book on the basis of given transactions Points of Knowledge:

Points of Knowledge:

(i) Here Bank is overdraft so it will affect the credit side of Cash Book (By Balance b/d).

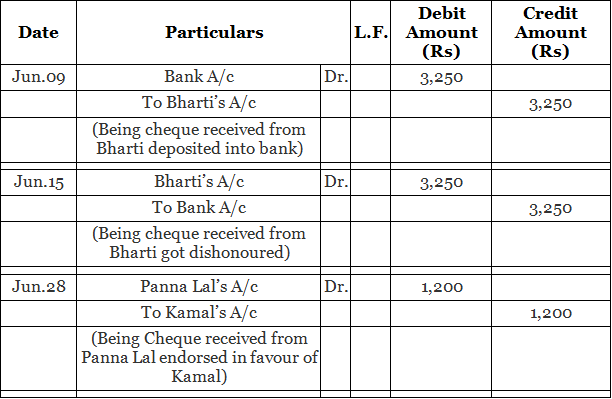

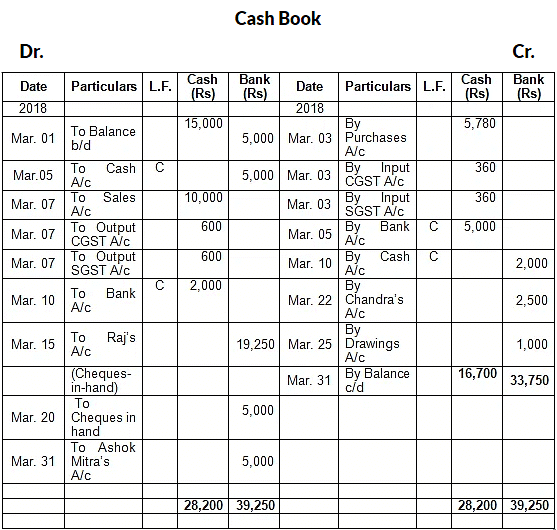

(ii) Below is the Journal of Some tricky transactions

Journal

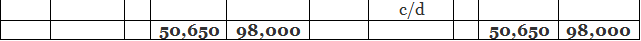

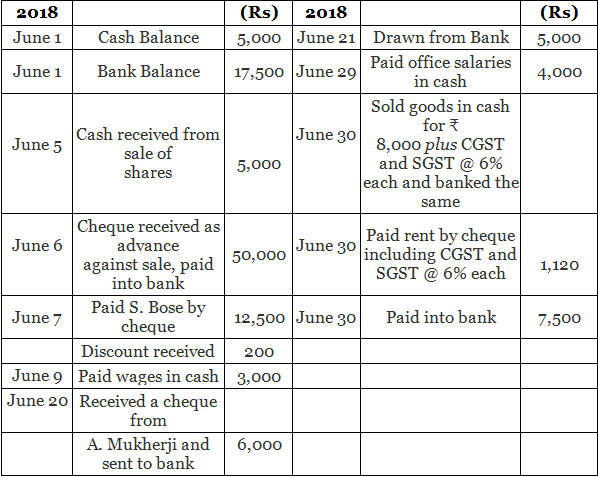

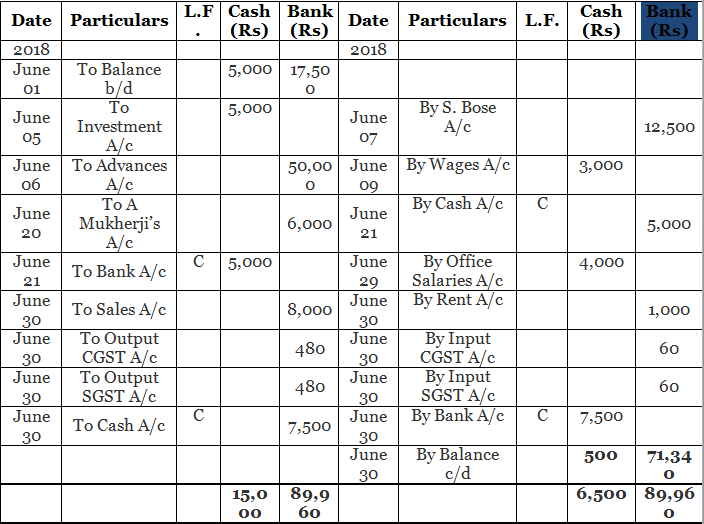

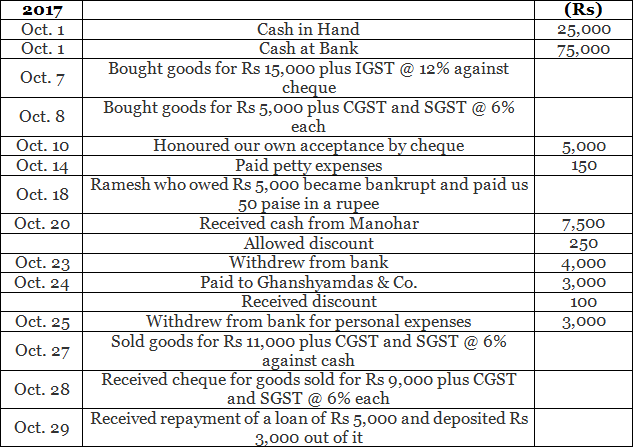

Question 8: Prepare Two-column Cash Book of Bimal, Lucknow from the following transactions:

ANSWER: Format of Two Column Cash Book on the basis of given transactions

Cash Book

Dr. Cr.

Point of knowledge:

(i) When a cheque is received and deposited into the bank on the same day the amount of the cheque is entered in the bank column on debit side.

(ii) When a cheque is received and does not represent on the same day, the amount of the cheque is entered in the cash column.

Page No 10.42:

Question 9: Prepare Two-column Cash Book from the following transactions of Mani, Kochi;

ANSWER: Format of Two Column Cash Book on the basis of given transactions

Point of Knowledge:

(i) On March 15th, cheque received from Raj post dated 3 months, being deposited in the bank on the same day and bank deducted discounting charges Rs. 750

Rs. 20,000 – Rs. 750 = Rs. 19,250

Note:

The closing balances of Cash Column and Bank Column are 16,700 and 33,750 respectively. But according to Text Book the closing balances are 14,700 and 33,750 respectively which is different from our calculation.

Journal

Page No 10.43:

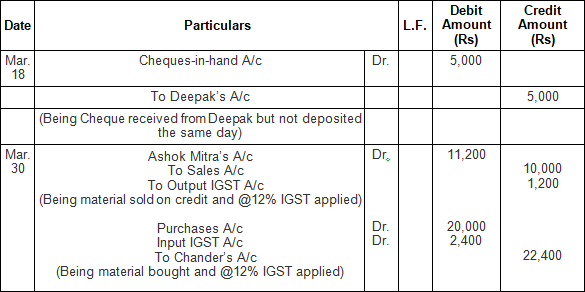

Question 10: Prepare Two-column Cash Book of Vinod, Delhi from the following transactions:

ANSWER: Format of Two Column Cash Book on the basis of given transactions

Point of Knowledge:

The contra entry is done when the cash is withdrawn for business use. If cash is withdrawn for personal use, it will be entered in the bank column of credit side of the cash book.

|

61 videos|227 docs|39 tests

|

FAQs on Special Purpose Books I- Other Book (Part-1) - Accountancy Class 11 - Commerce

| 1. What are special purpose books in commerce? |  |

| 2. What is the purpose of using special purpose books in commerce? |  |

| 3. What types of special purpose books are commonly used in commerce? |  |

| 4. How do special purpose books differ from general purpose books in commerce? |  |

| 5. What are the advantages of using special purpose books in commerce? |  |