Composition Levy Scheme | Goods and Services Tax (GST) - B Com PDF Download

Composition Scheme

The Government of India provides for simplified and easy of doing business scheme for payment of taxes and filling of returns to certain categories of taxable person. As a result such taxable person is not required to maintain elaborate records and filing detailed returns. Section 10 of the CGST Act, provides for composition levy to such person.

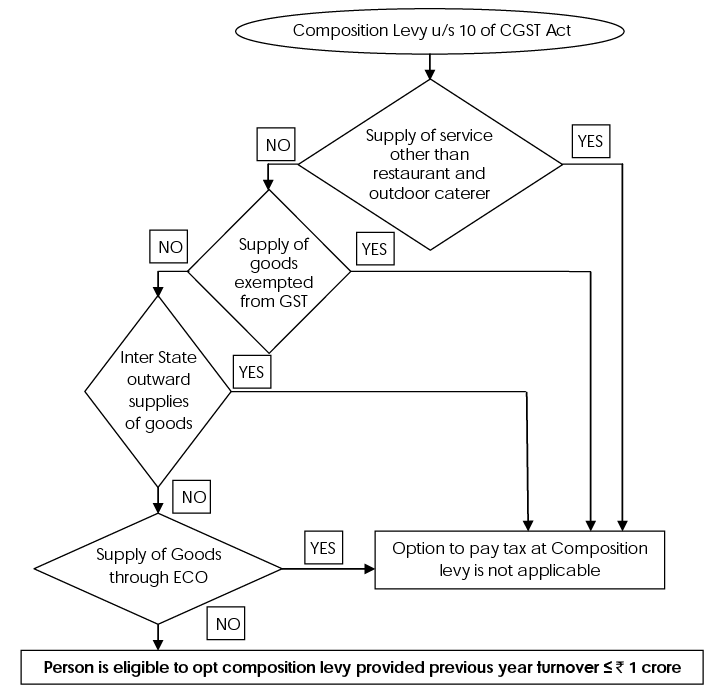

Person eligible for Composition Levy u/s 10 of CGST Act:

Changes to be made prospectively from 15th November 2017: Composition scheme limit to be increased to ₹ 1.5 crore (can be extended to ₹ 2 crore later).

As per Section 10(1) of CGST Act, 2017, Registered person, whose aggregate turnnover in the financial year did not exceed ₹ 1 crore (₹ 75 Lakhs for north-eastern states), may opt to pay composition levy. (vide notification No. 46/2017 - Central Tax, Dt.-13/10/2017).

Note: North eastern states includes

1. Arunachal Pradesh;

2. Assam;

3. Manipur

4. Meghalaya

5. Mizoram;

6. Nagaland;

7. Sikkim;

8. Tripura;

9. Himachal Pradesh.

The turnover threshold for Jammu & Kashmir and Uttarakhand shall be ₹ 1 crore

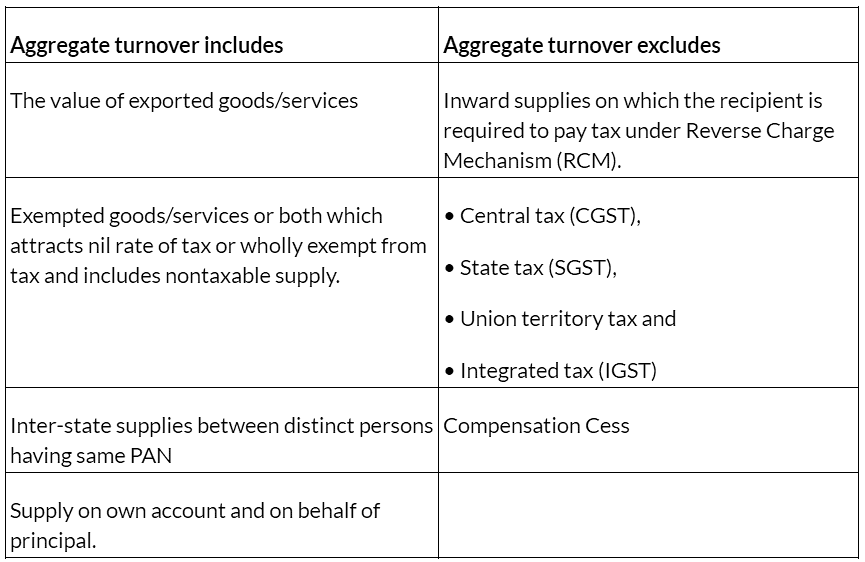

Aggregate turnover as per Section 2(6) of CGST Act, 2017

The term “aggregate turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-state supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, state tax, union territory tax, integrated tax and cess.

Important points:

- The turnover will be computed PAN wise.

- The partner and partnership firm will have different PAN Nos. Thus the turnover of the partner and partnership firm will not be aggregated.

- The HUF and individual coparcener of the family have different PAN Nos. Hence, turnover of Karta of HUF in his individual capacity and turnover of Karta as a Karta of HUF will not be aggregated.

Supply of goods, after completion of jobwork, by a registered jobworker shall be treated as the supply of goods by the principal referred to in Sec. 143 of the CGST Act, 2017, and the value of such goods shall not be included in the aggregate turnover of the registered jobworker. It will be included in the turnover of principal.

Persons not entitled to avail Composition Scheme:

The Section 10(2) of the CGST Act, 2017 specifies the benefit of composition scheme shall not be granted if a taxable person is:

- engaged in the supply of services (other than restaurant and outdoor catering service);

- engaged in making any supply of goods which are not leviable to tax under this Act;

- engaged in making any inter-state outward supplies of goods;

- engaged in making any supply of goods through an electronic commerce operator who is required to collect tax at source under section 52; and

- a manufacturer of such goods as may be notified by the Government on the recommendations of the Council:

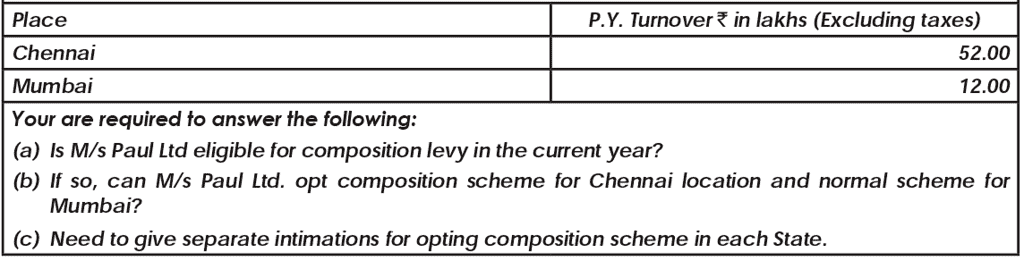

Example 1: M/s Paul Ltd. being a trader of laptops has two units in Chennai and in Mumbai.

(a) Yes. M/s Paul Ltd. is eligible to avail the composition scheme in both the states namely Tamil Nadu and Maharashtra. Since, M/s Paul Ltd. has same PAN, and his aggregate turnover does not exceeds rupees one crore, it is eligible for composition levy, even though the company has multiple registrations under GST.

(b) No. M/s Paul Ltd. cannot opt composition scheme for one location and normal scheme for another location. Where more than one registered persons are having the same Permanent Account Number (issued under the Income-tax Act, 1961), the registered person shall not be eligible to opt for the scheme under sub-section (1) of Section 10 of CGST Act, 2017 unless all such registered persons opt to pay tax under that sub-section.

(c) Intimation to opt composition scheme in respect of any place of business in any State or Union Territory shall be deemed to be intimation in respect of all other places of business registered on the same Permanent Account Number (PAN).

Conditions and Restrictions for Composition Levy (Rule 5 of Chapter II of the CGST Rules, 2017):

- The person opting for the scheme must neither be a casual taxable person nor a non-resident taxable person.

- The goods held in stock by him on the appointed day have not been -

- purchased in the course of inter-state trade or commerce or

- imported from a place outside India or

- received from his branch situated outside the State or

- from his agent or principal outside the State, where option is exercised under rule 3(1) of the CGST Rules, 2017 (i.e. who opted composition scheme at the time of migrating into GST).

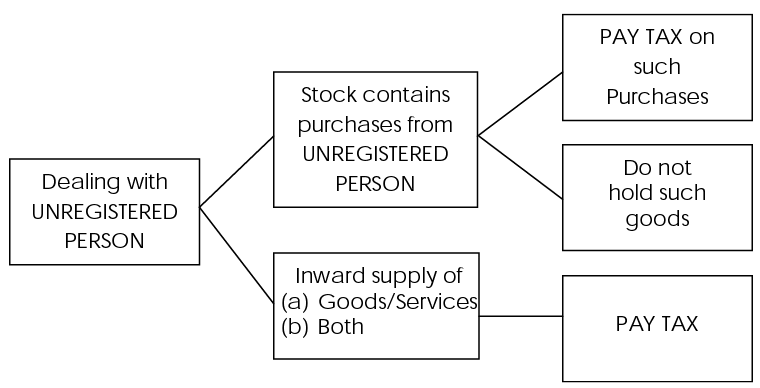

- The goods held in stock by him have not been purchased from an unregistered supplier and where purchased, he pays the tax under reverse charge (i.e. Section 9(4) of CGST).

- He shall pay tax as per normal rates, in case of inward supply of goods and services or both received under Section 9(3) or (4) of CGST Act, 2017. These sub-sections provides for payment of tax by recipient of goods or services.

Where the taxpayers deals with unregistered person, tax must be paid or no stock must be held.

- He was not engaged in the manufacture of goods as notified u/s 10(2)(e) of the CGST Act, 2017 during the preceding financial year.

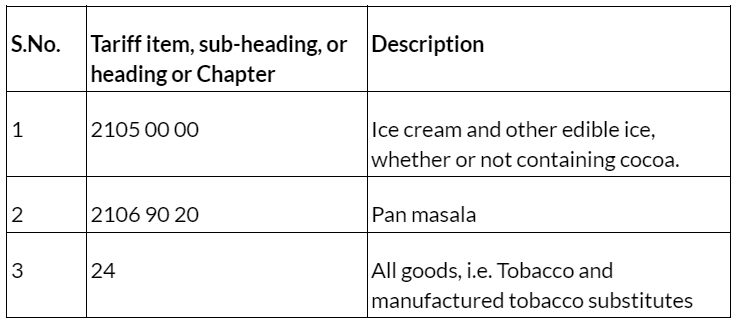

The registered person shall not be eligible to opt for composition levy under clause (e) of sub-section (1) of section 10 of the said Act if such person is a manufacturer of the following goods:

- Mandatory display on invoices of the words ”composition taxable person, not eligible to collect tax on supplies”.

- Mandatory display of the words “Composition Taxable Person” on every notice and signboard displayed at a prominent place.

Intimation for Composition levy and Effective Date

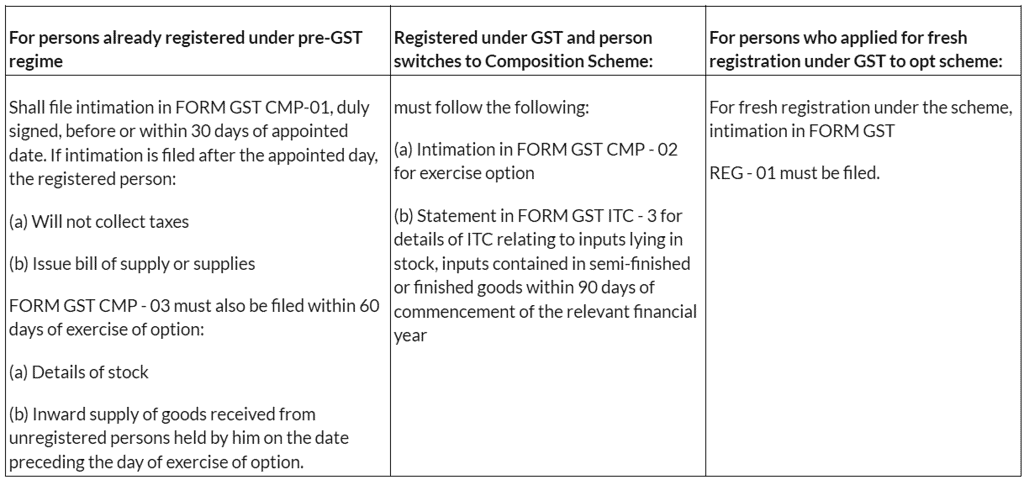

Procedure for opting for composition levy is provided in Rule 3 and 4 of CGST Rules, 2017. The assessee can be divided into three categories as follows:

Intimation for Composition Levy

As per rule 3(5) of CGST Rules 2017 intimation sent by any place of business in any State shall be deemed to be intimation in respect of other place of business under same PAN.

Rule 5(2) of the CGST Rules, 2017: Intimation in every year is not required.

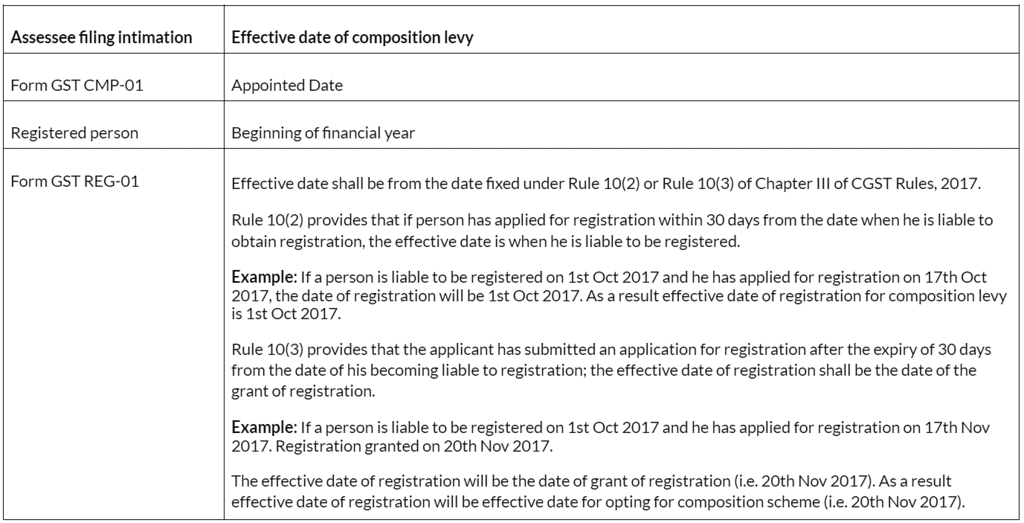

Effective date for opting composition Scheme

|

19 videos|83 docs|14 tests

|