Input Tax Credit | Goods and Services Tax (GST) - B Com PDF Download

| Table of contents |

|

| Need for ITC |

|

| What is Input? |

|

| What is Input Tax? |

|

| What is input credit? |

|

| What is Electronic Credit Ledger? |

|

| What is Electronic Cash Ledger? |

|

| Input Tax Credit of CGST/ SGST/ UTGST/ IGST |

|

Input Tax Credit (ITC) means claiming the credit of the GST paid on purchase of Goods and Services which are used for the furtherance of business. In other words, Input Tax Credit means reducing the taxes paid on inputs from taxes to be paid on output. The Mechanism of Input Tax Credit is the backbone of GST and is one of the most important reasons for the introduction of GST. As GST is a single tax levied across India (right from manufacture of goods/ services till it reaches the end customer), the chain does not get broken and everybody is able to take benefit of the same and there is seamless flow of credit.

Need for ITC

The concept is not entirely new as it already existed under the pre-GST indirect taxes regime (service tax, VAT and excise duty). Now its scope has been widened under GST. Earlier, it was not possible to claim input tax credit for Central Sales Tax, Entry Tax, Luxury Tax and other taxes. In addition, manufacturers and service providers could not claim the Central Excise duty.

Under the previous indirect tax regime of levy of Service Tax, VAT, and Excise etc. – a lot of input tax credit was not properly utilized. Earlier there were multiple types of indirect taxes and the input tax credit of one tax could not be claimed against the input tax credit of another tax. For example: Retailers who used to pay Service Tax on Rent for their Shops were not able to claim Input Tax Credit of Service Tax with the VAT which they used to charge their customers on sale of goods. However, such issues have now been removed with the introduction of GST as there is only a single indirect tax which would be levied and there would be seamless flow of credit.

What is Input?

Under GST law, the term input denotes goods except capital goods used by a supplier during his/her business to make outward supplies.

What is Input Tax?

Input tax is a tax imposed on the person when he/she receives supply of goods & services which are used for his business. In other words, when any supply of services or goods is supplied to a taxable person, the GST charged is known as Input Tax. Hence, cannot claim ITC for goods & services used for personal purposes.

What is input credit?

Input credit means at the time of paying tax on output, the trader can reduce the tax that is already paid on inputs. For example – Mr. A is a manufacturer – tax payable on output (FINAL PRODUCT) is Rs 450 and tax paid on input (PURCHASES) is Rs 300. Then the manufacture or a trader can claim INPUT CREDIT of Rs 300 and he only needs to deposit Rs 150 in taxes.

What is Electronic Credit Ledger?

It is like a passbook containing all the credits you have accumulated that is maintained on the common portal.

What is Electronic Cash Ledger?

Similar to a passbook, which contains all the taxes you have paid on the supplies that is maintained at the common portal for each taxable person registered under GST.

Conditions for availing of ITC: (Entitlement of Input Tax Credit under GST)

- Goods & services on which you want to claim ITC, should have been used onl y for business purposes

- If the constitution of registered taxable person changes due to sale, merger or transfer of business, then unused ITC shall be transferred to the sold, merged or transferred business

- To claim ITC, the Input Tax must be paid through electronic cash ledger or electronic credit ledger.

- Taxpaying documents should be available like such as tax invoice, debit note etc. They are also supporting documents.

- ITC can be claimed on taxable & zero rated supplies (exports).

- Goods / service should have been received / deemed to be received by the taxable person

- Tax charged on the invoice and should have been paid to the credit of government.

- Return should have been furnished by the tax payer.

- Credit for goods against an invoice received in lots / installments can be availed only on last lot in installment.

- The timelines for entitlement of credit against a particular invoice shall lapse on the expir y of one year from date of issue of invoice.

Input Tax Credit of CGST/ SGST/ UTGST/ IGST

GST comprises of the following levies

- Central Goods and Services Tax (CGST) [also known as Central Tax] which is levied on intra-state or intra-union territory on supply of goods or services or both.

- State Goods and Services Tax (SGST) [also known as State Tax] which is levied on supply of goods or services or both within the same state.

- Union Territory Goods and Services Tax(UTGST) [also known as Union Territory Tax] which is levied on supply of goods or services within the same union territory.

- Integrated Goods & Services Tax (IGST) [also known as Integrated Tax) on inter-state supply of goods or services of both.

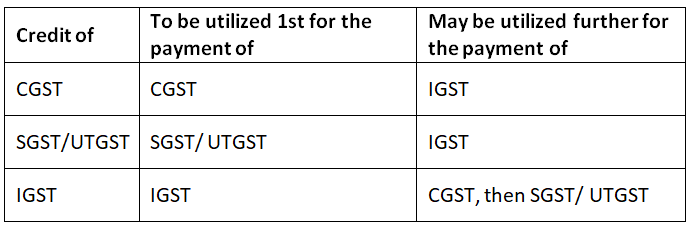

The input tax credit of these components of GST would be allowed in the following manner

- Credit of CGST: Allowed 1st for payment of CGST and the balance can be utilized for the payment of IGST. Credit of CGST is not allowed for payment of SGST.

- Credit of SGST/ UTGST: Allowed 1st for payment of SGST/UTGST and the balance can be utilized for the payment of IGST. Credit of SGST/ UTGST is not allowed for payment of CGST.

- Credit of IGST: Allowed 1st for payment of IGST, then for payment of CGST and the balance for payment of SGST/ UTGST.

This has been explained in the following table

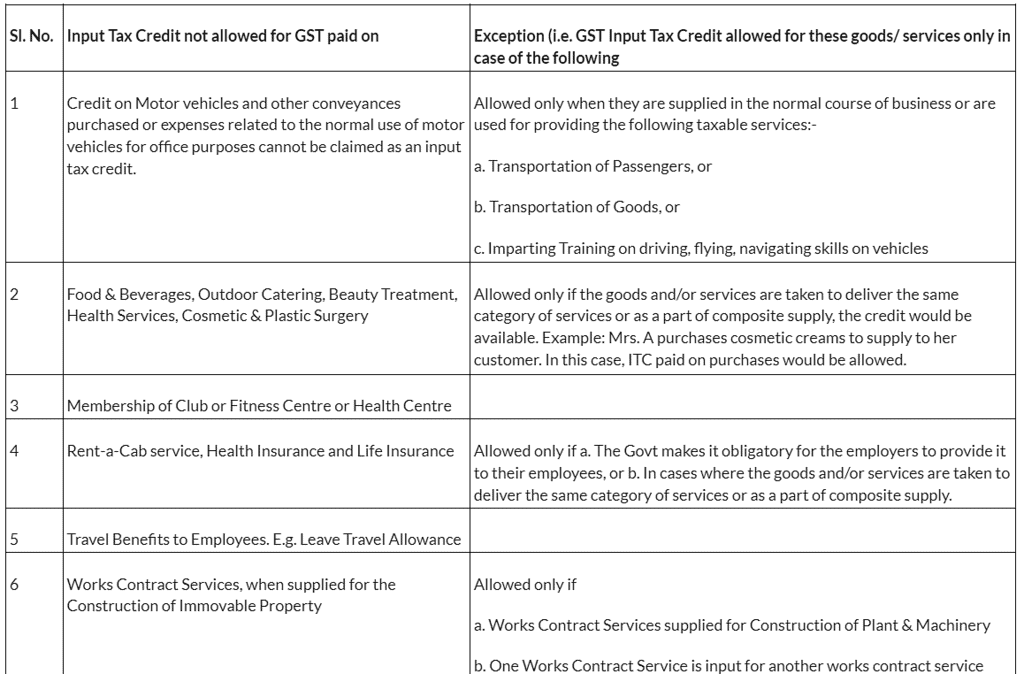

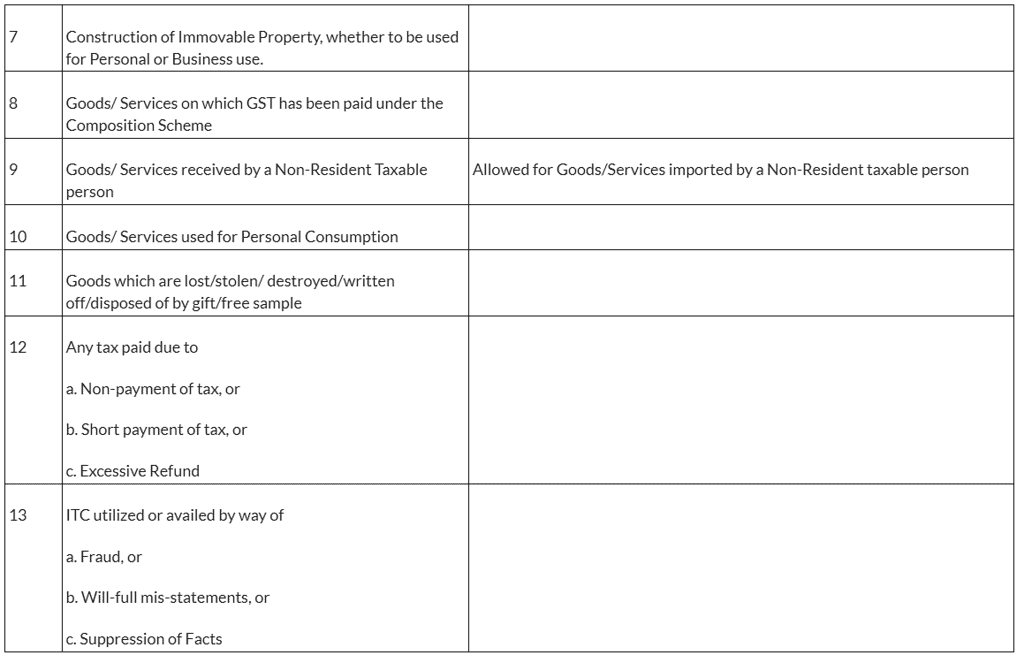

Input Tax Credit is not available to be claimed in the following cases, u/s 16(9):

Allowance/ Disallowance of Input Tax Credit

Under the GST Regime, ITC can be claimed b y every registered taxable person on all inputs used or intended to be used (whether goods or services) in the course of or for the furtherance of business (Except in certain specified cases). The specified cases where the input tax credit would not be allowed are mentioned below:

The Input Tax Credit of GST paid on all other goods and services which are used for the furtherance of business would be allowed.

Documents On The Basis Of Which the ITC Can Be Claimed

- Invoice issued by supplier of goods or services or both.

- Invoice issued by Recipient along with proof of payment of Tax.

- A Debit note issued by the supplier.

- Bill of entry or similar document prescribed under the Customs Act.

- Revised Invoice.

- Document issued by the Input Service Distributer.

ITC Allowed Only For Goods and/or Services Used For Business

- Input Tax Credit is not allowed for Goods and Services used for Personal Use.

- When Goods and/or Services are received partly for Business and partly for personal use, one can avail ITC but only for the portion which is used for Business.

- When goods and/or services are used partly for taxable supplies and partly for exempt supplies, one can avail ITC only on the portion used for making taxable supplies and zero rated supplies.

- ITC is not allowed on the portion used for making exempt supplies.

Transfer of Input Tax Credit

- A registered taxpayer can apply for transfer of matched input tax credit that is available in the Electronic Ledger to another business organization in case of transfer of business by way of sale of business/merger/demerger by the filing of ITC declaration in Form GST ITC – 02.

- For a registered taxable person, if the constitution changes due to merger, sale or transfer of business, then the input tax credit which is unused shall be transferred to the merged, sold or transferred business.

Claim of Input Tax Credit

The following conditions have to be met to be entitled to Input Tax Credit under the GST scheme:

- One must be a registered taxable person.

- One can claim Input Tax Credit only if the goods and services received is used for business purposes.

- Input Tax Credit can be claimed on exports/zero-rated supplies and are taxable.

- For a registered taxable person, if the constitution changes due to merger, sale or transfer of business, then the Input Tax Credit which is unused shall be transferred to the merged, sold or transferred business.

- One can credit the Input Tax Credit in his Electronic Credit Ledger in a provisional manner on the common portal as prescribed in model GST law.

- Supporting documents – debit note, tax invoice, supplementary invoice, are needed to claim the Input Tax Credit.

- If there is an actual receipt of goods and services, an Input Tax Credit can be claimed.

- The Input Tax should be paid through Electronic Credit/Cash ledger.

- All GST returns such as GST-1, 2,3, 6, and 7 needs to be filed.

Other Relevant Points Regarding GST Input Tax Credit

- Input Tax Credit can be availed by a registered person only if all the applicable particulars as prescribed in the Invoice Rules are mentioned in the Invoice.

- If the tax paid on inputs is more than the tax paid on output, the ITC can either be carried forward or claimed as refund.

- The balance tax after claiming the input tax credit shall be deposited with the Govt under GST Input Tax Credit (ITC).

- Claiming of ITC would not be allowed beyond September of the following Financial Year to which the invoice pertains or the date of filing of Annual Return whichever is earlier.

- A person who has applied for GST Registration within 30 days of becoming liable for Registration is entitled to claim ITC in respect of goods held in stock on the day immediately preceding the date from which he becomes liable to pay tax.

- A person switching over to the normal scheme from the composition scheme u/s 10 is entitled to ITC in respect of goods held in stock and capital goods on the day immediately preceding the day from which he becomes liable to pay tax as a normal taxpayer.

- Where an exempt supply of goods or services or both becomes taxable, the person making such supplies shall be entitled to take ITC in respect of goods held in stock relatable to exempt supplies. He shall also be entitled to take credit on capital goods used exclusively for such exempt supply.

- In case of change of constitution of a registered person on account of sale, merger, demerger etc. the unutilized ITC shall be allowed to be transferred to the transferee.

- The GST paid under the Reverse Charge Mechanism can also be claimed as Input Tax Credit.

- The Input Tax Credit is also allowed on GST paid on Capital Goods.

- No ITC would be allowed if Depreciation has been claimed on the Tax component of the Capital Goods.

- The details of GST paid on inputs would be auto-populated in the GSTR 2.

However, the details of GST paid on Inputs on Reverse Charge basis would not be auto populated. The details of GST paid on Reverse Charge Basis would be manually required to be furnished in the GSTR 2.

Matching, Reversal and Reclaim of Input Tax Credit: (Section 42 of CGST Act 2017)

Provisions under Section 42 of the Central Goods and Services Tax (CGST) Act, 2017 relating to “Matching, Reversal and Reclaim of Input Tax Credit (ITC)”, are as under:

- The details of every inward supply furnished by a registered person (hereafter referred to as the “recipient”) for a tax period shall, in such manner and within such time as may be prescribed, be matched–

- With the corresponding details of outward supply furnished by the corresponding registered person (hereafter referred to as the “supplier”) in his valid return for the same tax period or any preceding tax period;

- With the integrated goods and services tax paid under section 3 of the Customs Tariff Act, 1975 in respect of goods imported by him; and

- For duplication of claims of input tax credit.

- The claim of input tax credit in respect of invoices or debit notes relating to inward supply that match with the details of corresponding outward supply or with the integrated goods and services tax paid under section 3 of the Customs Tariff Act, 1975 in respect of goods imported by him shall be finally accepted and such acceptance shall be communicated, in such manner as may be prescribed, to the recipient.

- Where the input tax credit claimed by a recipient in respect of an inward supply is in excess of the tax declared by the supplier for the same supply or the outward supply is not declared by the supplier in his valid returns, the discrepancy shall be communicated to both such persons in such manner as may be prescribed.

- The duplication of claims of input tax credit shall be communicated to the recipient in such manner as may be prescribed.

- The amount in respect of which any discrepancy is communicated under sub-section (3) and which is not rectified by the supplier in his valid return for the month in which discrepancy is communicated shall be added to the output tax liability of the recipient, in such manner as may be prescribed, in his return for the month succeeding the month in which the discrepancy is communicated.

- The amount claimed as input tax credit that is found to be in excess on account of duplication of claims shall be added to the output tax liability of the recipient in his return for the month in which the duplication is communicated.

- The recipient shall be eligible to reduce, from his output tax liability, the amount added under sub-section (5), if the supplier declares the details of the invoice or debit note in his valid return within the time specified in sub-section (9) of section 39.

- A recipient in whose output tax liability any amount has been added under sub-section (5) or sub-section (6), shall be liable to pay interest at the rate specified under sub-section (1) of section 50 on the amount so added from the date of availing of credit till the corresponding additions are made under the said sub-sections.

- Where any reduction in output tax liability is accepted under sub-section (7), the interest paid under sub-section (8) shall be refunded to the recipient by crediting the amount in the corresponding head of his electronic cash ledger in such manner as may be prescribed: Provided that the amount of interest to be credited in any case shall not exceed the amount of interest paid by the supplier;

- The amount reduced from the output tax liability in contravention of the provisions of subsection (7) shall be added to the output tax liability of the recipient in his return for the month in which such contravention takes place and such recipient shall be liable to pay interest on the amount so added at the rate specified in sub-section (3) of section 50.

|

20 videos|77 docs|14 tests

|

FAQs on Input Tax Credit - Goods and Services Tax (GST) - B Com

| 1. What is the need for Input Tax Credit (ITC)? |  |

| 2. What is meant by Input Tax? |  |

| 3. What is Input Credit? |  |

| 4. What is an Electronic Credit Ledger? |  |

| 5. What is an Electronic Cash Ledger? |  |