SSC CGL Income Tax Inspector Salary, Syllabus, Eligibility PDF Download

The SSC CGL Income Tax Inspector is a Group ‘C’ position within the Central Board of Direct Taxes (CBDT) under the Ministry of Finance, Government of India. This position is highly sought after by SSC CGL candidates. As an Income Tax Inspector, the individual holds an authoritative role within the Income Tax Department and handles tax-related matters under the jurisdiction of the Central Board of Direct Taxes (CBDT).

SSC CGL Income Tax Inspector: Training and Job Profile

Upon selection, Income Tax Inspectors are assigned to one of the various divisions of the Income Tax department such as Raids and Surveys, TDS, Corporate Taxation, International Taxation, etc. throughout India. - Following selection, they undergo a mandatory induction training period of 3 months at the Direct Taxes Regional Training Institute (DTRTI), where they receive lectures on their responsibilities, the basics of the income-tax system, standard operating procedures (SOPs) for conducting raids and surveys, etc.

- The work profile of an Income Tax Inspector is categorized into Assessment and Non-Assessment Sections, and the two areas can be interchanged every two years. The Assessment Section mainly involves desk job activities such as assessment and verification of income tax returns filed by citizens, handling TDS-related queries, managing ITR refund claims, preparing audit reports, and daily departmental file work.

- Income Tax Inspectors posted in the Non-Assessment section are typically involved in conducting scheduled raids and surveys for income tax cases, and assist senior officers in reporting to the Ministry of Finance such as ITO, Joint Secretary, etc.

SSC CGL Income Tax Inspector: Salary

The salary package of an SSC CGL Income Tax Inspector varies according to their location of recruitment. The approximate in-hand monthly salary for this position can be seen below:

SSC CGL Income Tax Inspector: Allowances and Deductions

An approximate salary breakdown for SSC CGL Income Tax Inspector can be seen below.

Classification of Cities

To grant House Rent Allowances to Central government employees, the cities/towns are categorized as “X’, “Y’ and "Z". The allowances then vary on the basis of the category of city. Candidates can see the list of cities in each category from the table given below.

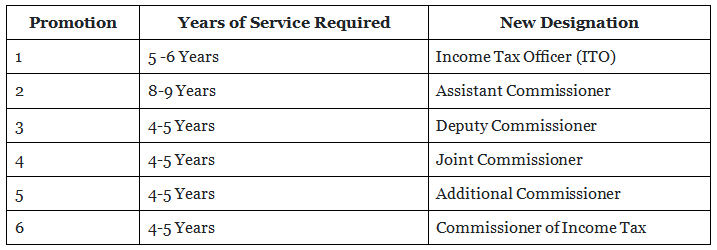

SSC CGL Income Tax Inspector: Promotion and Career Growth

The career growth of candidates who are recruited as Income Tax Inspectors is purely based on their hard work and skills. The following promotions are there in the career graph of Income Tax Inspectors if they serve diligently for a certain period.

SSC CGL Income Tax Inspector: Eligibility Criteria

SSC CGL Income Tax Inspector eligibility criteria are given in the following table. The candidates are advised to thoroughly go through the eligibility criteria before they apply for the job. Colour Blind candidates can also apply for the Income Tax Officer post.

SSC CGL Income Tax Inspector: Vacancy

The details about SSC CGL Income Tax Inspector vacancies for the current and previous years have been given below for the reference of the candidates.

SSC CGL Income Tax Inspector: Selection Process

The SSC CGL selection process has been revised according to the official notification for the 2022 exam. The selection process for the post of Income Tax Inspector is outlined below.- All candidates must take the Tier 1 exam.

- Candidates applying for the Income Tax Inspector post need only appear for Paper I in the Tier 2 exam. Paper I comprises three sections, each of which is divided into two modules. The sections and their modules are as follows:

- Section 1: Mathematical Abilities (Module 1) and Reasoning and General Intelligence (Module 2)

- Section 2: English Language and Comprehension (Module 1) and General Awareness (Module 2)

- Section 3: Computer Knowledge Test (Module 1) and Data Entry Speed Test (Module 2)

- Qualifying candidates will undergo document verification and a medical examination for final selection.

SSC CGL Income Tax Inspector: Exam Pattern

For the SSC CGL Income Tax Inspector post, the selection process is now conducted in two tiers i.e. Tier 1 and Tier 2. The questions will be set both in Hindi and English. The exam pattern can be seen below in the table.

SSC CGL Income Tax Inspector: Cutoff

SSC CGL Exam for Income Tax Inspector is conducted in 3 tiers and Cutoff marks are released separately for Tiers 1, 2, and 3. The aspirants can check the Cutoff range for the General category given here to get an approximate idea of the expected SSC CGL cutoff.

SSC CGL: Income Tax Inspector v/s Sub Inspector (CBI)

The Income Tax Department, an enforcement agency under the Government of India, is responsible for monitoring income tax collection, while the Central Bureau of Investigation serves as a police agency focused on preventing corruption. An Income Tax Inspector holds investigative powers related to income tax and enjoys a balanced work-life profile, whereas a CBI Sub Inspector wields criminal investigation powers and operates in a more challenging work environment. Income Tax Officers generally have better opportunities for promotion than CBI Sub Inspectors. Being a popular job offered by SSC CGL, the Income Tax Inspector position boasts high social status and a competitive salary. Working in one of the oldest departments and receiving timely promotions contribute to its prestige. As a government job that ensures a stable career, the SSC CGL exam is among the most coveted and sought-after exams in the country.SSC CGL Income Tax Inspector FAQs

What is the minimum salary of an SSC CGL Income Tax Inspector?

The minimum salary of an SSC CGL Income Tax Inspector varies according to the geographical location, but the basic salary for a fresher is Rs. 44,900 per month.

What is the career growth possibility of an Income Tax Inspector in CBDT?

The Income Tax Department is highly respected due to its timely promotions and progression opportunities. An Income Tax Inspector can expect promotions based on their years of service. The first promotion is to the post of Income Tax Officer, followed by Assistant Commissioner of Income Tax (ACIT), Deputy Commissioner of Income Tax (DCIT), Joint Commissioner of Income Tax (JCIT), Additional Commissioner of Income Tax (ADCIT), and Commissioner of Income Tax.

How long is the training period for an Income Tax Inspector?

The training period for an Income Tax Inspector is 12 weeks, which is mandatory for all selected candidates. The training will be conducted at the Direct Taxes Regional Training Institute (DTRTI).

How many vacancies are there for the post of Income Tax Inspector?

According to the SSC CGL 2022 vacancy details, there are a total of 355 vacancies available for the post of Income Tax Inspector.

Can a colorblind person apply for the inspector post in the Income Tax Department?

Yes, a colorblind person is eligible to apply for the post of Income Tax Inspector in the Central Board of Direct Taxes.

Is it possible for an Income Tax Inspector in CBDT to be transferred?

Yes, a transfer is possible for an Income Tax Inspector, but it may not be easy to get. There are two options available for transfers: Annual General Transfer and Interchange Transfer. To avail a transfer, vacancies must be available in the desired zone and the candidate must either be eligible for applying for a transfer or have completed at least 3 years of service.

FAQs on SSC CGL Income Tax Inspector Salary, Syllabus, Eligibility

| 1. What is the salary of an SSC CGL Income Tax Inspector? |  |

| 2. What is the eligibility criteria for the SSC CGL Income Tax Inspector exam? |  |

| 3. What is the selection process for the SSC CGL Income Tax Inspector exam? |  |

| 4. What is the job profile of an SSC CGL Income Tax Inspector? |  |

| 5. How is the promotion and career growth for an SSC CGL Income Tax Inspector? |  |

|

Explore Courses for SSC CGL exam

|

|