Talbot Trucks Case Interview | Case Studies - Interview Preparation PDF Download

Client goal

Our client is Talbot Trucks. Talbot Trucks has approached McKinsey for help in assessing the feasibility of manufacturing electric trucks to reduce its fleet’s carbon footprint.

Situation description

Talbot Trucks is a Europe-based private truck OEM. It produces and sells trucks all over the world. Talbot Trucks is considered a leader in quality manufacturing. Its primary customer base includes large trucking companies that own thousands of trucks and owner-operators, which are smaller customers that own fewer trucks.

Trucks today are mainly powered by diesel engines and require carbon-based petroleum fuel. Talbot Trucks is interested in exploring ways to reduce the carbon footprint of its vehicles and has specifically asked about electric trucks, or “eTrucks.”

ETrucks and diesel trucks differ in the design—e-motor and batteries versus combustion engines—and also in the way they are fueled, meaning comparably slow charging versus quick refilling with diesel fuel at gas stations. The introduction of this new technology is disruptive for the manufacturers as well as customers both large and small.

McKinsey study

The CEO of Talbot Trucks has approached McKinsey to help determine the attractiveness of an investment in eTruck manufacturing for its European market.

Helpful hints

- Write down important information.

- Feel free to ask the interviewer to explain anything that is not clear to you.

Q.1. What information would you want to collect to understand the attractiveness for Talbot Trucks in producing and selling eTrucks in Europe?

Market:

(i) What are the differences between large and small truck customers in terms of price, features, reliability, and volume, and how will this impact the success of Talbot Trucks' eTrucks?

(ii) Which European geographies are most receptive to eTrucks and why? Is it due to an environmentally conscious population, government policies, or other factors?

(iii) How will Talbot Trucks' eTrucks be perceived by customers in comparison to existing competitors or new entrants, and what potential substitutes, such as rail, could impact the market?Financials:

(i) Are there different market segments or use cases for eTrucks, and how does revenue potential differ between these segments?

(ii) What are the main cost drivers for Talbot Trucks, and how do they compare to competitors in the eTruck market?

(iii) What price points can be expected for Talbot Trucks' eTrucks in different market segments?Risks:

(i) How much experience does Talbot Trucks have with eTrucks, and what are the potential risks associated with producing a new product in a cost-efficient and reliable way?

(ii) What will happen to sales of Talbot Trucks' current truck models when eTrucks are introduced to the market?

(iii) Will legislation force a move towards eTrucks, and what risks are associated with actively addressing the issue instead of waiting it out?

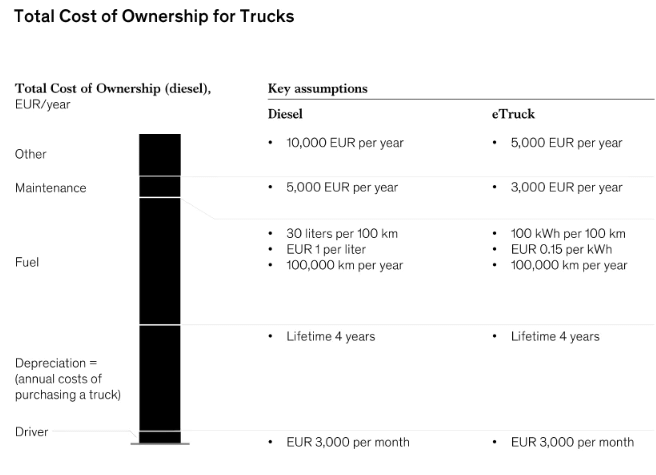

Q.2. The team set out to investigate the major cost drivers for buying and operating one diesel truck, an analysis commonly referred to as “total cost of ownership” (TCO). You have been given the following information comparing the TCO for a diesel truck against that for an eTruck:

Driver: A driver costs around €3,000 per month. There is a significant shortage of drivers in the market

Depreciation: Diesel trucks costs €100,000. The typical lifespan is four years. Residual value—the value at which you can resell the truck—is assumed to be €0

Fuel: A heavy duty diesel truck consumes around 30 liters of diesel per 100 kilometers. Diesel costs €1 per liter

Maintenance: As a general rule, maintenance per truck is around €5,000 a year for a diesel truck Other, including tolls, insurances, and taxes: €10,000 per year

Using this data, what can you infer about the differences in TCO for diesel trucks vs eTrucks?

(i) The main cost drivers for eTrucks are fuel and depreciation.

(ii) Compared to diesel trucks, eTrucks have a lower cost per kilometer, making them more attractive for long-distance haulage.

(iii) Depreciation can be higher for eTrucks, as the technology is newer and may be more expensive.

(iv) Other costs, such as maintenance and repair, are generally lower for eTrucks, possibly due to tax breaks or other financial incentives.

Q.3: After running focus groups with Talbot Trucks’ customers, the team concluded that the total cost of an eTruck needs to be the same as a diesel truck to be considered attractive to customers. Currently, a Talbot Trucks diesel truck costs €100,000.

Assuming that the figures above do not change, what is the maximum price Talbot Trucks can charge for its eTruck so that the total cost of ownership is equal to that of a diesel truck?

To determine the total cost of ownership (TCO) for a diesel truck, the following five components need to be considered:

(i) Driver costs: €3,000 per month x 12 months = €36,000

(ii) Depreciation: €100,000 over a lifespan of 4 years = €25,000 per year

(iii) Fuel: 30 liters / 100 km x €1 per liter x 100,000 km per year = €30,000

(iv) Maintenance: €5,000

(v) Other: €10,000This results in a total annual cost of ownership of €106,000 for a diesel truck.

On the other hand, an eTruck's TCO is comprised of four components:

(i) Driver costs: €3,000 per month x 12 months = €36,000

(ii) Fuel: 100 kWh / 100 km x €0.15 per kWh x 100,000 km per year = €15,000

(iii) Maintenance: €3,000

(iv) Other: €5,000This results in a total annual cost of ownership of €59,000, not including depreciation.

If the annual TCO for an eTruck is equal to that of a diesel truck, which is €106,000, the annual depreciation for an eTruck would be €47,000 (€106,000 - €59,000).

To match the TCO of a diesel truck over a four-year lifetime, the maximum purchase price for an eTruck would be €188,000 (€47,000 x 4 years).

|

16 docs

|