ABC Analysis | Cost Accounting - B Com PDF Download

ABC analysis/ABC classification

- ABC classification (also called ABC analysis) is used by inventory management teams to help identify the most important stock items in their portfolio and ensure they focus on managing them above those less valuable. Using ABC classification, inventory is divided into three categories, A (most important), B (fairly important) and C (least important).

- An ABC inventory classification system, or ABC analysis, is based on the theory that all inventory is not of equal value. Instead it follows the Pareto Principle, where 20% of stock accounts for 80% of the value to the business.

we’re going to discuss how you can practically classify your inventory into categories, using a working ABC classification example. We’ll then show you how to take things one step further by introducing the concept of XYZ analysis.

Working Examples

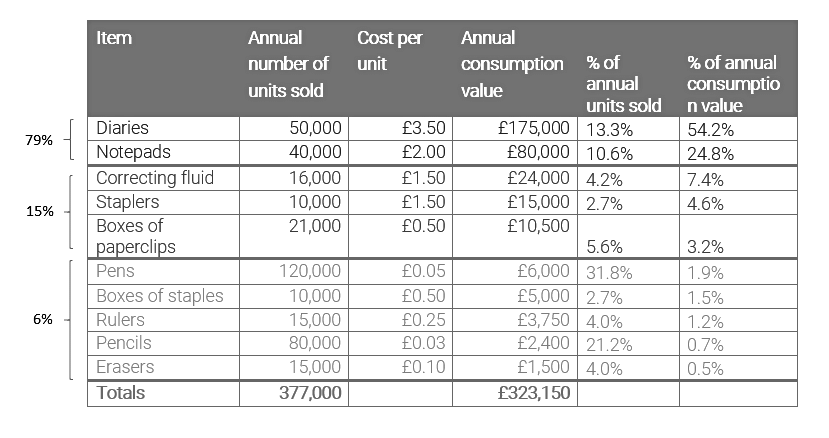

Here is a working example of ABC classification, showing how to divide up your inventory, using annual consumption value (or usage value).

We’re going to use Sam’s Stationery business as the example:

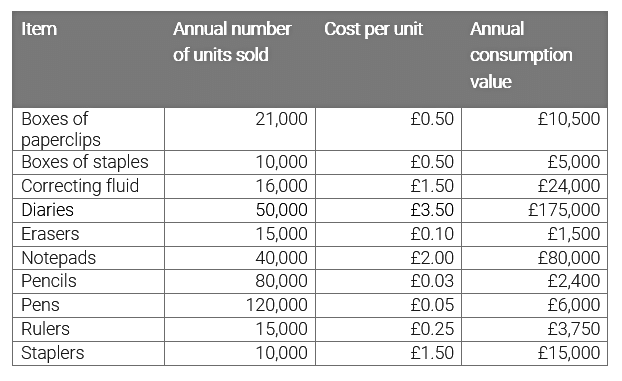

Example 1: Use the formula ‘annual number of units sold x cost per unit’ to calculate the annual consumption value of each item

Annual number of units sold (per item) x cost per unit

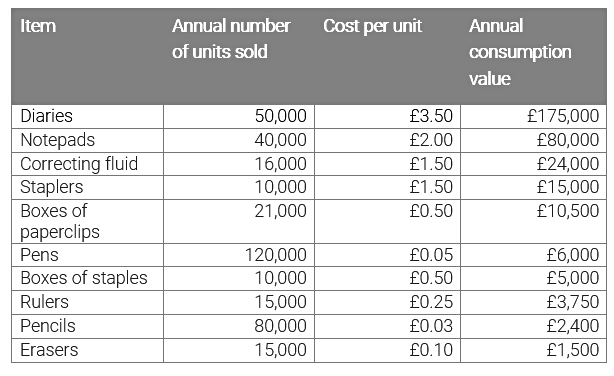

Example 2: List your products in descending order, based on their annual consumption value

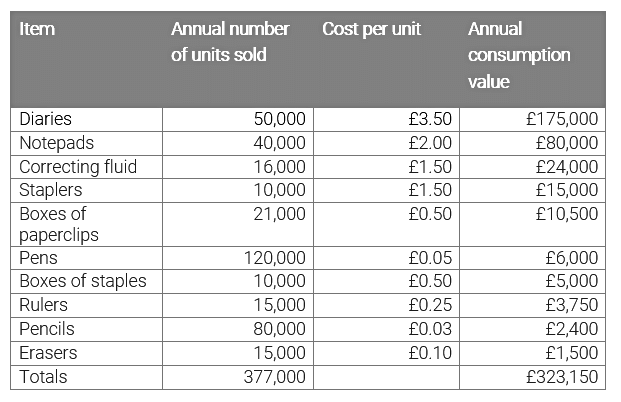

Example 3: Total up the number of units sold and the annual consumption value

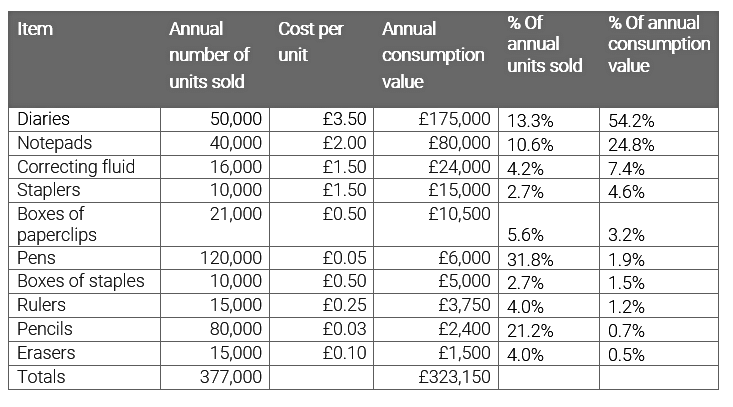

Example 4: Calculate the cumulative percentage of items sold and cumulative percentage of the annual consumption values

Example 5: Determine the thresholds for splitting the data into A, B and C categories. The threshold for determining the ABC split will be unique to your company and your product mix, but typically it’s close to 80% / 15% / 5%.

Utilising ABC classification data

With the calculations complete, you can use your final data to review how you currently manage the inventory in each category. If you find that you’re treating all items the same, in terms of the stock you hold and the purchases you make – regardless of their category – then you’re most likely to have inefficient inventory policies. This means you’re probably over and under ordering on many product lines.

The good news is that there’s plenty of room for improvement! And this will bring about reduced storage, delivery and management costs.

Good practice is to adapt your purchasing and inventory policies for each group. This could include setting up sophisticated ordering processes for all A items, such as checking every purchase order and spending more time discussing lead times with suppliers to guarantee best value and timely deliveries.

In contrast, C items should take up much less of your time and could be ordered automatically to save valuable human resource.

From ABC classification calculations in excel to automation systems

ABC classification is a simple framework that allows you to prioritise what to stock to focus on and how to manage your time. However, the model does have its drawbacks.

For starters it’s one-dimensional, so can only use one factor to evaluate and categorise products. For a more advanced classification framework that is still possible to carry out in excel, you could consider ABC XYZ analysis. This introduces the concept of forecastability, e.g how easy it is to forecast the demand for an item, based on its variability of demand. ABC XYZ analysis therefore allows you to segment items based on their value AND forecastability, again improving your stocking policies and inventory management processes.

ABC classification and XYZ analysis both still have a glaringly obvious limitation – they are manual processes, taking up value time and quickly becoming out-of-date. Despite some enterprise resource planning (ERP) systems or inventory management software solutions providing basic inventory classification functionality, often inventory planners will use excel spreadsheets for such calculations. This can lead to classification models quickly becoming out of date. Products can rapidly move between categories as their sales/consumption rises and falls. Updating calculations once a quarter, or even every month can be very time consuming. Unfortunately, as soon as your spreadsheet is completed it will begin to go out-of-date.

The answer is to use an inventory optimisation tool to automate the process. By automating your inventory classification process, you can be sure that it stays up-to-date with re-classifications taking place daily, so products are always managed according to the most relevant inventory policy.

|

103 videos|131 docs|14 tests

|