Key Notes: Depreciation, Provisions and Reserves | Accountancy and Financial Management - B Com PDF Download

Learning Objectives

After studying this lesson, you will be able to:

- State the meaning and concept of depreciation.

- Explain the need and factors affecting depreciation.

- Explain the methods of charging depreciation.

- Show the Accounting Treatment of Depreciation.

- State the meaning of Provisions and Reserve.

- Differentiate between Provision and Reserve.

Teaching Methods

Teachers are advised to use various examples from daily life in order to clear the concept of depreciation.

Depreciation Concept:

- Fixed assets are held on a long term basis and used to generate periodic revenue. That portion of assets, which is believed to have been consumed or expired to earn the revenue, needs to be charged as cost. Such an appropriate proportion of the cost of fixed assets is called Depreciation.

- Business enterprises require fixed assets for their business operations such as furniture and fixtures, office equipment’s plant and machinery, motor vehicles, land and building etc. In the process of converting Raw material into finished products, the fixed assets depreciate in value over a period of time, i.e. its useful life.

In other words, the process of allocation of the cost of a fixed asset over its useful life is known as depreciation.

Need or objectives of providing Depreciation

- Ascertaining true profit or loss:

(i) The true profit of an enterprise can be ascertained when all costs incurred for the purpose of earning revenues have been debited to the profit and loss account.

(ii) Fall in the value of assets used in business operations is a part of the cost and should be shown in the profit and loss account of concerned accounting period.

(iii) Keeping this in view, depreciation must be debited to profit & loss account, since loss in value of fixed assets is also an expenses like other expenses. - Presentation of True and Fair value of assets: If depreciation is not pro- vided, the value of assets shown in Balance sheet will not present the true and fair value of assets because assets are shown at the cost price but actual value is less than cost price of the assets.

- To ascertain the accurate cost of the Production: Depreciation is an item of expense, the correct cost of production cannot be calculated unless it is also taken consideration. Hence, depreciation must be provided to ascertain the corn- recto cost of production.

- Computation of correct income tax:

(i) Income tax of an enterprise is determined after charging all the costs of production.

(ii) If depreciation is not charged, the profits will be higher and the income tax will also be higher.

(iii) If depreciation is charged, Tax liability is reduced. - Provision of funds and replacement of assets: Depreciation is a non-cash expense. So that amount of depreciation charged to profit and loss accounts is retained in business every year. These funds are available for replacement of the assets when its useful life is over.

Methods of providing depreciation

- Straight line method

(i) This method is also known as ‘original cost method’

(ii) Under this method, depreciation is charged at fixed percentage on the original cost of the asset, throughout its estimated life.

(iii) Under this method of the amount of depreciation is uniform from year to year. That is why this method is also known as ‘Fixed Installment Method’ or Equal installment method’.

(iv) The annual amount of depreciation can be easily calculated by the following formula:

Annual Depreciation = Original Cost – Estimated scrap value/Estimated life in Years

For examples: A firm purchases a machine for Rs. 2,25,000 on April 1, 2013. The expected life of this machine is 5 years. After 5 years the scrap of this machine would be realized Rs. 25,000. Under straight line method, the amount of depreciation can be calculated as under:

Annual Depreciation =

= Rs. 40,000

Hence Rs. 40,000 will be charged every year as depreciation on this machine. - Diminishing balance method: Under this method, depreciation is charged as a fixed percentage on the book value of the asset every year. In first year the depreciation will be charged at the end of the year, on the total cost the asset.

Hence, in Straight Line method, amount of depreciation is same but in Diminishing Balance Method amount of depreciation goes on decreasing every year.

Depreciation can be recorded by crediting it to the Assets account.

Working Notes:

Cost of 1st Machine – Rs. 5,82,000 + Rs. 18,000 – Rs. 6,00,000 Profit/Loss on sale of 1st

Machine = Cost of 1st July – Sale Value

(Rs. 4,86,000 – Rs. 24,300) Rs. 4,61,700 – Rs. 2,86,000 Loss on Sale of Machine

= Rs. 1,75,700

Working Notes:

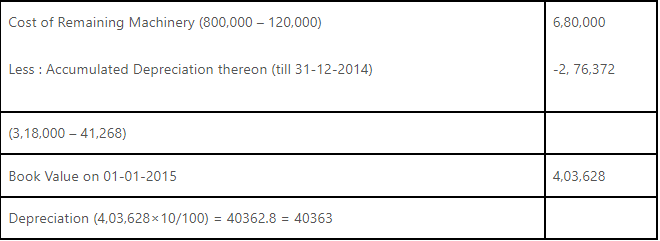

Depreciation charged on Sold Machinery

Depreciation on Remaining Machinery

Provisions

- Provision is to be made is respect of a liability, which is certain to be incurred, but its accurate amount is not known.

- It is charged in the Profit and loss Account on estimate basis. It Should be clearly understood that if the amount of a known liability can be determined with reasonable accuracy, it can not a provision.

Notes: Provision is a charge against profits it means provision has to be made irrespective of business enterprise it earning enough profits or incurring losses.

Examples of Provisions: Provision for Depreciation on assets, Provision for Repairs and Renewals of assets. Provision for Taxation, Provision for Discount on Debtors, Provision for Bad and Doubtful Debts.

Reserves

- Reserves are the amount set aside out of profits. It is an appropriation of profits and not a charge on the profits.

- The amount of profit retained is used in the business when difficult time comes. Since reserves are neither expenses nor losses, so these are not charged to profit & loss Account rather these are debited to Profit & Loss Appropriation Account which is prepared after Profit and Loss Account.

- Reserves are also known as ‘Plough Back of Profits’.

- Reserves are created to strengthening the financial positions of the business enterprise.

- Examples are General Reserves, Dividend Equalization Reserve etc.

- If the amount of reserve is invested outside the business then, it is called ‘Reserve Fund’.

- Creation of reserve does not reduce the not profit but only reduced the divisible profits.

Difference between Provisions And Reserve

Types of Reserve

- General Reserve/Revenue Reserves: If the purpose of creating the reserve is to meet any unforeseen contingency (Liability which is not known) in future, the reserve is called ‘General Reserve’. These are retained for strengthening the financial position of the enterprise. These reserves are also known as Revenue Reserves.

- Specific Reserves: Specific reserves are those reserves which are created for a specific purpose and can be utilized only for that purpose. ‘Dividend Equalization Reserve’ and ‘Reserve for Replacement of Asset’ are the examples of Specific Reserve.

- Capital Reserve: In addition to the normal profits, capital profits are also earned in the business from many sources. Reserves created out of capital profits which are.

- Not of recurring nature.

- Not readily available for distribution as dividend among the shareholders.

- These reserve can be utilized for writing off capital losses.

Capital Reserves may be created out of profits such as Profit on sale of any fixed asset, Profit on revaluation of assets, Profit from forfeiture of shares, Profit prior to incorporation of company.

|

44 videos|75 docs|18 tests

|

|

44 videos|75 docs|18 tests

|

|

Explore Courses for B Com exam

|

|