Long Answer Questions: Forms of Business Organisation | Business Studies (BST) Class 11 - Commerce PDF Download

Q1: Explain the important characteristics and differentiate between the various types of business enterprises.

Ans: Characteristics of Business Enterprises:

The main characteristics of various types of business enterprises are given below –

- Public Sector Enterprises: Public enterprises or public sector enterprises are those enterprises that are owned and operated by the government. The capital of such enterprise is contributed by the central government, state government, or the local government.

Their characteristics are as follows:

(a) State ownership: Public enterprises are owned by the government. Even where private entrepreneurs are permitted to invest capital, more than 50 percent of capital is in government hands.

(b) Government control: The management and control of public enterprise exclusively risk with the government. Parliamentary control is exercised over public enterprises.

(c) Service motive: The public welfare or service is the main objective of public enterprise though it may also earn profits. There is usually benevolent management in public enterprises.

(d) Public accountability: The capital of public enterprise is supplied from the public exchequer or government department in charge of public money. Therefore, public enterprises are accountable to the general public.

Private Sector Enterprises: The characteristics of private sector enterprises are as follows:

(a) Private ownership: It is owned and managed by a private enterprise or group of individuals. The entire share capital is provided by these businessmen.

(b) No state participation: There is no participation by the Central or state governments in the establishment and ownership of a private-sector enterprise.

(c) Independent management: The management and control of a private-sector enterprise are vested in the hands of one or more private businessmen.

Management is accountable to the owners (their elected representatives). There is no interference by the government in internal management.

(d) Profit motive: The main object of a private-sector enterprise is to earn profits rather than to render service to society.

Joint Sector Enterprises: The characteristics of joint sector enterprises are as follows:

(a) Mixed ownership: The government, private entrepreneurs, and the investing public jointly own a joint sector enterprise.

(b) Combined management: The management and control of a joint sector enterprise lie with the nominees or representatives of the government, private businessmen, and the public.

(c) Share capital: The shares of the government, private businessmen and the public in the capital are 26 percent, 25 percent, and 49 percent, respectively. The aim is to pool the financial resources and technical knowledge how of the state and the private individuals.

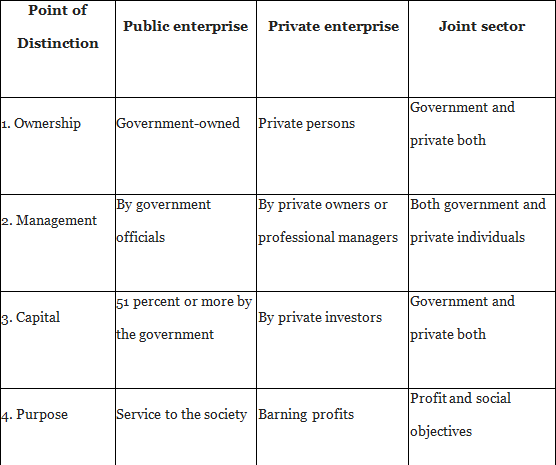

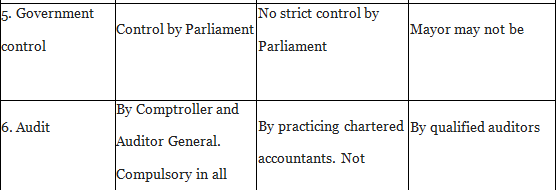

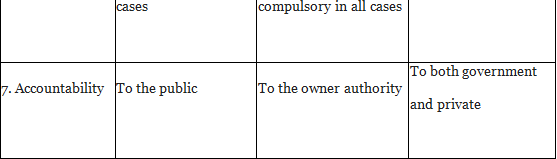

Comparison Between Private, Public, And Joint Sector Enterprises:

Q2: What is the scope of setting small business and also give reasons for considerable scope of setting small scale businesses in our country?

Ans: Scope of setting up small business enterprises:

There is considerable scope for setting up small scale units due to the following reasons –

- Limited Demand: The demand for certain products is local and seasonal. In such cases, it is not economical to attempt a scale of operation which exceeds local demands. Brick kilns, hair: cutting saloons, restaurants, etc. are examples of such cases. In the case of perishable goods also, the size of firms tends to be small. In certain cases, the nature of the production process favors small units.

- Specialised Service: When an enterprise supplies specialized services, small scale firms are more suitable. Beauty parlors, interior decorators, and tailoring shops are examples of this type. A small firm can understand its customers and can provide personal attention which may not be possible in a large-scale enterprise. Similarly, firms providing professional services like eye clinic, tax consultancy, chartered accountancy, etc. are also organized as a small scale because they must maintain, personal touch with their clients. Thus, small firms are required to cater to individual tastes and fashions and to render personalized services to consumers.

- Flexibility: Certain businesses are subject to wide variations in demand, e.g. manufacture of jewelry, ready: made garments, etc. In such cases, greater flexibility of operations is required. Small firms can be more flexible due to simple technology and low overheads. They are capable of being adapted to changing tastes and fashions. They can easily make changes in products and can shift to new lines of business whenever the need arises. Therefore, small firms are more suitable for manufacturing and selling specialty items that may be popular for only a short period of time.

- Employee relations: When close rapport with employees is essential to provide high-quality products to the customers, small scale unit is in a better position. The owners, also the managers of such business have the most valuable advantage of being close to the employees. They know better their problems and can take necessary remedial measures quickly and efficiently.

- Introduction of New Products: Before starting the production of a new product on a commercial scale, it is always desirable to test it in the market. In the initial stages, the requirements of customers and management are uncertain and unknown. Therefore, operations are usually carried on a small scale when new products or ideas are being introduced in the market. This also helps to reduce the risk.

- Direct Motivation: Small scale enterprises foster individual initiative and skill. The identity of ownership and management serves to curb misconduct as mistakes bear directly on one’s property and income. There is maximum incentive to put the resources to best use because the resulting gains accrue directly to the owner. Red: tapis is absent and prompt decisions are possible.

- Human Inertia: Many businessmen do not want to expand their business due to fear of loss of freedom. Growth may involve more work and worry. People who want to lead a comfortable and simple life may be satisfied with the small scale of business.

Shield to Big Business Many small firms serve as ancillary units or feeders to large firms. Such units also provide a training ground for entrepreneurs. Small firms also provide some guarantee against the emergence of new competition. A threat to the big firms. They provide superficial evidence that monopoly does not exist in the industry. - Social Utility: Small scale industries are helpful in generating self: employment for a large number of persons. These industries are also useful in preventing the concentration of income and wealth. They facilitate the economic development of rural and backward areas. Small firms use local resources and their social cost is comparatively low.

- State Assistance and Patronage: Small scale industries get several concessions from the government on account of their social benefits. The government provides then loans on concessional rates of interest. Technical, managerial, and marketing assistance is also provided. The government has reserved several products for exclusive production in the small scale sector. Several institutions have been set up to protect and promote the growth of small scale industries in the country.

Q3: Discuss the main types of partners.

Ans: A partnership firm can have different types of partners with different roles and liabilities. There can be the following types of partners:

- Active Partner

- Sleeping or Dormant Partner

- Secret Partner

- Nominal Partner

- Partner by estoppel

- Partner by holding out

- Minor Partner

Active Partner: Those partners who contribute capital and also takes an active part in the management of the firm are called active partners. These partners act as agents of the firm and have unlimited liability. All other partners are responsible for their deals.

Sleeping or dormant partner: Those partners who contribute capital only but do not take an active part in the affairs of the business are called sleeping partners. They have shared in the profit loss of the firm and also have unlimited liability. But they do not come face to face with the third party.

Secret Partner: This type of partner contributes capital and takes an active part in the management of the firm’s business. He shares in the profit and losses of the firm and has unlimited liability. However, his connection with the business of a partnership firm is not known to the outside world.

Nominal Partner: Those partners who neither invest money nor have shared in the profit and loss and also have no role in the administration of the firm. The firm makes them partners to gain from their personal goodwill. They have unlimited liability also.

Partner by estoppel: A person who by his words or conduct, represents himself as a partner becomes liable to those who advance money to the firm on the basis of such representation. He cannot avoid the consequences of his previous act.

Partner by holding out: When a person is declared as a partner and he does not deny this even after becoming aware of it, he becomes liable to third parties who lend money or credit to the firm on the basis of such a declaration.

Minor Partner: A minor is a person who has not completed 18 years of age. Minor may be admitted as a partner only for the benefits of the partnership with the mutual consent of all the partners. On being so admitted, a minor can impact and copy the books of accounts but could not take an active part in the management. His liability is limited to the intent of his share in the capital and profit of the firm.

Q4: Explain the various types of partnerships.

Ans: A partnership can be classified on the basis of two factors:

- Duration,

- Liability.

On the basis of duration, there can be two types of partnership:

- Partnership at will,

- Particular partnership

On the basis of liability, the two types of partnership are:

- Partnership with limited liability

- Partnership with unlimited liability.

On the basis of Duration:

- Partnership at will: It is a partnership formed for an indefinite period. It can continue for any length at any time depending upon the will of the partners. It can be dissolved by any partner by giving notice to the other partners of his desire to quit the firm.

- Particular Partnership: It is a partnership formed for a particular objective. It is formed fora specific time period or to achieve specified objectives. It is automatically dissolved on the expiry of the specified period or on the completion of the specific purpose for which it was formed.

On the basis of liability:

- Partnership with limited liability:

In this type of partnership the liabilities of partners are limited to the amount of capital introduced by them except one partner who has unlimited liability. Registration of such a partnership is compulsory. The limited partner could not take an active part in the firm’s management and their acts also do not bind the firm or other partners. - Partnership with unlimited liability:

This is also called a general partnership. In this liability of the partner is unlimited and joint. They enjoy the right to participate in the management of the firm and their acts are binding on each other as well as on the firm. Registration of this type of firm is optional. Because of unlimited liability, the firm’s creditors can realize these dues in full from any of the partners by attaching their personal property if the firm’s assets are found to be inadequate to pay off its debts.

|

38 videos|180 docs|28 tests

|