Worksheet: Business Services- 1 | Business Studies (BST) Class 11 - Commerce PDF Download

MCQ Questions

Q1: Mr Ankit has a current account in State Bank of India, he is having many transactions of funds transfer every day. One day he asked bank manager to transfer ₹ 40,000 to a client in Mumbai immediately. The bank manager replied to transfer the fund immediately minimum amount should be ₹ 2,00,000. Identify the concept discussed in the above case.

(a) NEFT

(b) Digital cash

(c) RTGS

(d) None of these

Q2: Which of the following is/are PoS terminals?

(a) Physical PoS

(b) Mobile PoS

(c) Virtual PoS

(d) All of these

Q3: Rakesh took the life insurance policy of his wife. After one year, the couple got divorced and after two years, his wife met with an accident and died on the spot. Rakesh entitled to get compensation from the insurance company, if Rakesh was regularly paying the premium amount?

(a) Yes

(b) No

(c) Can’t say

(d) None of these

Q4: When a customer makes a payment using the credit card, his account balance is automatically reduced.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q5: Customers are required to deposit a specified sum of money every month in his account in case of ____, which is also known as cumulative time deposit account.

(a) savings account

(b) current account

(c) recurring deposit account

(d) joint account

Q6: It is an electronic card issued by a financial institution authorising the holder to buy goods or services on credit.

(a) Debit card

(b) Credit card

(c) Both (a) and (b)

(d) None of these

Q6: Banks generally put certain restrictions on number of withdrawals from current account.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q7: The main objective of this account is to enable the businessman to conduct its business transactions smoothly.

(a) Multiple opiton deposit account

(b) Savings account

(c) Recurring deposit account

(d) Current account

Q8: Mr Kabir Khan desires to have two benefits from his bank account, first, to earn higher interest on balance and second, to face minimum risk of dishonou-ring a cheque. Which type of account should be opened by him in Indus Bank?

(a) Current account

(b) Saving account

(c) Multiple option account

(d) Recurring account

Q9: The amount deposited in a savings bank account of a person is an asset for the depositor, while on the other hand it is a liability for the bank. Based on its nature it can be classified as a

(a) time liability

(b) demand liability

(c) long-term liability

(d) None of these

Q10: When a ship is insured against any type of danger, it is know as

(a) Life insurance

(b) Fire insurance

(c) Hull insurance

(d) None of the above

Q11: The commission charged on banker’s cheque is more than that on a bank draft.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q13: Banker’s cheque is also known as ____ .

(a) Overdraft

(b) Cash credit

(c) Pay order

(d) None of these

Q14: Under ____ insurance, subject matter is ship, cargo or freight.

(a) life

(b) marine

(c) reinsurance

(d) None of these

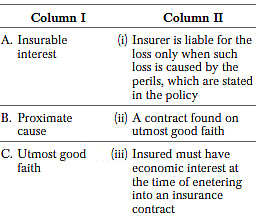

Q15: Match the following.

Codes A B C

(a) (i) (ii) (iii)

(b) (ii) (i) (iii)

(c) (iii) (i) (ii)

(d) (i) (iii) (ii)

Q16: Under which policy, policy money is payable after the assured attains, a certain age in monthly, quarterly, half yearly or annual installments?

(a) Annuity policy

(b) Life insurance policy

(c) Both (a) and (b)

(d) None of the above

Q17: Hari took a fire insurance policy of ₹ 20 lakh for his factory at the annual premium of ₹ 24,000. In order to avoid premium more than this amount, he did not disclose that highly explosive chemicals are being manufactured in his factory.

Due to a fire, his factory gets severly damaged.The insurance company refused to make the payment for claim as it became aware about the highly explosive chemicals. Identify the principle of insurnace violated by Hari.

(a) Insurable interest

(b) Utmost good faith

(c) Indemnity

(d) Subrogation

Q18: Which of the following services provides protection from risk?

(a) Banking

(b) Transportation

(c) Insurance

(d) Postal and Telecom

Q19: The purpose of principle of ____ is to put the insured, in the event of loss, in the same position that he occupied immediately before the happening of the event.

(a) subrogation

(b) indemnity

(c) mitigation

(d) None of these

Q20: A company has undertaken a fire insurnace policy for ₹ 10 lakh. After two months, due to fire it incurred a loss of ₹ 3 lakh. How much money will the company get as compensation?

(a) ₹ 10 lakh

(b) ₹ 3 lakh

(c) ₹ 5 lakh

(d) ₹ 2 lakh

Q21: AEPS service can be availed only when Aadhaar number is registered with the bank where account is held.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q21: Which of the following is the full form of ATM?

(a) Automatic Take Money

(b) Any Time Money

(c) Automated Teller Machine

(d) None of the above

Q22: Savings account is suitable for mobilisation of savings of people.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q23: Name the banking service in which the customer can conduct banking activities like managing savings, checking accounts, applying for loans etc over the internet.

(a) Mobile banking

(b) e-banking

(c) RTGS

(d) None of these

Q24: Mobile wallets provide which kind of services to the society?

(a) Sending and receiving money

(b) Making payments to merchants

(c) Online purchases

(d) All of the above

Q25: Ankit’s warehouse was covered by a fire insurance policy of ₹ 10,00,000, two years back, his warehouse caught fire. Ankit, immediately called up the nearest fire station and started removing the goods from warehouse in order to save them from fire. He took all reasonable steps to minimise the loss or damage. As a result, the actual loss by fire to him was ₹ 3,00,000 which could have gone up to ₹ 7,00,000, if he had not acted as a prudent person.

After scrutiny of the loss, the insurance company handed over the cheque of ₹ 3,00,000 to Ankit.

Identify and state the principle of insurance, which was followed by Ankit in the given case?

(a) Subrogation

(b) Mitigation

(c) Contribution

(d) Proximate cause

Q26: Deepak has taken fire insurnace policy of ₹ 9,00,000 for his factory. Due to fire, he suffered a loss of ₹ 6,00,000. He claimed the loss from the insurance company and he gets the compensation within a month.

Goods that were lost by fire were scrapped for ₹ 70,000. Deepak wants to keep this money with himself, while the insurnace company claims that ₹ 70,000 should be handed over to the company. Identify the principle of insurance which is applicable is the given case.

(a) Utmost good faith

(b) Insurable interest

(c) Subrogation

(d) None of these

Q27: An arrangement by which a bank allows its customer to borrow money upto the specified limit.

(a) Cash credits

(b) Pass book

(c) Cash book

(d) Account page

Q28: In case of cash credits, loan amount is credited in the borrower’s account and interest is charged on the total amount credited.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q29: If a person take fire insurance policy from 3 insurers. During loss due to fire he will get

(a) loss amount compensation from all three separately

(b) loss amount, which will be contributed by all three

(c) policy amount from all insurers

(d) None of the above

Q30: Match the following.

Codes A B C

(a) (i) (ii) (iii)

(b) (iii) (ii) (i)

(c) (i) (iii) (ii)

(d) (ii) (iii) (i)

Q31: Which of the following is not applicable in life insurance contract?

(a) Conditional contract

(b) Unilateral contract

(c) Indemnity contract

(d) None of the above

Q32: The validity period of a demand draft is

(a) one month

(b) two months

(c) three months

(d) six months

Q33: In case of which card, a holder can spend money only upto the balance in his account?

(a) Credit card

(b) Debit card

(c) Both (a) and (b)

(d) None of these

Q34: As per the basic principle of the fire insurance policy, it is the primary duty of the insured to take reasonable steps to prevent fire from occuring and to minimise the losses or damage to the insured property.

It is the duty of the insured to behave with great prudence and not to be careless just because he has an insurance cover. This principle is known as the principle of

(a) indemnity

(b) proximate cause

(c) subrogation

(d) mitigation

Q35: This health insurance policy combines health insurance with investment. The insurer pays back a specified amount at the end of the period. Identify which policy is this?

(a) Individual mediclaim policy

(b) Family floater policy

(c) Unit linked health plans

(d) None of the above

Q36: When the loss is the result of two or more causes, which of the following terms refers to the direct cause of which the loss is the natural consequence?

(a) Subrogation

(b) Proximate

(c) Mitigation

(d) Indemnity

Q37: A countrywide system through which person can electronically transfer from one bank branch to another person having an account with the other bank branch in the country is known as

(a) Pay order

(b) RTGS

(c) Bank draft

(d) NEFT

Q38: _____account is meant for people who wish to save a part of their income to safeguard the future and can interest on it.

(a) Current account

(b) Savings account

(c) Recurring account

(d) Multiple option account

Q39: Kavya took a marine policy worth ₹ 2,00,000 to protect her goods from the perils of sea. On the way, the goods were spoiled by rats. She suffered a loss of ₹ 100,000. She filed a claim for loss against the insurance company.

Which principal of insurance is highlighted in the given case?

(a) Subrogation

(b) Mitigation

(c) Proximate cause

(d) Contribution

Q40: Mobile banking refers to the process of carrying out banking transactions online.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q41: Abhinav took a fire insurance policy for his property worth ₹ 5,00,000 with two insurers: ICICI Lombard General Insurance Co. Ltd. for ₹ 4,00,000 and Bajaj Allianz General Insurance Co. Ltd. for ₹ 20,000.

An electric short circuit in his property caused fire and it resulted in a loss of ₹ 1,50,000.

He filed a claim for ₹ 100,000 against each of the two insurance companies. Which principle of insurnace has been highlighted in given case?

(a) Mitigation

(b) Proximate cause

(c) Contribution

(d) Indemnity

Q42: Match the following.

Codes

A B C

(a) (i) (ii) (iii)

(b) (i) (iii) (ii)

(c) (iii) (i) (ii)

(d) (ii) (i) (iii)

Q43: In case of fire insurance policy, the insurer is liable to compensate for the loss only when the proximate cause of loss is fire.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q43: State which of the following statements is false?

(a) Recurring deposit account is a time deposit account

(b) Number of transactions every month is limited in saving bank account

(c) A current account can be opened with an initial deposit of₹ 5,000

(d) Fixed deposit account is demand deposit account

Q44: Manav gets the information about the rate of interest on fixed deposit by a telephonic conversation with an officer of a bank. Name this type of banking.

(a) Internet banking

(b) e-banking

(c) Tele-banking

(d) None of these

Q45: The minimum period of deposit in case of recurring deposit account is ____ and maximum is ____.

(a) 12 months, 2 years

(b) 6 months, 10 years

(c) 4 months, 1 year

(d) 8 months, 3 years

Q46: When a property is insured by more than one insurance (i.e. in case of multiple insurance), the insurers are to share losses in what proportion?

(a) Ratio of premiums received

(b) Ratio of duration of insurance

(c) Ratio of amount insured

(d) Equal ratio

Q47: If the cargo does not reach its destination due to damage or destruction in the transit, the shipping company is not paid freight charges. To overcome losses suffered by such circumstances, shipping companies opt for

(a) ship insurance

(b) hull insurance

(c) cargo insurance

(d) freight insurance

Q48: ____ is a contract of insurance, in which an insurer enters into a contract with another insurer to insure the whole or a part of risk covered by the first insurer.

(a) Double insurance

(b) Hull insurance

(c) Reinsurance

(d) Burglary insurance

Q49: It is a type of payment instrument in which money is loaded in advance to make purchases. Identify which type of digital payment method is described above?

(a) Credit card

(b) Debit card

(c) Prepaid card

(d) None of these

Q50: There are services which are experienced differently by different customers. These kind of services depend upon customers preferences and demands and are known as

(a) Personal services

(b) Social services

(c) Business services

(d) Financial services

Q51: ‘‘It is another type of digital payment method, in which ‘*99#’ can be used to carry out mobile transactions.’’ Which type of digital payment is described above?

(a) Unified Payment Interface (UPI)

(b) Unstructured Supplementary Service Data (USSD)

(c) Aadhaar Enabled Payment System (AEPS)

(d) None of the above

Q52: Nitesh insured his factory for ₹ 5,00,000 against fire. Due to fire in his factory, he suffered a loss of stock worth ₹ 3,00,000. He is of the opinion that he can recover the entire policy amount of ₹ 5,00,000 from the insurance company. Identify the relevant insurance principle in this regard.

(a) Subrogation

(b) Mitigation

(c) Indemnity

(d) None of these

Q53: Joint life policy is taken up by a person for his/her children to meet the expenses of their education or marriage.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q54: Mr. Virat, a businessmen, has a current account in SBI, his current account shows balance of just ₹ 40,000, while he urgently needs ₹ 2,50,000 to pay off one of his creditors.

He approaches SBI to allow him to withdraw ₹ 2,50,000, using the facility extended by the bank to him due to his creditworthiness. The bank agrees to it. Identify the facility which has been provided by SBI to Virat.

(a) Borrowing

(b) Bank overdraft

(c) Banker’s cheque

(d) None of these

Q55: Match the following.

Codes A B C D

(a) (ii) (iii) (iv) (i)

(b) (iii) (i) (ii) (iv)

(c) (iv) (i) (iii) (iv)

(d) (i) (ii) (iv) (iii)

Q56: Anuj has taken a loan from Avi against the security of his factory. Can Avi take a fire insurance policy of that factory?

(a) No

(b) Yes

(c) Can’t say

(d) None of the above

Q57: A electronic fund transfer system under which transfer of funds take place from one branch of bank to another branch on real time and on grow basis is know as

(a) NEFT

(b) EFT

(c) RTGS

(d) ATM

Q58: In recurring deposit account, the depositor enjoys the liquidity of saving account and interest rate of fixed deposit account.

(a) True

(b) False

(c) Can’t say

(d) Partially true

Q59: A cheque which is deposited only to the payee’s bank account is known as ____ .

(a) Bearers cheque

(b) Demand draft

(c) Crossed cheque

(d) None of these

Q60: ‘‘The insured must have an interest in the subject matter of insurance’’.

Which principle of insurance is related to this statement?

(a) Principle of mitigation

(b) Principle of insurable interest

(c) Principle of proximate cause

(d) None of the above

Q61: Which of the following is not a function of insurance?

(a) Risk sharing

(b) Assist in capital formation

(c) Lending of funds

(d) None of the above

Q62: ____ is a temporary arrangement under which a dpositor is allowed to draw by cheque more than the amount available to his credit upto a specified limit.

(a) Cash credit

(b) Term loan

(c) Bank overdraft

(d) Consumer credit

Q63: A contract by which the insurer, in consideration of a certain amount known as premium, undertakes to pay to a person or his heirs a certain amount of money on his death or on attaining a certain age is known as

(a) General insurance

(b) Life insurance

(c) Special insurance

(d) Burglary insurance

|

37 videos|142 docs|38 tests

|

FAQs on Worksheet: Business Services- 1 - Business Studies (BST) Class 11 - Commerce

| 1. What are business services in commerce? |  |

| 2. How important are business services for a company? |  |

| 3. Can small businesses benefit from business services? |  |

| 4. How can businesses find reliable business service providers? |  |

| 5. Are business services only relevant for large corporations? |  |

|

Explore Courses for Commerce exam

|

|