Worksheet: Reconstitution of a Partnership Firm : Retirement/Death of a Partner- 2 | Accountancy Class 12 - Commerce PDF Download

Q21: Alok, Narendra and Shiv were partners in a firm sharing profits in the ratio of 5 : 3 : 2. Goodwill appeared at ₹ 90,000 and general reserve at ₹ 50,000 in the books of the firm. Narendra decided to retire from the firm. On the date of his retirement, goodwill of the firm was valued at f 2,40,000. The new profit sharing ratio of Alok and Shiv was 2 : 3. Record necessary journal entries on Narendra’s retirement.

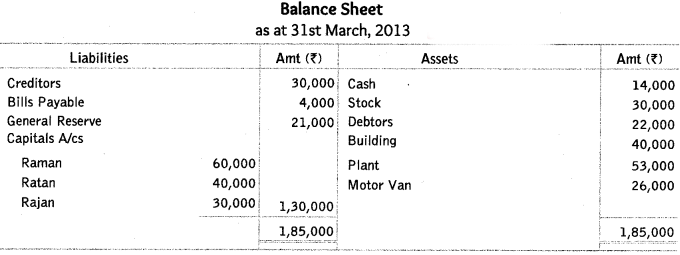

Q22: Raman, Ratan and Rajan were partners sharing profits in the ratio of 4 : 2 : 1 respectively. Following was their balance sheet as at 31st March, 2013.

On the above date, Raman retired and following were agreed

(i) The assets and liabilities were valued as: stock ₹ 24,000; debtors ₹ 21,000; building ₹ 45,200; plant ₹ 50,000 and creditors ₹ 28,000.

(ii) Amount due to Raman will be transferred to Raman’s loan account.

Prepare revaluation account and Raman’s capital account.

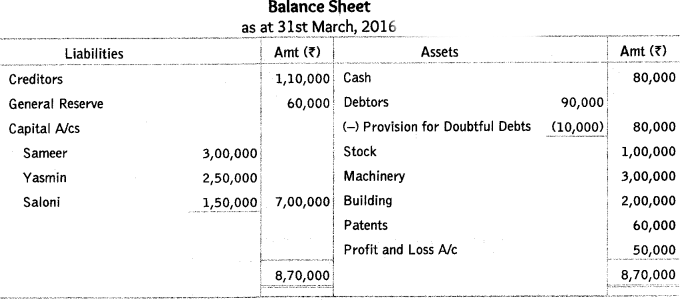

Q23: Sameer, Yasmin and Saloni were partners in a firm sharing profits and losses in the ratio of 4 : 3 : 3. On 31st March, 2016, their balance sheet was as follows:

On the above date, Sameer retired and it was agreed that

(i) Debtors of ₹ 4,000 will be written-off as bad debts and a provision of 5% on debtors for bad and doubtful debts will be maintained.

(ii) An unrecorded creditor of ₹ 20,000 will be recorded.

(iii) Patents will be completely written-off and 5% depreciation will be charged on stock, machinery and building.

(iv) Yasmin and Saloni will share the future profits in the ratio of 3 : 2.

(v) Goodwill of the firm on Sameer’s retirement was valued at ₹ 5,40,000.

Pass necessary journal entries for the above transactions in the books of the firm on Sameer’s retirement.

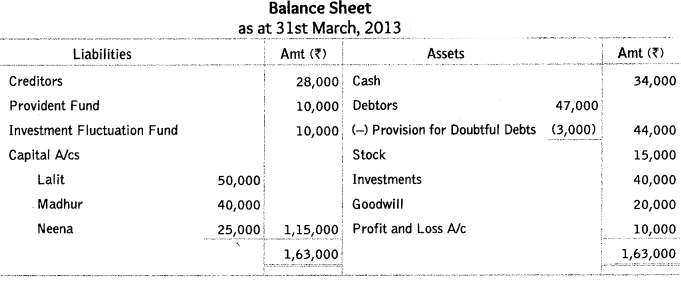

Q24: Lalit, Madhur and Neena were partners sharing profits as 50%, 30% and 20% respectively. On 31st March, 2013 their balance sheet was as follows

On this date, Madhur retired and Lalit and Neena agreed to continue on the following terms

(i) The goodwill of the firm was valued at ₹ 51,000.

(ii) There was a claim for workmen’s compensation to the extent of ₹ 6,000.

(iii) Investments were brought down to ₹ 15,000.

(iv) Provision for bad debts was reduced by ₹ 1,000.

(v) Madhur was paid ₹ 10,300 in cash and the balance was transferred to his loan account payable in two equal instalments together with interest @ 12% per annum.

Prepare revaluation account, partners capital accounts and Madhur’s loan account till the loan is finally paid off.

Q25: X, Y and Z are partners in a firm sharing profits in the ratio of 3 : 2 : 1. On 1st April, 2009, X retires from the firm, Y and Z agrees that the capital of the new firm shall be fixed at ₹ 2,10,000 in the profit sharing ratio. The capital accounts of Y and Z after all adjustments on the date of retirement showed balances of ₹ 1,45,000 and ₹ 63,000 respectively. State the amount of actual cash to be brought in or to be paid to the partners.

Q26: X, Y and Z are partners in a firm sharing profits in the ratio of 3 : 2 : 1. On 1st April, 2009, Y retires form the firm. X and Z agree that the capital of the new firm shall be fixed at ₹ 2,10,000 in the profit sharing ratio. The capital accounts of X and Z after all adjustments on the date of retirement showed balances of ₹ 1,45,000 and ₹ 63,000 respectively. State the amount of actual cash to be brought in or to be paid to the partners.

Q27: Nandan, John and Rosa are partners sharing profits in the ratio of 4 : 3 : 2. On 1st April, 2012, John gave a notice to retire from the firm. Nandan and Rosa decided to share future profits in the ratio of 1 : 1. The capital accounts of Nandan and Rosa after all adjustments showed a balance of ? 43,000 and ₹ 80,500 respectively. The total amount to be paid to John was ₹ 95,500. This amount was to be paid by Nandan and Rosa in such a way that then- capitals become proportionate to their new profit sharing ratio. Pass necessary journal entries in the books of the firm for the above transactions. Show your workings clearly.

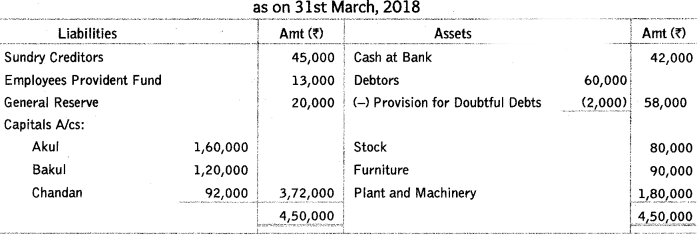

Q28: Akul, Bakul and Chandan were partners in a firm sharing profits in the ratio of 2 : 2 : 1. On 31st March, 2018 their balance sheet was as follows

Balance Sheet of Akul, Bakul and Chandan

Bakul retired on the above date and it was agreed that

(i) Plant and Machinery was undervalued by 10%.

(ii) Provision for doubtful debts was to be increased to 15% on debtors.

(iii) Furniture was to be decreased to ₹ 87,000.

(iv) Goodwill of the firm was valued at ₹ 3,00,000 and Bakul’s share was to be adjusted through the capital accounts of Akul and Chandan.

(v) Capital of the new firm was to be in the new profit sharing ratio of the continuing partners.

Prepare revaluation account, partners’ capital accounts and balance sheet of the reconstituted firm.

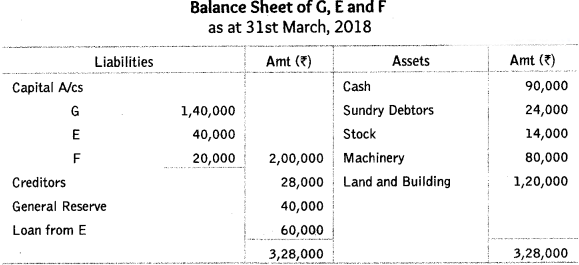

Q29: G, E and F were partners in a firm sharing profits in the ratio of 7 : 2 : 1. The balance sheet of the firm as at 31st March, 2018 was as follows

E retired on the above date. On E’s retirement the following was agreed upon

(i) Land and building were revalued at ₹ 1,88,000, machinery at ₹ 76,000 and stock at ₹ 10,000 and goodwill of the firm was valued at ₹ 90,000.

(ii) A provision of 2.5% was to be created on debtors for doubtful debts.

(iii) The net amount payable to E was transferred to his loan account to be paid later on

(iv) Total capital of the new firm was fixed at ₹ 2,40,000 which will be adjusted according to their new profit sharing ratio by opening current accounts.

Prepare revaluation account, partners’ capital accounts and balance sheet of reconstituted firm.

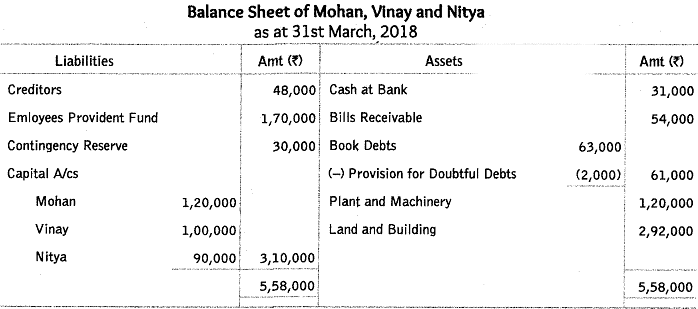

Q30: Mohan, Vinay and Nitya were partners in a firm sharing profits and losses in the proportion of  respectively. On 31st March, 2018 their balance sheet was as follows

respectively. On 31st March, 2018 their balance sheet was as follows

Mohan retired on the above date and it was agreed that

(i) Plant and machinery will be depreciated by 5%.

(ii) An old computer previously written off was sold for ₹ 4,000.

(iii) Bad debts amounting to ₹ 3,000 will be written off and a provision of 5% on debtors for bad and doubtful debts will be maintained.

(iv) Goodwill of the firm was valued at ₹ 1,80,000 and Mohan’s share of the same was credited in his account by debiting Vinay’s and Nitya’s accounts.

(v) The capital of the new firm was to be fixed at ₹ 90,000 and necessary adjustments were to be made by bringing in or paying off cash as the case may be.

(vi) Vinay and Nitya will share future profits in the ratio of 3 : 2.

Prepare revaluation account, partners’ capital accounts and balance sheet of the reconstituted firm.

Q31: J, H and K were partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 31st March, 2015 their balance sheet was as follows

On the above date, H retired and J and K agreed to continue the business on the following terms

(i) Goodwill of the firm was valued at ₹ 1,02,000.

(ii) There was a claim of ₹ 8,000 for workmen’s compensation.

(iii) Provision for bad debts was to be reduced by 12,000.

(iv) H will be paid ₹ 14,000 in cash and the balance will be transferred in his loan account which will be paid in four equal yearly instalments together with interest @ 10% per annum.

(v) The new profit sharing ratio between J and K will be 3 : 2 and their capitals will be in their new profit sharing ratio. The capital adjustments will be done by opening current accounts.

Prepare revaluation account, partners capital accounts and balance sheet of the new firm.

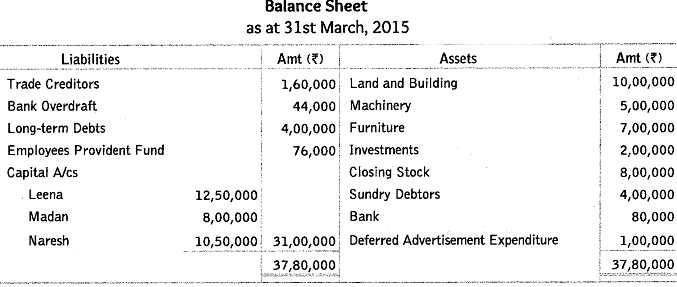

Q32: Leena, Madan and Naresh were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 3. On 31st March, 2015 their balance sheet was as follows

On 31st March, 2015, Madan retrired from the firm and the remaining partners decided to carry on the business. It was decided to revalue assets and liabilities as under

(i) Land and building be appreciated by ₹ 2,40,000 and machinery be depreciated by 10%.

(ii) 50% of investments were taken over by the retiring partner at book value.

(iii) An old customer Mohit whose account was written-off as bad debt had promised to pay ₹ 7,000 in settlement of his full debt of ₹ 10,000.

(iv) Provision for doubtful debts was to be made at 5% on debtors.

(v) Closing stock will be valued at market price which is ₹ 1,00,000 less than the book value.

(vi) Goodwill of the firm be valued at ₹ 5,60,000 and Madan’s share of goodwill be adjusted in the accounts of Leena and Naresh. Leena and Naresh decided to share future profits and losses in the ratio of 3 : 2.

(vii) The total capital of the new firm will be ₹ 32,00,000 which will be in the proportion of the profit sharing ratio of Leena and Naresh.

(viii) Amount due to Madan was settled by accepting a bill of exchange in his favour payable after 4 months.

Prepare revaluation account, partners capital accounts and balance sheet of the firm after

Madan’s retirement.

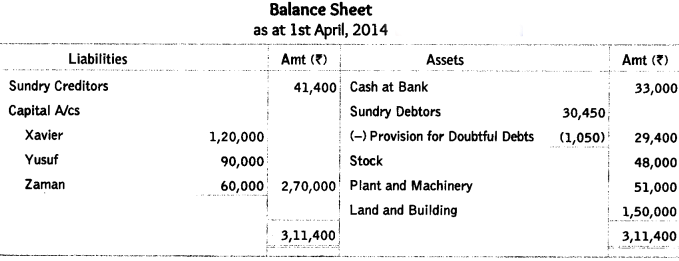

Q33: Xavier, Yusuf and Zaman were partners in a firm sharing profits in the ratio of 4 : 3 : 2. On 1st April, 2014 their balance sheet was as follows

Yusuf had been suffering from ill health and thus gave notice of reitrement from the firm. An agreement was, therefore, enterd into as on 1st April, 2014, the terms of which were as follows

(i) That land and building be appreciated by 10%.

(ii) The provision for bad debts is no longer necessary.

(iii) That stock be appreciated by 20%.

(iv) That goodwill of the firm be fixed at ₹ 54,000. Yusuf s share of the same be adjusted into Xavier’s and Zaman’s capital accounts, who are going to share future profits in the ratio of 2 : 1.

(v) The entire capital of the newly constituted firm be readjusted by bringing in or paying necessary cash so that the future capitals of Xavier and Zaman will be in their profits sharing ratio.

Prepare revaluation account and partners capital accounts.

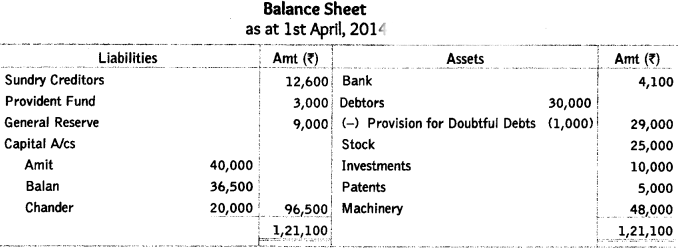

Q34: Amit, Balan and Chander were partners in a firm sharing profits in the proportion of 1/2, 1/3 and 1/6 respectively. Chander retired on 1st April, 2014. The balance sheet of the firm on the date of Chander’s retirement was as follows

It was agreed that

(i) Goodwill will be valued at ₹ 27,000.

(ii) Depreciation of 10% was to be provided on machinery.

(iii) Patents were to be reduced by 20%.

(iv) Liability on account of provident fund was estimated at ₹ 2,400.

(v) Chander took over investments for ₹ 15,800.

(vi) Amit and Balan decided to adjust their capitals in proportion of their profit sharing ratio by opening current accounts.

Prepare revaluation account and partners’ capital accounts on Chander’s retirement.

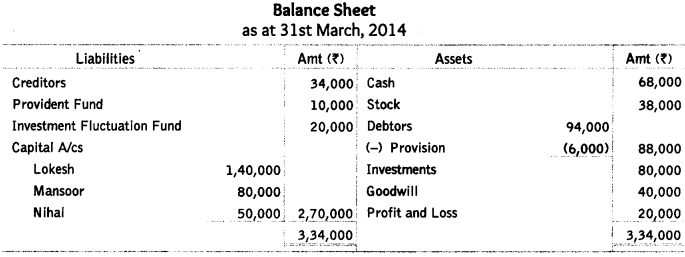

Q35: Lokesh, Mansoor and Nihal were partners in a firm sharing profits as 50%, 30% and 20% respectively. On 31st March, 2014, their balance sheet was as follows

On the above date, Mansoor retired and Lokesh and Nihal agreed to continue on the following terms

(i) Firm’s goodwill was valued at ₹ 1,02,000 and it was decided to adjust Mansoor’s share of goodwill into the capital accounts of the continuing partners.

(ii) There was a claim for workmen’s compensation to the extent of ₹ 12,000 and investments were brought down to ₹ 30,000.

(iii) Provision for bad debts was to be reduced by ₹ 2,000.

(iv) Mansoor was to be paid ₹ 20,600 in cash and the balance will be transferred to his loan account which was paid in two equal instalments together with interest @ 10% per annum.

(v) Lokesh’s and Nihal’s capitals were to be adjusted in their new profit sharing ratio by bringing in or paying off cash as the case may be.

Prepare revaluation account and partners’ capital accounts.

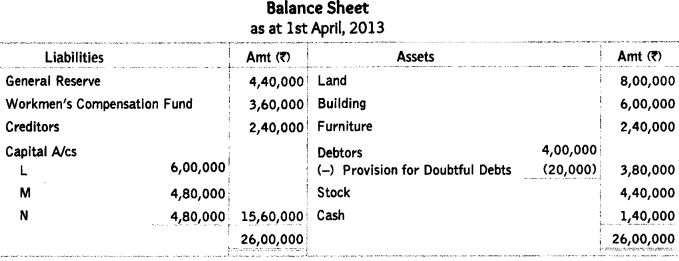

Q36: L, M and N were partners in a firm sharing profits in the ratio of 2 : 1 : 1. On 1st April, 2013 their balance sheet was as follows

On the above date, N retired. The following were agreed

(i) Goodwill of the firm was valued at ₹ 6,00,000.

(ii) Land was to be appreciated by 40% and building was to be depreciated by ₹ 1,00,000.

(iii) Furniture was to be depreciated by ₹ 30,000.

(iv) The liabilities for workmen’s compensation fund was determined at ₹ 1,60,000.

(v) Amount payable to N was transferred to his loan account.

(vi) Capitals of L and M were to be adjusted in their new profit sharing ratio and for this purpose current accounts of the partners will be opened.

Prepare revaluation account, partner’s capital accounts and the balance sheet of the new firm.

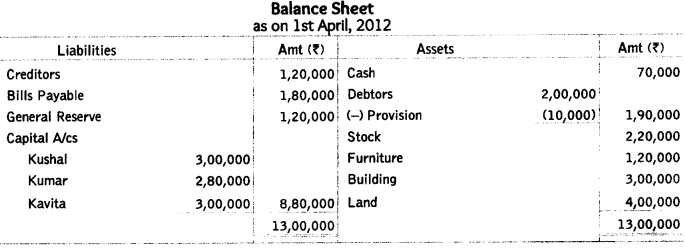

Q37: Kushal, Kumar and Kavita were partners in a firm sharing profits in the ratio of 3 : 1 : 1. On 1st April, 2012 their balance sheet was as follows

On the above date, Kavita retired and the following was agreed

(i) Goodwill of the firm was valued at ₹ 40,000.

(ii) Land was to be appreciated by 30% and building was to be depreciated by ₹ 1,00,000.

(iii) Value of furniture was to be reduced by ₹ 20,000.

(iv) Bad debts reserve is to be increased to ₹ 15,000.

(v) 10% of the amount payable to Kavita was paid in cash and the balance was transferred to her loan account.

(vi) Capitals of Kushal and Kumar will be in proportion to their new profit sharing ratio. The surplus/deficit, if any in their capital accounts will be adjusted through current accounts.

Prepare revaluation account, partner’s capital accounts and balance sheet of Kushal and Kumar after Kavita’s retirement.

Q38: State the basis of calculating the amount of profit payable to the legal representative of a deceased partner in the year of death.

Q39: Dinkar, Navita and Vani were partners sharing profits and losses in the ratio of 3 : 2 : 1. Navita died on 30th June, 2017. Her share of profit for the intervening period was based on the sales during that period, which were ₹ 6,00,000. The rate of profit during the past four years had been 10% on sales. The firm closes its books on 31st March every year.

Calculate Navita’s share of profit.

Q40: Jayant, Kartik and Leena were partners in a firm sharing profits and losses in the ratio of 6 : 2 : 3. Kartik died and Jayant and Leena decided to continue the business. Their gaining ratio was 2 : 3. Calculate the new profit sharing ratio of Jayant and Leena.

You can access the solutions to this worksheet here.

|

42 videos|199 docs|43 tests

|

FAQs on Worksheet: Reconstitution of a Partnership Firm : Retirement/Death of a Partner- 2 - Accountancy Class 12 - Commerce

| 1. What are the key steps involved in reconstituting a partnership firm after a partner retires? |  |

| 2. How is the profit-sharing ratio affected when a partner retires? |  |

| 3. What happens to the assets and liabilities of the partnership when a partner dies? |  |

| 4. What legal formalities need to be completed after a partner's retirement or death? |  |

| 5. How can disagreements among remaining partners be resolved after a partner retires or dies? |  |